Polymer Concrete Market by Class (PMC, PC, PIC), Type (Epoxy, Polyester, Latex), Application (Containments, Pump Bases, Wastewater Containers), End-Use Industries (Infrastructures, Non-Residential Structures), and Region - Global Forecast to 2022

[160 Pages Report] Polymer Concrete Market size was valued at USD 417.4 Million in 2016 and is projected to reach USD 641.9 Million by 2022, at a CAGR of 7.5% during the forecast period. In this study, 2016 has been considered the base year and 2022 as the forecast year to estimate the polymer concrete market size.

The objectives of the study are:

- To analyze and forecast the global polymer concrete market, in terms of value and volume

- To provide detailed information about the key growth factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market on the basis of class, type, application, and end-use industry

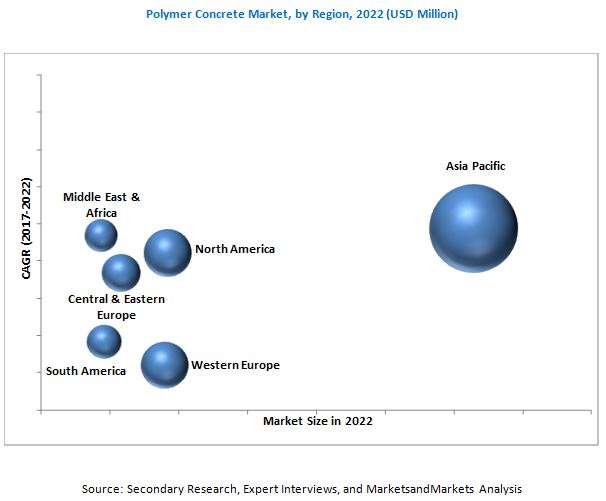

- To estimate and forecast the market size on the basis of six regions, namely, Western Europe, Central & Eastern Europe, Asia Pacific, North America, Middle East & Africa, and South America

- To estimate and forecast the polymer concrete market at country-level in each of the regions

- To analyze the market opportunities and competitive landscape of the market

- To analyze competitive developments such as new product launches & developments, expansions, mergers & acquisitions, and joint ventures & partnerships in the polymer concrete market

- To strategically identify and profile the key market players and analyze their core competencies*

Note: Core competencies* of the companies are determined in terms of their key developments and key strategies adopted by them to sustain their position in the market.

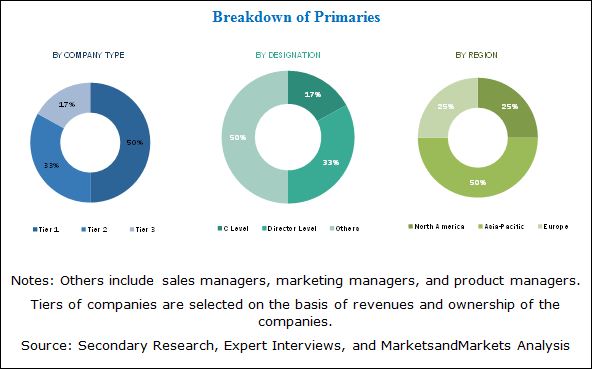

Different secondary sources, such as company websites, encyclopedias, directories, and databases such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource have been used to identify and collect information useful for this extensive, commercial study of the global polymer concrete market. Primary sources, including experts from related industries, have been interviewed to verify and collect critical information and assess prospects of the market. The top-down approach has been implemented to validate the market size in terms of value. With data triangulation procedures and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

The polymer concrete market has a diversified and established ecosystem of upstream players, such as raw material suppliers, and downstream stakeholders, such as manufacturers, vendors, end users, and government organizations.

This study answers several questions for stakeholders, primarily, which market segments they should focus upon during the next two to five years to prioritize their efforts and investments. These stakeholders include polymer concrete manufacturers such as BASF (Germany), Sika (Switzerland), Mapei (Italy), Fosroc (UK), Dow Chemical (US), SAUEREISEN (US), Kwik Bond Polymers (US), Dudick (US), ErgonArmor (US), and Crown Polymers (US).

Key Target Audience:

- Regional Manufacturers Associations

- Raw Material Manufacturers

- Traders, Distributors, and Suppliers of Polymer Concrete

- Government and Regional Agencies and Research Organizations

This study answers several questions for the stakeholders, primarily, which market segments they need to focus on during the next two to five years to prioritize their efforts and investments

Scope of the Report:

This research report categorizes the global polymer concrete market based on class, type, application, end-use industry, and region and forecasts revenue growth and provides an analysis of trends in each of the submarkets.

Based on Class:

- Polymer Modified Concrete (PMC)

- Polymer Resin Concrete (PC)

- Polymer Impregnated Concrete (PIC)

Each class is further described in detail in the report with value forecasts until 2022.

Based on Type:

- Epoxy

- Latex

- Acrylate

- Polyester

- Vinyl

- Furan

- Others (phenolic-formaldehyde, acetone-formaldehyde, carbamide)

Each type is further described in detail in the report with value and volume forecasts until 2022.

Based on Application:

- Containments

- Pump Bases

- Waste Containers

- Flooring Blocks

- Trench Drains

- Others (park benches & outdoor furniture, solid surface counter and overlays)

Each application segment is further described in detail in the report, with value forecasts until 2022.

Based on End-use Industry:

- Non-residential Structures

- Infrastructure

- Residential

Each end-use industry segment is further described in detail in the report, with value forecasts until 2022.

Based on Region:

- Asia Pacific

- North America

- Western Europe

- Central & Eastern Europe

- Middle East & Africa

- South America

Each region is further segmented by key countries, such as China, India, Japan, South Korea, Australia, the US, Mexico, Canada, Germany, the UK, Italy, France, Turkey, Russia, Saudi Arabia, the UAE, Argentina, and Brazil.

Available Customizations: The following customization options are available for the report:

- Company Information

Analysis and profiles of additional global as well as regional market players (up to three)

Customer Interested in this Report also can view

-

Polymer Modified Cementitious Coatings Market by Polymer Type (Acrylic Polymer and SBR Latex), Application (Non-Residential Buildings, Residential Buildings, and Public Infrastructures), and Region - Global Forecast to 2022

-

Cast Polymers Market by Type (Solid Surface, Engineered Stone, Cultured Marble), Material (Alumina Trihydrate, Calcium Carbonate, Resins, Natural Stone/Quartz), End User (Non-Residential, and Residential) and Region - Global Forecast to 2022

The global polymer concrete market is estimated at USD 448.1 Million in 2017 and is projected to reach USD 641.9 Million by 2022, at a CAGR of 7.5% between 2017 and 2022. The market is witnessing growth due to the growing awareness regarding the use of polymers in concrete due to their high performance and multifunctionality. Increase in spending on repair & maintenance and growth in infrastructural activities in emerging economies are some of the factors driving the market for polymer concrete.

Based on class, polymer modified concrete was the largest segment in 2016. Polymer modified concrete is required in less quantity and is cost effective in nature. It has process technology quite similar to the conventional cement concrete which makes it the largest segment in the polymer concrete market.

Based on type, epoxy was the largest segment of the global polymer concrete market in 2016. The large market size of epoxy is due to its great adhesion, high resistivity to chemicals, and appreciable fatigue and creep resistance. It is used for special applications such as industrial flooring, skid-resistant overlays in highways, exterior walls, and resurfacing material for deteriorated areas to give superior finishing. These factors are responsible for making epoxy-based polymer concrete the largest segment by type.

Containments was the largest application of polymer concrete in 2016. Growing industrialization gives a boost to chemical manufacturing industries which uses containments to store fluids. The growth in industrial sector due to high scale economic expansion, especially in Asia Pacific and Middle East & Africa regions, is expected to drive the polymer concrete market for containments.

Based on end-use industry, infrastructure was the largest segment of the polymer concrete market in 2016. Increasing use of polymer concrete in repair & maintenance activities and increase in building & construction operations to support the growing industrialization makes infrastructure the largest end-use industry for the polymer concrete market.

Asia Pacific was the largest market for polymer concrete in 2016. The regions flourishing manufacturing sector, ample availability of labor, competitive cost base, and increasing consumer demand are expected to drive the market for polymer concrete across the region. Furthermore, the influence of macroeconomic stimuli such as population growth, rise in disposable income, and most importantly the increasing investments for building & construction activities in Southeast Asian countries is also expected to make the region one of the most promising markets for polymer concrete.

The global polymer concrete market is witnessing significant growth. Factors restraining and challenging the growth of the polymer concrete market are the higher cost of polymer concrete than the traditional Portland cement concrete, high cost of raw materials used to manufacture polymer concrete, and unstable economic cycles.

BASF (Germany), Sika (Switzerland), Mapei (Italy), Fosroc (UK), and Dow Chemical (US) lead the global polymer concrete market. These players are the major polymer resin providers for polymer concrete and they are gaining a strong foothold in the market through their strategies of expansions & joint ventures to regenerate the trailing growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1.1 Top-Down Approach

2.2.1.2 Bottom-Up Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Polymer Concrete Market

4.2 Market, By Region

4.3 Market, By Type

4.4 Market in APAC, By Type and Country

4.5 Market Attractiveness

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview and Trends

5.4.1 Trends and Forecast of GDP

5.4.2 Trends of Construction Industry

6 Polymer Concrete Market, By Class (Page No. - 43)

6.1 Introduction

6.2 Polymer Modified Concrete (PMC)

6.3 Polymer Resin Concrete (PC)

6.4 Polymer Impregnated Concrete (PIC)

7 Polymer Concrete Market, By Type (Page No. - 48)

7.1 Introduction

7.2 Epoxy

7.3 Latex

7.4 Acrylate

7.5 Polyester

7.6 Vinyl

7.7 Furan

7.8 Others

8 Polymer Concrete Market, By Application (Page No. - 62)

8.1 Introduction

8.2 Containments

8.3 Pump Bases

8.4 Waste Containers

8.5 Flooring Blocks

8.6 Trench Drains

8.7 Others

9 Polymer Concrete Market, By End-Use Industry (Page No. - 72)

9.1 Introduction

9.2 Infrastructures

9.3 Non-Residential Structures

9.4 Residential Structures

10 Polymer Concrete Market, By Region (Page No. - 78)

10.1 Introduction

10.2 APAC

10.2.1 China

10.2.2 Japan

10.2.3 India

10.2.4 Australia

10.2.5 South Korea

10.2.6 Rest of APAC

10.3 Western Europe

10.3.1 Germany

10.3.2 Italy

10.3.3 France

10.3.4 UK

10.3.5 Rest of Western Europe

10.4 North America

10.4.1 US

10.4.2 Canada

10.4.3 Mexico

10.5 Central & Eastern Europe

10.5.1 Russia

10.5.2 Turkey

10.5.3 Rest of Central & Eastern Europe

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

10.7 Middle East & Africa

10.7.1 UAE

10.7.2 Saudi Arabia

10.7.3 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 127)

11.1 Overview

11.2 Competitive Scenario

11.2.1 Expansion

11.2.2 Merger & Acquisition

11.2.3 New Product Launch

11.2.4 Joint Venture

11.3 Market Ranking

12 Company Profiles (Page No. - 132)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 BASF

12.2 Sika

12.3 Mapei

12.4 Fosroc

12.5 DOW Chemical

12.6 Sauereisen

12.7 Kwik Bond Polymers

12.8 Dudick

12.9 Ergonarmor

12.10 Crown Polymers

12.11 Additional Company Profiles

12.11.1 Forte Composites

12.11.2 Basetek

12.11.3 Armorock

12.11.4 MEA Group

12.11.5 ACO Group

12.11.6 Ulma Group

12.11.7 Armorcast

12.11.8 Civilworks Group

12.11.9 DWD System

12.11.10 Jiangsu Polycon

12.11.11 Cornerstone Construction Material

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 152)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (114 Tables)

Table 1 Growth Trend in World GDP Per Capita, in USD (20162022)

Table 2 Contribution of Construction Industry to GDP By Country, 20142021 (USD Billion)

Table 3 PMC Market Size, By Class, 20152022 (USD Million)

Table 4 PMC Market Size, By Region, 20152022 (USD Million)

Table 5 Pc Market Size, By Region, 20152022 (USD Million)

Table 6 Pic Market Size, By Region, 20152022 (USD Million)

Table 7 Polymer Concrete Market Size, By Type, 20152022 (USD Million)

Table 8 Polymer Concretes Market Size, By Type, 20152022 (Kiloton)

Table 9 Epoxy Polymer Concretes Market Size, By Region, 20152022 (USD Million)

Table 10 Epoxy Polymer Concretes Market Size, By Region, 20152022 (Kiloton)

Table 11 Latex Polymer Concretes Market Size, By Region, 20152022, (USD Million)

Table 12 Latex Polymer Concretes Market Size, By Region, 20152022, (Kiloton)

Table 13 Acrylate Polymer Concretes Market Size, By Region, 20152022 (USD Million)

Table 14 Acrylate Polymer Concretes Market Size, By Region, 20152022 (Kiloton)

Table 15 Polyester Polymer Concretes Market Size, By Region, 20152022, (USD Million)

Table 16 Polyester Polymer Concretes Market Size, By Region, 20152022, (Kiloton)

Table 17 Vinyl Polymer Concretes Market Size, By Region, 20152022, (USD Million)

Table 18 Vinyl Polymer Concretes Market Size, By Region, 20152022, (Kiloton)

Table 19 Furan Polymer Concretes Market Size, By Region, 20152022 (USD Million)

Table 20 Furan Polymer Concretes Market Size, By Region, 20152022 (Kiloton)

Table 21 Others Polymer Concretes Market Size, By Region, 20152022 (USD Million)

Table 22 Others Polymer Concretes Market Size, By Region, 20152022 (Kiloton)

Table 23 Polymer Concretes Market Size, By Application, 20152022 (USD Million)

Table 24 Polymer Concretes Market Size in Containments Application, By Region, 20152022 (USD Million)

Table 25 By Market Size in Pump Bases Application, By Region, 20152022 (USD Million)

Table 26 Polymer Concretes Market Size in Waste Containers Application, By Region, 20152022 (USD Million)

Table 27 By Market Size in Flooring Blocks Application, By Region, 20152022 (USD Million)

Table 28 Polymer Concretes Market Size in Trench Drains Application, By Region, 20152022 (USD Million)

Table 29 By Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 30 Polymer Concretes Market Size, By End-Use Industry, 20152022 (USD Million)

Table 31 By Market Size in Infrastructures, By Region, 20152022 (USD Million)

Table 32 Polymer Concretes Market Size in Non-Residential Structures, By Region, 20152022 (USD Million)

Table 33 By Market Size in Residential Structures, By Region, 20152022 (USD Million)

Table 34 Polymer Concretes Market Size, By Region, 20152022 (USD Million)

Table 35 By Market Size, By Region, 20152022 (Kiloton)

Table 36 APAC: Polymer Concretes Market Size, By Country, 20152022 (USD Million)

Table 37 APAC: By Market Size, By Country, 20152022 (Kiloton)

Table 38 China: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 39 China: By Market, By Type, 20152022 (Kiloton)

Table 40 China: By Market, By End-Use Industry 20152022 (USD Million)

Table 41 Japan: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 42 Japan: By Market, By Type, 20152022 (Kiloton)

Table 43 Japan: By Market, By End-Use Industry 20152022 (USD Million)

Table 44 India: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 45 India: By Market, By Type, 20152022 (Kiloton)

Table 46 India: By Market, By End-Use Industry 20152022 (USD Million)

Table 47 Australia: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 48 Australia: By Market, By Type, 20152022 (Kiloton)

Table 49 Australia: By Marker, By End-Use Industry 20152022 (USD Million)

Table 50 South Korea: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 51 South Korea: By Market, By Type, 20152022 (Kiloton)

Table 52 South Korea: By Market, By End-Use Industry 20152022 (USD Million)

Table 53 Rest of APAC: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 54 Rest of APAC: By Market, By Type, 20152022 (Kiloton)

Table 55 Rest of APAC: By Market, By End-Use Industry 20152022 (USD Million)

Table 56 Western Europe: Polymer Concretes Market Size, By Country, 20152022 (USD Million)

Table 57 Western Europe: By Market Size, By Country, 20152022 (Kiloton)

Table 58 Germany: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 59 Germany: By Market, By Type, 20152022 (Kiloton)

Table 60 Germany: By Market, By End-Use Industry, 20152022 (USD Million)

Table 61 Italy: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 62 Italy: By Market, By End-Use Industry 20152022 (USD Million)

Table 63 France: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 64 France: By Market, By Type, 20152022 (Kiloton)

Table 65 France: By Market, By End-Use Industry, 20152022 (USD Million)

Table 66 UK: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 67 UK: By Market, By Type, 20152022 (Kiloton)

Table 68 UK: By Market, By End-Use Industry 20152022 (USD Million)

Table 69 Rest of Western Europe: Polymer Concretes Market Size, By Type, 20152022 (USD Million)

Table 70 Rest of Western Europe: By Market, By Type, 20152022 (Kiloton)

Table 71 Rest of Western Europe: By Market, By End-Use Industry 20152022 (USD Million)

Table 72 North America: Polymer Concretes Market Size, By Country, 20152022 (USD Million)

Table 73 North America: By Market Size, By Country, 20152022(Kiloton)

Table 74 US: Polymer Concrete Market, By End-Use Industry, 20152022 (USD Million)

Table 75 Canada: Polymer Concretes Market, By End-Use Industry 20152022 (USD Million)

Table 76 Mexico: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 77 Mexico: By Market, By Type, 20152022 (Kiloton)

Table 78 Mexico: By Market, By End-Use Industry, 20152022 (USD Million)

Table 79 Central & Eastern Europe: Polymer Concretes Market Size, By Country, 20152022 (USD Million)

Table 80 Central & Eastern Europe: By Market Size, By Country, 20152022 (Kiloton)

Table 81 Russia: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 82 Russia: By Market, By Type, 20152022 (Kiloton)

Table 83 Russia: By Market, By End-Use Industry, 20152022 (USD Million)

Table 84 Turkey: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 85 Turkey: By Market, By Type, 20152022 (Kiloton)

Table 86 Turkey: By Market, By End-Use Industry, 20152022 (USD Million)

Table 87 Rest of Central & Eastern Europe: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 88 Rest of Central & Eastern Europe: By Market, By Type, 20152022 (Kiloton)

Table 89 Rest of Central & Eastern Europe: By Market, By End-Use Industry, 20152022 (USD Million)

Table 90 South America: Polymer Concretes Market Size, By Country, 20152022 (USD Million)

Table 91 South America: By Market Size, By Country, 20152022 (Kiloton)

Table 92 Brazil: Polymer Concretes Market Size, By Type, 20152022 (USD Million)

Table 93 Brazil: By Market, By Type, 20152022 (Kiloton)

Table 94 Brazil: By Market, By End-Use Industry, 20152022 (USD Million)

Table 95 Argentina: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 96 Argentina: By Market, By Type, 20152022 (Kiloton)

Table 97 Argentina: By Market, By End-Use Industry, 20152022 (USD Million)

Table 98 Rest of South America: Polymer Concretes Market, By Type, 20152022 (USD Million)

Table 99 Rest of South America: By Market, By Type, 20152022 (Kiloton)

Table 100 Middle East & Africa: Polymer Concretes Market Size, By Country, 20152022 (USD Million)

Table 101 Middle East & Africa: By Market Size, By Country, 20152022 (Kiloton)

Table 102 UAE: By Market, By Type, 20152022 (USD Million)

Table 103 UAE: By Market, By Type, 20152022 (Kiloton)

Table 104 UAE: By Market, By End-Use Industry 20152022 (USD Million)

Table 105 Saudi Arabia: By Market, By Type, 20152022 (USD Million)

Table 106 Saudi Arabia: By Market, By Type, 20152022 (Kiloton)

Table 107 Saudi Arabia: By Market, By End-Use Industry 20152022 (USD Million)

Table 108 Rest of Middle East & Africa: By Market, By Type, 20152022 (USD Million)

Table 109 Rest of Middle East & Africa: By Market, By Type, 20152022 (Kiloton)

Table 110 Rest of Middle East & Africa: By Market, By End-Use Industry 20152022 (USD Million)

Table 111 Expansion, 20122017

Table 112 Merger & Acquisition, 2012-2017

Table 113 New Product Launch, 20122017

Table 114 Joint Venture, 20122017

List of Figures (56 Figures)

Figure 1 Polymer Concrete Market Segmentation

Figure 2 Polymer Concretes Market: Research Design

Figure 3 Polymer Concrete: Data Triangulation

Figure 4 PMC to Be the Largest Class in Polymer Concrete Market

Figure 5 Epoxy-Based Polymer Concrete Dominated Market in 2016

Figure 6 Containment to Be the Largest Application of Polymer Concrete

Figure 7 Infrastructures to Be the Largest End-Use Industry of Polymer Concrete

Figure 8 APAC Dominated the Global Polymer Concretes Market in 2016

Figure 9 Infrastructures Growth to Drive the Demand of this Market

Figure 10 APAC to Be the Fastest-Growing Market

Figure 11 Polyester to Be the Fastest-Growing Type

Figure 12 China Accounted for the Largest Share of Polymer Concrete Market in 2016

Figure 13 Polymer Concretes Market to Register High Growth in Japan and China Between 2017 and 2022, By Volume

Figure 14 Drivers, Restraints, Opportunities, and Challenges in Market

Figure 15 Porters Five Forces Analysis

Figure 16 PMC to Be the Largest and Fastest-Growing Segment of Market Between 2017 and 2022

Figure 17 APAC to Be the Largest PMC Market Between 2017 and 2022

Figure 18 Pc Market to Register Highest CAGR in APAC

Figure 19 Pic Market in North America to Register Highest CAGR

Figure 20 Epoxy to Dominate Polymer Concrete Market

Figure 21 APAC to Be the Largest Epoxy Polymer Concretes Market Between 2017 and 2022

Figure 22 APAC to Be the Largest Market for Latex Polymer Concrete Between 2017 and 2022

Figure 23 North America is the Fastest-Growing Acrylate Polymer Concrete Market Between 2017 and 2022

Figure 24 APAC to Be the Largest and Fastest-Growing Market for Polyester Polymer Concrete Between 2017 and 2022

Figure 25 APAC to Be the Largest and Fastest-Growing Market for Vinyl Polymer Concrete Between 2017 and 2022

Figure 26 Central & Eastern Europe to Be the Fastest-Growing Furan-Based Polymer Concretes Market Between 2017 and 2022

Figure 27 North America to Be the Fastest-Growing Polymer Concrete Market for Other Types Between 2017 and 2022

Figure 28 Containments to Dominate the Polymer Concretes Market Between 2017 and 2022

Figure 29 APAC to Be the Largest Polymer Concrete Market in Containments Between 2017 and 2022

Figure 30 APAC to Be the Largest Market for Pump Bases

Figure 31 APAC to Be the Fastest-Growing Market in Waste Containers

Figure 32 APAC to Dominate the Market for Polymer Concrete in Flooring Blocks

Figure 33 APAC to Be the Fastest-Growing Market in Trench Drains

Figure 34 North America to Be the Fastest-Growing Market in Other Applications

Figure 35 Infrastructures to Be the Most Dominant End-Use Industry in Polymer Concretes Market

Figure 36 APAC to Be the Largest Market in Infrastructures

Figure 37 APAC to Be the Largest Market in Non-Residential Structures

Figure 38 APAC to Be the Largest Market in Residential Structures

Figure 39 China, India and UAE to Emerge as A New Strategic Destinations for Polymer Concrete Market

Figure 40 APAC Snapshot: Polymer Concretes Market

Figure 41 Western Snapshot: Polymer Concrete

Figure 42 North America Snapshot: Polymer Concrete Market

Figure 43 Central & Eastern Europe Snapshot

Figure 44 South America Snapshot: Polymer Concretes Market

Figure 45 Middle East & Africa Snapshot: Polymer Concrete Market

Figure 46 Companies Adopted Expansion as the Key Growth Strategy, 20122017

Figure 47 Market Ranking of Key Players in 2016

Figure 48 BASF: Company Snapshot

Figure 49 BASF: SWOT Analysis

Figure 50 Sika: Company Snapshot

Figure 51 Sika: SWOT Analysis

Figure 52 Mapei: Company Snapshot

Figure 53 Mapei: SWOT Analysis

Figure 54 Fosroc: SWOT Analysis

Figure 55 DOW Chemical: Company Snapshot

Figure 56 DOW Chemical: SWOT Analysis

Growth opportunities and latent adjacency in Polymer Concrete Market