Revenue Cycle Management Market Size by Product & Services (Eligibility Verification, Clinical Coding, CDI Solutions, Claims Processing, Denial Management, Outsourcing Services), Delivery (Cloud), End Users (Payers, Hospitals) & Region - Global Forecast to 2028

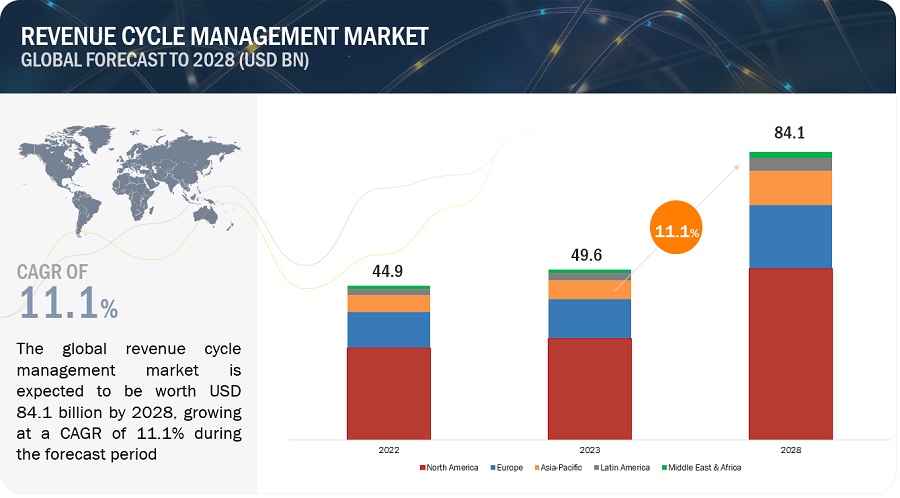

The size of global revenue cycle management market in terms of revenue was estimated to be worth $49.6 billion in 2023 and is poised to reach $84.1 billion by 2028, growing at a CAGR of 11.1% from 2023 to 2028. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Adoption of RCM solutions has increased post the pandemic to reduce the burden on healthcare resources. Newly developed RCM solutions help streamline workflows, enhance data accuracy, improve compliance, and provide a better overall experience for healthcare providers and patients. Furthermore, these RCM solutions offer real-time insights, enable seamless data exchange, support interoperability, and reduce costs for managing multiple standalone systems. Therefore, the rising availability of highly efficient RCM solutions has positively influenced market growth. Moreover, improving data integration standards such as HL7 for efficient data transfer has further enhanced the RCM market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Revenue cycle management Market Dynamics

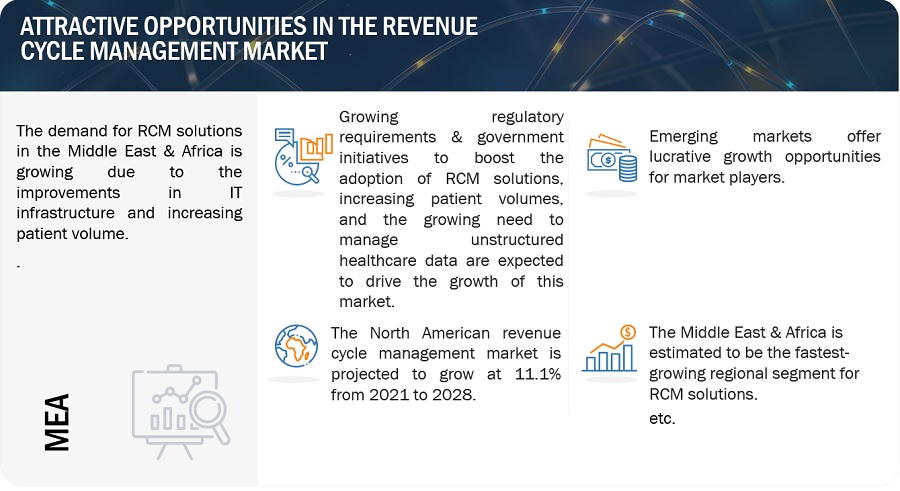

Driver: Growing need to manage unstructured healthcare data

In the last few years, the volume of electronic data produced in the healthcare industry, primarily due to rising patient volumes and the digitization of administrative, clinical, and financial information, has expanded to terabytes and petabytes. This generates an imperative need to use revenue cycle management solutions. According to industry experts, by using natural language processing (NLP) and optical character recognition (OCR) technology, organizations can transform unstructured data from files, such as medical records, scanned documents, and audio recordings, into structured and normalized data. Other significant factors contributing to this trend are the sheer diversity of data in healthcare and the rising prominence and usage of HCIT tools.

Restraint: Deployment costs include licensing and subscription costs, hardware infrastructure, customization costs, and implementation services cost.

Cost of licensing and implementation is substantially high. Moreover, the price associated with maintaining revenue cycle management software has also significantly increased. Furthermore, IT support and maintenance services, including modifying and upgrading software per changing user requirements and maintaining an efficient IT infrastructure, represent a recurring expenditure. This accounts for a large share of the total cost of ownership. Also, post-sale custom interface development for device integration requires additional verification and validation to ensure solution accuracy and completeness. In 2021, many healthcare providers and their revenue cycle management (RCM) departments faced challenges. Operational costs outpaced revenue growth leading to months and quarters in the red. At the end of 2022, the American Hospital Association anticipated that between 53% and 68% of hospitals would be in deficit, compared to 34% in 2019. This further increases the total cost of ownership for healthcare providers. As a result of the high costs involved, small healthcare facilities, especially in emerging countries, are reluctant to replace their legacy systems with RCM solutions.

Opportunity: Growing demand for AI & cloud-based deployment

The combination of data and artificial intelligence (AI) has the potential to improve outcomes and reduce costs by applying machine learning algorithms and predictive analytics to reduce drug discovery times, provide virtual assistance to patients, and reduce the diagnosing time for ailments by processing medical images. The adoption of AI in healthcare is rising due to its ability to optimize clinical as well as non-clinical processes, thereby solving a variety of problems for patients, providers, and the overall healthcare industry. According to MarketsandMarkets estimates, AI in Healthcare market is predicted to grow at a double-digit rate. AI has experienced high demand for RCM solutions to overcome the load on human resources. Manual and redundant tasks that occur during patient access, coding, billing, collections, and denials can be automated with the help of AI. AI integrated with RCM can perform these functions more accurately by imitating intelligent human behavior through algorithms that find patterns and plan future actions to produce a positive outcome.

Challenge: Issues related to data security and confidentiality

The increased use of automated technologies such as EHRs, healthcare integration, and health information exchanges have helped expand the healthcare privacy and security landscape. Electronic patient data exchange offers greater reach and efficiency in healthcare delivery but has high-security risks due to the broader access. The Anthem Inc. Data breach, Ransomware attack, and Accellion FTA Hack have been the most significant cyberattacks in recent years, jeopardizing USD 47.76 million patient records altogether, causing USD 81.5 million loss. Concerns over the security of proprietary data and applications form a significant challenge to the growth of the market.

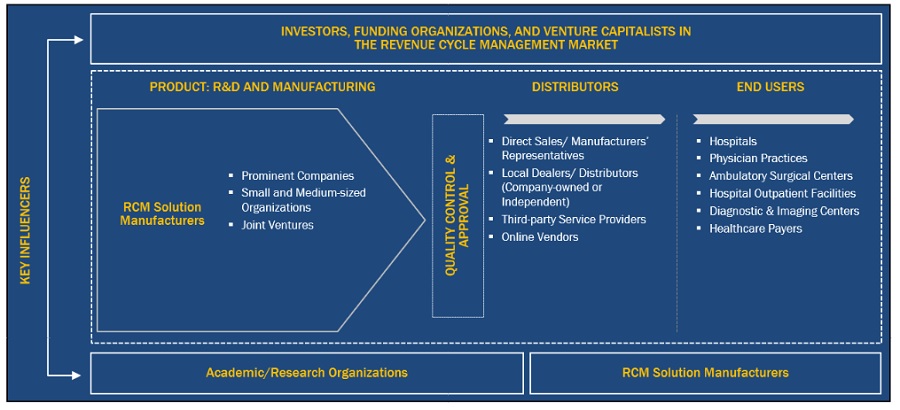

Revenue Cycle Management Market Ecosystem

The aspects present in this market are included in the ecosystem market map of the overall revenue cycle management market, and each element is defined with a list of the organizations involved. Products and services are included. The manufacturers of various products include the organizations involved in the entire process of research, product development, optimization, and launch. Vendors provide the services to end users either directly or through a collaboration with a third party.

In-house research facilities, contract research organizations, and contract development and manufacturing companies are all part of research and product development and are essential for outsourcing product development services.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

By product & services segment, the outsourcing services segment of revenue cycle management industry is expected to grow at the highest growth rate during the forecast period

The outsourcing services segment of revenue cycle management market is expected to grow at the highest CAGR during the forecast period among the product & services. RCM services are outsourced to improve financial performance, navigate complex regulatory landscapes, access specialized expertise, leverage advanced technology, and focus on core healthcare operations. Outsourcing RCM allows organizations to optimize revenue cycles, enhance financial outcomes, and streamline processes in a rapidly changing healthcare environment. Therefore, due to the above-mentioned benefits, the segment is predicted to have a significant growth rate.

The on-premise segment is expected to account for the largest revenue cycle management industry share by delivery mode.

The on-premise segment accounted for the largest share of the revenue cycle management market in 2022. On-premise RCM software provides organizations with greater customization and flexibility. Since the software is deployed locally, it can be tailored to specific workflows, processes, and reporting requirements. This allows organizations to align the RCM software more closely with their unique needs, providing a more personalized and efficient solution thereby, elevating the segment share.

By end user, the healthcare providers segment is expected to account for the largest revenue cycle management industry share.

Healthcare payers and providers are the two segments of the global revenue cycle management market based on end users. The healthcare providers segment accounted for the largest market share 2022. The significant market share of this sector can be ascribed to the effective RCM processes and technologies that provide healthcare providers with improved financial performance, streamlined workflows, enhanced compliance, and a better overall patient experience. By leveraging RCM solutions, healthcare organizations can optimize revenue cycles, increase efficiency, and allocate resources more effectively to deliver high-quality patient care. The aforementioned factors have positively impacted segmental growth.

To know about the assumptions considered for the study, download the pdf brochure

During the forecast period, the Asia Pacific region had a substantial growth rate in the revenue cycle management market. The regional growth can be attributed to the rising penetration of digital healthcare technologies along with improving infrastructure. Moreover, medical tourism is increasing especially in the South East Countries that has further elevated the regional market growth to a certain extent.

The major players in the global revenue cycle management market are R1 RCM (US), Oracle (US), Optum (US). Other prominent players in the market include AdvantEdge Healthcare (US), McKesson Corporation (US), Change Healthcare (US), 3M (US), Experian plc (Ireland), Conifer Health Solutions (US), Veradigm (US), GE Healthcare (US), Cognizant (US), athenahealth (US), SSI Group LLC (US), McKesson Corporation (US), and Huron Consulting Group (US).

Scope of the Revenue Cycle Management Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$49.6 billion |

|

Projected Revenue Size by 2028 |

$84.1 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 11.1% |

|

Market Driver |

Technological advancements and increasing R&D investments |

|

Market Opportunity |

Improvisation of healthcare infrastructure across emerging countries |

The research report categorizes the revenue cycle management market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Services

-

Solutions

-

Patient Access Solutions

- Eligibility Verification Solutions

- Pre-certification & Authorization Solutions

- Other Patient Access Solutions

-

Mid-Revenue cycle Solutions

- Clinical Coding Solutions

- Clinical Documentation Improvement Solutions

- Other Mid-revenue cycle Solutions

-

Back-end Revenue cycle Solutions

- Claims Processing Solutions

- Denial Management Solutions

- Other Back-end Revenue cycle Solutions

-

Outsourcing Services

- Patient Access Outsourcing Services

- Mid-revenue cycle Outsourcing Services

- Back-end Revenue cycle Outsourcing Services

-

Patient Access Solutions

By Delivery Mode

- On-premise Solutions

- Cloud-based Solutions

By End User

-

Healthcare Providers

-

Inpatient Facilities

- Hospitals

- Others

-

Outpatient Facilities

- Physicians Practices

- Ambulatory Surgical Centers (ASCs)

- Hospital Outpatient Facilities

- Diagnostic & Imaging Centers

- Other Outpatient Facilities

-

Inpatient Facilities

- Healthcare Payers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments of Revenue Cycle Management Industry

- In 2023, Optum partnered with Owensboro Health to manage revenue cycle and information technology and improve patient outcomes and safety.

- In 2022, the R1 RCM announced 10-year end-to-end RCM partnerships with Scion Health, Sutter Health, and St. Clair Health to streamline workflow standardization and improve patient access platforms.

- In 2022, McKesson signed a definitive agreement to acquire Rx Savings Solutions to offer medication therapy more affordable and increase medication adherence to improve outcomes.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global revenue cycle management market?

The global revenue cycle management market boasts a total revenue value of $84.1 billion by 2028.

What is the estimated growth rate (CAGR) of the global revenue cycle management market?

The global revenue cycle management market has an estimated compound annual growth rate (CAGR) of 11.1% and a revenue size in the region of $49.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial revenue cycle management market study. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

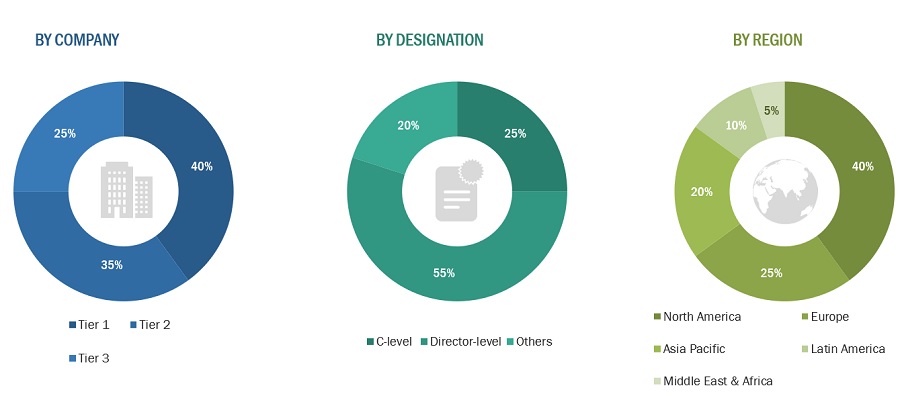

In the primary research process, various sources from supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the revenue cycle management market. The primary sources from the demand side include clinicians, cardiologists, hospital managers, professors, and and stakeholders in corporate & government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents is provided below:

Tiers are defined based on a company’s total revenue. As of 2022: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the revenue cycle management market was arrived at after data triangulation from four different approaches. After each course, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Method for calculating the revenue of different players in revenue cycle management. Annual reports, SEC filings, online publications, and in-depth primary interviews were used to determine the size of the worldwide revenue cycle management market. The market segment sizes were determined using a percentage split. In order to determine the size for each sub-segment, additional splits were used. Primary participants verified these percentage splits. The country-level market numbers from yearly reports, SEC filings, online publications, and in-depth primary interviews were summed up to determine the total market size for regions. The global revenue cycle management market was calculated by adding the market sizes for each region.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Global revenue cycle management market size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was divided into a number of segments and sub-segments after the overall market size was estimated through the above-described market size estimation processes. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Revenue cycle management (RCM) is the process used to track the revenue from patients, from their initial appointment or encounter with the healthcare system to their final payment of the balance. This process helps streamline the business operations of healthcare organizations and private practices. RCM solutions help providers manage and enhance revenue cycle functions such as medical coding & billing, patient insurance eligibility verification, electronic health records, clinical documentation, and claims & denials management.

Key Stakeholders

- Healthcare Providers

- Healthcare Vendors

- Technology Developers

- Patients

- Regulators and Policy makers

- Insurance companies and payers

- Government Institutions

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Objectives of the Study

- To define, describe, and forecast the global revenue cycle management market by product & services, delivery mode, end-user, and region

- To provide detailed information about the significant factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall revenue cycle management market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the revenue cycle management market in five major regions along with their respective key countries (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa)

- To profile the key players in the global revenue cycle management market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as mergers, acquisitions, developments, expansions, partnerships, alliances, and R&D activities of leading players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of the Asia Pacific market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe market into Belgium, Russia, Switzerland, and others

- Further breakdown of the Rest of the Latin America market into Brazil, Argentina, Colombia, Chile, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Revenue Cycle Management Market

Which are the major growth driving factors for the End User segment of the Global Revenue Cycle Management Market?

How the healthcare providers segment holds the largest share of the Revenue Cycle Management Market?

Which are the fastest growing economies in the global Revenue Cycle Management Market?