Product Lifecycle Management Market by Software (Collaborative Product Definition Management (cPDm) Software, Mechanical Computer Aided-Design Software (MCAD) and others), Service, Deployment, Organization, Vertical, and Region - Global Forecast to 2024

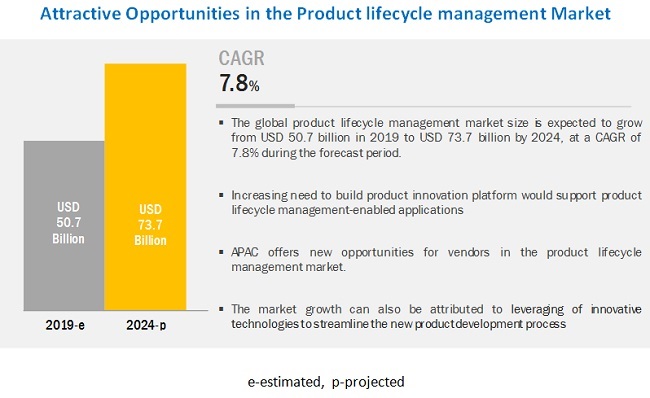

[168 Pages Report] MarketsandMarkets projects the product lifecycle management market to grow from USD 50.7 billion in 2019 to USD 73.7 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period. Major factors expected to drive the growth of the market include growing focus on developing groundbreaking smart products and factories, increasing need to build product innovation platform would support product lifecycle management-enabled applications, and growing demand for cloud-based product lifecycle management solutions for scalability and secure IT infrastructure.

By deployment type, on-premises to hold a larger market size during the forecast period

The on-premises deployment type refers to the installation of the product lifecycle management on the premises of an organization rather than at a remote facility. On-premises solutions are delivered with a one-time licensing fee, along with a service agreement.

Furthermore, deployment of the solution requires vast infrastructure and a personal data center, which is affordable only for large organizations. Hence, SMEs often face the dilemma of choosing between the hosted and on-premises solutions. In spite of its advantages, such as control over the system and data, and dedicated staff for maintenance and support, the on-premises deployment type has various drawbacks, which include high deployment costs and reasonable infrastructure requirements that are not always possible for every organization. The growth of the on-premises deployment type is expected to be affected by the rapid development of cloud computing solutions.

Support and maintenance services segment to grow at a higher CAGR during the forecast period

Support and maintenance services are crucial, as they directly deal with customer satisfaction and issues. Every software vendor has a dedicated support team to serve the customers. Support, software maintenance, customer portal, post-deployment assistance, and client testimonials are some of the services provided under the support and maintenance segment. To derive consistent customer satisfaction, service providers regularly focus on enhancing their product knowledge base by receiving feedbacks through interviews and surveys. These services also provide a single point of contact who would help solve customer issues quickly. The customer portal is another helping aid that offers technical tips and software updates to customer forums.

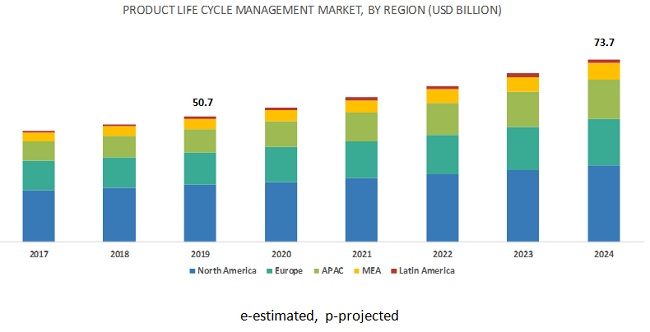

North America to account for the largest market size during the forecast period.

North America consists of developed countries, such as the US and Canada. This region is open to the adoption of new and emerging technologies. Moreover, its strong financial position enables it to invest heavily in the adoption of the latest and leading tools and technologies for ensuring effective business operations. Such advantages help organizations in this region gain a competitive edge. North America has the first-mover advantage in the adoption of new technologies, such as smartphones and cloud platforms. North America has the headquarters of many large enterprises and is host to various international events. Enterprises are willingly investing in North America. The factors expected to drive the growth of the product lifecycle management market in North America are the stable economy, technological enhancements, and advanced infrastructure.

Key Market Players

Key and emerging market players include SAP (Germany), Dassault System (France), PTC (US), Siemens (Germany), Autodesk (US), IBM (US), Oracle (US), HP (US), Atos (France), Accenturs (Ireland), Arena (US), Ansys (US), Aras (US), Infor (US), Propel (US), Kalypso (US), FusePLM (US), Bamboo Rose (US), Inflectra (US), and TCS (India). These players have adopted various strategies to grow in the product lifecycle management market. The companies are focused on inorganic and organic growth strategies to strengthen their market position.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Product lifecycle management Market by Software (Collaborative Product Definition Management (cPDm) Software, Mechanical Computer Aided-Design Software (MCAD), Simulation and Analysis (S&A) Software and Digital Manufacturing (DM) Software), Service, Deployment Type, Organization Size, Vertical, and Region - Global Forecast to 2024 |

|

Geographies covered |

North America, Europe, APAC, MEA and LATAM |

|

Companies covered |

SAP (Germany), Dassault System (France), PTC (US), Siemens (Germany), Autodesk (US), IBM (US), Oracle (US), HP (US), Atos (France), Accenturs (Ireland), Arena (US), Ansys (US), Aras (US), Infor (US), Propel (US), Kalypso (US), FusePLM (US), Bamboo Rose (US), Inflectra (US), TCS (India) |

The research report categorizes the market to forecast the revenues and analyze trends in each of the following subsegments:

By Component

Product Lifecycle Management Market By Software

- Collaborative Product Definition Management (cPDm) Software

- Mechanical Computer Aided-Design Software (MCAD)

- Simulation and Analysis (S&A) Software

- Digital Manufacturing (DM) Software

Product Lifecycle Management Market By Service

- Professional Services

- Deployment and Integration

- Consulting

- Support and Maintenance

- Managed Services

By Deployment type

- On-premises

- Cloud

By Organization size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Vertical

- Automotive and transportation

- Industrial machinery and heavy equipment

- Aerospace and defense

- Semiconductor and electronics

- Energy and utilities

- Retail and consumer goods

- Healthcare and life sciences

- Others (education and it telecom)

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- MEA

- China

- Japan

- Rest of APAC

- APAC

- Kingdom of Saudi Arabia (KSA)

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Frequently Asked Questions (FAQ):

What are the various softwares included in Product Lifecycle Management Market?

- Collaborative Product Definition Management (cPDm) Software

- Mechanical Computer Aided-Design Software (MCAD)

- Simulation and Analysis (S&A) Software

- Digital Manufacturing (DM) Software

Who are the top companies providing Product Lifecycle Management Market?

SAP, Dassault System, PTC, Siemens, Autodesk, IBM, Oracle, HP, Atos, Accenture, Arena, Ansys, Aras, Infor, Propel, Kalypso, FusePLM, Bamboo Rose, Inflectra, TCS

What are the industries adopting Product Lifecycle Management software ?

Automotive and transportation, Industrial machinery and heavy equipment, Aerospace and defense, Semiconductor and electronics, Energy and utilities, Retail and consumer goods, and Healthcare and life sciences

What are various trends in Cloud ITSM Market?

Driver:

- Growing Focus on Developing Groundbreaking Smart Products and Factories

- Increasing Need to Build Product Innovation Platforms Would Support Product Lifecycle Management-Enabled Applications

- Growing Demand for Cloud-Based Product Lifecycle Management Solutions to Achieve Scalability and Secure IT Infrastructure

Opportunities:

- Leveraging Innovative Technologies to Streamline the New Product Development Process

- Increasing Integration of Product Lifecycle Management Solutions With Internet of Things Platforms

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 35)

4.1 Attractive Growth Opportunities in the Product Lifecycle Management Market

4.2 Market By Vertical, 2019

4.3 Market By Type, 2019

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Focus on Developing Groundbreaking Smart Products and Factories

5.2.1.2 Increasing Need to Build Product Innovation Platforms Would Support Product Lifecycle Management-Enabled Applications

5.2.1.3 Growing Demand for Cloud-Based Product Lifecycle Management Solutions to Achieve Scalability and Secure IT Infrastructure

5.2.2 Restraints

5.2.2.1 Lack of Interoperability and Integration of Complex Systems

5.2.3 Opportunities

5.2.3.1 Leveraging Innovative Technologies to Streamline the New Product Development Process

5.2.3.2 Increasing Integration of Product Lifecycle Management Solutions With Internet of Things Platforms

5.2.4 Challenges

5.2.4.1 Slow Adoption of Product Lifecycle Management Solutions Among Small and Medium-Sized Enterprises

5.3 Industry Trends

5.3.1 Use Case 1: RBR Ltd

5.3.2 Use Case 2: Techn GmbH

5.3.3 Use Case 3: Schlatter

5.3.4 Use Case 4: Navantia

6 Product Lifecycle Management Market By Component (Page No. - 43)

6.1 Introduction

6.2 Software

6.2.1 Collaborative Product Definition Management Software

6.2.1.1 Growing Need to Effectively Manage Product Data and Enhance Business Operations to Pave the Way for Collaborative Product Definition Management Software in the Market

6.2.2 Mechanical Computer Aided-Design Software

6.2.2.1 Growing Need to Effectively Manage Product Data and Enhance Product Quality to Fuel the Adoption of Collaborative Product Definition Management Software in the Market

6.2.3 Simulation and Analysis Software

6.2.3.1 1.2.2.1 Rise in Technological Advancements and Innovations in Managing Product Lifecycle to Fuel the Demand for Simulation and Analysis Software in the Market

6.2.4 Digital Manufacturing Software

6.2.4.1 Increasing Need to Handle Complex Manufacturing Process and Reduce Operational Cost to Fuel the Need of Digital Manufacturing Software in the Market

6.3 Services

6.3.1 Professional Services

6.3.1.1 Consulting

6.3.1.1.1 Consulting Services Help Organizations in Understanding Various Software Capabilities and Deciding on Specific Software Implementation

6.3.1.2 Deployment and Integration

6.3.1.2.1 Deployment and Integration Services Help Reduce Complexities in Configuring Software in Existing Systems

6.3.1.3 Support and Maintenance

6.3.1.3.1 Support and Maintenance Services Enhance Product Knowledge Base Through Interviews and Surveys

6.3.2 Managed Services

6.3.2.1 Managed Service Providers Help Reduce Network Infrastructure Maintenance Costs and Enable Organizations to Concentrate on Core Businesses

7 Product Lifecycle Management Market By Deployment Type (Page No. - 54)

7.1 Introduction

7.2 Cloud

7.2.1 Cloud- Based Solution Helps Reduce the Overall Operational Costs Through Hosted IT Infrastructure Providers

7.3 On-Premises

7.3.1 Security and Privacy Concerns to Increase Adoption of On-Premises Deployment Type Security and Privacy Concerns to Increase Adoption of On-Premises Deployment Type in Coming Years

8 Market By Organization Size (Page No. - 58)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.2.1 SMEs to Reduce IT Infrastructure Costs and Focus on Core Activities Prefer Adopting Cloud Based Solutions

8.3 Large Enterprises

8.3.1 Increasing Need to Reduce Product Lifecycle and Reduce Operational Cost to Fuel the Adoption of PLM Solution Among Large Enterprises Among Large Enterprises

9 Product Lifecycle Management Market By Vertical (Page No. - 62)

9.1 Introduction

9.2 Automotive and Transportation

9.2.1 Growing Demand for Autonomous Vehicles to Fuel the Demand of Product Life Cycle Management Solutions in the Automotive and Transportation Vertical

9.3 Industrial Machinery and Heavy Equipment

9.3.1 Growing Need to Predict Equipment Performance to Boost Vertical the Adoption of PLM Solutions

9.4 Aerospace and Defense

9.4.1 Aerospace and Defense Vertical to Adopt PLM Solutions to Ensure Passenger Safety

9.5 Semiconductor and Electronics

9.5.1 Semiconductor and Electronics Vertical Leverage PLM Solutions to Improve Product Quality and Reduce Time-To-Market

9.6 Energy and Utilities

9.6.1 Growing Demand to Manage IT Infrastructure and Oilfield Equipment Lifecycle Process Will Give A Boost to the Growth of PLM in the Energy and Utilities Vertical

9.7 Retail and Consumer Goods

9.7.1 Growing Demand to Enhance Customer Experience and Reduce Operating Costs to Fuel the Growth of PLM Solutions Vertical

9.8 Healthcare and Life Sciences

9.8.1 Growing Need to Handle Patient Data and Reduce Operational Cost to Drive the Growth of PLM Solutions in the Healthcare and Life Sciences Vertical Segment

9.9 Others

10 Product Lifecycle Management Market By Region (Page No. - 72)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 The Growing Need to Enhance Customer Experience and Reduce the Operational Cost to Pave the Way for the End Users to Adopt PLM Solution in the Us

10.2.2 Canada

10.2.2.1 Organizations Operating in Canada to Deploy PLM Software to Maximize Revenue and Reduce Operating Cost

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 The Growing Need for Streamlined Product Lifecycle Process and Reduced Time to Market to Boost the PLM Market in the Uk

10.3.2 Germany

10.3.2.1 Increasing Digitalization and Effective Management of the Product Lifecycle Process to Fuel the Growth of PLM in Germany

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Growing Need Among Industries to Adopt Simulation Techniques to Fuel the Market Growth of PLM Solutions in China

10.4.2 Japan

10.4.2.1 Leading Organizations in Japan Prefer PLM to Improve Customer Experiences and Reduce Production Costs

10.4.3 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Kingdom of Saudi Arabia

10.5.1.1 The Increasing Need to Effectively Manage Product Lifecycle Process to Fuel the Demand of PLM Software in KSA

10.5.2 South Africa

10.5.2.1 Government Initiatives to Improve Product Quality is Expected to Boost the PLM Market in South Africa

10.5.3 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Increasing Awareness Regarding the Use of PLM Solutions to Improve Product Lifecycle Process is Expected to Drive the Market Brazil

10.6.2 Mexico

10.6.2.1 Increasing Awareness for Optimization of Organizations Production Speed to Boost the PLM Market in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 120)

11.1 Overview

11.2 Competitive Scenario

11.2.1 New Product/Solution Launches and Product Enhancements

11.2.2 Business Expansions

11.2.3 Acquisitions

11.2.4 Partnerships, Agreements, and Collaborations

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

12 Company Profiles (Page No. - 127)

12.1 SAP

(Business Overview, Solution, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 Autodesk

12.3 Dassault Systems

12.4 Seimens

12.5 PTC

12.6 IBM

12.7 Oracle

12.8 HP

12.9 ATOS

12.10 Accenture

12.11 Arena

12.12 Ansys

12.13 Aras

12.14 Infor

12.15 Propel

12.16 Kalypso

12.17 Fuseplm

12.18 Bamboo Rose

12.19 Inflectra

12.20 TCS

*Details on Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 159)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (134 Tables)

Table 1 United States Dollar Exchange Rate, 20162018

Table 2 Factor Analysis

Table 3 Product Lifecycle Management Market Size, By Component, 20172024 (USD Million)

Table 4 Software: Market Size By Region, 20172024 (USD Million)

Table 5 Software: Market Size By Type, 20172024 (USD Million)

Table 6 Collaborative Product Definition Management Software: Market Size, By Region, 20172024 (USD Million)

Table 7 Mechanical Computer Aided-Design Software: Market Size By Region, 20172024 (USD Million)

Table 8 Simulation and Analysis Software: Market Size By Region, 20172024 (USD Million)

Table 9 Digital Manufacturing Software: Market Size By Region, 20172024 (USD Million)

Table 10 Services: Market Size, By Region, 20172024 (USD Million)

Table 11 Services: Market Size By Type, 20172024 (USD Million)

Table 12 Professional Services: Market Size By Region, 20172024 (USD Million)

Table 13 Professional Services: Market Size By Professional Service Type, 20172024 (USD Million)

Table 14 Consulting Market Size, By Region, 20172024 (USD Million)

Table 15 Deployment and Integration Market Size, By Region, 20172024 (USD Million)

Table 16 Support and Maintenance Market Size, By Region, 20172024 (USD Million)

Table 17 Managed Services: Market Size By Region, 20172024 (USD Million)

Table 18 Product Lifecycle Management Market Size, By Deployment Type, 20172024 (USD Million)

Table 19 Cloud: Market Size By Region, 20172024 (USD Million)

Table 20 On-Premises: Market Size By Region, 20172024 (USD Million)

Table 21 Market Size, By Organization Size, 20172024 (USD Million)

Table 22 Small and Medium-Sized Enterprises: Market Size By Region, 20172024 (USD Million)

Table 23 Large Enterprises: Market Size By Region, 20172024 (USD Million)

Table 24 Market, By Vertical, 20172024 (USD Million)

Table 25 Automotive and Transportation: Market Size By Region, 20172024 (USD Million)

Table 26 Industrial Machinery and Heavy Equipment: Market Size By Region, 20172024 (USD Million)

Table 27 Aerospace and Defense: Market Size By Region, 20172024 (USD Million)

Table 28 Semiconductor and Electronics: Market Size By Region, 20172024 (USD Million)

Table 29 Energy and Utilities: Market Size By Region, 20172024 (USD Million)

Table 30 Retail and Consumer Goods: Market Size By Region, 20172024 (USD Million)

Table 31 Healthcare and Life Sciences: Market Size By Region, 20172024 (USD Million)

Table 32 Others: Market Size By Region, 20172024 (USD Thousand)

Table 33 Product Lifecycle Management Market Size, By Region, 20172024 (USD Million)

Table 34 North America: Market Size, By Component, 20172024 (USD Million)

Table 35 North America: Market Size By Software, 20172024 (USD Million)

Table 36 North America: Market Size By Service, 20172024 (USD Million)

Table 37 North America: Market Size By Professional Service, 20172024 (USD Million)

Table 38 North America: Market Size By Deployment Type, 20172024 (USD Million)

Table 39 North America: Market Size By Organization Size, 20172024 (USD Million)

Table 40 North America: Market Size By End User, 20172024 (USD Million)

Table 41 North America: Market Size By Country 20172024 (USD Million)

Table 42 United States: Market Size, By Component, 20172024 (USD Million)

Table 43 United States: Market Size By Software, 20172024 (USD Million)

Table 44 United States: Market Size By Services, 20172024 (USD Million)

Table 45 United States: Market Size By Professional Service, 20172024 (USD Million)

Table 46 United States: Market Size By Deployment Type, 20172024 (USD Million)

Table 47 United States: Market Size By Organization Size, 20172024 (USD Million)

Table 48 United States: Market Size By End User, 20172024 (USD Million)

Table 49 Canada: Product Lifecycle Management Market Size, By Component, 20172024 (USD Million)

Table 50 Canada: Market Size By Software, 20172024 (USD Million)

Table 51 Canada: Market Size By Service, 20172024 (USD Million)

Table 52 Canada: Market Size By Professional Service, 20172024 (USD Million)

Table 53 Canada: Market Size By Deployment Type, 20172024 (USD Million)

Table 54 Canada: Market Size By Organization Size, 20172024 (USD Million)

Table 55 Canada: Market Size By End User, 20172024 (USD Million)

Table 56 Europe: Market Size, By Component, 20172024 (USD Million)

Table 57 Europe: Market Size By Software, 20172024 (USD Million)

Table 58 Europe: Market Size By Service, 20172024 (USD Million)

Table 59 Europe: Market Size By Professional Service, 20172024 (USD Million)

Table 60 Europe: Market Size By Organization Size, 20172024 (USD Million)

Table 61 Europe: Market Size By Deployment Mode, 20172024 (USD Million)

Table 62 Europe: Market Size By End User, 20172024 (USD Million)

Table 63 Europe: Market Size By Country, 20172024 (USD Million)

Table 64 United Kingdom: Product Lifecycle Management Market Size, By Component, 20172024 (USD Million)

Table 65 United Kingdom: Market Size By Software, 20172024 (USD Million)

Table 66 United Kingdom: Market Size By Service, 20172024 (USD Million)

Table 67 United Kingdom: Market Size By Professional Service, 20172024 (USD Million)

Table 68 United Kingdom: Market Size By Organization Size, 20172024 (USD Million)

Table 69 United Kingdom: Market Size By Deployment Mode, 20172024 (USD Million)

Table 70 United Kingdom: Market Size By End User, 20172024 (USD Million)

Table 71 Germany: Market Size, By Component, 20172024 (USD Million)

Table 72 Germany: Market Size By Software, 20172024 (USD Million)

Table 73 Germany: Market Size By Service, 20172024 (USD Million)

Table 74 Germany: Market Size By Professional Service, 20172024 (USD Million)

Table 75 Germany: Market Size By Organization Size, 20172024 (USD Million)

Table 76 Germany: Market Size By Deployment Mode, 20172024 (USD Million)

Table 77 Germany: Market Size By End User, 20172024 (USD Million)

Table 78 Rest of Europe: Product Lifecycle Management Market Size, By Component, 20172024 (USD Million)

Table 79 Rest of Europe: Market Size By Software, 20172024 (USD Million)

Table 80 Rest of Europe: Market Size By Service, 20172024 (USD Million)

Table 81 Rest of Europe: Market Size By Professional Service, 20172024 (USD Million)

Table 82 Rest of Europe: Market Size By Organization Size, 20172024 (USD Million)

Table 83 Rest of Europe: Market Size By Deployment Mode, 20172024 (USD Million)

Table 84 Rest of Europe: Market Size By End User, 20172024 (USD Million)

Table 85 Asia Pacific: Market Size, By Component, 20172024 (USD Million)

Table 86 Asia Pacific: Market Size By Software, 20172024 (USD Million)

Table 87 Asia Pacific: Market Size By Service, 20172024 (USD Million)

Table 88 Asia Pacific: Market Size By Professional Service, 20172024 (USD Million)

Table 89 Asia Pacific: Market Size By Organization Size, 20172024 (USD Million)

Table 90 Asia Pacific: Market Size By Deployment Mode, 20172024 (USD Million)

Table 91 Asia Pacific: Market Size By End User, 20172024 (USD Million)

Table 92 Asia Pacific: Market Size By Country, 20172024 (USD Million)

Table 93 China: Product Lifecycle Management Market Size, By Component, 20172024 (USD Million)

Table 94 China: Market Size By Software, 20172024 (USD Million)

Table 95 China: Market Size By Service, 20172024 (USD Million)

Table 96 China: Market Size By Professional Service, 20172024 (USD Million)

Table 97 China: Market Size By Organization Size, 20172024 (USD Million)

Table 98 China: Market Size By Deployment Mode, 20172024 (USD Million)

Table 99 China: Market Size By End User, 20172024 (USD Million)

Table 100 Japan: Market Size, By Component, 20172024 (USD Million)

Table 101 Japan: Market Size By Software, 20172024 (USD Million)

Table 102 Japan: Market Size By Service, 20172024 (USD Million)

Table 103 Japan: Market Size By Professional Service, 20172024 (USD Million)

Table 104 Japan: Market Size By Organization Size, 20172024 (USD Million)

Table 105 Japan: Market Size By Deployment Mode, 20172024 (USD Million)

Table 106 Japan: Market Size By End User, 20172024 (USD Million)

Table 107 Rest of APAC: Product Lifecycle Management Market Size, By Component, 20172024 (USD Million)

Table 108 Rest of APAC: Market Size By Software, 20172024 (USD Million)

Table 109 Rest of APAC: Market Size By Service, 20172024 (USD Million)

Table 110 Rest of APAC: Market Size By Professional Service, 20172024 (USD Million)

Table 111 Rest of APAC: Market Size By Organization Size, 20172024 (USD Million)

Table 112 Rest of APAC: Market Size By Deployment Mode, 20172024 (USD Million)

Table 113 Rest of APAC: Market Size By End User, 20172024 (USD Million)

Table 114 MEA: Market Size, By Component, 20172024 (USD Million)

Table 115 MEA: Market Size By Software, 20172024 (USD Million)

Table 116 MEA: Market Size By Service, 20172024 (USD Million)

Table 117 MEA: Market Size By Professional Service, 20172024 (USD Million)

Table 118 MEA: Market Size By Deployment Type, 20172024 (USD Million)

Table 119 MEA: Market Size By Organization Size, 20172024 (USD Million)

Table 120 MEA: Market Size By End User, 20172024 (USD Million)

Table 121 MEA: Market Size By Country 20172024 (USD Million)

Table 122 Latin America: Product Lifecycle Management Market Size, By Component, 20172024 (USD Million)

Table 123 Latin America: Market Size By Software, 20172024 (USD Million)

Table 124 Latin America: Market Size By Service, 20172024 (USD Million)

Table 125 Latin America: Market Size By Professional Service, 20172024 (USD Million)

Table 126 Latin America: Market Size By Deployment Type, 20172024 (USD Million)

Table 127 Latin America: Market Size By Organization Size, 20172024 (USD Million)

Table 128 Latin America: Market Size By End User, 20172024 (USD Million)

Table 129 Latin America: Market Size By Country 20172024 (USD Million)

Table 130 New Product/Solution Launches and Product Enhancements, 20162019

Table 131 Business Expansions, 2019

Table 132 Acquisitions, 20162019

Table 133 Partnerships, Agreements, and Collaborations, 20172019

Table 134 Evaluation Criteria

List of Figures (36 Figures)

Figure 1 Product Lifecycle Management Market: Research Design

Figure 2 Product Lifecycle Management Software Market: Bottom-Up and Top-Down Approaches

Figure 3 Competitive Leadership Mapping: Criteria Weightage

Figure 4 Global Market Size, 20172024 (USD Million)

Figure 5 Segments With the Highest CAGR in the Market, 2019

Figure 6 North America Accounted for the Largest Market Share in 2019

Figure 7 Increasing Need to Automate Innovation to Drive Product Lifecycle Management

Figure 8 Automotive and Transportation to have the Largest Market Share in 2019

Figure 9 Collaborative Product Definition Management (CPDM) Software to Hold the Largest Market Share in 2019

Figure 10 Drivers, Restraints, Opportunities, and Challenges: Market

Figure 11 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 12 Managed Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 13 Support and Maintenance Services Segment to Grow at the Highest CAGR During the Forecast Period

Figure 14 Cloud Segment to Grow at A Higher CAGR During the Forecast Period

Figure 15 Small and Medium-Sized Enterprises to Grow at A Higher CAGR During the Forecast Period

Figure 16 Healthcare and Life Sciences Segment to Grow at the Highest CAGR During the Forecast Period

Figure 17 Asia Pacific to Witness A Significant Growth During the Forecast Period

Figure 18 North America: Market Snapshot

Figure 19 Asia Pacific: Market Snapshot

Figure 20 Key Developments By the Leading Players in the PLM Market, 20172019

Figure 21 PLM Market (Global) Competitive Leadership Mapping, 2019

Figure 22 SAP: Company Snapshot

Figure 23 SAP: SWOT Analysis

Figure 24 Autodesk: Company Snapshot

Figure 25 Autodesk: SWOT Analysis

Figure 26 Dassault Systems: Company Snapshot

Figure 27 Dassault Systems: SWOT Analysis

Figure 28 Siemens: Company Snapshot

Figure 29 Seimens: SWOT Analysis

Figure 30 PTC: Company Snapshot

Figure 31 PTC: SWOT Analysis

Figure 32 IBM: Company Snapshot

Figure 33 Oracle: Company Snapshot

Figure 34 HP: Company Snapshot

Figure 35 ATOS: Company Snapshot

Figure 36 Accenture: Company Snapshot

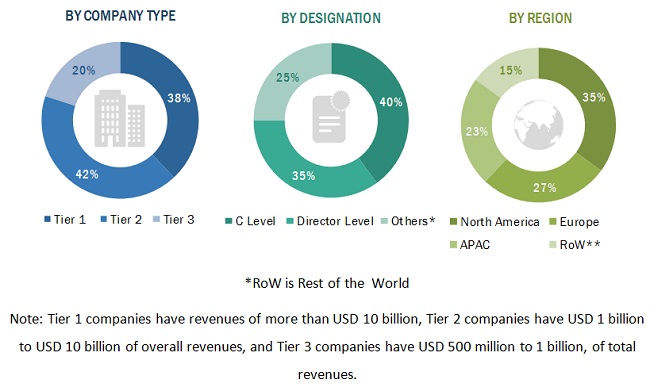

The study involved four major activities in estimating the current size of the product lifecycle management market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the market.

Secondary Research

The market size of the companies offering product lifecycle management and services was arrived at based on the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of the major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; articles from recognized authors; directories; and databases.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for making the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the product lifecycle management market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make market estimations and forecast the product lifecycle management market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall size of the global market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The global market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the product lifecycle management market based on components (software and services), deployment types, organization size, verticals, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market for individual growth trends, prospects, and contributions to the total market

- To analyze and forecast the market size in terms of business value

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players of the market and comprehensively analyze their core competencies1 in each subsegment

- To analyze the competitive developments, such as agreements, partnerships, collaborations, joint ventures, and mergers and acquisitions, in the market

- To forecast the market size of the segments for five main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the product lifecycle management market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakup of the North American Product lifecycle management market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the MEA market

- Further breakup of the LATAM market

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Product Lifecycle Management Market