Polycarbonate Resin Market by Application (Electrical & Electronics, Optical Media, Construction, Consumer, Automotive, Packaging, Medical), and Region (Asia Pacific, Europe, North America, Middle East & Africa) - Global Forecast to 2029

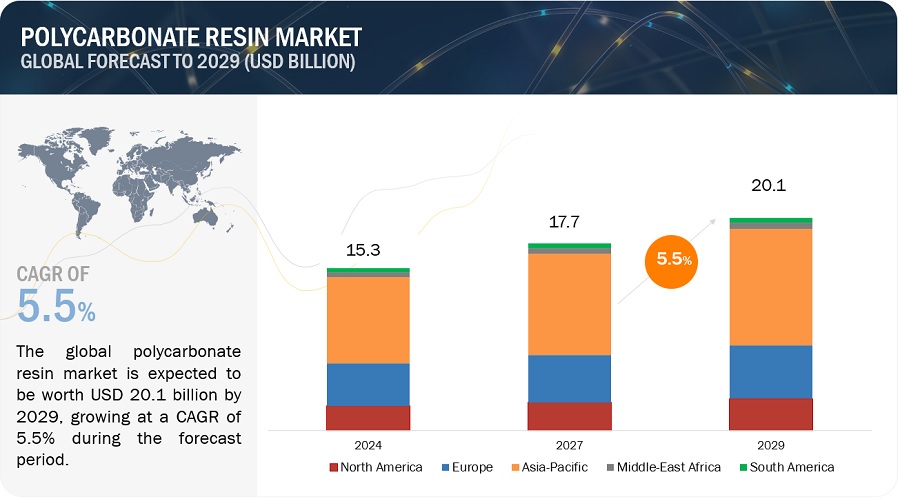

The polycarbonate resin market size was estimated to be USD 15.3 billion in 2024 and is projected to reach USD 20.1 billion by 2029 at a CAGR of 5.5% between 2024 and 2029. The growth of the polycarbonate resin market is boosted by its increased demand in applications in the automotive industry, especially in the glazing application. The growing demand from the consumer sector is also one of the key drivers of the polycarbonate resin market. The market for polycarbonate resin is primarily driven by its exceptional properties that cater to the needs of various industries. In automotive applications, demand is fueled by the requirement for lightweight materials that offer both, impact resistance and design flexibility. In electronics, the increasing preference for durable yet esthetically pleasing housings for gadgets contributes to the growing adoption of polycarbonate resins. However, the pricing of polycarbonate resin compared to alternative materials such as acrylic or glass could raise economic concerns, particularly in extensive projects. Although it exhibits UV stability, prolonged exposure to sunlight can result in yellowing and deterioration unless properly shielded.

Opportunities in the Polycarbonate Resin Market

To know about the assumptions considered for the study, Request for Free Sample Report

Recession Impact

During a recession, the polycarbonate market typically experiences several significant impacts due to changes in consumer behavior, industrial activity, and market dynamics. Reduced consumer spending often leads to decreased demand for products such as electronics, automotive parts, and construction materials, all of which utilize polycarbonate resins extensively. This decline in demand can result in excess inventory levels, leading to pricing pressures and reduced profit margins for manufacturers within the polycarbonate industry. However, despite these challenges, the polycarbonate market can also exhibit resilience during recessions, as the material's durability, versatility, and cost-effectiveness may continue to attract demand in certain applications, such as packaging and consumer goods, where performance outweighs economic fluctuations.

Polycarbonate resin: Market Dynamics

Driver: Rapid urbanization and infrastructure development

Rapid urbanization and infrastructure development projects worldwide have spurred the demand for polycarbonate resin in construction materials. This demand stems from polycarbonate resin's unique properties, which make it well-suited for various building applications. In roofing, polycarbonate sheets offer durability, impact resistance, and light transmission properties, making them ideal for both, residential and commercial structures. The use of polycarbonate in roofing solutions allows for the diffusion of natural light, reducing the need for artificial lighting during the day and promoting energy efficiency. Similarly, in cladding applications, polycarbonate panels provide thermal insulation, weather resistance, and design flexibility, enhancing the esthetics and performance of buildings. The lightweight nature of polycarbonate resin also simplifies installation and reduces structural load, contributing to cost savings and construction efficiency. Additionally, polycarbonate's transparency and versatility make it a popular choice for lighting solutions such as skylights, canopies, and façades, allowing architects to incorporate natural light into building designs while maintaining thermal comfort and visual appeal. Overall, the use of polycarbonate resin in construction materials plays a significant role in the development of sustainable and energy-efficient buildings, aligning with global efforts to promote environmental responsibility and mitigating the impacts of urbanization on the built environment.

Restrain: Residual BPA in food packaging and medical applications

One of the primary concerns regarding BPA in packaging is its potential for leaching into food or beverages. BPA can be released from packaging materials through a process known as leaching, particularly when the material comes into contact with acidic or high-temperature substances. Factors such as the type of packaging material, the duration of contact, and the acidity of the contents can influence the rate of BPA leaching. This has been associated with hormone disruption and various health issues. As a result, there has been a push for stricter regulations governing BPA use in food contact materials and medical devices, prompting manufacturers to seek alternatives. Consumer preferences have also shifted toward BPA-free options, leading companies to invest in research & development for safer formulations. Various countries have implemented significant restrictions on BPA use.

Opportunity: Growth in emerging economies to boost the market growth

Economic growth in emerging markets, particularly in regions such as the Asia Pacific and Latin America, presents a significant opportunity for the polycarbonate resin market. Rapid industrialization, urbanization, and rising disposable incomes in these regions drive demand for polycarbonate resin across various applications such as construction, automotive, electronics, and consumer goods. In the construction sector, rapid urbanization is leading to increased construction activities, driving demand for polycarbonate resin in building materials like roofing, cladding, and lighting solutions. Furthermore, the burgeoning automotive industry in these regions, fueled by rising consumer purchasing power and infrastructure development, present opportunities for polycarbonate resin in automotive glazing, interior components, and structural parts. The growing electronic manufacturing sector in emerging markets, driven by the expansion and demand for digitalization and consumer electronics, offers prospects for polycarbonate resin in electronic components, housings, and display screens. As these emerging markets continue to evolve and invest in various sectors, the demand for polycarbonate resin is poised to grow.

Challenge: Intense competition from alternative materials

Competition from alternative materials presents a formidable challenge to the market expansion of polycarbonate resin across diverse industries. Polycarbonate resin contends with a broad spectrum of materials, including other thermoplastics like polyethylene terephthalate (PET), polyethylene (PE), and polypropylene (PP), as well as traditional materials such as glass and metal. These alternatives offer properties akin to polycarbonate resin, such as lightweight construction, durability, and ease of processing. PET, renowned for its transparency and recyclability, is extensively utilized in packaging applications, while PE and PP find widespread use across industries owing to their versatility and cost-effectiveness. Moreover, heightened environmental consciousness has spurred interest in eco-friendly materials, with PET's recyclability and the emergence of biodegradable and bio-based plastics posing challenges to polycarbonate resin's market expansion. Additionally, the cost competitiveness of alternatives, combined with technological advancements that produce innovative materials with superior properties, further intensifies the competitive landscape. For instance, advancements in glass technology have led to the development of thin and lightweight glass variants, directly competing with polycarbonate resin in applications like automotive glazing.

Polycarbonate Resinmarket: Ecosystem

The medical application is projected to be fastest growing application in the Polycarbonate resin market during the forecast period.

Applications of polycarbonate resin in the medical industry continue to grow with new innovations and technologies; it is the fastest-growing application. Currently, polycarbonate resins are used in the medical industry in various applications such as dialyzers, injection systems, baby incubators, dental or surgical instruments, disinfectant systems, and patient monitoring systems. One significant application of polycarbonate in the medical field is for the manufacture of medical device components. Polycarbonate's biocompatibility ensures that it does not elicit adverse reactions when in contact with biological tissues or fluids, making it suitable for implants, surgical instruments, catheters, and diagnostic equipment. Its transparency allows for easy visualization during surgical procedures and medical imaging, enhancing accuracy and efficiency.

Asia Pacific is the fastest growing in the Polycarbonate resin market, in terms of value.

The Asia-Pacific region asserts its dominance in the polycarbonate resin market through a multitude of factors. To begin, the swift industrialization in nations like China, India, and Japan has ignited a surge in demand for polycarbonate resin across various sectors such as automotive, electronics, and construction, solidifying its pivotal role in the regional economy. Additionally, the burgeoning population in the Asia-Pacific region has fueled a heightened consumption of consumer goods, many of which heavily rely on polycarbonate resin for their production, further cementing its market supremacy. Furthermore, supportive government policies and substantial investments in infrastructure development have acted as key drivers, propelling the demand for polycarbonate resin-based products to unprecedented levels. Moreover, the presence of well-established manufacturers and a robust supply chain network has fortified the region's leadership position in the global market. Lastly, the Asia-Pacific region's strong emphasis on sustainability and the recyclability of polycarbonate resin resonates with its dedication to eco-friendly solutions, fostering widespread adoption and continual market expansion.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The top market players involved in the polycarbonate resin business are SABIC Innovative Plastics (US), Covestro (Germany), TEIJIN LTD. (Japan), Mitsubishi Engineering-Plastics Corporation (Japan), and LG Chem (South Korea). These players have established a strong foothold in the market by adopting strategies, such as expansions, joint ventures, and mergers & acquisitions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2021–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Volume (KiloTons) and Value (USD Billion) |

|

Segments |

Application And Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

The top market players involved in the polycarbonate resin business are SABIC Innovative Plastics (US), Covestro (Germany), TEIJIN LTD. (Japan), Mitsubishi Engineering-Plastics Corporation (Japan), and LG Chem (South Korea). |

The study categorizes the PC resin market based on application & region

By application:

- Electrical & Electronics

- Optical Media

- Consumer

- Automotive

- Films & Sheets

- Packaging

- Medical

- Others

By Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In April 2024, Lotte Chemical formed a partnership with Neste. This partnership aims to replace fossil resources with renewable raw materials in the manufacturing of chemicals and plastics.

- In January 2024, Covestro launched the APEC 2045, a high heat copolycarbonate, specifically designed for medical devices. It offers biocompatibility, heat-resistance, transparency, and durability. Its high heat resistance property enables medical OEMs to significantly slash production time and cost, without sacrificing quality, performance, or appearance.

- In September 2023, Sabic announced a commercial operation of the polycarbonate plant with Sinopec, one of the largest integrated energy and chemical companies with upstream, midstream, and downstream operations in China. This joint venture is unlocking significant and mutual growth opportunities that complement the national agendas of Saudi Arabia and China.

Frequently Asked Questions (FAQ):

What is the current size of the global Polycarbonate resin market?

Global Polycarbonate resin market size is estimated to reach USD 20.1 billion by 2029 from USD 15.3 billion in 2024, at a CAGR of 5.5% during the forecast period.

Who are the winners in the global Polycarbonate resin market?

SABIC Innovative Plastics (US), Covestro (Germany), TEIJIN LTD. (Japan), Mitsubishi Engineering-Plastics Corporation (Japan), fall under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use product launch, expansions, and mergers & acquisitions as important growth tactics.

What is the recession on Polycarbonate resin manufacturers?

During recession, the Polycarbonate resin market witnesses reduced consumer spending, leading to decreased demand. Manufacturers face challenges in adjusting production and distribution strategies amid intensified competition and limited investment in innovation.

What are some of the drivers in the market?

Increasing demand for automotive & electronics industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current market size for polycarbonate resin. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

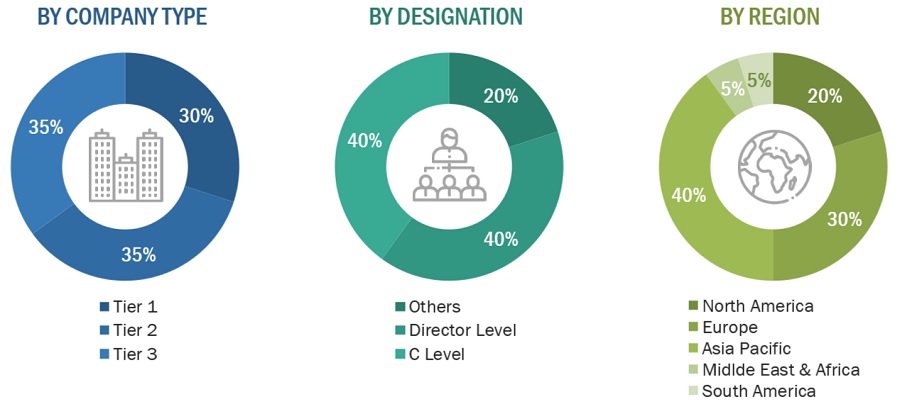

The polycarbonate resin market involves a variety of stakeholders across the value chain, including raw material suppliers, manufacturers, and end-users. For this study, both the supply and demand sides of the market were interviewed to gather qualitative and quantitative information. Key opinion leaders from various end-use sectors were interviewed from the demand side, while manufacturers and associations were interviewed from the supply side.

Primary interviews helped to gather insights on market statistics, revenue data, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to identify trends related to grade, application, end-use industries, and region. C-level executives from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand their perspective on suppliers, products, and component providers, which will affect the overall market.

Breakdown of primary interviews

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Mitsubishi Engineering-Plastics Corporation |

Sales Manager |

|

Sabic |

Sales Manager |

|

Bayer |

Technical Sales Manager |

|

Teijin Ltd. |

Marketing Manager |

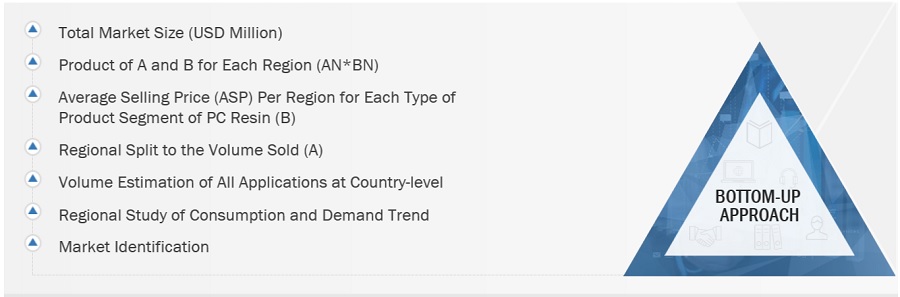

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for polycarbonate resin for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on application, and country were determined using secondary sources and verified through primary sources.

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed input and analysis and presented in this report.

Polycarbonate Resin Market: Bottum-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Polycarbonate Resin Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of polycarbonate resin and their applications.

Market Definition

Polycarbonate (PC) is a transparent thermoplastic featuring carbonate functional groups. Polycarbonate is one of the most dominant engineering plastics with properties, such as high impact strength, electrical non-conductivity, good heat resistance, high transparency, and flame retardancy, which make polycarbonate resin a versatile material and are responsible for its continuously expanding use in various applications. The high recyclability of polycarbonate resin also makes it an environmentally friendly material.

Key Stakeholders

- Manufacturers of polycarbonate resin products

- Raw Material Suppliers

- Manufacturers In End-use Industries

- Traders, Distributors, and Suppliers

- Regional Manufacturers’ Associations

- Government and regional Agencies and Research Organizations

Objectives of the Study:

- To analyze and forecast the size of the polycarbonate resin market in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze and forecast the market by type, application and end-use industry, and region.

- To forecast the size of the market with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders.

- To analyze competitive developments in the market, such as investment & expansion, joint venture, partnership, and merger & acquisition

- To strategically profile key players and comprehensively analyze their market shares and core competencies2.

Notes: Micromarkets1 are the sub-segments of the polycarbonate resin market included in the report.

Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report.

- Additional country-level analysis of the Polycarbonate resin market

- Profiling of additional market players (up to 3)

Growth opportunities and latent adjacency in Polycarbonate Resin Market

Interested in Polycarbonate report with coverage on Vietnam and Thailand

Market size and forecasts.

Information on silicone materials in polycarbonate for automotive, electronics market

Polycarbonate Resin Market by Applications (Automotive, Consumer, Electrical & Electronic, Medical, Optical Media, and Packaging