Quantum Computing in Automotive Market by Application (Route Planning & Traffic Management, Battery Optimization, Material Research, Production Planning & Scheduling), Deployment, Component, Stakeholder & Region - Global Forecast to 2035

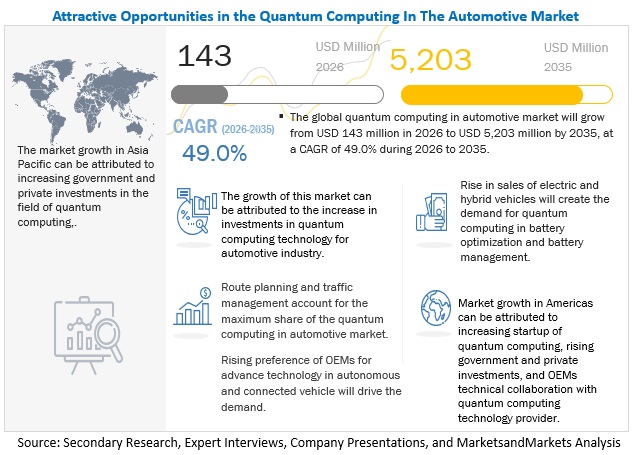

[203 Pages Report] The quantum computing in automotive market is estimated to grow from USD 143 million in 2026 to USD 5,203 million by 2035, at a CAGR of 49.0% from 2026 to 2035. The growth of this quantum computing in automotive market is driven by rising investment by automotive companies to deploy advanced & innovative technology to solve complex problems and increasing government focus on evolving quantum computing expertise across various industry applications.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increase in government investment

Quantum computing is in the infancy stage. The development of scalable quantum computer technology requires many dedicated investments to unlock the future potential of critical applications so that different optimization and simulation strategies can be implemented with quantum computers. Regional governments worldwide are investing in the development of quantum computing technology to initiate pilot projects across various applications. Different nations are funding their research institutions with substantial money to further the development of quantum computing. China, the US, and European countries such as Germany, France, Sweden, Netherlands, India, and Japan are some of the frontrunners for investments in quantum computing. Small countries like Canada, Australia, and Israel are joining the race to develop quantum computing technologies. These countries are investing in developing R&D infrastructure specialized for quantum computing space.

Restraint: Stability and quantum error correction issues

Currently, quantum computers use physical qubits, which are error-prone. To achieve a single logical qubit error free, 1,000 physical qubits are reportedly required, a goal that has not yet been accomplished. A commercially viable quantum computer is expected to be a 200-logical qubit machine with 200,000 physical qubits, even though devices with up to 5,000 physical qubits have already been produced as of 2020. This is one of the major challenges to commercially introducing quantum computers. Due to their fragility and ease of disruption by changes in their environment's temperature, noise, and frequency, qubits cannot be kept in their quantum mechanical state for a longer time. Moreover, many blockchain-based solutions rely on the elliptic curve signature algorithm, which is currently not quantum-safe. The continuously changing mechanical state of quantum due to difficulties in building a commercialized quantum machine restricts the development of physical quantum computers.

Opportunities: Rise in sales of electric and hybrid electric vehicle

The rising adoption of BEVs and HEVs would force automotive companies to improve on various EVs, such as vehicle architecture, driving range, fast charging capabilities, etc. With reference to quantum computing can help in trying and building several material compositions under different test conditions. Quantum computing automotive for an electric vehicle can perform battery material research, battery optimization & simulations, and battery thermal management systems. Few collaborations have occurred in recent years to perform such activities and achieve an optimal outcome. In 2022, Hyundai Motor Company (South Korea) and IonQ (US) formed a technical collaboration to simulate EV battery chemical reactions using quantum computing technology. In 2020, Mercedes-Benz (Germany) and IBM Corporation formed a technical collaboration to develop next-generation lithium-sulfur batteries using quantum computing technology. An increasing sale of electric vehicles will create the demand for improved batteries and unlock exponential growth opportunities for various automotive and other hardware, software, and platform providers for quantum computing.

Challenges: Lack of Skilled Professionals and Infrastructure

Quantum Computing is an innovative and promising technology. A team of experts with the necessary skillsets is required to deploy this technology. The companies in this business face challenge of finding people with the required skill sets. Many countries and quantum computer manufacturers plan to launch training programs to address the shortage of skilled professionals. For instance, D-Wave Systems, inc. started training modules to train its client about quantum computers. However, the cost of this training module is one obstacle to companies wishing to train their employees. Further, these components are complicated, and understanding them takes time and effort. As a result, quantum computer manufacturers must invest more money in various post-sales activities to reduce their profit margins.

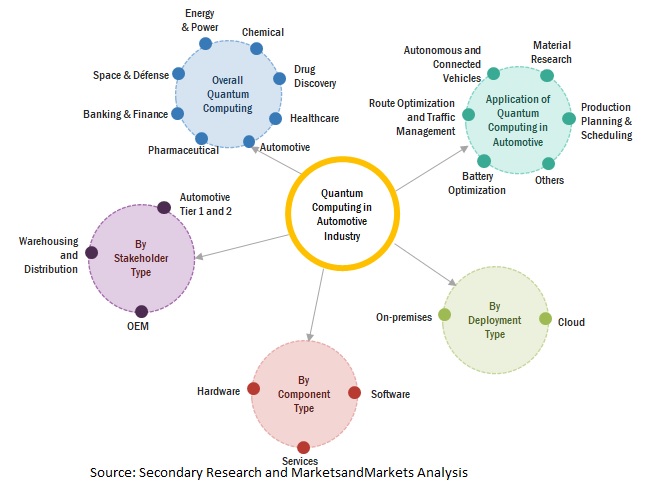

Quantum computing in Automotive Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Cloud-based quantum computing is estimated to be the largest market by deployment

The cloud-based segment is projected to lead the quantum computing in automotive market during the review period. Developing highly powerful systems will drive the demand for cloud-based access to quantum computing services. Automotive OEMs and Tier 1 companies focus on cloud-based deployment type, which is cost-effective without needing large physical setup and maintenance. Quantum computing is in the infancy stage and prone to rapidly advancing several hardware and software updates quickly, owing to constant development activities to make technology more efficient and error-free. Thus, the cloud model enables automotive companies to access the latest updates. Microsoft Corporation, Amazon, Alibaba, and D-wave Systems Inc. offers a sustainable cloud platform for quantum computing access that can suit the environment easily.

Automotive tier 1 and 2 segments are expected to grow at the fastest CAGR during the forecast period

Automotive tier 1 and 2 companies are projected to grow at the fastest CAGR for the quantum computing in automotive industry from 2026 to 2035. At present, most vehicle manufacturers are exploring quantum computing capabilities, and a few tier 1 and tier 2 players are also following these strategic developments and would examine future potential across the automotive industry. Tier 1 players can use Quantum computing to design and optimize cutting-edge components and systems, improve the design of vehicle parts using lightweight structure, enhanced battery, motor design and other related components, autonomous driving mechanism, etc., which will be provided to OEMs. Moreover, quantum computing will also be helpful for Tier 2 companies in material research and production procedures, decrease waste, boost productivity, and create innovative products. These newly developed products can optimize their supply chain management with quantum computers, lowering costs, boosting efficiency, and creating brand-new cutting-edge parts and systems. Global automotive companies such as Robert Bosch, AISIN Group, and Denso Corporation have tie-ups with quantum computing technology providers to study and gain important insights into material research and fluid dynamics. Hence, quantum computing has significant potential to transform and lead the industry's innovation process for Tier 1 and Tier 2 organizations covering a broad spectrum of research areas.

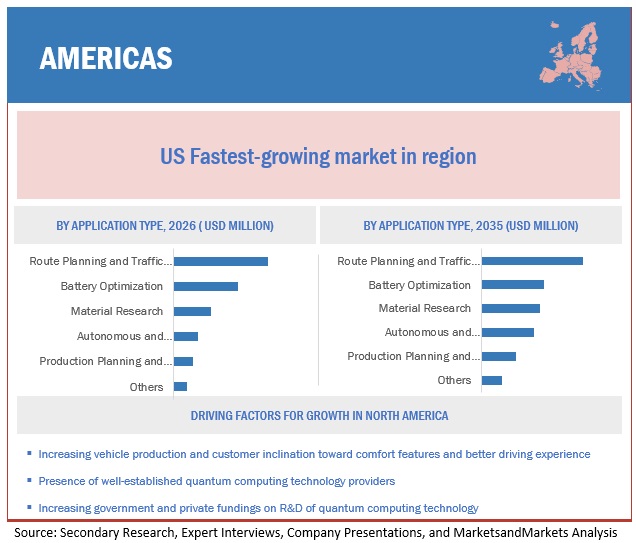

Americas is projected to be the largest market during the forecast period

Americas is projected to dominate quantum computing in automotive market from 2026 to 2035. The region's dominance is mainly due to the early adoption of quantum computing systems and supported software and services owing to the presence of major technology companies such as IBM Corporation, Microsoft Corporation, Alphabet Inc., D-Wave Systems Inc., Rigetti Computing, and Zapata Computing, among others. These companies have a technological advantage and abundant capital to invest in innovations. For instance, IBM Corporation has initiated R&D efforts on quantum computing since 1998. Alphabet Inc., Microsoft Corporation, D-wave Systems Inc., IonQ, etc., are some frontrunners in experimenting with quantum computing technologies. These companies can offer quantum computing solutions for the automotive industry and can help provide some real use cases leveraging quantum computing technology.

Key Market Players & Start-ups

Quantum computing in automotive market is led by globally established players such as IBM Corporation (US), Microsoft Corporation (US), D-Wave Systems, Inc. (US), Amazon (US), and Rigetti & Co, LLC (US). These companies adopted expansion strategies and undertook collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2026–2035 |

|

Forecast period |

2026–2035 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Application, Component, Deployment, Stakeholder, and Region |

|

Geographies covered |

Asia Pacific, Europe, and the Americas |

|

Companies covered |

IBM Corporation (US), Microsoft Corporation (US), D-wave systems, inc. (Canada), Amazon (US), Alphabet Inc. (US), Rigetti & Co, LLC (US), PASQAL (France), Accenture plc (Ireland), Terra Quantum (Switzerland), and IONQ (US) |

The study categorizes quantum computing in automotive market based on the following segments:

Quantum Computing in Automotive Market By Application Type

- Route Planning and Traffic Management

- Battery Optimization

- Material Research

- Autonomous and Connected Vehicle

- Production Planning and Scheduling

- Others

Quantum Computing in Automotive Market By Component Type

- Software

- Hardware

- Services

Quantum Computing in Automotive Market By Deployment type

- Cloud

- On-premises

Quantum computing in Automotive Market By Stakeholder type

- OEM

- Automotive Tier 1 and 2

- Warehousing and Distribution

Quantum Computing in Automotive Market By Region

- Asia Pacific

- Europe

- Americas

Recent Developments

- In September 2023, Rigetti & Co, LLC launched its QCS on Microsoft's Azure Quantum platform with a public preview. The Aspen-M-2 80-qubit and Aspen-11 40-qubit superconducting quantum processors from Rigetti are available to all Azure Quantum users for the development and execution of quantum applications.

- In January 2023, PASQAL announced the launch of Pulser Studio, a no-code development platform for neutral atoms quantum computers. Pulser Studio enables users to graphically build quantum registers and design pulse sequences without coding knowledge.

- In November 2022, IBM Corporation introduced Next-Generation IBM Quantum System Two and 400 Qubit-Plus Quantum Processors. This processor can perform quantum computations that are much more complex than what can be done on any classical computer.

- In November 2022, IBM Corporation launched its most effective quantum computer, which has three times the number of qubits than its Eagle machine. This new quantum computer with 433 qubit capacity called Osprey is capable of previously insolvable problems.

- In November 2022, Amazon launched its first natural-atom quantum processor for Amazon Bracket. This new processor has been developed with Qu Era technologies and is 256 qubits. This new device is designed to solve optimization problems.

- In October 2022, D-wave Systems Inc. launched its quantum software & services on the AWS marketplace. It makes finding, testing, buying, and deploying software that runs on Amazon Web Services is simple. Customers of the AWS Marketplace will have simple access to a selection of quantum computing products from D-Wave, including the use of the Leap quantum cloud service.

- In May 2022, IonQ introduced its latest generation quantum system IonQ Forte. The new system feature includes innovative, cutting-edge optics technology that increases accuracy and improves IonQ's industry system performance.

- In February 2022, Rigetti & Co, LLC announced the commercial availability of the 80-qubit Aspen-M quantum system through Rigetti Quantum Cloud Services. The technology is accessible to direct and distribution clients (QCS). Rigetti & Co, LLC also reported the results of system speed tests performed on Aspen-M.

- In December 2021, D-wave Systems Inc. launched a new quantum acceleration bundle, the quantum QuickStart, incorporating cloud access and instruction in quantum programming. The Quantum QuickStart bundle offers developers a complete training experience and a month of unlimited, real-time quantum cloud access. It was created to train developers quickly and enable them to effortlessly employ quantum computing and quantum hybrid resources to build quantum apps.

- In December 2021, Rigetti & Co, LLC introduced an 80-qubit Aspen -M next-generation quantum computer.

- In November 2021, IBM Corporation unveiled its new 127-quantum bit (qubit) Eagle processor. It signals the hardware development stage, where quantum circuits can no longer be accurately simulated on a conventional computer.

- In October 2020, D-wave System Inc. announced its next-generation quantum annealing processor chip, which uses quantum effects to solve the minimization and optimization problems.

Frequently Asked Questions (FAQ):

What is the future market size of global quantum computing in automotive market?

Quantum computing in automotive market is projected to grow from USD 143 million in 2026 to USD 5,203 million by 2035, at a CAGR of 49.0% from 2026 to 2035.

Who are the winners in the global quantum computing in automotive market?

Quantum computing in automotive market is led by globally established players such as IBM Corporation (US), Microsoft Corporation (US), D-Wave Systems, Inc. (US), Amazon (US), and Rigetti & Co, LLC (US). These companies adopted expansion strategies and undertook collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth quantum computing in automotive market.

Which are the adjacent market which will be impacted due to quantum computing in automotive?

The adjacent market which will be impacted due to quantum computing in the automotive industry will be ride-sharing, last-mile delivery, and the logistics sector.

What are the key applications and their sub-applications for quantum computing in automotive?

The key application is battery optimization and due to which advancements in solid-state batteries and the development of next-generation lithium-sulfur batteries will be possible.

Which deployment type is expected to drive the fastest CAGR during the forecast period?

The cloud-based deployment type is estimated to drive the fastest CAGR of 49.0% from 2026 to 2035, owing to less maintenance and easy access to quantum services available on the cloud..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased government investments- Strategic partnerships and collaborationsRESTRAINTS- Stability and quantum error correction issuesOPPORTUNITIES- Rise in sales of electric and hybrid vehicles- Advancements in quantum computing technologyCHALLENGES- Lack of skilled professionals and infrastructure

- 5.3 IMPACT OF QUANTUM COMPUTING IN AUTOMOTIVE INDUSTRY

-

5.4 PORTER'S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 QUANTUM COMPUTING IN AUTOMOTIVE ECOSYSTEM

-

5.6 SUPPLY CHAIN ANALYSISROLE OF STAKEHOLDERS IN SUPPLY CHAIN

-

5.7 CASE STUDIESQUANTUM COMPUTING APPLICATIONS- Pharmaceutical and Healthcare- Banking and Finance- Aerospace & Defense- Automotive IndustryDAIMLER AG AND IBM CORPORATION WORKING ON QUANTUM COMPUTING TO UNDERSTAND SIMULATION OF LI-SULFUR BATTERIESBMW GROUP AND PASQAL COMPUTING DEVELOPED QUANTUM COMPUTING SYSTEM TO IMPROVE AUTO DESIGN AND MANUFACTURINGHYUNDAI MOTOR COMPANY AND IONQ WORKING ON QUANTUM COMPUTING FOR 3D OBJECT DETECTION FOR AUTONOMOUS VEHICLESVOLKSWAGEN AND GOOGLE TO DEVELOP QUANTUM COMPUTERS FOR MATERIAL RESEARCH AND TRAFFIC MANAGEMENT

-

5.8 KEY CONFERENCES AND EVENTS IN 2022–2023QUANTUM COMPUTING IN AUTOMOTIVE MARKET: UPCOMING CONFERENCES AND EVENTS

-

5.9 REGULATORY STANDARDSP1913 – SOFTWARE-DEFINED QUANTUM COMMUNICATIONP7130 – STANDARD FOR QUANTUM TECHNOLOGIES DEFINITIONSP7131 – STANDARD FOR QUANTUM TECHNOLOGIES DEFINITIONS

- 5.10 QUANTUM COMPUTING VS. EXISTING DIGITAL PLATFORM

-

5.11 TECHNOLOGY ANALYSISDEVELOPMENT OF QUANTUM COMMUNICATION TECHNOLOGYDEVELOPMENT OF ERROR MITIGATION APPROACH AND DYNAMIC CIRCUITS FOR ADVANCED QUANTUM COMPUTING SYSTEM

-

6.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

6.2 ROUTE PLANNING AND TRAFFIC MANAGEMENTSHOWCASES REAL-TIME VEHICLE TRAFFIC AND TRACKING

-

6.3 BATTERY OPTIMIZATIONPROVIDES FAST CHARGING AND LONG DRIVING RANGE

-

6.4 MATERIAL RESEARCHRISING FOCUS ON MATERIAL COMPOSITION FOR ENHANCED PRODUCT DEVELOPMENT

-

6.5 AUTONOMOUS AND CONNECTED VEHICLESINCORPORATES ADAS FEATURES

-

6.6 PRODUCTION PLANNING AND SCHEDULINGHELPS IN PRODUCTION SCHEDULING, INVENTORY MANAGEMENT, AND QUALITY CONTROL

-

6.7 OTHERSPROVIDES PREDICTIVE MAINTENANCE AND BETTER SUPPLY CHAIN MANAGEMENT

-

7.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

7.2 OEMINCREASING TECHNICAL COLLABORATION BETWEEN OEMS AND QUANTUM COMPUTING SUPPLIERS

-

7.3 TIER 1 AND 2INCREASING POTENTIAL APPLICATIONS IN PRODUCT DESIGN AND MATERIAL RESEARCH

-

7.4 WAREHOUSING AND DISTRIBUTIONASSISTS IN SUPPLY CHAIN OPTIMIZATION AND DEMAND FORECASTING

-

8.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

8.2 SOFTWAREGROWING END USE AND NUMBER OF SOFTWARE STARTUPS

-

8.3 HARDWARERISING GOVERNMENT AND PRIVATE INVESTMENTS IN QUANTUM HARDWARE

-

8.4 SERVICESINCREASING ACCESS TO CLOUD QUANTUM COMPUTING SERVICES

-

9.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

9.2 CLOUDEASY ACCESS AND LESS MAINTENANCE

-

9.3 ON-PREMISESGREATER CONTROL OVER QUANTUM HARDWARE AND DATA SECURITY

-

10.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE

-

10.2 ASIA PACIFICCHINA- Rising investment in quantum computingINDIA- Rising government support and collaboration with quantum suppliersJAPAN- Growing government investments and launch of new advanced quantum computersSOUTH KOREA- Initiatives by government and automotive OEMs

-

10.3 EUROPEGERMANY- Government initiatives to spread awareness about importance of quantum computing for economyFRANCE- Growing demand for advanced technologies to ensure secure communication in automotive industryUK- Rising preference of OEMs for advanced technologySPAIN- Financial support by government to develop quantum computingITALY- Rising focus on R&DRUSSIA- Increasing government spending and investments on quantum computersSWEDEN- R&D by universities on quantum computing

-

10.4 AMERICASUS- Increasing government investment and presence of leading suppliersCANADA- Technological advancements by academic institutions, businesses, and government programsMEXICO- Growing demand for quantum computing for various applicationsBRAZIL- Requires more funding and infrastructure

- 11.1 AMERICAS TO DOMINATE REGIONAL MARKET AND ASIA PACIFIC TO GROW AT FASTEST RATE

- 11.2 KEY FOCUS AREAS TO BE ROUTE OPTIMIZATION, BATTERY OPTIMIZATION, AND AUTONOMOUS AND CONNECTED VEHICLES

- 11.3 CONCLUSION

- 12.1 OVERVIEW

- 12.2 MARKET RANKING ANALYSIS, 2022

- 12.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

-

12.4 COMPETITIVE EVALUATION QUADRANTTERMINOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.5 COMPETITIVE SCENARIOPRODUCT LAUNCHES/ENHANCEMENTSDEALSEXPANSIONS

- 12.6 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN, 2018–2022

- 12.7 COMPETITIVE BENCHMARKING

-

13.1 QUANTUM COMPUTING IN AUTOMOTIVE MARKET – KEY PLAYERSIBM CORPORATION- Business overview- Products offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products offered- Recent developments- MnM viewD-WAVE SYSTEMS INC.- Business overview- Products offered- Recent developments- MnM viewALPHABET INC.- Business overview- Products offered- Recent developments- MnM viewRIGETTI & CO, LLC- Business overview- Products offered- Recent developments- MnM viewACCENTURE PLC- Business overview- Products offered- Recent developmentsIONQ- Business overview- Products offeredAMAZON- Business overview- Products offered- Recent developmentsTERRA QUANTUM- Business overview- Products offered- Recent developmentsPASQAL- Business overviewPRODUCTS OFFERED- Recent developments

-

13.2 QUANTUM COMPUTING IN AUTOMOTIVE MARKET – ADDITIONAL PLAYERSQUANTINUUM LTD. (CAMBRIDGE QUANTUM COMPUTING LTD.)INTEL CORPORATIONCAPGEMINIZAPATA COMPUTINGXANADU QUANTUM TECHNOLOGIES INC.QUANTICA COMPUTACAOQC WARE CORPATOM COMPUTING INC.MAGIQ TECHNOLOGIES INC.ANYON SYSTEMS

- 14.1 INDUSTRY INSIGHTS FROM EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

14.4 CUSTOMIZATION OPTIONSQUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY STAKEHOLDER AND DEPLOYMENT TYPE- OEMs- Tier 1 and Tier 2- Warehouse and Distribution

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 COUNTRY-WISE OVERALL INVESTMENTS IN QUANTUM COMPUTING TECHNOLOGY

- TABLE 3 LIST OF AUTOMOTIVE COMPANIES COLLABORATING WITH QUANTUM COMPUTING TECHNOLOGY PROVIDERS

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 MARKET, BY APPLICATION, 2026–2030 (USD MILLION)

- TABLE 7 MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

- TABLE 8 ROUTE PLANNING AND TRAFFIC MANAGEMENT MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 9 ROUTE PLANNING AND TRAFFIC MANAGEMENT MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 10 BATTERY OPTIMIZATION MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 11 BATTERY OPTIMIZATION MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 12 MATERIAL RESEARCH MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 13 MATERIAL RESEARCH MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 14 AUTONOMOUS AND CONNECTED VEHICLES MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 15 AUTONOMOUS AND CONNECTED VEHICLES MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 16 PRODUCTION PLANNING AND SCHEDULING MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 17 PRODUCTION PLANNING AND SCHEDULING MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 18 OTHERS MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 19 OTHERS MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 20 MARKET, BY STAKEHOLDER TYPE, 2026–2030 (USD MILLION)

- TABLE 21 MARKET, BY STAKEHOLDER TYPE, 2031–2035 (USD MILLION)

- TABLE 22 OEM: MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 23 OEM: MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 24 TIER 1 AND 2: MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 25 TIER 1 AND 2: MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 26 WAREHOUSING AND DISTRIBUTION: MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 27 WAREHOUSING AND DISTRIBUTION: MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 28 MARKET, BY COMPONENT, 2026–2030 (USD MILLION)

- TABLE 29 MARKET, BY COMPONENT, 2031–2035 (USD MILLION)

- TABLE 30 SOFTWARE: MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 31 SOFTWARE: MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 32 HARDWARE: MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 33 HARDWARE: MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 34 SERVICES: MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 35 SERVICES: MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 36 MARKET, BY DEPLOYMENT, 2026–2030 (USD MILLION)

- TABLE 37 MARKET, BY DEPLOYMENT, 2031–2035 (USD MILLION)

- TABLE 38 CLOUD: MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 39 CLOUD: MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 40 ON-PREMISES: MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 41 ON-PREMISES: MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 42 MARKET, BY REGION, 2026–2030 (USD MILLION)

- TABLE 43 MARKET, BY REGION, 2031–2035 (USD MILLION)

- TABLE 44 ASIA PACIFIC: MARKET, BY COUNTRY, 2026–2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: MARKET, BY COUNTRY, 2031–2035 (USD MILLION)

- TABLE 46 CHINA: MARKET, BY APPLICATION TYPE, 2026–2030(USD MILLION)

- TABLE 47 CHINA: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 48 INDIA: MARKET, BY APPLICATION TYPE, 2026–2030(USD MILLION)

- TABLE 49 INDIA: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 50 JAPAN: MARKET, BY APPLICATION TYPE, 2026–2030(USD MILLION)

- TABLE 51 JAPAN: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 52 SOUTH KOREA: QUANTUM COMPUTING IN AUTOMOTIVE MARKET, BY APPLICATION TYPE, 2026–2030(USD MILLION)

- TABLE 53 SOUTH KOREA: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 54 EUROPE: MARKET, BY COUNTRY, 2026–2030 (USD MILLION)

- TABLE 55 EUROPE: MARKET, BY COUNTRY, 2031–2035 (USD MILLION)

- TABLE 56 GERMANY: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 57 GERMANY: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 58 FRANCE: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 59 FRANCE: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 60 UK: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 61 UK: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 62 SPAIN: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 63 SPAIN: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 64 ITALY: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 65 ITALY: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 66 RUSSIA: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 67 RUSSIA: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 68 SWEDEN: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 69 SWEDEN: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 70 AMERICAS: MARKET, BY COUNTRY, 2026–2030 (USD MILLION)

- TABLE 71 AMERICAS: MARKET, BY COUNTRY, 2031–2035 (USD MILLION)

- TABLE 72 US: MARKET, BY APPLICATION, 2026–2030 (USD MILLION)

- TABLE 73 US: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 74 CANADA: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 75 CANADA: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 76 MEXICO: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 77 MEXICO: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 78 BRAZIL: MARKET, BY APPLICATION TYPE, 2026–2030 (USD MILLION)

- TABLE 79 BRAZIL: MARKET, BY APPLICATION TYPE, 2031–2035 (USD MILLION)

- TABLE 80 MARKET: COMPANY PRODUCT FOOTPRINT, 2021

- TABLE 81 MARKET: COMPANY APPLICATION FOOTPRINT, 2021

- TABLE 82 MARKET: COMPANY REGION FOOTPRINT, 2021

- TABLE 83 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, MARCH 2018–JANUARY 2023

- TABLE 84 MARKET: DEALS, NOVEMBER 2017–DECEMBER 2022

- TABLE 85 MARKET: EXPANSIONS, JULY 2020–JULY 2022

- TABLE 86 KEY GROWTH STRATEGIES, 2017–2022

- TABLE 87 MARKET: KEY PLAYERS

- TABLE 88 IBM CORPORATION: COMPANY OVERVIEW

- TABLE 89 IBM CORPORATION: PRODUCT LAUNCHES

- TABLE 90 IBM CORPORATION – BOSCH GMBH

- TABLE 91 IBM CORPORATION – DAIMLER AG

- TABLE 92 IBM CORPORATION: EXPANSIONS

- TABLE 93 MICROSOFT CORPORATION.: COMPANY OVERVIEW

- TABLE 94 MICROSOFT CORPORATION– PRODUCT LAUNCHES

- TABLE 95 MICROSOFT CORPORATION-FORD MOTOR COMPANY

- TABLE 96 D-WAVE SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 97 D-WAVE SYSTEMS INC.: PRODUCT LAUNCHES

- TABLE 98 D-WAVE SYSTEMS INC.-VOLKSWAGEN AG

- TABLE 99 D-WAVE SYSTEMS INC.-DENSO CORPORATION

- TABLE 100 D-WAVE SYSTEMS INC.: EXPANSIONS

- TABLE 101 ALPHABET INC.: COMPANY OVERVIEW

- TABLE 102 ALPHABET INC. – PRODUCT LAUNCHES

- TABLE 103 ALPHABET INC.- DAIMLER AG

- TABLE 104 ALPHABET INC.- VOLKSWAGEN AG

- TABLE 105 ALPHABET INC.: OTHERS

- TABLE 106 RIGETTI & CO, LLC: COMPANY OVERVIEW

- TABLE 107 RIGETTI & CO, LLC – PRODUCT LAUNCHES

- TABLE 108 RIGETTI & CO, LLC: DEALS

- TABLE 109 RIGETTI & CO, LLC: EXPANSIONS

- TABLE 110 ACCENTURE PLC: COMPANY OVERVIEW

- TABLE 111 ACCENTURE PLC: DEALS

- TABLE 112 ACCENTURE PLC-FAURECIA

- TABLE 113 IONQ: COMPANY OVERVIEW

- TABLE 114 IONQ – PRODUCT LAUNCHES

- TABLE 115 IONQ: DEALS

- TABLE 116 IONQ- HYUNDAI MOTOR COMPANY

- TABLE 117 IONQ: EXPANSIONS

- TABLE 118 AMAZON: COMPANY OVERVIEW

- TABLE 119 AMAZON – PRODUCT LAUNCHES

- TABLE 120 AMAZON -BMW GROUP

- TABLE 121 AMAZON: EXPANSIONS

- TABLE 122 TERRA QUANTUM: COMPANY OVERVIEW

- TABLE 123 TERRA QUANTUM: DEALS

- TABLE 124 TERRA QUANTUM-VOLKSWAGEN AG

- TABLE 125 PASQAL: COMPANY OVERVIEW

- TABLE 126 PASQAL – PRODUCT LAUNCHES

- TABLE 127 PASQAL-BMW GROUP

- TABLE 128 PASQAL: DEALS

- TABLE 129 PASQAL: EXPANSIONS

- TABLE 130 QUANTINUUM LTD. (CAMBRIDGE QUANTUM COMPUTING LTD.): COMPANY OVERVIEW

- TABLE 131 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 132 CAPGEMINI: COMPANY OVERVIEW

- TABLE 133 ZAPATA COMPUTING: COMPANY OVERVIEW

- TABLE 134 XANADU QUANTUM TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 135 QUANTICA COMPUTACAO: COMPANY OVERVIEW

- TABLE 136 QC WARE CORPORATION: COMPANY OVERVIEW

- TABLE 137 ATOM COMPUTING INC.: COMPANY OVERVIEW

- TABLE 138 MAGIQ TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 139 ANYON SYSTEMS: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN – QUANTUM COMPUTING IN AUTOMOTIVE MARKET

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET, BY REGION, 2026 VS. 2035 (USD MILLION)

- FIGURE 6 RISING GOVERNMENT INVESTMENTS AND TECHNICAL COLLABORATIONS OF OEMS WITH QUANTUM COMPUTING PROVIDERS TO DRIVE MARKET

- FIGURE 7 ROUTE PLANNING AND TRAFFIC MANAGEMENT TO DOMINATE APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 8 CLOUD SEGMENT TO HOLD LARGEST MARKET SHARE (2026–2035)

- FIGURE 9 SOFTWARE SEGMENT TO HAVE HIGHEST GROWTH FROM 2026 TO 2035

- FIGURE 10 OEM SEGMENT PROJECTED TO HOLD MAXIMUM MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 AMERICAS TO WITNESS HIGHEST MARKET GROWTH IN 2026

- FIGURE 12 MARKET DYNAMICS

- FIGURE 13 ELECTRIC AND PLUG-IN HYBRID VEHICLE SALES FORECAST, 2021 VS. 2030 (THOUSAND UNITS)

- FIGURE 14 TECHNOLOGIES/PROCESSES/TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 15 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 MARKET ECOSYSTEM

- FIGURE 17 SUPPLY CHAIN ANALYSIS: MARKET

- FIGURE 18 MARKET, BY APPLICATION, 2026 VS. 2035 (USD MILLION)

- FIGURE 19 MARKET, BY STAKEHOLDER, 2026 VS. 2035 (USD MILLION)

- FIGURE 20 MARKET, BY COMPONENT, 2026 VS. 2035 (USD MILLION)

- FIGURE 21 MARKET, BY DEPLOYMENT, 2026 VS. 2035 (USD MILLION)

- FIGURE 22 MARKET, 2026 VS. 2035 (USD MILLION)

- FIGURE 23 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 24 EUROPE: MARKET, 2026–2035 (USD MILLION)

- FIGURE 25 AMERICAS: MARKET SNAPSHOT

- FIGURE 26 RANKING OF KEY PLAYERS, 2022

- FIGURE 27 QUANTUM COMPUTING IN AUTOMOTIVE MARKET: COMPETITIVE EVALUATION MATRIX, 2021

- FIGURE 28 IBM CORPORATION: COMPANY SNAPSHOT

- FIGURE 29 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 30 D-WAVE SYSTEMS INC.: COMPANY SNAPSHOT

- FIGURE 31 ALPHABET INC.: COMPANY SNAPSHOT

- FIGURE 32 RIGETTI & CO, LLC: COMPANY SNAPSHOT

- FIGURE 33 ACCENTURE PLC: COMPANY SNAPSHOT

- FIGURE 34 AMAZON: COMPANY SNAPSHOT

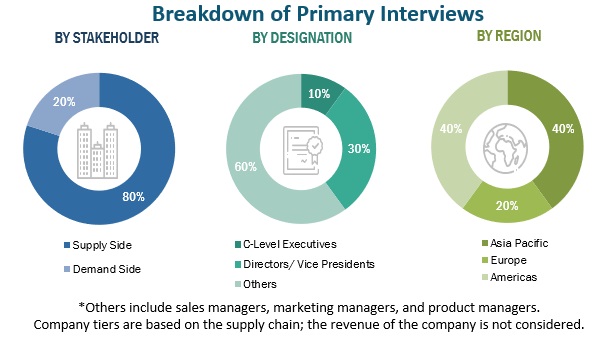

The study involves four main activities to estimate the current size of quantum computing in automotive market. Exhaustive secondary research was done to collect information on the market, such as the quantum computing application types in automotive, upcoming technologies, deployment types, component types, and stakeholder types. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. The Top-down approach was employed to estimate the market size for different segments considered in this study.

Secondary Research

The secondary sources referred for this research study include quantum computing associations such as the Quantum World Association, Harvard college quantum computing association, EPFL quantum computing association, and Quantum Industry Coalition, The Institute for Advanced Composites Manufacturing Innovation, corporate filings (such as annual reports, investor presentations, and financial statements), Factiva, Marklines and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which multiple industry experts further validate.

Primary Research

Extensive primary research has been conducted after understanding quantum computing in automotive market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (quantum computing hardware, software, and services provider) across major regions, namely, North America, Europe, and Asia Pacific. Approximately 20% and 80% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in our report.

After interacting with industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size of quantum computing in automotive market, by application, was calculated using the top-down approach. Extensive secondary and primary research was carried out to understand the global market of quantum computing. Further, the share of the automotive industry in the total quantum computing market is identified from secondary and primary research. market is bifurcated at the regional level based on regional-level industry developments in terms of strategic collaborations and investments. To analyze the country-level market by application, country-level futuristic penetration of different applications – route planning and traffic management, battery optimization, material research, autonomous & connected vehicles, production planning & scheduling, and others have been estimated and analyzed. Several primary interviews were conducted with key opinion leaders related to the quantum computing hardware, software, and automotive stakeholders, including key OEMs, Tier I and II suppliers, and warehouse and distribution companies. Other subsegments, such as deployment type (on-premises and cloud), component (software, hardware, and services), and stakeholder (OEM, tier 1 and 2, and warehousing and distribution), are analyzed using the top-down approach.

Quantum Computing in Automotive Market: Top-Down Approach

Report Objectives

-

To define, describe, and forecast quantum computing in automotive market in terms of value (USD million/USD Billion) based on the following segments:

- By Application Type (Route Planning & Traffic Management, Battery optimization, Material Research, Autonomous & Connected vehicles, Production planning & scheduling, and others)

- By Component Type (Software, Hardware, and Services)

- By Deployment Type (Cloud and On-premises)

- By Stakeholder type (OEM, Automotive Tier 1 and 2, Warehousing and Distribution)

- By Region (Asia Pacific, Europe, and Americas)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of market

- To analyze the market ranking and market share of key players operating in market

- To understand the dynamics of quantum computing in automotive market competitors and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry players in market.

- To conduct case study analysis, Porter’s five forces analysis, technology analysis, patent analysis, average premium analysis, and revenue analysis of the top 5 players

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Quantum Computing in automotive market, by stakeholder and deployment Type

- OEM

- Automotive Tier 1 and 2

- Warehousing and Distribution

Note: Each stakeholder can be further bifurcated by deployment type (on-premises and cloud). No further breakup at the regional level will be provided.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Quantum Computing in Automotive Market