Automotive IoT Market Size, Share, Trends, Statistics and Industry Growth Analysis Report by Offering (Hardware, Software, Services), by Connectivity Form Factor (Embedded, Tethered, Integrated), by Communication Type, by Application (Navigation, Telematics, Infotainment) and Global Growth Driver and Industry Forecast to 2028

Updated on : November 13, 2024

Automotive IoT Market Size & Growth

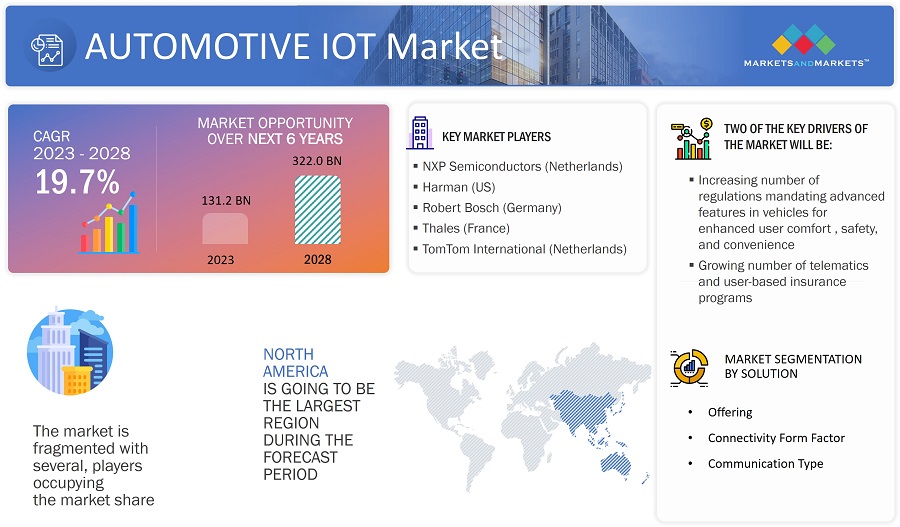

The global Automotive IoT Market size in terms of revenue was estimated to be USD 131.2 billion in 2023 and is poised to reach USD 322.0 billion by 2028, growing at a CAGR of 19.7% from 2023 to 2028. The new research study consists of an industry trend analysis of the market.

The growth of the automotive IoT industry is governed by the increase in the number of regulations mandating advanced features in vehicles for enhanced user comfort, safety, and convenience along with the growing use of telematics and user-based insurance programs are the major factors driving growth of the automotive IoT market share.

Automotive IoT Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive IoT Market Key Trends & Dynamics

Drivers: Rising adoption of electric and hybrid vehicles to reduce CO2 emissions

Motor vehicles not running on fossil fuels, such as electric vehicles, hybrid electric vehicles, and solar-powered vehicles, are the primary choice for alternate technologies of powering engines that do not involve petroleum. The increasing use of electric and hybrid vehicles will help consumers reduce fuel costs, minimize air pollution due to the reduction in greenhouse gases (GHGs), improve air quality in urban areas, and reduce dependence on fossil fuels.

Environmental problems and the need to conserve energy are powerful factors that have advanced the development of HEVs and EVs. Along with an engine, hybrid vehicles are equipped with a motor and a high-voltage, high-power battery to drive that motor. Hybrid vehicles fulfil the need for high power require The stringency of emission norms across the world has resulted in technological advancements in the automotive sector to reduce the harmful exhaust emissions from vehicles. The advent of EVs is one of the most important steps in the automotive industry for environmental protection. These vehicles do not use any conventional fuel, thereby not producing any harmful gases. All these factors have accelerated the demand for electric cars, especially in developed regions such as North America and Europe. As these vehicles completely rely on an electrical power supply, the use of electronic devices is much more in these vehicles. Power electronics is a key technology for hybrids and represents 20% of the total cost of a vehicle, giving a significant amount of scope for semiconductor technology. These new technologies are in the introduction phase and are poised to impact the automotive semiconductor market in the coming years. The rising adoption of HEVs and EVs drives the requirement for automotive semiconductors. Governments of several countries, such as Germany, the US, Denmark, China, France, Sweden, the UK, and India, offer several incentives to promote the use of electric and hybrid cars within the country. Hence, advanced technologies and new vehicle features have increased the scope for electrification. As a result, original equipment manufacturers (OEMs) are installing a greater number of ICs, microprocessors, and sensors in high-end electric vehicles.ments and environmental benefits whenever necessary.

Restraint: Lack of infrastructure for proper functioning of connected vehicles

High-speed connectivity, telematics devices, and sensor-equipped fleets are vital for the smooth functioning of connected cars. Applications such as real-time monitoring and geo-fencing gather data using telematics devices, sensors, and software. On highways, information such as lane change, object detection, the distance between vehicles, and traffic statuses, and services such as navigation and connectivity are very important for connected cars. However, vehicles are not connected to each other and the cloud due to limited network connectivity on highways. In developing countries such as Mexico, Brazil, and India, IT infrastructure development on highways is slower than in developed economies. 3G and 4G-LTE communication networks required for connectivity are offered only in urban and semi-urban areas. While several third-party logistics companies operate in semi-urban and rural areas, there are low connectivity issues. Therefore, the lack of IT and communication infrastructure in developing regions can hamper the growth of the connected car market in these countries.

Opportunity: Integration of predictive maintenance platform with vehicles

Predictive maintenance (PdM) is one of the key growth areas for the automotive IoT market. It helps in lowering the operating and capital costs by facilitating proactive servicing and repair of assets while allowing more efficient use of maintenance personnel and replacement components. PdM enables companies to accurately diagnose and prevent failures in real-time, which is vital in critical infrastructure applications.

When technological advancementstechnologies such as the Over the Air (OTA) update are integrated with vehicles, car owners do not have to perform routine car maintenance activities at a service station. They need to visit the service centrescenters only for crucial or emergency servicing activities. Predictive maintenance is highly successful in assuring these comforts to vehicle owners.

Typically, technicians are sent to carry out routine diagnostic inspections and preventive maintenance according to fixed schedules, which can be a costly and labor-intensive process with little assurance that the failure would not occur between inspections. PdM is a more sophisticated technology for remotely monitoring the vehicle’s condition and identifying potential failures.

Challenge: Threats associated with cybersecurity

Despite major developments in connected vehicles technology, cybersecurity remains a major challenge to be tackled. IoT-enabled automobiles comprise hardware, software, mobile apps, and Bluetooth, and each of them is vulnerable to cyberattacks. There are various instances where cybersecurity has created a nuisance. In 2021, luxury brands Volkswagen and Audi were hit by a data breach that exposed the contact details and, in a few cases, personal information such as the driver’s license numbers in the US and Canada.

According to a white paper published by Accenture, data breaches have increased by 67%, with the US being the number one target of cyberattacks. Various stakeholders are working on cybersecurity systems to make connected cars safer by integrating cybersecurity and threat detection systems with data analytics and AI. In collaboration with a leading car manufacturer, Viasat developed the first-ever advanced, in-car connectivity system with military-grade security features.

There is an inherent risk due to the number of companies involved in handling data and the stakeholders present in the IoT value chain, along with observing the flow of data from end to end. From enterprises’ perspective, managing the security of data transferred from various devices at multiple locations is going to be a more complex task. To handle these flows, enterprises must adopt distributed data center management methods. The current model of centralized applications for reducing costs would not be applicable to IoT. Data management companies are expected to aggregate the data in multiple data centers for primary processing and then forward it to a central data center for further processing. In data center networking, the existing network links are not prepared to handle the data generated by IoT devices

Automotive IoT Ecosystem

Automotive Battery Management System Market Share

In-vehicle communication to hold significant market share during the forecast period.

The in-vehicle-communication segment accounted for the largest share of the overall automotive IoT market, in terms of value, in 2022. With the increasing demand for advanced navigation and infotainment applications in both in luxury as well as economy cars, in-vehicle communication is growing rapidly.Global Positioning System ( GPS) and Bluetooth are mandatory systems inside a car that help connecting the vehicle with IoT for navigation and infotainment services.

Microcontrollers to account for the largest share of the automotive IoT market for hardware segment during the forecast period

Microcontrollers are the most commonly used semiconductor devices in almost all automotive electronic systems. On average, every high-end vehicle requires numerous microcontrollers for several applications, from controlling windshield wipers to internal temperature control. The MCU embedded in the automobile monitors and controls large complex electronic systems and is also useful for smaller independent applications, such as head-up displays and instrument clusters. A microcontroller-based engine control unit (ECU) is a critical part of automobile that contains 25 to 35 ECUs per design, while as many as 70 control units can be found on luxury vehicles today. Major companies offering microcontrollers for IoT in automotive industry include Texas Instruments (US), Intel Corporation (US), and NXP Semiconductor (Netherlands), among others. For instance, in August 2022, NXP Semiconductors launched the NCJ37x Secure Element (SE), an automotive-qualified secure microcontroller with advanced cryptographic accelerators and physical built-in electrical attack resistance for various security-critical automotive applications such as smart access key fobs, Qi 1.3 authentication or car-to-cloud communication.

FPGAs to exhibit highest growth in terms of automotive IoT market for the hardware segment during the forecast period

FPGAs is expected to witness highest market growth for the automotive IoT market share for semiconductor components hardware segment. In the case of autonomous vehicles, FPGAs can be used to handle data input from multiple sensors, such as cameras, LIDAR, and audio sensors. With the reconfigure and reprogrammed architecture, FPGA becomes ideal for AI and deep learning workload, where algorithms can be changed as per needs while using less space and low power consumption. These factors has led to the increase in their adoption for automotive applications.

Connectivity ICs to witness higher growth compared to semiconductor components for automotive IoT hardware market during the forecast period

Connectivity enables vehicles to interact with each other and with the infrastructure- for safer, greener, and more efficient roads. Car manufacturers are integrating wireless communication in both luxury and economy vehicles and need reliable wireless connectivity technology that reduces the total cost of a vehicle, from production to after-sales services. The demand for wireless technologies such as Wi-Fi, Bluetooth, and cellular networks (LTE, 3G, and HSPA+) is accelerating in the automotive industry, this in turn is expected to lead to increase in demand for connectivity ICs.

IoT in Automotive Industry

The IoT in automotive industry is revolutionizing the way vehicles operate, offering enhanced connectivity, safety, and efficiency. By integrating IoT technology, vehicles can communicate with each other, traffic systems, and even the cloud, enabling real-time data exchange that improves driving experiences and reduces operational costs. IoT in automotive industry applications includes features like vehicle tracking, predictive maintenance, infotainment systems, and autonomous driving capabilities. The integration of IoT sensors helps monitor critical vehicle conditions such as tire pressure, engine health, and fuel efficiency, allowing for proactive maintenance and reducing the likelihood of costly repairs. As the demand for smart cars and connected vehicles continues to rise, IoT technology is set to play a pivotal role in shaping the future of the automotive industry, making vehicles safer, more efficient, and environmentally friendly.

Automotive IoT Market Regional Analysis

Automotive IoT market in Asia Pacific estimated to grow at the fastest rate during the forecast period

The automotive IoT market size in Asia Pacific is expected to grow at the highest CAGR during the forecast period. China, Japan, South Korea, and India are the major contributors to the market in the Asia Pacific region. China is the largest automobile market, making it attractive for automotive IoT. The market growth in Asia Pacific can be attributed to the changing government norms regarding the adoption of ADAS and connected services systems. Factors such as the high adoption rate of IoT in automotives due to their smart features, such as fleet management, better monitoring of fuel consumption and travel time, among others, coupled with the rising production of IoT-enabled automotive in the Asia Pacific region, have been instrumental in market growth. Moreover, government initiatives for collecting traffic data for proper monitoring of vehicles have also been beneficial for the adoption of automotive IoT technology in the Asia Pacific region.

Automotive IoT Market Size by Region

To know about the assumptions considered for the study, download the pdf brochure

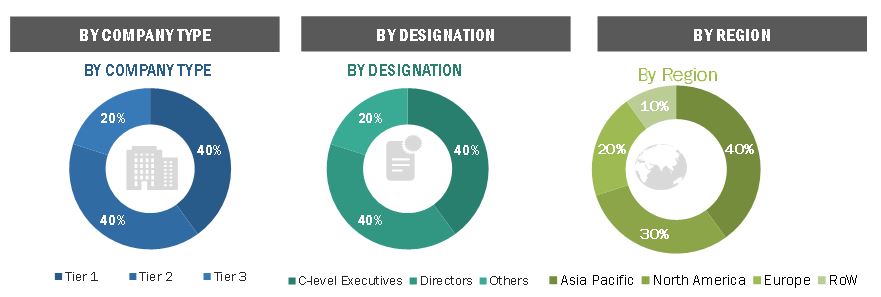

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the automotive IoT market space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 – 40%, Tier 2 – 40%, and Tier 3 – 20%

- By Designation: C-level Executives – 40%, Directors –40%, and Others – 20%

- By Region: North America –30%, Asia Pacific– 40%, Europe – 20%, and RoW – 10%

Top Automotive IoT Companies - Key Market Players

Major vendors in the automotive IoT Companies include

- NXP Semiconductors (Netherlands),

- Harman (US),

- Robert Bosch (Germany),

- Thales (France),

- TomTom International (Netherlands),

- IBM (US), Geotab Inc. (Canada),

- Texas Instruments (US),

- Intel Corp. (US),

- Eurotech (Italy),

- STMicroelectronics (Switzerland),

- Renesas (Japan),

- Infineon Technologies (Germany).

Apart from this, Airbiquity (US), Qualcomm (US), Visteon (US), Vodafone Group (UK), Microsoft Corporation (US), Alphabet Inc. (US), AT&T (US), Cloudmade (UK), Sierra Wireless (Canada) are among a few emerging companies in the automotive IoT market.

Automotive IoT Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 131.2 Billion |

| Projected Market Size | USD 322.0 Billion |

| Growth Rate | CAGR of 19.7% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

NXP Semiconductors (Netherlands), Harman (US), Robert Bosch (Germany), Thales (France), TomTom International (Netherlands), IBM (US), Geotab Inc. (Canada), Texas Instruments (US), Intel Corp. (US), Eurotech (Italy), STMicroelectronics (Switzerland), Renesas (Japan), Infineon Technologies (Germany). Apart from this, Airbiquity (US), Qualcomm (US), Visteon (US), Vodafone Group (UK), Microsoft Corporation (US), Alphabet Inc. (US), AT&T (US), Cloudmade (UK), Sierra Wireless (Canada), Verizon Communications, Inc. (US), Telefonica SA (Spain), Mitsubishi Electric Corp. (Japan), Tech Mahindra Ltd. (India), Desay SV HV Automotive (China), Valeo (France), Aptiv Plc (Ireland), Intellias (Ukraine) |

Automotive IoT Market Size & Highlights

This research report categorizes the automotive IoT market size based on offering, connectivity form factor, communication type, application, and Region.

|

Segment |

Subsegment |

|

Automotive IoT Market, Offering : |

|

|

Automotive IoT Market Size , by Connectivity Form Factor: |

|

|

Automotive IoT Market Size , by Communication Type: |

|

|

Automotive IoT Market, by Application: |

|

|

Automotive IoT Market, By Region: |

|

Recent Developments in Automotive IoT Industry

- In January 2023 , VinFast and NXP Semiconductors announced their collaboration on VinFast’s next generation of automotive applications. The collaboration supports VinFast’s goal of developing smarter, cleaner, connected electric vehicles. Under the collaboration, VinFast seeks to leverage NXP’s processors, semiconductors, and sensors. VinFast and NXP will engage in the early development phases of new VinFast automotive projects, leveraging NXP’s rich portfolio of system solutions for innovative applications.

- In January 2023, HARMAN unveiled HARMAN Ready on Demand, a software platform for delivering branded audio value, feature enhancement, upgrades, and monetization opportunities in an easy to-use app. An industry-first product, Ready on Demand is the foundation for providing expanded experiences and future upgrades that can be unlocked by the consumer at any time via in-app purchases throughout the life of the vehicle.

- In November 2022, TomTom International, announced it will power PTV Truck Navigator G2, the next generation of PTV Group’s professional truck navigation app. In a move that expands the firms’ partnership, PTV Group will be using TomTom’s recently launched Navigation SDK (Mobile Software Development Kit) to power up-to-date maps, custom truck routing, and more in their app, now available globally for the first time.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of automotive IoT market based on type?

The software segment is expected to hold the largest share of the automotive IoT market during the the forecast period. The software market includes platforms and solutions which are vital to the functioning of IoT in an automobile. Software solutions are designed to meet interoperability challenges that arise due to varied heterogeneous devices and to manage large volumes of data and its security and privacy. Factors such as the increasing adoption of connected cars and the evolution of high-speed networking technologies have led to the adoption of IoT software solutions.

Which connectivity form factor will contribute more to the overall market share by 2028?

The embedded segment will contribute the most to the automotive IoT market. The market for embedded segment is expected to account for largest share of the automotive IoT market during the forecast period. Increase in demand for the best consumer experience is met by upgrade of infotainment systems in vehicles connected to the Internet and with cloud facility. For automotive IoT applications like infotainment, embedded connectivity results in avoidance of incompatibility, interoperability, or tethering issues, resulting in good communication performance.

How will technological developments such as Artificial Intelligence (AI) technology, machine learning (ML) technology change the automotive IoT landscape in the future?

5G will be a key enabler for connected cars and autonomous vehicles ? it will enable them to communicate with each other, buildings, and infrastructure almost instantaneously. 5G will also offer digital services from within the car, thereby enhancing the passenger experience and increasing mobility revenue potential. OEMs are increasingly investing in adopting 5G technology for enhanced functions, connectivity, and safety. This is expected to further drive the connected car market. The generation of humongous data while dealing with connected cars has led to the explosion of AI in the automotive industry. AI is used in connected cars for different purposes, such as speech and gesture recognition, eye tracking, enhanced HMI, driver monitoring, virtual assistance, radar-based detection, and engine control (fused with sensors). Deep learning used to implement AI is estimated to be growing at a faster rate than other technologies in the automotive sector.

Which region is expected to adopt automotive IoT systems at a fast rate?

Asia Pacific region is expected to adopt automotive IoT systems at the fastest rate. Developing countries such as India and China are expected to have a high potential for the future growth of the market.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

Predictive maintenance (PdM) is one of the key growth areas for the automotive IoT market. It helps in lowering the operating and capital costs by facilitating proactive servicing and repair of assets while allowing more efficient use of maintenance personnel and replacement components. PdM enables companies to accurately diagnose and prevent failures in real-time, which is vital in critical infrastructure applications.

When technologies such as the Over the Air (OTA) update are integrated with vehicles, car owners do not have to perform routine car maintenance activities at a service station. They need to visit the service centers only for crucial or emergency servicing activities. Predictive maintenance is highly successful in assuring these comforts to vehicle owners.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing number of regulations mandating advanced features in vehicles for enhanced user comfort, safety, and convenience- Growing use of telematics and user-based insurance programs- Increasing adoption of connected vehicle technology to reduce fuel wastage- Rising adoption of electric and hybrid vehicles to reduce CO2 emissionsRESTRAINTS- Lack of infrastructure for proper functioning of connected vehicles- Additional cost burden on consumersOPPORTUNITIES- Emergence of technologies such as 5G and AI- Ongoing technological developments in autonomous vehicles- Integration of predictive maintenance platform with vehiclesCHALLENGES- Threats associated with cybersecurity

-

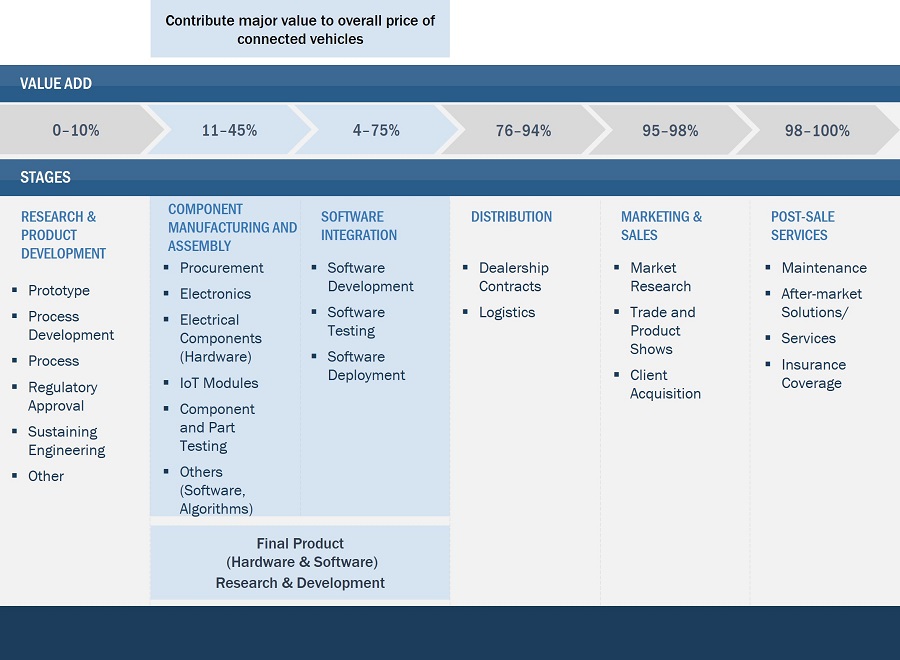

5.3 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTCOMPONENT MANUFACTURING & ASSEMBLYSOFTWARE INTEGRATIONDISTRIBUTION AND SUPPLYMARKETING AND SALESPOST-SALES SERVICES

-

5.4 ECOSYSTEM/MARKET MAP

-

5.5 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.6 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.7 CASE STUDY ANALYSISHONDA CARS INDIA IMPROVES CUSTOMER CONNECTION AND SERVICES WITH IOT AND CLOUDBMW MOTORRAD PROVIDES RIDERS WITH CUSTOM BUILT-IN NAVIGATION EXPERIENCE WITH HELP OF TOMTOMTOMTOM DELIVERED PRECISE HD MAPPING SOLUTION IN COLLABORATION WITH HELLA AGLAIA FOR AUTOMATED DRIVINGIBM HELPS AUDI WITH REAL-TIME VEHICLE TRACKINGALLGO EMBEDDED DEVELOPED PLATFORM FOR FUTURISTIC CAR INFOTAINMENT DEMONSTRATION

-

5.8 TRENDS/DISRUPTIONS IMPACTING BUSINESS OF MARKET PLAYERS AND RAW MATERIAL SUPPLIERS

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Advancements in infotainment systems- Adoption of cloud technologyADJACENT TECHNOLOGY- Future of automotive displays

-

5.10 PATENT ANALYSIS

-

5.11 TRADE ANALYSISIMPORT SCENARIO- Import scenario for semiconductor ICsEXPORT SCENARIO- Export scenario for semiconductor ICs

- 5.12 TARIFFS

-

5.13 REGULATORY STANDARDSREGULATORY COMPLIANCE- Standards

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 PRICING ANALYSISAVERAGE SELLING PRICE OF AUTOMOTIVE IOT HARDWARE COMPONENTS OFFERED BY MARKET PLAYERS

- 6.1 INTRODUCTION

-

6.2 HARDWARESEMICONDUCTOR COMPONENTS- Microcontrollers- Field programmable gate arrays (FPGAs)- Digital signal processors (DSPs)- Memory chipsCONNECTIVITY TECHNOLOGY ICS- Cellular- Wi-Fi- Bluetooth- Others

-

6.3 SOFTWAREPLATFORMS- Device management platform- Application management platform- Network management platformSOLUTIONS- Real-time streaming analytics- Security solutions- Data management- Remote monitoring systems- Network bandwidth management

-

6.4 SERVICESDEPLOYMENT & INTEGRATION SERVICES- Deployment and integration services to hold larger market share during forecast periodSUPPORT & MAINTENANCE SERVICES- Help lower risk, reduce complexity, and raise return on investment

- 7.1 INTRODUCTION

-

7.2 EMBEDDEDREDUCTION IN PRICE OF SERVICE PLANS TO FUEL DEMAND FOR EMBEDDED CONNECTIVITY

-

7.3 TETHEREDLOWER PRICE OF TETHERED SYSTEMS LIKELY TO CONTRIBUTE TO THEIR DEMAND DURING FORECAST PERIOD- Use case: Tethered IoT platform for Tata Motors connected vehicles

-

7.4 INTEGRATEDINCREASED PENETRATION OF SMARTPHONES TO INDUCE DEMAND FOR INTEGRATED FORM FACTOR

- 8.1 INTRODUCTION

-

8.2 IN-VEHICLE COMMUNICATIONIN-VEHICLE COMMUNICATION SEGMENT HELD LARGEST MARKET SHARE IN 2022- Use case: Honda Motors incorporated integrated in-vehicle connected services offered by Google for customers in North America

-

8.3 VEHICLE-TO-VEHICLE COMMUNICATIONMARKET FOR VEHICLE-TO-VEHICLE COMMUNICATION TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD- Use case: Implementation of Ambulance Alerting System based on V2V communication

-

8.4 VEHICLE-TO-INFRASTRUCTURE COMMUNICATIONENABLES SEVERAL VEHICLES TO SHARE INFORMATION WITH VARIOUS DEVICES- Use case: Vodafone assists in facilitating vehicle-to-infrastructure (V2I) communication for providing parking assistance and anti-theft functions

- 9.1 INTRODUCTION

-

9.2 NAVIGATIONUSE CASE: TOMTOM NAVIGATION SDK POWERED PTV GROUP’S (GERMANY) TRUCK NAVIGATION APPLICATIONREAL-TIME DATA CAPTURE- Real-time data capture navigation application to exhibit higher growth during forecast period- Use case: Hyundai Motor Group (HMG) selected TomTom navigation offerings to capture real-time dataROAD & VEHICLE MONITORING- Includes managing data available through controller area network (CAN) or other vehicle internal bus systems- Use case: GreenMile integrated TomTom Map APIs into its solutions to facilitate vehicle monitoring and real-time route planning- Use case: Implementation of system for monitoring of vehicles

-

9.3 TELEMATICSFLEET & ASSET MANAGEMENT- Eliminate paperwork and reduce maintenance costs- Use case: Kent Central Ambulance Service adopted fleet management solution offered by TomTom Telematics- Use case: Wabco Holdings Inc. (US) acquired AssetTrackr (India) to expand its fleet management solutions businessINTELLIGENT TRAFFIC SYSTEM- Integral part of smart cities- Use case: Honda Motors uses IoT Telematics solutions from Bright BoxCOLLISION AVOIDANCE- Alerts drivers about imminent crashes and can assist in braking and stopping vehicles- Use case: Driver safety solution developed by Affectiva and TomTom helps in collision avoidancePARKING MANAGEMENT SYSTEM- Allows efficient use of on-street parking spaces or areasPASSENGER INFORMATION SYSTEM- Provides information to public about status of transportation mediums- Use case: Tamil Nadu State Transport Corporation uses IoT-based passenger information system for crowd estimationEMERGENCY VEHICLE NOTIFICATION- Designed to alert family members and emergency personnel about accidentsPREDICTIVE MAINTENANCE- Predicts ambient conditions, fuel consumption, and other factors critical for ideal performanceREMOTE MONITORING AND DIAGNOSTICS- Offer health and diagnosis report for vehicles through wireless networks

-

9.4 INFOTAINMENTENTERTAINMENT- Focus on rear seat entertainment to create demand for automotive IoTCOMMUNICATION- Enables consumers to seamlessly interconnect their smartphones or network devices to their vehicles

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- US accounted for largest share of North American automotive IoT market in 2022- Use case: Honda Motors incorporated integrated in-vehicle connected services offered by Google for its customers in North AmericaCANADA- Growing popularity of mobile broadband access in vehicles to drive demand for automotive IoT solutions- Use case: Public vehicles in Wellington County, Ontario (Canada), integrated with telematics solution from GeotabMEXICO- Presence of established automotive manufacturing base to support market growth- Use case: Telefonica Mexico offers unlimited connected car data via General Motors' OnStar platform

-

10.3 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Increased R&D and government bill supporting automated driving to support market growth- Use case: TomTom Navigation SDK powers PTV Group’s (Germany) new truck navigation applicationUK- Premium and sports car manufacturers to support market growth- Use case: Volvo UK incorporated new vehicle tracking deviceFRANCE- Significant investments in security technologies to drive market- Use case: COYOTE, in collaboration with Sigfox Network (France), implemented COYOTE Secure stolen vehicle recovery solutionITALY- Presence of comprehensive intelligent traffic system infrastructure to drive market- Use case: DUEL (Italy) leveraged location and navigation services from TomTom to provide real-time traffic information in Italy- Use case: LoJack Italia brought enhanced telematics to ALD Automotive Italy- OCTO Telematics (Italy) leveraged Ford’s connected vehicle data to enhance its telematics servicesSPAIN- Adoption of AI and cognitive computing to accelerate market growth- Use case: Telefónica España collaborated with Spain’s Directorate General for?Traffic and SEAT on IoT road safety projectREST OF EUROPE- Use case: Bara Posten AB (Sweden) leverages Geotab’s fleet telematics platform to deliver sustainable services

-

10.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- 5G rollout to foster market growth- Use case: Huawei Technologies (China) leverages navigation applications offered by TomTomJAPAN- Need for real-time traffic information to propel demand for automotive IoT solutions- Use case: KDDI in Japan leverages Gemalto’s connected cars and IoT solutionSOUTH KOREA- Government initiatives to introduce autonomous cars in South Korea to contribute to market growth- Use case: Hyundai Motor Group leverages maps and real-time traffic data provided by TomTomINDIA- Demand for high-end navigation systems in India to foster market growth- Use case: MG Motor partnered with Jio India to incorporate Internet of Things (IoT) features in its upcoming mid-size SUVREST OF ASIA PACIFIC- Use case: Toyota Motor Corporation Australia delivered connected vehicles with support from Intelematics

-

10.5 REST OF THE WORLDIMPACT OF RECESSION ON REST OF THE WORLDMIDDLE EAST & AFRICA- Government initiatives to introduce autonomous vehicles to favor market growthSOUTH AMERICA- Demand for vehicle tracking and safety features to drive market- Use case: Hyundai Motors leveraged Vivo’s IoT platform to launch its internet-based service in Brazil

- 11.1 INTRODUCTION

- 11.2 REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS, 2022

-

11.4 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 STARTUPS/SMES EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSNXP SEMICONDUCTORS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHARMAN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROBERT BOSCH GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHALES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOMTOM INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTEXAS INSTRUMENTS INC.- Business overview- Products/Solutions/Services offered- Recent developmentsINTEL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsIBM- Business overview- Products/Solutions/Services offered- Recent developmentsGEOTAB INC.- Business overview- Products/Solutions/Services offered- Recent developments- DealsEUROTECH- Business overview- Products/Solutions/Services offered- Recent developmentsINFINEON TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsSTMICROELECTRONICS- Business overview- Products/Solutions/Services offered- Recent developmentsRENESAS- Business overview- Products/Solutions/Services offered- Recent developments

-

12.3 OTHER PLAYERSAIRBIQUITYQUALCOMMVISTEONVODAFONE GROUPMICROSOFT CORPORATIONALPHABET INC.AT&TCLOUDMADESIERRA WIRELESSVERIZON COMMUNICATIONTELEFONICAMITSUBISHI ELECTRIC CORP.TECH MAHINDRADESAY HV AUTOMOTIVEVALEOAPTIV PLCINTELLIAS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AVERAGE EXCHANGE RATES FOR EUROS TO USD CONVERSION

- TABLE 2 PLAYERS AND THEIR ROLE IN ECOSYSTEM

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON AUTOMOTIVE IOT MARKET

- TABLE 6 NUMBER OF PATENTS REGISTERED IN MARKET FROM 2012 TO 2022

- TABLE 7 PATENT REGISTRATIONS RELATED TO MARKET

- TABLE 8 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 9 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 10 MFN TARIFFS FOR PARTS OF ELECTRONIC CIRCUITS EXPORTED BY US

- TABLE 11 MFN TARIFFS FOR PARTS OF ELECTRONIC CIRCUITS EXPORTED BY CHINA

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 AUTOMOTIVE IOT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 17 PRICING OF AUTOMOTIVE IOT HARDWARE COMPONENTS

- TABLE 18 AVERAGE SELLING PRICE OF AUTOMOTIVE IOT HARDWARE COMPONENTS OFFERED BY KEY PLAYERS

- TABLE 19 MARKET, BY OFFERING, 2019–2022 (USD BILLION)

- TABLE 20 MARKET, BY OFFERING, 2023–2028 (USD BILLION)

- TABLE 21 HARDWARE: AUTOMOTIVE IOT MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 22 HARDWARE: MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 23 HARDWARE: MARKET, BY SEMICONDUCTOR COMPONENT, 2019–2022 (USD BILLION)

- TABLE 24 HARDWARE: MARKET, BY SEMICONDUCTOR COMPONENT, 2023–2028 (USD BILLION)

- TABLE 25 HARDWARE: AUTOMOTIVE IOT MARKET, BY SEMICONDUCTOR COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 26 HARDWARE: MARKET, BY SEMICONDUCTOR COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 27 HARDWARE: MARKET, BY CONNECTIVITY TECHNOLOGY ICS, 2019–2022 (USD BILLION)

- TABLE 28 HARDWARE: MARKET, BY CONNECTIVITY TECHNOLOGY ICS, 2023–2028 (USD BILLION)

- TABLE 29 HARDWARE: AUTOMOTIVE IOT MARKET, BY CONNECTIVITY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 30 HARDWARE:MARKET, BY CONNECTIVITY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 31 SOFTWARE: MARKET, BY OFFERING, 2019–2022 (USD BILLION)

- TABLE 32 SOFTWARE: AUTOMOTIVE IOT MARKET, BY OFFERING, 2023–2028 (USD BILLION)

- TABLE 33 SERVICES: MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 34 SERVICES: MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 35 AUTOMOTIVE IOT MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 36 MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 37 EMBEDDED: MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 38 EMBEDDED: AUTOMOTIVE IOT MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 39 EMBEDDED: MARKET, BY COMMUNICATION TYPE, 2019–2022 (USD BILLION)

- TABLE 40 EMBEDDED: MARKET, BY COMMUNICATION TYPE, 2023–2028 (USD BILLION)

- TABLE 41 EMBEDDED: MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 42 EMBEDDED: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 43 TETHERED: AUTOMOTIVE IOT MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 44 TETHERED: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 45 TETHERED: MARKET, BY COMMUNICATION TYPE, 2019–2022 (USD BILLION)

- TABLE 46 TETHERED: MARKET, BY COMMUNICATION TYPE, 2023–2028 (USD BILLION)

- TABLE 47 TETHERED: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 TETHERED: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 INTEGRATED: AUTOMOTIVE IOT MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 50 INTEGRATED: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 51 INTEGRATED: MARKET, BY COMMUNICATION TYPE, 2019–2022 (USD BILLION)

- TABLE 52 INTEGRATED: MARKET, BY COMMUNICATION TYPE, 2023–2028 (USD BILLION)

- TABLE 53 INTEGRATED: MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 54 INTEGRATED: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 55 MARKET, BY COMMUNICATION TYPE, 2019–2022 (USD BILLION)

- TABLE 56 MARKET, BY COMMUNICATION TYPE, 2023–2028 (USD BILLION)

- TABLE 57 IN-VEHICLE COMMUNICATION: AUTOMOTIVE IOT MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 58 IN-VEHICLE COMMUNICATION: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 59 VEHICLE-TO-VEHICLE COMMUNICATION: MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 60 VEHICLE-TO-VEHICLE COMMUNICATION: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 61 VEHICLE-TO-INFRASTRUCTURE COMMUNICATION: MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 62 VEHICLE-TO-INFRASTRUCTURE COMMUNICATION: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 63 AUTOMOTIVE IOT MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 64 MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 65 NAVIGATION: MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 66 NAVIGATION: MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 67 NAVIGATION: MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 68 NAVIGATION: MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 69 NAVIGATION: MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 70 NAVIGATION: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 71 TELEMATICS: MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 72 TELEMATICS: MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 73 TELEMATICS: AUTOMOTIVE IOT MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 74 TELEMATICS: MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 75 TELEMATICS: MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 76 TELEMATICS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 77 INFOTAINMENT: MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 78 INFOTAINMENT: MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 79 INFOTAINMENT: AUTOMOTIVE IOT MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 80 INFOTAINMENT: MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 81 INFOTAINMENT: MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 82 INFOTAINMENT: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 83 AUTOMOTIVE IOT MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 84 MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 88 NORTH AMERICA: AUTOMOTIVE IOT MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 91 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 92 EUROPE: AUTOMOTIVE IOT MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 93 ITALY: MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 94 ITALY: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 95 ITALY: MARKET, BY TELEMATICS APPLICATION TYPE, 2019–2022 (USD MILLION)

- TABLE 96 ITALY: MARKET, BY TELEMATICS APPLICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 97 ITALY: AUTOMOTIVE IOT MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 98 ITALY: MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 99 ITALY: MARKET, BY OFFERING, 2019–2022 (USD BILLION)

- TABLE 100 ITALY: MARKET, BY OFFERING, 2023–2028 (USD BILLION)

- TABLE 101 ITALY: MARKET, BY COMMUNICATION TYPE, 2019–2022 (USD BILLION)

- TABLE 102 ITALY: MARKET, BY COMMUNICATION TYPE, 2023–2028 (USD BILLION)

- TABLE 103 ITALY: MARKET, BY VEHICLE TYPE, 2019–2022 (USD BILLION)

- TABLE 104 ITALY: MARKET, BY VEHICLE TYPE, 2023–2028 (USD BILLION)

- TABLE 105 ITALY: PASSENGER CARS MARKET, BY OFFERING, 2019–2022 (USD BILLION)

- TABLE 106 ITALY: PASSENGER CARS MARKET, BY OFFERING, 2023–2028 (USD BILLION)

- TABLE 107 ITALY: COMMERCIAL VEHICLES MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 108 ITALY: COMMERCIAL VEHICLES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 109 ITALY: PASSENGER CARS MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 110 ITALY: PASSENGER CARS MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 111 ITALY: COMMERCIAL VEHICLES MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 112 ITALY: COMMERCIAL VEHICLES AUTOMOTIVE IOT MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD MILLION)

- TABLE 113 ITALY: PASSENGER CARS MARKET, BY COMMUNICATION TYPE, 2019–2022 (USD BILLION)

- TABLE 114 ITALY: PASSENGER CARS MARKET, BY COMMUNICATION TYPE, 2023–2028 (USD BILLION)

- TABLE 115 ITALY: COMMERCIAL VEHICLES MARKET, BY COMMUNICATION TYPE, 2019–2022 (USD MILLION)

- TABLE 116 ITALY: COMMERCIAL VEHICLES MARKET, BY COMMUNICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 117 ITALY: PASSENGER CARS MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 118 ITALY: PASSENGER CARS AUTOMOTIVE IOT MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 119 ITALY: COMMERCIAL VEHICLES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 120 ITALY: COMMERCIAL VEHICLES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 122 EUROPE: MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 123 EUROPE: AUTOMOTIVE IOT MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 124 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 125 ASIA PACIFIC:MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 128 ASIA PACIFIC: MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 129 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 130 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 131 REST OF THE WORLD: AUTOMOTIVE IOT MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 132 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 133 REST OF THE WORLD: MARKET, BY CONNECTIVITY FORM FACTOR, 2019–2022 (USD BILLION)

- TABLE 134 REST OF THE WORLD: MARKET, BY CONNECTIVITY FORM FACTOR, 2023–2028 (USD BILLION)

- TABLE 135 REST OF THE WORLD: MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 136 REST OF THE WORLD: MARKET, BY APPLICATION, 2 023–2028 (USD BILLION)

- TABLE 137 AUTOMOTIVE IOT MARKET: KEY GROWTH STRATEGIES ADOPTED BY COMPANIES FROM 2021 TO 2023

- TABLE 138 MARKET: DEGREE OF COMPETITION

- TABLE 139 STARTUPS/SMES IN AUTOMOTIVE MARKET

- TABLE 140 STARTUPS/SMES MATRIX: DETAILED LIST OF KEY STARTUPS

- TABLE 141 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 142 COMPANY PRODUCT FOOTPRINT

- TABLE 143 COMPANY OFFERING FOOTPRINT

- TABLE 144 COMPANY COMMUNICATION FOOTPRINT

- TABLE 145 COMPANY CONNECTIVITY FORM FACTOR FOOTPRINT

- TABLE 146 COMPANY APPLICATION FOOTPRINT

- TABLE 147 COMPANY REGION FOOTPRINT

- TABLE 148 AUTOMOTIVE IOT MARKET: TOP PRODUCT LAUNCHES AND DEVELOPMENTS, JUNE 2019 TO JANUARY 2023

- TABLE 149 MARKET: TOP DEALS AND OTHER DEVELOPMENTS, JULY 2019 TO JANUARY 2023

- TABLE 150 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

- TABLE 151 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 153 NXP SEMICONDUCTOR: DEALS

- TABLE 154 HARMAN: BUSINESS OVERVIEW

- TABLE 155 HARMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 HARMAN: PRODUCT LAUNCHES

- TABLE 157 HARMAN: DEALS

- TABLE 158 ROBERT BOSCH: BUSINESS OVERVIEW

- TABLE 159 ROBERT BOSCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 ROBERT BOSCH: PRODUCT LAUNCHES

- TABLE 161 ROBERT BOSCH: DEALS

- TABLE 162 THALES: BUSINESS OVERVIEW

- TABLE 163 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 THALES: PRODUCT LAUNCHES

- TABLE 165 THALES: DEALS

- TABLE 166 TOMTOM INTERNATIONAL.: BUSINESS OVERVIEW

- TABLE 167 TOMTOM INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 TOMTOM INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 169 TOMTOM INTERNATIONAL B.V.: DEALS

- TABLE 170 TEXAS INSTRUMENTS INC.: BUSINESS OVERVIEW

- TABLE 171 TEXAS INSTRUMENTS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 TEXAS INSTRUMENTS INC.: PRODUCT LAUNCHES

- TABLE 173 TEXAS INSTRUMENTS INC.: DEALS

- TABLE 174 INTEL CORPORATION: BUSINESS OVERVIEW

- TABLE 175 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 177 INTEL CORPORATION: DEALS

- TABLE 178 IBM: BUSINESS OVERVIEW

- TABLE 179 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 IBM: DEALS

- TABLE 181 GEOTAB INC.: BUSINESS OVERVIEW

- TABLE 182 GEOTAB INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 GEOTAB INC.: PRODUCT LAUNCHES

- TABLE 184 GEOTAB INC.: DEALS

- TABLE 185 EUROTECH: BUSINESS OVERVIEW

- TABLE 186 EUROTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 EUROTECH: PRODUCT LAUNCHES

- TABLE 188 EUROTECH: DEALS

- TABLE 189 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 190 INFINEON TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 INFINEON TECHNOLOGIES.: DEALS

- TABLE 192 STMICROELECTRONICS: BUSINESS OVERVIEW

- TABLE 193 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 195 STMICROELECTRONICS: DEALS

- TABLE 196 RENESAS: BUSINESS OVERVIEW

- TABLE 197 RENESAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 RENESAS: PRODUCT LAUNCHES

- FIGURE 1 AUTOMOTIVE IOT MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 GDP GROWTH PROJECTION FOR MAJOR ECONOMIES TILL 2023

- FIGURE 8 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 INTEGRATED CONNECTIVITY FORM FACTOR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 VEHICLE-TO-VEHICLE COMMUNICATION SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 NAVIGATION APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 13 GROWING DEMAND FOR NAVIGATION AND INFOTAINMENT APPLICATIONS TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 14 SOFTWARE SEGMENT TO HOLD LARGEST SHARE OF MARKET BETWEEN 2023 AND 2028

- FIGURE 15 INFOTAINMENT APPLICATION HELD LARGEST SIZE OF MARKET IN 2022

- FIGURE 16 INTEGRATED SEGMENT REGISTERED HIGHEST CAGR IN AUTOMOTIVE IOT MARKET IN 2022

- FIGURE 17 AUTOMOTIVE IOT MARKET TO GROW AT HIGHEST CAGR IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 18 MARKET IN ASIA PACIFIC, BY COUNTRY AND FORM FACTOR

- FIGURE 19 CHINA TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 AUTOMOTIVE TELEMATICS MARKET, 2022 VS. 2027

- FIGURE 22 MARKET DRIVERS AND THEIR IMPACT

- FIGURE 23 MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 24 MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 25 MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 28 AUTOMOTIVE IOT MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR AUTOMOTIVE IOT PLAYERS

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS BETWEEN 2012 AND 2022

- FIGURE 31 AUTOMOTIVE IOT PATENTS ISSUED BETWEEN 2012 AND 2022

- FIGURE 32 AVERAGE SELLING PRICE FORECAST FOR AUTOMOTIVE IOT HARDWARE COMPONENTS

- FIGURE 33 AVERAGE SELLING PRICE OF AUTOMOTIVE IOT HARDWARE COMPONENTS OFFERED BY KEY PLAYERS

- FIGURE 34 SERVICES SEGMENT TO EXHIBIT HIGHEST GROWTH RATE BETWEEN 2023 AND 2028

- FIGURE 35 MARKET, BY CONNECTIVITY FORM FACTOR

- FIGURE 36 EMBEDDED SEGMENT TO HOLD LARGEST SIZE OF MARKET BETWEEN 2023 AND 2028

- FIGURE 37 MARKET, BY COMMUNICATION TYPE

- FIGURE 38 VEHICLE-TO-VEHICLE COMMUNICATION SEGMENT EXPECTED TO GROW AT HIGHEST RATE BETWEEN 2023 AND 2028

- FIGURE 39 MARKET, BY APPLICATION

- FIGURE 40 NAVIGATION APPLICATION EXPECTED TO GROW AT HIGHEST RATE BETWEEN 2023 AND 2028

- FIGURE 41 AUTOMOTIVE IOT MARKET, BY REGION

- FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 43 EUROPE: MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 45 REST OF THE WORLD: MARKET SNAPSHOT

- FIGURE 46 FOUR-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET

- FIGURE 47 MARKET SHARE, 2022

- FIGURE 48 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 49 MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2022

- FIGURE 50 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 51 HARMAN: COMPANY SNAPSHOT

- FIGURE 52 ROBERT BOSCH: COMPANY SNAPSHOT

- FIGURE 53 THALES: COMPANY SNAPSHOT

- FIGURE 54 TOMTOM INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 55 TEXAS INSTRUMENTS INC.: COMPANY SNAPSHOT

- FIGURE 56 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 IBM: COMPANY SNAPSHOT

- FIGURE 58 EUROTECH: COMPANY SNAPSHOT

- FIGURE 59 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 60 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 61 RENESAS: COMPANY SNAPSHOT

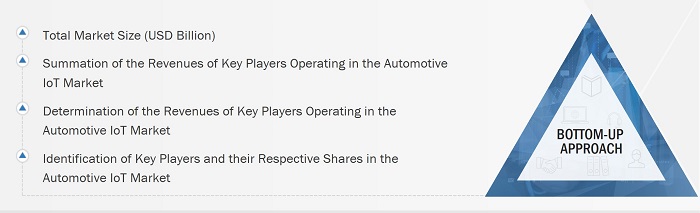

The study involved four major activities in estimating the size for automotive IoT market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the automotive IoT market size . Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the automotive IoT market share scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (automotive IoT offering providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the automotive IoT market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Automotive IoT Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Definition

The automotive industry is witnessing a technological revolution, with the Internet of Things (IoT) being at the core of it since connectivity is becoming an integral part of an automobile’s value. Bluetooth, cellular, and Wi-Fi are the major technologies used for the purpose of connectivity. Connected vehicles and intelligent transportation are the key verticals wherein IoT is being implemented for applications such as navigation, telematics, and infotainment. Increase in embedded connectivity in cars is leading to the development and uptake of connected cars solutions. Safety & security are some of the major factors driving the growth of automotive IoT. Early warning systems, blind spot detection, and automated or assisted braking are some of the major safety features that can be enabled through connectivity.

Key Stakeholders

- Senior Management

- Application

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and estimate the automotive IoT market share based on offerings, connectivity technologies, connectivity form factors, communication types, applications and region.

- To forecast the size of the market, by region—North America, Europe, Asia Pacific, and the Rest of the World (RoW)—in terms of value

- To forecast the automotive IoT market size, in terms of volume, by hardware offerings

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the automotive IoT market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and their contribution to the automotive IoT market

- To map the competitive landscape based on company profiles, key player strategies, and key developments.

- To provide a detailed overview of the automotive IoT value chain and ecosystem

- To provide information about the key technology trends and patents related to the automotive IoT market size .

- To provide information regarding trade data related to the automotive IoT market.

- To identify the key players operating in the automotive IoT market and comprehensively analyze their market shares and core competencies.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the automotive IoT market size

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio.

- To analyze competitive developments such as contracts, acquisitions, product launches, collaborations, partnerships, and research and development (R&D) in the automotive IoT market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive IoT Market