Robot Software Market by Software Type (Recognition Software, Data Management & Analysis Software, and Communication Management Software), Robot Type (Industrial and Service Robot), Deployment Model, Vertical, and Region - Global Forecast to 2022

[132 Pages Report] The robot software market size was valued at USD 843.0 Million in 2016 and is expected to reach USD 7,527.1 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 45.8%. The base year considered for this report is 2016 and the forecast period is 20172022.

Objectives of the Study:

The main objective of this report is to define, describe, and forecast the global robot software market on the basis of software types, robot types, deployment models, organization sizes, verticals, and regions. The report analyzes the major factors influencing the market growth, such as drivers, restraints, opportunities, and challenges. It aims to strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the market. The report attempts to forecast the market size for 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. It contains key vendor profiles and comprehensively analyzes their core competencies. Moreover, the report tracks and analyzes competitive developments, including partnerships, collaborations, acquisitions, new product developments, and R&D activities in the market.

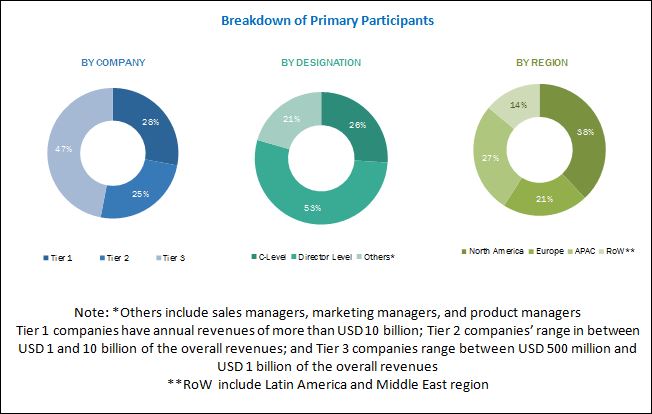

The research methodology used to estimate and forecast the robot software market starts with data collection through secondary research on the key vendors. The sources referred for secondary research include journals and magazines, such as Vehicular Communications, Accident Analysis & Prevention, and M2M Magazine, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. The vendor offerings were taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the market. Post-estimation of overall market size, the total market was divided into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the key personnel, such as Chief Marketing Officers (CMOs), Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of primary profiles is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The key providers of the robot software market are ABB (Switzerland), AIBrain (US), Brain Corp (US), CloudMinds (US), Energid Technologies (US), Furhat Robotics (Sweden), H2O.ai (US), IBM (US), Liquid Robotics (US), Neurala (US), NVIDIA (US), and Oxbotica (UK).

Key Target Audience of Robot Software Market

- Robot manufacturers

- Investors and venture capitalists

- Value-added Resellers (VARs)

- Small, medium-sized, and large-sized enterprises

- Third-party providers

- Consultants/consultancies/advisory firms

- Professional service providers

- Software and application developers

- Government agencies

Study answers several questions for the stakeholders, primarily which market segments to focus in the next 25 years for prioritizing the efforts and investments.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Software Type, Robot Type, Deployment Mode, Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA) |

|

Companies covered |

ABB (Switzerland), AIBrain (US), Brain Corp (US), CloudMinds (US), Energid Technologies (US), Furhat Robotics (Sweden), H2O.ai (US), IBM (US), Liquid Robotics (US), Neurala (US), NVIDIA (US), and Oxbotica (UK). |

The research report categorizes the robot software market to forecast the revenues and analyze the trends in each of the following subsegments:

Robot Software Market By Software Type:

- Recognition software

- Simulation software

- Predictive maintenance software

- Data management and analysis software

- Communication management software

Robot Software Market Robot Software Market research report By Robot type:

- Industrial robots

- Service robots

Robot Software Market By Deployment Mode:

- On-premises

- On-demand

Robot Software Market By Organization Size:

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Robot Software Market By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Retail and eCommerce

- Government and Defense

- Healthcare and Life Sciences

- Transportation and Logistics

- Manufacturing

- Telecommunications and IT

- Academia and Research

- Others (travel and hospitality, energy and utilities, and real estate)

Robot Software Market By Region:

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customization

With the given market data, MarketsandMarkets offers customizations as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

Product matrix gives a detailed comparison of product portfolio for each company.

Geographic Analysis

- Further breakdown of the North American robot software market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed profiling and analysis of additional market players

The global robot software market is expected to grow from USD 1,142.2 Million in 2017 to USD 7,527.1 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 45.8%. Growing need to reduce costs while maintaining quality, and increasing adoption of Internet of Things (IoT) and Artificial Intelligence (AI) are the key drivers for the market.

The report provides detailed insights into the global robot software market based on software types, robot types, deployment models, organization sizes, verticals, and regions. Among the software types, recognition software is expected to have the largest market size during the forecast period. This software is integrated behind the robots that offer them the cognitive ability to recognize the object and respond to them appropriately.

In the robot type, industrial robots are expected to have the largest market share during the forecast period. As labor issues and competitive pressures increases, organizations need solutions that reduce manual labor and increase operational efficiency.

The on-demand deployment model is expected to have a higher adoption rate as compared to the on-premises deployment model. By using cloud-based deployment, organizations can avoid a large amount of cost pertaining to hardware, software, data, maintenance cost, and staff. The manufacturing vertical is expected to have the largest market size during the forecast period due to robot simulation software, which makes robotic automation a viable option for all the manufacturers.

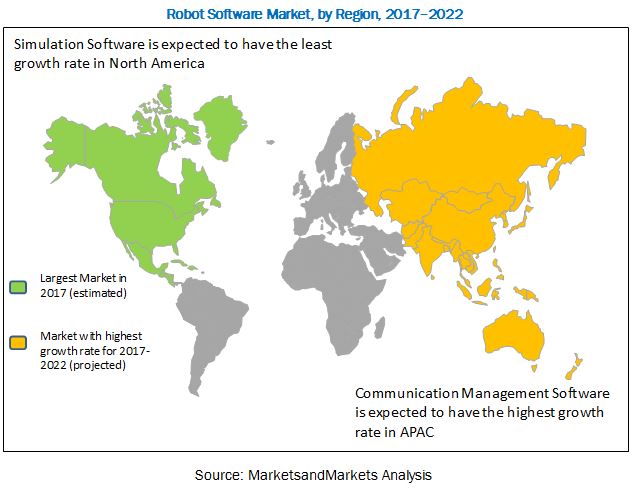

The report covers all the major aspects of the robot software market and provides an in-depth analysis in the regions of North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The market in North America is expected to have the largest market share. The APAC region is projected to provide significant opportunities in the market and is expected to grow at the highest CAGR during the forecast period. APAC being a manufacturing hub is expected to adopt the robot software substantially, to remain cost-efficient and export high-quality goods to other countries.

On contrary, malware attack on data engulfed by robots is the major restraining factor for the growth of the robot software market. Challenges related to criminal liability, and concerns over data protection and cybersecurity are the major challenges in the market.

Most of the vendors in the robot software market have adopted various growth strategies, such as acquisitions, agreements, collaborations and partnerships, new product launches, product upgradations, and expansions, to expand their client base and enhance the customer experience. For instance, in July 2017, IBM unveiled an IBM Watson-based service platform, built on IBM cloud. The platform is expected to supplement human intelligence to offer the cognitive technology that helps users to enhance their productivity.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Robot Software Market

4.2 Market Top 4 Verticals and Regions

4.3 Market By Region

4.4 Life Cycle Analysis, By Region, 2017

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need to Reduce Costs While Maintaining Quality

5.2.1.2 Increasing Adoption of IoT and AI

5.2.2 Restraints

5.2.2.1 Malware Attacks on Data Engulfed By Robots

5.2.3 Opportunities

5.2.3.1 Growth of Raas

5.2.3.2 Higher Adoption By SMEs

5.2.4 Challenges

5.2.4.1 Challenges Related to Criminal Liability

5.2.4.2 Concerns Over Data Protection and Cybersecurity

5.3 Industry Trends

5.3.1 Innovation Spotlight

5.3.1.1 Sophia: Social Humanoid Robot

5.3.1.2 Helena: Virtual Recruiting Assistant

5.3.1.3 Pepper: Autonomous Talking Humanoid

5.3.2 Technologies Behind AI-Powered Robot Software

5.3.2.1 AI

6 Robot Software Market, By Software Type (Page No. - 39)

6.1 Introduction

6.2 Recognition Software

6.3 Simulation Software

6.4 Predictive Maintenance Software

6.5 Data Management and Analysis Software

6.6 Communication Management Software

7 Market By Robot Type (Page No. - 47)

7.1 Introduction

7.2 Industrial Robots

7.3 Service Robots

8 Market By Deployment Model (Page No. - 51)

8.1 Introduction

8.2 On-Premises

8.3 On-Demand

9 Market By Organization Size (Page No. - 55)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Robot Software Market, By Vertical (Page No. - 59)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.2.1 Use Case: Personal Banking Assistant to Help Clients in Deciding Investment Plans

10.3 Retail and Ecommerce

10.3.1 Use Case: Help Buyers Find Goods They are Searching for

10.4 Government and Defense

10.4.1 Use Case: Reduction in the Frequency of Call on the Police Helpline Number

10.5 Healthcare and Life Sciences

10.5.1 Use Case: Point-Of-Care Testing (POCT)

10.6 Transportation and Logistics

10.6.1 Use Case: Improve Navigation and Object Detection

10.7 Manufacturing

10.7.1 Use Case: Automate Traditional Industrial Robots

10.8 Telecommunications and IT

10.8.1 Use Case: Streamline Customer Support Processes

10.9 Academia and Research

10.9.1 Use Case: Use AI to Write Research Papers

10.10 Others

11 Robot Software Market, By Region (Page No. - 73)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 90)

12.1 Overview

12.2 Prominent Players in the Robot Software Market

12.3 Competitive Scenario

12.3.1 New Product Launches and Product Upgradations

12.3.2 Partnerships, Collaborations, and Agreements

12.3.3 Mergers and Acquisitions

12.3.4 Business Expansions

13 Company Profiles (Page No. - 96)

(Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 IBM

13.2 ABB

13.3 Nvidia

13.4 Cloudminds

13.5 Liquid Robotics

13.6 Brain Corp

13.7 Aibrain

13.8 Furhat Robotics

13.9 Neurala

13.10 Energid Technologies

13.11 H2o.AI

13.12 Oxbotica

*Details on Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 123)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (65 Tables)

Table 1 Robot Software Market Size, By Software Type, 20152022 (USD Million)

Table 2 Recognition Software: Market Size By Region, 20152022 (USD Million)

Table 3 Simulation Software: Market Size By Region, 20152022 (USD Million)

Table 4 Predictive Maintenance Software: Market Size By Region, 20152022 (USD Million)

Table 5 Data Management and Analysis Software: Market Size By Region, 20152022 (USD Million)

Table 6 Communication Management Software: Market Size By Region, 20152022 (USD Million)

Table 7 Robot Software Market Size, By Robot Type, 20152022 (USD Million)

Table 8 Industrial Robots: Market Size By Region, 20152022 (USD Million)

Table 9 Service Robots: Market Size By Region, 20152022 (USD Million)

Table 10 Market Size By Deployment Model, 20152022 (USD Million)

Table 11 On-Premises: Market Size By Region, 20152022 (USD Million)

Table 12 On-Demand: Market Size By Region, 20152022 (USD Million)

Table 13 Market Size By Organization Size, 20152022 (USD Million)

Table 14 Small and Medium-Sized Enterprises: Market Size By Region, 20152022 (USD Million)

Table 15 Large Enterprises: Market Size By Region, 20152022 (USD Million)

Table 16 Robot Software Market Size By Vertical, 20152022 (USD Million)

Table 17 Banking, Financial Services, and Insurance: Market Size By Region, 20152022 (USD Million)

Table 18 Banking, Financial Services, and Insurance: Market Size By Robot Type, 20152022 (USD Million)

Table 19 Retail and Ecommerce: Market Size By Region, 20152022 (USD Million)

Table 20 Retail and Ecommerce: Market Size By Robot Type, 20152022 (USD Million)

Table 21 Government and Defense: Market Size By Region, 20152022 (USD Million)

Table 22 Government and Defense: Market Size By Robot Type, 20152022 (USD Million)

Table 23 Healthcare and Life Sciences: Market Size By Region, 20152022 (USD Million)

Table 24 Healthcare and Life Sciences: Market Size By Robot Type, 20152022 (USD Million)

Table 25 Transportation and Logistics: Market Size By Region, 20152022 (USD Million)

Table 26 Transportation and Logistics: Market Size By Robot Type, 20152022 (USD Million)

Table 27 Manufacturing: Robot Software Market Size, By Region, 20152022 (USD Million)

Table 28 Manufacturing: Market Size By Robot Type, 20152022 (USD Million)

Table 29 Telecommunications and IT: Market Size By Region, 20152022 (USD Million)

Table 30 Telecommunications and IT: Market Size By Robot Type, 20152022 (USD Million)

Table 31 Academia and Research: Market Size By Region, 20152022 (USD Million)

Table 32 Academia and Research: Market Size By Robot Type, 20152022 (USD Million)

Table 33 Others: Market Size By Region, 20152022 (USD Million)

Table 34 Others: Market Size By Robot Type, 20152022 (USD Million)

Table 35 Robot Software Market Size, By Region, 20152022 (USD Million)

Table 36 North America: Market Size By Software Type, 20152022 (USD Million)

Table 37 North America: Market Size By Robot Type, 20152022 (USD Million)

Table 38 North America: Market Size By Deployment Model, 20152022 (USD Million)

Table 39 North America: Market Size By Organization Size, 20152022 (USD Million)

Table 40 North America: Market Size By Vertical, 20152022 (USD Million)

Table 41 Europe: Robot Software Market Size, By Software Type, 20152022 (USD Million)

Table 42 Europe: Market Size By Robot Type, 20152022 (USD Million)

Table 43 Europe: Market Size By Deployment Model, 20152022 (USD Million)

Table 44 Europe: Market Size By Organization Size, 20152022 (USD Million)

Table 45 Europe: Market Size By Vertical, 20152022 (USD Million)

Table 46 Asia Pacific: Robot Software Market Size, By Software Type, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size By Robot Type, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size By Deployment Model, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size By Organization Size, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size By Vertical, 20152022 (USD Million)

Table 51 Middle East and Africa: Robot Software Market Size, By Software Type, 20152022 (USD Million)

Table 52 Middle East and Africa: Market Size By Robot Type, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size By Deployment Model, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size By Organization Size, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size By Vertical, 20152022 (USD Million)

Table 56 Latin America: Robot Software Market Size, By Software Type, 20152022 (USD Million)

Table 57 Latin America: Market Size By Robot Type, 20152022 (USD Million)

Table 58 Latin America: Market Size By Deployment Model, 20152022 (USD Million)

Table 59 Latin America: Market Size By Organization Size, 20152022 (USD Million)

Table 60 Latin America: Market Size By Vertical, 20152022 (USD Million)

Table 61 Prominent Players in the Robot Software Market

Table 62 New Product Launches and Product Upgradations, 20152017

Table 63 Partnerships, Collaborations, and Agreements, 20142017

Table 64 Mergers and Acquisitions, 20142017

Table 65 Business Expansions, 20142017

List of Figures (35 Figures)

Figure 1 Robot Software Market Segmentation

Figure 2 Market Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Robot Software Market: Assumptions

Figure 7 Robot Software Market, 20152022

Figure 8 Market By Software Type, 2017

Figure 9 Market By Robot Type, 2017 vs 2022

Figure 10 Market By Deployment Model, 2017

Figure 11 Market By Organization Size, 2017

Figure 12 Market By Vertical, 2017 vs 2022

Figure 13 Higher Adoption By Small and Medium-Sized Enterprises is Expected to Provide Significant Growth Opportunities in the Robot Software Market During the Forecast Period

Figure 14 Manufacturing Vertical and North America are Estimated to Have the Largest Market Shares in 2017

Figure 15 North America is Estimated to Dominate the Robot Software Market in 2017

Figure 16 Asia Pacific is Expected to Enter the Exponential Growth Phase During the Forecast Period

Figure 17 Robot Software Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Communication Management Software Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Service Robots Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 On-Demand Deployment Model is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Transportation and Logistics Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia Pacific is Expected to Have the Highest CAGR in the Market During the Forecast Period

Figure 24 North America Snapshot

Figure 25 Asia Pacific Snapshot

Figure 26 Key Developments By the Leading Players in the Robot Software Market, 20142017

Figure 27 Market Evaluation Framework

Figure 28 IBM: Company Snapshot

Figure 29 IBM: SWOT Analysis

Figure 30 ABB: Company Snapshot

Figure 31 ABB: SWOT Analysis

Figure 32 Nvidia: Company Snapshot

Figure 33 Nvidia: SWOT Analysis

Figure 34 Cloudminds: SWOT Analysis

Figure 35 Neurala: SWOT Analysis

Growth opportunities and latent adjacency in Robot Software Market