Rubber Repair Adhesives Market by Process (Hot Bond, Cold Bond), Application (Conveyor Belts, Tanks & Vessels, Pipes & Fittings, and Others), End-use Industry (Mining & Quarrying, Cement & Aggregate, Steel and Others), Region - Global Forecast to 2025

Updated on : June 18, 2024

Rubber Repair Adhesives Market

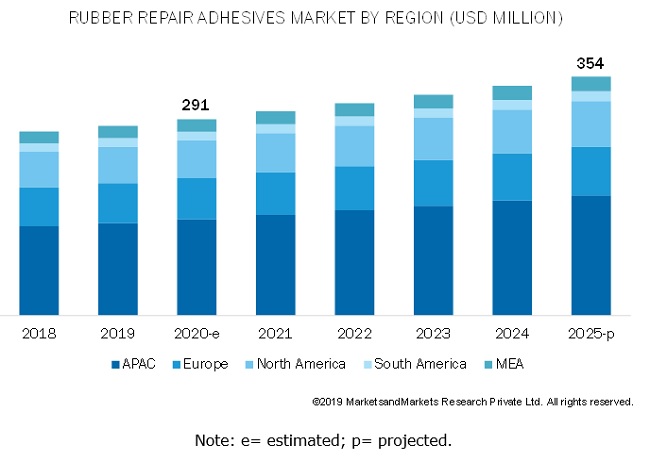

Rubber Repair Adhesives Market was valued at USD 291 million in 2020 and is projected to reach USD 354 million by 2025, growing at 4.0% cagr from 2020 to 2025. The market is growing due to the rise in the demand from mining & quarrying, cement & aggregate, and steel industries.

Rubber Repair Adhesives Market Dynamics

The hot bond process in rubber repair adhesives accounts for a significant market share in terms of value.

The hot bond process in the rubber repair adhesives segment dominated the market in terms of value in 2019. The adhesives used in the hot bond process offer more reliable repairing solutions for conveyor belts, as compared to adhesives used cold bond process.

Mining & quarrying industry accounts for a significant share in the rubber repair adhesives market in terms of value.

Rubber repair adhesives are widely used in the mining & quarrying industry for repair of conveyor belts, pulleys, and rollers. The industry requires rubber conveyor belts for bulk material handling and transporting materials from one place to the other. These rubber conveyor belts are subjected to damage in the process of material handling and transporting and require continuous repair and maintenance after a certain period of time.

The conveyor belt application has the largest share in the rubber repair adhesives market.

The conveyor belt application accounts for the largest share in the rubber repair adhesives market in terms of value. Rubber conveyor belts reinforced with nylon or steel cords are the most expensive part of a conveyor system. However, due to the extreme working conditions, and harsh environments, and abrasive nature of the materials transported; the conveyor systems are constantly exposed to heavy wear and impact damage and hence regular maintenance and upkeep play a crucial role in increasing the service life of a conveyor belts. Thus there is a high demand for rubber repair adhesives in the conveyor belt application.

APAC held the largest market share in the rubber repair adhesives market in 2019.

APAC dominated the rubber repair adhesives market in terms of value. APAC led the rubber repair adhesives market due to the presence of established mining & quarrying, cement & aggregate, and steel end-use industries in the region. These industries use rubber repair adhesives-based in conveyor belts, pulleys and rollers. The market in these end-use segments is led by China, Japan, India, Australia and South Korea, and other countries. With the continuous technological advancements, the demand for high performing rubber repair adhesives is increasing. This has led to developments in the APAC rubber repair adhesives market.

Rubber Repair Adhesives Market Players

The key players in the global rubber repair adhesives market are LORD Corporation (US), Fourthane (Chile), 3M (US), Henkel AG & Co. KGaA (Germany), Sika AG (Switzerland), H.B. Fuller Company (US), Belzona International Ltd. (England), Rema Tip Top AG (Germany), ITW Performance Polymers (US) and Eli-Chem Resins UK Limited (UK). These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the rubber repair adhesives industry. The study includes an in-depth competitive analysis of these companies in the rubber repair adhesives market, with their company profiles, recent developments, and key market strategies.

Rubber Repair Adhesives Market Report Scope

|

Report Metric |

Details |

|

Years Considered for the study |

2020–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Ton) |

|

Segments |

Process, Application, End-use Industry, and Region |

|

Regions |

Europe, North America, APAC, MEA, and South America |

|

Companies |

LORD Corporation (US), Fourthane (Chile), 3M (US), Henkel AG & Co. KGaA (Germany), Sika AG (Switzerland), H.B. Fuller Company (US), Belzona International Ltd. (England), Rema Tip Top AG (Germany), ITW Performance Polymers (US) and Eli-Chem Resins UK Limited (UK) |

This research report categorizes the rubber repair adhesives market based on type, source, end-use industry, and region.

Rubber Repair Adhesives Market by Process:

- Hot Bond

- Cold Bond

Rubber Repair Adhesives Market by Application:

- Conveyor Belts

- Tanks & Vessels

- Pipes & Fittings

- Others

Rubber Repair Adhesives Market by End-use Industry:

- Mining & Quarrying

- Cement & Aggregate

- Steel

- Others

Rubber Repair Adhesives Market by Region:

- North America

- Europe

- APAC

- MEA

- South America

Key Questions Addressed By the Report

- Which are the major end-use industries of rubber repair adhesives?

- Which industry is the major consumer of rubber repair adhesives?

- Which region is the largest and fastest-growing market for rubber repair adhesives?

- What are the major process in which rubber repair adhesives?

- What are the major applications of rubber repair adhesives?

- What are the major strategies adopted by leading market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE ANALYSIS

2.2.2 SEGMENT ANALYSIS

2.2.3 FORECAST

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 29)

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 ATTRACTIVE OPPORTUNITIES IN THE RUBBER REPAIR ADHESIVES MARKET

4.2 RUBBER REPAIR ADHESIVES MARKET,BY APPLICATION AND REGION,2019

4.3 RUBBER REPAIR ADHESIVES MARKET,BY END-USE INDUSTRY

4.4 RUBBER REPAIR ADHESIVES MARKET,BY PROCESS

4.5 RUBBER REPAIR ADHESIVES MARKET,BY KEY COUNTRIES

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 High demand for rubber conveyor belts from various end-use industries

5.2.1.2 Superior performance of rubber repair adhesives over metal fasteners

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material pricing and supply availability

5.2.2.2 Global economic slowdown due to pandemic corona outbreak

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing mining activities in APAC and South America

5.2.3.2 Robust growth in the global cement industry

5.2.4 CHALLENGES

5.2.4.1 Stringent local and international regulations

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 MACROECONOMIC OVERVIEW AND KEY TRENDS (Page No. - 41)

6.1 INTRODUCTION

6.2 TRENDS AND FORECAST OF GDP

6.3 PER CAPITA GDP VS. PER CAPITA RUBBER REPAIR ADHESIVES DEMAND

6.4 TRENDS IN THE MINING & QUARRYING INDUSTRY

6.5 TRENDS IN THE CONSTRUCTION INDUSTRY

6.6 IMPACT OF PANDEMIC CORONAVIRUS ON END-USE INDUSTRIES

6.6.1 MINING & QUARRYING

6.6.2 CEMENT & AGGREGATE INDUSTRY

6.6.3 STEEL INDUSTRY

7 RUBBER REPAIR ADHESIVES MARKET,BY PROCESS (Page No. - 48)

7.1 INTRODUCTION

7.2 HOT BOND ADHESIVES

7.2.1 HOT BOND RUBBER REPAIR ADHESIVES MARKET SIZE,BY REGION

7.3 COLD BOND ADHESIVES

7.3.1 COLD BOND RUBBER REPAIR ADHESIVES MARKET SIZE,BY REGION

8 RUBBER REPAIR ADHESIVES MARKET,BY APPLICATION (Page No. - 52)

8.1 INTRODUCTION

8.2 CONVEYOR BELTS

8.2.1 RUBBER REPAIR ADHESIVES MARKET SIZE IN CONVEYOR BELTS,BY REGION

8.3 TANKS & VESSELS

8.3.1 RUBBER REPAIR ADHESIVES MARKET SIZE IN TANKS & VESSELS,BY REGION

8.4 PIPES & FITTINGS

8.4.1 RUBBER REPAIR ADHESIVES MARKET SIZE IN PIPES & FITTINGS,BY REGION

8.5 OTHERS

8.5.1 RUBBER REPAIR ADHESIVES MARKET SIZE IN OTHER APPLICATIONS,BY REGION

9 RUBBER REPAIR ADHESIVES MARKET,BY END-USE INDUSTRY (Page No. - 59)

9.1 INTRODUCTION

9.2 MINING & QUARRYING

9.2.1 RUBBER REPAIR ADHESIVES MARKET SIZE IN MINING & QUARRYING INDUSTRY,BY REGION

9.3 CEMENT & AGGREGATE

9.3.1 RUBBER REPAIR ADHESIVES MARKET SIZE IN CEMENT & AGGREGATE INDUSTRY,BY REGION

9.4 STEEL

9.4.1 RUBBER REPAIR ADHESIVES MARKET SIZE IN STEEL INDUSTRY,BY REGION

9.5 OTHERS

9.5.1 CHEMICAL

9.5.2 WATER TREATMENT

9.5.3 THERMAL (HEAT & POWER)

9.5.4 RUBBER REPAIR ADHESIVES MARKET SIZE IN OTHER INDUSTRIES,BY REGION

10 RUBBER REPAIR ADHESIVES MARKET,BY REGION (Page No. - 66)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION

10.2.2 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS

10.2.3 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY

10.2.3.1 US

10.2.3.1.1 US: rubber repair adhesives market size,by application

10.2.3.2 Canada

10.2.3.2.1 Canada: rubber repair adhesives market size,by application

10.2.3.3 Mexico

10.2.3.3.1 Mexico: rubber repair adhesives market size,by application

10.3 EUROPE

10.3.1 EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION

10.3.2 EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS

10.3.3 EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY

10.3.3.1 Germany

10.3.3.1.1 Germany: rubber repair adhesives market size,by application

10.3.3.2 Russia

10.3.3.2.1 Russia: rubber repair adhesives market size,by application

10.3.3.3 UK

10.3.3.3.1 UK: rubber repair adhesives market size,by application

10.3.3.4 Italy

10.3.3.4.1 Italy: rubber repair adhesives market size,by application

10.3.3.5 France

10.3.3.5.1 France: rubber repair adhesives market size,by application

10.3.3.6 Spain

10.3.3.6.1 Spain: rubber repair adhesives market size,by application

10.3.3.7 Rest of Europe

10.3.3.7.1 Rest of Europe: rubber repair adhesives market size,by application

10.4 APAC

10.4.1 APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION

10.4.2 APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS

10.4.3 APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY

10.4.3.1 China

10.4.3.1.1 China: rubber repair adhesives market size,by application

10.4.3.2 Japan

10.4.3.2.1 Japan: rubber repair adhesives market size,by application

10.4.3.3 India

10.4.3.3.1 India: rubber repair adhesives market size,by application

10.4.3.4 South Korea

10.4.3.4.1 South Korea: rubber repair adhesives market size,by application

10.4.3.5 Australia

10.4.3.5.1 Australia: rubber repair adhesives market size,by application

10.4.3.6 Rest of APAC

10.4.3.6.1 Rest of APAC: rubber repair adhesives market size,by application

10.5 MIDDLE EAST & AFRICA (MEA)

10.5.1 MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION

10.5.2 MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS

10.5.3 MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY

10.5.3.1 Saudi Arabia

10.5.3.1.1 Saudi Arabia: rubber repair adhesives market size,by application

10.5.3.2 UAE

10.5.3.2.1 UAE: rubber repair adhesives market size,by application

10.5.3.3 South Africa

10.5.3.3.1 South Africa: rubber repair adhesives market size,by application

10.5.3.4 Rest of MEA

10.5.3.4.1 Rest of MEA: rubber repair adhesives market size,by application

10.6 SOUTH AMERICA

10.6.1 SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION

10.6.2 SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS

10.6.3 SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY

10.6.3.1 Brazil

10.6.3.1.1 Brazil: rubber repair adhesives market size,by application

10.6.3.2 Argentina

10.6.3.2.1 Argentina: rubber repair adhesives market size,by application

10.6.3.3 Rest of South America

10.6.3.3.1 Rest of South America: rubber repair adhesives market size,by application

11 COMPETITIVE LANDSCAPE (Page No. - 105)

11.1 INTRODUCTION

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 VISIONARY LEADERS

11.2.2 DYNAMIC DIFFERENTIATORS

11.2.3 EMERGING COMPANIES

11.2.4 INNOVATORS

11.3 STRENGTH OF PRODUCT PORTFOLIO

11.4 BUSINESS STRATEGY EXCELLENCE

11.5 MARKET RANKING

11.6 COMPETITIVE SCENARIO

11.6.1 EXPANSION

11.6.2 NEW PRODUCT/TECHNOLOGY LAUNCH

11.6.3 ACQUISITION

12 COMPANY PROFILES (Page No. - 112)

(Business overview,Products offered,Recent developments,SWOT analysis,Winning imperatives,Current focus and strategies,Threat from competition,Right to win & MnM view)*

12.1 LORD CORPORATION

12.2 3M

12.3 HENKEL AG & CO. KGAA

12.4 SIKA AG

12.5 H.B. FULLER COMPANY

12.6 FOURTHANE

12.7 BELZONA INTERNATIONAL LTD.

12.8 REMA TIP TOP AG

12.9 ITW PERFORMANCE POLYMERS

12.10 ELI-CHEM RESINS UK LIMITED

*Details on Business overview,Products offered,Recent developments,SWOT analysis,Winning imperatives,Current focus and strategies,Threat from competition,Right to win & MnM view might not be captured in case of unlisted companies.

12.11 OTHER PLAYERS

12.11.1 BOSTIK

12.11.2 PERMABOND LLC

12.11.3 IMTECH

12.11.4 GERMANBELT SYSTEMS GMBH

12.11.5 SHANXI BETOP INDUSTRY AND TRADE CO.,LTD.

12.11.6 ANS CONVEYOR & RUBBER PRODUCTS LIMITED

12.11.7 SMOOTH-ON,INC.

12.11.8 OLIVER RUBBER INDUSTRIES

12.11.9 THEJO ENGINEERING LIMITED

12.11.10 NILOS GMBH & CO. KG

13 APPENDIX (Page No. - 135)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (114 Tables)

TABLE 1 TRENDS AND FORECAST OF GDP,2017–2024 (USD BILLION)

TABLE 2 PER CAPITA GDP VS. PER CAPITA RUBBER REPAIR ADHESIVES DEMAND,2019

TABLE 3 NORTH AMERICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP,BY COUNTRY,2017–2024 (USD BILLION)

TABLE 4 EUROPE: CONTRIBUTION OF CONSTRUCTION INDUSTRY TO GDP,BY COUNTRY,2017–2024 (USD BILLION)

TABLE 5 APAC: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP,BY COUNTRY,2017–2024 (USD BILLION)

TABLE 6 MEA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP,BY COUNTRY,2017–2024 (USD BILLION)

TABLE 7 SOUTH AMERICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP,BY COUNTRY,2017–2024 (USD BILLION)

TABLE 8 RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (USD MILLION)

TABLE 9 RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (TON)

TABLE 10 HOT BOND RUBBER REPAIR ADHESIVES MARKET SIZE,BY REGION,2018–2025 (USD MILLION)

TABLE 11 HOT BOND RUBBER REPAIR ADHESIVES MARKET SIZE,BY REGION,2018–2025 (TON)

TABLE 12 COLD BOND RUBBER REPAIR ADHESIVES MARKET SIZE,BY REGION,2018–2025 (USD MILLION)

TABLE 13 COLD BOND RUBBER REPAIR ADHESIVES MARKET SIZE,BY REGION,2018–2025 (TON)

TABLE 14 RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 15 RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 16 RUBBER REPAIR ADHESIVES MARKET SIZE IN CONVEYOR BELTS,BY REGION,2018–2025 (USD MILLION)

TABLE 17 RUBBER REPAIR ADHESIVES MARKET SIZE IN CONVEYOR BELTS,BY REGION,2018–2025 (TON)

TABLE 18 RUBBER REPAIR ADHESIVES MARKET SIZE IN TANKS & VESSELS,BY REGION,2018–2025 (USD MILLION)

TABLE 19 RUBBER REPAIR ADHESIVES MARKET SIZE IN TANKS & VESSELS,BY REGION,2018–2025 (TON)

TABLE 20 RUBBER REPAIR ADHESIVES MARKET SIZE IN PIPES & FITTINGS,BY REGION,2018–2025 (USD MILLION)

TABLE 21 RUBBER REPAIR ADHESIVES MARKET SIZE IN PIPES & FITTINGS,BY REGION,2018–2025 (TON)

TABLE 22 RUBBER REPAIR ADHESIVES MARKET SIZE IN OTHER APPLICATIONS,BY REGION,2018–2025 (USD MILLION)

TABLE 23 RUBBER REPAIR ADHESIVES MARKET SIZE IN OTHER APPLICATIONS,BY REGION,2018–2025 (TON)

TABLE 24 RUBBER REPAIR ADHESIVES MARKET SIZE,BY END-USE INDUSTRY,2018–2025 (USD MILLION)

TABLE 25 RUBBER REPAIR ADHESIVES MARKET SIZE,BY END-USE INDUSTRY,2018–2025 (TON)

TABLE 26 RUBBER REPAIR ADHESIVES MARKET SIZE IN MINING & QUARRYING INDUSTRY,BY REGION,2018–2025 (USD MILLION)

TABLE 27 RUBBER REPAIR ADHESIVES MARKET SIZE IN MINING & QUARRYING INDUSTRY,BY REGION,2018–2025 (TON)

TABLE 28 RUBBER REPAIR ADHESIVES MARKET SIZE IN CEMENT & AGGREGATE INDUSTRY,BY REGION,2018–2025 (USD MILLION)

TABLE 29 RUBBER REPAIR ADHESIVES MARKET SIZE IN CEMENT & AGGREGATE INDUSTRY,BY REGION,2018–2025 (TON)

TABLE 30 RUBBER REPAIR ADHESIVES MARKET SIZE IN STEEL INDUSTRY,BY REGION,2018–2025 (USD MILLION)

TABLE 31 RUBBER REPAIR ADHESIVES MARKET SIZE IN STEEL INDUSTRY,BY REGION,2018–2025 (TON)

TABLE 32 RUBBER REPAIR ADHESIVES MARKET SIZE IN OTHER INDUSTRIES,BY REGION,2018–2025 (USD MILLION)

TABLE 33 RUBBER REPAIR ADHESIVES MARKET SIZE IN OTHER INDUSTRIES,BY REGION,2018–2025 (TON)

TABLE 34 RUBBER REPAIR ADHESIVES MARKET SIZE,BY REGION,2018–2025 (USD MILLION)

TABLE 35 RUBBER REPAIR ADHESIVES MARKET SIZE,BY REGION,2018–2025 (TON)

TABLE 36 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 38 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (TON)

TABLE 40 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (USD MILLION)

TABLE 41 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (TON)

TABLE 42 US: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 43 US: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 44 CANADA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 45 CANADA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 46 MEXICO: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 47 MEXICO: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 48 EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 49 EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 50 EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (USD MILLION)

TABLE 51 EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (TON)

TABLE 52 EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (USD MILLION)

TABLE 53 EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (TON)

TABLE 54 GERMANY: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 55 GERMANY: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 56 RUSSIA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 57 RUSSIA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 58 UK: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 59 UK: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 60 ITALY: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 61 ITALY: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 62 FRANCE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 63 FRANCE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 64 SPAIN: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 65 SPAIN: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 66 REST OF EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 67 REST OF EUROPE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 68 APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 69 APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 70 APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (USD MILLION)

TABLE 71 APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (TON)

TABLE 72 APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (USD MILLION)

TABLE 73 APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (TON)

TABLE 74 CHINA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 75 CHINA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 76 JAPAN: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 77 JAPAN: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 78 INDIA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 79 INDIA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 80 SOUTH KOREA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 81 SOUTH KOREA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 82 AUSTRALIA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 83 AUSTRALIA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 84 REST OF APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 85 REST OF APAC: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 86 MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 87 MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 88 MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (USD MILLION)

TABLE 89 MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (TON)

TABLE 90 MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (USD MILLION)

TABLE 91 MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (TON)

TABLE 92 SAUDI ARABIA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 93 SAUDI ARABIA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 94 UAE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 95 UAE: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 96 SOUTH AFRICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 97 SOUTH AFRICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 98 REST OF MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 99 REST OF MEA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 100 SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 101 SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 102 SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (USD MILLION)

TABLE 103 SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY PROCESS,2018–2025 (TON)

TABLE 104 SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (USD MILLION)

TABLE 105 SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY COUNTRY,2018–2025 (TON)

TABLE 106 BRAZIL: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 107 BRAZIL: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 108 ARGENTINA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 109 ARGENTINA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 110 REST OF SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (USD MILLION)

TABLE 111 REST OF SOUTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SIZE,BY APPLICATION,2018–2025 (TON)

TABLE 112 EXPANSION,2014-2019

TABLE 113 NEW PRODUCT/TECHNOLOGY LAUNCH,2014-2019

TABLE 114 ACQUISITION,2014-2019

LIST OF FIGURES (38 Figures)

FIGURE 1 RUBBER REPAIR ADHESIVES MARKET: RESEARCH DESIGN

FIGURE 2 MARKET NUMBER ESTIMATION

FIGURE 3 RUBBER REPAIR ADHESIVES MARKET: DATA TRIANGULATION

FIGURE 4 HOT BOND PROCESS WAS THE LARGER SEGMENT IN 2019

FIGURE 5 CONVEYOR BELT APPLICATION ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

FIGURE 6 MINING & QUARRYING INDUSTRY ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2019

FIGURE 7 APAC TO BE THE FASTEST-GROWING RUBBER REPAIR ADHESIVES MARKET

FIGURE 8 HIGH DEMAND FROM THE MINING & QUARRYING INDUSTRY TO DRIVE THE MARKET BETWEEN 2020 AND 2025

FIGURE 9 APAC AND CONVEYOR BELTS SEGMENT ACCOUNTED FOR THE LARGEST SHARES

FIGURE 10 MINING & QUARRYING SEGMENT TO HOLD THE LARGEST SHARE

FIGURE 11 HOT BOND TO REGISTER HIGHER CAGR

FIGURE 12 CHINA TO REGISTER THE HIGHEST CAGR

FIGURE 13 DRIVERS,RESTRAINTS,OPPORTUNITIES,AND CHALLENGES IN THE RUBBER REPAIR ADHESIVES MARKET

FIGURE 14 PORTER’S FIVE FORCES ANALYSIS OF RUBBER REPAIR ADHESIVES MARKET

FIGURE 15 TRENDS AND FORECAST OF GDP,2019 (USD BILLION)

FIGURE 16 PER CAPITA GDP VS. PER CAPITA RUBBER REPAIR ADHESIVES DEMAND

FIGURE 17 MINING & QUARRYING INDUSTRY’S CONTRIBUTION TOWARD GDP,USD BILLION (2017–2018)

FIGURE 18 HOT BOND SEGMENT TO REGISTER HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 19 CONVEYOR BELTS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 20 MINING & QUARRYING SEGMENT TO ACCOUNT FOR THE LARGEST SHARE

FIGURE 21 CHINA TO BE THE FASTEST-GROWING MARKET

FIGURE 22 NORTH AMERICA: RUBBER REPAIR ADHESIVES MARKET SNAPSHOT

FIGURE 23 EUROPE: RUBBER REPAIR ADHESIVES MARKET SNAPSHOT

FIGURE 24 APAC: RUBBER REPAIR ADHESIVES MARKET SNAPSHOT

FIGURE 25 EXPANSION IS THE KEY GROWTH STRATEGY ADOPTED BETWEEN 2014 AND 2019

FIGURE 26 RUBBER REPAIR ADHESIVES MARKET: COMPETITIVE LEADERSHIP MAPPING

FIGURE 27 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN RUBBER REPAIR ADHESIVES MARKET

FIGURE 28 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN RUBBER REPAIR ADHESIVES MARKET

FIGURE 29 MARKET RANKING OF TOP FIVE COMPANIES,2019

FIGURE 30 LORD CORPORATION: SWOT ANALYSIS

FIGURE 31 3M: COMPANY SNAPSHOT

FIGURE 32 3M: SWOT ANALYSIS

FIGURE 33 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

FIGURE 34 HENKEL AG & CO. KGAA: SWOT ANALYSIS

FIGURE 35 SIKA AG: COMPANY SNAPSHOT

FIGURE 36 SIKA AG: SWOT ANALYSIS

FIGURE 37 H.B. FULLER COMPANY: COMPANY SNAPSHOT

FIGURE 38 H.B. FULLER COMPANY: SWOT ANALYSIS

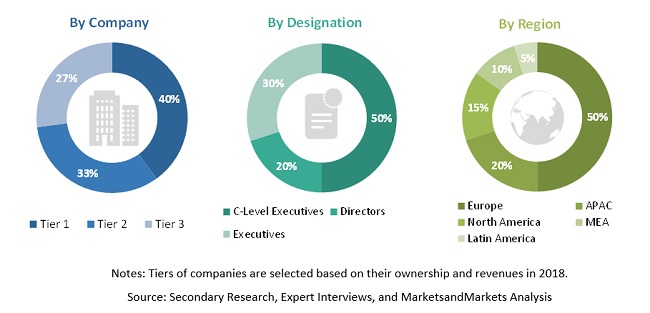

The study involves two major activities in estimating the current size of the rubber repair adhesives market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The rubber repair adhesives market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the mining & quarrying, cement & aggregate and steel end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total rubber repair adhesives market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and market were identified through extensive secondary research.

- The industry’s supply chain and market size in terms of value were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall rubber repair adhesives market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the mining & quarrying, cement & aggregate, and steel end-use industries.

Report Objectives

- To define, describe, and forecast the market size of the rubber repair adhesives market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on process, application and end-use industry

- To analyze and forecast the market based on five regions, namely, Europe, North America, APAC, the MEA, and South America

- To strategically analyze micro markets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC rubber repair adhesives market

- Further breakdown of Rest of European rubber repair adhesives market

- Further breakdown of Rest of MEA rubber repair adhesives market

- Further breakdown of Rest of Latin American rubber repair adhesives market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Rubber Repair Adhesives Market