Industrial PU Elastomer Market by Type (Thermoset PU Elastomer, Thermoplastic PU Elastomer), End-use Industry (Transportation, Industrial, Medical, Building & Construction, Mining Equipment) and Region - Global Forecast to 2026

Updated on : May 23, 2024

Industrial Polyurethane Elastomer Market

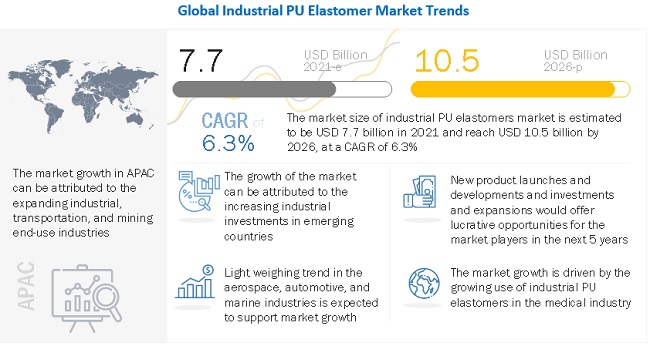

The global Industrial Polyurethane Elastomer Market size was valued at USD 7.7 billion in 2021 and is projected to reach USD 10.5 billion by 2026, growing at 6.3% cagr from 2021 to 2026. Rising demand for industrial PU elastomer can be attributed to the increasing demand for highly efficient and lightweight materials in the transportation industry and stringent emission regulations laid by the governments of various countries. Moreover, automobile manufacturers worldwide prefer elastomers over conventional metals as they increase automobile efficiency by reducing fuel consumption, carbon emissions, and engine size.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Industrial PU elastomer Market

The industrial PU elastomer are used mainly in transportation and industrial sector in the form of different components such as seals, O-rings, gaskets, and many others. They are also used in to manufacture transportation mounts, suspension pads, damper springs, busing, drive belts, bunnage, bed liners, filters, wheels, tires, tire fills, rollers, and many other industrial components.

- In the transportation industry, the manufacturing and fabrication facilities of the aerospace, automotive, and marine components had been paused due to the unavailability of raw materials, logistics slowdown and reduced workforce. The automotive production halted in major countries such as the US, Germany, and China. Decline in consumer footfalls in stores and sales of automotive have faced sharp downfall along with shortage of workforce.

- Medical devices such as ventilators, thermal scanners, patient care systems, and related equipment will grow at a faster pace than others during the pandemic. Ventilators are critical devices in fight against Covid pandemic, which necessitates a quicker supply of raw materials such as plastics, adhesives, and elastomers, their proper and timely logistical support, and regulatory approvals. Diagnostic instruments & devices such as thermal scanners are equipment designed to diagnose and monitor medical conditions are also in greater demand due to their requirement in diagnosing initial onset of the disease.

Industrial PU elastomer Market Dynamics

Driver: Light weighing of different transportation equipment

The demand for industrial PU elastomers is expected to increase at a significant rate during the forecast period owing to their growing use in various industries, such as automotive, aerospace, and marine. Transportation is one of the largest end-use industries of PU elastomers due to its properties such as tear and abrasion resistance, high load-bearing capacity, chemical resistance, and superior dynamic performance. Industrial PU elastomers play a crucial role in reducing the overall weight of transportation equipment, thus enhancing fuel efficiency and limiting the emission of pollutants.

Nowadays, lightweight designs are extensively utilized in a wide range of end-use industries. Light weighing of equipment used in the manufacturing of transportation mediums, such as automobiles and aircraft, helps to reduce emissions, increase energy efficiency, and reduce fuel consumption. Critical requirements for these structural materials include mechanical, physical, and chemical properties, such as high strength, stiffness, low density, high thermal stability, and high corrosion resistance. Advanced materials such as thermoplastic PU elastomer composites, thermoplastic PU elastomer, and thermoset elastomers meet all the critical requirements related to the light weighing of transportation mediums.

Restrain: Higher cost of thermoplastic PU elastomer than conventional materials

The manufacturing of thermoplastic PU elastomer requires considerably high investments, as the process is complex than that of other groups of plastics, such as PE, PVC, natural rubbers, and conventional PU. Products with high temperature functions and a high level of technical expertise are required in the manufacturing of thermoplastic PU elastomers. The high manufacturing cost of industrial PU elastomers has restricted its large-scale usage, mostly in high-end applications. Besides, compounding grades of polyethylene, polypropylene, acrylonitrile butadiene styrene, and PU are being developed that exhibit similar properties as of industrial PU elastomers and are available at a lower price. This is expected to hamper the adoption rate of PU elastomers in some end-use industries, such as transportation, building & construction, and manufacturing. Also, the increasing prices of raw materials are affecting the final prices of PU elastomers, which is consequently expected to restrain their adoption rate and growth of the market.

Opportunity: Growing demand for minimally invasive surgical procedures

The medical industry presents enormous growth opportunities for thermoplastic PU elastomer manufacturers. It is used in various medical applications, such as catheters, medical devices, orthodontic products, and wound care products. Safety and comfort are the prime factors considered while selecting materials to manufacture medical products, as some of the medical products are inserted into the human body for treatment purposes. Therefore, materials with flexibility and biocompatibility features make surgical and operating procedures minimally invasive. Thermoplastic PU elastomer possesses excellent chemical and mechanical characteristics and is biocompatible, which are of prime importance in medical applications. In addition, properties such as resistance to wear, low temperature, oil, chemical, and resiliency make thermoplastic PU elastomer an ideal choice than PVC. Thermoplastic PU elastomer is highly responsive to temperature, as it can be rigid at the point of insertion and flexible once inside the body. These properties have increased the use of thermoplastic PU elastomers in medical applications. PVC contains plasticizers, which can lead to safety concerns. Plasticizers have phthalates, which can cause liver issues, cancer, and disruption in the development of the reproductive tract in male infants. PVC also emits harmful chemicals when incinerated and creates environmental problems.

Thermoplastic PU elastomer healthcare grades are currently used to create oxygen masks and medical tubing, high-pressure contrast media tubing, and in a variety of catheters, such as central venous, IV, and intra-aortic balloon catheters. They are also used to create soft and pliable post-surgical appliances, stopcocks, component housings, soft-touch grips, dental ligature retainers, and dental devices.

Challenge: Volatility in raw material prices

Price and availability of raw materials are the key factors for PU precursor manufacturers for determining the cost structure of their products. Major raw materials used in the production of PU include MDI, TDI, and polyols. The principal raw materials for PU precursors are crude oil and natural gas. These petroleum-based raw materials are vulnerable to fluctuations in prices.

Volatility in raw material prices has led to instability in the price of thermoplastic PU elastomers. Adipic acid is one of the polyester polyols that is used in the manufacturing of thermoplastic PU elastomers. Globally, a major share of adipic acid goes into the production of nylon. The increased demand for nylon, coupled with changing lifestyles in developing countries such as China and India, has caused an imbalance in the supply of adipic acid. This imbalance has further increased the price of PU elastomers.

MDI is used along with adipic acid and a diol to manufacture PU elastomers. However, the global demand for MDI is very high as it is the highly produced diisocyanate globally. The gap in demand and supply of MDI has caused an increase in the price, further increasing the cost of PU elastomers. However, new plants to manufacture MDI are being set in Asian countries, such as China, India, and Indonesia, for tackling the challenges of the supply–demand gap and increasing cost of MDI.

Thermoset PU Elastomer is estimated to be the largest market in the overall industrial PU elastomer market in 2021.

Thermoset PU elastomer accounted for the largest market share in the global industrial PU elastomer market. Thermoset PU elastomer exhibit high impact strength, excellent resilience, high load-bearing capacity, exceptional resistance to oil and grease, and high abrasion resistance. These properties make them a suitable material for a wide range of industries, including transportation, building & construction, mining equipment, medical, manufacturing, and material handling. These elastomers are consumed in hydraulic and reciprocating seals, gaskets, diaphragms, hoses, conveyor belts, and many other applications.

Transportation is expected to be the largest industrial PU elastomer consuming end-use industry in 2021.

Industrial PU elastomer are used in manufacturing various automotive component, including cable jackets, gearshift knobs, brake tubes, cup holders, bellows, snow traction devices, slush molding, and bumpers. PU elastomers are replacing conventional metals and rubbers because of their easy processing, high impact strength, low weight, temperature resistance, good abrasion resistance, and cost-effectiveness. Thermoset and thermoplastic elastomers are used in aerospace, automotive, and marine fields to manufacture components such as

Based on region, APAC is projected to grow the fastest in the industrial PU elastomer market during the forecast period.

APAC is the largest and fastest-growing market for industrial PU elastomers. The APAC region is segmented into China, India, Japan, South Korea, Australia, and the Rest of APAC. The Rest of APAC includes Singapore, New Zealand, Indonesia, and Malaysia. In the recent years, there has been a shift in the manufacturing facilities of industrial PU elastomers from Europe to APAC, especially China and India, for various applications mainly transportation, mining equipment, and building & construction. This shift is due to the availability of cheap labor, supportive government policies, and availability of natural resources, which have resulted in APAC to be the largest consumer of industrial PU elastomers. In addition, the growth of these applications is largely driven by the growing population, per capita income, and changing lifestyles in the region. The rapidly growing building & construction applications, owing to increased investments by governments and the private sector due to the increasing population, are expected to drive the industrial PU elastomer market. The demand for automobiles is increasing with the growing disposable income of middle-class families. Additionally, the penetration of e-vehicles in the regional market is expected to drive the demand for industrial PU elastomer market in APAC.

The recent COVID-19 pandemic has impacted the global industrial and transportation sectors. The manufacturing and fabrication facilities of the transportation equipment and industrial equipment had been paused due to the unavailability of raw materials, logistics slowdown and reduced workforce. Decline in consumer footfalls in stores and sales of automotives have faced sharp downfall along with shortage of workforce.

To know about the assumptions considered for the study, download the pdf brochure

Industrial PU Elastomer Market Players

The key players in the industrial PU elastomer market BASF (Germany), Dow (US), Huntsman (US), Covestro (Germany), Era Polymers (Australia), Notedome (England), Mitsui Chemicals (Japan), Lanxess (Germany), The Lubrizol Corporation (US), and Wanhua (China) are some of the key players in the market. These players have established a strong foothold in the market by adopting strategies, such as new product launches, collaborations, expansions, and mergers & acquisitions.

Industrial PU Elastomer Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 7.7 billion |

|

Revenue Forecast in 2026 |

USD 10.5 billion |

|

CAGR |

6.3% |

|

Years considered for the study |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Volume (Kiloton) and Value (USD) |

|

Segments |

Type, End-use Industry, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

BASF (Germany), Dow (US), Huntsman (US), Covestro (Germany), Mitsui Chemicals (Japan), Lanxess (Germany), The Lubrizol Corporation (US), and Wanhua (China) |

This research report categorizes the industrial PU elastomer market based on type, end-use industry, and region.

By Type:

- Thermoset PU Elastomer

- Thermoplastic PU Elastomer

By End-use Industry

-

Transportation

- Automotive

- Aerospace

- Marine

-

Industrial

- Manufacturing

- Material Handling

- Mining Equipment

- Building & Construction

- Medical

- Others

By Region:

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The industrial PU elastomer market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In December 2020, BASF collaborated with Meiban, to create the Elastollan soft touch feel thermoplastic PU series that enables new design possibilities.

- In May 2020, Covestro and global plastics compounder Teknor Apex collaborated for developing compounding industrial thermoplastic PU elastomer. The collaboration was aimed at providing customized products to its existing and new customers.

- In August 2019, Lanxess developed a new range of MDI polyether prepolymers from bio-based raw materials under the brand name Adiprene Green. The properties of Adiprene Green are similar to the fossil-based polyether elastomers offered by the company.

- In June 2021, Dow established an integrated MDI distillation and Prepolymers facility in Freeport, Texas, to address the increasing demand for PU systems and products. The MDI facility is expected to be operational in 2023, post which, the company will shut down its PU assets at the La Porte site, US.

Frequently Asked Questions (FAQ):

What is the current size of the global industrial PU elastomer market?

Global industrial PU elastomer market size is estimated to reach USD 10.5 billion by 2026 from USD 7.7 billion in 2021, at a CAGR of 6.3% during the forecast period.

Who are the winners in the global industrial PU elastomer market?

Companies such as BASF (Germany), Dow (US), Huntsman (US), Covestro (Germany), Era Polymers (Australia), Notedome (England), Mitsui Chemicals (Japan), Lanxess (Germany), The Lubrizol Corporation (US), and Wanhua (China) fall under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on industrial PU elastomer manufacturers?

Industry experts believe that COVID-19 could affect the end-use industries globally. Decline in vehicle sales, reduced industrial output, reduction in air traffic, downfall of construction activities, increase in requirement of medical devices such as ventilators and accessories, cannulas, catheters, and other disposables are some of the major disruptions caused by the pandemic.

What are some of the drivers in the market?

The increasing requirement of industrial PU elastomer in lightweighing of transportation equipment and rising demand in medical and aerospace applications drive the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 INDUSTRIAL PU ELASTOMER MARKET: SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

FIGURE 2 INDUSTRIAL PU ELASTOMER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 INDUSTRIAL PU ELASTOMER MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 INDUSTRIAL PU ELASTOMER MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 INDUSTRIAL PU ELASTOMER MARKET: DATA TRIANGULATION

2.3.1 INDUSTRIAL PU ELASTOMER MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

FIGURE 6 INDUSTRIAL PU ELASTOMER MARKET ANALYSIS THROUGH SECONDARY SOURCES

FIGURE 7 INDUSTRIAL PU ELASTOMER MARKET ANALYSIS

2.4 LIMITATIONS

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

FIGURE 8 THERMOSET PU ELASTOMER SEGMENT TO ACCOUNT FOR LARGER SHARE OF INDUSTRIAL PU ELASTOMER DURING FORCAST PERIOD

FIGURE 9 TRANSPORTATION TO BE LARGEST END-USE INDUSTRY OF INDUSTRIAL PU ELASTOMER MARKET DURING FORECAST PERIOD

FIGURE 10 APAC ACCOUNTED FOR LARGEST SHARE OF INDUSTRIAL PU ELASTOMER MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL PU ELASTOMER MARKET

FIGURE 11 EXPANDING TRANSPORTATION INDUSTRY TO DRIVE GROWTH OF INDUSTRIAL PU ELASTOMER MARKET

4.2 INDUSTRIAL PU ELASTOMER MARKET, BY TYPE

FIGURE 12 THERMOSET PU ELASTOMER TO HOLD LARGER SHARE IN TERMS OF VOLUME OF INDUSTRIAL PU ELASTOMER MARKET

4.3 INDUSTRIAL PU ELASTOMER MARKET, BY END-USE INDUSTRY

FIGURE 13 TRANSPORTATION TO BE LARGEST END-USE INDUSTRY IN INDUSTRIAL PU ELASTOMER MARKET

4.4 INDUSTRIAL PU ELASTOMER MARKET, BY COUNTRY

FIGURE 14 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4.5 INDUSTRIAL PU ELASTOMER MARKET IN APAC, BY END-USE INDUSTRY AND TYPE

FIGURE 15 THERMOSET PU ELASTOMER AND TRANSPORTATION SEGMENTS ACCOUNTED FOR LARGEST SHARES OF APAC MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INDUSTRIAL PU ELASTOMER MARKET

5.2.1 DRIVERS

5.2.1.1 Replacement of conventional materials with industrial PU elastomers in various industries

5.2.1.2 Light weighing of different transportation equipment

5.2.2 RESTRAINTS

5.2.2.1 Higher cost of thermoplastic PU elastomer than conventional materials

5.2.2.2 Hazardous impact on human health and environment

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for minimally invasive surgical procedures

5.2.3.2 Emerging market for bio-based thermoplastic PU elastomers

5.2.4 CHALLENGES

5.2.4.1 Volatility in raw material prices

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 INDUSTRIAL PU ELASTOMER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS OF INDUSTRIAL PU ELASTOMER MARKET

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 INDUSTRIAL PU ELASTOMER MANUFACTURERS

5.4.3 COMPOUNDERS

5.4.4 COMPONENT MANUFACTURERS

5.4.5 END-USE INDUSTRIES

5.5 PATENT ANALYSIS

5.5.1 INTRODUCTION

5.5.2 METHODOLOGY

5.5.3 DOCUMENT TYPE

FIGURE 19 GRANTED AND APPLIED PATENTS IN PAST 10 YEARS

FIGURE 20 PUBLICATION TRENDS—LAST 10 YEARS

5.5.4 INSIGHT

FIGURE 21 JURISDICTION ANALYSIS

5.5.5 TOP COMPANIES/APPLICANTS

FIGURE 22 TOP COMPANIES/APPLICANTS OF PATENTS

TABLE 1 LIST OF PATENTS BY DOW GLOBAL TECHNOLOGIES LLC.

TABLE 2 LIST OF PATENTS BY BASF

TABLE 3 LIST OF PATENTS BY TOYO TIRE & RUBBER CO

TABLE 4 LIST OF PATENTS BY NIKE INC

TABLE 5 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.6 IMPACT OF COVID-19 ON INDUSTRIAL PU ELASTOMER MARKET

5.6.1 COVID-19

5.6.2 REPORTED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 23 PACE OF GLOBAL PROPAGATION OF COVID-19 IS UNPRECEDENTED

5.6.3 IMPACT ON END-USE INDUSTRIES

6 INDUSTRIAL PU ELASTOMER MARKET, BY TYPE (Page No. - 52)

6.1 INTRODUCTION

FIGURE 24 THERMOSET PU ELASTOMER SEGMENT TO LEAD INDUSTRIAL PU ELASTOMER MARKET DURING FORECAST PERIOD

TABLE 6 INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 7 INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 8 THERMOSET VS. THERMOPLASTIC TYPE OF PU ELASTOMERS

6.2 THERMOSET PU ELASTOMER

6.2.1 COLD CAST ELASTOMERS

6.2.2 HOT CAST ELASTOMERS

6.3 THERMOPLASTIC PU ELASTOMER (TPU)

6.3.1 POLYESTER

6.3.2 POLYETHER

6.3.3 POLYCAPROLACTONE

7 INDUSTRIAL PU ELASTOMERS, BY END-USE INDUSTRY (Page No. - 57)

7.1 INTRODUCTION

FIGURE 25 TRANSPORTATION SEGMENT TO LEAD INDUSTRIAL PU ELASTOMER MARKET FROM 2021 TO 2026

TABLE 9 INDUSTRIAL PU ELASTOMER MARKET, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 10 INDUSTRIAL PU ELASTOMER MARKET, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

7.2 TRANSPORTATION

7.2.1 AUTOMOTIVE

7.2.2 AEROSPACE

7.2.3 MARINE

7.3 INDUSTRIAL

7.3.1 MANUFACTURING

7.3.2 MATERIAL HANDLING

7.4 BUILDING & CONSTRUCTION

7.5 MINING EQUIPMENT

7.6 MEDICAL

7.6.1 CATHETERS

7.6.2 MEDICAL DEVICES

7.6.3 WOUND CARE PRODUCTS

7.7 OTHERS

7.7.1 AGRICULTURE

7.7.2 OIL & GAS

7.7.3 ELECTRICAL & ELECTRONICS

8 INDUSTRIAL PU ELASTOMER MARKET, BY REGION (Page No. - 65)

8.1 INTRODUCTION

FIGURE 26 INDUSTRIAL PU ELASTOMER MARKET IN INDIA TO REGITER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 INDUSTRIAL PU ELASTOMER MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 12 INDUSTRIAL PU ELASTOMER MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.2 APAC

FIGURE 27 APAC: INDUSTRIAL PU ELASTOMER MARKET SNAPSHOT

TABLE 13 APAC: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 14 APAC: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 15 APAC: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 16 APAC: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 17 APAC: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 18 APAC: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.1 CHINA

8.2.1.1 China’s dominant position is attributed to presence of huge manufacturing base

TABLE 19 CHINA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 20 CHINA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.2 JAPAN

8.2.2.1 Growing automotive sector to boost market growth

TABLE 21 JAPAN: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 22 JAPAN: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.3 SOUTH KOREA

8.2.3.1 Increasing investments in end-use industries to drive market growth

TABLE 23 SOUTH KOREA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 24 SOUTH KOREA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.4 INDIA

8.2.4.1 Government initiatives to boost automobile and medical electronics production to fuel market growth

TABLE 25 INDIA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 26 INDIA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.5 AUSTRALIA

8.2.5.1 Mining and mining equipment industry to fuel consumption of industrial PU elastomers

TABLE 27 AUSTRALIA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 28 AUSTRALIA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2.6 REST OF APAC

TABLE 29 REST OF APAC: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 30 REST OF APAC: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3 SOUTH AMERICA

TABLE 31 SOUTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 32 SOUTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 33 SOUTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 34 SOUTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 SOUTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 36 SOUTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.1 BRAZIL

8.3.1.1 Industrial growth to boost consumption of industrial PU elastomers

TABLE 37 BRAZIL: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 38 BRAZIL: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.2 ARGENTINA

8.3.2.1 Emerging automotive industry to fuel market growth

TABLE 39 ARGENTINA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 40 ARGENTINA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.3.3 REST OF SOUTH AMERICA

TABLE 41 REST OF SOUTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 42 REST OF SOUTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4 MIDDLE EAST & AFRICA

TABLE 43 MIDDLE EAST & AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 44 MIDDLE EAST & AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 46 MIDDLE EAST & AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 48 MIDDLE EAST & AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.1 SAUDI ARABIA

8.4.1.1 Saudi’s industrial sector to contribute to significant rise in demand for industrial PU elastomers

TABLE 49 SAUDI ARABIA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 50 SAUDI ARABIA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.2 SOUTH AFRICA

8.4.2.1 Developments in automotive sector to drive market growth

TABLE 51 SOUTH AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 52 SOUTH AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.3 UAE

8.4.3.1 Growing automotive and building and construction industries to boost demand for industrial PU elastomers

TABLE 53 UAE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 54 UAE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.4.4 REST OF MIDDLE EAST & AFRICA

TABLE 55 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 56 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5 NORTH AMERICA

FIGURE 28 NORTH AMERICA MARKET SNAPSHOT: TRANSPORTATION INDUSTRY TO DRIVE DEMAND FOR INDUSTRIAL PU ELASTOMERS

TABLE 57 NORTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 58 NORTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 60 NORTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 62 NORTH AMERICA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.1 US

8.5.1.1 High growth of various end-use industries to drive market growth

TABLE 63 US: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 64 US: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.2 CANADA

8.5.2.1 Diversified industrial sector to fuel consumption of industrial PU elastomers

TABLE 65 CANADA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 66 CANADA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.5.3 MEXICO

8.5.3.1 Growing automotive OEM manufacturing to drive market growth

TABLE 67 MEXICO: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 68 MEXICO: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6 EUROPE

FIGURE 29 EUROPE MARKET SNAPSHOT: TRANSPORTATION INDUSTRY TO DRIVE DEMAND FOR INDUSTRIAL PU ELASTOMERS

TABLE 69 EUROPE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 70 EUROPE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 71 EUROPE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 72 EUROPE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 EUROPE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 74 EUROPE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.1 GERMANY

8.6.1.1 Constant innovations across end-use industries to fuel market growth

TABLE 75 GERMANY: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 76 GERMANY: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.2 UK

8.6.2.1 Growing demand from automotive industry to boost market growth in UK

TABLE 77 UK: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 78 UK: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.3 FRANCE

8.6.3.1 Presence of large automotive and aerospace industry players to increase demand for industrial PU elastomers

TABLE 79 FRANCE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 80 FRANCE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.4 RUSSIA

8.6.4.1 Industrial development to boost demand for industrial PU elastomers

TABLE 81 RUSSIA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 82 RUSSIA: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.5 ITALY

8.6.5.1 Demand from transportation and manufacturing industries to favor market growth

TABLE 83 ITALY: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 84 ITALY: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.6 SPAIN

8.6.6.1 Growing domestic demand and rising export of automobiles to drive market growth

TABLE 85 SPAIN: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 86 SPAIN: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.6.7 REST OF EUROPE

TABLE 87 REST OF EUROPE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 88 REST OF EUROPE: INDUSTRIAL PU ELASTOMER MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 119)

9.1 OVERVIEW

FIGURE 30 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY DURING 2017–2021

9.2 MARKET EVALUATION FRAMEWORK

TABLE 89 NUMBER OF RECENT DEVELOPMENTS OVER PAST 5 YEARS

9.3 MARKET SHARE ANALYSIS

FIGURE 31 INDUSTRIAL PU ELASTOMER MARKET SHARE, BY COMPANY (2020)

TABLE 90 INDUSTRIAL PU ELASTOMER: DEGREE OF COMPETITION

9.4 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2021

FIGURE 32 RANKING OF TOP 5 PLAYERS IN INDUSTRIAL PU ELASTOMER MARKET, 2021

9.5 COMPANY EVALUATION MATRIX, 2021 (TIER 1)

9.5.1 STAR

9.5.2 EMERGING LEADER

9.5.3 PERVASIVE

9.5.4 PARTICIPANT

FIGURE 33 COMPANY EVALUATION MATRIX, 2021

FIGURE 34 COMPANY PRODUCT FOOTPRINT (TIER1)

FIGURE 35 BUSINESS STRATEGY EXCELLENCE (TIER1)

9.6 STARTUP AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.6.1 PROGRESSIVE COMPANY

9.6.2 RESPONSIVE COMPANY

9.6.3 STARTING BLOCK

9.6.4 DYNAMIC COMPANY

FIGURE 36 INDUSTRIAL PU ELASTOMER MARKET: STARTUP AND SMES MATRIX, 2020

FIGURE 37 STRENGTH OF PRODUCT PORTFOLIO (SMES)

FIGURE 38 BUSINESS STRATEGY EXCELLENCE (SMES)

9.7 COMPANY FOOTPRINT

TABLE 91 OVERALL COMPANY FOOTPRINTS

TABLE 92 COMPANY TYPE FOOTPRINT

TABLE 93 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 94 COMPANY REGION FOOTPRINT

9.8 COMPETITIVE SCENARIO

9.8.1 INDUSTRIAL PU EASTOMER MARKET: NEW PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 95 INDUSTRIAL PU ELASTOMER MARKET: NEW PRODUCT LAUNCHES AND DEVELOPMENTS

9.8.2 INDUSTRIAL PU ELASTOMER MARKET: DEALS

TABLE 96 INDUSTRIAL PU ELASTOMER MARKET: DEALS

9.8.3 OTHER DEVELOPMENTS

TABLE 97 INDUSTRIAL PU ELASTOMER MARKET: OTHER DEVELOPMENTS

10 COMPANY PROFILES (Page No. - 135)

(Business Overview, Products Strategic Choices Made, Weaknesses and Competitive Threats, Key strengths / Right to win, Recent Developments, MnM View)*

10.1 BASF

FIGURE 39 BASF: COMPANY SNAPSHOT

TABLE 98 BASF: BUSINESS OVERVIEW

10.2 HUNTSMAN

FIGURE 40 HUNTSMAN: COMPANY SNAPSHOT

TABLE 99 HUNSTMAN: BUSINESS OVERVIEW

10.3 COVESTRO

FIGURE 41 COVESTRO: COMPANY SNAPSHOT

TABLE 100 COVESTRO: BUSINESS OVERVIEW

10.4 LANXESS

FIGURE 42 LANXESS: COMPANY SNAPSHOT

TABLE 101 LANXESS: BUSINESS OVERVIEW

10.5 DOW

FIGURE 43 DOW : COMPANY SNAPSHOT

TABLE 102 DOW: BUSINESS OVERVIEW

10.6 MITSUI CHEMICAL

FIGURE 44 MITSUI CHEMICALS: COMPANY SNAPSHOT

TABLE 103 MITSUI: BUSINESS OVERVIEW

10.7 WANHUA CHEMICAL

FIGURE 45 WANHUA CHEMICALS: COMPANY SNAPSHOT

TABLE 104 WANHUA: BUSINESS OVERVIEW

TABLE 105 PRODUCTS OFFERED

10.8 NOTEDOME

FIGURE 46 NOTEDOME: COMPANY SNAPSHOT

TABLE 106 BUSINESS OVERVIEW

10.9 ERA POLYMERS

TABLE 107 ERA POLYMER: BUSINESS OVERVIEW

10.10 LUBRIZOL

TABLE 108 LUBRIZOL: BUSINESS OVERVIEW

*Details on Business Overview, Products Strategic Choices Made, Weaknesses and Competitive Threats, Key strengths / Right to win, Recent Developments, MnM View might not be captured in case of unlisted companies.

10.11 OTHER MARKET PLAYERS

10.11.1 COIM GROUP

10.11.2 TRELLEBORG

10.11.3 VCM POLYURETHANES

10.11.4 TSE INDUSTRIES

10.11.5 SUNDOW POLYMERS

10.11.6 MIRACLL CHEMICALS

10.11.7 GREAT EASTERN RESINS INDUSTRIAL CO. LTD.(GRECO)

10.11.8 TOWNSEND CHEMICALS

10.11.9 SUZHOU NEW MSTAR TECHNOLOGIES

10.11.10 SUMEI CHEMICAL

10.11.11 SONGWON

10.11.12 AVIENT

10.11.13 TAIWAN PU CORPORATION

10.11.14 TOSOH CORPORATION

10.11.15 ARGONICS

10.11.16 HEADWAY GROUP

10.11.17 SHANDONG HUADA CHEMICAL NEW MATERIAL

11 APPENDIX (Page No. - 168)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

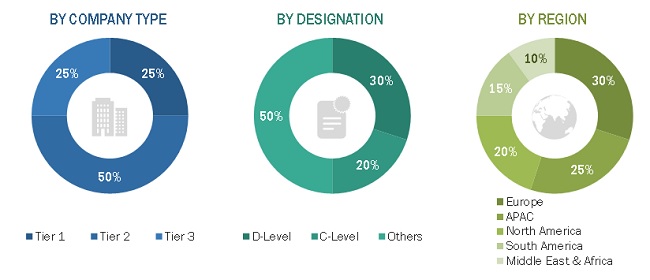

The study involved four major activities in estimating the current market size for industrial PU elastomer. The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulations form agencies such as the CIA Factbook, Chemical Weekly, Factiva, and other government & private websites and associations related to the industrial PU elastomer market, such as the European Diisocyanate and Polyol Producers Association and Polyurethane Manufacturers Association (PMA), regulatory bodies, and databases.

Primary Research

The industrial PU elastomer market comprises several stakeholders such as raw material suppliers, distributors of industrial PU elastomer, end-users, and regulatory organizations in the supply chain. The demand side of this market consists of transportation, industrial, mining equipment, building & construction, medical, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial PU elastomer market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, materials, in the industry, and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of industrial PU elastomer and their applications.

Objectives of the Study:

- To define and analyze the industrial PU elastomer market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type and end-use industry

- To forecast the size of the market with respect to five regions, namely, APAC, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze the competitive developments such as new product launches and developments, investments, expansions, partnerships, joint ventures, and acquisitions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- Notes: Micromarkets1 are the sub-segments of the Industrial PU elastomer market included in the report.

- Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the industrial PU elastomer market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial PU Elastomer Market