Polycarbonate Films Market by Type (Optical, Flame Retardant, and Weatherable), End-Use Industry (Electrical & Electronics, Transportation, and Medical Packaging), and Region (APAC, NA, EU, SA and MEA) - Global Forecast to 2022

Polycarbonate Films Market Size And Forecast

[143 Pages Report] Polycarbonate Films Market size was USD 1.04 Billion in 2016 and is projected to reach USD 1.52 Billion by 2022, at a CAGR of 6.6% during the forecast period. In this study, 2016 has been considered as the base year and the forecast period considered is between 2017 and 2022 for estimating the polycarbonate films market size.

Objectives of the Study

- To estimate and forecast the polycarbonate films market size in terms of value and volume

- To identify and analyze the key drivers, restraints, challenges, and opportunities influencing the polycarbonate films market

- To define, describe, and forecast the polycarbonate films market by type, end-use industry, and region

- To forecast the polycarbonate films market size based on key regions, namely, North America, Europe, APAC, South America, and the Middle East & Africa

- To estimate and forecast the polycarbonate films market at the country-level in each of the regions

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of the submarkets to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To track and analyze competitive developments such as expansion, new product development, and joint venture in the market

- To strategically identify and profile the key players and comprehensively analyze their core competencies

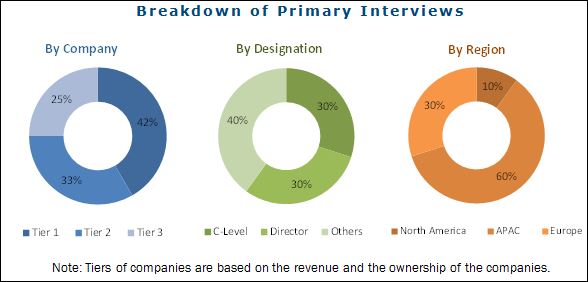

This research study involves the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the polycarbonate films market. The primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to different segments of the industry’s supply chain. The bottom-up approach has been used to estimate the size of polycarbonate films market on the basis of type, end-use industry, and region in terms of volume and value. The top-down approach has been implemented to validate the market size in terms of volume and value. With the data triangulation procedure and validation of data through primary interviews, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

Major Players

The polycarbonate films market is led by major players, such as SABIC (Saudi Arabia), Covestro (Germany), Teijin Limited (Japan), 3M Company (US), Suzhou Omay Optical Materials (China), and Mitsubishi Gas Chemical Company (Japan). These key players have adopted various organic and inorganic strategies to maintain their shares in the polycarbonate films market.

Target Audience:

- Manufacturers of Polycarbonate Films and Resins

- Traders, Distributors, and Suppliers of Polycarbonate Films and Resins

- End-use Market Participants of Different Segments of the Polycarbonate films Market

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

“This study answers several questions for stakeholders, primarily which market segments they need to focus upon in the next two to five years to prioritize their efforts and investments.”

Scope of the Report:

This research report categorizes the polycarbonate films market on the basis of the type, end-use industry, and region. It forecasts revenue growth and analyzes the trends in each of the submarkets.

Polycarbonate films Market, based on Type:

- Optical

- Flame Retardant

- Weatherable

- Others

Polycarbonate films Market, based on End-use Industry:

- Electrical & Electronics

- Transportation

- Medical Packaging

- Others

Polycarbonate films Market, based on Region:

-

APAC

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Malaysia

- Rest of APAC

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

South America

- Brazil

- Argentina

- Rest of South America

-

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

These segments are further described in detail in the report. The value and volume forecasts for these segments have also been provided till 2022.

Available Customizations:

The following customization options are available in the report:

- Company Information

Analysis and profiles of additional global as well as regional market players (up to three)

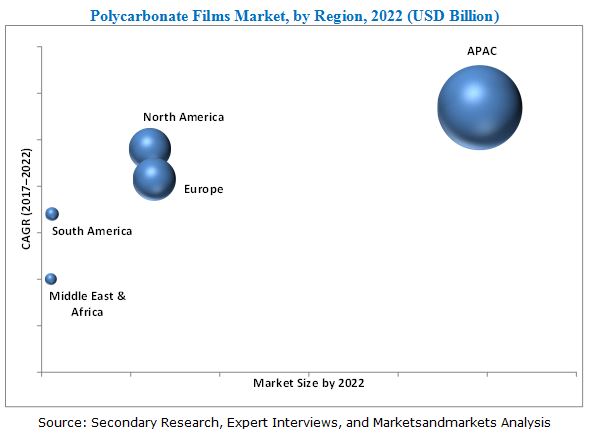

The global polycarbonate films market is estimated at USD 1.10 Billion in 2017 and is projected to reach USD 1.52 Billion by 2022, at a CAGR of 6.6% between 2017 and 2022. The high demand for polycarbonate films from the electrical & electronics industry, especially in APAC, and the continuous expansions and new product developments undertaken by the major companies are the key factors driving the global polycarbonate films market.

Optical polycarbonate films is projected to be the most dominant type of polycarbonate films between 2017 and 2022. They are widely preferred for the display and lighting applications in the electrical & electronics industry. Optical polycarbonate films are increasingly used in LCDs for consumer electronics as these films have superior optical properties. In addition, due to their excellent impact resistance, these films are also preferred for other applications such as overlays and automotive.

Electrical & electronics is the largest end-use industry of polycarbonate films. This can be attributed to the growing number of consumer electronics which has resulted in an increased demand for polycarbonate films in it. Due to the superior properties of polycarbonate films, such as impact resistance, good thermal properties, optical clarity, and dimensional stability, these films are widely preferred in this end-use industry.

APAC is the global forerunner in the polycarbonate films market, in terms of value and volume, and this trend is expected to continue till 2022. Countries in this region such as China, India, Japan, South Korea, Taiwan, Thailand, and Malaysia are witnessing significant increase in the use of polycarbonate films in industries such as electrical & electronics and transportation. The growth of the APAC polycarbonate films market is also attributed to the increasing urbanization and the growing population which is increasing the need for consumer electronics and automotive in the region. This, in turn, is boosting the consumption of polycarbonate films in the consumer electronics and automotive applications in this region. China is the fastest-growing market and this trend is estimated to continue till 2022.

Though the polycarbonate films market is expected to witness rapid growth globally, the major restraint for this market is the setting up of a polycarbonate resins plant. Hence, the availability of polycarbonate resin is uncertain in every region. Therefore, various polycarbonate films manufacturers have shut their plants or reduced the production capacities.

SABIC (Saudi Arabia), Covestro (Germany), Teijin Limited (Japan), 3M Company (US), Suzhou Omay Optical Materials (China), and Mitsubishi Gas Chemical Company, Inc. (Japan) are the leading players in the polycarbonate films market. These companies have adopted various organic and inorganic growth strategies, such as expansions, joint venture, and new product launches, to enhance their shares in the polycarbonate films market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in Polycarbonate Films Market

4.2 Market, By Type

4.3 APAC Market, By Country and Type

4.4 Market, Developing vs Developed Countries

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use of Polycarbonate Films in Various Industries

5.2.1.2 Growing Demand for Recyclable Plastics

5.2.2 Restraints

5.2.2.1 Difficulty of Setting Up Polycarbonate Resin Plant

5.2.3 Opportunities

5.2.3.1 Electrification in the Automotive Industry

5.2.4 Challenges

5.2.4.1 Shortage of Raw Materials

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Trends and Forecast of GDP

6 Polycarbonate Films Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Optical PC Films

6.3 Flame Retardant PC Films

6.4 Weatherable PC Films

6.5 Others

7 Polycarbonate Films Market, By End-Use Industry (Page No. - 46)

7.1 Introduction

7.2 Electrical & Electronics

7.3 Transportation

7.4 Medical Packaging

7.5 Others

8 Polycarbonate Films Market, By Region (Page No. - 51)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.2 Japan

8.2.3 South Korea

8.2.4 India

8.2.5 Taiwan

8.2.6 Thailand

8.2.7 Malaysia

8.2.8 Rest of APAC

8.3 Europe

8.3.1 Germany

8.3.2 France

8.3.3 Spain

8.3.4 UK

8.3.5 Italy

8.3.6 Rest of Europe

8.4 North America

8.4.1 US

8.4.2 Canada

8.4.3 Mexico

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 UAE

8.5.3 South Africa

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 104)

9.1 Introduction

9.2 Competitive Scenario

9.2.1 Expansion

9.2.2 New Product Development

9.2.3 Joint Venture

9.3 Market Ranking Analysis

10 Company Profiles (Page No. - 109)

10.1 SABIC

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Recent Developments

10.1.4 SWOT Analysis

10.1.5 MnM View

10.2 Covestro

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Recent Developments

10.2.4 SWOT Analysis

10.2.5 MnM View

10.3 3M Company

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 SWOT Analysis

10.3.4 MnM View

10.4 Teijin Limited

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Recent Developments

10.4.4 SWOT Analysis

10.4.5 MnM View

10.5 Mitsubishi Gas Chemical Company

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.5.4 SWOT Analysis

10.5.5 MnM View

10.6 Suzhou Omay Optical Materials

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 Recent Developments

10.7 RoWland Technologies

10.7.1 Business Overview

10.7.2 Products Offered

10.8 Macdermid Autotype

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 Recent Developments

10.9 MGC Filsheet

10.9.1 Business Overview

10.9.2 Products Offered

10.10 Dr. Dietrich Müller GmbH

10.10.1 Business Overview

10.10.2 Products Offered

10.11 Excelite

10.11.1 Business Overview

10.11.2 Products Offered

10.12 Sichuan Longhua Film

10.12.1 Business Overview

10.12.2 Products Offered

10.13 Wiman Corporation

10.13.1 Business Overview

10.13.2 Products Offered

11 Appendix (Page No. - 133)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (118 Tables)

Table 1 Trends and Forecast of GDP, 2015–2022 (USD Billion)

Table 2 Polycarbonate Films Market Size, By Type, 2015–2022 (USD Million)

Table 3 Polycarbonate Film Market Size, By Type, 2015–2022 (Million Square Meter)

Table 4 Optical Polycarbonate Film Market Size, By Region, 2015–2022 (USD Million)

Table 5 Optical Polycarbonate Film Market Size, By Region, 2015–2022 (Million Square Meter)

Table 6 Flame Retardant Polycarbonate Film Market Size, By Region, 2015–2022 (USD Million)

Table 7 Flame Retardant Polycarbonate Film Market Size, By Region, 2015–2022 (Million Square Meter)

Table 8 Weatherable Polycarbonate Film Market Size, By Region, 2015–2022 (USD Million)

Table 9 Weatherable Polycarbonate Film Market Size, By Region, 2015–2022 (Million Square Meter)

Table 10 Other Polycarbonate Film Market Size, By Region, 2015–2022 (USD Million)

Table 11 Other Polycarbonate Film Market Size, By Region, 2015–2022 (Million Square Meter)

Table 12 Polycarbonate Film Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 13 Polycarbonate Film Market Size in Electrical & Electronics, By Region, 2015–2022 (USD Million)

Table 14 Polycarbonate Film Market Size in Transportation, By Region, 2015–2022 (USD Million)

Table 15 Polycarbonate Film Market Size in Medical Packaging, By Region, 2015–2022 (USD Million)

Table 16 Polycarbonate Film Market Size in Other End-Use Industries, By Region, 2015–2022 (USD Million)

Table 17 Polycarbonate Film Market Size, By Region, 2015–2022 (USD Million)

Table 18 Polycarbonate Film Market Size, By Region, 2015–2022 (Million Square Meter)

Table 19 APAC: Polycarbonate Film Market Size, By Country, 2015–2022 (USD Million)

Table 20 APAC: By Market Size, By Country, 2015–2022 (Million Square Meter)

Table 21 APAC: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 22 APAC: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 23 APAC: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 24 China: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 25 China: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 26 China: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 27 Japan: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 28 Japan: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 29 Japan: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 30 South Korea: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 31 South Korea: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 32 South Korea: Polycarbonate Film Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 33 India: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 34 India: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 35 India: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 36 Taiwan: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 37 Taiwan: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 38 Taiwan: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 39 Thailand: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 40 Thailand: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 41 Thailand: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 42 Malaysia: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 43 Malaysia: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 44 Malaysia: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 45 Rest of APAC: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 46 Rest of APAC: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 47 Rest of APAC: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 48 Europe: Polycarbonate Film Market Size, By Country, 2015–2022 (USD Million)

Table 49 Europe: By Market Size, By Country, 2015–2022 (Million Square Meter)

Table 50 Europe: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 51 Europe: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 52 Europe: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 53 Germany: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 54 Germany: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 55 Germany: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 56 France: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 57 France: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 58 France: Polycarbonate Film Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 59 Spain: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 60 Spain: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 61 Spain: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 62 UK: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 63 UK: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 64 UK: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 65 Italy: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 66 Italy: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 67 Italy: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 68 Rest of Europe: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 69 Rest of Europe: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 70 Rest of Europe: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 71 North America: Polycarbonate Film Market Size, By Country, 2015–2022 (USD Million)

Table 72 North America: By Market Size, By Country, 2015–2022 (Million Square Meter)

Table 73 North America: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 74 North America: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 75 North America: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 76 US: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 77 US: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 78 US: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 79 Canada: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 80 Canada: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 81 Canada: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 82 Mexico: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 83 Mexico: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 84 Mexico: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 85 Middle East & Africa: Polycarbonate Film Market Size, By Country, 2015–2022 (USD Million)

Table 86 Middle East & Africa: By Market Size, By Country, 2015–2022 (Million Square Meter)

Table 87 Middle East & Africa: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 88 Middle East & Africa: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 89 Middle East & Africa: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 90 Saudi Arabia:Polycarbonate Film By Market Size, By Type, 2015–2022 (USD Million)

Table 91 Saudi Arabia: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 92 Saudi Arabia: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 93 UAE: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 94 UAE: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 95 UAE: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 96 South Africa: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 97 South Africa: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 98 South Africa: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 99 Rest of Middle East & Africa: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 100 Rest of Middle East & Africa: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 101 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 102 South America: Polycarbonate Film Market Size, By Country, 2015–2022 (USD Million)

Table 103 South America: By Market Size, By Country, 2015–2022 (Million Square Meter)

Table 104 South America: By Market Size, By Type, 2015–2022 (USD Million)

Table 105 South America: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 106 South America: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 107 Brazil: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 108 Brazil: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 109 Brazil: Polycarbonate Film Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 110 Argentina: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 111 Argentina: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 112 Argentina: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 113 Rest of South America: Polycarbonate Film Market Size, By Type, 2015–2022 (USD Million)

Table 114 Rest of South America: By Market Size, By Type, 2015–2022 (Million Square Meter)

Table 115 Rest of South America: Polycarbonate Film Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 116 Expansion, 2012–2017

Table 117 New Product Development, 2012–2017

Table 118 Joint Venture, 2012–2017

List of Figures (37 Figures)

Figure 1 Polycarbonate Films: Market Segmentation

Figure 2 Polycarbonate Film Market: Research Design

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Polycarbonate Film Market: Data Triangulation

Figure 6 Optical Polycarbonate Film to Be Largest Type During the Forcast Period

Figure 7 Electrical & Electronics to Be Largest End-Use Industry for Polycarbonate Film Market

Figure 8 APAC Was the Largest Polycarbonate Film Market in 2016

Figure 9 Electrical & Electronics Industry to Drive the Demand of Polycarbonate Films During the Forecast Period

Figure 10 Optical Polycarbonate Films to Be Largest Type

Figure 11 Optical Polycarbonate Film Was Largest Type in APAC

Figure 12 China to Emerge as Most Lucrative Polycarbonate Film Market

Figure 13 Drivers, Restraints, Opportunities, and Challenges in Polycarbonate Film Market

Figure 14 Porter’s Five Forces Analysis

Figure 15 GDP Trends of Major Countries, 2016

Figure 16 Optical Polycarbonate Films to Lead Market

Figure 17 APAC is Largest Optical Polycarbonate Film Market

Figure 18 Electrical & Electronics to Be Fastest-Growing End-Use Industry

Figure 19 APAC is Largest Market in Electrical & Electronics End-Use Industry

Figure 20 APAC Market to Register Highest CAGR Between 2017 and 2022

Figure 21 APAC Polycarbonate Film Market Snapshot

Figure 22 European Polycarbonate Film Market Snapshot

Figure 23 North American Polycarbonate Film Market Snapshot

Figure 24 Saudi Arabia to Register High Growth in Polycarbonate Film Market

Figure 25 South American Polycarbonate Film Market Snapshot

Figure 26 Companies Adopted Expansion as the Key Growth Strategy Between 2012 and 2017

Figure 27 Market Ranking of Key Players in 2016

Figure 28 SABIC: Company Snapshot

Figure 29 SABIC: SWOT Analysis

Figure 30 Covestro: Company Snapshot

Figure 31 Covestro: SWOT Analysis

Figure 32 3M Company: Company Snapshot

Figure 33 3M Company: SWOT Analysis

Figure 34 Teijin Limited: Company Snapshot

Figure 35 Teijin Limited: SWOT Analysis

Figure 36 Mitsubishi Gas Chemical Company: Company Snapshot

Figure 37 Mitsubishi Gas Chemical Company: SWOT Analysis

Growth opportunities and latent adjacency in Polycarbonate Films Market