Medical Wearables Market by Device (Vital Signs Monitoring, Blood Pressure Monitor, Glucose Monitor, ECG Monitor, Pulse Oximeter), Product (Smartwatch, Patches, Wristbands), End User (Hospitals, Nursing Homes, Ambulatory) & Region - Global Forecast to 2025

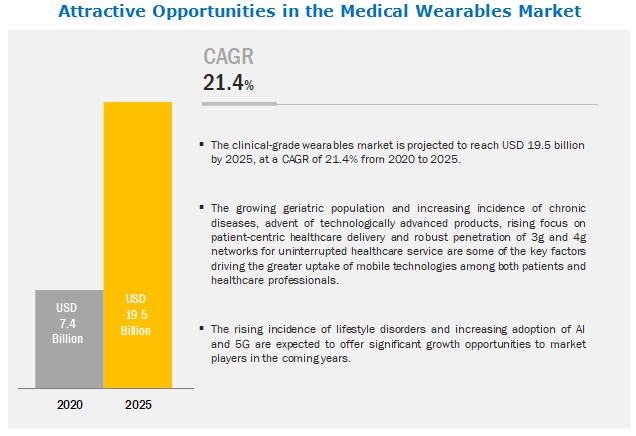

The global medical wearables market in terms of revenue was estimated to be worth $7.4 billion in 2020 and is poised to reach $19.5 billion by 2025, growing at a CAGR of 21.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growing adoption of smartphones, increasing penetration of 3G/4G networks, increasing utilization of connected devices for the management of chronic diseases, rising focus on cost containment in healthcare delivery, rising focus on patient-centric healthcare delivery and the increasing demand for home healthcare services are some of the key factors driving the greater uptake of mobile technologies among both patients and healthcare professionals. However, the lack of standards and regulations, lack of accuracy, standardization and analysis of the wearable-generated data in Clinical- Grade Wearable Market.

The vital signs monitoring segment accounted for the largest share of the market in 2019.

In 2019, the vital signs monitoring segment accounted for the largest share of the Clinical-Grade market. The large share of this segment can be attributed to the growing use of high-tech devices, which are compact, user-friendly, and come with a better graphical user interface for easy visibility of resulted data are helping to increase the market penetration of clinical-grade wearables. These wearables are playing an integral role in treating and monitoring various medical conditions in patients and driving better health outcomes.

The patches segment accounted for the largest share of the medical wearables industry in 2019.

In 2019, the patches segment accounted for the largest share of the medical wearables market. The large share of this segment can be attributed to the growth in the adoption of wearable technology is largely dependent on technological advancements on the telecommunications front. In the past few years, the clinical-grade wearables market has benefited from the growing penetration of 3G and 4G connections across the globe.

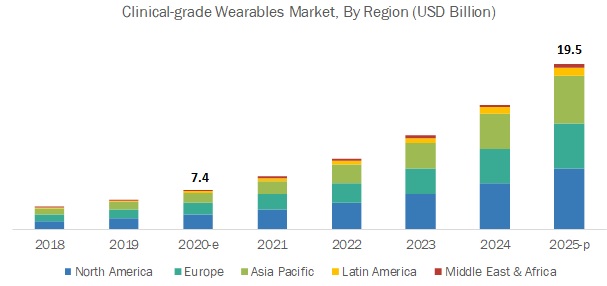

North America will continue to dominate the medical wearables industry during the forecast period

North America dominated the medical wearables market, followed by Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The large share of North America in the Clinical-Grade Wearable market can be attributed to the high penetration of smartphones, tablets, and other mobile platforms; increasing utilization of connected devices & Clinical-Grade Wearable apps for the management of chronic diseases; development & adoption of innovative technologies; rising government initiatives; and the presence of major companies in these regions.

The global medical wearables market is highly fragmented, with many large and small firms operating at the regional and country levels. The prominent players in the global Clinical-Grade Wearable market are Medtronic plc. (Ireland), Koninklijke Philips N.V. (Netherlands), OMRON Corporation (Japan), Biotelemetry Inc.(US), Apple, Inc. (US ), Dexcom Inc. (US), Abbott Laboratories(US), Masimo Corporation(US), GE Healthcare (US), Bio-Beat Technologies (Israel), iRhythm Technologies, Inc.(US), VitalConnect (US), Minttihealth (US), Preventice Solutions, Inc. (US), Contec Medical Systems Co.Ltd(China), Biotricity Inc.(US), Verily Life Sciences. (US), Cyrcardia Asia Limited (Hong Kong ), ten3T healthcare (India), VivaLnk, Inc.(US).

Scope of the Medical Wearables Industry:

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$7.4 billion |

|

Estimated Value by 2025 |

$19.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 21.4% |

|

Market Driver |

Robust penetration of 3G and 4G networks for uninterrupted healthcare services |

|

Market Opportunity |

Growing adoption of mobile platforms |

The research report categorizes the medical wearables market to forecast revenue and analyze trends in each of the following submarkets:

By Products

- Patches

- Wristband and Activity Monitors

- Smartwatches

- Others (Clothing, glasses, others)

By Device Type

-

Diagnostic & Monitoring Medical Devices

-

Vital Signs Monitoring Devices

- ECG /Holter Heart Rate Monitors

- Pulse Oximeters

- Blood Pressure Monitors

- Multiparameter Trackers

- Glucose Monitoring Devices

- Sleep Apnea Monitors

- Fetal Monitoring Devices

- Neurological Monitoring Devices

-

Vital Signs Monitoring Devices

By End User

- Hospitals and Clinics

- Long-term Care Centers /Assisted Living Facilities /Nursing Homes

- Home healthcare/Patients

- Ambulatory care centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent developments of Medical Wearables Industry

- In 2019, Medtronic launched the Envision Pro Continuous Glucose Monitoring System.

- In 2019, Phillips Healthcare launched its sleep and respiratory care wearable — Philips NightBalance.

- In 2019, Medtronic Plc (Netherlands) entered into a partnership Tidepool(US) to develop a Bluetooth enabled MiniMed™ pump compatible with automated insulin delivery application.

- In 2018, Koninklijke Philips N.V (Netherlands) entered into a partnership Dispatch Health (US) to remotely monitor senior citizens at home with Phillips’ advanced remote monitoring devices.

- In 2019, Omron Healthcare (US) collaborated with PhyIQ, Inc. (US) To integrate Omron’s innovative FDA-cleared device, HeartGuide, the first wearable blood pressure monitor into the pinpointIQ (physIQ ) platform to monitor at-risk patients in an outpatient setting.

- In 2019, Apple Inc. (US) collaborated with Johnson & Johnson To explore the role Apple Watches could play in senior health monitoring.

- In 2019, BioTelemetry (US) acquired ADEA Medical AB (Sweden). The acquisition is aligned with BioTelemetry’s longer-term strategy to increase its international footprint and offer its products and services to physicians and patients in the Nordics and other parts of Europe.

Key Questions Addressed by the Report:

- Who are the top 10 players operating in the global Clinical-Grade Wearable market?

- What covers the drivers, restraints, opportunities, and challenges in the Clinical-Grade Wearable market?

- What are the new technological advancements in the Clinical-Grade Wearable market?

- Comment on the regulatory scenario for the Clinical-Grade Wearable market in various geographies.

- What are the growth trends in the Clinical-Grade Wearable market at the segmental and overall market levels?

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global medical wearables market?

The global medical wearables market boasts a total revenue value of $19.5 billion by 2025.

What is the estimated growth rate (CAGR) of the global medical wearables market?

The global medical wearables market has an estimated compound annual growth rate (CAGR) of 21.4% and a revenue size in the region of $7.4 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKETS COVERED

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH APPROACH

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.2 GROWTH FORECAST

2.3 DATA TRIANGULATION APPROACH

2.4 MARKET SHARE ESTIMATION

3 MARKET OVERVIEW (Page No. - 42)

3.1 INTRODUCTION

3.2 MARKET DYNAMICS

3.2.1 DRIVERS

3.2.1.1 Increasing awareness of fitness and incidence of lifestyle disorders

3.2.1.2 Advent of technologically advanced products

3.2.1.3 Growing geriatric population and incidence of chronic diseases

3.2.1.4 Cost-containment in healthcare delivery

3.2.1.5 Robust penetration of 3G and 4G networks for uninterrupted healthcare services

3.2.2 RESTRAINTS

3.2.2.1 Unfavorable standards and regulations

3.2.2.2 Accuracy, standardization, and analysis of wearable-generated data

3.2.3 OPPORTUNITIES

3.2.3.1 Growing adoption of mobile platforms

3.2.3.2 Increasing adoption of AI and 5G

3.2.4 CHALLENGES

3.2.4.1 Patent protection of clinical-grade wearables

3.2.4.2 Lack of data security and concerns over data theft and healthcare fraud

3.2.4.3 Limited battery life

3.2.4.4 Device design complexity

4 INDUSTRY INSIGHTS (Page No. - 48)

4.1 INDUSTRY TRENDS

4.2 ONCOLOGY - THE NEXT FRONTIER FOR CLINICAL-GRADE WEARABLES

4.3 FUTURE TRENDS IN CLINICAL-GRADE WEARABLES

4.4 INVESTMENTS IN CLINICAL-GRADE WEARABLE STARTUPS

5 MEDICAL WEARABLES MARKET, BY DEVICE TYPE (Page No. - 50)

5.1 INTRODUCTION

5.2 VITAL SIGN MONITORING DEVICES

5.2.1 MULTIPARAMETER TRACKERS

5.2.1.1 Increase in the prevalence of chronic diseases to drive this market segment

5.2.2 ECG/HOLTER/HEART RATE MONITORS

5.2.2.1 ECG monitors help improve the quality of care by facilitating the continuous monitoring of patients—a key factor driving market growth

5.2.3 BLOOD PRESSURE MONITORS

5.2.3.1 Clinical-grade wearable blood pressure monitors form a popular category as these devices are convenient to use and relatively less expensive

5.2.4 PULSE OXIMETERS

5.2.4.1 Growing adoption of pulse oximeters for self-monitoring purposes to drive growth in this market segment

5.3 GLUCOSE MONITORING DEVICES & INSULIN PUMPS

5.3.1 GROWTH IN THE NUMBER OF DIABETICS PROPELS THE ADOPTION OF BLOOD GLUCOSE MONITORING DEVICES

5.4 FETAL MONITORING & OBSTETRIC DEVICES

5.4.1 RISE IN THE NUMBER OF PRETERM BIRTHS TO DRIVE THIS SEGMENT

5.5 NEUROMONITORING DEVICES

5.5.1 GROWING PREVALENCE OF NEUROLOGICAL DISEASES TO DRIVE THIS SEGMENT

5.6 SLEEP MONITORING DEVICES

5.6.1 CONTINUOUS MONITORING OF SLEEP PATTERNS HELPS IDENTIFY THE ROOT CAUSE OF SLEEP-RELATED DISORDERS, THEREBY AIDING PROPER DISEASE MANAGEMENT

6 MEDICAL WEARABLES MARKET, BY PRODUCT (Page No. - 66)

6.1 INTRODUCTION

6.2 PATCHES

6.2.1 EASE OF USE, CONVENIENCE, NON-INVASIVENESS, AND COMPACT DESIGN ARE EXPECTED TO DRIVE THE GROWTH OF THIS SEGMENT

6.3 SMARTWATCHES

6.3.1 DATA ACCURACY, LIMITED BATTERY LIFE, AND COMPETITION FROM FITNESS BANDS MAY LIMIT MARKET GROWTH TO A CERTAIN EXTENT

6.4 ACTIVITY MONITORS & WRISTBANDS

6.4.1 INCREASING PREVALENCE OF CHRONIC DISEASES HAS RESULTED IN A SIGNIFICANT INCREASE IN THE DEMAND FOR ACTIVITY MONITORS

6.5 OTHER CLINICAL-GRADE WEARABLES

7 MEDICAL EARABLES MARKET, BY END USER (Page No. - 74)

7.1 INTRODUCTION

7.2 LONG-TERM CARE CENTERS, ASSISTED-LIVING FACILITIES, AND NURSING HOMES

7.2.1 INCREASING NUMBER OF PEOPLE REQUIRING LONG-TERM CARE AS A RESULT OF THE RISING GERIATRIC POPULATION TO DRIVE MARKET GROWTH

7.3 HOSPITALS

7.3.1 LEADING HOSPITALS ARE USING WEARABLE TECHNOLOGIES TO TRANSFORM RESIDENT TRAINING AND EMERGENCY MEDICINE COMMUNICATION, WHICH PROVIDES THEM WITH A CRITICAL ADVANTAGE

7.4 AMBULATORY CARE CENTERS

7.4.1 THE SHIFT OF PATIENT CARE FROM INPATIENT TO OUTPATIENT SETTINGS IS DRIVING THE GROWTH OF THIS END USER SEGMENT

7.5 HOME CARE SETTINGS

7.5.1 GOVERNMENT INITIATIVES ARE EXPECTED TO SUPPORT THE MARKET GROWTH

8 MEDICAL WEARABLES MARKET, BY REGION (Page No. - 80)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 US

8.2.1.1 In 2019, the US accounted for the largest share of the clinical-grade wearables market in North America

8.2.2 CANADA

8.2.2.1 Need to curtail escalating healthcare costs to drive the market in Canada

8.3 EUROPE

8.3.1 GERMANY

8.3.1.1 Need for better and improved healthcare services will drive the adoption of clinical-grade wearables in Germany

8.3.2 UK

8.3.3 CLINICAL-GRADE WEARABLE DEVICES HAVE WITNESSED HIGH PENETRATION IN THE UK

8.3.4 FRANCE

8.3.4.1 Use of telehealth solutions and services through big data to propel market growth

8.3.5 ITALY

8.3.5.1 Increasing government initiatives for the implementation of eHealth technologies to support market growth

8.3.6 SPAIN

8.3.6.1 Spain has one of the highest levels of mobile phone penetration in Europe

8.3.7 REST OF EUROPE (ROE)

8.4 ASIA PACIFIC

8.4.1 JAPAN

8.4.2 JAPAN IS A HIGHLY DEVELOPED MARKET FOR WIRELESS TECHNOLOGIES WITH A RAPIDLY EVOLVING MOBILE HEALTHCARE SECTOR

8.4.3 CHINA

8.4.4 GROWING FOCUS OF PUBLIC & PRIVATE PLAYERS ON CLINICAL-GRADE WEARABLES DEPLOYMENT IN CHINA TO DRIVE MARKET GROWTH

8.4.5 INDIA

8.4.6 INCREASING NUMBER OF INITIATIVES FROM BOTH GOVERNMENT ORGANIZATIONS AND PRIVATE PLAYERS TO IMPROVE ACCESS TO HEALTHCARE TO DRIVE MARKET GROWTH

8.4.7 REST OF ASIA PACIFIC

8.5 LATIN AMERICA

8.5.1 INCREASE IN THE ADOPTION OF MOBILITY SOLUTIONS IN BRAZIL AND MEXICO TO DRIVE GROWTH IN THE CLINICAL-GRADE WEARABLES MARKET

8.6 MIDDLE EAST & AFRICA

8.6.1 GOVERNMENT INVESTMENTS IN BUILDING A HEALTHCARE MOBILITY FRAMEWORK IN THE MEA REGION TO DRIVE MARKET GROWTH

9 COMPETITIVE LANDSCAPE (Page No. - 123)

9.1 OVERVIEW

9.2 MARKET RANKING ANALYSIS

9.3 COMPETITIVE LEADERSHIP MAPPING, 2019

9.3.1 VISIONARY LEADERS

9.3.2 INNOVATORS

9.3.3 EMERGING COMPANIES

9.3.4 DYNAMIC DIFFERENTIATORS

9.4 COMPETITIVE SITUATION AND TRENDS

9.4.1 NEW PRODUCT LAUNCHES & ENHANCEMENTS

9.4.2 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

9.4.3 ACQUISITIONS

10 Company profiles (Page No. - 132)

10.1 KONINKLIJKE PHILIPS N.V.

10.1.1 BUSINESS OVERVIEW

10.1.2 PRODUCTS OFFERED

10.1.3 RECENT DEVELOPMENTS

10.1.4 MNM VIEW

10.2 MEDTRONIC PLC

10.2.1 BUSINESS OVERVIEW

10.2.2 PRODUCTS OFFERED

10.2.3 RECENT DEVELOPMENTS

10.2.4 MNM VIEW

10.3 OMRON HEALTHCARE CO., LTD. (A PART OF OMRON CORPORATION)

10.3.1 BUSINESS OVERVIEW

10.3.2 PRODUCTS OFFERED

10.3.3 RECENT DEVELOPMENTS

10.3.4 MNM VIEW

10.4 BIOTELEMETRY, INC.

10.4.1 BUSINESS OVERVIEW

10.4.2 PRODUCTS OFFERED

10.4.3 RECENT DEVELOPMENTS

10.5 APPLE, INC.

10.5.1 BUSINESS OVERVIEW

10.5.2 PRODUCTS OFFERED

10.5.3 RECENT DEVELOPMENTS

10.6 GE HEALTHCARE

6.6.1 BUSINESS OVERVIEW

6.6.2 PRODUCTS OFFERED

6.6.3 RECENT DEVELOPMENTS

10.7 ABBOTT LABORATORIES

10.7.1 BUSINESS OVERVIEW

10.7.2 PRODUCTS OFFERED

10.7.3 RECENT DEVELOPMENTS

10.8 DEXCOM, INC.

10.8.1 BUSINESS OVERVIEW

10.8.2 PRODUCTS OFFERED

10.8.3 RECENT DEVELOPMENTS

10.9 IRHYTHM TECHNOLOGIES, INC.

10.9.1 BUSINESS OVERVIEW

10.9.2 IRHYTHM TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2018)

10.9.3 PRODUCTS OFFERED

10.10 MASIMO CORPORATION

10.10.1 BUSINESS OVERVIEW

10.10.2 PRODUCTS OFFERED

10.11 PREVENTICE SOLUTIONS, INC.

10.11.1 BUSINESS OVERVIEW

10.11.2 PRODUCTS OFFERED

10.11.3 RECENT DEVELOPMENTS

10.12 CONTEC MEDICAL SYSTEMS CO. LTD.

10.12.1 BUSINESS OVERVIEW

10.12.2 PRODUCTS OFFERED

10.13 BIO-BEAT TECHNOLOGIES

10.13.1 BUSINESS OVERVIEW

10.13.2 PRODUCTS OFFERED

10.13.3 RECENT DEVELOPMENTS

10.14 VITALCONNECT

10.14.1 BUSINESS OVERVIEW

10.14.2 PRODUCTS OFFERED

10.14.3 RECENT DEVELOPMENTS

10.15 MINTTIHEALTH

10.15.1 BUSINESS OVERVIEW

10.15.2 PRODUCTS OFFERED

10.15.3 RECENT DEVELOPMENTS

10.16 BIOTRICITY INC.

10.17 VERILY LIFE SCIENCES (A PART OF ALPHABET INC.)

10.18 CYRCARDIA ASIA LIMITED

10.19 TEN3T HEALTHCARE

10.20 VIVALNK, INC.

11 APPENDIX (Page No. - 165)

11.1 INSIGHTS FROM INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

LIST OF TABLES (20 Tables)

TABLE 1 MEDICAL WEARABLES MARKET SNAPSHOT

TABLE 2 MAJOR INVESTMENTS IN START-UP COMPANIES

TABLE 3 MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 4 VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD BILLION)

TABLE 5 VITAL SIGN MONITORING DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 6 MULTIPARAMETER TRACKERS OFFERED BY KEY MARKET PLAYERS

TABLE 7 MULTIPARAMETER TRACKERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 8 ECG/HOLTER/HEART RATE MONITORS OFFERED BY KEY MARKET PLAYERS

TABLE 9 ECG/HOLTER/HEART RATE MONITORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 BLOOD PRESSURE MONITORS OFFERED BY KEY MARKET PLAYERS

TABLE 11 BLOOD PRESSURE MONITORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 PULSE OXIMETERS OFFERED BY KEY MARKET PLAYERS

TABLE 13 PULSE OXIMETERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 GLUCOSE MONITORING DEVICES OFFERED BY KEY MARKET PLAYERS

TABLE 15 GLUCOSE MONITORING DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 16 FETAL MONITORING & OBSTETRIC DEVICES OFFERED BY KEY MARKET PLAYERS

TABLE 17 FETAL MONITORING & OBSTETRIC DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 NEUROMONITORING DEVICES OFFERED BY KEY MARKET PLAYERS

TABLE 19 NEUROMONITORING DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 20 SLEEP MONITORING DEVICES OFFERED BY KEY MARKET PLAYERS

TABLE 21 SLEEP MONITORING DEVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 MEDICAL WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 23 CLINICAL-GRADE WEARABLE PATCHES BY KEY MARKET PLAYERS

TABLE 24 CLINICAL-GRADE WEARABLE PATCHES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 25 CLINICAL-GRADE WEARABLE SMARTWATCHES BY KEY MARKET PLAYERS

TABLE 26 CLINICAL-GRADE WEARABLE SMARTWATCHES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 CLINICAL-GRADE WEARABLE ACTIVITY MONITORS & WRISTBANDS BY KEY MARKET PLAYERS

TABLE 28 CLINICAL-GRADE WEARABLE ACTIVITY MONITORS & WRISTBANDS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 OTHER CLINICAL-GRADE WEARABLES BY KEY MARKET PLAYERS

TABLE 30 OTHER CLINICAL-GRADE WEARABLES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 31 CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 32 CLINICAL-GRADE WEARABLES MARKET FOR LONG-TERM CARE CENTERS, ASSISTED-LIVING FACILITIES, AND NURSING HOMES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 CMEDICAL WEARABLES MARKET FOR HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 CLINICAL-GRADE WEARABLES MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 CLINICAL-GRADE WEARABLES MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: MEDICAL WEARABLES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: CLINICAL-GRADE WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 41 NORTH AMERICA: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 42 US: MACROECONOMIC INDICATORS FOR THE CLINICAL-GRADE WEARABLES MARKET

TABLE 43 US: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 44 US: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 US: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 46 US: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 47 CANADA: MACROECONOMIC INDICATORS FOR THE CLINICAL-GRADE WEARABLES MARKET

TABLE 48 CANADA: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 49 CANADA: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 50 CANADA: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 51 CANADA: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: MEDICAL WEARABLES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 EUROPE: CLINICAL-GRADE WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 54 EUROPE: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 55 EUROPE: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 56 EUROPE: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 57 GERMANY: MACROECONOMIC INDICATORS FOR THE CLINICAL-GRADE WEARABLES MARKET

TABLE 58 GERMANY: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 59 GERMANY: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 GERMANY: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 61 GERMANY: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 62 UK: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 63 UK: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 UK: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 65 UK: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 66 FRANCE: MACROECONOMIC INDICATORS FOR THE CLINICAL-GRADE WEARABLES MARKET

TABLE 67 FRANCE: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 68 FRANCE: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 FRANCE: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 70 FRANCE: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 71 ITALY: MACROECONOMIC INDICATORS FOR THE CLINICAL-GRADE WEARABLES MARKET

TABLE 72 ITALY: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 73 ITALY: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 ITALY: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 75 ITALY: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 76 SPAIN: HEALTHCARE IT INITIATIVES

TABLE 77 SPAIN: MACROECONOMIC INDICATORS FOR THE CLINICAL-GRADE WEARABLES MARKET

TABLE 78 SPAIN: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 79 SPAIN: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 SPAIN: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 81 SPAIN: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 82 REST OF EUROPE: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 83 REST OF EUROPE: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 REST OF EUROPE: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 85 REST OF EUROPE: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 86 ASIA PACIFIC: MEDICAL WEARABLES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: CLINICAL-GRADE WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 88 ASIA PACIFIC: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 ASIA PACIFIC: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 90 ASIA PACIFIC: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 91 JAPAN: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 92 JAPAN: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 JAPAN: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 94 JAPAN: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 95 CHINA: MACROECONOMIC INDICATORS FOR THE CLINICAL-GRADE WEARABLES MARKET

TABLE 96 CHINA: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 97 CHINA: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 CHINA: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 99 CHINA: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 100 INDIA: MACROECONOMIC INDICATORS FOR THE CLINICAL-GRADE WEARABLES MARKET

TABLE 101 INDIA: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 102 INDIA: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 INDIA: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 104 INDIA: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 105 REST OF ASIA PACIFIC: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 106 REST OF ASIA PACIFIC: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 107 REST OF ASIA PACIFIC: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 108 REST OF ASIA PACIFIC: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 109 LATIN AMERICA: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 110 LATIN AMERICA: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 111 LATIN AMERICA: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 112 LATIN AMERICA: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: MEDICAL WEARABLES MARKET, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 114 MIDDLE EAST & AFRICA: VITAL SIGN MONITORING DEVICES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 117 CLINICAL GRADE WEARABLES MARKET RANKING ANALYSIS, BY PLAYER, 2019

TABLE 118 PRODUCT LAUNCHES AND ENHANCEMENTS (2019)

TABLE 119 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS (2019)

TABLE 120 ACQUISITIONS (2018 & 2019)

LIST OF FIGURES (30 Figures)

FIGURE 1 CLINICAL-GRADE WEARABLES MARKET SEGMENTATION

FIGURE 2 RESEARCH DESIGN

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 MARKET SIZE APPROACH 1

FIGURE 5 MARKET SIZE APPROACH 2

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 DATA TRIANGULATION METHODOLOGY

FIGURE 8 CLINICAL-GRADE WEARABLES BY DEVICE TYPE, 2020 VS. 2025 (USD BILLION)

FIGURE 9 VITAL SIGNS MONITORING MARKET, BY TYPE, 2020 VS. 2025 (USD BILLION)

FIGURE 10 CLINICAL-GRADE WEARABLES MARKET, BY END USER, 2020 VS. 2025 (USD BILLION)

FIGURE 11 CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT, 2020 VS. 2025 (USD BILLION)

FIGURE 12 CLINICAL-GRADE WEARABLES MARKET: REGIONAL SNAPSHOT

FIGURE 13 INCREASING GERIATRIC POPULATION AND RISING FOCUS ON PATIENT CENTRIC HEALTHCARE DELIVERY TO DRIVE MARKET GROWTH

FIGURE 14 PATCHES COMMANDED THE LARGEST SHARE OF THE APAC PRODUCT MARKET IN 2019

FIGURE 15 MARKET IN JAPAN TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 16 ASIA PACIFIC MARKET TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 17 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING THE FORECAST PERIOD

FIGURE 18 CLINICAL-GRADE WEARABLES DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 19 GEOGRAPHIC SNAPSHOT OF THE CLINICAL-GRADE WEARABLES MARKET

FIGURE 20 NORTH AMERICA: CLINICAL-GRADE WEARABLES MARKET SNAPSHOT

FIGURE 21 ASIA PACIFIC: CLINICAL-GRADE WEARABLES MARKET SNAPSHOT

FIGURE 22 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2019)

FIGURE 23 MEDTRONIC PLC: COMPANY SNAPSHOT (2019)

FIGURE 24 OMRON HEALTHCARE CO., LTD.: COMPANY SNAPSHOT (2018)

FIGURE 25 BIOTELEMETRY, INC.: COMPANY SNAPSHOT (2018)

FIGURE 26 APPLE, INC.: COMPANY SNAPSHOT (2019)

FIGURE 27 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

FIGURE 28 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2019)

FIGURE 29 DEXCOM, INC.: COMPANY SNAPSHOT (2018)

FIGURE 30 MASIMO CORPORATION: COMPANY SNAPSHOT (2018)

The study involved four major activities in estimating the size of the medical wearables market. Exhaustive secondary research was done to collect information on the adoption of different solutions and their trends at the country level. Industry experts further validated the data obtained through secondary research through primary research. Furthermore, the market size estimates and forecasts provided in this study are derived through a mix of the revenue share analysis and top-down approach (assessment of utilization/adoption/penetration trends, by product & service, and region). After that, market breakdown and data triangulation methods were used to estimate the size of segments and subsegments.

Secondary Research

Various secondary sources such as the US Department of Health and Human Services, Healthcare Information and Management Systems Society (HIMSS), Medical Device Manufacturers Association (MDMA), American Public Health Association (APHA), Advanced Medical Technology Association (AdvaMed), Economist Intelligence Unit, American Health Information Management Association (AHIMA), World Health Organization (WHO), annual reports/SEC filings, investor presentations, and press releases of key players have been used to identify and collect information useful for the study of the Clinical-Grade wearable market.

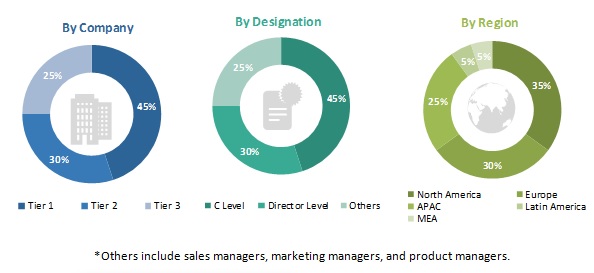

Primary Research

Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess the dynamics of this market. The primary participants mainly include product managers, business development directors, sales managers, and healthcare providers across the industry. The breakdown of primaries is shown in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

Medical Wearables Market Size Estimation

Both top-down and revenue share analysis approaches were used to anticipate and validate the size of Clinical-Grade wearable market and to estimate the size of various other dependent submarkets.

Data Triangulation

After arriving at the market size, the total clinical-grade wearable market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Report Objectives:

- To define, describe, and forecast the global clinical-grade wearable market based on product & service and region

- To provide detailed information regarding major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall clinical-grade wearable market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the global Clinical-Grade wearable market with respect to five main regions (along with countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global clinical-grade wearable market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as partnerships, agreements, & collaborations; acquisitions; expansions; product launches & enhancements; and research and development activities in the Clinical-Grade wearable market

Target Audience:

- Healthcare Application Developers

- Medical Device Vendors

- Mobile Network Providers

- Connectivity Providers

- Mobile Platform Developers

- Insurance Providers (Payers)

- Healthcare Institutions (Hospitals, Medical Schools, And Outpatient Clinics)

- Research and Consulting Firms

- Research Institutes

- Contract Research Organizations (CROs)

- Contract Manufacturing Organizations (CMOS)

- Venture Capitalists

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Segment Analysis

- Further breakdown of the diagnostic & monitoring devices into vital signs monitoring devices, glucose monitoring, sleep monitoring devices, fetal monitoring devices, and neuromonitoring devices.

- Further breakdown of the product market into patches, wristbands and activity monitors, smartwatches and others (clothing, glass and others)

- Further breakdown of the end-user market into Hospitals and clinics, Long term Care Centers, Home Healthcare and Ambulatory Care Centers

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Wearables Market