Release Coating Market Material(Silicone, Non-Silicone), Formulation(Solvent Based, Solventless, Emulsions), Release Liner, Application (Labels, Tapes, Hygiene, Industrial, Medical, Food Bakery) and Region - Global Forecast to 2025

Updated on : August 25, 2025

Release Coating Market

The release coating market is projected to reach USD 225 million by 2025, at a CAGR of 7.5%. The rising awareness of health, increase consumer spending, growth of e-commerce, and increase of women workforce and the key factors driving sectors such as packaging, hygiene, consumer products, cosmetics, households, retails, and pharmaceuticals.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global release coating market

The impact of COVID-19 has been severe, with the release coating market estimated to decline by 15.4% in 2020 in terms of value. All the end-user applications in the release coating market except for hygiene and medical is estimated to register negative growth due to factors such as lockdown, supply chain disruption, and decline in consumer spending affecting end-use industries such as packaging, electrical & electronics, logistics, hygiene & personal care, consumer goods, and retail. The panic buying of hygiene products during the start of the CVID-19 pandemic and the increased demand for medical attention pertaining to the COVID-19 pandemic is expected to keep the growth of hygiene and medical application positive.

Non-silicone release coating: the fastest-growing type of release coating in the material segment

The increasing environmental regulations are restraining the growth of silicone release coating in North America and the European region, while lenient regulatory standards in the APAC drives the silicone release coating to grow faster than other regions. The strict regulatory standards are driving the non-silicone release coating to register the fastest growth in the material segment during the forecast period.

Hygiene application is the fastest growing in the release coating market

Increasing penetration of hygiene products such as baby diapers, sanitary napkins, and adult incontinence products in the developing countries and increased consumption of premium hygiene products in the developed countries is expected to drive the global release coating market during the forecast period. The growing awareness, increasing consumer spending, and growth of e-commerce are the factors that are driving the hygiene application in the release coating market.

Release Coating Market Dynamics

Driver: Rising global population, increase in per capita income, healthcare awareness is expanding the end-use markets

Better healthcare facilities are leading toward an increase in life expectancy. More than 75% of costs in healthcare facilities is from people suffering from chronic diseases, which in turn helps the growth of the medical device and equipment market. Various medical applications benefit from release coating, ranging from analytical and surgical instruments to sterilization equipment and packaging of pharmaceutical products. The release coating is particularly useful with implantable instruments such as orthopedic and respiratory devices due to their low friction qualities and ease of insertion. In the future, the growing demand for medical devices and equipment, and tools will drive the release coating market as the demand for healthcare facilities rise.

The aging population worldwide is driving the use of disposable medical devices and transdermal patches for therapeutics and pharmaceuticals. The rise in per-capita income in developing countries increases the expenditure on healthcare facilities. As the income level increases, people tend to choose better healthcare facilities. The growth in the medical industry will lead to the growth of the release coating market

Restraints: Differences in release control may result in failure of the release coating

Control release polymers (CRPs) are widely used in release coating for the tapes and label industries to increase the release force needed to remove a label or transfer the adhesive from a release liner during delamination. These tight-release liners are used with removable labels where premature delamination is a concern and with transfer adhesives where there must be a release differential between the two liners of the laminate construction. Tight release control depends upon various factors such as adhesive formulations, adhesive thickness, laminate storage conditions, liner handling, and incomplete cure. Any of these factors could contribute to a significant difference in release control. In the absence of suitable release control as per different substrates, release coating could become soft and break easily, thus affecting the very purpose of non-sticking. However, many big manufacturers are coming up with advanced technologies that can help in delivering good controlled release across a wider range of substrates while supporting increasing line speeds and volumes, maintaining superior quality, and thus reducing systems costs.

Opportunity: Opportunities for Polydimethylsiloxane (PDMS) based release coating

Among different materials, silicones are preferred as they can be applied and cured into a PDMS network on various backing substrates, thereby limiting migration problems. They also offer substantially lower release forces than other materials.

The silicone polymer may be selected on the basis of specific release capabilities and other desired properties depending upon the end applications. The preferred silicone polymers are the PDMS polymers, although the organomodified polymers may be used. Coatings made from PDMS offer excellent anchorage to many different substrates and are compatible with a wide variety of adhesives. Furthermore, PDMS based release coating can be cured quickly, and they are easy to adjust. It enhances the processing, release performance, and cost-effectiveness of the substrate on which coating is applied.

Other materials such as fluorocarbons, carbamates, polyacrylates, and polyolefins can also be used by the manufacturers while producing release coating, as they provide a cure temperature of 210°F and efficient performance to various applications such as tapes, labels, and packaging. However, due to the inexpensive nature and other superior properties of PDMS based release coating, many big manufacturers are focusing on PDMS based release coating

Challenges: The development of cost-effective products under stringent environmental regulations is a challenge

Increasingly stringent environmental regulations governing the use of release coating have compelled manufacturers to develop products with low VOCs, high solid content, and less harmful biocides. REACH, Green Seal, SED, and BPD are stringent environmental regulations to cut down the usage of VOCs and HAPs. This has resulted in technical difficulties in the use of solvent-borne coatings. These regulations also make the industries shift to eco-friendly coatings. However, the challenge exists in the development of new products that conform to these strict regulations and also make it efficient for the industries economically.

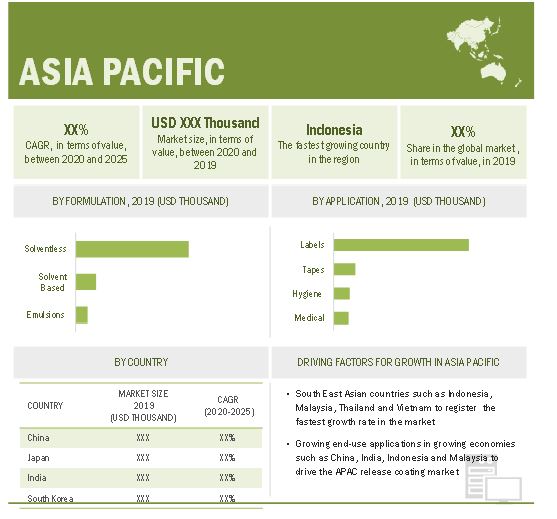

APAC estimated to be the fastest-growing market for release coating

Asia-Pacific is estimated to be the fastest-growing market for release coating. This high growth is associated with the increasing penetration of hygiene products in the APAC countries. China is projected to be the largest market for release coating in APAC, followed by Japan. India, South Korea, Indonesia, Taiwan, and Malaysia are other major countries contributing to the growth of the release coating market in the region. The growing pharmaceutical, retail, consumer goods, cosmetics, and household segments in the region drive the packaging industry, and with it, the label application grows, which holds the largest share in the APAC release coating market.

The semiconductor industry in the region is anticipated to pick growth with the increasing adoption of disruptive technologies such as Artificial Intelligence (AI) and 5G during the forecast period. This growth drives the demands of tapes application in the release coating market. Countries such as Taiwan, China, Japan, and South Korea are the front runners in this upcoming development.

The packaging industry in developing economies such as India, Indonesia, Malaysia, and other South East Asian countries is expected to grow in double digits during the forecast period. The fast-growing packaging industry drives the label application of the release coating market in the region, with the application holding a major share in the market.

Release Coating Market Players

The key companies profiled in the release coating market research report are Dow (US), Wacker Chemie AG (Germany), Elkem (Norway), Evonik Industries AG (Germany), Shin-Etsu Chemical Co. Ltd. (Japan), Omnova Solutions Inc. (US), Momentive Performance Materials Inc. (US), Mayzo Inc. (US), HITAC Adhesives and Coatings (US) and SOLV Inc. (US).

Release Coating Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 157 million |

|

Revenue Forecast in 2025 |

USD 225 million |

|

CAGR |

7.5% |

|

Years Considered |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Unit considered |

Value (USD Thousand), Volume (Ton) |

|

Segments |

Material, Formulation, Release Liner, Application, and Region |

|

Regions |

APAC, North America, Europe, South America, and Middle East & Africa |

|

Companies |

The major players are Dow (US), Wacker Chemie AG (Germany), Elkem (Norway), Evonik Industries AG (Germany), Shin-Etsu Chemical Co. Ltd. (Japan), Omnova Solutions Inc. (US), Momentive Performance Materials Inc. (US), Mayzo Inc. (US), HITAC Adhesives and Coatings (US) and SOLV Inc. (US). |

This research report categorizes the release coating market on the basis of material, formulation, release liner, application, and region.

Release Coating Market on the basis of Material

- Silicone

- Non-silicone

Release Coating Market on the basis of Formulation

- Solvent based

- Solventless

- Emulsions

Release Coating Market on the basis of Release Liner

- Paper Liners

- Filmic Liners

Release Coating Market on the basis of Application

- Labels

- Tapes

- Hygiene

- Industrial

- Medical

- Food bakery

- Others (Envelope and graphic)

Release Coating Market on the basis of Region

- North America

- South America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In May 2020, Shin-Etsu Chemical Co. Ltd. developed a new technology for reducing the amount of platinum used in silicone release coatings by about one-half. The main applications are primarily as coated release paper for stickers, labels, and adhesive tapes as well as for release films and manufacturing process release liner.

- In November 2019, Wacker Chemie AG opened a new silicon metal production facility in Holla, Norway. The company invested USD 111 million in the new plant. The new furnace in this location is one of the largest in the world.

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the release coating market?

The major drivers influencing the growth of release coating are the growing population, increasing per capita income, and the growing e-commerce.

How is the release coating market segmented in terms of material?

The release coating market into silicone and non-silicone in terms of material.

How is the release coating segmented in terms of formulation?

The release coating is segmented into solvent based, solventless, and emulsions.

What are the major applications for release coating?

The major applications of release coating are labels, tapes, hygiene, industrial, medical, food bakery, and others.

What are the biggest restraints for release coating?

The biggest restraints in the release coating market are the differences in release control may result in failure of the release coating

What are the new opportunities in the release coating market?

The new Opportunities in the release coating are the development of Polydimethylsiloxane (PDMS) based release coating and to tap the fast-growing markets of release coating, given in detail in the report.

Who are the major manufacturers of release coating?

The major manufacturers of release coating are Dow (US), Wacker Chemie AG (Germany), Elkem (Norway), Evonik Industries AG (Germany), Shin-Etsu Chemical Co. Ltd. (Japan), Omnova Solutions Inc. (US), Momentive Performance Materials Inc. (US), Mayzo Inc. (US), HITAC Adhesives and Coatings (US) and SOLV Inc. (US)

How is the application aligned in the release coating market?

The market is expected to be the fastest growth during the forecast period. In the hygiene application, the disposable baby diapers and disposable sanitary napkins will grow at a faster pace in developing economies while the adult diapers will grow in both developed as well as developing economies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

211

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 RELEASE COATING

TABLE 1 MARKET SEGMENTATION DEFINITION, BY MATERIAL

TABLE 2 MARKET SEGMENTATION DEFINITION, BY RELEASE LINER

TABLE 3 MARKET SEGMENTATION DEFINITION, BY FORMULATION

TABLE 4 MARKET SEGMENTATION DEFINITION, BY APPLICATION

1.3 MARKET SCOPE

FIGURE 1 RELEASE COATING: MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED IN THE REPORT

1.4 INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY

1.6 PACKAGE SIZE

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 RELEASE COATING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

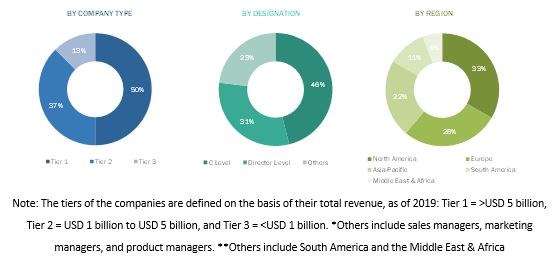

2.1.2.3 Breakdown of primary interviews

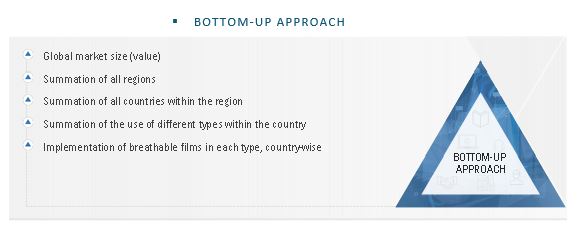

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION APPROACH 1: BASED ON GLOBAL RELEASE LINER MARKET - 2017

FIGURE 4 MARKET SIZE ESTIMATION APPROACH 2: BASED ON THE PRESSURE SENSITIVE LABELS MARKET - 2018

2.3 DATA TRIANGULATION

FIGURE 5 RELEASE COATING MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 6 SILICONE TO REMAIN THE DOMINANT MATERIAL FOR RELEASE COATING TILL 2025

FIGURE 7 PAPER LINER DOMINATED THE RELEASE COATING MARKET IN 2019

FIGURE 8 SOLVENTLESS BASED RELEASE COATING DOMINATED THE RELEASE COATING MARKET IN 2019

FIGURE 9 LABELS APPLICATION DOMINATED THE RELEASE COATING MARKET IN 2019

FIGURE 10 APAC TO BE THE FASTEST-GROWING RELEASE COATING MARKET

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN THE RELEASE COATING MARKET

FIGURE 11 APAC TO DRIVE THE RELEASE COATING MARKET

4.2 APAC RELEASE COATING MARKET, BY MATERIAL AND COUNTRY, 2019

FIGURE 12 SILICONE ACCOUNTED FOR THE LARGER SHARE IN THE RELEASE COATING MARKET

4.3 RELEASE COATING MARKET, BY MATERIAL

FIGURE 13 NON-SILICONE SEGMENT TO REGISTER THE FASTER-GROWTH

4.4 RELEASE COATING MARKET, BY RELEASE LINER

FIGURE 14 PAPER LINERS TO DOMINATE THE RELEASE COATING MARKET

4.5 RELEASE COATING MARKET, BY FORMULATION

FIGURE 15 EMULSIONS TO BE THE FASTEST-GROWING FORMULATION SEGMENT

4.6 RELEASE COATING MARKET, BY APPLICATION

FIGURE 16 HYGIENE APPLICATION SEGMENT TO RECORD THE HIGHEST CAGR

4.7 RELEASE COATING MARKET COUNTRY WISE

FIGURE 17 INDONESIA TO BE THE FASTEST-GROWING RELEASE COATING MARKET

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE RELEASE COATING MARKET

5.1.1 DRIVERS

5.1.1.1 Rising aging population, increase in per capita income, and growing healthcare awareness

5.1.1.2 Increased demand for solventless coatings

5.1.1.3 Growing digital label printing industry to support market growth

5.1.2 RESTRAINTS

5.1.2.1 Differences in release control may result in failure of release coating

5.1.2.2 Preference for shrink sleeve labels over pressure-sensitive labels

5.1.3 OPPORTUNITY

5.1.3.1 Opportunities in polydimethylsiloxane (PDMS) based release coating segment

5.1.4 CHALLENGES

5.1.4.1 Development of cost-effective products under stringent environmental regulations

5.1.4.2 Disposing of release liner waste is a challenge due to infrastructural problems, expensive recycling, and separate sorting of release liner

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 19 RELEASE COATING MARKET: PORTER'S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITION RIVALRY

5.3 YC, YCC SHIFT

FIGURE 20 GROWING HEALTH & HYGIENE AND MEDICAL SUPPLIES WILL BRING IN CHANGE IN FUTURE REVENUE MIX

5.4 COVID-19 IMPACT ON RELEASE COATING MARKET

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 21 SUPPLY CHAIN ANALYSIS

5.6 AVERAGE SELLING PRICE ANALYSIS

FIGURE 22 AVERAGE SELLING PRICE OF RELEASE COATING IN NORTH AMERICA, BY APPLICATION

FIGURE 23 AVERAGE SELLING PRICE OF RELEASE COATING IN EUROPE, BY APPLICATION

FIGURE 24 AVERAGE SELLING PRICE OF RELEASE COATING IN APAC, BY APPLICATION

FIGURE 25 AVERAGE SELLING PRICE OF RELEASE COATING IN MEA, BY APPLICATION

FIGURE 26 AVERAGE SELLING PRICE OF RELEASE COATING IN SOUTH AMERICA, BY APPLICATION

5.7 PATENT ANALYSIS

FIGURE 27 NUMBER OF GRANTED PATENTS PER YEAR

TABLE 5 JURISDICTION VS. GRANTED PATENT

TABLE 6 NUMBER OF GRANTED PATENTS, BY TOP KEY PLAYERS (TILL DATE)

TABLE 7 PATENTS ON RELEASE COATING

5.8 MACROECONOMIC OVERVIEW

TABLE 8 WORLD GDP GROWTH PROJECTION

TABLE 9 INDUSTRIAL PRODUCTION INDEX, BY COUNTRY

6 RELEASE COATING MARKET, BY MATERIAL (Page No. - 72)

6.1 INTRODUCTION

FIGURE 28 SILICONE ACCOUNTED FOR LARGER SHARE IN RELEASE COATING MARKET, 2019 (USD MILLION)

TABLE 10 RELEASE COATING MARKET SIZE, BY MATERIAL, 2018–2025 (TON)

TABLE 11 RELEASE COATING MARKET SIZE, BY MATERIAL, 2018-2025 (USD THOUSAND)

6.1.1 SILICONE

TABLE 12 SILICONE-BASED RELEASE COATING MARKET SIZE, BY REGION, 2018-2025 (TON)

TABLE 13 SILICONE-BASED RELEASE COATING MARKET SIZE, BY REGION, 2018-2025 (USD THOUSAND)

6.1.2 NON-SILICONE

TABLE 14 NON-SILICONE BASED RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 15 NON-SILICONE BASED RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

7 RELEASE COATING MARKET, BY RELEASE LINER (Page No. - 77)

7.1 INTRODUCTION

FIGURE 29 PAPER LINERS ACCOUNTED FOR MAJOR SHARE OF RELEASE COATING MARKET, 2019 (USD MILLION)

TABLE 16 RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2018–2025 (TON)

TABLE 17 RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2018–2025 (USD THOUSAND)

7.2 PAPER LINERS

7.2.1 GLASSINE & CALENDERED KRAFT

7.2.2 POLYOLEFIN COATED PAPER

7.2.3 CLAY COATED PAPER

7.2.4 OTHER PAPERS

TABLE 18 RELEASE COATING MARKET SIZE IN PAPER LINERS, BY REGION, 2018–2025 (TON)

TABLE 19 RELEASE COATING MARKET SIZE IN PAPER LINERS, BY REGION, 2018–2025 (USD THOUSAND)

7.3 FILMIC LINERS

TABLE 20 RELEASE COATING MARKET SIZE IN FILMIC LINERS, BY REGION, 2018–2025 (TON)

TABLE 21 RELEASE COATING MARKET SIZE IN FILMIC LINERS, BY REGION, 2018–2025 (USD THOUSAND)

8 RELEASE COATING MARKET, BY FORMULATION (Page No. - 82)

8.1 INTRODUCTION

FIGURE 30 SOLVENTLESS RELEASE COATING ACCOUNTED FOR LARGEST SHARE IN 2019

FIGURE 31 APPLICATION VS FORMULATION MATRIX

TABLE 22 RELEASE COATING MARKET SIZE, BY FORMULATION, 2018–2025 (TON)

TABLE 23 RELEASE COATING MARKET SIZE, BY FORMULATION, 2018–2025 (USD THOUSAND)

8.1.1 SOLVENT BASED

TABLE 24 SOLVENT-BASED RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 25 SOLVENT-BASED RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8.1.2 SOLVENTLESS

TABLE 26 SOLVENTLESS RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 27 SOLVENTLESS RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8.1.3 EMULSIONS

TABLE 28 EMULSION RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 29 EMULSION RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

9 RELEASE COATING MARKET, BY APPLICATION (Page No. - 88)

9.1 INTRODUCTION

FIGURE 32 LABELS APPLICATION WAS THE LARGEST SEGMENT IN 2019

FIGURE 33 APPLICATION WISE PRODUCT USAGE AND BENEFITS OF RELEASE COATING

TABLE 30 RELEASE COATING MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 31 RELEASE COATING MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

9.1.1 LABELS

TABLE 32 RELEASE COATING MARKET SIZE IN LABELS, BY REGION, 2018–2025 (TON)

TABLE 33 RELEASE COATING MARKET SIZE IN LABELS, BY REGION, 2018–2025 (USD THOUSAND)

9.1.2 TAPES

TABLE 34 RELEASE COATING MARKET SIZE IN TAPES, BY REGION, 2018–2025 (TON)

TABLE 35 RELEASE COATING MARKET SIZE IN TAPES, BY REGION, 2018–2025 (USD THOUSAND)

9.1.3 HYGIENE

TABLE 36 RELEASE COATING MARKET SIZE IN HYGIENE, BY REGION, 2018–2025 (TON)

TABLE 37 RELEASE COATING MARKET SIZE IN HYGIENE, BY REGION, 2018–2025 (USD THOUSAND)

9.1.4 INDUSTRIAL

TABLE 38 RELEASE COATING MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2018–2025 (TON)

TABLE 39 RELEASE COATING MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2018–2025 (USD THOUSAND)

9.1.5 MEDICAL

TABLE 40 RELEASE COATING MARKET SIZE IN MEDICAL, BY REGION, 2018–2025 (TON)

TABLE 41 RELEASE COATING MARKET SIZE IN MEDICAL, BY REGION, 2018–2025 (USD THOUSAND)

9.1.6 FOOD BAKERY

TABLE 42 RELEASE COATING MARKET SIZE IN FOOD & BAKERY, BY REGION, 2018–2025 (TON)

TABLE 43 RELEASE COATING MARKET SIZE IN FOOD & BAKERY, BY REGION, 2018–2025 (USD THOUSAND)

9.1.7 OTHERS

TABLE 44 RELEASE COATING MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (TON)

TABLE 45 RELEASE COATING MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD THOUSAND)

10 RELEASE COATING MARKET, BY REGION (Page No. - 99)

10.1 INTRODUCTION

FIGURE 34 REGIONAL SNAPSHOT: RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 46 RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 47 RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

10.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA SNAPSHOT: STRINGENT ENVIRONMENTAL REGULATIONS DRIVING SOLVENTLESS AND EMULSIONS BASED RELEASE COATING MARKET

TABLE 48 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 49 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 50 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 51 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 52 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 53 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 54 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 55 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 56 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 57 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.2.1 US

TABLE 58 US: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 59 US: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 60 US: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 61 US: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 62 US: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 63 US: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 64 US: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 65 US: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.2.2 CANADA

TABLE 66 CANADA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 67 CANADA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 68 CANADA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 69 CANADA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 70 CANADA: RELEASE COATING MARKET SIZE, BY FORMULATION,2020–2025 (TON)

TABLE 71 CANADA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 72 CANADA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 73 CANADA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.2.3 MEXICO

TABLE 74 MEXICO: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 75 MEXICO: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 76 MEXICO: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 77 MEXICO: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 78 MEXICO: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 79 MEXICO: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 80 MEXICO: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 81 MEXICO: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3 APAC

FIGURE 36 APAC SNAPSHOT: INDONESIA TO BE FASTEST-GROWING MARKET

TABLE 82 APAC: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 83 APAC: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 84 APAC: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 85 APAC: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 86 APAC: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 87 APAC: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 88 APAC: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 89 APAC: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 90 APAC: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 91 APAC: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.1 CHINA

TABLE 92 CHINA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 93 CHINA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 94 CHINA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 95 CHINA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 96 CHINA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 97 CHINA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 98 CHINA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 99 CHINA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 100 JAPAN: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 101 JAPAN: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 102 JAPAN: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 103 JAPAN: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 104 JAPAN: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 105 JAPAN: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 106 JAPAN: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 107 JAPAN: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.3 INDIA

TABLE 108 INDIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD TON)

TABLE 109 INDIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 110 INDIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 111 INDIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 112 INDIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 113 INDIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 114 INDIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 115 INDIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.4 SOUTH KOREA

TABLE 116 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 117 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 118 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 119 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 120 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 121 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 122 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 123 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.5 TAIWAN

TABLE 124 TAIWAN: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 125 TAIWAN: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 126 TAIWAN: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 127 TAIWAN: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 128 TAIWAN: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 129 TAIWAN: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 130 TAIWAN: RELEASE COATING MARKET SIZE, BY APPLICATION,2020–2025 (TON)

TABLE 131 TAIWAN: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.6 INDONESIA

TABLE 132 INDONESIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 133 INDONESIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 134 INDONESIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 135 INDONESIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 136 INDONESIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 137 INDONESIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 138 INDONESIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 139 INDONESIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.7 MALAYSIA

TABLE 140 MALAYSIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 141 MALAYSIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 142 MALAYSIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 143 MALAYSIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 144 MALAYSIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 145 MALAYSIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 146 MALAYSIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 147 MALAYSIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.8 REST OF APAC

TABLE 148 REST OF APAC: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 149 REST OF APAC: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 150 REST OF APAC: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 151 REST OF APAC: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 152 REST OF APAC: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 153 REST OF APAC: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 154 REST OF APAC: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 155 REST OF APAC: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4 EUROPE

TABLE 156 EUROPE: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 157 EUROPE: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 158 EUROPE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 159 EUROPE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 160 EUROPE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 161 EUROPE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 162 EUROPE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 163 EUROPE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 164 EUROPE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 165 EUROPE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.1 GERMANY

TABLE 166 GERMANY: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 167 GERMANY: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 168 GERMANY: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 169 GERMANY: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 170 GERMANY: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 171 GERMANY: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 172 GERMANY: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 173 GERMANY: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 174 FRANCE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 175 FRANCE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 176 FRANCE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 177 FRANCE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 178 FRANCE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 179 FRANCE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 180 FRANCE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 181 FRANCE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.3 UK

TABLE 182 UK: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 183 UK: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 184 UK: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 185 UK: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 186 UK: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 187 UK: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 188 UK: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 189 UK: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.4 RUSSIA

TABLE 190 RUSSIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 191 RUSSIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 192 RUSSIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 193 RUSSIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 194 RUSSIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 195 RUSSIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 196 RUSSIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 197 RUSSIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.5 ITALY

TABLE 198 ITALY: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 199 ITALY: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 200 ITALY: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 201 ITALY: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 202 ITALY: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 203 ITALY: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 204 ITALY: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 205 ITALY: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.6 REST OF EUROPE

TABLE 206 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 207 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 208 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 209 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 210 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 211 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 212 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 213 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.5 MIDDLE EAST & AFRICA

TABLE 214 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 215 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 216 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 217 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 218 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 219 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 220 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 221 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 222 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 223 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.5.1 SAUDI ARABIA

TABLE 224 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 225 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 226 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 227 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 228 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 229 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 230 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 231 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.5.2 SOUTH AFRICA

TABLE 232 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 233 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 234 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 235 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 236 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 237 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 238 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 239 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 240 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 241 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 242 REST OF THE MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 243 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 244 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 245 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 246 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 247 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.6 SOUTH AMERICA

TABLE 248 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 249 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 250 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 251 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 252 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 253 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 254 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 255 SOUTH AMERICA RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 256 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 257 SOUTH AMERICA RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.6.1 BRAZIL

TABLE 258 BRAZIL: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 259 BRAZIL: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 260 BRAZIL: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 261 BRAZIL: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 262 BRAZIL: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 263 BRAZIL: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 264 BRAZIL: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 265 BRAZIL: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.6.2 ARGENTINA

TABLE 266 ARGENTINA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 267 ARGENTINA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 268 ARGENTINA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 269 ARGENTINA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 270 ARGENTINA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 271 ARGENTINA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 272 ARGENTINA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 273 ARGENTINA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.6.3 REST OF SOUTH AMERICA

TABLE 274 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 275 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 276 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 277 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 278 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 279 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 280 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 281 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 180)

11.1 INTRODUCTION

FIGURE 37 COMPANIES MAJORLY ADOPTED ORGANIC GROWTH STRATEGIES BETWEEN 2017 AND 2020

11.2 COMPETITIVE SCENARIO

11.2.1 INVESTMENT & EXPANSION

TABLE 282 INVESTMENT & EXPANSION, 2017-2020

11.2.2 NEW PRODUCT LAUNCH

TABLE 283 NEW PRODUCT LAUNCH, 2016-2020

11.3 INDUSTRY TIER STRUCTURE

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 38 RELEASE COATING MARKET: COMPANY EVALUATION QUADRANT, 2019

11.5 MARKET SHARE ANALYSIS

FIGURE 39 MARKET SHARE OF KEY PLAYERS, 2019

12 COMPANY PROFILES (Page No. - 185)

(Business overview, Products offered, Recent Developments, COVID-19 impact on business segment, MNM view)*

12.1 DOW

FIGURE 40 DOW: COMPANY SNAPSHOT

12.2 WACKER CHEMIE AG

FIGURE 41 WACKER CHEMIE AG: COMPANY SNAPSHOT

12.3 ELKEM

FIGURE 42 ELKEM: COMPANY SNAPSHOT

12.4 EVONIK INDUSTRIES AG

FIGURE 43 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

12.5 SHIN-ETSU CHEMICAL CO., LTD.

FIGURE 44 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

12.6 OMNOVA SOLUTIONS INC.

FIGURE 45 OMNOVA SOLUTIONS INC.: COMPANY SNAPSHOT

12.7 MOMENTIVE PERFORMANCE MATERIALS INC.

12.8 MAYZO INC.

12.9 HITAC ADHESIVES AND COATINGS INC.

12.10 SOLV INC.

12.11 SILIBASE SILICONE

*Details on Business overview, Products offered, Recent Developments, COVID-19 impact on business segment, MNM view might not be captured in case of unlisted companies.

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 RELEASE COATING

TABLE 1 MARKET SEGMENTATION DEFINITION, BY MATERIAL

TABLE 2 MARKET SEGMENTATION DEFINITION, BY RELEASE LINER

TABLE 3 MARKET SEGMENTATION DEFINITION, BY FORMULATION

TABLE 4 MARKET SEGMENTATION DEFINITION, BY APPLICATION

1.3 MARKET SCOPE

FIGURE 1 RELEASE COATING: MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED IN THE REPORT

1.4 INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY

1.6 PACKAGE SIZE

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 RELEASE COATING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION APPROACH 1: BASED ON GLOBAL RELEASE LINER MARKET - 2017

FIGURE 4 MARKET SIZE ESTIMATION APPROACH 2: BASED ON THE PRESSURE SENSITIVE LABELS MARKET - 2018

2.3 DATA TRIANGULATION

FIGURE 5 RELEASE COATING MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 6 SILICONE TO REMAIN THE DOMINANT MATERIAL FOR RELEASE COATING TILL 2025

FIGURE 7 PAPER LINER DOMINATED THE RELEASE COATING MARKET IN 2019

FIGURE 8 SOLVENTLESS BASED RELEASE COATING DOMINATED THE RELEASE COATING MARKET IN 2019

FIGURE 9 LABELS APPLICATION DOMINATED THE RELEASE COATING MARKET IN 2019

FIGURE 10 APAC TO BE THE FASTEST-GROWING RELEASE COATING MARKET

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN THE RELEASE COATING MARKET

FIGURE 11 APAC TO DRIVE THE RELEASE COATING MARKET

4.2 APAC RELEASE COATING MARKET, BY MATERIAL AND COUNTRY, 2019

FIGURE 12 SILICONE ACCOUNTED FOR THE LARGER SHARE IN THE RELEASE COATING MARKET

4.3 RELEASE COATING MARKET, BY MATERIAL

FIGURE 13 NON-SILICONE SEGMENT TO REGISTER THE FASTER-GROWTH

4.4 RELEASE COATING MARKET, BY RELEASE LINER

FIGURE 14 PAPER LINERS TO DOMINATE THE RELEASE COATING MARKET

4.5 RELEASE COATING MARKET, BY FORMULATION

FIGURE 15 EMULSIONS TO BE THE FASTEST-GROWING FORMULATION SEGMENT

4.6 RELEASE COATING MARKET, BY APPLICATION

FIGURE 16 HYGIENE APPLICATION SEGMENT TO RECORD THE HIGHEST CAGR

4.7 RELEASE COATING MARKET COUNTRY WISE

FIGURE 17 INDONESIA TO BE THE FASTEST-GROWING RELEASE COATING MARKET

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE RELEASE COATING MARKET

5.1.1 DRIVERS

5.1.1.1 Rising aging population, increase in per capita income, and growing healthcare awareness

5.1.1.2 Increased demand for solventless coatings

5.1.1.3 Growing digital label printing industry to support market growth

5.1.2 RESTRAINTS

5.1.2.1 Differences in release control may result in failure of release coating

5.1.2.2 Preference for shrink sleeve labels over pressure-sensitive labels

5.1.3 OPPORTUNITY

5.1.3.1 Opportunities in polydimethylsiloxane (PDMS) based release coating segment

5.1.4 CHALLENGES

5.1.4.1 Development of cost-effective products under stringent environmental regulations

5.1.4.2 Disposing of release liner waste is a challenge due to infrastructural problems, expensive recycling, and separate sorting of release liner

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 19 RELEASE COATING MARKET: PORTER'S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITION RIVALRY

5.3 YC, YCC SHIFT

FIGURE 20 GROWING HEALTH & HYGIENE AND MEDICAL SUPPLIES WILL BRING IN CHANGE IN FUTURE REVENUE MIX

5.4 COVID-19 IMPACT ON RELEASE COATING MARKET

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 21 SUPPLY CHAIN ANALYSIS

5.6 AVERAGE SELLING PRICE ANALYSIS

FIGURE 22 AVERAGE SELLING PRICE OF RELEASE COATING IN NORTH AMERICA, BY APPLICATION

FIGURE 23 AVERAGE SELLING PRICE OF RELEASE COATING IN EUROPE, BY APPLICATION

FIGURE 24 AVERAGE SELLING PRICE OF RELEASE COATING IN APAC, BY APPLICATION

FIGURE 25 AVERAGE SELLING PRICE OF RELEASE COATING IN MEA, BY APPLICATION

FIGURE 26 AVERAGE SELLING PRICE OF RELEASE COATING IN SOUTH AMERICA, BY APPLICATION

5.7 PATENT ANALYSIS

FIGURE 27 NUMBER OF GRANTED PATENTS PER YEAR

TABLE 5 JURISDICTION VS. GRANTED PATENT

TABLE 6 NUMBER OF GRANTED PATENTS, BY TOP KEY PLAYERS (TILL DATE)

TABLE 7 PATENTS ON RELEASE COATING

5.8 MACROECONOMIC OVERVIEW

TABLE 8 WORLD GDP GROWTH PROJECTION

TABLE 9 INDUSTRIAL PRODUCTION INDEX, BY COUNTRY

6 RELEASE COATING MARKET, BY MATERIAL (Page No. - 72)

6.1 INTRODUCTION

FIGURE 28 SILICONE ACCOUNTED FOR LARGER SHARE IN RELEASE COATING MARKET, 2019 (USD MILLION)

TABLE 10 RELEASE COATING MARKET SIZE, BY MATERIAL, 2018–2025 (TON)

TABLE 11 RELEASE COATING MARKET SIZE, BY MATERIAL, 2018-2025 (USD THOUSAND)

6.1.1 SILICONE

TABLE 12 SILICONE-BASED RELEASE COATING MARKET SIZE, BY REGION, 2018-2025 (TON)

TABLE 13 SILICONE-BASED RELEASE COATING MARKET SIZE, BY REGION, 2018-2025 (USD THOUSAND)

6.1.2 NON-SILICONE

TABLE 14 NON-SILICONE BASED RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 15 NON-SILICONE BASED RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

7 RELEASE COATING MARKET, BY RELEASE LINER (Page No. - 77)

7.1 INTRODUCTION

FIGURE 29 PAPER LINERS ACCOUNTED FOR MAJOR SHARE OF RELEASE COATING MARKET, 2019 (USD MILLION)

TABLE 16 RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2018–2025 (TON)

TABLE 17 RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2018–2025 (USD THOUSAND)

7.2 PAPER LINERS

7.2.1 GLASSINE & CALENDERED KRAFT

7.2.2 POLYOLEFIN COATED PAPER

7.2.3 CLAY COATED PAPER

7.2.4 OTHER PAPERS

TABLE 18 RELEASE COATING MARKET SIZE IN PAPER LINERS, BY REGION, 2018–2025 (TON)

TABLE 19 RELEASE COATING MARKET SIZE IN PAPER LINERS, BY REGION, 2018–2025 (USD THOUSAND)

7.3 FILMIC LINERS

TABLE 20 RELEASE COATING MARKET SIZE IN FILMIC LINERS, BY REGION, 2018–2025 (TON)

TABLE 21 RELEASE COATING MARKET SIZE IN FILMIC LINERS, BY REGION, 2018–2025 (USD THOUSAND)

8 RELEASE COATING MARKET, BY FORMULATION (Page No. - 82)

8.1 INTRODUCTION

FIGURE 30 SOLVENTLESS RELEASE COATING ACCOUNTED FOR LARGEST SHARE IN 2019

FIGURE 31 APPLICATION VS FORMULATION MATRIX

TABLE 22 RELEASE COATING MARKET SIZE, BY FORMULATION, 2018–2025 (TON)

TABLE 23 RELEASE COATING MARKET SIZE, BY FORMULATION, 2018–2025 (USD THOUSAND)

8.1.1 SOLVENT BASED

TABLE 24 SOLVENT-BASED RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 25 SOLVENT-BASED RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8.1.2 SOLVENTLESS

TABLE 26 SOLVENTLESS RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 27 SOLVENTLESS RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8.1.3 EMULSIONS

TABLE 28 EMULSION RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 29 EMULSION RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

9 RELEASE COATING MARKET, BY APPLICATION (Page No. - 88)

9.1 INTRODUCTION

FIGURE 32 LABELS APPLICATION WAS THE LARGEST SEGMENT IN 2019

FIGURE 33 APPLICATION WISE PRODUCT USAGE AND BENEFITS OF RELEASE COATING

TABLE 30 RELEASE COATING MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 31 RELEASE COATING MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

9.1.1 LABELS

TABLE 32 RELEASE COATING MARKET SIZE IN LABELS, BY REGION, 2018–2025 (TON)

TABLE 33 RELEASE COATING MARKET SIZE IN LABELS, BY REGION, 2018–2025 (USD THOUSAND)

9.1.2 TAPES

TABLE 34 RELEASE COATING MARKET SIZE IN TAPES, BY REGION, 2018–2025 (TON)

TABLE 35 RELEASE COATING MARKET SIZE IN TAPES, BY REGION, 2018–2025 (USD THOUSAND)

9.1.3 HYGIENE

TABLE 36 RELEASE COATING MARKET SIZE IN HYGIENE, BY REGION, 2018–2025 (TON)

TABLE 37 RELEASE COATING MARKET SIZE IN HYGIENE, BY REGION, 2018–2025 (USD THOUSAND)

9.1.4 INDUSTRIAL

TABLE 38 RELEASE COATING MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2018–2025 (TON)

TABLE 39 RELEASE COATING MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2018–2025 (USD THOUSAND)

9.1.5 MEDICAL

TABLE 40 RELEASE COATING MARKET SIZE IN MEDICAL, BY REGION, 2018–2025 (TON)

TABLE 41 RELEASE COATING MARKET SIZE IN MEDICAL, BY REGION, 2018–2025 (USD THOUSAND)

9.1.6 FOOD BAKERY

TABLE 42 RELEASE COATING MARKET SIZE IN FOOD & BAKERY, BY REGION, 2018–2025 (TON)

TABLE 43 RELEASE COATING MARKET SIZE IN FOOD & BAKERY, BY REGION, 2018–2025 (USD THOUSAND)

9.1.7 OTHERS

TABLE 44 RELEASE COATING MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (TON)

TABLE 45 RELEASE COATING MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD THOUSAND)

10 RELEASE COATING MARKET, BY REGION (Page No. - 99)

10.1 INTRODUCTION

FIGURE 34 REGIONAL SNAPSHOT: RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 46 RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 47 RELEASE COATING MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

10.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA SNAPSHOT: STRINGENT ENVIRONMENTAL REGULATIONS DRIVING SOLVENTLESS AND EMULSIONS BASED RELEASE COATING MARKET

TABLE 48 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 49 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 50 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 51 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 52 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 53 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 54 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 55 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 56 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 57 NORTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.2.1 US

TABLE 58 US: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 59 US: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 60 US: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 61 US: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 62 US: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 63 US: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 64 US: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 65 US: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.2.2 CANADA

TABLE 66 CANADA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 67 CANADA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 68 CANADA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 69 CANADA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 70 CANADA: RELEASE COATING MARKET SIZE, BY FORMULATION,2020–2025 (TON)

TABLE 71 CANADA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 72 CANADA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 73 CANADA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.2.3 MEXICO

TABLE 74 MEXICO: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 75 MEXICO: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 76 MEXICO: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 77 MEXICO: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 78 MEXICO: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 79 MEXICO: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 80 MEXICO: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 81 MEXICO: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3 APAC

FIGURE 36 APAC SNAPSHOT: INDONESIA TO BE FASTEST-GROWING MARKET

TABLE 82 APAC: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 83 APAC: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 84 APAC: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 85 APAC: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 86 APAC: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 87 APAC: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 88 APAC: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 89 APAC: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 90 APAC: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 91 APAC: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.1 CHINA

TABLE 92 CHINA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 93 CHINA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 94 CHINA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 95 CHINA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 96 CHINA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 97 CHINA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 98 CHINA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 99 CHINA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 100 JAPAN: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 101 JAPAN: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 102 JAPAN: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 103 JAPAN: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 104 JAPAN: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 105 JAPAN: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 106 JAPAN: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 107 JAPAN: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.3 INDIA

TABLE 108 INDIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD TON)

TABLE 109 INDIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 110 INDIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 111 INDIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 112 INDIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 113 INDIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 114 INDIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 115 INDIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.4 SOUTH KOREA

TABLE 116 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 117 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 118 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 119 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 120 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 121 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 122 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 123 SOUTH KOREA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.5 TAIWAN

TABLE 124 TAIWAN: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 125 TAIWAN: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 126 TAIWAN: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 127 TAIWAN: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 128 TAIWAN: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 129 TAIWAN: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 130 TAIWAN: RELEASE COATING MARKET SIZE, BY APPLICATION,2020–2025 (TON)

TABLE 131 TAIWAN: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.6 INDONESIA

TABLE 132 INDONESIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 133 INDONESIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 134 INDONESIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 135 INDONESIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 136 INDONESIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 137 INDONESIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 138 INDONESIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 139 INDONESIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.7 MALAYSIA

TABLE 140 MALAYSIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 141 MALAYSIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 142 MALAYSIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 143 MALAYSIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 144 MALAYSIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 145 MALAYSIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 146 MALAYSIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 147 MALAYSIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.3.8 REST OF APAC

TABLE 148 REST OF APAC: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 149 REST OF APAC: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 150 REST OF APAC: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 151 REST OF APAC: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 152 REST OF APAC: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 153 REST OF APAC: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 154 REST OF APAC: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 155 REST OF APAC: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4 EUROPE

TABLE 156 EUROPE: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 157 EUROPE: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 158 EUROPE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 159 EUROPE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 160 EUROPE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 161 EUROPE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 162 EUROPE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 163 EUROPE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 164 EUROPE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 165 EUROPE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.1 GERMANY

TABLE 166 GERMANY: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 167 GERMANY: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 168 GERMANY: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 169 GERMANY: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 170 GERMANY: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 171 GERMANY: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 172 GERMANY: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 173 GERMANY: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

TABLE 174 FRANCE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 175 FRANCE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 176 FRANCE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 177 FRANCE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 178 FRANCE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 179 FRANCE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 180 FRANCE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 181 FRANCE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.3 UK

TABLE 182 UK: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 183 UK: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 184 UK: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 185 UK: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 186 UK: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 187 UK: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 188 UK: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 189 UK: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.4 RUSSIA

TABLE 190 RUSSIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 191 RUSSIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 192 RUSSIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 193 RUSSIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 194 RUSSIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 195 RUSSIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 196 RUSSIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 197 RUSSIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.5 ITALY

TABLE 198 ITALY: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 199 ITALY: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 200 ITALY: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 201 ITALY: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 202 ITALY: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 203 ITALY: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 204 ITALY: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 205 ITALY: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.4.6 REST OF EUROPE

TABLE 206 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 207 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 208 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 209 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 210 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 211 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 212 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 213 REST OF EUROPE: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.5 MIDDLE EAST & AFRICA

TABLE 214 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 215 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 216 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 217 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 218 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 219 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 220 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 221 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 222 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 223 MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.5.1 SAUDI ARABIA

TABLE 224 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 225 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 226 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 227 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 228 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 229 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 230 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 231 SAUDI ARABIA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.5.2 SOUTH AFRICA

TABLE 232 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 233 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 234 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 235 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 236 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 237 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 238 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 239 SOUTH AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 240 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 241 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 242 REST OF THE MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 243 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 244 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 245 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 246 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 247 REST OF MIDDLE EAST & AFRICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.6 SOUTH AMERICA

TABLE 248 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (TON)

TABLE 249 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 250 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 251 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 252 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 253 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 254 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 255 SOUTH AMERICA RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 256 SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 257 SOUTH AMERICA RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.6.1 BRAZIL

TABLE 258 BRAZIL: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 259 BRAZIL: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 260 BRAZIL: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 261 BRAZIL: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 262 BRAZIL: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 263 BRAZIL: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 264 BRAZIL: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 265 BRAZIL: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.6.2 ARGENTINA

TABLE 266 ARGENTINA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 267 ARGENTINA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 268 ARGENTINA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 269 ARGENTINA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 270 ARGENTINA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 271 ARGENTINA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 272 ARGENTINA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 273 ARGENTINA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.6.3 REST OF SOUTH AMERICA

TABLE 274 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (TON)

TABLE 275 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY MATERIAL, 2020–2025 (USD THOUSAND)

TABLE 276 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (TON)

TABLE 277 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY RELEASE LINER, 2020–2025 (USD THOUSAND)

TABLE 278 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (TON)

TABLE 279 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY FORMULATION, 2020–2025 (USD THOUSAND)

TABLE 280 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (TON)

TABLE 281 REST OF SOUTH AMERICA: RELEASE COATING MARKET SIZE, BY APPLICATION, 2020–2025 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 180)

11.1 INTRODUCTION