Privacy Management Software Market by Application (Data Discovery & Mapping, DSAR, PIA, Consent & Preference Management), Deployment Mode, Organization Size (Large Enterprises, SMEs), Vertical and Region - Global Forecast to 2028

Privacy Management Software Market Overview

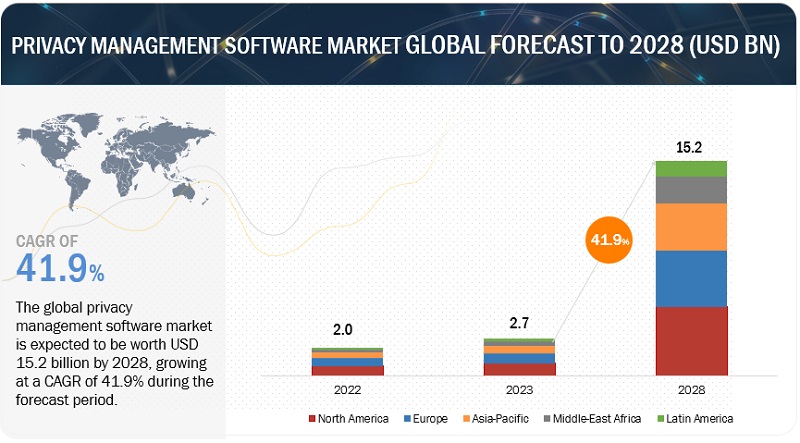

The privacy management software market size was estimated at USD 2.7 billion in 2023 and is projected to reach USD 15.2 billion by 2028 at a CAGR of 41.9% during the forecast period. As privacy regulations became more stringent, privacy impact assessments (PIAs) gained prominence.

Privacy management software incorporated PIA frameworks to evaluate the potential risks and impacts on individuals' privacy associated with data processing activities. These tools facilitated the systematic assessment of data flows, risk identification, and implementation of appropriate mitigations. Modern privacy management software has evolved into comprehensive platforms that provide organizations with holistic privacy governance capabilities. These platforms integrate various modules, including data inventory, risk assessments, vendor management, policy management, privacy by design, and ongoing compliance monitoring. They offer centralized visibility, automation, and analytics to enable proactive privacy management, risk mitigation, and ongoing compliance with evolving regulations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Privacy management software market

The global recession caused by the COVID-19 pandemic has had a mixed impact on the privacy management software market. Factors like the Russia-Ukraine war, the global pandemic, inflation, rising interest rates, and rising oil prices have resulted in recession across the various regions. These market uncertainties have resulted in reduced spending by organizations that may impact the demand for privacy management software across industries in the short term. The impact of a recession on the privacy management software market may vary across industries. Certain verticals, such as finance, healthcare, and retail & eCommerce, where privacy and data protection are critical, may prioritize privacy management software investments despite economic challenges. In contrast, industries heavily affected by the recession may delay or reduce spending on privacy management software until economic conditions improve. In addition, The Russia-Ukraine war has been accompanied by reports of cyber espionage, hacking attempts, and disinformation campaigns. These activities highlight the importance of robust cybersecurity measures. This will likely drive the growth of privacy management software during the forecast period. While the recession has a mixed impact on the privacy management software market, the long-term prospects for the industry remain positive. The continued growth in internet penetration, the increasing popularity of mobile devices, advent of technologies such as AI, IoT, cloud, and changing regulatory landscape across the globe, are likely to drive continued growth in the market. However, the impact of the recession on the market is likely to be felt for some time, particularly in terms of investment and advertising revenue.

Privacy Management Software Market Dynamics

Driver: Need for personal data protection with increasing privacy concerns

With the exponential growth of digital technologies and the extensive collection and processing of personal data, individuals are becoming more aware of the potential risks to their privacy. Organizations are increasingly demanding to protect personal data and ensure responsible data handling practices. Data privacy management software enables organizations to establish effective data governance frameworks. It helps organizations define data handling policies, track data flows, and implement controls to ensure responsible data processing practices. This promotes accountability and transparency in data management. As per the Cisco Consumer Privacy Survey 2022, organizations can perform a variety of activities to fulfill customer demands and build trust. These include complying with all applicable privacy laws and regulations, refraining from selling the customer’s personal information, avoiding data breaches that might expose personal data, allowing the customer to configure their privacy settings, and providing clear information on how the customer’s data is being used. As per the survey, 39% of consumers selected how their data is being used as the top priority.

Restraint: integration of privacy management software with existing systems

Privacy management software must seamlessly integrate with various existing systems and databases within an organization. However, compatibility issues can arise due to differences in data formats, protocols, or system architectures. These technical disparities can make the integration process complex and time-consuming. Organizations often have unique processes and requirements when it comes to privacy management. Integrating privacy management software may require customization and configuration to align with specific workflows, data structures, and business rules. This customization can be tedious and may require specialized expertise.

In some cases, existing systems may already have privacy management features or modules. Integrating additional privacy management software can result in duplication of efforts and redundant functionalities. This duplication can lead to confusion, increased complexity, and wasted resources. Organizations should conduct thorough planning and analysis to overcome this, involving key stakeholders from IT, privacy, and relevant departments. It is crucial to assess the compatibility of privacy management software with existing systems, anticipate customization needs, allocate sufficient resources for data migration and mapping, and provide employees comprehensive training and change management support.

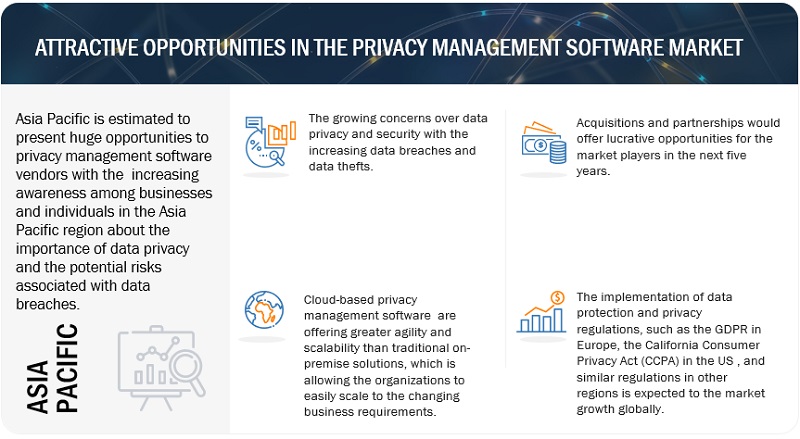

Opportunity: Growing spending on cybersecurity initiatives

As cyber threats become more sophisticated and prevalent, organizations allocate more resources to bolster their cybersecurity measures. As per a recent meeting at the White House, several tech giants such as Apple, AWS, and IBM announced new cybersecurity initiatives from 2021 to 2025.This includes investing in privacy management software as an essential component of their overall security strategy. Privacy management software helps protect sensitive data, prevent unauthorized access, and mitigate the risks of data breaches and privacy violations. In addition, Privacy management software provides tools and features to facilitate compliance, such as data mapping, consent management, and incident response capabilities. The increasing emphasis on regulatory compliance drives the need for privacy management software and justifies the increased spending in this area.

Challenge: Time to implement data privacy management software

The duration to implement data privacy management software can vary significantly depending on several factors, including the complexity of the software, the organization’s size and structure, the scope of the implementation, and the level of customization required. As per a survey conducted by g2.com in March 2021, the implementation time for products including TrustArc, DataGrail, Secure Privacy, SAI360, Collibra, SureCloud, DPOrganizer, and OneTrust was in the range of 24 days to 160 days. The shortest implementation time has been cited as DPOrganizer at just under one month, followed by Secure Privacy, with an implementation time of a month and a half. At the same time, the longest implementation periods are reported at just over five months. SAI360 reported an implementation period of 159 days, and Collibra completed theirs in 156 days. This will engage the IT and security teams in implementing and integrating the privacy management software and may impact the performance of other applications and business performance. Thus, the implementation time for various vendors of privacy management software will pose a challenge in adopting privacy management software across industry verticals.

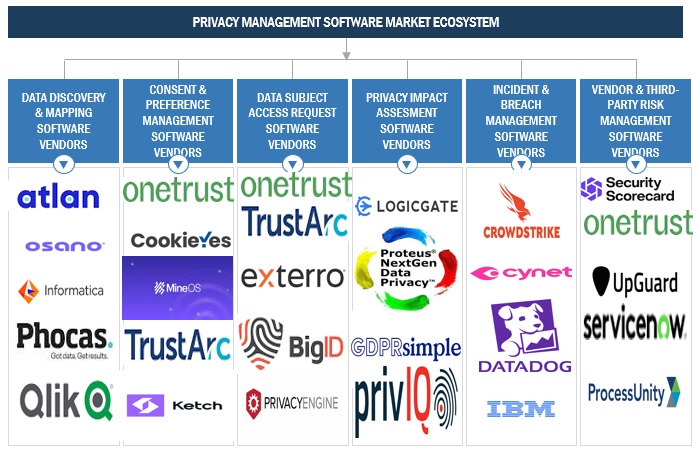

Privacy Management Software Market Ecosystem

Based on deployment mode, the on-premises segment is projected to witness the highest market share during the forecast period.

Organizations opting for on-premises privacy management software prioritize data control, customization, and compliance with internal policies. They are willing to take on the responsibility of managing the software and infrastructure to maintain full control over their privacy management processes. However, it is important to carefully assess the organization's needs, resources, and capabilities before deciding on an on-premises deployment mode. The adoption of on-premises privacy management software is not as widespread as cloud-based solutions. However, for organizations with specific needs and priorities, such as data security, compliance, integration requirements, or cost considerations, on-premises solutions remain viable. Organizations should carefully evaluate their unique circumstances, risk appetite, and long-term objectives before deciding on the most suitable deployment mode for their privacy management software.

By Vertical, the healthcare segment is expected to grow at a higher CAGR during the forecast period.

Privacy management software plays a crucial role in the healthcare industry, where patient privacy and data protection are paramount. Privacy management software is essential in the healthcare industry for ensuring compliance with privacy regulations, protecting patient data, managing consent, facilitating secure data sharing, handling privacy incidents, maintaining accountability, and managing data subject rights. By leveraging privacy management software, healthcare organizations can enhance patient privacy, maintain regulatory compliance, and foster trust in the healthcare ecosystem.

Privacy management software significantly benefits the healthcare industry by ensuring regulatory compliance, protecting patient data, facilitating consent management, enabling secure data sharing, assisting in privacy incident management, enhancing accountability, and supporting data subject rights management. By leveraging privacy management software, healthcare organizations can strengthen patient privacy, maintain compliance with privacy regulations, and build trust in handling sensitive patient information.

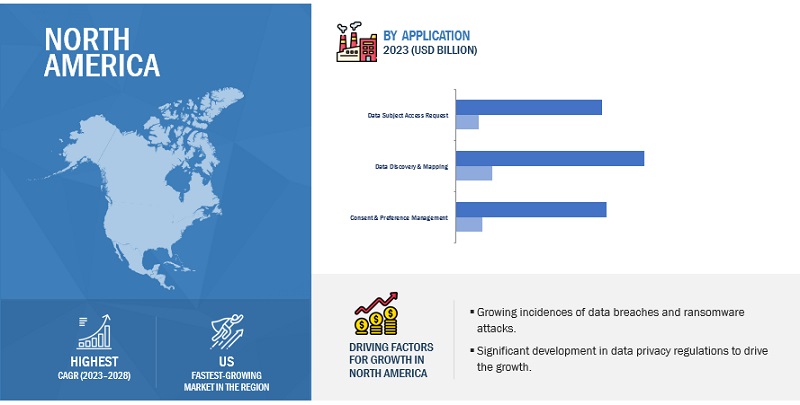

Based on Region, North America to hold the largest market share during the forecast period.

The privacy landscape in North America is characterized by a mix of federal, state, and sector-specific privacy laws, evolving regulatory frameworks, advocacy efforts, and public demand for privacy rights. The push for comprehensive federal privacy legislation and the need to navigate the complexities of privacy compliance is expected to drive the growth of the market in the region. Regional privacy laws and regulations, industry standards, and evolving privacy expectations influence privacy management practices in North America. Various industry-specific regulations and standards influence data protection practices in North America. For instance, the Payment Card Industry Data Security Standard (PCI DSS) sets requirements for handling payment card data, while the National Institute of Standards and Technology (NIST) provides cybersecurity and privacy frameworks widely adopted by organizations. In addition, the adoption of cloud technology is also driving cross-border data transfers. Organizations in North America now rely on mechanisms such as Standard Contractual Clauses (SCCs) and Binding Corporate Rules (BCRs) to ensure lawful cross-border data transfers. With the outbreak of COVID-19, consumer awareness regarding data privacy and the importance of protecting personal information has grown with the growing usage of digital platforms, leading to increased expectations for privacy safeguards from organizations. As per EY Global Consumer Privacy Survey 2020, 58% of respondents in North America are more conscious about the personal information shared via digital communication platforms than before the pandemic. These factors are likely to drive the adoption of privacy management software in the region.

Key Market Players

The privacy management software market is dominated by a few globally established players such as OneTrust (US), among others, are the key vendors that secured privacy management software contracts in last few years. These vendors can bring global processes and execution expertise to the table, the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the privacy management software market.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Application, Deployment Mode, Organization Size, and Vertical |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

OneTrust (US), TrustArc (US), Securiti (US), BigID (US), Exterro (US), SAP (Germany), IBM (US), Collibra (US), DataGuard (Germany), LogicGate (US), Truyo (US), Segment (US), Spirion (US), Didomi (France), SureCloud (UK), DataGrail (US), Egnyte (US), WireWheel (US), Data Privacy Manager (UK), SAI360 (US), Straits Interactive (Singapore), Corporater (Norway), Transcend (US), Ketch (US), Secuvy (US), Clarip (US), DPOrganizer (UK), MineOS (Israel), Osano (Ireland), and PrivacyEngine (Ireland). |

This research report categorizes the privacy management software market to forecast revenue and analyze trends in each of the following submarkets:

Based on Application:

- Data Discovery & Mapping

- Data Subject Access Request (DSAR)

- Privacy Impact Assessment (PIA)

- Consent & Preference Management (CPM)

- Incident & Breach Management

- Vendor & Third-Party Risk Management

- Other Applications

Based on Deployment Mode:

- Cloud

- On-premises

Based on Organization Size:

- Large Enterprises

- SMEs

Based on Vertical:

- BFSI

- Government & Defense

- Healthcare

- Retail & eCommerce

- Manufacturing

- IT & Telecommunications

- Other Verticals

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2023, OneTrust launched AI-driven document classification to support organizations to completely identify and classifying unstructured data to enhance data governance and data discovery.

- In April 2023, BigID announced a technology partnership with Thales, a data security technology provider, to combine BigID data intelligence and Thales CipherTrust Platform to encrypt, anonymize, and delete data.

- In May 2021, Securiti announced the collaboration between Security and Workday by launching Securiti for Workday to enhance security, privacy, governance, and compliance for sensitive employee and financial data within the Workday platform.

- In March 2021, IBM announced the launch of the launch of IBM OpenPages Data Privacy Management, a new module in the OpenPages platform that enables organizations to meet new data privacy challenges.

- In December 2020, Exterro acquired AccessData, a forensic investigation technology provider, to help customers manage legal governance, risk, and compliance (GRC) obligations.

- In June 2020, TrustArc partnered with BigID, a leading provider of data discovery and intelligence solutions for privacy, protection, and insights. This collaboration aims to assist organizations in discovering, classifying, understanding, and safeguarding personal and sensitive data to ensure ongoing privacy compliance.

Frequently Asked Questions (FAQ):

What is Privacy Management Software?

Privacy management software provides a comprehensive solution for users to manage their company’s privacy program, including mapping sensitive data and replying to consumer requests or data subject requests. Many privacies management software also have additional functionalities of privacy impact assessment software, consent & preference management, vendor & third-party risk management, incident & breach management, regulatory compliance management, and privacy policy management tools.

Which country is the early adopter of Privacy Management Software?

The US is at the initial stage of the adoption of Privacy Management Software.

Which are the key vendors exploring Privacy Management Software?

Some of the major vendors offering privacy management software across the globe include OneTrust (US), TrustArc (US), Securiti (US), BigID(US), Exterro (US), SAP (Germany), IBM (US), Collibra (US), DataGuard (Germany), LogicGate (US), Truyo (US), Segment (US), Spirion (US), Didomi (France), SureCloud (UK), DataGrail (US), Egnyte (US), WireWheel (US), Data Privacy Manager (UK), SAI360 (US), Straits Interactive (Singapore), Corporater (Norway), Transcend (US), Ketch (US), Secuvy (US), Clarip (US), DPOrganizer (UK), MineOS (Israel), Osano (Ireland), and PrivacyEngine (Ireland).

What is the total CAGR expected to be recorded for the Privacy management software market during 2023-2028?

The Privacy management software market is expected to record a CAGR of 41.9% from 2023-2028

What is the projected market value of the privacy management software market?

The privacy management software market size is expected to grow from USD 2.7 billion in 2023 to USD 15.2 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 41.9% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need for personal data protection with increasing privacy concerns- Growing number of data subject access requests from consumers to access personal data- Growing cases of data breaches and misuse with digital transformationRESTRAINTS- Integration of privacy management software with existing systemsOPPORTUNITIES- Rising adoption of IoT devices with increasing internet penetration- Growing expenditure on cybersecurity initiativesCHALLENGES- Time to implement data privacy management software- Rapid pace of technological advancements

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: MINEOS STREAMLINED AND AUTOMATED ENTIRE DSR PROCESS FOR GLASSESUSACASE STUDY 2: MANNI GROUP IMPROVED DECISION-MAKING AND OPERATIONAL EFFICIENCY THROUGH INTEGRATED VIEW OF ORGANIZATION’S RISK MANAGEMENTCASE STUDY 3: MILLENNIUM PHYSICIAN GROUP ENHANCED ITS COMPLIANCE & ETHICS STRUCTURE WITH SAI360CASE STUDY 4: CREDIT SUISSE UTILIZED COLLIBRA PLATFORM TO STRENGTHEN ITS DATA PRIVACY PRACTICESCASE STUDY 5: ABEILLE ASSURANCES IMPLEMENTED DIDOMI TO ENSURE TRANSPARENCY AND COMPLIANCE WITH DATA PROTECTION REGULATIONS

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 ECOSYSTEM

-

5.6 TECHNOLOGICAL ANALYSISDATA MASKING AND PSEUDONYMIZATIONPRIVACY-ENHANCING TECHNOLOGIESPRIVACY BY DESIGNINTERNET OF THINGSMACHINE LEARNINGCLOUD COMPUTINGBLOCKCHAINARTIFICIAL INTELLIGENCE

- 5.7 PRICING ANALYSIS

-

5.8 PATENT ANALYSIS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY CONFERENCES AND EVENTS IN 2023 & 2024

-

5.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.12 REGULATIONSNORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST & AFRICALATIN AMERICA

-

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.14 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONAPPLICATION: MARKET DRIVERS

-

6.2 DATA DISCOVERY & MAPPINGINCREASING EMPHASIS ON DATA PRIVACY AND REGULATORY COMPLIANCE TO LEAD TO ADOPTION OF DATA & MAPPING

-

6.3 DATA SUBJECT ACCESS REQUESTDSAR TO BECOME POPULAR WITH INCREASING AWARENESS AND DEMAND FOR INDIVIDUAL DATA PRIVACY RIGHTS

-

6.4 PRIVACY IMPACT ASSESSMENT(PIA)ORGANIZATIONS TO CONDUCT PIA WITH INTRODUCTION OF STRINGENT PRIVACY REGULATIONS

-

6.5 CONSENT & PREFERENCE MANAGEMENTINCREASING FOCUS ON PERSONALIZATION AND CUSTOMER-CENTRIC APPROACHES IN BUSINESSES

-

6.6 INCIDENT & BREACH MANAGEMENTGROWING FREQUENCY OF DATA BREACHES AND CYBERSECURITY INCIDENTS

-

6.7 VENDOR & THIRD-PARTY RISK MANAGEMENTINCREASING RELIANCE ON EXTERNAL VENDORS AND SERVICE PROVIDERS TO FUEL DEMAND FOR VENDOR & THIRD-PARTY MANAGEMENT

- 6.8 OTHER APPLICATIONS

-

7.1 INTRODUCTIONDEPLOYMENT MODE: MARKET DRIVERS

-

7.2 CLOUDINCREASING ADOPTION OF CLOUD-BASED SERVICES TO DRIVE GROWTH

-

7.3 ON-PREMISESORGANIZATIONS IN GOVERNMENT, HEALTHCARE, AND BFSI TO MINIMIZE DATA BREACHES

-

8.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

-

8.2 SMALL & MEDIUM ENTERPRISESINCREASING EMPHASIS ON PRIVACY AND DATA PROTECTION REGULATIONS AMONG SMES

-

8.3 LARGE ENTERPRISESINCREASING COMPLEXITY OF PRIVACY REGULATIONS TO DRIVE GROWTH

-

9.1 INTRODUCTIONVERTICAL: MARKET DRIVERS

-

9.2 BFSIBFSI ORGANIZATIONS TO IMPLEMENT PRIVACY MANAGEMENT TO HANDLE SENSITIVE CUSTOMER FINANCIAL DATA

-

9.3 GOVERNMENT & DEFENSEGOVERNMENT & DEFENSE ORGANIZATIONS TO DEAL WITH SENSITIVE AND CLASSIFIED INFORMATION

-

9.4 HEALTHCAREHEALTHCARE ORGANIZATIONS TO PROTECT PATIENT DATA AND ENSURE SECURITY OF SENSITIVE INFORMATION

-

9.5 RETAIL & ECOMMERCEORGANIZATIONS TO GAIN COMPETITIVE EDGE AND FOSTER LONG-TERM CUSTOMER RELATIONSHIPS BASED ON TRUST AND DATA SECURITY

-

9.6 MANUFACTURINGMANUFACTURING ORGANIZATIONS TO PROTECT SENSITIVE DATA BY MANAGING PRIVACY RISKS ACROSS SUPPLY CHAIN

-

9.7 IT & TELECOMMUNICATIONSORGANIZATIONS TO ENSURE COMPLIANCE, PROTECT CUSTOMER PRIVACY, AND MITIGATE PRIVACY RISKS

- 9.8 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSUS- Growing concerns of data breaches and consumer awareness of their privacy rightsCANADA- Changing privacy landscape to drive growth

-

10.3 EUROPEEUROPE: PRIVACY MANAGEMENT SOFTWARE MARKET DRIVERSUK- Higher adoption rate of digital technologies to drive market growthGERMANY- Growing emphasis on data privacy and security to drive growthFRANCE- Accelerated pace of digital transformation with outbreak of COVID-19 to drive growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: PRIVACY MANAGEMENT SOFTWARE MARKET DRIVERSCHINA- Growing technological innovation to drive growthJAPAN- Growth in adoption of cloud-based applications across verticals to drive growthINDIA- Rapid digitalization and ecommerce to drive marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSSAUDI ARABIA- Growing adoption of cloud to drive demand for data privacy and security managementUAE- Growing technological advancements to support adoption of data privacy solutionsREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: PRIVACY MANAGEMENT SOFTWARE MARKET DRIVERSBRAZIL- Growing ecommerce sector and technological innovation to drive marketMEXICO- Rise in internet penetration to drive demand for data protectionREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 MARKET EVALUATION FRAMEWORK

- 11.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.4 COMPANY FINANCIAL METRICS

- 11.5 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 11.6 MARKET SHARE ANALYSIS

-

11.7 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY PRODUCT FOOTPRINT ANALYSIS (FOR TOP 10 VENDORS)

-

11.8 STARTUPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.9 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHES & ENHANCEMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSONETRUST- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewTRUSTARC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSECURITI- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewBIGID- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEXTERRO- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewSAP- Business overview- Products/Solutions/Services offeredIBM- Business overview- Products/Solutions/Services offered- Recent developmentsCOLLIBRA- Products/Solutions/Services offered- Recent developmentsDATAGUARD- Business overview- Products/Solutions/Services offered- Recent developmentsLOGICGATE- Business overview- Products/Solutions/Services offered- Recent developments

-

12.3 OTHER PLAYERSTRUYOSEGMENTSPIRIONDIDOMISURECLOUDDATAGRAILEGNYTEWIREWHEELDATA PRIVACY MANAGERSAI360STRAITS INTERACTIVECORPORATERTRANSCENDKETCHSECUVYCLARIPDPORGANIZERMINEOSOSANO

-

13.1 INTRODUCTIONRELATED MARKETS

- 13.2 THIRD-PARTY RISK MANAGEMENT MARKET

- 13.3 CONSENT MANAGEMENT MARKET

- 13.4 DATA DISCOVERY MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2015–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ETHYCA: PRICING ANALYSIS OF VENDORS IN PRIVACY MANAGEMENT SOFTWARE MARKET

- TABLE 4 SEGMENT: PRICING ANALYSIS OF VENDORS IN MARKET

- TABLE 5 TOP 10 PATENT APPLICANTS (US), 2022

- TABLE 6 MARKET: PATENTS

- TABLE 7 PRIVACY MANAGEMENT SOFTWARE: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 PRIVACY MANAGEMENT SOFTWARE MARKET: KEY CONFERENCES AND EVENTS IN 2023 & 2024

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- TABLE 14 KEY BUYING CRITERIA FOR END USERS

- TABLE 15 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 16 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 17 DATA DISCOVERY & MAPPING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 18 DATA DISCOVERY & MAPPING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 DATA SUBJECT ACCESS REQUEST: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 DATA SUBJECT ACCESS REQUEST: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 PRIVACY IMPACT ASSESSMENT: PRIVACY MANAGEMENT SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 PRIVACY IMPACT ASSESSMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 CONSENT & PREFERENCE MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 CONSENT & PREFERENCE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 INCIDENT & BREACH MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 INCIDENT & BREACH MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 VENDOR & THIRD-PARTY RISK MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 VENDOR & THIRD-PARTY RISK MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 OTHER APPLICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 32 MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 33 CLOUD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 ON-PREMISES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 PRIVACY MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 38 MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 39 SMALL & MEDIUM ENTERPRISES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 SMALL & MEDIUM ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 LARGE ENTERPRISES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 44 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 45 BFSI: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 HEALTHCARE: PRIVACY MANAGEMENT SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 RETAIL & ECOMMERCE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MANUFACTURING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 IT & TELECOMMUNICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 IT & TELECOMMUNICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 OTHER VERTICALS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: PESTLE ANALYSIS

- TABLE 62 NORTH AMERICA: PRIVACY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 US: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 73 US: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 74 US: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 75 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 76 CANADA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 77 CANADA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 79 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: PESTLE ANALYSIS

- TABLE 81 EUROPE: PRIVACY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 UK: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 92 UK: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 93 UK: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 94 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 95 GERMANY: PRIVACY MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 96 GERMANY: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 97 GERMANY: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 98 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 99 FRANCE: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 100 FRANCE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 101 FRANCE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 102 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 104 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 105 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 106 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: PESTLE ANALYSIS

- TABLE 108 ASIA PACIFIC: PRIVACY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 118 CHINA: PRIVACY MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 119 CHINA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 120 CHINA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 121 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 122 JAPAN: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 123 JAPAN: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 124 JAPAN: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 125 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 126 INDIA: PRIVACY MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 127 INDIA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 128 INDIA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 129 INDIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

- TABLE 135 MIDDLE EAST & AFRICA: PRIVACY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 145 SAUDI ARABIA: PRIVACY MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 146 SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 147 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 148 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 149 UAE: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 150 UAE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 151 UAE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 152 UAE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 153 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 154 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: PESTLE ANALYSIS

- TABLE 158 LATIN AMERICA: PRIVACY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 159 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 161 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 163 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 164 LATIN AMERICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 165 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 167 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 168 BRAZIL: PRIVACY MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 169 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 170 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 171 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 172 MEXICO: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 173 MEXICO: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 174 MEXICO: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 175 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 176 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 180 OVERVIEW OF STRATEGIES ADOPTED BY KEY PRIVACY MANAGEMENT SOFTWARE VENDORS

- TABLE 181 MARKET: DEGREE OF COMPETITION

- TABLE 182 PRIVACY MANAGEMENT SOFTWARE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 183 STARTUPS/SMES FOOTPRINT

- TABLE 184 PRODUCT LAUNCHES & ENHANCEMENTS, 2021–2023

- TABLE 185 DEALS, 2021–2023

- TABLE 186 ONETRUST: BUSINESS OVERVIEW

- TABLE 187 ONETRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 ONETRUST: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 189 ONETRUST: DEALS

- TABLE 190 TRUSTARC: BUSINESS OVERVIEW

- TABLE 191 TRUSTARC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 TRUSTARC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 193 TRUSTARC: DEALS

- TABLE 194 SECURITI: BUSINESS OVERVIEW

- TABLE 195 SECURITI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 SECURITI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 197 SECURITI: DEALS

- TABLE 198 SECURITI: OTHERS

- TABLE 199 BIGID: BUSINESS OVERVIEW

- TABLE 200 BIGID: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 BIGID: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 202 BIGID: DEALS

- TABLE 203 EXTERRO: BUSINESS OVERVIEW

- TABLE 204 EXTERRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 EXTERRO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 206 EXTERRO: DEALS

- TABLE 207 EXTERRO: OTHERS

- TABLE 208 SAP: BUSINESS OVERVIEW

- TABLE 209 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 IBM: BUSINESS OVERVIEW

- TABLE 211 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 213 IBM: DEALS

- TABLE 214 COLLIBRA: BUSINESS OVERVIEW

- TABLE 215 COLLIBRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 COLLIBRA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 217 COLLIBRA: DEALS

- TABLE 218 DATAGUARD: BUSINESS OVERVIEW

- TABLE 219 DATAGUARD: PRODUCTS/SOLUTIONS OFFERED

- TABLE 220 DATAGUARD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 221 DATAGUARD: DEALS

- TABLE 222 LOGICGATE: BUSINESS OVERVIEW

- TABLE 223 LOGICGATE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 LOGICGATE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 225 LOGICGATE: DEALS

- TABLE 226 THIRD-PARTY RISK MANAGEMENT MARKET, BY COMPONENT, 2017–2024 (USD MILLION)

- TABLE 227 THIRD-PARTY RISK MANAGEMENT MARKET, BY SOLUTION, 2017–2024 (USD MILLION)

- TABLE 228 THIRD-PARTY RISK MANAGEMENT MARKET, BY SERVICE, 2017–2024 (USD MILLION)

- TABLE 229 THIRD-PARTY RISK MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

- TABLE 230 THIRD-PARTY RISK MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

- TABLE 231 THIRD-PARTY RISK MANAGEMENT MARKET, BY VERTICAL, 2017–2024 (USD MILLION)

- TABLE 232 THIRD-PARTY RISK MANAGEMENT MARKET, BY REGION, 2017–2024 (USD MILLION)

- TABLE 233 CONSENT MANAGEMENT MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 234 CONSENT MANAGEMENT MARKET, BY TOUCHPOINT, 2018–2025 (USD MILLION)

- TABLE 235 CONSENT MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2018–2025 (USD MILLION)

- TABLE 236 CONSENT MANAGEMENT MARKET, BY ORGANIZATION, 2018–2025 (USD MILLION)

- TABLE 237 CONSENT MANAGEMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 238 DATA DISCOVERY MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

- TABLE 239 DATA DISCOVERY MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

- TABLE 240 DATA DISCOVERY MARKET, BY ORGANIZATION, 2014–2019 (USD MILLION)

- TABLE 241 DATA DISCOVERY MARKET, BY ORGANIZATION, 2019–2025 (USD MILLION)

- TABLE 242 DATA DISCOVERY MARKET, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

- TABLE 243 DATA DISCOVERY MARKET, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

- TABLE 244 DATA DISCOVERY MARKET, BY FUNCTIONALITY, 2014–2019 (USD MILLION)

- TABLE 245 DATA DISCOVERY MARKET, BY FUNCTIONALITY, 2019–2025 (USD MILLION)

- TABLE 246 DATA DISCOVERY MARKET, BY APPLICATION, 2014–2019 (USD MILLION)

- TABLE 247 DATA DISCOVERY MARKET, BY APPLICATION, 2019–2025 (USD MILLION)

- TABLE 248 DATA DISCOVERY MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

- TABLE 249 DATA DISCOVERY MARKET, BY VERTICAL, 2019–2025 (USD MILLION)

- TABLE 250 DATA DISCOVERY MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 251 DATA DISCOVERY MARKET, BY REGION, 2019–2025 (USD MILLION)

- FIGURE 1 PRIVACY MANAGEMENT SOFTWARE MARKET: RESEARCH DESIGN

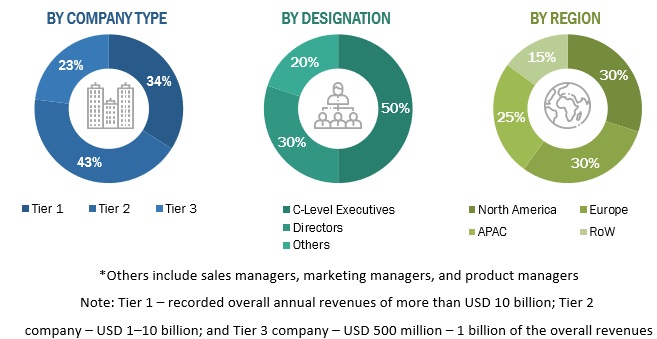

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM PRIVACY MANAGEMENT SOFTWARE VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH SUPPLY SIDE): COLLECTIVE REVENUE OF PRIVACY MANAGEMENT SOFTWARE VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - TOP-DOWN (DEMAND SIDE): MARKET

- FIGURE 7 FASTEST-GROWING SEGMENTS IN MARKET, 2023–2028

- FIGURE 8 DATA SUBJECT ACCESS REQUEST SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 9 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 10 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 11 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 12 PRIVACY MANAGEMENT SOFTWARE MARKET: REGIONAL SNAPSHOT

- FIGURE 13 RISING NUMBER OF DATA BREACHES AND CYBER THREATS TO DRIVE NEED FOR IMPLEMENTATION OF TRANSPARENT AND SECURE DATA PRACTICES

- FIGURE 14 DATA SUBJECT ACCESS REQUEST SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 ON-PREMISES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 19 MARKET DYNAMICS: MARKET

- FIGURE 20 PROVIDING CLEAR INFORMATION ON DATA USAGE TO ACCOUNT FOR LARGEST SHARE

- FIGURE 21 SOURCES OF MAJORITY OF DATA SUBJECT ACCESS REQUESTS IN FY 21-22

- FIGURE 22 AVERAGE COST OF DATA BREACHES, 2016-2022

- FIGURE 23 REGIONAL SHARE OF SMART DEVICES AND CONNECTIONS, 2017 VS 2022

- FIGURE 24 DAYS TO IMPLEMENT DATA PRIVACY MANAGEMENT SOFTWARE FOR VARIOUS VENDORS

- FIGURE 25 CONCERN ABOUT PERSONAL DATA USAGE IN AI

- FIGURE 26 MARKET: SUPPLY CHAIN

- FIGURE 27 MARKET: ECOSYSTEM

- FIGURE 28 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 29 TOP FIVE PATENT OWNERS (GLOBAL), 2022

- FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 PRIVACY MANAGEMENT SOFTWARE MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 33 KEY BUYING CRITERIA FOR END USERS

- FIGURE 34 DATA DISCOVERY & MAPPING SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 35 ON-PREMISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 36 LARGE ENTERPRISES TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 37 BFSI VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 TRADING COMPARABLES -2023 (EV/EBITDA)

- FIGURE 42 MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- FIGURE 43 MARKET: MARKET SHARE ANALYSIS, 2022

- FIGURE 44 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 45 MARKET, KEY COMPANY EVALUATION QUADRANT, 2022

- FIGURE 46 RANKING OF KEY PLAYERS IN MARKET, 2022

- FIGURE 47 STARTUPS/SMES EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 48 PRIVACY MANAGEMENT SOFTWARE MARKET, STARTUPS/SMES COMPANY EVALUATION QUADRANT, 2022

- FIGURE 49 SAP: COMPANY SNAPSHOT

- FIGURE 50 IBM: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size of the privacy management software market. Extensive secondary research was done to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the various segments in the privacy management software market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to for identifying and collecting information useful for this technical, market-oriented, and commercial study of the privacy management software market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs); the installation teams of governments/end users using privacy management software; and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of services, which would affect the overall privacy management software market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the privacy management software market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the privacy management software market.

Market Definition

Privacy management software is software that provides a comprehensive solution for users to manage their company’s privacy program, including mapping sensitive data and replying to consumer requests or data subject requests. Many privacies management software also have additional functionalities of privacy impact assessment software, consent & preference management, vendor & third-party risk management, incident & breach management, regulatory compliance management, and privacy policy management tools

Key Stakeholders

- Privacy Management Software providers

- Independent Software Vendors (ISVs)

- Investors and Venture Capitalists (VCs)

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-Added Resellers (VARs) and distributors

Report Objectives

- To define, describe, and forecast the global privacy management software market based on application (data discovery & mapping, consent & preference management, data subject access request, privacy impact assessment, incident & breach management, vendor & third-party risk management, and other applications), deployment mode (cloud and on-premises), organization size (SMEs and large enterprises), vertical (BFSI, retail & eCommerce, IT & telecommunications, government & defense, healthcare, manufacturing, and other verticals) and region.

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the Privacy Management Software market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile key players in the market and comprehensively analyze their market share/ranking and core-competencies across segments and subsegments.

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Privacy Management Software Market