Quantum Photonics Market Size, Share & Industry Trends Analysis Report by Offering (Systems, and Services), Application (Quantum Communications, Quantum Computing, and Quantum Sensing & Metrology), Vertical (Banking & Finance, Agriculture & Environment) and Region - Global Forecast to 2030

Updated on : Sep 18, 2024

Quantum Photonics Market Size & Share

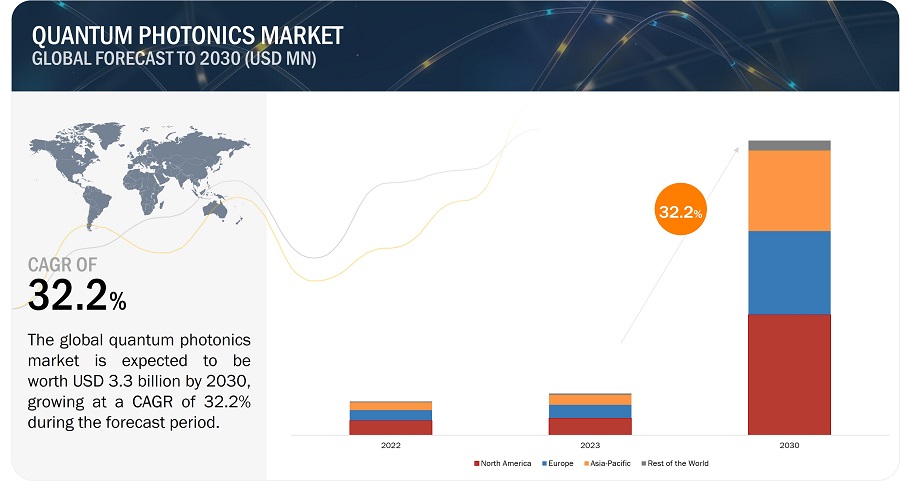

[223 Pages Report] The global quantum photonics market size is projected to grow from USD 0.4 billion in 2023 and is anticipated to USD 3.3 billion by 2030, growing at a CAGR of 32.2% from 2023 to 2030.

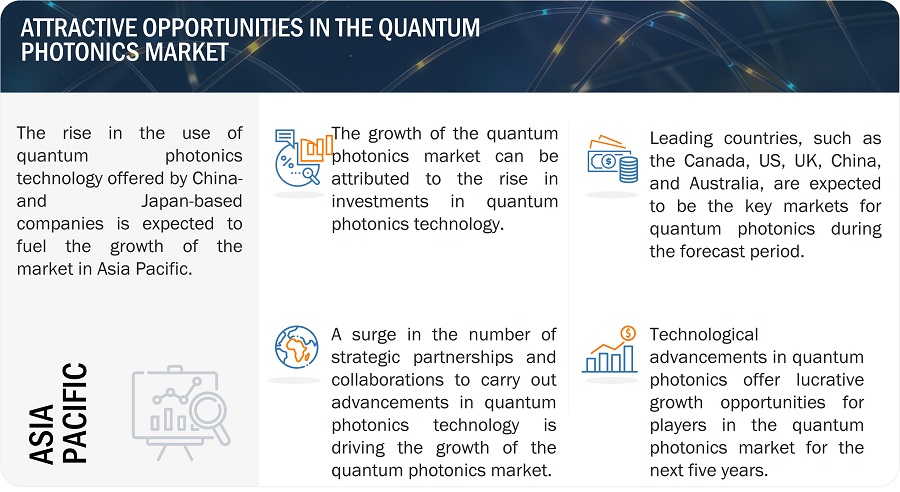

Rising demand for secure communication and growing investment in quantum photonics computing to drive market growth during the forecast period. Factors such as growing R&D and investments in quantum photonics computing provides market growth opportunities for market.

Quantum Photonics Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Quantum Photonics Market Trends

Driver: Rising demand for secure communication

The need for more reliable and secure communication systems at a time of rising cyber threats is driving the rising need for secure communication in quantum photonics. Classical cryptography-based traditional communication systems are susceptible to hacking and eavesdropping, but quantum computing presents a viable answer to these security issues.

Quantum cryptography, which is founded on the fundamental ideas of quantum mechanics, is used in quantum photonics to provide very secure communication. Quantum cryptography is very resistant to hacking and eavesdropping because it harnesses the characteristics of quantum states to encrypt and transfer information.

For instance, two parties can create a shared secret key using photons in quantum key distribution (QKD), which can then be used to encrypt and decode data. The safety of QKD is predicated on the fact that any effort to measure or intercept the photons will invariably cause them to lose their quantum states, alerting the parties to the presence of an observer.

There is an increasing demand for highly secure communication systems that can guard against hacking and eavesdropping as the volume and sensitivity of digital communication continue to expand. In the future of secure communication, quantum photonics is anticipated to play a significant role and offers a possible solution to this problem.

Multiple factors that contribute the necessity for secure communication in quantum photonics, including Protection against cyber threats, Global connectivity, High-security applications, Legal requirements. Overall, the demand for secure communication in quantum photonics industry is driven by the need for protection against cyber threats, the need for high-security applications, the need for global connectivity, and legal requirements. As the demand for secure communication continues to grow, it is expected that the market for quantum photonics will continue to expand.

In April 2022, British Telecommunications (UK) and Toshiba (Japan) launched the first commercial testing of quantum encrypted communication services. BT, Toshiba, and EY (UK) have started a trial of the world's first commercial quantum-secured metro network.

The infrastructure was able to connect a large number of clients across London, allowing them to secure the transmission of vital data and information between different physical locations utilizing quantum key distribution (QKD) over regular fiber optic cables. QKD is an essential technology that plays a critical role in defending networks and data from the rising threat of quantum computing-based cyber-attacks. The London network is an important step toward the UK government's goal of becoming a quantum-enabled economy.

Restraint: Regulatory challenges can hinder quantum photonics adoption and commercialization

Regulations can be a significant obstacle for companies seeking to develop and commercialize quantum photonics technology. These regulations can come from a variety of sources, such as data privacy, intellectual property, export controls, safety regulations, and standards and interoperability.

For example, strict data privacy regulations in finance and healthcare may require additional security measures to comply, while patent disputes and licensing agreements can add complexity and cost to development. Export controls and safety regulations may also delay deployment. Also, establishing new standards and interoperability with existing technologies can add further complexity and time to the development process. Companies need to work with regulatory bodies and stakeholders to ensure compliance and navigate these challenges, which can slow down the adoption and commercialization of quantum photonics computing technology.

Opportunity: Advancements in quantum communications

Researchers working on quantum communication are concentrating on creating safe communication protocols that make advantage of entanglement and superposition. Quantum key distribution, which enables the safe exchange of cryptographic keys between two parties, is one of the most promising uses of quantum communication.

Researchers are aiming to create quantum computers that employ photonic qubits (quantum bits) rather than conventional electrical qubits in quantum photonics computing. In comparison to electrical qubits, photonic qubits offer a number of benefits, such as the capacity to travel across great distances without suffering substantial information loss and their comparatively simple manipulation.

The demonstration of large-scale integrated photonic circuits for processing quantum information, such as the development of a 100-qubit photonic chip by researchers at the University of Bristol, are recent developments in quantum photonics computing.

The development of effective photon sources and detectors for use in quantum photonics computing systems has also advanced. Several companies are actively working an advancements in the field of quantum photonics, which include PsiQuantum (US), Xanadu (Canada), Toshiba (Japan), etc. These are only a few instances of businesses engaged in developments in the area of quantum photonics computing. Numerous other businesses and university research teams are also making important contributions to this fascinating topic.

Challenge: Experimental constraints in quantum photonics computing

Quantum photonics computing is a new area of study that intends to employ photons, which are light particles, to carry and analyze quantum information. While this technology has the potential to revolutionize computing, various obstacles must be overcome before it can be implemented in practice.

The area of quantum photonics computing has recently experienced various hurdles that have hindered its development toward practical applications. Experimental constraints provide a substantial hurdle to quantum photonics. Although theoretical models and methods for quantum photonics computing have been established, implementing them in actual devices remains a significant issue due to experimental constraints. Some of these challenges include high error rates, scaling up quantum photonics computing systems, maintaining the coherence of qubits which are the basic building blocks of quantum computers, detection and measurement of photonic qubits.

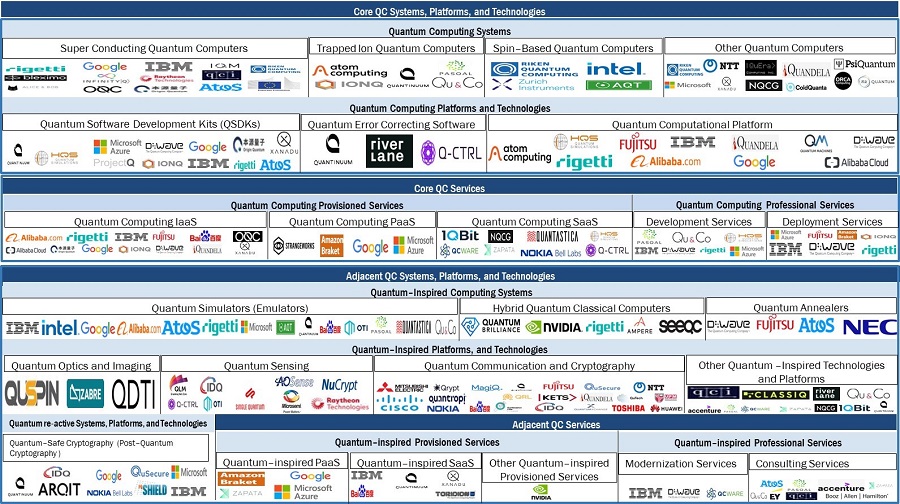

Quantum Photonics Industry Ecosystem

The quantum photonics market is highly competitive. It is marked by the presence of a few tier-1 companies, such as Toshiba (Japan), Xanadu (Canada), Quandela (France), and ID Quantique (Switzerland).These companies have created a competitive ecosystem by investing in research and development activities to launch highly efficient and reliable quantum photonics solutions.

Systems segment to register highest CAGR during forecast period

During the forecast period, the systems segment is expected to experience the highest growth rate and hold the largest market share in the quantum photonics market. The systems segment is likely to hold the largest share of the market during the forecast period. This segment has witnessed rapid growth due to advanced hardware technology and a rise indemand across industries. Companies such as Xanadu (Canada) and Quandela (France) have introduced high-performance quantum photonics hardware, making the technology accessible and beneficial for various applications such as cryptography, machine learning, and optimization.

Quantum communications segment to hold the largest market share during forecast period

The quantum communications segment within the quantum photonics market is anticipated to witness substantial growth during the forecast period. Quantum communications involve the transfer of quantum information using photons between quantum devices such as quantum computers or sensors. It uses quantum key distribution (QKD) and quantum random number generation to provide robust security against spying or hacking. These technologies have potential applications in the military, government, and healthcare, where secure communication is vital.

Transportation & logistics segment is expected to grow at the highest CAGR quantum photonics market during the forecast period

The transportation & logistics segment market is projected to grow at the fastest CAGR during the forecast period. Factors driving this growth include the ability of quantum computing to optimize logistical operations such as route planning and supply chain management, resulting in cost savings and faster delivery times. Quantum sensors provide real-time environmental data for better decision-making, while advancements in quantum technologies promise innovative solutions for transportation system design.

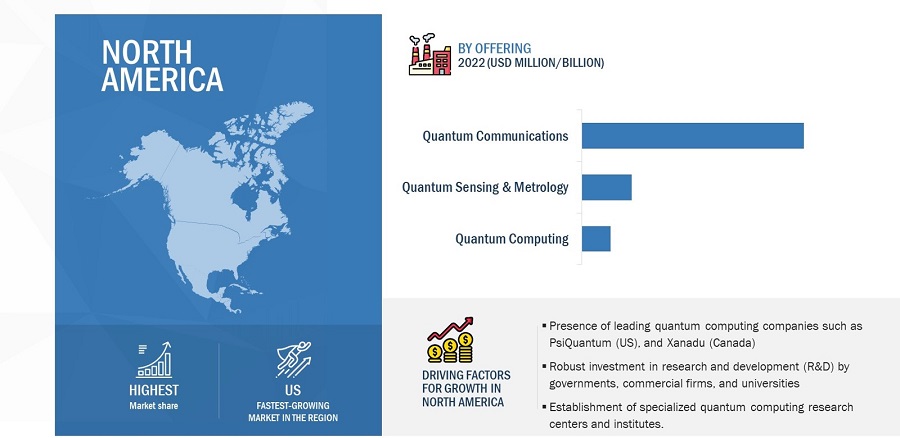

North America by region to hold the larger share during the forecast period

North America plays an important role in the development and commercialization of quantum photonics computer technologies. Several leading quantum computing companies, research institutions, and universities are located in the region, driving innovation in the field. PsiQuantum (US), Xanadu (Canada), AOsense (US), and Quantum Xchange (US) are some of the companies catering to this market in North America. The development of quantum computers and associated technologies is one of the primary ways North America contributes to the quantum photonics business.

Quantum Photonics Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Quantum Photonics - Key Market Players

The quantum photonics companies is dominated by globally established players such as

- Toshiba (Japan),

- Xanadu (Canada),

- Quandela (France),

- ID Quantique (Switzerland),

- ORCA Computing (UK),

- PsiQuantum (US),

- TundraSystems (UK),

- Quix Quantum (Netherlands),

- Nordic Quantum Computing Group (Norway),

- Thorlabs (US),

- AOSense (US),

- Single Quantum (Netherlands),

- Qubitekk (US),

- QuintessenceLabs (Australia),

- NTT Technologies (Japan), NEC (Japan), M Squared (UK), CryptaLabs (UK), Nu Quantum (UK), Microchip Technology (US), Amazon Web Services (AWS) (US), QuantumXchange (US), Quantum Dice (UK), Menlo Systems (Germany), and QUSIDE (UK). These players have adopted product launches/developments, contracts, collaborations, agreements, and acquisitions for growth in the market.

Quantum Photonics Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 0.4 billion in 2023 |

| Projected Market Size | USD 3.3 billion by 2030 |

| Quantum Photonics Market Growth Rate | CAGR of 32.2% |

|

Quantum Photonics Market size available for years |

2020–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By offering, By application, By vertical, and By Region |

|

Region covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The key players in the quantum photonics market are Toshiba (Japan), Xanadu (Canada), Quandela (France), ID Quantique (Switzerland), ORCA Computing (UK), PsiQuantum (US), TundraSystems (UK), Quix Quantum (Netherlands), Nordic Quantum Computing Group (Norway), Thorlabs (US), AOSense (US), Single Quantum (Netherlands), Qubitekk (US), QuintessenceLabs (Australia), NTT Technologies (Japan), NEC (Japan), M Squared (UK), CryptaLabs (UK), Nu Quantum (UK), Microchip Technology (US), Amazon Web Services (AWS) (US), QuantumXchange (US), Quantum Dice (UK), Menlo Systems (Germany), and QUSIDE (UK). |

Quantum Photonics Market Highlights

The study categorizes the quantum photonics market based offering, application, vertical, and region

|

Segment |

Subsegment |

|

By Offering |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in Quantum Photonics Industry

- In March 2023, CryptoNext Security (France), and Quandela (France) partnered to develop an integrated solution for securing post-quantum communication protocols. The solution leverages their expertise in quantum computing and post-quantum cryptography remediation. They aim to offer a fully integrated quantum-safe solution to secure sensitive data transfer in various industries, including defense, finance, manufacturing, energy, automotive, and digital services.

- In October 2022, Quandela (France) partnered with the Electronics and Information Technology Laboratory of the French Atomic Energy Commission (CEA-Leti) to manufacture a high-performance photonic chip entirely in France.

- In June 2022, Xanadu launched Borealis, a photonic-based quantum computer. According to Xanadu, it is the world’s largest photonic quantum computer with 216 squeezed-state qubits. Xanadu claims to achieve the quantum advantage due to Borealis’ capability of performing a task in 36 microseconds which would take more than 9,000 years for a supercomputer.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of the desiccant dehumidifier market based on product type?

The fixed or mounted is expected to hold the largest share of the desiccant dehumidifier market during the forecast period. This can be attributed to the growing expansion of manufacturing units, warehouses, water treatment facilities, and lithium-ion battery production plants across the globe. These plants and facilities require large desiccant dehumidifiers that cannot be moved due to the large area.

Which application will contribute more to the overall market share by 2028?

The energy segment will contribute the most to the desiccant dehumidifier market. The market for energy segment is expected to account for the largest share of the desiccant dehumidifier market during the forecast period owing to their growing adoption in power plants as desiccant dehumidifiers can provide the ideal low humidity environment for preservation and deactivation of power plants, as they can maintain RH as low as 1% or even lower at a constant level, regardless of ambient conditions.

How will technological developments such as cloud computing technology, and artificial intelligence (AI) technology change the desiccant dehumidifier market landscape in the future?

Cloud computing technology utilizes IOT connected to IoT gateway modules and Edge computing devices, which collect data from the system and send it for analysis for different AI applications. Most commercial companies and factories are starting to manage energy efficiency better using AI and IoT solutions for building desiccant dehumidifiers to minimize and save on unnecessary operation costs without sacrificing ambient comfort status. With cloud computing, the AI model can predict maintenance requirements for the system, reducing downtime and improving the efficiency of the system. With cloud computing technology, desiccant dehumidifiers can be connected to the internet, allowing for remote monitoring and control. This can enable users to monitor the performance and status of their dehumidifiers from anywhere with an internet connection.

Which region is expected to adopt desiccant dehumidifier systems at a fast rate?

Asia Pacific region is expected to adopt desiccant dehumidifiers at the fastest rate. Developing countries such as India and China are expected to have a high potential for the future growth of the market.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

The construction sector is booming with an upsurge in residential, commercial, and infrastructure projects worldwide. The demand for construction is rising due to huge economic growth in developing countries and low-interest rates in a number of developed countries. Also, factors such as increasing private sector investments in construction, technological development, and rising disposable income are expected to provide momentum to construction activities worldwide. As the construction industry has evolved, and through practical application, it has been evident that a desiccant dehumidifier is much more effective at drying construction materials than a heater. Because a desiccant dehumidifier reduces both humidity and vapor pressure, it is the most effective method for providing a construction environment where materials dry at an accelerated pace, and the potential for mold growth is considerably decreased.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for secure communication- Potential for quantum supremacy- Growing investment in quantum photonics- Integration with existing technologiesRESTRAINTS- Lack of standardization in quantum photonics- Regulatory challenges hinder quantum photonics adoption and commercialization- Difficulty in quantum photonics scalingOPPORTUNITIES- Advancements in quantum communications- Growing R&D and investments in quantum photonics computing- Opportunities for hardware and software in quantum photonics computing marketCHALLENGES- Experimental constraints in quantum photonics computing

-

5.3 VALUE CHAIN ANALYSISRESEARCH, DESIGN, AND DEVELOPMENTMANUFACTURERSSOFTWARE PROVIDERSSYSTEM INTEGRATORSEND-USER INDUSTRIES

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.6 PRICING ANALYSIS

- 5.7 CASE STUDY ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.9 TARIFF ANALYSIS

-

5.10 REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDS- P1913 – Software-defined quantum communication- P7130 – Standard for quantum technologies definitions- P7131 – Standard for quantum computing performance metrics and benchmarking

-

5.11 TECHNOLOGY ANALYSISQUANTUM IMAGINGQUANTUM CRYPTOGRAPHYQUANTUM SIMULATIONQUANTUM NANOPHOTONICSQUANTUM ERROR CORRECTIONPROCESSORS & CHIPSDEVELOPMENT TOOLSMACHINE LEARNING

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.14 REVENUE SHIFT AND NEW REVENUE POCKETS FOR CUSTOMERS’ BUSINESSES

-

5.15 KEY STAKEHOLDERS AND BUYING PROCESSKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 SYSTEMSINCREASING DEVELOPMENT OF QUANTUM PHOTONICS COMPUTING SYSTEMS TO DRIVE MARKET

-

6.3 SERVICESQUANTUM COMPUTING AS A SERVICE (QCAAS)- Accessing power of quantum photonics through cloud-based platforms to fuel marketCONSULTING SERVICES- Increase in awareness of advantages of quantum photonics to drive market

- 7.1 INTRODUCTION

-

7.2 QUANTUM COMMUNICATIONSQUANTUM RANDOM GENERATORS- Generation of random numbers for advanced level of security to boost marketQUANTUM KEY DISTRIBUTION- Secure data transfer provided by quantum key distribution to drive market

-

7.3 QUANTUM SENSING & METROLOGYATOMIC CLOCKS- Precise measurement of time provided by atomic clocks to fuel market growthQUANTUM DOT PHOTODETECTORS- Ability of quantum dot photodetectors to make precise measurements to fuel market growthPAR (PHOTOSYNTHETICALLY ACTIVE RADIATION) QUANTUM SENSORS- Use of PAR to monitor plant growth to drive marketQUANTUM LIDAR- Precise and detailed images even in challenging conditions to drive market

-

7.4 QUANTUM COMPUTINGON-PREMISES- On-premises photonic quantum computer to offer enhanced security and low latencyCLOUD- Growing adoption of cloud-based quantum computing for research and development

- 8.1 INTRODUCTION

-

8.2 SPACE & DEFENSERISE IN USE OF QUANTUM PHOTONICS FOR CONCURRENT EXECUTION OF PROCESSES TO BOOST MARKET

-

8.3 BANKING & FINANCEINCREASE IN USE OF QUANTUM PHOTONICS IN BANKING & FINANCE SECTORS TO FUEL MARKET

-

8.4 HEALTHCARE & PHARMACEUTICALRISE IN REQUIREMENT FOR PERSONALIZED DIAGNOSTIC TOOLS AND TAILORED THERAPIES TO BOOST MARKET

-

8.5 TRANSPORTATION & LOGISTICSINCREASE IN USE OF QUANTUM-BASED METHODS TO IMPROVE TRAFFIC FLOW TO DRIVE MARKET

-

8.6 GOVERNMENTSPIKE IN INVESTMENTS FOR DEVELOPMENT OF QUANTUM PHOTONICS TECHNOLOGY TO DRIVE MARKET

-

8.7 AGRICULTURE & ENVIRONMENTPRECISE DETECTION CAPABILITIES FOR MONITORING CRUCIAL PARAMETERS TO BOOST MARKET

- 8.8 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Extensive investments in quantum photonics research & development to drive marketCANADA- Spike in government-led investments for development of new technologies to fuel marketMEXICO- Rise in quantum photonics developmental initiatives to boost market

-

9.3 EUROPEEUROPE: RECESSION IMPACTUK- Industrial developments and increase in adoption of quantum photonics to fuel marketGERMANY- Strong industrial and research presence in Germany to drive quantum photonics marketFRANCE- Surge in demand for advanced technologies for secure communications to fuel marketNETHERLANDS- Rise in initiatives to develop quantum photonics technology to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Government-led initiatives and spike in funding for development of quantum computers to fuel marketJAPAN- Rise in focus on deployment of emerging technologies to boost marketSOUTH KOREA- Growing adoption of quantum photonics technology by key consumer electronics manufacturers to drive marketREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDSOUTH AMERICA- Establishment of quantum communities to drive marketMIDDLE EAST & AFRICA- Rise in initiatives to increase awareness regarding quantum photonics to boost market

- 10.1 INTRODUCTION

- 10.2 KEY STRATEGIES ADOPTED BY MAJOR COMPANIES

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS, 2022

-

10.5 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPETITIVE BENCHMARKINGCOMPANY FOOTPRINT: OFFERINGCOMPANY FOOTPRINT: REGIONCOMPANY FOOTPRINT: APPLICATIONOVERALL COMPANY FOOTPRINT

-

10.7 STARTUP/SME EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.8 COMPETITIVE SITUATIONS AND TRENDS

-

11.1 KEY PLAYERSXANADU- Business overview- Products offered- Recent developments- MnM viewPSI QUANTUM- Business overview- Products offered- Recent developments- MnM viewQUANDELA- Business overview- Products offered- Recent developments- MnM viewID QUANTIQUE- Business overview- Products offered- Recent developments- MnM viewTOSHIBA- Business overview- Products offered- Recent developments- MnM viewORCA COMPUTING- Business overview- Products offered- Recent developmentsQUIX QUANTUM- Business overview- Products offered- Recent developmentsTUNDRASYSTEMS GLOBAL- Business overview- Products offeredNORDIC QUANTUM COMPUTING GROUP (NQCG)- Business overview- Products offeredNU QUANTUM- Business overview- Products offered

-

11.2 OTHER KEY PLAYERSSINGLE QUANTUMAMAZON WEB SERVICESNTT TECHNOLOGIESM SQUAREDAOSENSENEC CORPORATIONQUANTUM XCHANGECRYPTA LABSMICROCHIP TECHNOLOGYMENLO SYSTEMSTHORLABSQUINTESSENCE LABSQUANTUM DICEQUSIDEQUBITEKK

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 CURRENCY CONVERSION RATES

- TABLE 2 QUANTUM PHOTONICS MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 QUANTUM PHOTONICS MARKET: RECESSION IMPACT APPROACH

- TABLE 4 QUANTUM PHOTONICS MARKET: RISK ASSESSMENT

- TABLE 5 QUANTUM PHOTONICS MARKET: ECOSYSTEM ANALYSIS

- TABLE 6 IDQ & SK BROADBAND EXPAND USE OF QKD TO PROTECT CRITICAL DATA IN SOUTH KOREA

- TABLE 7 CHARACTERIZING AND ENTANGLEMENT OF PHOTON-PAIR SOURCES

- TABLE 8 ROLLS-ROYCE PARTNERS WITH XANADU TO CO-DEVELOP QUANTUM ALGORITHM TO ACCELERATE AEROSPACE RESEARCH

- TABLE 9 QUANDELA AND CRYPTONEXT SECURITY PARTNERED TO OFFER FULLY INTEGRATED QUANTUM-SAFE SOLUTION

- TABLE 10 ORCA COMPUTING PARTNERED WITH UK MINISTRY OF DEFENCE (MOD) TO DEVELOP QUANTUM COMPUTING FOR FUTURE DATA PROCESSING CAPABILITIES

- TABLE 11 IMPORT DATA FOR ELECTRONIC INTEGRATED CIRCUITS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 12 EXPORT DATA FOR ELECTRONIC INTEGRATED CIRCUITS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 13 TARIFFS IMPOSED BY US ON IMPORTS OF ELECTRONIC INTEGRATED CIRCUITS; PARTS THEREOF, 2021

- TABLE 14 TARIFFS IMPOSED BY CHINA ON IMPORTS OF ELECTRONIC INTEGRATED CIRCUITS; PARTS THEREOF, 2021

- TABLE 15 TARIFFS IMPOSED BY GERMANY ON IMPORTS OF ELECTRONIC INTEGRATED CIRCUITS; PARTS THEREOF, 2021

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 PATENT REGISTRATIONS, 2019–2022

- TABLE 21 TOP 20 PATENT OWNERS IN LAST 10 YEARS, 2013–2022

- TABLE 22 QUANTUM PHOTONICS MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 25 QUANTUM PHOTONICS MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 26 QUANTUM PHOTONICS MARKET, BY OFFERING, 2023–2030 (USD MILLION)

- TABLE 27 SYSTEMS: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 28 SYSTEMS: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 29 SYSTEMS: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 30 SYSTEMS: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 31 QUANTUM PHOTONICS MARKET, BY SERVICES, 2020–2022 (USD MILLION)

- TABLE 32 QUANTUM PHOTONICS MARKET, BY SERVICES, 2023–2030 (USD MILLION)

- TABLE 33 SERVICES: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 34 SERVICES: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 35 SERVICES: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 36 SERVICES: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 37 QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 38 QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 39 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 40 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 41 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 42 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 43 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 44 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY OFFERING, 2023–2030 (USD MILLION)

- TABLE 45 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 46 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 47 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 48 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 49 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 50 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 51 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 52 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 53 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 54 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 55 QUANTUM PHOTONICS MARKET, BY SERVICES, 2020–2022 (USD MILLION)

- TABLE 56 QUANTUM PHOTONICS MARKET, BY SERVICES, 2023–2030 (USD MILLION)

- TABLE 57 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY DEPLOYMENT MODE, 2020–2022 (USD MILLION)

- TABLE 58 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY DEPLOYMENT MODE, 2023–2030 (USD MILLION)

- TABLE 59 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 60 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY OFFERING, 2023–2030 (USD MILLION)

- TABLE 61 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 62 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 63 QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 64 QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 65 SPACE & DEFENSE: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 66 SPACE & DEFENSE: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 67 BANKING & FINANCE: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 68 BANKING & FINANCE: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 69 HEALTHCARE & PHARMACEUTICAL: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 70 HEALTHCARE & PHARMACEUTICAL: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 71 TRANSPORTATION & LOGISTICS: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 72 TRANSPORTATION & LOGISTICS: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 73 GOVERNMENT: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 74 GOVERNMENT: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 75 AGRICULTURE & ENVIRONMENT: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 76 AGRICULTURE & ENVIRONMENT: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 77 OTHERS: QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 78 OTHERS: QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 79 QUANTUM PHOTONICS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 80 QUANTUM PHOTONICS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 87 EUROPE: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 88 EUROPE: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 89 EUROPE: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 90 EUROPE: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 91 EUROPE: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 92 EUROPE: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 99 ROW: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 100 ROW: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 101 ROW: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 102 ROW: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 103 ROW: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 104 ROW: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 105 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN QUANTUM PHOTONICS MARKET

- TABLE 106 QUANTUM PHOTONICS MARKET: DEGREE OF COMPETITION

- TABLE 107 QUANTUM PHOTONICS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 108 QUANTUM PHOTONICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 109 QUANTUM PHOTONICS MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 110 QUANTUM PHOTONICS MARKET: DEALS, 2020–2023

- TABLE 111 QUANTUM PHOTONICS MARKET: OTHERS, 2020–2023

- TABLE 112 XANADU: COMPANY OVERVIEW

- TABLE 113 XANADU: PRODUCTS OFFERED

- TABLE 114 XANADU: PRODUCT LAUNCHES

- TABLE 115 XANADU: DEALS

- TABLE 116 PSIQUANTUM: COMPANY OVERVIEW

- TABLE 117 PSIQUANTUM: PRODUCTS OFFERED

- TABLE 118 PSIQUANTUM: DEALS

- TABLE 119 QUANDELA: COMPANY OVERVIEW

- TABLE 120 QUANDELA: PRODUCTS OFFERED

- TABLE 121 QUANDELA: PRODUCT LAUNCHES

- TABLE 122 QUANDELA: DEALS

- TABLE 123 ID QUANTIQUE: COMPANY OVERVIEW

- TABLE 124 ID QUANTIQUE: PRODUCTS OFFERED

- TABLE 125 ID QUANTIQUE: PRODUCT LAUNCHES

- TABLE 126 ID QUANTIQUE: DEALS

- TABLE 127 TOSHIBA: COMPANY OVERVIEW

- TABLE 128 TOSHIBA: PRODUCT LAUNCHES

- TABLE 129 TOSHIBA: DEALS

- TABLE 130 ORCA COMPUTING: COMPANY OVERVIEW

- TABLE 131 ORCA COMPUTING: PRODUCTS OFFERED

- TABLE 132 ORCA COMPUTING: DEALS

- TABLE 133 QUIX QUANTUM: COMPANY OVERVIEW

- TABLE 134 QUIX QUANTUM: PRODUCTS OFFERED

- TABLE 135 QUIX QUANTUM: PRODUCT LAUNCHES

- TABLE 136 QUIX QUANTUM: DEALS

- TABLE 137 TUNDRASYSTEMS GLOBAL: COMPANY OVERVIEW

- TABLE 138 TUNDRASYSTEMS GLOBAL: PRODUCTS OFFERED

- TABLE 139 NORDIC QUANTUM COMPUTING GROUP: COMPANY OVERVIEW

- TABLE 140 NORDIC QUANTUM COMPUTING GROUP: PRODUCTS OFFERED

- TABLE 141 NORDIC QUANTUM COMPUTING GROUP: DEALS

- TABLE 142 NU QUANTUM: COMPANY OVERVIEW

- TABLE 143 NU QUANTUM: PRODUCTS OFFERED

- TABLE 144 NU QUANTUM: DEALS

- FIGURE 1 QUANTUM PHOTONICS MARKET: SEGMENTATION

- FIGURE 2 QUANTUM PHOTONICS MARKET: RESEARCH DESIGN

- FIGURE 3 QUANTUM PHOTONICS MARKET: RESEARCH APPROACH

- FIGURE 4 RESEARCH FLOW FOR MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUES OF COMPANIES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 QUANTUM PHOTONICS MARKET: RESEARCH LIMITATIONS

- FIGURE 10 SYSTEMS SEGMENT TO ACCOUNT FOR LARGER SHARE OF QUANTUM COMPUTING MARKET DURING FORECAST PERIOD

- FIGURE 11 QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023 VS. 2030

- FIGURE 12 BANKING & FINANCE SEGMENT TO DOMINATE QUANTUM PHOTONICS MARKET IN 2030

- FIGURE 13 ASIA PACIFIC QUANTUM PHOTONICS MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 RISING INVESTMENTS IN QUANTUM PHOTONICS TECHNOLOGY TO CREATE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 SYSTEMS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 QUANTUM COMMUNICATIONS TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 17 QUANTUM COMMUNICATIONS TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2023

- FIGURE 18 BANKING & FINANCE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 SOUTH KOREA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 QUANTUM PHOTONICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 ANALYSIS OF IMPACT OF DRIVERS ON QUANTUM PHOTONICS MARKET

- FIGURE 22 ANALYSIS OF IMPACT OF RESTRAINTS ON QUANTUM PHOTONICS MARKET

- FIGURE 23 ANALYSIS OF IMPACT OF OPPORTUNITIES ON QUANTUM PHOTONICS MARKET

- FIGURE 24 ANALYSIS OF IMPACT OF CHALLENGES ON QUANTUM PHOTONICS MARKET

- FIGURE 25 QUANTUM PHOTONICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 QUANTUM PHOTONICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 QUANTUM PHOTONICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE OF PHOTONIC QUANTUM COMPUTER OFFERED BY XANADU, BY APPLICATION

- FIGURE 29 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICANTS IN LAST 10 YEARS, 2013–2022

- FIGURE 30 NUMBER OF PATENTS GRANTED OVER LAST 10 YEARS, 2013–2022

- FIGURE 31 REVENUE SHIFT IN QUANTUM PHOTONICS MARKET

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 34 SYSTEMS SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 35 SERVICES SEGMENT: ASIA PACIFIC TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 QUANTUM COMMUNICATIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 QUANTUM COMMUNICATIONS SEGMENT: ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 38 BANKING & FINANCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA SEGMENT TO DOMINATE QUANTUM PHOTONICS MARKET FOR SPACE & DEFENSE DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO RECORD HIGHEST CAGR FOR BANKING & FINANCE DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC SEGMENT TO DOMINATE MARKET FOR HEALTHCARE & PHARMACEUTICAL DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC SEGMENT TO GROW AT HIGHEST CAGR IN QUANTUM PHOTONICS MARKET FOR TRANSPORTATION & LOGISTICS DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC SEGMENT TO DOMINATE MARKET FOR GOVERNMENT SECTOR DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA SEGMENT TO GROW AT HIGHEST CAGR FOR AGRICULTURE & ENVIRONMENT MARKET DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC SEGMENT TO LEAD MARKET FOR OTHERS SEGMENT DURING FORECAST PERIOD

- FIGURE 46 SOUTH KOREA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: SNAPSHOT OF QUANTUM PHOTONICS MARKET

- FIGURE 48 EUROPE: SNAPSHOT OF QUANTUM PHOTONICS MARKET

- FIGURE 49 ASIA PACIFIC: SNAPSHOT OF QUANTUM PHOTONICS MARKET

- FIGURE 50 REVENUE ANALYSIS OF KEY PLAYERS IN QUANTUM PHOTONICS MARKET, 2020–2022

- FIGURE 51 QUANTUM PHOTONICS MARKET: SHARE OF KEY PLAYERS, 2022

- FIGURE 52 QUANTUM PHOTONICS MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 53 QUANTUM PHOTONICS MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- FIGURE 54 TOSHIBA: COMPANY SNAPSHOT

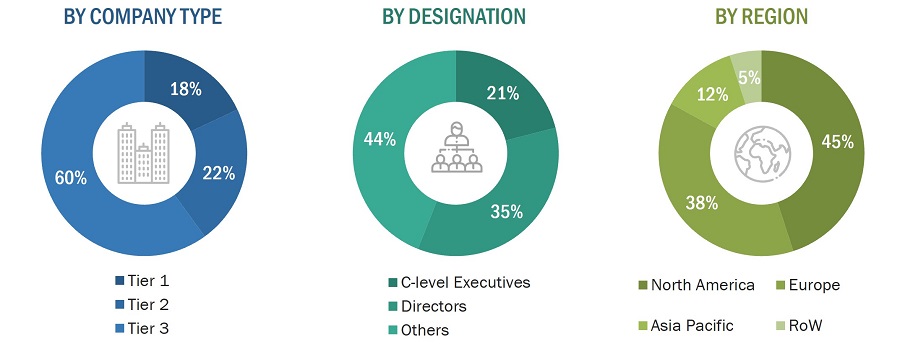

The study involved four major activities in estimating the size of the quantum photonics market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation were used to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources were referred to in the secondary research process for identifying and collecting information pertinent to this study. Secondary sources included annual reports, press releases, investor presentations, white papers, journals & certified publications, articles by recognized authors, directories, and databases. Secondary research was conducted to obtain key information about the quantum photonics supply chain, value chain, the total pool of the key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary sources used for this research study included government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall market size, which was further validated through primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from the major companies and organizations operating in the quantum photonics market.

After the complete market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at in this process. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by the players operating in the quantum photonics market.

Extensive primary research was conducted after gaining knowledge about the current scenario of the quantum photonics market through secondary research. Several primary interviews were conducted with the market experts from the demand- (quantum computer users) and supply (service and system providers) sides across four key regions: North America, Europe, Asia Pacific, and RoW. Approximately 20% and 80% of the primary interviews have been conducted with parties from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the quantum photonics market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying various applications that use or are expected to use quantum photonics.

- Analyzing historical and current data pertaining to the size of the quantum photonics market for each application

- Analyzing the average selling prices of quantum photonics based on different technologies

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases

- Identifying leading providers of quantum photonics products, studying their portfolios, and understanding features of their products and their underlying technologies, as well as the types of quantum photonics products offered

- Tracking ongoing and identifying upcoming developments in the market through investments, research and development activities, product launches, expansions, and partnerships, and forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the technologies used in quantum photonics, and products wherein they are deployed, and analyze the break-up of the scope of work carried out by key manufacturers of quantum photonics products providers

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders, such as CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall size of the quantum photonics market from the estimation process explained earlier, the market’s overall size has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, and forecast the quantum photonics market based on offering, application, and vertical in terms of value

- To forecast the size of the quantum photonics market for North America, Europe, Asia Pacific, and the Rest of the World (RoW) regions, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To describe the quantum photonics value chain

- To analyze opportunities in the market for the stakeholders and provide a detailed competitive landscape of the quantum photonics market

- To strategically profile the key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as product launches, partnerships, and collaborations, in the quantum photonics market

Market Definition

Quantum photonics is a field of study that focuses on the use of photons, which are fundamental particles of light, to manipulate and control quantum information. It involves the generation, manipulation, and detection of individual photons in order to develop new technologies for communication, computing, and sensing & metrology that are based on quantum mechanics. In quantum photonics, researchers use various techniques such as single-photon sources, photonic circuits, and detectors to create and manipulate quantum states of light for quantum information processing. This field is at the forefront of research in quantum technologies and has the potential to revolutionize various industries, including telecommunications, cryptography, and computing.

Stakeholders

- Research organizations and universities

- Original equipment manufacturers (OEMs)

- Technology standard organizations, forums, alliances, and associations

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- End users

Research Objectives

- To define, describe, and forecast the quantum photonics market size, offering, application, vertical, and region, in terms of value

- To forecast the market size, in terms of value, for various segments with respect to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify the drivers, restraints, opportunities, and challenges impacting the growth of the market and submarkets

- To analyze the quantum photonics supply chain and identify opportunities for the supply chain participants

- To provide key technology trends and patent analysis related to the quantum photonics market

- To provide information regarding trade data related to the quantum photonics market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the quantum photonics ecosystem

- To strategically profile the key players in the quantum photonics market and comprehensively analyze their market shares and core competencies in each segment

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as product launches, alliances and partnerships, joint ventures, and mergers and acquisitions in the quantum photonics market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Quantum Photonics Market