Robotic Dentistry Market by Product and Services (Standalone Robots, Robot Assisted Systems, Software, Services), Application (Implantology, Endodontics), End User (Dental Hospitals, Clinics, Dental Academic, Research Institute) & Region - Global Forecast to 2028

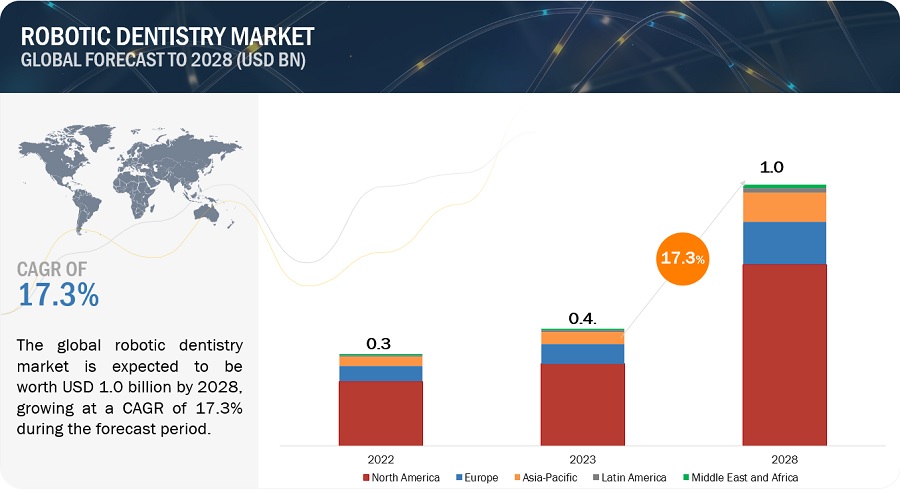

The global robotic dentistry market, valued at US$0.3 billion in 2022, stood at US$0.4 billion in 2023 and is projected to advance at a resilient CAGR of 17.3% from 2023 to 2028, culminating in a forecasted valuation of US$1.0 billion by the end of the period.

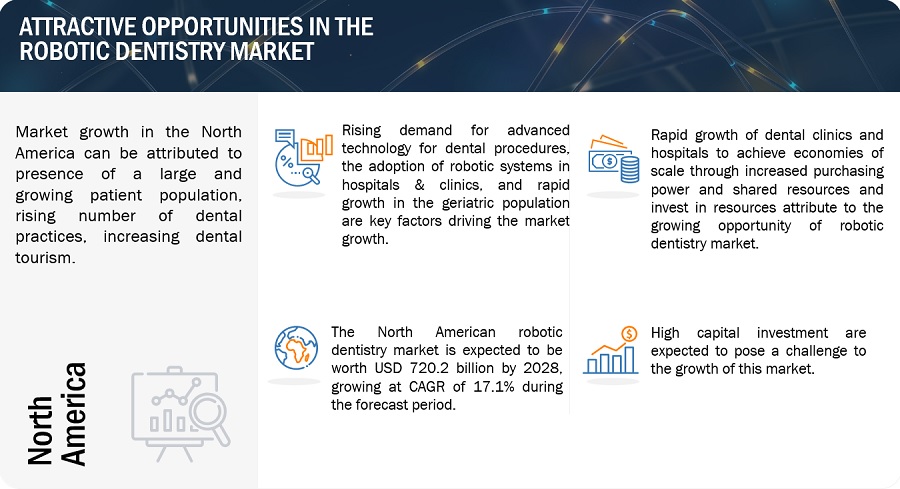

The incidence of dental problems such as dental caries and the growing market for dental tourism in developing countries, rising incidences of oral health disorders, benefits of using robot systems and adoption of advanced technologies are major key drivers for the market. However, the high cost of standalone robot is the factor which impede the market growth.

In this report, the robotic dentistry market is segmented into –products and services, applications, end user and region.

Attractive Opportunities in the Robotic dentistry Market

To know about the assumptions considered for the study, Request for Free Sample Report

Robotic Dentistry Market Dynamics

Driver: Technological advancements in robotic dentistry

The Robot assisted system and software can be used in detection and objective monitoring of oral diseases such as periodontal diseases and implant placements. Recent technological advancements includes use of standalone robots. In implantology the robotic dentistrys can be used for guided surgery, which can be used for the precise placement of implant roots.

Restraint: High cost of robotic dentistry and dental procedures

The average cost of one robotic system can go up to USD 1,50,000. Due to this, most small and medium sized dental businesses are unable to invest in robotic systems.

Additionally, most dental procedures are offered at a high cost especially in developed countries. For instance, most of the insurance providers in developed regions across North America and Europe consider dental implants a cosmetic product. Hence, they provide minimal or no reimbursements for dental implants. Therefore, patients must bear the major portion of the cost, with little support from insurance coverage. Because of this, patients decision to opt for treatment largely depends on their ability to afford it. This is a major factor restricting the adoption of technologically advanced solutions in developed countries leading to become a retraint for the adoption of robotic dentistry due to high cost.

Opportunity: Potential for growth in emerging countries

China, Japan, the Middle East, Australia, and India are the some of the emerging markets for robotic dentistry systems. In most of these geographies, the market is in a primitive stage.

The high growth potential of these markets can be attributed to their expanding middle-class population and increasing income levels. The expeditious increase in the incidences of oral health disorders, developing oral healthcare infrastructure, willingness to spend on dental treatments due to an increase in disposable incomes, and increase in the awareness of oral hygiene are expected to spur the demand for robotic dentistry.

Challenge: Dearth of trained dental practitioners

The dearth of the dental professionals in countries potrays a significant challenge as the dental disorders amongst the population is increasing. There is an increase in the incidences of dental diseases and dental problems. According to National Health Resources and Services Administration, US will face a shortage of over 4,000 general dentists in 2030.

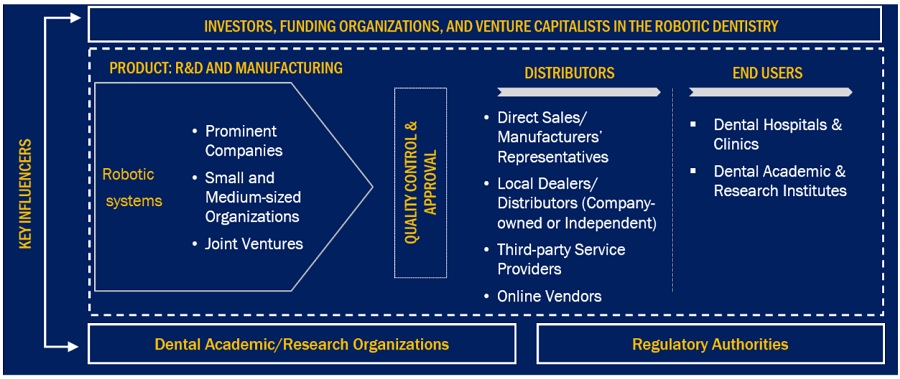

Robotic Dentistry Market Ecosystem

The top key players of the market include well-established, financially stable manufacturers of robotic dentistry. These companies have a divergent product portfolio, strong sales network globally, and state-of-the-art technologies.

Some key market players include Planmeca Oy (Finland), Align Technology Inc. (US), Intutive surgical Inc,(US), DENTSPLY SIRONA Inc. (US) and Envista Holdings Inc. (US).

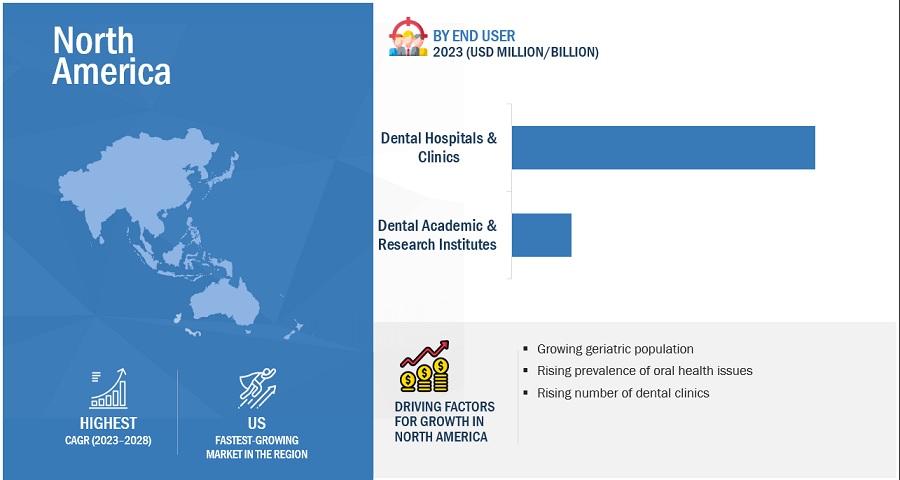

Among end users, Dental Hospitals and Clinics occupy the largest share of the robotic dentistry industry in 2022.

The dental hospitals and clinics, occupy the largest share of the robotic dentistry market. This can be attributed to increasing number of dental practices, rising dental expenditure and growing patient population. Dental tourism is a growing and emerging phenomenon which is becoming more attractive due to its potential for decreased expenses, increased convenience, and immediacy of treatment.

Among products and services, robot-assisted systems and software occupy the largest share of the robotic dentistry industry in 2022.

Robot-assisted systems & software includes the tools and software to enhance and carry out dental treatment and planning smoothly without any errors. These systems and software support the robotic systems for better treatment and diagnosis. Additionally, the location and angulation detection of software and systems is much more accurate Therefore, it is anticipated that the increased output provided by these systems will accelerate the segment’s expansion.

Among Applications, Implantology occupy the largest share of the robotic dentistry industry in 2022.

A primary factor in the use and growth implantology application is immediate solution, which allows an implant to be placed immediately in a tooth extraction socket or for a prosthesis to be mounted on an implant immediately after its placement. This allows for fewer dentist visits and faster treatment times. The positioning of the drill incorrectly might result in extensive bleeding, nerve injury, and other complcations. Due to the accuracy of the robot-assisted systems and software robots it is anticipated to produce dental implants that are more dependable and successful.

North America was the largest market in the world for robotic dentistry industry in 2022.

In 2022, the The north America occupies largest share in the robotic dentistry market globally. The growth of this market can mostly be attributed to availability of reimbursements and support from the government support. There is also an increase in number of hospitals which can attribute to the growth of the robotic dentistry market. The region's growth is attributed to technological advancements, and the presence of key players is expected to boost the market in the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the robotic dentistry market include DENTSPLY SIRONA Inc, (US), Align Technology Inc. (US), Envista Holdings Corporation (US), Intutuive Surgical Inc,(US), and Planmeca Oy.(Finland) .

These companies adopted strategies such as partnerships, acquisitions, and collaborations to strengthen their presence in the robotic dentistry market.

Scope of the Robotic Dentistry Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.4 billion |

|

Projected Revenue by 2028 |

$1.0 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 17.3% |

|

Market Driver |

Technological advancements in robotic dentistry |

|

Market Opportunity |

Potential for growth in emerging countries |

The study categorizes the robotic dentistry market to forecast revenue and analyze trends in each of the following submarkets:

By Product & service

- Standalone robot

- Robot-assisted system and software

- Services

By Applications

- Implantology

- Endodontics

- Others

By End User

- Dental Hospitals and Clinics

- Dental Academic and research institutes

By Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments of Robotic Dentistry Industry

- In November 2022, Neocis announced its FDA approval for the product Yomi Robot, which will now enable dental professionals to perform robot-guided alveoloplasty of the mandible and/or maxilla (often referred to as bone reduction).

- In October 2022, Intutive Surgicals, Inc.(US) were joined by Neocis’ existing partners,with an investment of USD 40 million bringing total investment in the Miami-based business

- In May 2022,DENTSPLY SIRONA Inc. launched a primeprint 3D printer which has a robotic arm

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global robotic dentistry market?

The global robotic dentistry market boasts a total revenue value of $1.0 billion in 2028.

What is the estimated growth rate (CAGR) of the global robotic dentistry market?

The global robotic dentistry market has an estimated compound annual growth rate (CAGR) of 17.3% and a revenue size in the region of $0.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Benefits of robotic surgery- Increasing prevalence of dental disordersRESTRAINTS- High cost of robotic systemsOPPORTUNITIES- Growth opportunities in emerging economiesCHALLENGES- Dearth of trained professionals- Limitations and possibility of errors

-

5.3 INDUSTRY TRENDSRISING NUMBER OF MINIMALLY INVASIVE DENTAL PROCEDURESFAVORABLE DENTAL INSURANCE IN US

-

5.4 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCENANODENTISTRY

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM MAP

-

5.7 REGULATORY ANALYSISNORTH AMERICA: REGULATORY SCENARIOEUROPE: REGULATORY SCENARIOASIA PACIFIC: REGULATORY SCENARIOMIDDLE EAST & AFRICA: REGULATORY SCENARIOLATIN AMERICA: REGULATORY SCENARIOREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.8 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR ROBOTIC DENTISTRYINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.10 ADJACENT MARKETS FOR ROBOTIC DENTISTRY

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY CONFERENCES & EVENTS, 2023

-

5.13 PRICING ANALYSISAVERAGE SELLING PRICE OF ROBOTIC DENTISTRY PRODUCTSAVERAGE SELLING PRICE TRENDS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ROBOT-ASSISTED SYSTEMS & SOFTWAREACCURACY AND PRECISION TO DRIVE DEMAND

-

6.3 STANDALONE ROBOTSHIGH COST TO LIMIT ADOPTION

-

6.4 SERVICESCONTINUOUS DEMAND FOR SERVICES TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 IMPLANTOLOGYPREFERENCE FOR ADVANCED TECHNOLOGIES TO SUPPORT MARKET GROWTH

-

7.3 ENDODONTICSRISING PREFERENCE FOR ROBOTIC DENTISTRY TO DRIVE MARKET

- 7.4 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 DENTAL HOSPITALS & CLINICSDENTAL HOSPITALS & CLINICS TO HOLD LARGEST MARKET SHARE

-

8.3 DENTAL ACADEMIC & RESEARCH INSTITUTESRISING INDUSTRY-ACADEMIA COOPERATION AND DENTAL RESEARCH FUNDING TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- High oral healthcare expenditure to drive marketCANADA- Favorable public & private funding investments to support market growth

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Favorable reimbursements for dental procedures to drive marketFRANCE- Rising awareness of dental diseases to support market growthUK- Rising government funding and increasing demand for private dental services to drive marketITALY- Low cost of dental treatment procedures to drive marketSPAIN- Improvements in healthcare infrastructure to support market growthREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Rising cases of edentulism to support market growthCHINA- Increasing cases of dental caries to drive marketINDIA- Growth in cosmetic dentistry procedures to drive marketAUSTRALIA- Increasing investments in advanced dental technologies to drive marketSOUTH KOREA- Increasing medical tourism for dental procedures to support market growthREST OF ASIA PACIFIC

-

9.5 LATIN AMERICALOWER COST OF DENTAL TREATMENTS TO SUPPORT MARKET GROWTHLATIN AMERICA: RECESSION IMPACT

-

9.6 MIDDLE EAST & AFRICAINCREASING AWARENESS ON ORAL HYGIENE TO FUEL MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.1 INTRODUCTION

- 10.2 KEY STRATEGIES ADOPTED BY PLAYERS IN ROBOTIC DENTISTRY MARKET

- 10.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIX (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIOPRODUCT LAUNCHES & APPROVALSDEALS

-

11.1 KEY PLAYERSNEOCIS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDENTSPLY SIRONA, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTUITIVE SURGICAL, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALIGN TECHNOLOGY, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewENVISTA HOLDINGS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewX-NAV TECHNOLOGIES, LLC- Business overview- Products/Solutions/Services offeredPLANMECA OY- Business overview- Products/Solutions/Services offered- Recent developmentsSTRAUMANN GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsROBODENT GMBH- Business overview- Products/Solutions/Services offeredAMANN GIRRBACH- Business overview- Products/Solutions/Services offered- Recent developmentsANATOMAGE, INC.- Business overview- Products/Solutions/Services offeredVATECH CO. LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsPRODIGIDENT INC.- Business overview- Products/Solutions/Services offered- Recent developmentsCLARONAV- Business overview- Products/Solutions/Services offered- Recent developments3SHAPE- Business overview- Products/Solutions/Services offered- Recent developmentsUEG MEDICAL GROUP LTD.- Business overview- Products/Solutions/Services offeredIMAGE NAVIGATION LTD.- Business overview- Products/Solutions/Services offeredTITAN SURGICAL SYSTEMS- Business overview- Products/Solutions/Services offeredDENTISTROBOT- Business overview- Products/Solutions/Services offeredCORUO- Business overview- Products/Solutions/Services offered

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (UNIT OF USD)

- TABLE 2 ROBOTIC DENTISTRY MARKET: ASSUMPTIONS

- TABLE 3 ROBOTIC DENTISTRY MARKET: RISK ASSESSMENT

- TABLE 4 PER CAPITA NATIONAL INCOME, 2000–2021 (USD)

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROBOTIC DENTISTRY: LIST OF MAJOR PATENTS

- TABLE 11 US ROBOTIC DENTISTRY AND SUPPLIES: EXPORTS, 2013–2018 (IN 000’)

- TABLE 12 ROBOTIC DENTISTRY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 KEY CONFERENCES & EVENTS, 2023

- TABLE 14 AVERAGE SYSTEM COST, BY TYPE

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PRODUCTS & SERVICES

- TABLE 16 KEY BUYING CRITERIA FOR ROBOTIC DENTISTRY PRODUCTS & SERVICES

- TABLE 17 ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 18 ROBOT-ASSISTED SYSTEMS & SOFTWARE OFFERED BY LEADING PLAYERS

- TABLE 19 ROBOT-ASSISTED SYSTEMS & SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 STANDALONE ROBOTS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 ROBOTIC DENTISTRY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 23 ROBOTIC DENTISTRY MARKET FOR IMPLANTOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 ROBOTIC DENTISTRY MARKET FOR ENDODONTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ROBOTIC DENTISTRY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 ROBOTIC DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 27 ROBOTIC DENTISTRY MARKET FOR DENTAL HOSPITALS & CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 TOP 10 NIDCR GRANTS TO US DENTAL INSTITUTIONS (USD MILLION)

- TABLE 29 ROBOTIC DENTISTRY MARKET FOR DENTAL ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 ROBOTIC DENTISTRY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 ROBOTIC DENTISTRY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: ROBOTIC DENTISTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: ROBOTIC DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 36 US: MACROECONOMIC INDICATORS

- TABLE 37 US: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 38 US: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 39 US: ROBOTIC DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 40 CANADA: MACROECONOMIC INDICATORS

- TABLE 41 CANADA: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 42 CANADA: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 43 CANADA: ROBOTIC DENTISTRY MARET, BY END USER,2021–2028 (USD MILLION)

- TABLE 44 EUROPE: ROBOTIC DENTISTRY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 EUROPE: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 47 EUROPE: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 48 GERMANY: MACROECONOMIC INDICATORS

- TABLE 49 GERMANY: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 50 GERMANY: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 51 GERMANY: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 52 FRANCE: MACROECONOMIC INDICATORS

- TABLE 53 FRANCE: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 54 FRANCE: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 55 FRANCE: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 56 UK: MACROECONOMIC INDICATORS

- TABLE 57 UK: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 58 UK: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 59 UK: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 60 ITALY: MACROECONOMIC INDICATORS

- TABLE 61 ITALY: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 62 ITALY: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 63 ITALY: ROBOTIC DENTISTRY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 64 SPAIN: MACROECONOMIC INDICATORS

- TABLE 65 SPAIN: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 66 SPAIN: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 67 SPAIN: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 68 REST OF EUROPE: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 69 REST OF EUROPE: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 REST OF EUROPE: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: ROBOTIC DENTISTRY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 75 JAPAN: MACROECONOMIC INDICATORS

- TABLE 76 JAPAN: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 77 JAPAN: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 JAPAN: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 CHINA: MACROECONOMIC INDICATORS

- TABLE 80 CHINA: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 81 CHINA: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 82 CHINA: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 INDIA: MACROECONOMIC INDICATORS

- TABLE 84 INDIA: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 85 INDIA: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 INDIA: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 88 AUSTRALIA: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 89 AUSTRALIA: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 90 AUSTRALIA: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 92 SOUTH KOREA: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 93 SOUTH KOREA: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 SOUTH KOREA: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 98 LATIN AMERICA: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 99 LATIN AMERICA: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 100 LATIN AMERICA: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: ROBOTIC DENTISTRY MARET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 104 ROBOTIC DENTISTRY MARKET: DEGREE OF COMPETITION

- TABLE 105 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 106 COMPANY PRODUCT & SERVICE FOOTPRINT

- TABLE 107 COMPANY END-USER FOOTPRINT

- TABLE 108 COMPANY APPLICATION FOOTPRINT

- TABLE 109 COMPANY REGIONAL FOOTPRINT

- TABLE 110 PRODUCT LAUNCHES & APPROVALS, 2019–2023

- TABLE 111 DEALS (JANUARY 2019– JULY 2023)

- TABLE 112 NEOCIS, INC.: BUSINESS OVERVIEW

- TABLE 113 PRODUCT APPROVALS

- TABLE 114 DENTSPLY SIRONA, INC.: BUSINESS OVERVIEW

- TABLE 115 INTUITIVE SURGICAL, INC.: BUSINESS OVERVIEW

- TABLE 116 ALIGN TECHNOLOGY, INC.: BUSINESS OVERVIEW

- TABLE 117 PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 118 ENVISTA HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 119 X-NAV TECHNOLOGIES, LLC.: BUSINESS OVERVIEW

- TABLE 120 PLANMECA OY: BUSINESS OVERVIEW

- TABLE 121 STRAUMANN GROUP: BUSINESS OVERVIEW

- TABLE 122 ROBODENT GMBH: BUSINESS OVERVIEW

- TABLE 123 AMANN GIRRBACH AG: BUSINESS OVERVIEW

- TABLE 124 ANATOMAGE, INC.: BUSINESS OVERVIEW

- TABLE 125 VATECH CO. LTD.: BUSINESS OVERVIEW

- TABLE 126 PRODIGIDENT INC.: BUSINESS OVERVIEW

- TABLE 127 CLARONAV: BUSINESS OVERVIEW

- TABLE 128 3SHAPE: BUSINESS OVERVIEW

- TABLE 129 UEG MEDICAL GROUP LTD.: BUSINESS OVERVIEW

- TABLE 130 IMAGE NAVIGATION LTD.: BUSINESS OVERVIEW

- TABLE 131 TITAN SURGICAL SYSTEMS: BUSINESS OVERVIEW

- TABLE 132 DENTISTROBOT: BUSINESS OVERVIEW

- TABLE 133 CORUO: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 KEY INDUSTRY INSIGHTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

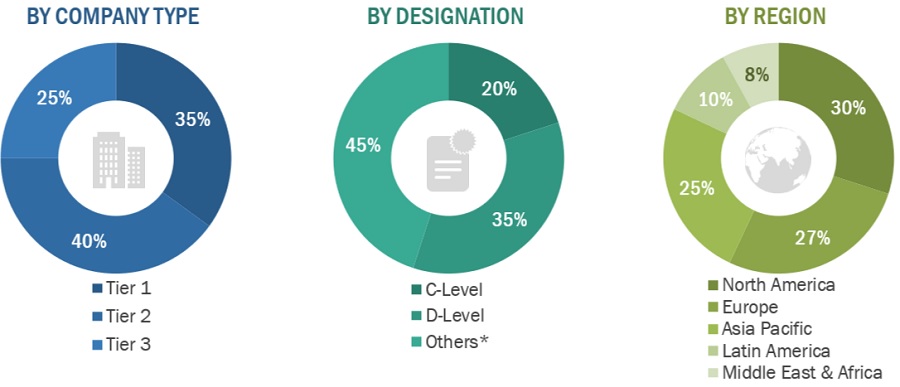

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: ALIGN TECHNOLOGY

- FIGURE 9 DEMAND-SIDE ANALYSIS: ROBOTIC DENTISTRY MARKET (2022)

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2028)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 TOP-DOWN APPROACH

- FIGURE 13 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 14 ROBOTIC DENTISTRY MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 ROBOTIC DENTISTRY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 ROBOTIC DENTISTRY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 GEOGRAPHIC SNAPSHOT: ROBOTIC DENTISTRY MARKET

- FIGURE 18 RISING CASES OF DENTAL DISORDERS TO DRIVE ADOPTION OF ROBOTIC DENTISTRY

- FIGURE 19 ROBOT-ASSISTED SYSTEMS & SOFTWARE HELD LARGEST MARKET SHARE IN 2022

- FIGURE 20 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 NORTH AMERICA TO DOMINATE ROBOTIC DENTISTRY MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 22 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES TILL 2028

- FIGURE 23 ROBOTIC DENTISTRY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 TOTAL DENTAL ENROLLMENT (2011–2020)

- FIGURE 25 VALUE CHAIN ANALYSIS

- FIGURE 26 ECOSYSTEM MAPPING

- FIGURE 27 PATENT PUBLICATION TRENDS (2013–2023)

- FIGURE 28 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR ROBOTIC DENTISTRY PATENTS (2013–2023)

- FIGURE 29 TOP APPLICANT COUNTRIES/REGIONS FOR ROBOTIC DENTISTRY PATENTS (2013–2023)

- FIGURE 30 ADJACENT MARKETS FOR ROBOTIC DENTISTRY

- FIGURE 31 AVERAGE SELLING PRICE OF ROBOTIC DENTISTRY PRODUCTS, BY TYPE

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PRODUCTS & SERVICES

- FIGURE 33 KEY BUYING CRITERIA FOR ROBOTIC DENTISTRY PRODUCTS & SERVICES

- FIGURE 34 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: ROBOTIC DENTISTRY MARKET SNAPSHOT

- FIGURE 36 US: RISE IN DENTAL EXPENDITURE, 2010–2030

- FIGURE 37 ASIA PACIFIC: ROBOTIC DENTISTRY MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 39 ROBOTIC DENTISTRY MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 40 ROBOTIC DENTISTRY MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 41 DENTSPLY SIRONA: COMPANY SNAPSHOT

- FIGURE 42 INTUITIVE SURGICAL, INC.: COMPANY SNAPSHOT

- FIGURE 43 ALIGN TECHNOLOGY, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 44 ENVISTA HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 45 STRAUMANN GROUP: COMPANY SNAPSHOT (2022)

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the robotic dentistry market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the robotic dentistry market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the robotic dentistry market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Tiers are defined based on a company’s total revenue. As of 2022: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million.

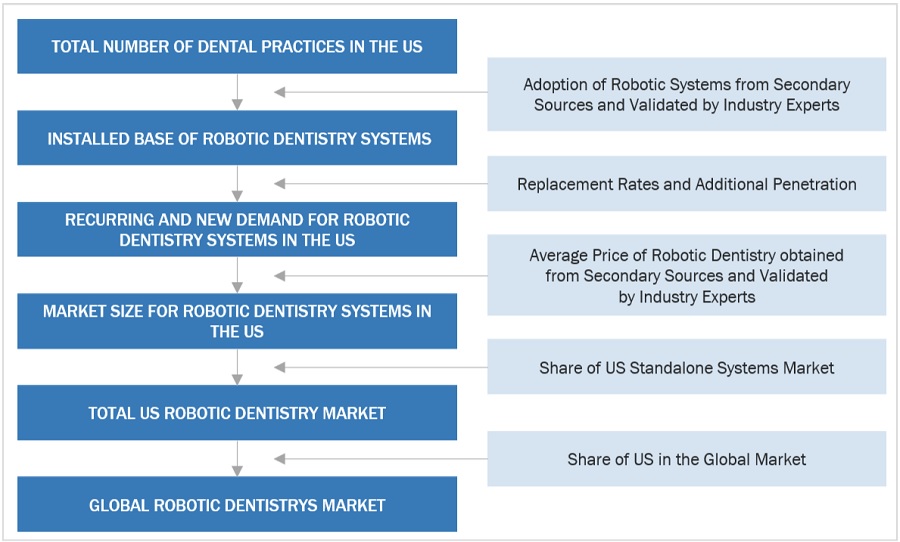

Market Size Estimation

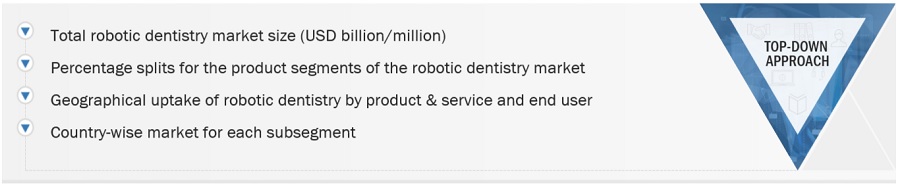

The total size of the robotic dentistry market was determined after data triangulation from four approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Robotic Dentistry Market Size

Approach to calculating the revenue of different players in the robotic dentistry market

The size of the global robotic dentistry market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global robotic dentistry market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Robotic dentistry refers to the automatically controlled programs that perform minimally invasive dental procedures. Robots are machines that perform automatic manual tasks programmed by a computer. Robotic dentistry uses robotic technology to carry out dental treatments with extreme efficiency and precision. The market is fueled by rising demand for minimally invasive procedures and the rising use of innovative dental technologies. These systems and software are mostly used for implant placements. Standalone robots are machines that perform all the treatments and manual tasks automatically programmed by a computer. These carry out the whole end-to-end dental treatments/Procedures/diagnostics. The services include the integration of systems or software, annual maintenance, and troubleshooting.

Key Stakeholders

- Manufacturers and distributors of medical devices

- Robotic dentistry manufacturers

- Contract manufacturers of robotic dentistry

- Distributors of robotic dentistry

- Research and consulting firms

- Raw material suppliers of robotic dentistry

- Dental hospitals and clinics

- Dental laboratories and associations

- Dental practitioners

- Dental laboratory technicians

- Healthcare institutions

- Diagnostic laboratories

- Hospitals and clinics

- Academic institutions

- Research institutions

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, and forecast the robotic dentistry market by type, application, end-user, and region/country

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the robotic dentistry market in Europe, North America, Asia Pacific, Latin America, and the Middle East and Africa.

- To strategically profile key players in the robotic dentistry market and comprehensively analyze their core competencies2

- To track and analyze competitive developments, such as acquisitions, product launches, partnerships, and collaborations

- To analyze the impact of the recession on the robotic dentistry market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Additional country-level analysis of the robotic dentistry market

- Profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Robotic Dentistry Market