Quantum Computing in Healthcare Market Size by Component (Hardware, Software), Deployment (0n-premises, Cloud-based), Technology (Superconducting qubits, Trapped ions), Application (Drug discovery, Genomics), End User, and Region - Global Forecast to 2028

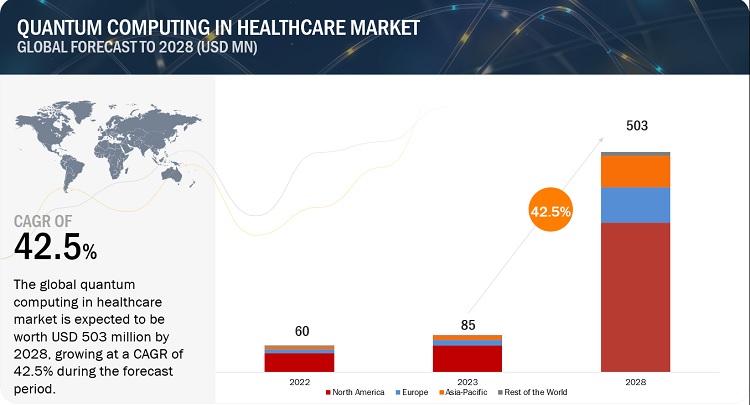

The size of global quantum computing in healthcare market in terms of revenue was estimated to be worth $85 million in 2023 and is poised to reach $503 million by 2028, growing at a CAGR of 42.5% from 2023 to 2028. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The technological advancements in quantum computing supporting various healthcare applications, potential applications in medical image analysis and oncology are some of the key factors offering opportunities to the market.However, lack of technical expertise and data management issuesare some of the key factors challenging the growth of the global market.

To know about the assumptions considered for the study, Request for Free Sample Report

Quantum Computing in Healthcare Market Dynamics

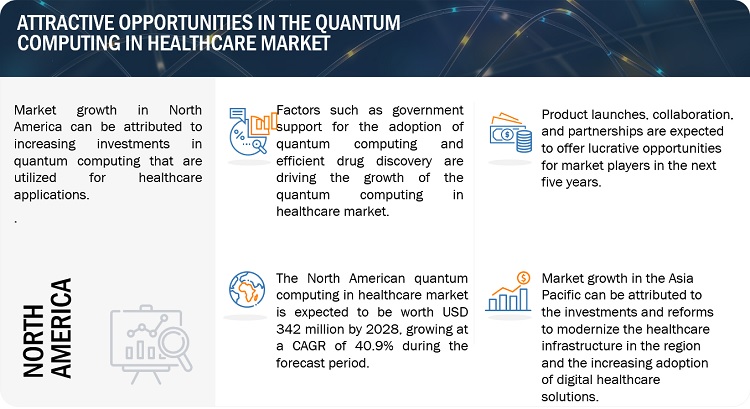

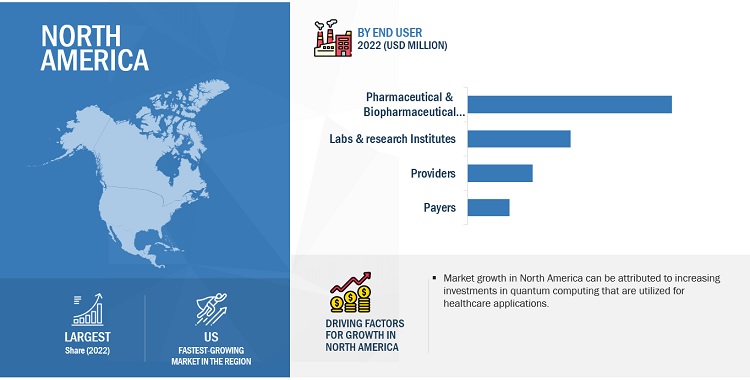

Driver: Increasing investments in quantum computing in developed as well as emerging economies

Developed as well as emerging economies have started investing significantly in quantum computing to support research activities in the healthcare sector. According to federal data, the US QIS research & development budget was approximately USD 900 million in FY 2022. This is twice that the US spent in this area in FY 2019, according to a report by the National Science and Technology Council Subcommittee on Quantum Information Science. European countries are also investing significantly in quantum computing. The German government announced investing significantly in IBM’s quantum computing research to facilitate its usage in various industries. The German government invested USD 720.5 million to support the transition of quantum technologies from basic research into market-ready applications. Similarly, France has made its mark in the quantum computing market by investing in it to support research activities. For instance, the National Strategy for Quantum Technologies invested approximately USD 1.8 billion. It supported the Grand Challenge on first-generation NISQ quantum accelerators, an industrial development program to help near-market public-private collaborative R&D, financial support for hundreds of new doctoral students, postdocs, and young researchers, as well as industry-specific training. Germany is another country in the European region focusing on promoting the use of quantum computing to combat the effects of COVID-19. Germany’s national strategy, Quantum Technologies?—?From Basic Research to Market, established in 2018, invests USD 3.1 billion to support quantum technology research in the country’s COVID-19 recovery with a framework encompassing a Centre of Excellence for Quantum Technologies. Investments are undertaken considering the progress of scientific discoveries through academic-industry collaborative projects.

Emerging economies, China and India, are also investing significantly in this field. The US’s primary competitor in the quantum computing sector is China. It started the Made in China 2025 (MIC 2025) national initiative that is expected to invest in R&D projects in quantum technology and other high-tech industries. Additionally, the Chinese Academy of Sciences Center for Excellence in Quantum Information and Quantum Physics, the Quantum Experiments at Space Scale (QUESS) project (the Micius satellite), the Beijing–Shanghai Quantum Secure Communication Backbone, and the National Quantum Laboratory?have received funding of USD 10 billion over past few years. These are some of the initiatives that help China in creating a footprint in this industry. Similarly, India’s National Mission on Quantum Technologies & Applications, established in 2020, includes a five-year plan with a budget of USD 1 billion that is expected to focus on using quantum computing in research. Government support, backed by initiatives and funding for healthcare research, is expected to boost market growth in the coming years.

Growing inclination of payers toward quantum computing

The use of quantum computing technology in the payer’s category is an emerging use case offering significant potential. Reimbursement is a tedious task and requires tremendous effort. Every year, a large amount of unstructured clinical data is collected from healthcare providers. More than 80% of the healthcare data is unstructured, making the process complex. Quantum computing can help break down complex tasks, reducing the pressure on humans and reducing healthcare costs significantly as well as predicting risk accurately. For instance, the insurance premium rate in the US has risen significantly during the last few years. The typical insurance carrier in an ACA exchange has requested a modest premium rate increase of 2.5%. Overall, 11 states saw the average health insurer reduce their premium rates. Georgia, Alabama, and Arizona experienced the largest average reduction in premium rates at 9.47%, 8.36%, and 7.92%, respectively. Meanwhile, West Virginia, Vermont, and Minnesota were the only three states whose average premium rate increased by more than 10%. West Virginia’s two insurers proposed 13.32% rate increases, followed by Vermont at 12.46% and Minnesota at 11.65%. Hence, understanding the pricing structure, items, and models that determine premium rates becomes essential. This task can be easily performed using quantum computing. Increasing the adoption of quantum computing for population health, disease risks, utilization, or provider pricing and utilization, and informed decision-making for developing granular risk models are expected to enhance market growth.

Restraint: Accuracy issues with quantum computing systems and high implementation costs

The quantum computing system has not yet reached optimum efficiency and 100% accuracy. Companies in drug discovery and genomics have experienced issues while operating with quantum computing. Lack of operational efficiency due to the complexity of the technology has also impacted accuracy. Moreover, the quantum computing system requires a long time to cool down after it reaches a particular temperature. This hampers its efficiency, leading to loss of productivity.

Quantum computers are costly, and their implementation process requires a long time. The high cost is attributed to the fact that it is a budding and niche technology. As the quantum computing technology reaches maturity, prices might drop in future. Therefore, currently, there is reluctance in using this technology, and traditional/conventional computing systems, especially in emerging countries such as India, are preferred. The aforementioned factors are expected to impact market growth to a certain extent.

Opportunity: Technological advancements in quantum computing supporting various healthcare applications

Key industry players have been investing significantly in the development of advanced quantum computing systems that help end users achieve maximum efficiency. In 2023, developments in the quantum computing field are not expected to be focused on hardware investments. Rather, focus is expected on creating systems with more qubits and that have international acceptance. For instance, in 2021, IBM revealed a system with a record-breaking 127 qubit system. Recently, it introduced the 433-qubit Osprey processor, and the company aims to release a 1,121-qubit processor called Condor in 2023. This year IBM is also expected to introduce its Heron processor with only 133 qubits. However, Heron’s qubits are expected to be of the highest quality, and each chip is expected to be able to connect directly to other Heron processors, heralding a shift from single quantum computing chips toward modular quantum computers built from multiple processors, a move that is expected to help quantum computers scale up significantly. A few companies are collaborating to develop quantum computing systems with minimum error rates. For instance, Google Quantum AI and Quantinuum, a new company formed by Honeywell and Cambridge Quantum Computing, issued papers demonstrating that qubits can be assembled into error-correcting ensembles that outperform the underlying physical qubits. Several other companies such as Horizon Quantum have also been building programming tools to enable these flexible computation routines. These advancements have facilitated clinical workflows, which, thereby, is expected to create potential in the coming years.

Challenge: Lack of technical expertise and data management issues

Quantum computing is a relatively complex technology that is difficult to operate and requires skilled staff. Though emerging countries have enormous populations, there is lack of skilled labor, which leads to difficulties in handling technologically advanced systems such as quantum computers. Adaptation to this nascent technology is challenging, especially in the healthcare field wherein there are large unstructured data repositories. Moreover, quantum computing systems are huge, which makes it difficult in managing and maintaining data sanity. The above-mentioned factors prove to be a challenge for quantum computing in the healthcare market. However, due to improvements in healthcare infrastructure, the magnitude of these challenges is bound to be reduced in the coming years.

Quantum Computing in Healthcare Market Ecosystem

The rising adoption of quantum computing solutions and services in the healthcare industry pertaining to the growing number of applications is driving the growth of the quantum computing market globally. The industry is leveraging advanced technologies such as cloud computing, IoT, and smart logistics to modify its business models and enhance operational efficiency. This has also led to the development of smart supply chains, improved manufacturing processes, and an efficient end-to-end ecosystem.

The services segment of quantum computing in healthcare industry registered the highest CAGR during the forecast period in healthcare market, by component.

On the basis of component, the quantum computing in healthcare market is segmented into hardware, software, and services. In 2022, the services segment accounted for a significant share & highest growth in the market. The growth of the services segment can be attributed to to the advantages offered by the services such as installation, equipment updates, periodic software upgrades or traditional licensing management are not required in case of services.

Genomics & precision medicine segment of quantum computing in healthcare industry is expected to register the highest growth by the application during the forecast period.

Genomics & precision medicine segment of the quantum computing in healthcare market is expected to register the highest growth by the application during the forecast period. The growth of the drug discovery & development segment can be attributed to to the efficient processing and analyzing of vast amounts of genetic data, leading to more personalized and effective treatments for patients.

APAC region of quantum computing in healthcare industry to witness the highest growth rate during the forecast period.

The Asia Pacific region of the quantum computing in healthcare market is projected to grow at the highest CAGR during the forecast period. Factors such as increasing medical tourisms, investments are expected to bring about the creation of new market participants and are anticipated to drive the development of quantum computing for healthcare applications in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Prominent companies in this market include IBM (US), Google, Inc. (US), Rigetti & Co, LLC. (US), Quandela (France), D-Wave Quantum Inc. (Canada), Quantinuum, Ltd. (US & UK), ID Quantique (Switzerland), Zapata Computing (US), Atos SE (France), IonQ (US), Classiq Technologies, Inc. (US), Xanadu Quantum Technologies Inc. (Canada), QC Ware (California), Protiviti, Inc. (US), Hefei Origin Quantum Computing Technology Co., Ltd. (China), PwC (UK), Deloitte (UK), Accenture (Ireland), Amazon Web Services (US), Pasqal (France), Fujitsu (Japan), Sandbox AQ (US), SEEQC (US), Quintessence Labs (Australia), and Qnami (Switzerland).

Scope of the Quantum Computing in Healthcare Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$85 million |

|

Projected Revenue Size by 2028 |

$503 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 42.5% |

|

Market Driver |

Increasing investments in quantum computing in developed as well as emerging economies |

|

Market Opportunity |

Technological advancements in quantum computing supporting various healthcare applications |

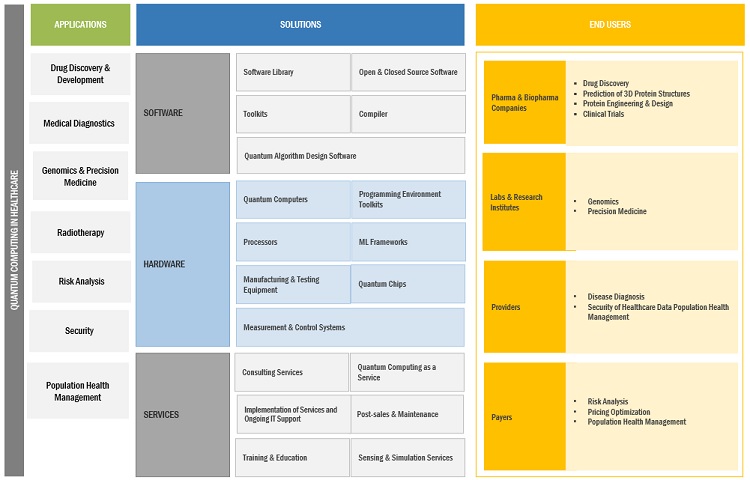

The study categorizes the quantum computing in healthcare market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Hardware

- Software

- Services

By Technology

- Superconducting Qubits

- Trapped Ions

- Quantum Annealing

- Others

By Application

- Drug Discovery and development

- Medical Diagnostics

- Genomics and Precision Medicine

- Radiotherapy

- Risk Analysis

- Others

By End User

- Pharmaceutical and Biopharmaceutical Companies

- Labs and Research Institutes

- Healthcare Providers

- Healthcare Payers

By Deployment

- On premises

- Cloud Based

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

-

Asia Pacific

- Japan

- China

- RoAPAC

-

Rest of the World

- Latin America

- Middle East and Africa

Recent Developments of Quantum Computing in Healthcare Industry:

- In March 2023 Quandela (France) partnered with CryptoNext (France) , This aimed to develop a fully integrated quantum-safe solution to secure transfer of sensitive data

- In March 2023, IBM (US) Partnered with Cleveland Clinic(UK), through this partnership, The IBM Quantum System One was installed at Cleveland Clinic and became the first quantum computer in the world to be uniquely dedicated to healthcare research with an aim to help Cleveland Clinic accelerate biomedical discoveries.

- In March 2023, D-Wave Quantum, Inc. (Canada) Launched Dwave-Scikit-Learn-Plugin, which is a new hybrid solver plug-in, helping companies leverage quantum technology to streamline the development of machine learning (ML) applications.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the quantum computing in healthcare market?

The quantum computing in healthcare market boasts a total revenue value of USD 503 million by 2028.

What is the estimated growth rate (CAGR) of the quantum computing in healthcare market?

The global quantum computing in healthcare market has an estimated compound annual growth rate (CAGR) of 42.5% and a revenue size in the region of USD 85 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of both, primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, annual reports, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the quantum computing in healthcare market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the quantum computing in healthcare market. Primary sources from the demand side included personnel from hospitals (small, medium-sized, and large hospitals), diagnostic centers, and stakeholders in corporate & government bodies.

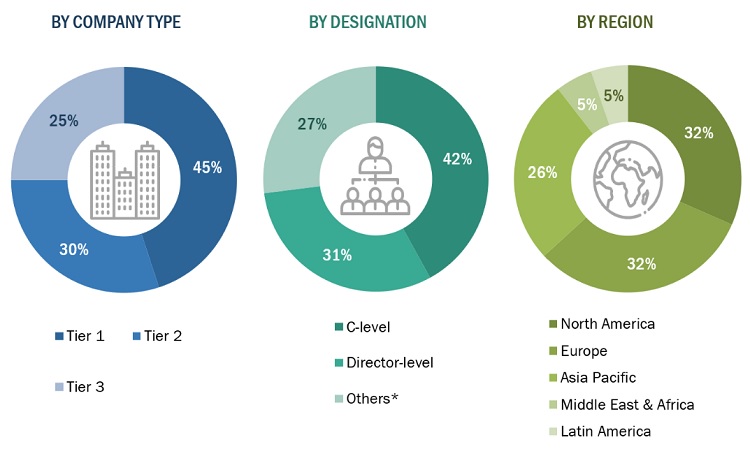

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the quantum computing in healthcare market was arrived at after data triangulation through the two different approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

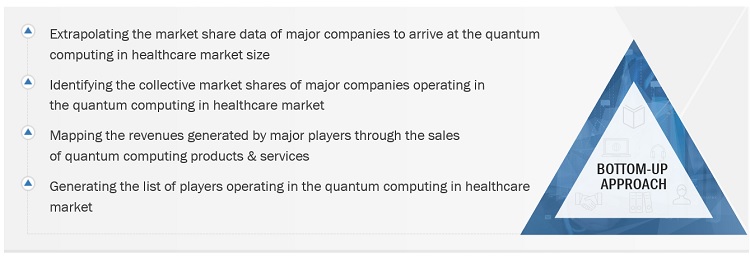

Data Triangulation

The size of the quantum computing in healthcare market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players in the market were gathered from secondary sources to the extent available. In certain cases, shares of quantum computing in healthcare businesses have been ascertained after a detailed analysis of various parameters including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

- The total revenue in the market was determined by extrapolating the Market share data of major companies.

Market Definition

Quantum computing is a multidisciplinary field that includes various aspects of physics, computer science, and mathematics utilizing quantum mechanics for solving complex problems faster as compared to classical computers. A quantum computing system involves hardware, software, and services.

This report provides a close look at quantum computing in the healthcare market. It offers applications in drug discovery, personalized medicine, medical imaging, and risk analysis reimbursement perspective.

Key Stakeholders

- Healthcare Providers

- Healthcare Vendors

- Quantum Computing Service Providers

- Healthcare Payers

- Academic Research Institutes

- Diagnostic Labs

- Imagining Labs

- Government Institutions

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Objectives of the Study

- To define, describe, and forecast the quantum computing in healthcare market based on component, deployment, technology, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of

- the competitive landscape for market leaders

- To forecast the size of the market with respect to three geographic regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW) which include regions such as Latin America and Middle East & Africa.

- To profile the key players and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as agreements, partnerships, collaborations, acquisitions, product/technology/service launches, and R&D activities of leading players

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Market into Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific Market into Vietnam, Pakistan, New Zealand, Australia, South Korea, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Quantum Computing in Healthcare Market