Prostate Health Market by Disease Indication (Prostate Cancer, PARP Inhibitors, Cytotoxic Drug, Benign Prostate Hyperplasia (BPH), Tamsulosin, 5 Alpha Reductase, Prostatitis, OTC, Prescription (Rx), & Region (NA, Europe, APAC) - Global Forecast to 2026

Market Growth Outlook Summary

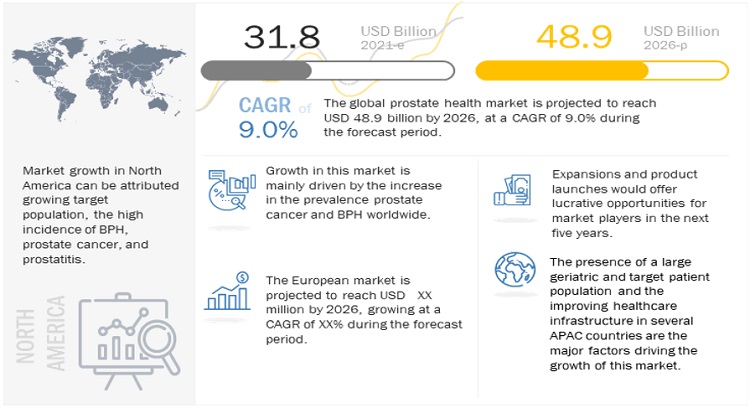

The global prostate health market growth forecasted to transform from USD 31.8 billion in 2021 to USD 48.9 billion by 2026, driven by a CAGR of 9.0%. The prostate gland (the prostate) is an organ of the male reproductive system. The three most common forms of prostate disease are inflammation (prostatitis), non-cancerous enlargement of the prostate (benign prostatic hyperplasia, or BPH), and prostate cancer. Growth in this market is primarily driven by the increasing prevalence of benign prostatic hyperplasia, increasing obesity, investments, funds, and grants for research in prostate health, an increase in the prevalence of prostate cancer, a surge in demand for hormone therapy drugs, emerging therapies for prostate cancer, and an increasing incidence of prostatitis.

To know about the assumptions considered for the study, Request for Free Sample Report

Prostate Health Market Dynamics

Driver: Growing prevalence of prostate cancer and BPH

The growing prevalence of prostate cancer and benign prostatic hyperplasia (BPH) is a major driver of the global prostate health market. According to the World Health Organization (WHO), prostate cancer is the most common type of cancer among men, with an estimated 1.3 million new cases and 359,000 deaths reported in 2018. Similarly, BPH is the most common prostate-related disorder, affecting over 200 million men worldwide. The increasing prevalence of these conditions is driving the demand for advanced prostate health-related treatments and products, thus driving the growth of the global prostate health market.

Restraint: Side effects associated with BPH medications

The most common side effects associated with BPH medications include dizziness, headaches, fatigue, decreased libido, and erectile dysfunction. Other side effects can include nausea, diarrhea, and urinary tract infections. In rare cases, more serious side effects may occur, such as hypotension, vision changes, and an increase in the risk of prostate cancer. People should speak to their doctor if they experience any side effects from BPH medications.

Opportunity: Promising product pipeline

The prostate health market is a promising one with a growing number of products in the pipeline. Some of the most promising products include new treatments for prostate cancer, medications that reduce the risk of prostate cancer recurrence, and drugs that can reduce the side effects of prostate treatments. Additionally, there are a number of supplements and herbal remedies that may help to prevent or reduce the risk of prostate cancer. The prostate health market is expected to grow in the coming years as new treatments become available and the demand for treatments and preventative care increases.

Challenges: Product recalls in the global market

Product recalls can create a number of challenges for companies in the global prostate health market. First, a recall can damage a company's reputation, resulting in a decrease in sales, as consumers may choose to purchase products from more reliable sources. Additionally, a recall can be expensive, as companies must both refund consumers and bear the costs associated with recalling and replacing defective products. Furthermore, a recall can lead to legal issues, as consumers may pursue legal action if they are adversely affected by a recalled product. Finally, recalls can also lead to increased regulatory scrutiny and the imposition of more stringent safety regulations on the industry.

The prostate cancer segment accounted for the largest share of the prostate health market, by disease type.

Based on disease indication, the market is bifurcated into prostate cancer, benign prostate hyperplasia, and prostatitis. Prostate cancer accounted for the largest share of the global market in 2020. Typically, hormone therapy is considered an efficient option as the first line of treatment for prostate cancer. Cancer vaccines, radiopharmaceutical agents, secondary hormone therapies, or chemotherapies follow hormonal therapy as treatment options. Cancerous cells are found to be developing a resistance to these therapies after some months, as a result of which immunotherapies are expected to be adopted extensively for the treatment of prostate cancer in the near future.

North America is the largest region for the prostate health market.

North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa are the five major regions of the market. In 2020, North America accounted for the largest share of this market. The North American market's growth can be attributed to the growing target population, the high incidence of BPH, prostate cancer, and prostatitis, and the strong presence of medical device manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Some of the prominent players operating in the prostate health market are Eli Lilly and Company (US), Pfizer Inc. (US), Merck & Co., Inc. (US), GlaxoSmithKline plc. (UK), Abbott (US), and Astellas Pharma Inc. (Japan), among others.

Scope of the Prostate Health Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$31.8 billion |

|

Projected Revenue Size by 2026 |

$48.9 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 9.0% |

|

Market Driver |

Growing prevalence of prostate cancer and BPH |

|

Market Opportunity |

Promising product pipeline |

This research report categorizes the prostate health market to forecast revenue and analyze trends in each of the following submarkets:

By Disease Indication

-

Prostate Cancer

- AR Directed Therapies

- Hormone ADT

- Cytotoxic Agents

- PARP Inhibitors

- Others

-

Benign Prostate Hyperplasia

-

Alpha Blockers

- Alfuzosin

- Doxazosin

- Tamsulosin

- Silodosin

- Other Alpha Blockers

-

5 Alpha Reductase

- Finasteride

- Dutasteride

- Others

-

Alpha Blockers

-

Prostatitis

- Prescription

- Over the counter

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

-

Asia

- Japan

- China

- India

- RoAPAC

- Latin America

- Middle East & Africa

Recent Developments

- In March 2022, Lantheus Holdings, Inc. (US) collaborated with Novartis AG (Switzerland) to include PYLARIFY (piflufolastat F18) in prostate cancer clinical trials with Pluvicto (lutetium Lu 177 vipivotide tetraxetan) to support prostate cancer clinical development.

- In March 2022, Novartis AG (Switzerland) received approval for PluvictoTM (lutetium Lu 177 vipivotide tetraxetan) (formerly referred to as 177Lu-PSMA-617) by FDA for the treatment of adult patients with a certain type of advanced cancer called prostate-specific membrane antigen–positive metastatic castration-resistant prostate cancer (PSMA-positive mCRPC).

- In January 2021, Pharex Tamsulosin for the treatment of benign prostatic hyperplasia was introduced by PHAREX Health Corporation (Philippines) in collaboration with the Philippine Urological Association (PUA).

- In October 2020, Israeli medical device manufacturer Butterfly Medical raised USD 7 million in a Series B round to develop an anatomically shaped nitinol implant positioned in the prostatic urethra to relieve BPH symptoms

- In 2020, Asahi Kasei Pharma (Japan) obtained drug approval in China for Flivas (naftopidil), an agent for treating dysuria associated with BPH.

Frequently Asked Questions (FAQs):

What is the projected market value of the global prostate health market?

The global market of prostate health is projected to reach USD 48.9 billion.

What is the estimated growth rate (CAGR) of the global prostate health market for the next five years?

The global prostate health market in terms of revenue was estimated to be worth $31.8 billion in 2021 and is poised to grow at a CAGR of 9.0%.

What are the major revenue pockets in the prostate health market currently?

In 2020, North America accounted for the largest share of this market. The North American market's growth can be attributed to the growing target population, the high incidence of BPH, prostate cancer, and prostatitis, and the strong presence of medical device manufacturers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 LIMITATIONS OF THE CURRENT EDITION OF THE REPORT

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.1 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

2.2.2 GROWTH FORECAST

2.2.3 TOP-DOWN APPROACH

FIGURE 4 PROSTATE HEALTH MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 MARKET DYNAMICS (Page No. - 28)

3.1 MARKET DYNAMICS

FIGURE 6 PROSTATE HEALTH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

3.1.1 DRIVERS

3.1.1.1 Increasing prevalence of benign prostatic hyperplasia

FIGURE 7 SHARE OF THE MALE POPULATION AGED 65 AND ABOVE, GLOBAL (2015-2019)

3.1.1.2 Increasing obesity

3.1.1.3 Investments, funds, and grants for research in BPH treatment

3.1.1.4 Rising prevalence of prostate cancer

3.1.1.5 Increasing demand for hormone therapy drugs

3.1.1.6 Emerging therapies for prostate cancer

TABLE 1 SELECT THERAPIES IN THE PHASE III PIPELINE FOR PROSTATE CANCER

3.1.2 RESTRAINTS

3.1.2.1 Side-effects associated with BPH medications

TABLE 2 SIDE-EFFECTS OF BPH DRUGS

3.1.3 OPPORTUNITIES

3.1.3.1 Emerging markets

3.1.3.2 Promising product pipeline

TABLE 3 PIPELINE DRUGS

3.1.4 CHALLENGES

3.1.4.1 Low awareness regarding prostate health among men

3.1.4.2 Product recalls in the global market

TABLE 4 PRODUCT RECALLS IN THE GLOBAL MARKET

4 PROSTATE HEALTH MARKET, BY DISEASE TYPE (Page No. - 35)

4.1 INTRODUCTION

TABLE 5 GLOBAL MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

4.2 PROSTATE CANCER

TABLE 6 PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 7 PROSTATE CANCER MARKET, BY REGION, 2018–2026 (USD MILLION)

4.2.1 AR-DIRECTED THERAPIES

4.2.1.1 AR-directed therapies are expected to remain the dominant drug class for the treatment of prostate cancer

TABLE 8 AR-DIRECTED THERAPIES MARKET, BY REGION, 2018–2026 (USD MILLION)

4.2.2 HORMONE ADT

4.2.2.1 ADT is the most common form of hormonal treatment

TABLE 9 HORMONAL ADT MARKET, BY REGION, 2018–2026 (USD MILLION)

4.2.3 CYTOTOXIC AGENTS

4.2.3.1 Newer cytotoxic agents are being studied in prostate cancer with the goal of achieving FDA approvals

TABLE 10 CYTOTOXIC AGENTS MARKET, BY REGION, 2018–2026 (USD MILLION)

4.2.4 POLY (ADP-RIBOSE) POLYMERASE (PARP) INHIBITORS

4.2.4.1 PARP inhibitors are expected to be the leading drug class for the treatment of prostate cancer

TABLE 11 PARP INHIBITORS MARKET, BY REGION, 2018–2026 (USD MILLION)

4.2.5 OTHER THERAPIES

TABLE 12 OTHER THERAPIES MARKET, BY REGION, 2018–2026 (USD MILLION)

4.3 BENIGN PROSTATIC HYPERPLASIA

TABLE 13 BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 14 BPH DRUG TREATMENT MARKET, BY REGION, 2018–2026 (USD MILLION)

4.3.1 ALPHA BLOCKERS

TABLE 15 BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 16 BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY REGION, 2018–2026 (USD MILLION)

4.3.1.1 Tamsulosin

4.3.1.1.1 Tamsulosin has been prescribed for BPH since 2000

TABLE 17 TAMSULOSIN MARKET, BY REGION, 2018–2026 (USD MILLION)

4.3.1.2 Silodosin

4.3.1.2.1 Benefits of silodosin and the launch of generics to support market growth

TABLE 18 SILODOSIN MARKET, BY REGION, 2018–2026 (USD MILLION)

4.3.1.3 Alfuzosin

4.3.1.3.1 Side-effects and fewer generic launches have hindered market growth to some extent

TABLE 19 ALFUZOSIN MARKET, BY REGION, 2018–2026 (USD MILLION)

4.3.1.4 Doxazosin

4.3.1.4.1 Doxazosin was introduced in 2005 and has seen many generic launches since

TABLE 20 DOXAZOSIN MARKET, BY REGION, 2018–2026 (USD MILLION)

4.3.1.5 Other alpha blockers

TABLE 21 OTHER ALPHA BLOCKERS MARKET, BY REGION, 2018–2026 (USD MILLION)

4.3.2 5-ALPHA REDUCTASE INHIBITORS

TABLE 22 BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 23 BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY REGION, 2018–2026 (USD MILLION)

4.3.2.1 Dutasteride

4.3.2.1.1 Availability of generics post-patent expiry to support market growth

TABLE 24 DUTASTERIDE MARKET, BY REGION, 2018–2026 (USD MILLION)

4.3.2.2 Finasteride

4.3.2.2.1 Finasteride is less effective than alpha blockers in improving LUTS

TABLE 25 FINASTERIDE MARKET, BY REGION, 2018–2026 (USD MILLION)

4.3.3 OTHER DRUG CLASSES

TABLE 26 OTHER BPH DRUG CLASSES MARKET, BY REGION, 2018–2026 (USD MILLION)

4.4 PROSTATITIS

TABLE 27 PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 28 PROSTATITIS MARKET, BY REGION, 2018–2026 (USD MILLION)

4.4.1 PRESCRIPTION PRODUCTS

4.4.1.1 Prescription drugs account for the larger share of the products used for the treatment of prostatitis

TABLE 29 PRESCRIPTION PRODUCTS MARKET, BY REGION, 2018–2026 (USD MILLION)

4.4.2 OVER-THE-COUNTER PRODUCTS

4.4.2.1 Sales of OTC products have risen over the past few years

TABLE 30 OVER-THE-COUNTER PRODUCTS MARKET, BY REGION, 2018–2026 (USD MILLION)

5 PROSTATE HEALTH MARKET, BY REGION (Page No. - 51)

5.1 INTRODUCTION

TABLE 31 GLOBAL MARKET, BY REGION, 2018–2026 (USD MILLION)

5.2 NORTH AMERICA

TABLE 32 NORTH AMERICA: PROSTATE HEALTH MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.2.1 US

5.2.1.1 The US holds the largest share of the North American market

TABLE 39 US: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 40 US: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 41 US: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 42 US: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 43 US: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 44 US: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.2.2 CANADA

5.2.2.1 Rising geriatric population and product approvals to support market growth

TABLE 45 CANADA: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 46 CANADA: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 47 CANADA: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 48 CANADA: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 49 CANADA: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 50 CANADA: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.3 EUROPE

TABLE 51 EUROPE: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 52 EUROPE: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 53 EUROPE: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 54 EUROPE: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 55 EUROPE: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 56 EUROPE: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 57 EUROPE: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

5.3.1 GERMANY

5.3.1.1 Increasing healthcare expenditure to support German market growth

TABLE 58 GERMANY: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 59 GERMANY: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 60 GERMANY: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 61 GERMANY: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 62 GERMANY: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 63 GERMANY: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.3.2.1 Availability of innovative treatment options to drive the market in the UK

TABLE 64 UK: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 65 UK: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 66 UK: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 67 UK: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 68 UK: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 69 UK: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.3.3 FRANCE

5.3.3.1 Rising geriatric population to accelerate the growth of the market

TABLE 70 FRANCE: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 71 FRANCE: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 72 FRANCE: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 73 FRANCE: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 74 FRANCE: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 75 FRANCE: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.3.4 REST OF EUROPE

TABLE 76 ROE: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 77 ROE: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 78 ROE: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 79 ROE: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 80 ROE: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 81 ROE: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.4 ASIA PACIFIC

TABLE 82 ASIA PACIFIC: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 83 ASIA PACIFIC: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 84 ASIA PACIFIC: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 85 ASIA PACIFIC: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 86 ASIA PACIFIC: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 87 ASIA PACIFIC: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

5.4.1 JAPAN

5.4.1.1 Japan holds the largest share of the APAC market

TABLE 89 JAPAN: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 90 JAPAN: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 91 JAPAN: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 92 JAPAN: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 93 JAPAN: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 94 JAPAN: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.4.2 CHINA

5.4.2.1 Increasing obese population to support market growth

TABLE 95 CHINA: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 96 CHINA: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 97 CHINA: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 98 CHINA: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 99 CHINA: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 100 CHINA: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.4.3 INDIA

5.4.3.1 Rising prevalence of obesity to accelerate market growth in India

TABLE 101 INDIA: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 102 INDIA: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 103 INDIA: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 104 INDIA: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 105 INDIA: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 106 INDIA: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.4.4 REST OF ASIA PACIFIC

TABLE 107 ROAPAC: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 108 ROAPAC: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 109 ROAPAC: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 110 ROAPAC: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 111 ROAPAC: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 112 ROAPAC: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.5 LATIN AMERICA

5.5.1 LATAM MARKETS DRIVEN BY GROWING PATIENT BASE

TABLE 113 LATAM: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 114 LATAM: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 115 LATAM: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 116 LATAM: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 117 LATAM: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 118 LATAM: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

5.6 MIDDLE EAST AND AFRICA

5.6.1 MEA COUNTRIES HOLD SMALLEST SHARE OF GLOBAL MARKET

TABLE 119 MEA: PROSTATE HEALTH MARKET, BY DISEASE TYPE, 2018–2026 (USD MILLION)

TABLE 120 MEA: PROSTATE CANCER MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 121 MEA: BPH DRUG TREATMENT MARKET, BY CLASS, 2018–2026 (USD MILLION)

TABLE 122 MEA: BPH DRUG TREATMENT MARKET FOR ALPHA BLOCKERS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 123 MEA: BPH DRUG TREATMENT MARKET FOR 5-ARIS, BY TYPE, 2018–2026 (USD MILLION)

TABLE 124 MEA: PROSTATITIS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

6 COMPETITIVE LANDSCAPE (Page No. - 87)

6.1 OVERVIEW

6.2 REVENUE ANALYSIS OF BPH TREATMENT MARKET

6.2.1 BPH MARKET REVENUE ANALYSIS OF TOP FOUR MARKET PLAYERS

FIGURE 8 TOP 5 PLAYERS HAVE DOMINATED THE MARKET IN THE LAST 3 YEARS

6.3 REVENUE ANALYSIS OF PROSTATE CANCER THERAPEUTICS MARKET

6.3.1 PROSTATE CANCER THERAPEUTICS REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 9 TOP 4 PLAYERS HAVE DOMINATED THE MARKET IN THE LAST 3 YEARS

6.4 MARKET SHARE ANALYSIS, 2020

6.4.1 GLOBAL MARKET SHARE ANALYSIS, 2020

FIGURE 10 GLOBAL MARKET SHARE ANALYSIS, 2019

6.5 COMPANY EVALUATION MATRIX

6.5.1 STARS

6.5.2 EMERGING LEADERS

6.5.3 PERVASIVE COMPANIES

6.5.4 PARTICIPANTS

FIGURE 11 GLOBAL MARKET: COMPANY EVALUATION MATRIX, 2020

7 COMPANY PROFILES (Page No. - 92)

7.1 GLAXOSMITHKLINE

7.2 ASTELLAS PHARMA

7.3 MERCK

7.4 ELI LILLY AND COMPANY

7.5 ABBOTT LABORATORIES

7.6 JOHNSON & JOHNSON SERVICES, INC.

7.7 ABBVIE

7.8 ASTRAZENECA

7.9 SANOFI

7.10 PFIZER, INC.

8 APPENDIX (Page No. - 97)

8.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

8.2 AVAILABLE CUSTOMIZATIONS

8.3 AUTHOR DETAILS

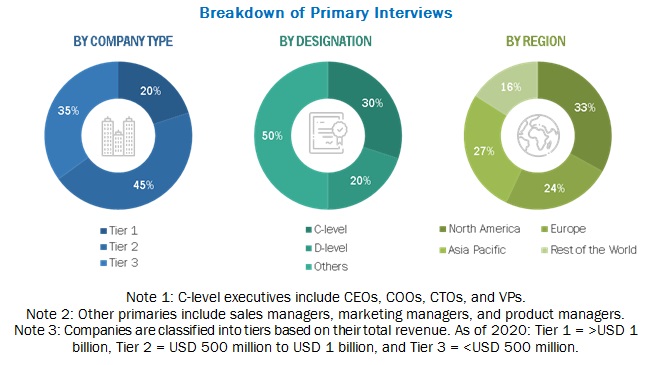

This study involved four major activities in estimating the size of the prostate health market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

This research study involved the use of widespread secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was mainly used to obtain key information about the industry’s total pool of key players, market classification and segmentation according to industry trends to the bottom-most segment level, global market trends, and key developments by public and private organizations. A database of the key industry leaders was also prepared using secondary research.

The secondary sources referred to for this research study include publications from government sources such as the Centers for Disease Control and Prevention, American Urological Association (AUA), National Health Service, European Association of Urology, US Food and Drug Administration, World Health Organization, Corporate Filings (such as annual reports, SEC filings, investor presentations, and financial statements), research journals, press releases, and trade, business, and professional associations.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report.

The primary sources from the supply side include CEOs, VPs, managing directors, marketing and sales heads/directors, marketing managers, regional/area sales managers, and prostate health scientists. Primary sources from the demand side include vice presidents, C-level executives, product managers, department heads, research scientists, research heads, and hospital directors. Other primary respondents include industry experts such as consultants, government, and officials/regulatory authorities.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the prostate health market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research.

- The entire procedure included the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Report Objectives

- To define, describe, and forecast the prostate health market based disease indication and region

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall prostate health market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of the market segments with respect to four main regions, namely,

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. - To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, collaborations, joint ventures, expansions, and acquisitions in the overall prostate health market

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product/service strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of prostate health market

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Prostate Health Market

How big is Prostate Health Market?

What are the latest trends in Prostate Health Market?

How recent developments impacting the Prostate Health Market?