The study involves four major activities that estimate the size of the isostatic pressing market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the isostatic pressing market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research. The relevant data is collected from various secondary sources, it is analyzed to extract insights and information relevant to the market research objectives. This analysis has involved summarizing the data, identifying trends, and drawing conclusions based on the available information.

Primary Research

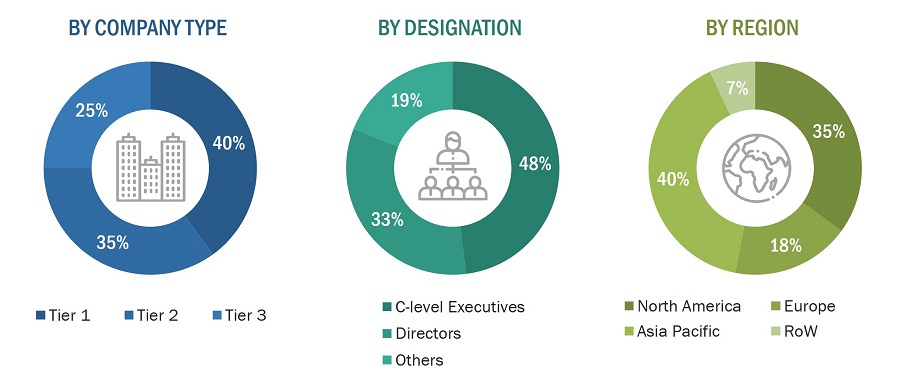

In the primary research process, numerous sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from isostatic pressing providers, (such as KPBE STEEL, LTD., Nikkiso, Co., Ltd., EPSI, Aegis Technology) research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the isostatic pressing market and other dependent submarkets listed in this report.

-

The key players in the industry and markets were identified through extensive secondary research.

-

Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top- Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

Isostatic pressing is a powder metallurgy-based process in which equal pressure is applied on powdered materials, such as metals, alloys, or ceramics, in all directions to achieve maximum uniformity of density and microstructure without the geometric limitations of uniaxial pressing. This process is categorized into two types: hot isostatic pressing (HIP) and cold isostatic pressing (CIP). The HIP processes materials using the synergistic effects of temperature and pressure. It is used as a part of the powder metrology process for pressure-assisted brazing and fabrication of metal composites. Manufacturing companies extensively install HIP systems to enhance their working efficiency. Meanwhile, the CIP is a powder-forming technology that applies uniform pressure to compress powdered materials into various shapes, mainly at room temperature. This technology is widely used in ceramic and powder metallurgy as an effective forming method. In the CIP system, a mold is placed into a chamber filled with a working fluid, usually water, with a corrosion inhibitor pressurized using an external pump.

Stakeholders

-

End users

-

Government bodies, venture capitalists, and private equity firms

-

Isostatic pressing manufacturers

-

Isostatic pressing distributors

-

Isostatic pressing industry associations

-

Professional service/solution providers

-

Research institutions and organizations

-

Standards organizations and regulatory authorities

-

System integrators

-

Technology consultants

The main objectives of this study are as follows:

-

To describe and forecast the isostatic pressing market in terms of value based on offering, type, capacity, process type, end-user industry, and region

-

To define and forecast the isostatic pressing market, by Type, in terms of volume

-

To forecast the market size for various segments with regard to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries, in terms of value

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

-

To provide a detailed overview of the value chain of the isostatic pressing ecosystem

-

To provide a detailed analysis of the impact of the recession on the isostatic pressing market, its segments, and market players

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze the opportunities for stakeholders and details of the competitive landscape of the market

-

To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2

-

To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

-

Analysis for additional countries (up to five)

Company Information:

-

Detailed analysis and profiling of different market players (up to five)

Oscar

Feb, 2020

Information on the isostatic Pressing Market in Mexico and LATAM. Also, hot and cold isostatic pressing in Mexico and LATAM..