Power Bank Market Size, Share & Industry Growth Analysis Report by Capacity (5,001-10,000 mAh, 10,001-15,000 mAh, 15,001-20,000 mAh), Units of USB Port, Indicator, Battery Type, Price Range, Application (Smartphone, Tablet, Wearable Device), and Region - Global Forecast

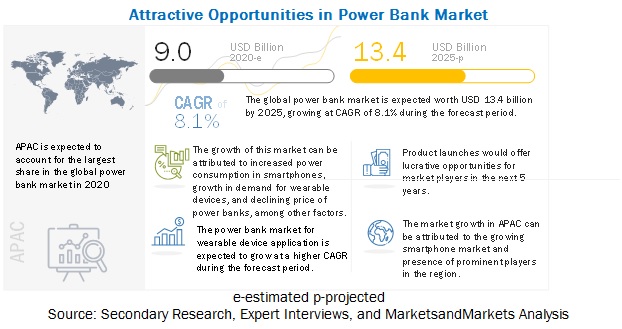

The global power bank market size is projected to reach USD 13.4 billion by 2025, growing at a CAGR of 8.1% during the forecast period. It was observed that the growth rate was 1% from 2021 to 2022.

Smartphone applciation is expected to account high market share of 54%. Increasing internet-related services through smartphones and tablets, the decline in the price of power banks, frequent electric outages in certain countries, increase in power consumption of smartphones, and sudden shift to work-from-home and remote learning due to COVID-19 resulting in spike in demand for laptops are among the factors driving the market for power banks. The report covers the power bank industry segmented into battery type, price range, capacity, unit of USB port, indicator, application, and geography.

COVID-19 impact on the power bank market

The power bank market has historically been subjected to moderate growth due to the rise in demand for consumer electronics with heavy features and usage. This is expected to drive the growth of the market during the forecast period.

The recent COVID-19 pandemic has resulted in a decline in the growth rate.As a result of COVID-19, the expected growth of power bank across applications is expected to decline as the pandemic is restricting the supply chain and adoption due to the severe disruptions to businesses and the global economy. The pandemic has resulted in limited production leading to a serious decline in business inputs.

The recovery depends on government assistance as well as the level of corporate debt and how the companies and markets cope with the lower demand. The market for 2020 is witnessing a sudden decrease due to COVID-19, which has majorly affected the R&D and supply chain of power banks. It may also affect the planned investments in this market. In addition, the per capita income of individuals has also been affected due to this pandemic. Thus, the demand for consumer electronics accessories such as power banks has decreased. With the trend of work-from-home, consumers are spending most of the time at their homes with constant access to electricity to power their devices. However, in countries such as India, where power cut is a major issue, power banks have been used to power their device during power shortage.

Power Bank Market Dynamics

Driver: Decline in price of power banks

The power bank market has become highly competitive with the presence of a large number of players and increasing number of new entrants in the market. The companies are reducing the prices of their power banks to remain competitive and increase their customer base.

For instance, since 2018, the 20,000 mAh Mi Power Bank 2i price in India declined and now retails for USD 21.8. Additionally, companies are innovating their products and focusing on launching power banks with newer technologies, which, in turn, reduce the price for older versions of power banks. Moreover, the drop in prices would not just increase the consumer base but would also affect the pricing of products provided by competitors. However, the COVID-19 had a huge impact on the financial performance of new entrants and small companies of the market. This, in turn, is likely to affect the price range of the power banks offered by these companies.

Restraint: Poor quality of power banks

Recently, a large number of players have ventured into the power bank market and are providing power banks of various capacities, prices, and designs. However, not all power banks are of superior quality as it is observed that a few power banks do not even last for six months.

Poor-quality power banks can cause overheating, reduce a phone’s battery life, and in the worst scenario, may even explode. These are mostly priced low to attract consumers. A few manufacturers use recycled batteries, which, in turn, increase the risk of explosion. Thus, poor-quality power banks can hinder the growth of the market.

Opportunity: Development of solar and hydrogen fuel cell-based power banks

Direct electricity is not the only source of power for power banks that are used to recharge the batteries of electronic devices, such as smartphones, tablets, and laptops. Apart from electric power banks, various companies are manufacturing power banks that are powered by solar energy or hydrogen fuel cells.

For instance, TW Horizon Fuel Cell Technologies (China) introduced a hydrogen fuel cell-based power bank named MINIPAK. It uses replaceable and refillable fuel cartridges to recharge a device. Its HYDROSTIK cartridge is certified to UN standard for metal hydrides. Uimi Technology Private Limited (India), Elixier Tech Innovatis LLP (India), Volatic Systems (US), EasyAcc (China), and Bonai (China) are among the companies that offer solar power banks. Solar power banks are an effective solution during power outages. Solar power banks are excellent solutions that utilize renewable source of energy and can function without any disruption. It does not contribute to environmental pollution and is user-friendly. These factors are expected to significantly increase the adoption of solar power banks.

Challenge: Highly competitive market

Power bank manufacturers face fierce competition within the market due to the large number of manufacturers existing in the market. Each manufacturer offers a wide range of power banks with a variety of features that cater to customers’ needs.

This makes it difficult for a company to survive in the market unless it periodically upgrades its power bank technology. Manufacturers constantly focus on integrating new technologies into their power bank design to gain a competitive advantage. For instance, in February 2019, Anker Innovations launched PowerCore 10,000 mAh PD power bank with dual USB ports, featured with USB Type-C port delivering power up to 18W, whereas Xiaomi in January 2019 launched the latest version of its power bank Mi Power Bank 3 Pro that supports two-way 45W fast charging through the USB Type-C port and includes low power support for smart wearables and nine layers of circuit chip protection. Furthermore, the power bank market is extremely price competitive. Manufacturers have to price their power bank devices in coordination with prices of other power banks in the market. In such a fiercely competitive market, it is difficult for a new entrant to survive and compete with established players unless they innovate their offerings.

Power Bank Market Segment Overview

Power banks with capacity ranging 10,001–15,000 mAh to witness highest CAGR during the forecast period

Based on capacity, the 10,001–15,000 mAh segment of the power bank market is expected to grow at the highest rate during the forecast period. These power banks have high output efficiency and longer battery life, as well as have LEDs or LCDs to indicate battery level.

These power banks are in high demand by consumers as they are priced reasonably than power banks with capacities of more than 15,000 mAh. These power banks are large-sized, come with a lot of additional features such as DC output ports used to recharge laptops, USB Type C ports, and Quick charge functionality. The COVID-19 outbreak has resulted in a substantial slowdown in terms of global economic growth and decreasing per capita income of the population owing to pay cuts.

These factors have affected the production of power banks with 10,001–15,000 mAh capacity, as these batteries are high cost and are not affordable for all customers in the current situation. However, the market for this capacity range will grow at a significant rate when the situation becomes stable.

Smartphones application to account for the largest market share during the forecast period

Smartphones are a major application market for power banks. The extensive use of data and internet services over smartphones is among the main factors that attribute to drain the battery power rapidly. This creates a huge demand for power banks to keep smartphones running for a longer duration.

Smartphones are equipped with batteries having a short life, which increases the need for power banks. Thus, this creates a vast potential for power banks in the smartphone application. The smartphone industry, which is one of the largest consumers of power banks, is disturbed due to the COVID-19 pandemic.

The shutdown of manufacturing facilities is leading to a halt in smartphone production, and decreasing consumer expenditure has affected the demand for power banks. However, the power bank market will gain momentum once the situation becomes stable.

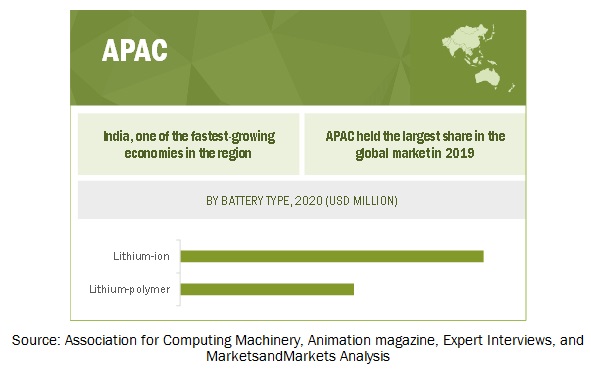

The power bank market in APAC is projected to grow at the highest CAGR during the forecast period.

APAC held the largest share of the power bank market in 2019. Major factors such as increasing adoption of wearables and other consumer electronic products, presence of prominent manufacturers of power banks, and increasing population and economic growth of developing countries are fueling the market growth of power banks in APAC.

The market in APAC is most severely impacted by the COVID-19 pandemic. The consumer electronics industry in China is witnessing a decline in production owing to the outbreak of COVID-19. However, continous product launches by leading companies might boost the growth. For instance, in June 2020, Xiaomi launched a massive 30,000 mAh power bank with Quick charge technology despite the COVID-19 situation.

Besides APAC, North America holds a significant market share. Manufacturers such as Griffin Technology (US), RAVPower (US), Zendure (US), ZeusBattery (US), Duracell (US), Belkin (US), and Zagg (mophie) (US) are based in this region.

Key Market Players in Power Bank Industry

The power bank market players have implemented mostly organic growth strategies, such as new product launches and developments, to strengthen their offerings in the market. ADATA (Taiwan), Anker Innovations (China), AUKEY (China), Xiaomi (China), RAVPower (US), GRIFFIN (US), Lenovo (China), mophie (US), AMBRANE (India), INTEX (India), myCharge (US), Omnicharge (US), UIMI (India), uNu Electronics Inc. (US), Zendure (US), and ROMOSS (China) are some of the major players in the market. The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Power Bank Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 9.0 billion |

| Projected Market Size | USD 13.4 billion |

| Growth Rate | CAGR of 8.1% |

|

Years Considered |

2016–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD million/billion) |

|

Segments Covered |

Battery Type, Indicator, Units of Port, Price Range, Capacity, and Application |

|

Regions Covered |

North America, APAC, Europe, and RoW |

|

Companies Covered |

Anker Innovations (China), AUKEY (China), Xiaomi (China), ADATA (Taiwan), RAVPower (US), GRIFFIN (US), Lenovo (China), mophie (US), AMBRANE (India), and INTEX (India), among other players. A total of 25 major players covered. |

In this report, the overall power bank market has been segmented based on capacity, units of USB port, price range, battery type, indicator, application, and region.

Power Bank Market By Battery Type

- Lithium-Ion (Li-Ion) Battery

- Lithium Polymer (Li-Polymer) Battery

By Unit of USB Port

- 1 USB Port

- 2 USB Ports

- More than 2 USB Ports

By Indicator

- LED Lighting

- Digital Display

By Capacity

- 1,000–5,000 mAh

- 5,001–10,000 mAh

- 10,001–15,000 mAh

- 15,001–20,000 mAh

- Above 20,001 mAh

By Price Range

- Low

- Medium

- Premium

Power Bank Market By Application

- Smart Phone

- Tablet

- Laptop

- Portable Media Device

- Wearable Device

- Digital Camera

- Others

Recent Developments in Power Bank Industry

- In May 2020, ADATA launched T5000C power bank with a power capacity of 5,000 mAh which features a beautifully engraved floral pattern for a refreshing spring-inspired look and a satisfying tactile feel.

- In March 2020, Xiaomi launched the 10,000 mAh wireless power bank in India, which supports up to 10W fast wireless charging. The power bank also supports two-way fast charging as well as 18W wired charging.

- In January 2019, Xiaomi launched the latest version of its power bank— the Mi Power Bank 3 Pro—in China. The USP of this power bank is it supports two-way 45 W fast charging through the USB Type-C port and includes low power support for smart wearables and nine layers of circuit chip protection.

Frequently Asked Questions (FAQ):

How is the power bank market segmented?

The power bank market has been segmented based on battery type, indicator, price range, capacity, unit of USB port, application, and region.

Who are the top 5 players in the power bank market?

The major players operating in the power bank market include Anker Innovations, AUKEY, Xiaomi, ADATA, and RAVPower.

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and rest of European countries.

What are the major applications of power banks?

Significant applications of power banks are smartphone, tablet, and wearable device.

Does this report include the impact of COVID-19 on the power bank market?

Yes, the report includes the impact of COVID-19 on the power bank market. It illustrates the impact of COVID-19 on the market segments and the players operating in the power bank market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET THROUGH DEMAND-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 1 POWER BANK MARKET, IN TERMS OF VALUE AND VOLUME, 2016–2019

TABLE 2 MARKET, IN TERMS OF VALUE AND VOLUME, 2020–2025

FIGURE 6 PORTABLE POWER BANK WITH COVID-19 UPDATE

3.1 PRE-COVID-19 SCENARIO

TABLE 3 PRE-COVID-19 SCENARIO: MARKET

3.2 POST-COVID-19 SCENARIO

TABLE 4 POST-COVID-19 SCENARIO: MARKET

3.3 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 5 OPTIMISTIC SCENARIO (POST-COVID-19): POWER BANK MARKET

3.4 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 6 PESSIMISTIC SCENARIO (POST-COVID-19): MARKET

FIGURE 7 POWER BANK WITH CAPACITY RANGING 10,001–15,000 MAH TO WITNESS THE HIGHEST CAGR

FIGURE 8 MARKET FOR WEARABLE DEVICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 APAC TO HOLD LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN POWER BANK MARKET

FIGURE 10 RISE IN USAGE OF SMARTPHONES TO CREATE ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 MARKET, BY CAPACITY

FIGURE 11 MARKET FOR POWER BANKS WITH CAPACITY RANGE OF 10,000–15,000 MAH TO WITNESS THE HIGHEST CAGR

4.3 MARKET, BY BATTERY TYPE

FIGURE 12 LITHIUM-POLYMER BASED POWER BANK TO WITNESS A HUGE DEMAND IN COMING YEARS

4.4 MARKET, BY APPLICATION

FIGURE 13 SMARTPHONE APPLICATION TO HOLD LARGEST SIZE OF MARKET FROM 2020 TO 2025

4.5 MARKET, BY PRICE RANGE

FIGURE 14 MEDIUM PRICE RANGE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET FROM 2020 TO 2025

4.6 MARKET IN APAC, BY COUNTRY AND APPLICATION

FIGURE 15 CHINA TO HOLD LARGEST SHARE OF MARKET IN APAC BY 2025

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 INHERENT ADVANTAGES DRIVE POWER BANK MARKET

5.2.1 DRIVERS

5.2.1.1 Sudden shift to work-from-home and remote learning due to covid-19 resulting in spike in demand for laptops

5.2.1.2 Integration of advanced technology in power banks

5.2.1.3 Increase in power consumption of smartphones

5.2.1.4 Decline in price of power banks

FIGURE 17 IMPACT OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 Poor quality of power banks

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in the adoption of wearable devices

TABLE 7 GLOBAL SHIPMENT OF WEARABLE DEVICES, 2017–2022 (MILLION UNITS)

5.2.3.2 Development of solar and hydrogen fuel cell-based power banks

FIGURE 18 IMPACT OF RESTRAINTS AND OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Shutdown of power bank manufacturing plants and delay in shipment of orders owing to covid-19

5.2.4.2 Complex design process

5.2.4.3 Highly competitive market

5.2.4.4 Li-ion batteries’ recycling cost

FIGURE 19 IMPACT OF CHALLENGES ON MARKET

5.3 IMPACT OF COVID-19 ON POWER BANK MARKET

5.4 DISTRIBUTION CHANNELS FOR POWER BANKS

5.4.1 OFFLINE DISTRIBUTION CHANNEL

5.4.2 ONLINE DISTRIBUTION CHANNEL

5.5 VALUE CHAIN ANALYSIS

FIGURE 20 MARKET: MAJOR VALUE ADDED BY MANUFACTURERS AND COMPONENT PROVIDERS

6 ENERGY SOURCES OF POWER BANKS (Page No. - 67)

6.1 INTRODUCTION

FIGURE 21 POWER BANK MARKET, BY ENERGY SOURCE

6.2 ELECTRIC

6.2.1 KEY PLAYER ARE INTEGRATING NEW TECHNOLOGIES IN ELECTRIC POWER BANKS

FIGURE 22 KEY TECHNOLOGIES ADOPTED IN ELECTRIC POWER BANKS

6.3 SOLAR

FIGURE 23 TYPES OF SOLAR PANELS

6.3.1 SOLAR POWER BANKS: A DISASTER RECOVERY SOLUTION

7 POWER BANK MARKET, BY CAPACITY (Page No. - 69)

7.1 INTRODUCTION

FIGURE 24 MARKET SEGMENTATION, BY CAPACITY RANGE

FIGURE 25 POWER BANK WITH CAPACITY RANGING 10,001–15,000 MAH GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 8 MARKET, BY CAPACITY, 2016–2019 (USD BILLION)

TABLE 9 MARKET, BY CAPACITY, 2020–2025 (USD BILLION)

7.2 1,000–5,000 MAH

7.2.1 COMPACT POWER BANKS FOR SMARTPHONES

TABLE 10 1,000–5,000 MAH POWER BANK MARKET, BY BATTERY TYPE, 2016–2019 (USD MILLION)

TABLE 11 1,000–5,000 MAH POWER BANK, BY BATTERY TYPE, 2020–2025 (USD MILLION)

TABLE 12 1,000–5,000 MAH POWER BANK, BY UNIT OF USB PORT, 2016–2019 (USD MILLION)

FIGURE 26 POWER BANK WITH BATTERY CAPACITY RANGING FROM 1,000 TO 5,000 MAH AND WITH 1 USB PORT TO DOMINATE DURING FORECAST PERIOD

TABLE 13 1,000–5,000 MAH POWER BANK, BY UNIT OF USB PORT, 2020–2025 (USD MILLION)

TABLE 14 1,000–5,000 MAH POWER BANK, BY INDICATOR, 2016–2019 (USD MILLION)

TABLE 15 1,000–5,000 MAH POWER BANK, BY INDICATOR, 2020–2025 (USD MILLION)

TABLE 16 1,000–5,000 MAH POWER BANK, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 17 1,000–5,000 MAH POWER BANK, BY APPLICATION, 2020–2025 (USD MILLION)

7.3 5,001–10,000 MAH

7.3.1 POWER BANKS WITH CAPACITY RANGING 5,001–10,000 MAH HOLD HIGHEST DEMAND IN THE MARKET DURING FORECAST PERIOD

TABLE 18 5,001–10,000 MAH POWER BANK MARKET, BY BATTERY TYPE, 2016–2019 (USD BILLION)

TABLE 19 5,001–10,000 MAH POWER BANK, BY BATTERY TYPE, 2020–2025 (USD BILLION)

TABLE 20 5,001–10,000 MAH POWER BANK, BY UNIT OF USB PORT, 2016–2019 (USD BILLION)

TABLE 21 5,001–10,000 MAH POWER BANK, BY UNIT OF USB PORT, 2020–2025 (USD BILLION)

TABLE 22 5,001–10,000 MAH POWER BANK, BY INDICATOR, 2016–2019 (USD BILLION)

TABLE 23 5,001–10,000 MAH POWER BANK, BY INDICATOR, 2020–2025 (USD BILLION)

TABLE 24 5,001–10,000 MAH POWER BANK, BY APPLICATION, 2016–2019 (USD MILLION)

FIGURE 27 WEARABLE DEVICE APPLICATION FOR POWER BANKS WITH 5,001–10,000 MAH BATTERY CAPACITY TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 25 5,001–10,000 MAH POWER BANK, BY APPLICATION, 2020–2025 (USD MILLION)

7.4 10,001–15,000 MAH

7.4.1 POWER BANKS WITH CAPACITY RANGING 10,001–15,000 MAH TO HAVE HIGH DEMAND IN COMING YEARS

TABLE 26 10,001–15,000 MAH POWER BANK MARKET, BY BATTERY TYPE, 2016–2019 (USD BILLION)

FIGURE 28 LITHIUM-ION BATTERY TYPE POWER BANKS TO HOLD LARGEST SHARE OF THE MARKET FOR 10,001–15,000 MAH BATTERY CAPACITY DURING THE FORECAST PERIOD

TABLE 27 10,001–15,000 MAH POWER BANK, BY BATTERY TYPE, 2020–2025 (USD BILLION)

TABLE 28 10,001–15,000 MAH POWER BANK, BY UNIT OF USB PORT, 2016–2019 (USD MILLION)

TABLE 29 10,001–15,000 MAH POWER BANK, BY UNIT OF USB PORT, 2020–2025 (USD MILLION)

TABLE 30 10,001–15,000 MAH POWER BANK, BY INDICATOR, 2016–2019 (USD MILLION)

TABLE 31 10,001–15,000 MAH POWER BANK, BY INDICATOR, 2020–2025 (USD MILLION)

TABLE 32 10,001–15,000 MAH POWER BANK, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 33 10,001–15,000 MAH POWER BANK, BY APPLICATION, 2020–2025 (USD MILLION)

7.5 15,001–20,000 MAH

7.5.1 POWER BANKS WITH CAPACITY RANGING 15,001–20,000 MAH HAVE ADVANCED PROTECTION TECHNOLOGY AND LONGER BATTERY LIFE

TABLE 34 15,001–20,000 MAH POWER BANK MARKET, BY BATTERY TYPE, 2016–2019 (USD BILLION)

TABLE 35 15,001–20,000 MAH POWER BANK BY BATTERY TYPE, 2020–2025 (USD BILLION)

TABLE 36 15,001–20,000 MAH POWER BANK, BY UNIT OF USB PORT, 2016–2019 (USD MILLION)

FIGURE 29 POWER BANK WITH CAPACITY RANGING FROM 15,001 TO 20,000 MAH AND WITH MORE THAN 2 USB PORTS TO WITNESS HIGHEST CAGR

TABLE 37 15,001–20,000 MAH POWER BANK, BY UNIT OF USB PORT, 2020–2025 (USD MILLION)

TABLE 38 15,001–20,000 MAH POWER BANK, BY INDICATOR, 2016–2019 (USD BILLION)

TABLE 39 15,001–20,000 MAH POWER BANK, BY INDICATOR, 2020–2025 (USD MILLION)

TABLE 40 15,001–20,000 MAH POWER BANK, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 41 15,001–20,000 MAH POWER BANK, BY APPLICATION, 2020–2025 (USD MILLION)

7.6 ABOVE 20,001 MAH

7.6.1 SUPER-FAST CHARGING POWER BANK EQUIPPED WITH HIGH-QUALITY BATTERY CELL

TABLE 42 ABOVE 20,001 MAH POWER BANK MARKET, BY BATTERY TYPE, 2016–2019 (USD MILLION)

TABLE 43 ABOVE 20,001 MAH POWER BANK, BY BATTERY TYPE, 2020–2025 (USD MILLION)

TABLE 44 ABOVE 20,001 MAH POWER BANK, BY UNIT OF USB PORT, 2016–2019 (USD MILLION)

TABLE 45 ABOVE 20,001 MAH POWER BANK, BY UNIT OF USB PORT, 2020–2025 (USD MILLION)

TABLE 46 ABOVE 20,001 MAH POWER BANK, BY INDICATOR, 2016–2019 (USD MILLION)

TABLE 47 ABOVE 20,001 MAH POWER BANK, BY INDICATOR, 2020–2025 (USD MILLION)

TABLE 48 ABOVE 20,001 MAH POWER BANK, BY APPLICATION, 2016–2019 (USD MILLION)

FIGURE 30 SMARTPHONE APPLICATION TO ACCOUNT FOR LARGEST SHARE OF THE MARKET FOR POWER BANKS WITH CAPACITY ABOVE 20,001 MAH

TABLE 49 ABOVE 20,001 MAH POWER BANK, BY APPLICATION, 2020–2025 (USD MILLION)

8 POWER BANK MARKET, BY BATTERY TYPE (Page No. - 89)

8.1 INTRODUCTION

FIGURE 31 POWER BANK MARKET, BY BATTERY TYPE

FIGURE 32 MARKET FOR LITHIUM-POLYMER BATTERY-BASED POWER BANK TO GROW AT HIGHER CAGR FROM 2020 TO 2025

TABLE 50 MARKET, BY BATTERY TYPE, 2016–2019 (USD BILLION)

TABLE 51 MARKET, BY BATTERY TYPE, 2020–2025 (USD BILLION)

8.2 LITHIUM-ION BATTERY

8.2.1 HIGH ENERGY DENSITY KEY ADVANTAGE OF LITHIUM-ION BATTERY

TABLE 52 MARKET FOR LITHIUM-ION BATTERY TYPE, BY CAPACITY, 2016–2019 (USD BILLION)

TABLE 53 MARKET FOR LITHIUM-ION BATTERY TYPE, BY CAPACITY, 2020–2025 (USD BILLION)

TABLE 54 MARKET FOR LITHIUM-ION BATTERY TYPE, BY REGION, 2016–2019 (USD BILLION)

TABLE 55 MARKET FOR LITHIUM-ION BATTERY TYPE, BY REGION, 2020–2025 (USD BILLION)

8.3 LITHIUM-POLYMER BATTERY

8.3.1 GROWING DEMAND FOR LIGHTWEIGHT POWER BANKS INCREASES DEMAND FOR LI-POLYMER BATTERIES

TABLE 56 MARKET FOR LITHIUM-POLYMER BATTERY TYPE, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 57 MARKET FOR LITHIUM-POLYMER BATTERY TYPE, BY CAPACITY, 2020–2025 (USD MILLION)

TABLE 58 MARKET FOR LITHIUM-POLYMER BATTERY TYPE, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 MARKET FOR LITHIUM-POLYMER BATTERY TYPE, BY REGION, 2020–2025 (USD MILLION)

9 POWER BANK MARKET, BY INDICATOR (Page No. - 97)

9.1 INTRODUCTION

FIGURE 33 MARKET, BY INDICATOR

FIGURE 34 POWER BANK WITH DIGITAL DISPLAY TO GROW AT HIGHER CAGR FROM 2020 TO 2025

TABLE 60 MARKET, BY INDICATOR, 2016–2019 (USD BILLION)

TABLE 61 MARKET, BY INDICATOR, 2020–2025 (USD BILLION)

9.2 LED LIGHTING

9.2.1 LED INDICATOR MOST ADOPTED TYPE BY MANUFACTURERS

FIGURE 35 BENEFITS OF LED LIGHTING IN POWER BANK

TABLE 62 MARKET WITH LED INDICATOR, BY CAPACITY, 2016–2019 (USD BILLION)

TABLE 63 MARKET WITH LED INDICATOR, BY CAPACITY, 2020–2025 (USD BILLION)

9.3 DIGITAL DISPLAY

9.3.1 POWER BANKS WITH DIGITAL DISPLAY WITNESS HIGH GROWTH OPPORTUNITY

TABLE 64 MARKET WITH DIGITAL DISPLAY, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 65 MARKET WITH DIGITAL DISPLAY, BY CAPACITY, 2020–2025 (USD MILLION)

10 POWER BANK MARKET, BY UNIT OF USB PORT (Page No. - 103)

10.1 INTRODUCTION

FIGURE 36 TYPES OF USB PORTS

FIGURE 37 MARKET, BY UNIT OF USB PORT

FIGURE 38 MARKET FOR POWER BANKS WITH 2 USB PORTS TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 66 MARKET, BY UNIT OF USB PORT, 2016–2019 (USD BILLION)

TABLE 67 MARKET, BY UNIT OF USB PORT, 2020–2025 (USD BILLION)

10.2 1 USB PORT

10.2.1 POWER BANKS WITH 1 USB PORT MOSTLY FEATURE LOW BATTERY CAPACITY

TABLE 68 MARKET FOR POWER BANKS WITH 1 USB PORT, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 69 MARKET FOR POWER BANKS WITH 1 USB PORT, BY CAPACITY, 2020–2025 (USD MILLION)

10.3 2 USB PORTS

10.3.1 POWER BANKS WITH DUAL USB PORTS ARE PREFERED

TABLE 70 MARKET FOR POWER BANKS WITH 2 USB PORTS, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 71 MARKET FOR POWER BANKS WITH 2 USB PORTS, BY CAPACITY, 2020–2025 (USD MILLION)

10.4 MORE THAN 2 USB PORTS

10.4.1 USAGE OF USB HUB MODE FOR MULTI-PORT POWER BANKS

TABLE 72 MARKET FOR POWER BANKS WITH MORE THAN 2 USB PORTS, BY CAPACITY, 2016-2019 (USD MILLION)

TABLE 73 MARKET FOR POWER BANKS WITH MORE THAN 2 USB PORTS, BY CAPACITY, 2020-2025 (USD MILLION)

11 POWER BANK MARKET, BY PRICE RANGE (Page No. - 111)

11.1 INTRODUCTION

FIGURE 39 PRICE RANGE OF POWER BANKS

TABLE 74 MARKET, BY PRICE RANGE, 2016–2019 (USD BILLION)

TABLE 75 MARKET, BY PRICE RANGE, 2020–2025 (USD BILLION)

11.2 LOW

11.2.1 LOW-PRICED POWER BANKS ARE GENERALLY COMPACT AND PALM-SIZED

11.3 MEDIUM

11.3.1 MEDIUM-PRICED POWER BANKS OFFER HIGH CAPACITY WITH SEVERAL INPUT & OUTPUT OPTIONS

11.4 PREMIUM

11.4.1 PREMIUM-PRICED POWER BANKS ARE EXTREMELY DURABLE AND INTEGRATED WITH MULTI-PROTECTION SAFETY SYSTEM

12 POWER BANK MARKET, BY APPLICATION (Page No. - 114)

12.1 INTRODUCTION

FIGURE 40 MARKET, BY APPLICATION

TABLE 76 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

FIGURE 41 MARKET FOR WEARABLE DEVICES TO REGISTER AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 77 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.2 IMPACT OF COVID-19 ON APPLICATIONS OF POWER BANK

12.2.1 MOST IMPACTED APPLICATION

12.2.2 LEAST IMPACTED APPLICATION

12.3 SMARTPHONE

12.3.1 SMARTPHONE APPLICATION HOLDS LARGEST SHARE OF POWER BANK MARKET

TABLE 78 MARKET FOR SMARTPHONE APPLICATION, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 79 MARKET FOR SMARTPHONE APPLICATION, BY CAPACITY, 2020–2025 (USD MILLION)

TABLE 80 MARKET FOR SMARTPHONE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 81 MARKET FOR SMARTPHONE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 82 MARKET FOR SMARTPHONE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 83 MARKET FOR SMARTPHONE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 84 MARKET FOR SMARTPHONE APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 85 MARKET FOR SMARTPHONE APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 86 MARKET FOR SMARTPHONE APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 87 MARKET FOR SMARTPHONE APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 88 MARKET FOR SMARTPHONE APPLICATION IN ROW, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 89 MARKET FOR SMARTPHONE APPLICATION IN ROW, BY COUNTRY, 2020–2025 (USD MILLION)

12.4 TABLET

12.4.1 POWER BANKS ARE USED TO PROVIDE UNINTERRUPTABLE POWER SUPPLY FOR TABLETS

TABLE 90 POWER BANK MARKET FOR TABLET APPLICATION, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 91 MARKET FOR TABLET APPLICATION, BY CAPACITY, 2020–2025 (USD MILLION)

TABLE 92 MARKET FOR TABLET APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 93 MARKET FOR TABLET APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 94 MARKET FOR TABLET APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 95 MARKET FOR TABLET APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 96 MARKET FOR TABLET APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 97 MARKET FOR TABLET APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 98 POWER BANK MARKET FOR TABLET APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 99 MARKET FOR TABLET APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 100 MARKET FOR TABLET APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 101 MARKET FOR TABLET APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.5 LAPTOP

12.5.1 POWER BANKS ENSURE LONG USAGE WITHOUT INTERRUPTION IN LAPTOPS

TABLE 102 MARKET FOR LAPTOP APPLICATION, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 103 MARKET FOR LAPTOP APPLICATION, BY CAPACITY, 2020–2025 (USD MILLION)

TABLE 104 MARKET FOR LAPTOP APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 105 MARKET FOR LAPTOP APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 106 MARKET FOR LAPTOP APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 107 MARKET FOR LAPTOP APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 108 MARKET FOR LAPTOP APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 109 MARKET FOR LAPTOP APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 110 MARKET FOR LAPTOP APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 111 MARKET FOR LAPTOP APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 112 MARKET FOR LAPTOP APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 113 MARKET FOR LAPTOP APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.6 WEARABLE DEVICE

12.6.1 MOST WEARABLE DEVICES ARE WIRELESS AND PORTABLE, REQUIRING CONTINUOUS SUPPLY OF POWER

TABLE 114 POWER BANK MARKET FOR WEARABLE DEVICE APPLICATION, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 115 MARKET FOR WEARABLE DEVICE APPLICATION, BY CAPACITY, 2020–2025 (USD MILLION)

TABLE 116 MARKET FOR WEARABLE DEVICE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 117 MARKET FOR WEARABLE DEVICE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 118 MARKET FOR WEARABLE DEVICE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 119 MARKET FOR WEARABLE DEVICE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 120 MARKET FOR WEARABLE DEVICE APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 121 MARKET FOR WEARABLE DEVICE APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 122 MARKET FOR WEARABLE DEVICE APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 123 MARKET FOR WEARABLE DEVICE APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 124 MARKET FOR WEARABLE DEVICE APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 125 MARKET FOR WEARABLE DEVICE APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.7 DIGITAL CAMERA

12.7.1 DIGITAL CAMERAS USE POWER BANKS AS EXTERNAL POWER SOURCE

TABLE 126 MARKET FOR DIGITAL CAMERA APPLICATION, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 127 MARKET FOR DIGITAL CAMERA APPLICATION, BY CAPACITY, 2020–2025 (USD MILLION)

TABLE 128 MARKET FOR DIGITAL CAMERA APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 129 MARKET FOR DIGITAL CAMERA APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 130 MARKET FOR DIGITAL CAMERA APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 131 MARKET FOR DIGITAL CAMERA APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 132 MARKET FOR DIGITAL CAMERA APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 133 MARKET FOR DIGITAL CAMERA APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 134 POWER BANK MARKET FOR DIGITAL CAMERA APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 135 MARKET FOR DIGITAL CAMERA APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 136 MARKET FOR DIGITAL CAMERA APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 137 MARKET FOR DIGITAL CAMERA APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.8 PORTABLE MEDIA DEVICE

12.8.1 PORTABLE MEDIA PLAYERS REQUIRE MORE BATTERY LIFE DUE TO FASTER DATA CONNECTIVITY AND SUBSEQUENT INCREASE IN DIGITAL CONTENT

TABLE 138 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 139 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION, BY CAPACITY, 2020–2025 (USD MILLION)

TABLE 140 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 141 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 142 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 143 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 144 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 145 POWER BANK MARKET FOR PORTABLE MEDIA DEVICE APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 146 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 147 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 148 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 149 MARKET FOR PORTABLE MEDIA DEVICE APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.9 OTHERS

12.9.1 GAMING DEVICES, GPS NAVIGATORS, AND E-READERS REQUIRE POWER BANKS TO REDUCE DEPENDENCY ON FIXED ELECTRICAL OUTLET

TABLE 150 MARKET FOR OTHER APPLICATIONS, BY CAPACITY, 2016–2019 (USD MILLION)

TABLE 151 MARKET FOR OTHER APPLICATIONS, BY CAPACITY, 2020–2025 (USD MILLION)

TABLE 152 MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 153 POWER BANK MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 154 MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 155 MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 156 MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 157 MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 158 MARKET FOR OTHER APPLICATIONS IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 159 MARKET FOR OTHER APPLICATIONS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 160 MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 161 MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2020–2025 (USD MILLION)

13 GEOGRAPHIC ANALYSIS (Page No. - 151)

13.1 INTRODUCTION

FIGURE 42 GEOGRAPHIC SNAPSHOT: INDIA TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

TABLE 162 POWER BANK MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 163 MARKET, BY REGION, 2020–2025 (USD BILLION)

FIGURE 43 APAC HELD LARGEST SHARE OF MARKET IN 2019

13.2 NORTH AMERICA

FIGURE 44 NORTH AMERICA: SNAPSHOT OF MARKET

FIGURE 45 MARKET IN PRE COVID-19 AND POST COVID-19 SCENARIO IN NORTH AMERICA

TABLE 164 MARKET IN NORTH AMERICA, BY PRE COVID-19 AND POST COVID-19, 2016–2025 (USD MILLION)

TABLE 165 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 166 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 167 MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 168 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

13.2.1 US

13.2.1.1 Us accounted for the largest share of power bank market in north america

TABLE 169 MARKET IN US, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 170 MARKET IN US, BY APPLICATION, 2020–2025 (USD MILLION)

13.2.2 CANADA

13.2.2.1 Major applications such as smartphones and tablets driving growth of this market

TABLE 171 MARKET IN CANADA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 172 MARKET IN CANADA, BY APPLICATION, 2020–2025 (USD MILLION)

13.2.3 MEXICO

13.2.3.1 Mexico expected to be lucrative market for power banks

TABLE 173 POWER BANK MARKET IN MEXICO, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 174 MARKET IN MEXICO, BY APPLICATION, 2020–2025 (USD MILLION)

13.3 EUROPE

FIGURE 46 EUROPE: SNAPSHOT OF MARKET

TABLE 175 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 176 MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 177 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Germany Invests Extensively In R&D Of Battery Production Due To Which It Holds Strong Market Value

TABLE 178 MARKET IN GERMANY, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 179 MARKET IN GERMANY, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.2 UK

13.3.2.1 Increasing demand for smart wearable electronics and smartphones in this country.

TABLE 180 MARKET IN UK, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 181 MARKET IN UK, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 France depicts significant growth in smartphone, internet use, and internet-connected mobile devices

TABLE 182 MARKET IN FRANCE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 183 MARKET IN FRANCE, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.4 REST OF EUROPE

TABLE 184 MARKET IN REST OF EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 185 MARKET IN REST OF EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

13.4 APAC

FIGURE 47 APAC: SNAPSHOT OF POWER BANK MARKET

FIGURE 48 MARKET FOR PRE COVID-19 AND POST COVID-19 SCENARIO IN APAC

TABLE 186 MARKET IN APAC, BY PRE COVID-19 AND POST COVID-19, 2016–2025 (USD MILLION)

TABLE 187 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 188 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 189 MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 190 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.1 CHINA

13.4.1.1 China has major presence of power bank manufacturers

TABLE 191 POWER BANK MARKET IN CHINA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 192 MARKET IN CHINA, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.2 JAPAN

13.4.2.1 Players based in japan focus on differentiating their products from other manufacturers

TABLE 193 MARKET IN JAPAN, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 194 MARKET IN JAPAN, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.3 SOUTH KOREA

13.4.3.1 South korea has presence of major battery manufacturers designing lithium batteries for power banks

TABLE 195 MARKET IN SOUTH KOREA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 196 MARKET IN SOUTH KOREA, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.4 INDIA

13.4.4.1 India presents huge opportunity for power bank market

TABLE 197 MARKET IN INDIA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 198 MARKET IN INDIA, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.5 REST OF APAC

TABLE 199 MARKET IN REST OF APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 200 MARKET IN REST OF APAC, BY APPLICATION, 2020–2025 (USD MILLION)

13.5 ROW

TABLE 201 POWER BANK MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 202 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 203 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 204 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

13.5.1 MIDDLE EAST & AFRICA

13.5.1.1 Increasing demand for wearables and growing penetration of smartphones and tablets

TABLE 205 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 206 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2020–2025 (USD MILLION)

13.5.2 SOUTH AMERICA

13.5.2.1 South america is among developing markets for power banks

TABLE 207 MARKET IN SOUTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 208 MARKET IN SOUTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 185)

14.1 OVERVIEW

14.2 RANKING ANALYSIS, 2019

FIGURE 49 POWER BANK MARKET: RANKING ANALYSIS (2019)

14.3 COMPETITIVE LEADERSHIP MAPPING

14.3.1 VISIONARY LEADERS

14.3.2 INNOVATORS

14.3.3 DYNAMIC DIFFERENTIATORS

14.3.4 EMERGING COMPANIES

FIGURE 50 POWER BANK MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

14.4 COMPETITIVE SITUATIONS AND TRENDS

14.4.1 PRODUCT LAUNCHES AND DEVELOPMENTS

14.4.2 OTHERS

15 COMPANY PROFILES (Business Overview, Products Offered, Recent Developments, Swot Analysis, Mnm View)* (Page No. - 191)

15.1 INTRODUCTION

15.1.1 IMPACT OF COVID-19 ON PLAYERS OF POWER BANK MARKET

15.2 KEY PLAYERS

15.2.1 ADATA

FIGURE 51 ADATA: COMPANY SNAPSHOT

15.2.2 ANKER INNOVATIONS

15.2.3 AUKEY

15.2.4 XIAOMI

FIGURE 52 XIAOMI: COMPANY SNAPSHOT

15.2.5 RAVPOWER

15.2.6 GRIFFIN

15.2.7 LENOVO

FIGURE 53 LENOVO: COMPANY SNAPSHOT

15.2.8 MOPHIE

15.2.9 AMBRANE

15.2.10 INTEX

15.3 RIGHT TO WIN

15.4 OTHER COMPANIES

15.4.1 MYCHARGE

15.4.2 OMNICHARGE

15.4.3 IWALK

15.4.4 EASYACC

15.4.5 DURACELL

15.4.6 SONY

15.4.7 SYSKA

15.4.8 TP-LINK TECHNOLOGIES

15.4.9 UIMI

15.4.10 UNU

15.4.11 VOLTAIC SYSTEMS

15.4.12 PNY

15.4.13 ZENDURE

15.4.14 PHILIPS

15.4.15 ROMOSS

*Details On Business Overview, Products Offered, Recent Developments, Swot Analysis, Mnm View Might Not Be Captured In Case Of Unlisted Companies.

16 ADJACENT MARKET REPORT: LITHIUM-ION BATTERY MARKET (Page No. - 228)

FIGURE 54 LITHIUM-ION BATTERY MARKET, BY INDUSTRY

TABLE 209 LITHIUM-ION BATTERY MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

16.1 CONSUMER ELECTRONICS

TABLE 210 LITHIUM-ION BATTERY MARKET FOR CONSUMER ELECTRONICS, BY POWER CAPACITY, 2017–2025 (USD MILLION)

TABLE 211 LITHIUM-ION BATTERY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2025 (USD MILLION)

16.1.1 SMARTPHONES

16.1.2 UPS

16.1.3 LAPTOPS

16.1.4 OTHERS (GAMES, GARDENING TOOLS, AND DRILLING)

16.2 AUTOMOTIVE

TABLE 212 LITHIUM-ION BATTERY MARKET FOR AUTOMOTIVE, BY POWER CAPACITY, 2017–2025 (USD MILLION)

TABLE 213 LITHIUM-ION BATTERY MARKET FOR AUTOMOTIVE, BY REGION, 2017–2025 (USD MILLION)

16.2.1 BATTERY ELECTRIC VEHICLES

16.2.2 PLUG-IN HYBRID ELECTRIC VEHICLES

16.3 AEROSPACE & DEFENSE

TABLE 214 LITHIUM-ION BATTERY MARKET FOR AEROSPACE & DEFENSE, BY POWER CAPACITY, 2017–2025 (USD MILLION)

TABLE 215 LITHIUM-ION BATTERY MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2017–2025 (USD MILLION)

16.3.1 COMMERCIAL AIRCRAFT

16.3.2 DEFENSE

16.4 MARINE

TABLE 216 LITHIUM-ION BATTERY MARKET FOR MARINE, BY POWER CAPACITY, 2017–2025 (USD MILLION)

TABLE 217 LITHIUM-ION BATTERY MARKET FOR MARINE, BY REGION, 2017–2025 (USD MILLION)

16.4.1 COMMERCIAL

16.4.2 TOURISM

16.4.3 DEFENSE

16.5 MEDICAL

TABLE 218 LITHIUM-ION BATTERY MARKET FOR MEDICAL, BY POWER CAPACITY, 2017–2025 (USD MILLION)

TABLE 219 LITHIUM-ION BATTERY MARKET FOR MEDICAL, BY REGION, 2017–2025 (USD MILLION)

16.6 INDUSTRIAL

TABLE 220 LITHIUM-ION BATTERY MARKET FOR INDUSTRIAL, BY POWER CAPACITY, 2017–2025 (USD MILLION)

TABLE 221 LITHIUM-ION BATTERY MARKET FOR INDUSTRIAL, BY REGION, 2017–2025 (USD MILLION)

16.6.1 MINING EQUIPMENT

16.6.2 CONSTRUCTION EQUIPMENT

16.6.3 FORKLIFTS, AUTOMATED GUIDED VEHICLES (AGV), AND AUTOMATED MOBILE ROBOTS (AMR)

16.7 POWER

TABLE 222 LITHIUM-ION BATTERY MARKET FOR POWER, BY POWER CAPACITY, 2017–2025 (USD MILLION)

TABLE 223 LITHIUM-ION BATTERY MARKET FOR POWER, BY REGION, 2017–2025 (USD MILLION)

16.8 TELECOMMUNICATION

TABLE 224 LITHIUM-ION BATTERY MARKET FOR TELECOM, BY POWER CAPACITY, 2017–2025 (USD MILLION)

TABLE 225 LITHIUM-ION BATTERY MARKET FOR TELECOM, BY REGION, 2017–2025 (USD MILLION)

17 APPENDIX (Page No. - 243)

17.1 INSIGHTS OF INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

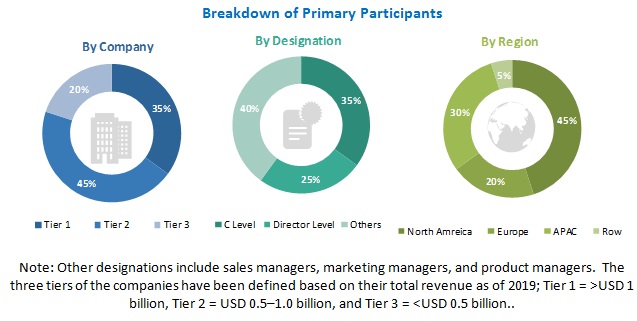

The study involves four major activities for estimating the size of the power bank market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the power bank market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, databases, the association for computing machinery, animation magazine, and VFX voice have been used to identify and collect information for an extensive technical and commercial study of the power bank market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the power bank market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the power bank market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches

Study Objectives

- To define and forecast the power bank market, in terms of value and volume, by battery type, capacity, indicator, price range, unit of USB port, and application

- To describe and forecast the power bank market, in terms of value, for regions such as

- North America, Europe, Asia Pacific (APAC), and the Rest of World (RoW), along with their respective countries

- To describe energy sources of power banks

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the power bank market

- To provide a detailed impact of COVID-19 on the power bank market

- To provide the impact of COVID-19 on the market segments and the players operating in the power bank market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the power bank ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with a detailed competitive landscape for market leaders

- To analyze strategic approaches such as product launches and developments, and partnerships in the power bank market

Geographic Analysis

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, and Rest of Europe)

- Asia Pacific (China, Japan, India, and Rest of APAC)

- Rest of the World (South America, Middle East, and Africa)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Growth opportunities and latent adjacency in Power Bank Market

I would like to get an report on wearable device market analysis, competitor market share and total market share over the period of the next five years.

I am currently working on 5,001–10,000 mAh power bank. Do you have such information qualitative or quantitative?

Currently trying to identify market size for Power Bank Market - particularly those used in smartphone and tablets.

We are a supplier of Lithium-Ion and are interested in this market. As your study seems quite interesting I would like to have a better outlook of it before buying it.

I am interested in power bank market of different capacity. Have you provided power bank capacity market by each applications?