The Automotive Augmented Reality (AR) and Virtual Reality (VR) market is rapidly transforming the automotive industry by integrating immersive technologies into design, manufacturing, and customer experience processes. AR and VR solutions are being utilized for virtual prototyping, driver-assistance systems, and immersive showrooms, allowing manufacturers and consumers to interact with vehicles in digital environments before physical production or purchase. In manufacturing, VR enables engineers to simulate assembly lines and test vehicle ergonomics, while AR enhances maintenance, repair, and training operations by overlaying digital instructions onto real-world components. The market is driven by growing investments in connected vehicles, smart mobility solutions, and autonomous driving technologies, with North America, Europe, and Asia-Pacific leading adoption due to strong R&D infrastructure, technological innovation, and increasing consumer demand for interactive automotive experiences.

Augmented and Virtual Reality in Healthcare Market by Offering (Hardware and Software), Device Type, End User, Application (Patient Care Management, Medical Training & Education, Pharmacy Management, Surgery), and Geography - Global Forecast to 2023

Augmented and Virtual Reality in Healthcare Market was valued at USD 504.5 Million in 2016 and is expected to reach USD 4,997.9 Million by 2023, at a CAGR of 36.6% during the forecast period. The base year considered for this study is 2016, and the forecast period considered is between 2017 and 2023.

The Augmented and Virtual Reality (AR & VR) in Healthcare market is rapidly evolving as immersive technologies transform diagnosis, treatment, training, and patient care. AR and VR allow clinicians, medical students, and patients to interact with 3D environments, simulate complex procedures, and enhance therapeutic outcomes without real-world risks. With advances in hardware like head-mounted displays and smart glasses, alongside sophisticated software applications, healthcare providers are increasingly adopting AR & VR solutions to improve clinical efficiency and patient experiences.

This growth trajectory reflects the utility of AR & VR in medical training, surgery planning and guidance, patient care management, pharmacy processes, and other clinical applications. Technologies that offer real-time interactivity, enhanced visualization, and immersive learning environments are gaining rapid adoption across healthcare settings worldwide.

The Augmented and Virtual Reality in Healthcare Market is experiencing rapid growth, driven by technological advancements, increasing demand for innovative medical training solutions, and rising adoption of AR and VR in patient care. AR and VR technologies enable realistic simulations, offering healthcare professionals enhanced training tools for complex surgical procedures and diagnostics. Additionally, these technologies are transforming patient engagement by providing immersive therapies, especially for mental health treatments and pain management. The growing investment in digital healthcare and the push toward telemedicine also propel the adoption of AR and VR, as they provide remote care solutions and enable visualization of patient data. This market growth is further fueled by improved hardware accessibility, with more affordable and portable VR headsets and AR devices, making it easier for healthcare facilities to integrate these solutions into daily operations.

The augmented and virtual reality in healthcare market is expanding swiftly as demand rises for immersive technologies that enhance patient care, medical training, and treatment outcomes. AR and VR are transforming healthcare by enabling detailed visualization for complex surgeries, creating interactive training environments for medical professionals, and offering therapeutic applications for pain management and mental health. Key trends driving this growth include advancements in wearable technology, which make AR/VR devices more comfortable and accessible for healthcare settings, and the integration of AI, allowing for highly personalized and precise simulations. Additionally, the surge in remote healthcare solutions and telemedicine is accelerating the adoption of these technologies, providing patients and professionals with immersive, real-time experiences even from a distance. As AR and VR continue to prove their value in improving both patient outcomes and practitioner skill sets, the market is positioned for substantial growth, with ongoing innovations expanding their use cases across multiple healthcare applications.

The AR and VR market has witnessed rapid growth over the past few years, driven by advancements in immersive technologies and their adoption across multiple industries. Augmented reality (AR) overlays digital information onto the real-world environment, while virtual reality (VR) creates entirely simulated experiences. Together, these technologies are transforming sectors such as healthcare, education, gaming, retail, and manufacturing. In healthcare, AR and VR are increasingly used for surgical planning, patient care management, and medical training, offering realistic simulations and reducing operational risks.

The AR/VR market is a rapidly expanding segment within the global technology landscape, encompassing both augmented reality and virtual reality solutions. AR/VR technologies are being adopted in healthcare, retail, education, and manufacturing to deliver immersive experiences, improve operational efficiency, and enhance training programs. In healthcare, AR/VR platforms enable medical professionals to visualize patient anatomy, rehearse surgeries, and provide patient-centric therapy, transforming traditional treatment and educational methods. The rising demand for smart, interactive solutions is fueling adoption of AR/VR across both commercial and consumer sectors.

Key Trends Driving Market Growth

The AR & VR in healthcare market is shaped by several major trends that elevate industry demand and technological sophistication:

• Advanced Hardware Development

High-performance devices such as head-mounted displays, smart glasses, and motion tracking systems provide realistic simulation and visualization capabilities essential for clinical and training applications.

• Increasing Software Innovation

Software platforms that support surgical simulations, patient care workflows, and remote therapy drive demand for tailored applications that enhance specific healthcare outcomes.

• Rising Adoption of AR & VR in Surgery

AR interfaces help surgeons overlay digital information onto real anatomy during procedures, while VR enables safe rehearsal of complex surgeries, improving precision and patient outcomes.

• Growth in Medical Training & Education

Healthcare professionals benefit from immersive educational environments that allow repeated practice and assessment without risks, expanding competence in advanced medical techniques.

• Telemedicine & Remote Care Integration

AR & VR technologies support telehealth by creating interactive platforms for remote diagnosis, therapy, and patient engagement, especially crucial in underserved areas.

These trends not only enhance clinical capabilities but also unlock broader uses of AR & VR across the healthcare ecosystem.

Market Segmentation

To understand the AR & VR in healthcare market more deeply, it is segmented by offering, device type, end user, and application:

By Offering

-

Hardware: Devices like VR headsets, smart glasses, and mixed-reality equipment comprise a major share due to their role in enabling immersive experiences.

-

Software: Software applications include simulation platforms, training modules, and clinical management tools that support AR & VR use cases.

By Device Type

-

Augmented Reality Devices: Overlay digital insights onto real-world settings, aiding surgery planning and medical imaging.

-

Virtual Reality Devices: Provide fully immersive environments, enabling surgical rehearsal, therapy, and patient education.

By End User

-

Hospitals: Hold the largest share as they invest in AR & VR for clinical care, diagnostics, and therapy.

-

Clinics & Surgical Centers: Adopt these technologies to improve procedural outcomes and patient engagement.

-

Academic & Research Institutions: Use AR & VR for medical education and research applications.

-

Government & Defense Institutions: Implement AR & VR for training and specialized healthcare programs.

By Application

-

Patient Care Management: Immersive support tools that enhance patient interaction, education, and personalized treatment paths.

-

Medical Training & Education: Simulated environments used to train medical staff and students in real-world skills.

-

Pharmacy Management: AR & VR systems that support drug discovery, training, and workflow management.

-

Surgery: A leading application area where AR overlays guidance and VR provides rehearsal spaces for surgical teams.

This segmentation reflects the broad applicability of AR & VR technologies across healthcare workflows.

Industry Analysis & Competitive Landscape

The AR & VR in healthcare market is competitive, with many global players investing in technology development, partnerships, and healthcare integrations:

Key Companies Include:

-

Microsoft (HoloLens & Mesh) — Provides mixed reality solutions for medical training and surgery planning.

-

Google & Oculus (Meta platforms) — Offer VR ecosystems that support immersive healthcare education and therapy.

-

CAE Healthcare — Specializes in VR training simulators for medical education.

-

Philips Healthcare — Integrates AR & VR into diagnostic imaging and clinical workflows.

-

Siemens Healthineers — Develops AR-enhanced imaging and procedural support tools.

-

Intuitive Surgical — Uses VR for robot-assisted surgery training and planning.

Regional Market Dynamics

-

North America: Dominates due to strong healthcare infrastructure, R&D investments, and early technology adoption.

-

Europe: Steady growth supported by digital health initiatives and integration into medical curricula.

-

Asia Pacific: Rapidly growing market, primed by rising healthcare access and embracing telehealth solutions.

The presence of tech giants, medical device innovators, and strong academia-industry collaborations accelerates competitive intensity and innovation across segments.

Future Outlook & Market Forecast

The future of the AR & VR in healthcare market looks highly promising as technological maturity and healthcare needs converge:

-

Continued Market Growth: With forecasts indicating expansion to around USD?30?billion by 2034, AR & VR will become core tools in clinical decision-making, training, and patient engagement.

-

Advances in Edge Computing & 5G: Faster networks and edge analytics will support higher-resolution, real-time experiences crucial for remote therapy and surgical assistance.

-

Personalized Patient Care: AR & VR applications will increasingly support tailored treatment plans, mental health therapy, and rehabilitation outcomes.

-

Integration with AI: Artificial intelligence will further enhance simulation accuracy, automate diagnostics, and provide predictive insights.

As healthcare continues its digital transformation, immersive technologies like AR and VR will play vital roles from medical education to bedside care.

The objectives of Augmented and Virtual Reality in Healthcare Market Study are as follows:

- To define, describe, and forecast the market for augmented reality in healthcare and virtual reality in healthcare, in terms of value, on the basis of offering, device type, end user, application, and geography

- To forecast the market size for various segments with regard to four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments in augmented and virtual reality in healthcare market

- To use the value chain analysis and market roadmaps to study the evolution and timeline of augmented reality in healthcare and virtual reality in healthcare

- To analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the market for augmented reality in healthcare and virtual reality in healthcare

- To strategically profile key players, comprehensively analyze their market share and core competencies and describe the competitive landscape of the augmented and virtual reality in healthcare market

The augmented reality and virtual reality in healthcare market was valued at USD 769.2 Million in 2017 and is expected to reach USD 4,997.9 Million by 2023, at a CAGR of 36.6% during the forecast period. The increasing penetration of connected devices in the healthcare sector, increased investment in the AR and VR healthcare, and the growing need to reduce the healthcare cost are the major drivers for the augmented and virtual reality in healthcare market.

This report covers the augmented and virtual reality in healthcare market on the basis of offering, device type, end user, application, and geography.

The patient care management application would lead the market for augmented reality in healthcare and virtual reality in healthcare. The use of AR and VR in therapies and rehabilitation would boost the augmented reality in healthcare and virtual reality in healthcare market. The rehabilitation includes brain injury, stroke, and physical therapy among other applications.

The head-mounted displays will hold a major share of the augmented reality in healthcare and virtual reality in healthcare market. Head-mounted displays are the most promising devices to boost the growth of the market for augmented reality in healthcare and virtual reality in healthcare. The use of HMDs in applications such as pharmacy management, patient care management, and medical training and education would be the major driver for the growth of HMDs in augmented and virtual reality in healthcare market.

The end-user segment would comprise hospitals, clinics, and surgical centers during the forecast period. Key challenges faced by hospitals and clinics are data management and clinical operations management due to the increasing number of patients with chronic diseases and the growing need for improved patient outcomes. Technological innovations help healthcare centers improve the service quality by providing care at low cost with less time to service.

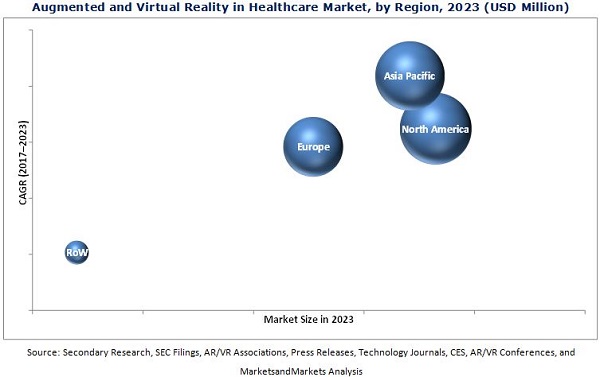

North America is expected to lead augmented reality in healthcare and virtual reality in healthcare market in terms of market size, and APAC is likely to witness the highest growth rate by 2023. The increase in research and development and the growing acceptance of newer technologies in APAC are the drivers for augmented and virtual reality in healthcare market.

The lack of competence in the deployment of AR and VR solutions and lack of expertise among medical practitioners to adopt new technologies are major restraints for the market in augmented reality in healthcare and virtual reality in healthcare.

Key Highlights: Augmented and Virtual Reality in Healthcare Market

-

Hardware Dominance: Head-mounted displays, smart glasses, and motion-tracking devices represent the largest segment, essential for enabling AR & VR applications in clinical and educational settings.

-

Software Growth: VR & AR software platforms for surgical simulation, patient care management, medical training, and pharmacy management are witnessing rapid growth due to rising demand for customized healthcare solutions.

-

Key Applications:

-

Patient Care Management: Enhances patient engagement, education, and therapy.

-

Medical Training & Education: Provides immersive, risk-free simulation environments.

-

Surgery: Supports preoperative planning, intraoperative guidance, and skill development.

-

Pharmacy Management: Facilitates drug training, workflow management, and process optimization.

-

-

End Users: Hospitals dominate the market, followed by clinics, surgical centers, research institutions, and government healthcare programs.

-

Regional Insights: North America leads due to advanced infrastructure and high R&D investment; Europe and Asia Pacific are growing rapidly due to digital health adoption and smart hospital initiatives.

-

Trends & Innovations: Integration with AI, 5G, and cloud/edge computing enhances real-time performance, predictive analytics, and immersive experiences for both patients and medical professionals.

-

Market Drivers: Increasing demand for precision medicine, cost-effective training solutions, telemedicine adoption, and immersive therapy options are major growth drivers.

-

Challenges: High initial costs, device interoperability issues, and privacy/security concerns may slow adoption in certain regions.

-

Future Outlook: AR & VR are expected to become core tools in healthcare, revolutionizing surgery, patient engagement, education, and operational efficiency across global healthcare systems.

This report discusses the drivers, restraints, opportunities, and challenges pertaining to the augmented and virtual reality in healthcare market. In addition, it analyzes the current market scenario and forecasts the market size till 2023. Some major companies operating in the market for augmented reality in healthcare and virtual reality in healthcare are Google (US), Microsoft (US), DAQRI (US), Psious (Spain), Mindmaze (Switzerland), Firsthand Technology (US), Medical Realities (UK), Atheer (US), Augmedix (US), and Oculus VR (US). The other major players in the market include CAE Healthcare (US), Philips Healthcare (Netherlands & US), 3D Systems (US), VirtaMed (Switzerland), HTC (Taiwan), Siemens Healthineers (Germany), and Virtually Better (US).

Frequently Asked Questions (FAQs): Augmented and Virtual Reality in Healthcare Market

Which segment holds the largest share in this market?

The hardware segment, including head-mounted displays, smart glasses, and motion-tracking devices, currently dominates due to its essential role in enabling immersive AR & VR experiences.

What are the key applications of AR & VR in healthcare?

The primary applications include:

-

Patient Care Management – immersive therapy, education, and engagement

-

Medical Training & Education – risk-free simulations for students and professionals

-

Surgery – planning, guidance, and rehearsal

-

Pharmacy Management – workflow optimization and drug training

Which regions lead the AR & VR in healthcare market?

North America leads globally due to advanced healthcare infrastructure, high R&D investment, and early technology adoption. Europe and Asia Pacific are growing rapidly due to smart hospital initiatives and digital health adoption.

What are the main factors driving growth in this market?

Growth is driven by increasing adoption of immersive healthcare solutions, precision medicine, telemedicine expansion, and cost-effective training tools, along with integration of AI, cloud computing, and 5G for enhanced real-time performance.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities for the AR and VR in Healthcare Market

4.2 Augmented and Virtual Reality in Healthcare Market in APAC

4.3 AR and VR in Healthcare Market: Developed vs Developing Markets, 2017 and 2023 (USD Million)

4.4 Augmented and Virtual Reality in Healthcare Market, By Country (2017–2023)

4.5 Augmented Reality (AR) and Virtual Reality (VR) in Healthcare Market, By Application

4.6 VR in Healthcare Market, By Device Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Augmented and Virtual Reality in Healthcare Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Penetration of Connected Devices in the Healthcare Sector

5.2.1.2 Increased Investment in the Healthcare AR and VR

5.2.1.3 Growing Need to Reduce the Healthcare Costs

5.2.2 Restraints

5.2.2.1 Lack of Competence in Deployment of the AR and VR Solutions

5.2.2.2 Lack of Expertise Among Medical Practitioners to Adopt New Technologies

5.2.3 Opportunities

5.2.3.1 Increasing Demand for AR and VR in Emerging Markets

5.2.3.2 Increased Use of Augmented Reality and Virtual Reality in Fitness Management

5.2.4 Challenges

5.2.4.1 Overcoming Social Challenges

5.2.4.2 Concerns Regarding Data Privacy

5.2.4.3 Lack of Compatibility and Interoperability Between AR and VR Solutions Offered By Different Vendors

5.3 Value Chain Analysis

5.4 Technologies in Augmented Reality and Virtual Reality in Healthcare Market

5.4.1 AR Technology

5.4.1.1 Marker-Based AR

5.4.1.1.1 Passive Marker

5.4.1.1.2 Active Marker

5.4.1.2 Markerless AR

5.4.1.2.1 Model-Based Tracking

5.4.1.2.2 Image Processing-Based Tracking

5.4.2 VR Technology

5.4.2.1 Nonimmersive Technology

5.4.2.2 Semi-Immersive and Fully Immersive Technologies

6 Augmented Reality and Virtual Reality in Healthcare Market, By Offering (Page No. - 45)

6.1 Introduction

6.2 Hardware

6.3 AR and VR Hardware Components

6.3.1 Sensors

6.3.1.1 Accelerometer

6.3.1.2 Gyroscope

6.3.1.3 Magnetometer

6.3.1.4 Proximity Sensor

6.3.2 Semiconductor Component

6.3.2.1 Controller/Processor

6.3.2.2 Integrated Circuits

6.3.3 Displays and Projectors

6.3.4 Position Tracker

6.3.5 Cameras

6.3.6 Others

6.4 Software

6.4.1 Software Development Kits

6.4.2 Cloud-Based Services

7 Augmented Reality and Virtual Reality in Healthcare Market, By Device Type (Page No. - 54)

7.1 Introduction

7.2 AR Healthcare Market, By Device Type

7.2.1 Head-Mounted Display

7.2.2 Handheld Device

7.3 VR Healthcare Market, By Device Type

7.3.1 Head-Mounted Display

7.3.2 Gesture-Tracking Device

7.3.2.1 Data Gloves

7.3.2.2 Others

7.3.3 Projectors and Display Walls

8 AR and VR Healthcare Market, By End User (Page No. - 61)

8.1 Introduction

8.2 Hospitals, Clinics, and Surgical Centers

8.3 Research Organizations and Pharma Companies

8.4 Government and Defense Institutions

8.5 Research and Diagnostics Laboratories

8.6 Others

9 Augmented Reality and Virtual Reality in Healthcare Market, By Application (Page No. - 70)

9.1 Introduction

9.2 Surgery

9.3 Fitness Management

9.4 Patient Care Management

9.5 Pharmacy Management

9.6 Medical Training and Education

9.7 Others

10 Geographic Analysis (Page No. - 83)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 UK

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Rest of APAC

10.5 Rest of the World

10.5.1 Middle East & Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 106)

11.1 Introduction

11.2 Competitive Scenario

11.2.1 Battle for Market Share: Product Launches and Developments Were the Key Strategies Between 2013 and 2017

12 Company Profiles (Page No. - 110)

12.1 Introduction

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

12.2 Google

12.3 Microsoft

12.4 Daqri

12.5 Psious

12.6 Mindmaze

12.7 Firsthand Technology

12.8 Atheer

12.9 Medical Realities

12.10 Augmedix

12.11 Oculus VR

12.12 Start-Up Ecosystem

12.12.1 Echopixel

12.12.2 Osso VR

12.12.3 Surgical Theatre

12.12.4 Orca Health

12.12.5 Widerun

12.13 Promising Companies

12.13.1 Samsung Electronics

12.13.2 Osterhout Design Group

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 135)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (60 Tables)

Table 1 Augmented and Virtual Reality in Healthcare Market, By Offering, 2015–2023 (USD Million)

Table 2 AR and VR in Healthcare Market, By Component, 2015–2023 (USD Million)

Table 3 AR Healthcare Market for Software, By Application, 2015–2023 (USD Million)

Table 4 VR Healthcare Market for Software, By Application, 2015–2023 (USD Million)

Table 5 AR Healthcare Market, By Device Type, 2015–2023 (USD Thousand)

Table 6 AR Healthcare Market for Device Type, By Application, 2015–2023 (USD Million)

Table 7 VR Healthcare Market, By Device Type, 2015–2023 (USD Million)

Table 8 VR Healthcare Market for Device Type, By Application, 2015–2023 (USD Million)

Table 9 Augmented and Virtual Reality in Healthcare Market, By End User, 2015–2023 (USD Million)

Table 10 VR Healthcare Market, By End User, 2015–2023 (USD Million)

Table 11 AR Healthcare Market for Hospitals, Clinics, and Surgical Centers, By Region, 2015–2023 (USD Million)

Table 12 VR Healthcare Market for Hospitals, Clinics, and Surgical Centers, By Region, 2015–2023 (USD Million)

Table 13 AR Healthcare Market for Research Organizations and Pharma Companies, By Region, 2015–2023 (USD Million)

Table 14 VR Healthcare Market for Research Organizations and Pharma Companies, By Region, 2015–2023 (USD Million)

Table 15 Augmented and Virtual Reality in Healthcare Market for Government and Defense Institutions, By Region, 2015–2023 (USD Million)

Table 16 VR Healthcare Market for Government and Defense Institutions, By Region, 2015–2023 (USD Million)

Table 17 AR Healthcare Market for Research and Diagnostics Laboratories, By Region, 2015–2023 (USD Million)

Table 18 VR Healthcare Market for Research and Diagnostics Laboratories, By Region, 2015–2023 (USD Million)

Table 19 AR Healthcare Market for Others, By Region, 2015–2023 (USD Million)

Table 20 VR Healthcare Market for Others, By Region, 2015–2023 (USD Million)

Table 21 AR Healthcare Market, By Application, 2015–2023 (USD Million)

Table 22 VR Healthcare Market, By Application, 2015–2023 (USD Million)

Table 23 Augmented and Virtual Reality in Healthcare Market for Surgery Application, By Technology, 2017–2023 (USD Million)

Table 24 AR Healthcare Market for Surgery Application, By Region, 2017–2023 (USD Million)

Table 25 VR Healthcare Market for Surgery Application, By Region, 2017–2023 (USD Million)

Table 26 Market for Fitness Management Application, By Technology, 2015–2023 (USD Million)

Table 27 AR Healthcare Market for Fitness Management Application, By Region, 2015–2023 (USD Million)

Table 28 VR Healthcare Market for Fitness Management Application, By Region, 2015–2023 (USD Million)

Table 29 Augmented Reality and Virtual Reality in Healthcare Market for Patient Care Management Application, By Technology, 2015–2023 (USD Million)

Table 30 AR Healthcare Market for Patient Care Management Application, By Region, 2015–2023 (USD Million)

Table 31 VR Healthcare Market for Patient Care Management Application, By Region, 2015–2023 (USD Million)

Table 32 Market for Pharmacy Management Application, By Technology, 2015–2023 (USD Million)

Table 33 AR Healthcare Market for Pharmacy Management Application, By Region, 2015–2023 (USD Million)

Table 34 VR Healthcare Market for Pharmacy Management Application, By Region, 2015–2023 (USD Million)

Table 35 Augmented and Virtual Reality in Healthcare Market for Medical Training and Education Application, By Technology, 2015–2023 (USD Million)

Table 36 AR Healthcare Market for Medical Training and Education Application, By Region, 2015–2023 (USD Million)

Table 37 VR Healthcare Market for Medical Training and Education Application, By Region, 2015–2023 (USD Million)

Table 38 Market for Other Applications, By Technology, 2015–2023 (USD Million)

Table 39 AR Healthcare Market for Other Applications, By Region, 2015–2023 (USD Million)

Table 40 VR Healthcare Market for Other Applications, By Region, 2015–2023 (USD Million)

Table 41 AR in Healthcare Market, By Region, 2015–2023 (USD Million)

Table 42 VR in Healthcare Market, By Region, 2015–2023 (USD Million)

Table 43 AR Healthcare Market in North America, By End User, 2015–2023 (USD Million)

Table 44 VR Healthcare Market in North America, By End User, 2015–2023 (USD Million)

Table 45 AR Healthcare Market in North America, By Country, 2015–2023 (USD Million)

Table 46 Augmented and Virtual Reality in Healthcare Market in North America, By Country, 2015–2023 (USD Million)

Table 47 AR Healthcare Market in Europe, By End User, 2015–2023 (USD Million)

Table 48 VR Healthcare Market in Europe, By End User, 2015–2023 (USD Million)

Table 49 AR Healthcare Market in Europe, By Country, 2015–2023 (USD Million)

Table 50 VR Healthcare Market in Europe, By Country, 2015–2023 (USD Million)

Table 51 AR Healthcare Market in APAC, By End User, 2015–2023 (USD Million)

Table 52 VR Healthcare Market in APAC, By End User, 2015–2023 (USD Million)

Table 53 AR Healthcare Market in APAC, By Country, 2015–2023 (USD Million)

Table 54 VR Healthcare Market in APAC, By Country, 2015–2023 (USD Million)

Table 55 AR Healthcare Market in RoW, By End User, 2015–2023 (USD Million)

Table 56 VR Healthcare Market in RoW, By End User, 2015–2023 (USD Million)

Table 57 AR Healthcare Market in RoW, By Region, 2015–2023 (USD Million)

Table 58 Augmented Reality and Virtual Reality in Healthcare Market in RoW, By Region, 2015–2023 (USD Million)

Table 59 Ranking of the Top 5 Hardware Device Players in the AR and VR in Healthcare Market

Table 60 Ranking of Top Technology Players in the AR and VR in Healthcare Market

List of Figures (38 Figures)

Figure 1 Market Segmentation

Figure 2 Augmented and Virtual Reality in Healthcare Market: Research Design

Figure 3 Bottom-Up Approach to Arrive at the Market Size

Figure 4 Top-Down Approach to Arrive at the Market Size

Figure 5 Data Triangulation Methodology

Figure 6 Augmented Reality and Virtual Reality in Healthcare Market, 2015–2023 (USD Million)

Figure 7 Software to Lead the AR and VR in Healthcare Market

Figure 8 Patient Care Management Expected to Lead the AR and VR in Healthcare Market Between 2017 and 2023

Figure 9 North America Held the Largest Share of the AR and VR in Healthcare Market in 2016

Figure 10 North America Expected to Lead the Augmented and Virtual Reality in Healthcare Market for Hospitals, Clinics, & Surgical Centers During the Forecast Period

Figure 11 Augmented Reality and Virtual Reality in Healthcare Market Expected to Grow at A High Rate Between 2017 and 2023

Figure 12 China Expected to Hold the Largest Share of the AR and VR in Healthcare Market in APAC By 2023

Figure 13 China Expected to Grow at the Highest CAGR in the AR and VR in Healthcare Market By 2023

Figure 14 Augmented Reality and Virtual Reality in Healthcare Market in China Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 15 Patient Care Management Expected to Dominate the AR and VR in Healthcare Market During the Forecast Period

Figure 16 Head-Mounted Displays Expected to Dominate the VR in Healthcare Market By 2023

Figure 17 Increasing Penetration of Connected Devices in the Healthcare Sector Expected to Drive the Growth of the AR and VR in Healthcare Market

Figure 18 Increasing Investment in the AR and VR Sector Expected to Drive the Augmented and Virtual Reality in Healthcare Market

Figure 19 Value Chain Analysis (2016): Major Values are Added During Research and Product Development, and Manufacturing Stages

Figure 20 Software Expected to Dominate the AR and VR in Healthcare Market During the Forecast Period

Figure 21 Displays and Projectors Dominated the AR and VR in Healthcare Market During the Forecast Period

Figure 22 Augmented Reality and Virtual Reality in Healthcare Market for Surgery Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 VR Healthcare Market for Surgery Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 AR Healthcare Market for HMDS Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 VR Healthcare Market for Head-Mounted Displays Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Augmented Reality and Virtual Reality in Healthcare Market for Research & Diagnostics Laboratories Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 VR Market for Research Organizations and Associations Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 AR Healthcare Market for Surgery Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 VR Healthcare Market for Surgery Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Geographic Snapshot: AR and VR in Healthcare Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 31 US to Hold Largest Size of Augmented and Virtual Reality in Healthcare Market By 2023

Figure 32 US to Hold Largest Size of VR in Healthcare Market By 2023

Figure 33 North America: Augmented Reality and Virtual Reality in Healthcare Market Snapshot

Figure 34 Europe: Augmented Reality and Virtual Reality in Healthcare Market Snapshot

Figure 35 APAC: Augmented and Virtual Reality in Healthcare Market Snapshot

Figure 36 Key Developments By Leading Players in the Market Between 2013 and 2017

Figure 37 Google: Company Snapshot

Figure 38 Microsoft: Company Snapshot

The research methodology includes the use of primary and secondary data. Both top-down and bottom-up approaches have been used to estimate and validate the size of the market and submarkets in overall market for augmented and virtual reality in healthcare market. Key players in the market have been identified through secondary research. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Some of these secondary sources include organizations and associations such as VR/AR Association, AugmentedReality.Org, and Augmented Reality for Enterprise Alliance.

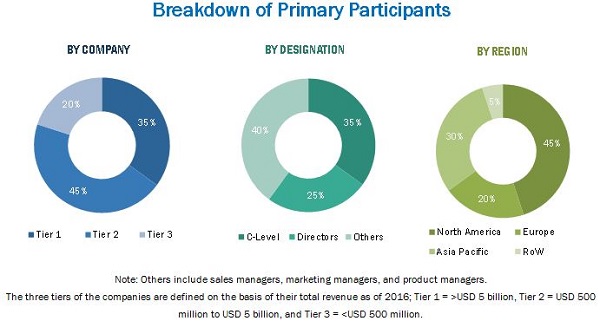

The research methodology includes the study of the annual and financial reports of the top augmented and virtual reality in healthcare market players and extensive interviews for key insights with industry leaders such as CEOs, VPs, directors, and marketing executives. All the percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. The breakdown of the profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of augmented and virtual reality in healthcare market includes original equipment manufacturers for AR and VR devices, software vendors, application developers among others. Major companies that are part of the value chain include Google (US), Microsoft (US), DAQRI (US), Psious (Spain), Mindmaze (Switzerland), Firsthand Technology (US), Medical Realities (UK), Atheer (US), Augmedix (US), Oculus VR (US), CAE Healthcare (US), Philips Healthcare (Netherlands & US), 3D Systems (US), VirtaMed (Switzerland), HTC (Taiwan), Siemens Healthineers (Germany), and Virtually Better (US).

Target Audience

- Raw Material and Manufacturing Equipment Suppliers

- Semiconductor Foundries

- Original Equipment Manufacturers (OEMs) (End-User Applications or Electronic Product Manufacturers)

- Product Manufacturers

- Original Design Manufacturers (ODMs) and OEM Technology Solution Providers

- Research Organizations

- Technology Standard Organizations, Forums, Alliances, and Associations

- Technology Investors

- Governments, Financial Institutions, and Investment Communities

- Analysts and Strategic Business Planners

“The study answers several questions for the target audiences, primarily which market segments to focus on in the next 2–5 years for prioritizing efforts and investments”

Scope of the Report

In this report, augmented and virtual reality in healthcare market has been segmented as follows:

Augmented Reality and Virtual Reality in Healthcare Market, by Offering

-

Hardware

-

Sensors

- Accelerometer

- Gyroscope

- Magnetometer

- Proximity Sensor

-

Semiconductor Component

- Controller/processor

- Integrated Circuits

- Displays and Projectors

- Position Tracker

- Cameras

- Others

-

Sensors

-

Software

- Software Development Kits

- Cloud-Based Services

Augmented Reality (AR) and Virtual Reality (VR) in Healthcare Market, by Device Type

-

Augmented Reality in Healthcare Market

- Head-Mounted Display (HMD)

- Handheld Device

-

Virtual Reality in Healthcare Market

- Head-Mounted Display (HMD)

-

Gesture Tracking Devices

- Data Gloves

- Others

- Projectors and Display Walls

Augmented and Virtual Reality in Healthcare Market, by End User

- Hospitals, Clinics, and Surgical Centers

- Research Organizations and Pharma Companies

- Research and Diagnostics Laboratories

- Government and Defense Institutions

- Others

Augmented and Virtual Reality in Healthcare Market, by Application

- Surgery

- Fitness Management

- Patient Care Management

- Pharmacy Management

- Medical Training and Education

- Others

Augmented and Virtual Reality in Healthcare Market, by Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Company Profiles

Detailed analysis of the major companies present in the market for augmented reality in healthcare and virtual reality in healthcare

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Detailed information of augmented and virtual reality in healthcare software market

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Augmented and Virtual Reality in Healthcare Market