Quantum Sensors Market Size, Share and Industry Growth Analysis Report by Product Type (Atomic Clocks, Magnetic Sensors, PAR Quantum Sensors, Gravimeters & Accelerometers), Application (Aerospace & Defense, Oil & Gas, Agriculture, Automotive, Mining, Healthcare) Global Growth Driver and Industry Forecast to 2027

Updated on : December 02, 2024

The Quantum Sensors Market is experiencing robust growth, driven by increasing demand for highly sensitive measurement technologies across various industries, including healthcare, telecommunications, and environmental monitoring. These sensors leverage the principles of quantum mechanics to provide unparalleled precision in detecting physical quantities such as magnetic fields, temperature, and pressure. Key trends influencing the market include advancements in quantum technology research, the miniaturization of sensor devices, and the rising adoption of quantum sensors in applications like navigation and geophysical exploration. As industries seek innovative solutions to enhance operational efficiency and accuracy, the future of the Quantum Sensors Market looks promising, with ongoing developments expected to expand their capabilities and applications.

Quantum Sensors Market Size & Growth

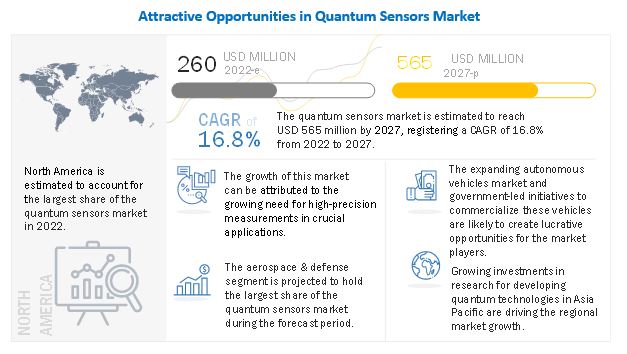

The global quantum sensors Market size in terms of revenue was estimated to be worth USD 260 million in 2022 and is poised to reach USD 565 million by 2027, growing at a CAGR of 16.8% from 2022 to 2027. The new research study consists of an industry trend analysis of the market.

Quantum sensors are witnessing rapid developments and are being used in different applications. In the future, there is a probability of quantum sensors taking over other alternative technologies in the fields of bioimaging, spectroscopy, communication, navigation, environmental monitoring, infrastructure monitoring, and geographic surveying.Quantum sensors can measure minute environmental changes that conventional sensors cannot detect. This advantage over conventional sensors is expected to boost the demand for quantum sensors in the coming years. In the last few years, the attention toward quantum technologies has been rising rapidly.

To know about the assumptions considered for the study, Request for Free Sample Report

Quantum Sensors Market Segment Overview

The atomic clocks segment of quantum sensors market is projected to grow at a significant CAGR during the forecast period.

A simple clock-a mechanical clock or quartz clock-is an arrangement that measures the repetition of an event. Likewise, an atomic clock is used to measure the repetition of an event, but with the help of atoms as they count the electronic transition from one state to the other. The atomic clock provides accurate timing using the quantum nature of atomic particles. Technological innovations in atomic clocks have reduced their size and improved accuracy. Thus, they are being used in various applications, such as communication tools, space navigation, and geological measurements.

The market for oil & gas applications is expected to grow at a significant CAGR during the forecast period

The sensors used in the oil & gas industry must be reliable and accurate as they deal with fire-catching substances. The industry faces challenges as these materials’ exploration, production and transportation are hazardous and performed in challenging situations. Detecting oil mines under the sea or ground is a tedious task. The quantum sensors can locate exploration mines accurately and precisely without damaging the environment. They are extremely sensitive to vibrations, making them a perfect instrument to precisely detect gas leaks in pipelines. It is estimated that the use of quantum sensors in oil and gas applications will rise during the forecast period and, ultimately, be used in other related applications.

To know about the assumptions considered for the study, download the pdf brochure

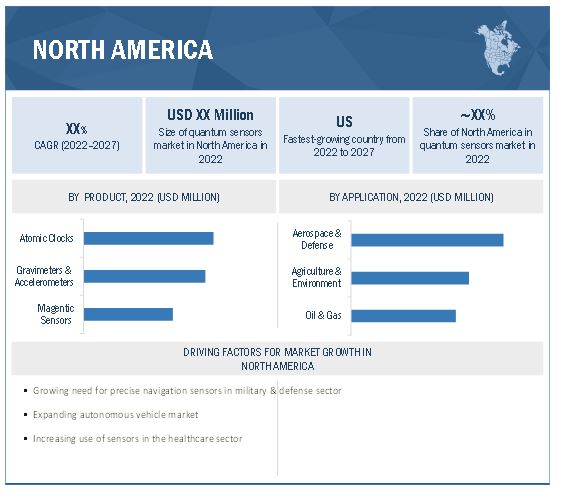

The market in North America projected to grow at the highest CAGR from 2022 to 2027.

The North American quantum sensors industry are expected to exhibit high growth rates in the coming years attributed to their rising applications in the aerospace & defense sector and autonomous vehicles.

The US is the most profound market for quantum sensors in North America. Most key companies are based in the US, making the country a prominent market for quantum sensors. The US automotive and military & defense sectors have already started using quantum sensors.

The US ranks first among the countries with the highest number of autonomous vehicles deployed on the road. The market for autonomous vehicles in the US is vast and growing rapidly, with several key players already testing their vehicles. Quantum sensors enable the proper functioning of autonomous vehicles. They enable the safety and brilliant performance of the autonomous vehicle. The US government department National Highway Traffic Safety Administration (NHTSA) also rolled out the AV test initiative in June 2020 to boost the autonomous vehicle market. This initiative lets the end users test autonomous vehicles, which raises awareness among the people. Thus, it is predicted that the autonomous vehicle market in the US will rapidly grow in the coming years, parallelly boosting the quantum sensors market

Top Quantum Sensors Companies - Key Market Players

-

Campbell Scientific, Inc. (US),

-

ID Quantique SA (Switzerland),

-

LI-COR, Inc. (US),

-

M Squared Ltd. (UK), and

-

Muquans SAS (France)

Quantum Sensors Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 260 Million |

| Projected Market Size | USD 565 Million |

| Growth Rate | 16.8% CAGR |

|

Market Size Available for Years |

2019–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Market Leaders |

|

| Key Market Driver | Increasing investments in development of quantum technologies |

| Key Market Opportunity |

Growing demand for quantum sensors in medical sector

|

| Largest Growing Region | North America |

|

Highest CAGR Segment

|

Atomic clocks segment |

| Largest Application Market Share | Oil & Gas Applications |

Quantum Sensors Market Dynamics

DRIVERS : Increasing investments in development of quantum technologies

Governments, industry associations, research institutions, and market players globally have increased their investments in quantum sensing research and development activities.

Quantum technologies can be categorized into three parts: quantum computing, quantum sensing, and quantum communications. The year-on-year investment growth in the development of quantum technologies has been rising at a fast pace globally. The table below depicts the total investments made by respective countries in quantum technologies over the past few years.

RESTRAINTS: Availability of low-cost alternatives

The manufacturing of quantum sensors includes complicated techniques and advanced materials, making their research and manufacturing processes expensive.

Also, there are many alternative products available for potential applications of quantum sensors that are less expensive. The market for such alternative technologies is well established globally. For instance, scientists and researchers worldwide already use conventional gravimeters and ground penetrating radars for gravity and underground measurements. In the field of quantum technology, companies have developed quantum gravimeters that can precisely measure gravity. However, conventional gravimeters are more affordable compared with quantum gravimeters. Also, traditional cost-effective magnetic sensors are being widely used in manufacturing, automotive, aerospace, healthcare, and other applications. Thus, the availability of affordable and competitive alternatives for quantum sensors, especially for non-critical applications, may restrain the growth of the quantum sensors market.

OPPORTUNITIES : Growing demand for quantum sensors in medical sector

Several organizations and research institutes have recently undertaken research and development initiatives to develop quantum sensors for medical and healthcare applications.

These research activities have proven that quantum-enabled devices could enhance the precision of medical testing and imaging processes. The highly accurate data generated by quantum devices can further improve the detection process of chronic diseases. For instance, researchers from the University of Stuttgart have stated that quantum sensors can detect cancer at an early stage. Moreover, they can transform robotic operations and prosthetics by measuring and monitoring the smallest variations. Quantum sensors also can outperform traditional detection processes such as Magnetic Resonance Imaging (MRI). Thus, the increasing applications of quantum sensors in the medical sector are expected to create lucrative opportunities for market players.

CHALLENGES: Technical challenges associated with the use of quantum sensors

Quantum sensors are sensitive in nature because they have to make measurements at quantum and atomic states. The high sensitivity makes them a preferred choice in critical applications across the aerospace & defense industry.

However, this makes them difficult to use in normal industrial applications. Hence, when it comes to other potential applications of these sensors outside of laboratory settings or controlled environments, they could face some technical challenges that have been listed below.

- Hardware Limitations: One of the key challenges for quantum sensor deployment is the lack of hardware designed for sensing outside the controlled laboratory setting where temperatures and conditions remain relatively stable. Limited availability of suitable hardware for real-world applications limits the deployment of quantum sensors in many applications.

- Handling Unwanted Noises: Quantum sensors can detect very small changes as they are highly sensitive to their surroundings. Hence, the quantum sensors are prone to pick up unwanted noises from their background.

Quantum Sensing Market

The quantum sensing market size is poised for significant growth, driven by advancements in quantum technologies and their increasing applications across various industries. Quantum sensors leverage the principles of quantum mechanics to provide unprecedented accuracy and sensitivity in measurements, making them highly valuable in fields like defense, healthcare, automotive, telecommunications, and environmental monitoring. These sensors can detect extremely subtle changes in physical quantities such as magnetic fields, time, and temperature, which are crucial for applications like navigation, medical diagnostics, and scientific research. As industries seek more precise measurement tools, the quantum sensing market size is expected to expand rapidly, with forecasts suggesting substantial growth in the coming years. The rising demand for quantum-based technologies and the growing investment in research and development are key drivers contributing to this market's expansion.

Quantum Sensors Market Categorization

This research report categorizes the quantum sensors market by platform, product type, application, Trends and region.

Quantum Sensors Market , By Platform:

- Neutral Atoms

- Trapped Ions

- Nuclear Magnetic Resonance

- Optomechanics

- Photons

- Defects In Diamonds

- Superconductors

Quantum Sensors Market Size, By Product Type:

- Atomic Clocks

- Magnetic Sensors

- Photosynthetically active radiation (PAR) Quantum Sensors

- Gravimeters and Accelerometers

Quantum Sensors Market Size , By Application:

- Aerospace & Defense

- Oil & Gas

- Agriculture & Environment

- Construction & Mining

- Automotive & Transportation

- Healthcare

- Others

Quantum Sensors Industry, By Region Analysis

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

-

Rest of the World

- Middle East & Africa

- South America

Recent Developments in Quantum Sensor Industry

- In July 2022, Qnami AG, installed its quantum sensor ProteusQ in the lab of the Center for Nanostructured Media (CNM) of Queen’s University Belfast (UK).

- In January 2022, ID Quantique SA announced the release of the new time controller series. It is a high-performance, cost-effective device used in advanced single-photon applications.

- In June 2021, Apogee Instruments, Inc. announced that the company would replace all the old models of the original quantum sensor series with the “X” models as they will be included with a different internal detector.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the quantum sensors market during 2022-2027?

The global quantum sensors market is expected to record a CAGR of 16.8% from 2022–2027.

What are the driving factors for the quantum sensors market?

Growing need for high-precision instruments in crucial applications and increasing investments in development of quantum technologies are key driving factors for this quantum sensors market.

Which are the significant players operating in the quantum sensors market?

Campbell Scientific, Inc. (US), ID Quantique SA (Switzerland), LI-COR, Inc. (US), M Squared Ltd. (UK) and Muquans SAS (France) are among a few key players in the quantum sensors market.

Which region will grow at a fast rate in the future?

The quantum sensors market in North American region is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 QUANTUM SENSORS MARKET: SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 QUANTUM SENSORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 MARKET: RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for deriving market size by bottom-up analysis (demand side)

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for deriving market size by using top-down analysis (supply side)

FIGURE 5 MARKET: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET USING SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 QUANTUM SENSORS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 QUANTUM SENSORS MARKET, 2019–2027 (USD MILLION)

FIGURE 9 ATOMIC CLOCKS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 AEROSPACE & DEFENSE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET BETWEEN 2022 AND 2027

FIGURE 11 NORTH AMERICA TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN QUANTUM SENSORS MARKET

FIGURE 12 EXPANDING AUTONOMOUS VEHICLES MARKET

4.2 MARKET, BY PRODUCT TYPE

FIGURE 13 MAGNETIC SENSORS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY APPLICATION

FIGURE 14 AEROSPACE & DEFENSE SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2027

4.4 NORTH AMERICAN MARKET, BY COUNTRY AND APPLICATION

FIGURE 15 US AND AEROSPACE & DEFENSE SEGMENT TO HOLD LARGEST SHARES OF NORTH AMERICAN MARKET IN 2027

4.5 QUANTUM SENSORS MARKET, BY COUNTRY

FIGURE 16 US TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 QUANTUM SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing need for high-precision measurements in various crucial applications

TABLE 2 CONVENTIONAL SENSORS VS. QUANTUM SENSORS

5.2.1.2 Increasing investments in development of quantum technologies

TABLE 3 INVESTMENTS IN DEVELOPMENT OF QUANTUM TECHNOLOGIES, BY COUNTRY

5.2.1.3 Growing use of quantum sensors in space industry

FIGURE 18 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Availability of low-cost alternatives

5.2.2.2 High deployment and maintenance costs

FIGURE 19 MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for quantum sensors in medical sector

5.2.3.2 Emerging autonomous vehicle market

5.2.3.3 Rising use of quantum sensors for accurate navigation in oceanography and marine applications

FIGURE 20 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Technical challenges associated with use of quantum sensors

FIGURE 21 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 23 MARKET: ECOSYSTEM ANALYSIS

TABLE 4 MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 5 INDICATIVE PRICE OF PAR QUANTUM SENSORS (USD)

5.5.1 AVERAGE SELLING PRICE OF PAR QUANTUM SENSORS OFFERED BY THREE KEY PLAYERS

FIGURE 24 AVERAGE SELLING PRICE OF PAR QUANTUM SENSORS OFFERED BY THREE KEY PLAYERS

TABLE 6 AVERAGE SELLING PRICE OF PAR QUANTUM SENSORS OFFERED BY THREE KEY PLAYERS (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS OPERATING IN MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 QUANTUM COMPUTING

5.7.2 QUANTUM SIMULATION

5.7.3 QUANTUM COMMUNICATION

5.7.4 AUTOMATED MACHINE LEARNING

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 QUANTUM SENSORS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 9 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.10 CASE STUDY ANALYSIS

TABLE 10 APOGEE INSTRUMENTS, INC.’S PAR SENSORS INCREASE CANNABIS YIELD

TABLE 11 US NATIONAL ECOLOGICAL OBSERVATORY NETWORK USES KIPP & ZONEN’S PAR SENSORS TO ACQUIRE ACCURATE DATA

TABLE 12 ADVANCE NAVIGATION PARTNERED WITH Q-CTRL PTY LTD. TO DEVELOP QUANTUM-ENABLED NAVIGATION SYSTEM

5.11 TRADE ANALYSIS

FIGURE 28 IMPORT SCENARIO OF PARTS AND ACCESSORIES FOR INSTRUMENTS AND APPARATUS, BY KEY COUNTRY, 2017−2021 (USD MILLION)

FIGURE 29 EXPORT DATA FOR PARTS AND ACCESSORIES FOR INSTRUMENTS AND APPARATUS, BY KEY COUNTRY, 2017−2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 13 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 31 NUMBER OF PATENTS GRANTED PER YEAR, 2012–2021

TABLE 14 LIST OF FEW PATENTS RELATED TO MARKET, 2020–2021

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 15 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.1 STANDARDS

TABLE 20 STANDARDS FOR MARKET

6 QUANTUM SENSORS MARKET, BY PLATFORM (Page No. - 71)

6.1 INTRODUCTION

FIGURE 32 MARKET, BY PLATFORM

6.2 NEUTRAL ATOMS

6.3 TRAPPED IONS

6.4 NUCLEAR MAGNETIC RESONANCE

6.5 OPTOMECHANICS

6.6 PHOTONS

6.7 DEFECTS IN DIAMONDS

6.8 SUPERCONDUCTORS

7 QUANTUM SENSORS MARKET, BY PRODUCT TYPE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 33 QUANTUM SENSORS MARKET, BY PRODUCT TYPE

FIGURE 34 MAGNETIC SENSORS SEGMENT TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 21 QUANTUM SENSORS MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 22 MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

7.2 ATOMIC CLOCKS

7.2.1 GROWING USE OF ATOMIC CLOCKS IN FINANCIAL SECTOR

TABLE 23 ATOMIC CLOCKS: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 24 ATOMIC CLOCKS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 25 ATOMIC CLOCKS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 26 ATOMIC CLOCKS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 MAGNETIC SENSORS

7.3.1 RISING DEMAND FOR MAGNETIC SENSORS IN HEALTHCARE SECTOR

TABLE 27 MAGNETIC SENSORS: QUANTUM SENSORS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 28 MAGNETIC SENSORS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 29 MAGNETIC SENSORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 30 MAGNETIC SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 PAR QUANTUM SENSORS

7.4.1 INCREASING USE OF PAR QUANTUM SENSORS IN AGRICULTURE INDUSTRY

TABLE 31 PAR QUANTUM SENSORS: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 32 PAR QUANTUM SENSORS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 33 PAR QUANTUM SENSORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 34 PAR QUANTUM SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 GRAVIMETERS AND ACCELEROMETERS

7.5.1 HIGH ADOPTION OF GRAVIMETERS IN OIL & GAS INDUSTRY

TABLE 35 QUANTUM SENSORS MARKET: TECHNOLOGY COMPARISON

TABLE 36 GRAVIMETERS AND ACCELEROMETERS: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 37 GRAVIMETERS AND ACCELEROMETERS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 38 GRAVIMETERS AND ACCELEROMETERS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 39 GRAVIMETERS AND ACCELEROMETERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 QUANTUM SENSORS MARKET, BY APPLICATION (Page No. - 84)

8.1 INTRODUCTION

FIGURE 35 MARKET, BY APPLICATION

TABLE 40 MARKET: USE CASES BASED ON APPLICATION

FIGURE 36 AEROSPACE & DEFENSE SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2027

TABLE 41 MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 42 QUANTUM SENSORS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 AEROSPACE & DEFENSE

8.2.1 GROWING NEED FOR NON-GPS-BASED TECHNOLOGIES

TABLE 43 AEROSPACE & DEFENSE: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 44 AEROSPACE & DEFENSE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 45 AEROSPACE & DEFENSE: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 46 AEROSPACE & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 OIL & GAS

8.3.1 RISING DEMAND FOR ACCURATE AND PRECISE DATA

TABLE 47 OIL & GAS: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 48 OIL & GAS: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 49 OIL & GAS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 50 OIL & GAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 AGRICULTURE & ENVIRONMENT

8.4.1 GROWING NEED TO MEASURE ACTIVE RADIATION

TABLE 51 AGRICULTURE & ENVIRONMENT: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 52 AGRICULTURE & ENVIRONMENT: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 53 AGRICULTURE & ENVIRONMENT: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 54 AGRICULTURE & ENVIRONMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 CONSTRUCTION & MINING

8.5.1 GROWING DEMAND FOR ACCURATE AND SAFE UNDERGROUND SURVEYING SYSTEMS

TABLE 55 CONSTRUCTION & MINING: QUANTUM SENSORS MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 56 CONSTRUCTION & MINING: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 57 CONSTRUCTION & MINING: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 58 CONSTRUCTION & MINING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 AUTOMOTIVE & TRANSPORTATION

8.6.1 HIGH DEMAND FOR RELIABLE AND SAFE NAVIGATION SYSTEMS

TABLE 59 AUTOMOTIVE & TRANSPORTATION: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 60 AUTOMOTIVE & TRANSPORTATION: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 61 AUTOMOTIVE & TRANSPORTATION: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 62 AUTOMOTIVE & TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 HEALTHCARE

8.7.1 RISING DEMAND FOR ACCURATE MEASUREMENTS

TABLE 63 HEALTHCARE: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 64 HEALTHCARE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 65 HEALTHCARE: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 66 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 OTHERS

TABLE 67 OTHERS: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 68 OTHERS: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 69 OTHERS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 70 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 QUANTUM SENSORS MARKET, BY REGION (Page No. - 99)

9.1 INTRODUCTION

FIGURE 37 QUANTUM SENSORS INDUATRY , BY REGION

FIGURE 38 US TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET FROM 2022 TO 2027

TABLE 71 MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 72 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: SNAPSHOT OF MARKET

FIGURE 40 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN MARKET DURING FORECAST PERIOD

TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Rising applications of quantum sensors in military & defense sector

9.2.2 CANADA

9.2.2.1 Increasing government-led research and development (R&D) initiatives

9.2.3 MEXICO

9.2.3.1 Growing awareness regarding benefits of quantum technology

9.3 EUROPE

FIGURE 41 EUROPE: SNAPSHOT OF MARKET

FIGURE 42 GERMANY TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN MARKET DURING FORECAST PERIOD

TABLE 79 EUROPE: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 84 EUROPE: QUANTUM SENSORS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 High research and development (R&D) investments

9.3.2 GERMANY

9.3.2.1 Presence of key automobile manufacturers

9.3.3 FRANCE

9.3.3.1 Rising government-led initiatives to boost quantum sensor industry

9.3.4 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: SNAPSHOT OF QUANTUM SENSORS MARKET

FIGURE 44 CHINA TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC MARKET DURING FORECAST PERIOD

TABLE 85 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Expanding automotive industry

9.4.2 JAPAN

9.4.2.1 Rising number of research projects related to quantum technologies

9.4.3 INDIA

9.4.3.1 High focus on deployment of quantum sensors

9.4.4 SOUTH KOREA

9.4.4.1 Rising focus on autonomous vehicles

9.4.5 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD (ROW)

FIGURE 45 MIDDLE EAST & AFRICA TO HOLD LARGER SHARE OF ROW MARKET DURING FORECAST PERIOD

TABLE 91 ROW: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 92 ROW: QUANTUM SENSORS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 93 ROW: MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 94 ROW: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 95 ROW: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 96 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Rising government-led initiatives and investments related to quantum sensing technologies

9.5.2 SOUTH AMERICA

9.5.2.1 Growing agriculture and automotive industries

10 COMPETITIVE LANDSCAPE (Page No. - 120)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 97 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MARKET

10.3 MARKET SHARE ANALYSIS, 2021

TABLE 98 QUANTUM SENSORS MARKET: MARKET SHARE ANALYSIS (2021)

10.4 COMPANY EVALUATION QUADRANT, 2021

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 46 MARKET: COMPANY EVALUATION QUADRANT, 2021

10.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 47 MARKET: SME EVALUATION QUADRANT, 2021

10.6 MARKET: COMPANY FOOTPRINT

TABLE 99 COMPANY FOOTPRINT

TABLE 100 APPLICATION: COMPANY FOOTPRINT

TABLE 101 REGION: COMPANY FOOTPRINT

10.7 COMPETITIVE BENCHMARKING

TABLE 102 QUANTUM SENSORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 103 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.8 COMPETITIVE SCENARIOS AND TRENDS

10.8.1 QUANTUM SENSORS MARKET: PRODUCT LAUNCHES

10.8.2 MARKET: DEALS

11 COMPANY PROFILES (Page No. - 133)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1.1 APOGEE INSTRUMENTS, INC.

TABLE 104 APOGEE INSTRUMENTS, INC.: COMPANY OVERVIEW

TABLE 105 APOGEE INSTRUMENTS, INC.: PRODUCT OFFERINGS

TABLE 106 APOGEE INSTRUMENTS, INC.: PRODUCT LAUNCHES

11.1.2 ID QUANTIQUE SA

TABLE 107 ID QUANTIQUE SA: COMPANY OVERVIEW

TABLE 108 ID QUANTIQUE SA: PRODUCT OFFERINGS

TABLE 109 ID QUANTIQUE SA: PRODUCT LAUNCHES

11.1.3 LI-COR, INC.

TABLE 110 LI-COR, INC.: COMPANY OVERVIEW

TABLE 111 LI-COR, INC.: PRODUCT OFFERINGS

11.1.4 M SQUARED LTD.

TABLE 112 M SQUARED LTD.: COMPANY OVERVIEW

TABLE 113 M SQUARED LTD.: PRODUCT OFFERINGS

TABLE 114 M SQUARED LTD.: PRODUCT LAUNCHES

TABLE 115 M SQUARED LTD.: OTHERS

11.1.5 MUQUANS SAS

TABLE 116 MUQUANS SAS: COMPANY OVERVIEW

TABLE 117 MUQUANS SAS: PRODUCT OFFERINGS

TABLE 118 MUQUANS SAS: PRODUCT LAUNCHES

TABLE 119 MUQUANS SAS: DEALS

11.1.6 AOSENSE, INC.

TABLE 120 AOSENSE, INC.: COMPANY OVERVIEW

TABLE 121 AOSENSE, INC.: PRODUCT OFFERINGS

TABLE 122 AOSENSE, INC.: PRODUCT LAUNCHES

11.1.7 CAMPBELL SCIENTIFIC, INC.

TABLE 123 CAMPBELL SCIENTIFIC, INC.: COMPANY OVERVIEW

TABLE 124 CAMPBELL SCIENTIFIC, INC.: PRODUCT OFFERINGS

TABLE 125 CAMPBELL SCIENTIFIC, INC.: OTHERS

11.1.8 IMPEDANS LTD.

TABLE 126 IMPEDANS LTD.: COMPANY OVERVIEW

TABLE 127 IMPEDANS LTD.: PRODUCT OFFERINGS

11.1.9 KIPP & ZONEN

TABLE 128 KIPP & ZONEN: COMPANY OVERVIEW

TABLE 129 KIPP & ZONEN: PRODUCT OFFERINGS

11.1.10 SEA-BIRD SCIENTIFIC

TABLE 130 SEA-BIRD SCIENTIFIC: COMPANY OVERVIEW

TABLE 131 SEA-BIRD SCIENTIFIC: PRODUCT OFFERINGS

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 ATOMIONICS PTE LTD.

11.2.2 GEM SYSTEMS

11.2.3 NOMAD ATOMICS PTY LTD.

11.2.4 Q-CTRL PTY LTD.

11.2.5 QNAMI AG

11.2.6 SKYE INSTRUMENTS LTD.

11.2.7 SOLAR LIGHT COMPANY, LLC

11.2.8 SPECTRUM TECHNOLOGIES, INC.

11.2.9 VECTOR ATOMIC

11.2.10 Q.ANT GMBH

12 ADJACENT AND RELATED MARKETS (Page No. - 157)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 SMART SENSORS MARKET, BY TECHNOLOGY

12.3.1 INTRODUCTION

TABLE 132 SMART SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD BILLION)

TABLE 133 SMART SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD BILLION)

12.3.2 MAJOR PACKAGING TYPES CONSIDERED IN SMART SENSORS MARKET

TABLE 134 TECHNICAL FEATURES OF SYSTEM-IN-PACKAGE (SIP) AND SYSTEM-ON-CHIP (SOC)

12.3.3 MEMS TECHNOLOGY

12.3.3.1 Increasing adoption of MEMS technology-based smart sensors in various process industries to boost market growth

TABLE 135 SMART SENSORS MARKET FOR MEMS TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 136 SMART SENSORS MARKET FOR MEMS TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

12.3.4 CMOS TECHNOLOGY

12.3.4.1 Characteristics such as low static power consumption and high noise immunity driving demand for CMOS technology

TABLE 137 SMART SENSORS MARKET FOR CMOS TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 138 SMART SENSORS MARKET FOR CMOS TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

13 APPENDIX (Page No. - 165)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

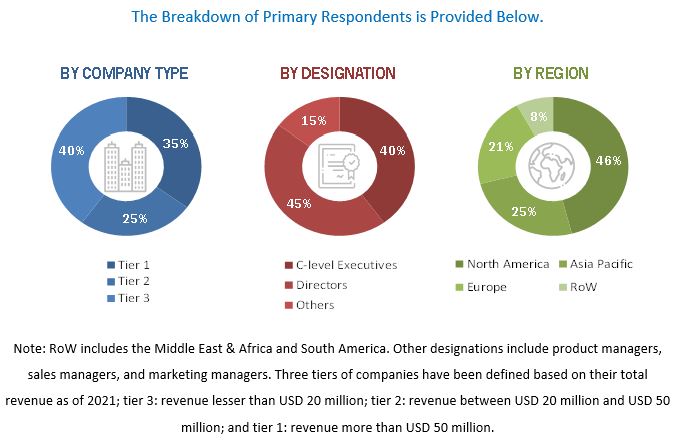

The study involved four major activities in estimating the current size of the quantum sensors market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the quantum sensors market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred quantum sensors providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from quantum sensors providers, such as Campbell Scientific, Inc. (US), ID Quantique SA (Switzerland), LI-COR, Inc. (US), M Squared Ltd. (UK), and Muquans SAS (France); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the quantum sensors market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the quantum sensors market based on offering and type

- To define, describe, and forecast the quantum sensors market based on different applications

- To describe and forecast the size of the quantum sensors market based on four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with their respective countries

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the quantum sensors market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Quantum Sensors Market