Engineering Plastics Market

Engineering Plastics Market by Type (Acrylonitrile Butadiene Styrene (ABS), Polyamide, Polycarbonate, Thermoplastic Polyester (PET & PBT), Polyacetal, and Fluoropolymer), End-use Industry, and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The engineering plastics market is expected to reach USD 130.98 billion by 2030 from USD 107.17 billion in 2025, at a CAGR of 4.1% during the forecast period. High-performance engineering plastics, including polyamide, polycarbonate, and PEEK, are suited for automotive, electrical & electronics, consumer appliances, and industrial applications due to their mechanical strength, thermal stability, and chemical resistance. The demand for lightweight, fuel-efficient, and durable components in the automotive industry is a key driver of market growth. Additionally, the increasing need for lightweight and high-performance materials, coupled with growing industrialization in emerging economies and the adoption of advanced polymer processing technologies, contributes to market expansion. Furthermore, the growth of the engineering plastics market is supported by government commitments to promote sustainable and environmentally friendly materials.

KEY TAKEAWAYS

-

BY TYPEThe engineering plastics market is segmented by type into acrylonitrile butadiene styrene (ABS), polyamide, polycarbonate, thermoplastic polyester (PET & PBT), polyacetal, fluoropolymer, and other types. Each type delivers distinct advantages, including toughness, heat resistance, chemical resistance, and dimensional stability, making it suitable for a wide range of industrial and consumer applications.

-

BY END-USE INDUSTRYKey end-use industries include automotive & transportation, consumer appliances, electrical & electronics, industrial & machinery, and packaging. Demand is driven by lightweighting in vehicles, miniaturization in electronics, and regulatory compliance in sensitive sectors.

-

BY REGIONAsia Pacific is expected to be the fastest-growing region, driven by rapid industrialization, automotive production, and electronics manufacturing.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, BASF, Covestro AG, Celanese Corporation, DuPont, and Syensqo entered into a number of agreements, partnerships, product launches, and expansions to cater to the growing demand for engineering plastics across innovative applications.

The engineering plastics industry is anticipated to expand rapidly in the coming years, driven by significant advancements in material science and increasing demand across diverse sectors. Due to their superior mechanical strength, thermal resistance, and design flexibility, engineering plastics are increasingly replacing metals and glass. Their lightweight yet long-lasting nature has made them a necessity in applications ranging from automotive and transportation to electrical and electronics, consumer appliances, and industrial applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business arises from customer trends or market disruptions. Hotbets are the clients of engineering plastics manufacturers, and target applications, such as automotive components, electronics, and consumer appliances, are the end users. Shifts in these markets, driven by trends like lightweighting, sustainability, and high-performance requirements, directly influence the revenues of end users. Changes in end-user revenue, in turn, affect the revenues of hotbets, ultimately impacting the overall sales and growth of manufacturers of engineering plastics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for engineering plastics in lightweight automotive and electric vehicles

-

Growth in electronics and electrical industries

Level

-

Fluctuating raw material prices

-

Competition from alternative materials and limited infrastructure

Level

-

Growing demand for biocompatible engineering plastics in medical devices

-

Development of high-performance specialty grades

Level

-

Balancing performance, sustainability, and processability

-

Global trade uncertainties

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for engineering plastics in lightweight automotive and electric vehicles

Engineering plastics, including polycarbonate (PC), polybutylene terephthalate (PBT), acrylonitrile butadiene styrene (ABS), polyamide (PA), and polyphenylene sulfide (PPS), offer exceptional strength, dimensional stability, corrosion-resistance, and weight reduction potential as alternative materials to metals. These polymers are incorporated into components, including battery systems, electronic-motor housing systems, inverter systems, and structural components, in various EVs to deliver significant safety mechanisms, enhanced thermal resistance, and improved energy efficiency. Some critical advantages of precision-molded plastic components include the ability to create complex geometries and multi-functional components, resulting in lower assembly costs. The US Department of Energy (DOE) recently published that reducing weight by 10% can increase fuel efficiency by 6–8%. In addition, over 17.3 million EVs were produced globally in 2024, attesting to the rapid adoption of lightweight, high-performance materials. For these reasons, the continued trend toward lightweighting in the automotive market is one of the strongest market drivers for engineering plastics.

Restraint: Fluctuating raw material prices

High-performance polymers are produced from petrochemical feedstocks, which makes engineering plastics susceptible to fluctuations in crude oil prices. According to the US Energy Information Administration (EIA), the price of crude oil ranged from USD 62–75 per barrel last year. This volatility impacted the costs of various monomers, such as caprolactam (PA6), adipic acid, hexamethylene diamine (PA66), bisphenol-A (PC), and styrene-acrylonitrile. Resin prices typically follow oil price trends with a delay of about 4 to 8 weeks; however, sudden price increases can lead to expenses climbing by USD 500–800 per ton, which negatively affects profitability. This unpredictability is especially challenging for cost-sensitive industries, including automotive, electronics, and consumer appliances.

Opportunity: Growing demand for biocompatible engineering plastics in medical devices

Biocompatible engineering polymers are essential for the advancement of healthcare technologies. Materials such as PEEK, PPS, PSU, and medical-grade polyamide are increasingly utilized in surgical instruments, orthopedic and dental implants, prosthetics, catheters, dialysis systems, and diagnostic devices. Their popularity stems from their strength, chemical resistance, compatibility with sterilization processes, and safety for tissues. The adoption of these materials is further enhanced by patient-specific solutions made possible through 3D printing, micro-molding, and advanced polymer chemistry. Safety and regulatory approval, as outlined in ISO 10993, FDA, and EMA standards, contribute to market growth in this sector.

Challenge: Balancing performance, sustainability, and processability

Achieving a balance between processability, sustainability, and performance is a challenge for the global engineering plastics industry. High-performance plastics with superior mechanical, thermal, and chemical qualities, such as polycarbonate (PC), polyamide (PA), and ABS, are extensively utilized in packaging, electronics, automotive, and aerospace applications. However, with 220 million tons of plastic waste expected worldwide in 2024, of which one-third is unregulated, environmental concerns are growing (OECD, 2024). Further, the amount of plastic waste generated in India increased from 1.57 million tons in 2016–17 to 9.3 million tons in 2024. Additives and fillers in formulations further limit recycling and often result in a move to metals or commodity plastics.

Engineering Plastics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

First production vehicle (86 GRMN sports car) with plasma-coated polycarbonate rear quarter window, developed with SABIC’s LEXAN resin | 50% lighter than conventional glass, superior durability, global regulatory compliance, and improved driver visibility |

|

GPC analysis of nylon 6, nylon 12, polycarbonate, polyacetal, and polysulfone to determine molecular weight distribution | Provides accurate polymer characterization, predicts mechanical performance and degradation, and supports advanced engineering applications |

|

Supplied TRISTAR PC-10R-GY339(V) to replace polycarbonate and support old tooling with on-site technical and inventory services | High gloss, UV resistant, impact and chemical resistant, UL 94 V-2 enables easier molding, reliable supply, and new application opportunities |

|

Makrolon outdoor polycarbonate with EMI shielding for PV and ESS inverter enclosures, replacing metal | Lightweight, durable, UV- and impact-resistant, flame-retardant, cost-effective, reliable, and eco-friendly |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The engineering plastics market ecosystem includes raw material suppliers, engineering plastic manufacturers, distributors, and end users. Raw material suppliers offer essential base chemicals. Engineering plastic manufacturers produce engineering plastics of different types to meet the needs of numerous end-use industries without compromising regulatory requirements. Distributors bring market access through a proper supply chain. The automotive & transportation, electrical & electronics, industrial & machinery, packaging, and other end-use industries employ engineering plastics for superior mechanical strength, thermal resistance, and design flexibility, enabling reliable performance in demanding applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Engineering Plastics Market, by Type

Acrylonitrile butadiene styrene (ABS) led the engineering plastics market in 2024 because of its robust attributes of toughness, durability, and processability. Its superior impact resistance, dimensional stability, and cost-effectiveness rendered it a favored material in automotive, electrical and electronics, and consumer goods applications. The increasing desire for lightweight, durable vehicle components and aesthetically pleasing, useful consumer products has further accelerated acceptance. ABS' capacity for facile molding into intricate forms, along with its recyclability and consistent performance, reinforced its dominance in the engineering plastics sector.

Engineering Plastics Market, by End-use Industry

In 2024, the automotive and transportation industry led the engineering plastics market due to the increasing demand for lightweight, durable, and fuel-efficient materials. Engineering plastics are being utilized in a variety of applications to reduce vehicle weight and enhance fuel economy, while also complying with strict emissions standards. Their high mechanical strength, heat resistance, and design flexibility enable these materials to be used in the production of components for interiors, exteriors, and under-the-hood applications. The growing adoption of electric and hybrid vehicles has further accelerated the use of engineering plastics in structural parts, electrical components, and battery casings, solidifying this segment's dominant position in the market.

REGION

Asia Pacific to be the fastest-growing region in the global engineering plastics market during the forecast period

The Asia Pacific is the fastest-growing region in the engineering plastics market, driven by swift industrialization, urbanization, and enhanced manufacturing capacity. Countries such as China, India, Japan, and South Korea are significant contributors, propelled by the increasing demand in the automotive, electrical and electronics, and construction industries. The growing utilization of lightweight, resilient materials in automotives, consumer appliances, and electrical & electronics facilitates market growth. Moreover, governmental programs advocating for electric vehicles, renewable materials, and sophisticated manufacturing bolster regional development. The robust consumer markets and resilient supply chains position the Asia Pacific as a key hub for the demand and innovation of engineering plastics.

Engineering Plastics Market: COMPANY EVALUATION MATRIX

BASF SE (Star) dominates the engineering plastics market matrix due to its substantial global presence, varied product offerings, and robust research and development capabilities. The corporation facilitates widespread use of high-performance polymers in the automotive, electronics, construction, and industrial sectors, solidifying its leadership position. Kingfa Sci.&Tech. Co., Ltd. (Emerging Leader) continues to grow by providing innovative and cost-effective engineered plastic solutions across a limited range of industries, such as automotive lightweighting, consumer applications, and sustainably engineered materials. BASF maintains its position in the leader’s quadrant by focusing on scalability and innovation, while Kingfa is gaining significant momentum and moving up into this quadrant as well.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 103.02 BN |

| Market Forecast in 2030 (Value) | USD 130.98 BN |

| CAGR | 4.1% |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • Type: Acrylonitrile Butadiene Styrene (ABS), Polyamide, Polycarbonate, Thermoplastic Polyester (PET & PBT), Polyacetal, Fluoropolymer, and Other Types • End-use Industry: Automotive & Transportation, Consumer Appliances, Electrical & Electronics, Industrial & Machinery, Packaging, and Other End-use Industries |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Engineering Plastics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Engineering Plastics Manufacturer | • Detailed profiles of key engineering plastic producers (financials, product range, key strategies, developments) • Segment-wise demand mapping • Analysis of partnership & distribution networks | • Identified & profiled 20+ carbon fiber recycling companies • Identify regional market gaps and supply chain vulnerabilities • Target and prioritize high-value customer segments for business development • Detect sector-specific growth inflection points |

| Polyamide Manufacturer | • Comparative benchmarking of polyamide grades (PA6, PA66, specialty PA) by application • Mapping of major OEM and converter customers • Assessment of switching costs and regulatory risks | • Identify and forecast migration trends • Pinpoint value pockets and risk exposures from competing materials • Accelerate focus on high-margin niche applications |

| Acrylonitrile Butadiene Styrene (ABS) Manufacturer | • Competitive analysis of ABS • End-use diversification and risk assessment • Forecast of sustainability-driven ABS trends | • Enable entry into fast-growing segments (e-mobility, advanced recycling) • Uncover untapped value streams and new market channels • Strengthen brand position with sustainability-linked solutions |

RECENT DEVELOPMENTS

- June 2025 : BASF launched Ultramid Advanced N3U42G6, a non-halogenated, flame-retardant polyphthalamide designed for high-voltage EV connectors.

- October 2024 : Celanese has expanded its presence in India with the opening of an India Technical Center in Silvassa and a Shared Service Center in Hyderabad.

- April 2024 : Covestro launched Makrolon RP, a new range of polycarbonates based on chemically recycled, mass-balanced post-consumer waste, developed in collaboration with Neste and Borealis.

- March 2024 : Covestro has inaugurated its first industrial-scale plant for polycarbonate copolymers in Antwerp, featuring a world-first solvent-free melt process with a new reactor concept that enables rapid market launch of customizable materials.

- March 2024 : BASF has appointed Bamberger Amco Polymers, M. Holland Company, Nexeo Plastics, and Polimeros Nacionales (exclusive to Mexico) as distribution partners for its engineering plastics in North America.

Table of Contents

Methodology

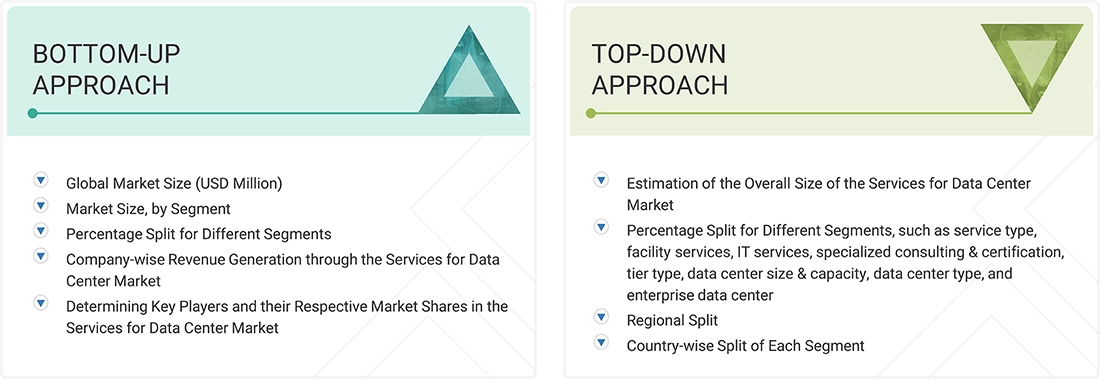

The study involved four major activities to estimate the current size of the global engineering plastics market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of engineering plastics through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the engineering plastics market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

The market for companies offering engineering plastics is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the engineering plastics market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the engineering plastics market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of engineering plastics offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

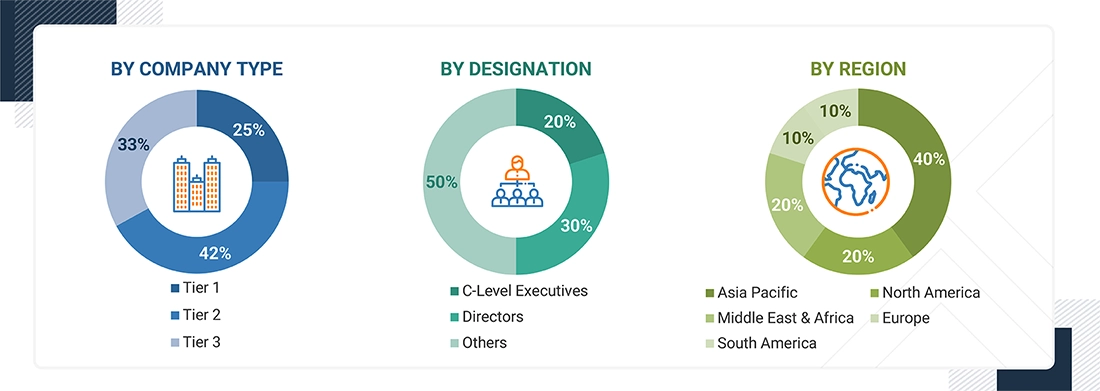

The following is the breakdown of primary respondents:

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 billion; Tier 2: USD 500 million–1 billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global engineering plastics market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Engineering plastics, or performance plastics, possess superior mechanical, thermal, and chemical resistance to commodity plastics. They are extensively utilized in situations where durability, safety, precision, and reliability are paramount. These materials offer enhanced properties, including elevated strength-to-weight ratios, resistance to impact and abrasion, dimensional stability, and durability against heat, chemicals, and wear, rendering them appropriate substitutes for metals, glass, and ceramics in structural and functional applications. Engineering plastics, acknowledged by organizations including the American Chemical Society (ACS), the Society of Plastics Engineers (SPE), and ASTM International, encompass materials such as Acrylonitrile Butadiene Styrene (ABS), Polyamide (PA), Polycarbonate (PC), Thermoplastic Polyester (PET & PBT), Polyacetal (POM), fluoropolymers, and various specialty polymers. The materials are developed and rigorously tested according to various global standards such as ISO 178 for flexural properties, ISO 527 for tensile properties, and ASTM D256 for impact resistance. Their versatility allows for lightweighting, energy efficiency, and freedom of design, allowing for use in the automotive and transportation, electrical and electronics, consumer appliances, industrial equipment, medical devices, and packaging sectors. Engineering plastics play an essential role in supporting innovation in many sectors, and their growing demand for high-performance, sustainable, and durable products.

Stakeholders

- To define, describe, and forecast the size of the global engineering plastics market, based on type, end-use industry, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, acquisitions, expansions, partnerships, and agreements in the engineering plastics market

- To provide the impact of AI/Gen AI on the market

Report Objectives

- Engineering Plastic Manufacturers

- Raw Material Suppliers

- Converters and Processors

- Distributors and Traders

- Industry Associations and Regulatory Bodies

- End Users

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Engineering Plastics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Engineering Plastics Market

Remi

Jun, 2019

General information on Engineering Plastics and Companies in the industry.

Frederik

Mar, 2014

Polymer markets that are prone to contaminations and thermal damage with good added value..

Tammy

Jun, 2019

Market entry opportunity in Electrophysiology Market, and competetive landscape .

Alberto

Feb, 2017

Report on engineering plastics market for Mexico.

soreq

Aug, 2019

Engineering plastics market report.

sobha

Jan, 2018

General information on Engineering Plastics Market .

Oskar

Nov, 2015

General information on Poland Engineering Plastics market .

K

Jul, 2014

General information on company certeria and price.

ANKIT

Jun, 2017

General information on Engineering Plastics and specifc focus on polyamides and polyester resins.

ANTÓNIO

Mar, 2013

data needed to understand Future prospects for Engineering Plastics Market for Europe only .

ANTÓNIO

Mar, 2013

Looking for the forecast information on engineering plastic market.

ANTÓNIO

Mar, 2013

Future prospects for engineering plastics in Europe.

ANTÓNIO

Mar, 2013

Future prospects for engineering plastics, constraints, European market/Query not ClearFTA .

Katherine

Mar, 2012

General market information on Engineered Plastics.