Remote Patient Monitoring Market / RPM Market Size by Product (Software, Services, Devices, Cardiology, Neurological, BP Monitors, Neonatal, Weight, Temperature, Neuro) End user (Providers, Hospitals, Clinics, Home care, Patients, Payers) - Global Forecast to 2028

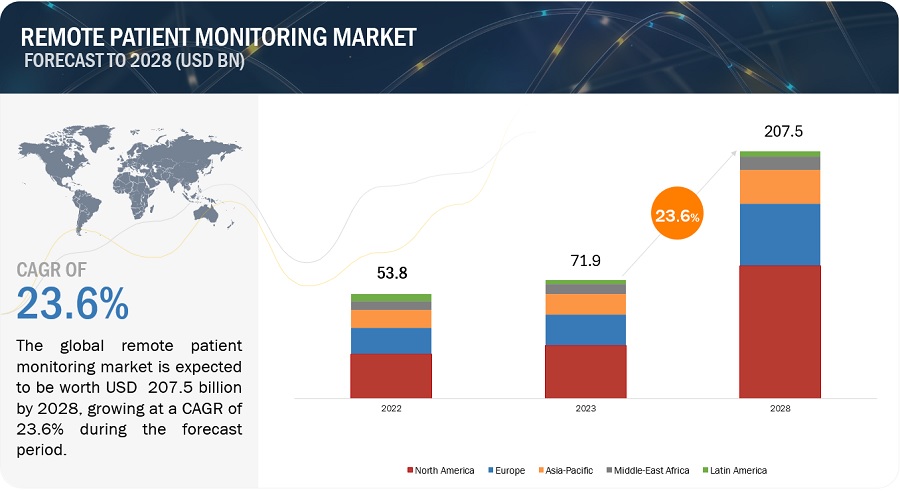

The size of global remote patient monitoring market in terms of revenue was estimated to be worth $71.9 billion in 2023 and is poised to reach $207.5 billion by 2028, growing at a CAGR of 23.6% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth of the remote patient monitoring (RPM) market is being driven by the healthcare related cost advantage owed to adoption of RPM. Additionally, there is a growing emphasis on patient-centered care, and RPM empowers patients to actively participate in their health management. This aligns with the trend towards personalized medicine and patient engagement driving the RPM market during the forecast period. However, regulatory variations across regions and the informal use of social media practices could restrain market growth during the forecast period.

Global Remote Patient Monitoring Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Remote Patient Monitoring Market Dynamics

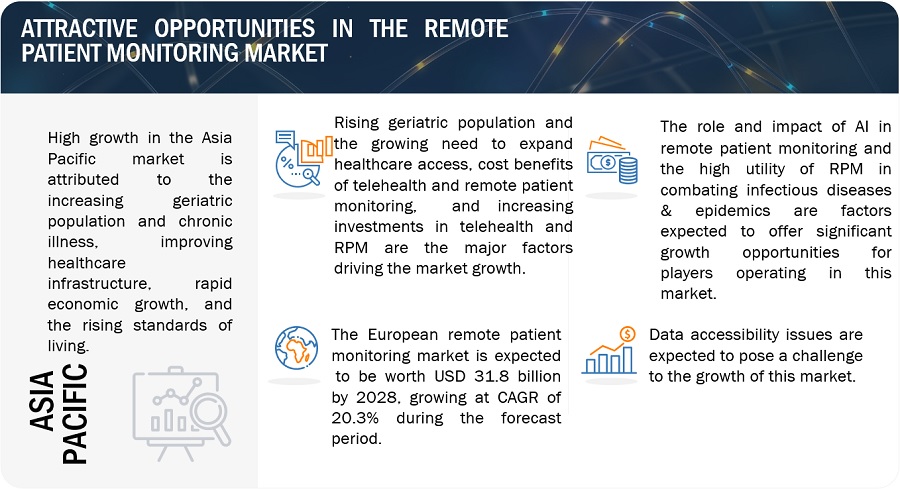

Driver: Rising geriatric population and growing need to expand healthcare access

The expanding geriatric demographic is a pivotal driver of growth in the Remote Patient Monitoring (RPM) market. This market segment is flourishing due to several key factors. Firstly, as the elderly are more susceptible to chronic ailments, RPM's capability to monitor and manage these conditions is in high demand. The elderly often require frequent medical attention, which can be costly, making RPM a cost-effective solution to minimize healthcare expenditures. Furthermore, the desire of many seniors to age in the comfort of their homes has given rise to the concept of 'aging in place.' RPM supports this notion by providing remote health monitoring, enhancing independence, and reducing the load on healthcare facilities. With mobility constraints common among the elderly, RPM, combined with telehealth, offers remote consultations and check-ups, increasing accessibility.

Restraint: Healthcare Fraud

Healthcare fraud poses a significant challenge that restrains the growth of the Remote Patient Monitoring (RPM) market. The healthcare industry's vulnerability to fraudulent activities can erode trust and hinder the wider adoption of RPM solutions. ealthcare fraud can involve data breaches and the unauthorized access of patient information. Concerns about data security and privacy breaches can undermine confidence in RPM systems, as individuals worry about the safety of their personal health data. To overcome these challenges, healthcare stakeholders must prioritize fraud detection and prevention measures, including robust authentication and authorization processes, strict adherence to regulatory requirements, and transparent billing practices

Challenge: behavioral barriers, healthcare affordability, and the lack of awareness

Behavioral barriers are less obvious but still important barriers to the adoption of telehealth and telemedicine. Many individuals, including both patients and healthcare providers, are resistant to change. They may be comfortable with traditional healthcare delivery methods and may be unwilling to embrace new technology or ways of managing healthcare. This resistance can impede the adoption of RPM services. Additionally, patients and even some healthcare providers may have limited awareness and understanding of RPM services. They may not fully comprehend the benefits of remote monitoring or how to use the technology effectively.

Opportunity: high utility of RPM in combating infectious diseases and epidemics

Infectious diseases are among the most difficult conditions to treat in hospital facilities, as both patients and healthcare workers are at equal risk of contracting the infection. In such cases, telemedicine has great potential to limit the spread of epidemics and healthcare-associated infections owing to its inherent benefits, such as the early detection of diseases and virtual visits, consequently reducing overall patient exposure. It certainly reduces the total number of in-person visits and travel included in the process of treatment. It is a safer mode of care delivery and slows down the spread of infectious diseases.

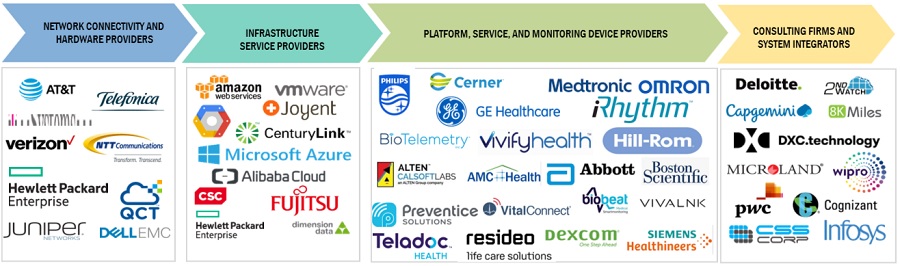

Remote Patient Monitoring Industry Ecosystem Map

Software and services segment is expected to grow at the highest rate of remote patient monitoring industry during the forecast period

Based on product, remote patient monitoring is segmented into software & services and devices. The software & services segment is projected to register a higher CAGR during the forecast period. The high growth rate of this segment is mainly due to the rising inclination towards preventive care adoption outside of a hospital settings among patients and other end users, convenience and utility of RPM devices, and adoption of AI.

Diabetes segment accounted for the largest share of the remote patient monitoring industry, by application, in 2022

Based on application, the global remote patient monitoring market is broadly segmented into oncology, cardiovascular diseases, diabetes, sleep disorders, weight management and fitness monitoring. The diabetes segment accounted for the largest share of the global market in 2022. This can be attributed to the prevalence and chronic nature of diabetes, and technological advancements.

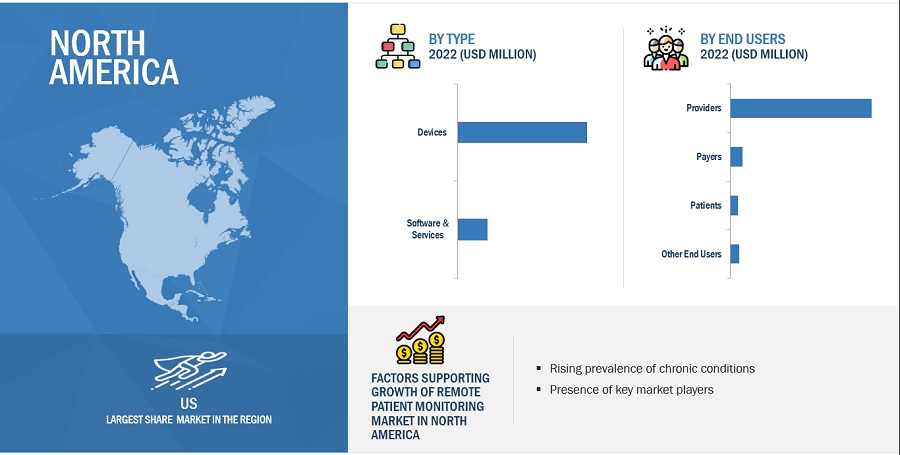

Providers segment accounted for the largest share of the remote patient monitoring industry, by end user, in 2022

Based on end users, the global remote patient monitoring market is broadly segmented into providers, payers, patients, and other end users. The providers' segment accounted for the largest share of the global market in 2022. This can be attributed to the advancements in RPM monitoring devices , increased adoption of remote monitoring in chronically ill and old aged patients, and the increasing number of RPM services offered by providers.

North America accounted for the largest share of the global remote patient monitoring industry in 2022.

In 2022, North America accounted for the largest share of the remote patient monitoring market, The large share of North America in the RPM market can be attributed to the rising funding investments for telehealth, increasing focus on the adoption of IoT medical devices in the region, and favourable reimbursement policies.

To know about the assumptions considered for the study, download the pdf brochure

Some of the key players include Biotronik SE & Co. KG (Germany), Alive Cor, Inc. (US), TytoCare Ltd. (US), Teledoc Health Inc. (US), Vivify Health, Inc. (US), Koninklijke Philips N.V. (Netherlands), Brook Inc. (US), Blue Spark Technology (US), Welch Allyn (US), Health Beats (Singapore),Medtronic (Ireland), Oracle (US), Siemens Healthineers AG (Germany), Omron Healthcare (Japan), Boston Scientific Corporation (US), Clear Arch, Inc (US), GE Healthcare (US), Abbott Laboratories (US), Alten Calsoft Labs (France), Bio-Beat (Israel), VitalConnect (US), VivaLNK Inc. (US), Bardy Diagnsotics, Inc. (US), and iRhythm Technologies (US).

Scope of the Remote Patient Monitoring Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$71.9 billion |

|

Projected Revenue Size by 2028 |

$207.5 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 23.6% |

|

Market Driver |

Rising geriatric population and growing need to expand healthcare access |

|

Market Opportunity |

high utility of RPM in combating infectious diseases and epidemics |

The study categorizes the remote patient monitoring market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Services & Software

-

Devices

- Cardiac Monitoring Devices

- Neurological Monitoring Devices

- Respiratory Monitoring Devices

- Multiparameter Monitoring Devices

- Blood Glucose Monitoring Devices

- Fetal & Neonatal Monitoring Devices

- Weight Monitoring Devices

- Other Monitoring Devices

By Application

- Oncology

- Cardiovascular Diseases

- Diabetes

- Sleep Disorders

- Weight Management & Fitness Monitoring

By End User

-

Providers

- Hospitals and Clinics

- Home Care Settings and Long Term Care Centers

- Ambulatory Care Centers

- Other End Users

- Passive Exoskeletons

- Payers

- Patients

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (LATAM)

- Middle East & Africa

Recent Developments of Remote Patient Monitoring Industry:

- In August 2023, EPIC Health, collaborated to address health inequities and reduce heart attack and stroke risk in underserved Detroit communities. The program will feature VitalSight, OMRON’s first remote patient monitoring service designed specifically for patients afflicted by high blood pressure and especially those with uncontrolled Stage 2 hypertension.

- In August 2022, Medtronic plc had announced it has entered into a strategic partnership with BioIntelliSense, a continuous health monitoring and clinical intelligence company, for the exclusive U.S. hospital and 30-day post-acute hospital to home distribution rights of the BioButton multi-parameter wearable for continuous, connected monitoring. The partnership enables the Medtronic Patient Monitoring business to offer access to a medical grade device that provides continuous vital sign measurements of general care patients in-hospital as well as post-discharge.

- In July 2022, Biobeat has partnered with Medidata Solutions and become part of the Sensor Cloud Network. By using Biobeat’s medical-grade wearables, they are able to enhance clinical trials with vital signs collection to generate real-world evidence remotely and conveniently from the patient’s home.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global remote patient monitoring market?

The global remote patient monitoring market boasts a total revenue value of $207.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global remote patient monitoring market?

The global remote patient monitoring market has an estimated compound annual growth rate (CAGR) of 23.6% and a revenue size in the region of $71.9 billion in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

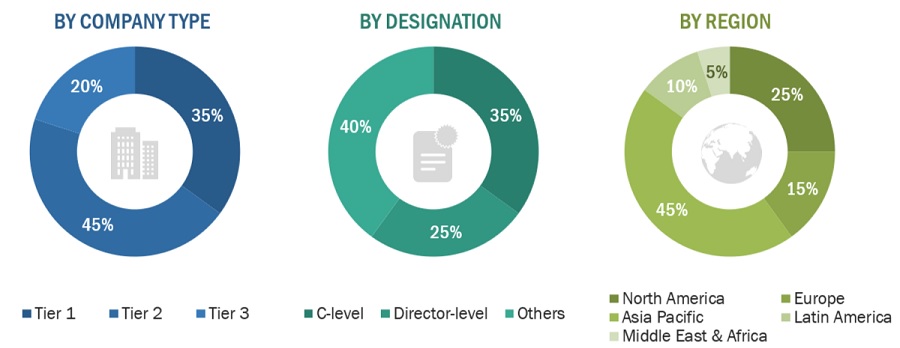

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global remote patient monitoring market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the blood collection devices market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, ATA, AHA and OECD. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global remote patient monitoring market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global remote patient monitoring market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as Individual Physicians, Physician Groups, Hospitals, Clinics and Other Healthcare Facilities, Payers- Private and Public Insurance Bodies, Other End Users- Employer Groups and Government Bodies) and supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Note 1: C-level primaries include CEOs, CFOs, and COOs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million..

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Medtronic |

Product Manager |

|

Koninklijke Philips N.V. |

Chief Technology Officer |

|

Oracle |

Vice President of Technology |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global remote patient monitoring market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of remote patient monitoring products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the remote patient monitoring market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market

Remote Patient Monitoring Market Size: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the remote patient monitoring market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market.

Market Definition

Remote patient monitoring, or RPM, is a part of the telehealth market. RPM involves using digital technologies to collect medical or other forms of health data from individuals in one location and electronically transmit that information securely to health care providers in a different location for assessment and recommendations.

RPM enables care professionals to track patient activities and vital signs from a distance or even at different times. Connected electronic devices record patient vitals and transmit them to the caregiver. Patients are connected to an external monitoring center through a central system that feeds information from sensors and monitoring equipment.

Key Stakeholders

- RPM Equipment Manufacturers

- Suppliers and Distributors of RPM Equipment

- Healthcare IT Service Providers

- Healthcare Insurance Companies/Payers

- Healthcare Institutions/Providers (Hospitals, Clinics, Medical Groups, Physician Practices, Diagnostic Centers, and Outpatient Clinics)

- Venture Capitalists

- Government Bodies/Regulatory Bodies

- Corporate Entities

- Accountable Care Organizations

- RPM Resource Centers

- Research and Consulting Firms

- Medical Research Institutes

- Clinical Departments

Report Objectives

- To define, describe, and forecast the remote patient monitoring market based on type, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall remote patient monitoring market

- To analyze opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to five main regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

- To profile key players and analyze their market shares and core competencies2

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, and collaborations, in the overall remote patient monitoring market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 25)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Remote Patient Monitoring Market

Can you explain your reasoning around the projection of the $72.8 Billion Mkt for RPM in North America? Thanks

Which are growth driving factors for the global growth of Remote Patient Monitoring Market?

What will be the size of the Remote Patient Monitoring Market for the European region?