This study extensively utilized both primary and secondary sources. Initially, secondary research methods were employed to gather data about the market, including its parent and peer markets. The next phase involved conducting primary research to validate these conclusions and assumptions by engaging with industry experts throughout the value chain. A combination of top-down and bottom-up approaches was applied to assess the overall market size. Subsequently, the market sizes of segments and subsegments were estimated using data triangulation techniques and market breakdown analysis.

Secondary Research

The secondary research process extensively utilizes a variety of secondary sources, including directories and databases such as Bloomberg Business, Factiva, and D&B Hoovers. It incorporates white papers, annual reports, investor presentations, and SEC filings from companies, along with publications from government bodies like the National Institutes of Health (NIH), the US Food and Drug Administration (FDA), the US Census Bureau, the World Health Organization (WHO), the International Trade Administration (ITA), the International Society on Thrombosis and Haemostasis (ISTH), the European Hematology Association (EHA), and the World Federation of Hemophilia (WFH). These resources were accessed to gather and analyze information for the global coagulation analyzers market study. The research aimed to identify key players in the market, categorize and segment the information according to industry trends, and capture important developments related to the market and technology perspectives. Additionally, a database of leading industry figures was created using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from important companies and organizations in the coagulation analyzers market. On the demand side, primary sources included hospitals, clinical laboratories, and other end users. This primary research was conducted to validate market segmentation, identify key players, and collect insights on significant industry trends and market dynamics.

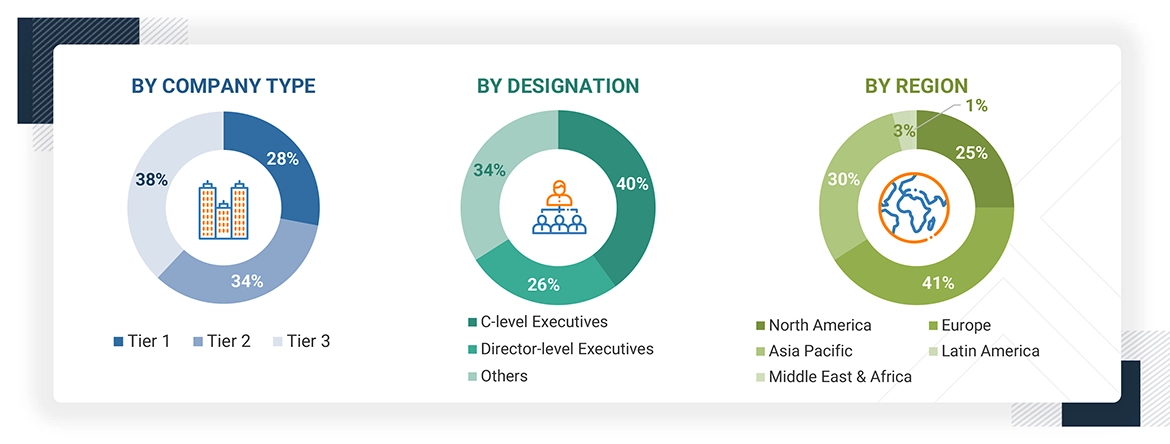

A breakdown of the primary respondents is provided below:

Note 1: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2024, Tier 1= >USD 10 billion, Tier 2 = USD 1 billion to USD 10 billion, and Tier 3 = < USD 1 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Annual revenues were calculated based on revenue data from major product manufacturers and OEMs involved in the global coagulation analyzers market to determine the global market value. Key manufacturers were identified at both the global and regional levels. Revenue mapping for their respective business segments and subsegments was conducted for these leading players.

The global coagulation analyzers market was categorized into various segments and subsegments based on the following criteria:

-

A list of major players operating in the product market at the regional and country levels.

-

Product mapping of various coagulation analyzer manufacturers at the regional and country levels.

-

Mapping of annual revenues generated by the listed major players, specifically from coagulation analyzers or related business units/products.

-

Extrapolation of the revenue data from these major players to estimate the global market value for the respective segments and subsegments.

-

Summation of the market values of all segments and subsegments to establish the total value of the global coagulation analyzers market.

This data was consolidated, along with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Market Size Estimation (Bottom-up Approach & Top-down Approach)

Data Triangulation

After arriving at the overall size of the global coagulation analyzers market through the above-mentioned methodology, this market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. Examining several macrovariables and regional trends from demand- and supply-side players helped triangulate the extrapolated market data.

Market Definition

A coagulation analyzer is an important medical diagnostic tool that checks how well blood can clot by measuring several key factors, including prothrombin time (PT), activated partial thromboplastin time (aPTT), thrombin time (TT), and fibrinogen levels. This device plays a crucial role in diagnosing bleeding disorders like hemophilia, monitoring anticoagulant therapies with drugs such as aspirin, heparin, or warfarin, and managing patients during surgeries. Coagulation analyzers provide fast and accurate evaluations of clotting efficiency and platelet counts, which helps healthcare providers make quick clinical decisions in both hospital and lab environments.

Stakeholders

-

Coagulation analyzer instrument manufacturers

-

Coagulation analyzer reagent manufacturers

-

Group purchasing organizations (GPOs)

-

Original equipment manufacturers (OEMs)

-

Pharmaceutical & biotechnology companies

-

Academic research institutes related to coagulation studies

-

Venture capitalists and investors

-

Healthcare facilities (hospitals, clinical laboratories, and other end users)

-

Research & consulting firms

-

Research institutes

Report Objectives

-

To define, describe, and forecast the coagulation analyzers market based on product, test, technology, end user, and region

-

To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

-

To assess the coagulation analyzers market with respect to Porter’s Five Forces, regulatory landscape, the value chain, the supply chain, patent analysis, pricing assessment, key stakeholders, and buying criteria

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

-

To analyze the opportunities in the coagulation analyzers market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of the coagulation analyzers market in five primary regions (along with countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

-

To profile the key players operating in the coagulation analyzers market and comprehensively analyze their core competencies and market shares

-

To track and analyze competitive developments such as partnerships, agreements, collaborations, acquisitions, expansions, product/technology developments, and product approvals

-

To benchmark players within the coagulation analyzers market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within categories of business strategies, market share, and product offerings

-

To understand the impact of AI/generative AI on the market

Growth opportunities and latent adjacency in Coagulation Analyzer Market