Satellite Cables and Assemblies Market by Satellite Type (Small, Medium, Large satellites), Component (Cables, Connectors), Cable Type (Round Cables, Flat Cables), Conductor Material, Insulation Type, Conductor Type and Region - Global Forecast to 2026

Update: 11/05/2024

Satellite Cables and Assemblies are specialized cabling systems that connect and support various satellite subsystems, enabling reliable signal transmission, power distribution, and data exchange in space. These assemblies include coaxial cables, fiber optics, and harnesses, which are designed to withstand the unique challenges of space, such as extreme temperatures, radiation, and vacuum conditions. Lightweight and durable, these cables are essential for managing signals between the satellite’s power systems, communication modules, sensors, and control units. As satellite technology advances, especially with the rise of small and nanosatellites, there is a growing demand for highly efficient, miniaturized, and resilient satellite cable systems that can enhance satellite performance while optimizing weight and space.

Satellite Cables and Assemblies Market Size & Growth

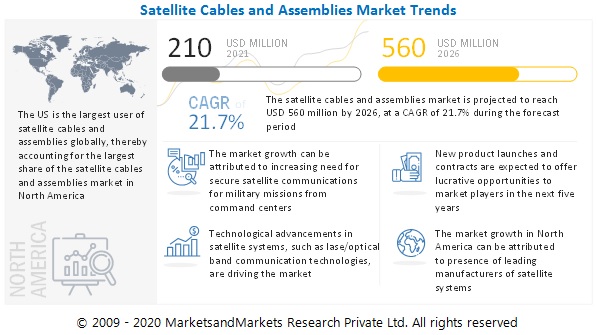

[216 Pages Report] The Global Satellite Cables and Assemblies Market Size was valued at USD 210 million in 2021 and is estimated to reach USD 560 million by 2026, growing at a CAGR of 21.7% during the forecast period. Satellite cables and assemblies systems hold a huge potential for satellite data service providers, small sat service providers, remote sensing service providers, technical service providers, and investors. Factors such as versatility, low cost, advanced materials, ease of manufacturing and assembly, mass production, and short lifecycles have driven investments in the Satellite Cables and Assemblies Industry. Satellite cables and assemblies are inherently balanced and provide better mechanical reliability than conventional cables for transmitting signals, supplying power, or sending earth images.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Satellite Cables and Assemblies Market

The COVID-19 pandemic has caused significant damage to the economic activities of countries across the world. The manufacturing of satellite cables and assemblies systems, subsystems, and components has also been impacted. Although satellite systems are critically important, disruptions in the supply chain have halted their manufacturing processes for the time being. Resuming manufacturing activities depends on the level of COVID-19 exposure, the level at which manufacturing operations are running, and import-export regulations, among other factors. While companies may still be taking in orders, delivery schedules may not be fixed.

Satellite Cables and Assemblies Market Trends

Driver: Increasing Launches of Small Satellites and Space Exploration Missions

An increase in the launches of satellites into low earth orbit (LEO) especially small satellites, which populate the 500–2,000 km band, is a major driver of the market. LEO satellites offer rapid communication, lower latency, and higher bandwidths per user than geostationary satellites, which account for the rising interest in this segment. Many companies have proposed or are implementing plans to build satellite constellations. Starlink had 356 satellites in orbit from 2019 to May 2020. SpaceX (US) is also in the race to deploy small LEO satellites. Amazon filed for launching 3,236 spacecraft in its Kuiper constellation and appeared to be progressing with plans to move its growing team into new facilities in 2020.

Telesat (Canada) proposed an initial constellation of 117 spacecraft, potentially deploying over 300. Its plan for the constellation is a global mesh network providing a highly secure broadband infrastructure. Its target markets are the government and enterprise sectors, where price tolerance is high. China is also investing in LEO constellations, with planned launches for 2 high-throughput satellites in 2021 and 2022.

According to the report, Prospects for Small Satellite Markets, published by Euroconsult in 2020, more than 8,500 satellites are expected to be launched globally by commercial companies between 2019 and 2028, half of which will support broadband constellations for a total market value of USD 42 billion. From January 1 to November 1, 2020, 1,079 satellites were launched, out of which 1,029 were small satellites. SpaceX internet Starlink satellites accounted for 773 of the 1,029 small satellites launched in the first 10 months of 2020.

Restrains: High Development and Maintenance Costs of Infrastructure to Support Satellite Wiring and Assemblies

The high cost incurred in the development and maintenance of earth station infrastructure is one of the major factors hindering the market growth. Most of the required components are typically custom-fabricated or purchased from commercial off-the-shelf (COTS) vendors, which is expensive. Besides, the design, development, and construction of wiring and assemblies and their components require several hours of work by trained personnel. The level of skill required itself poses a significant barrier to entry. Significant investments are required in the R&D, manufacturing, system integration, and assembly stages of the value chains of these systems.

Moreover, wiring and assemblies used in satellite communication services are used for highly sophisticated defense systems, due to which any incident of system failure is unfavorable. These services should be accurate, reliable, durable, energy-efficient, and have a wide detection range. Companies in this market should develop highly functional and efficient ground facilities to maintain market leadership and stay competitive. This translates into significant investments in testing and infrastructure and collaborations with universities, research institutes, and other companies.

Opportunities: Satellite Wiring Demand for Interconnect Solutions

Interconnect and cabling systems are used in the satellite industry due to growing demands for high- throughput, ruggedness, small size, and less spacecraft weight. Signal speed and integrity are essential for effective communication among spacecraft components. Cables — the lifeline of data transmission — are often run through very tight spaces in the spacecraft. For cables to reliably maintain signal integrity, they need to be flexible, and they need to be tough. Interconnects offer the best combination of solid mechanical durability and excellent signal integrity for spacecraft component connections.

These solutions are widely used in missions such as European Remote Sensing Satellite (ERS1/ERS2), Polar Platform, ENVISAT satellite, XMM-Newton space observatory, International Space Station (ISS), INMARSAT.

Challenges: Concerns Over Space Debris

Space debris refers to the uncontrolled and unwanted fall onto the earth of no longer functional space vehicles or parts of any size. Since the beginning of human activities in space, the number of variously defined objects in orbit around the earth has increased exponentially. The trend is up now more than ever with the new wave of small satellites. National Aeronautics and Space Administration (NASA) (US) and European Space Agency (ESA) estimate in their webpages that over 150 million objects are orbiting between the LEO up to 10,000 km from earth’s surface and GEO, for a total weight of more than 5000 tons.

Space debris may prove to be a hazard for small satellites, which may, in turn, increase the amount of debris due to collision or system failure. Besides the risks of collision with flying space vehicles, there is a growing concern for earth impacts since debris, by definition, is uncontrolled and may survive atmospherical re-entry friction falling almost anywhere when eventually reattracted by gravity. NASA and the Department of Defense’s (US) global Space Surveillance Network (SSN) sensors statistics account for more than 27,000 large debris, approximately 23,000 pieces of debris larger than a softball orbiting the earth, half a million pieces of debris the size of a marble or larger (up to 0.4 inches, or 1 centimeter), and approximately 100 million pieces of debris about .04 inches (or one millimeter) and larger. There is even smaller micrometer-sized (0.000039 of an inch in diameter) debris. 1 piece of debris a day is the current average fallout. This is a significant challenge in this field and is under research by various space agencies.

Satellite Cables and Assemblies Market Segment Analysis

Based on Satellite Type, the Large Satellites Segment is Expected to Lead the Satellite Cables and Assemblies Market From 2021 to 2026

Satellites that weigh >1,000 kg are termed large satellites. Government space agencies dominate the majority of the large satellite market. The heaviest artificial objects to reach lower earth orbit mainly include space stations and various upper stages of rockets. The increase in space platforms, deep space explorations are driving the usage of large satellites.

Based on Component, the Cables Segment is Expected to Lead the Satellite Cables and Assemblies Market From 2021 to 2026

Cables are used in satellites that are increasingly being adopted in modern communication technologies, miniaturization, deep space exploration. The introduction of wireless satellite internet and development of miniature hardware systems are exploiting numerous opportunities in the field of satellite-enabled communication. Cables incorporate multiple layers of wires, insulation, and fillers, which limits heat dissipation.

Satellite Cables and Assemblies Market Regional Analysis

Based on Region, North America is Expected to Lead the Satellite Cables and Assemblies Market From 2021 to 2026

The US is a lucrative market for satellite cables and assemblies systems in the North America region. The US government is increasingly investing in advanced satellite technologies to enhance the quality and effectiveness of satellite communication. The increasing investment on satellite equipment to enhance defense and surveillance capabilities of the armed forces, modernization of existing communication in military platforms, critical infrastructure and law enforcement agencies using satellite systems, are key factors expected to drive the satellite cables and assemblies market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Satellite Cables and Assemblies Companies: Top Key Market Players

The Satellite Cables and Assemblies Companies are dominated by globally established players such as:

- Nexans S.A (France)

- Amphenol Corporation (US)

- T.E Connectivity (Switzerland)

- Huber +Suhner (Switzerland)

- W.L Gore & Associates (US)

Contracts were the main strategy adopted by leading players to sustain their position in the satellite cables and assemblies market, followed by new product developments with advanced technologies. Many companies also collaborated to set up special centers for the research & development of advanced satellite systems.

Scope of the Report

|

Report Metric |

Details |

|

Expected Market Size |

USD 210 million in 2021 |

|

Projected Market Size |

USD 560 million by 2026 |

|

Growth Rate (CAGR) |

21.7% |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Satellite Type, By Cable Type, By Conductor Material, By Insulation Type, By Component, By Conductor Type, and By Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Nexans S.A (France), Amphenol Corporation (US), T.E Connectivity (Switzerland), Huber +Suhner (Switzerland), W.L Gore & Associates (US) are some of the major players of satellite cables and assemblies market. (25 Companies) |

The study categorizes the satellite cables and assemblies market based on Satellite Type, Cable Type, Conductor Material, Insulation Type, Component, Conductor Type and Region.

By Satellite Type

- Small satellite

- Medium satellite

- Large satellite

By Cable Type

- Round Cables

- Flat/ Ribbon Cables

By Conductor Material

- Metal Alloys

- Fibers

By Component

- Cables

- Connectors

- Others

By Insulation Type

- Thermosetting

- Thermoplastic

By Conductor Type

- Twisted pair

- Coaxial

- Fiber Optics

- Shielded/ Jacketed

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In January 2022, The Rosenberger Group changed its antenna and coverage solution product portfolio with a new brand entity, PROSE. The strategic focus of PROSE will be towards the development of base station antennas, microwave antennas, indoor and outdoor coverage solutions, Open RAN subsystems, and related services.

- In September 2021, WL Gore & Associates launched M12 X-Code cable assembly while building a complete M8/M12 connector portfolio. This portfolio focuses on sensor applications, data supports, and industrial communication. M12 X-Code cables are a category 6A cable (CAT6A), standardized twisted-pair cables for Ethernet, and other network layers that can handle data up to 10Gbps.

- In July 2021, TE Connectivity has launched its Rochester Greaseless Cable Technology, which provides more efficient field operation for downhole logging applications. This solution replaces steel cables in cased hole operations. It Provides a lower coefficient of friction over traditional wireline cables, which uses a specially formulated cable jacket material. It has improved rig up and rig down efficiencies. It has faster run speeds than traditional wireline. It is cleaner and more environmentally friendly than conventional downhole wireline cables.

- In January 2021, Carlisle announced its new UTiPHASE microwave cable assembly series, an innovative solution that delivers outstanding electrical phase stability versus temperature without compromising microwave performance. UTiPHASE is ideal for defense, space, and testing applications.

- In January 2020, TE Connectivity launched M12 data cable assemblies supporting Ethernet protocols as part of its Industrial Ethernet and Fieldbus solutions package. This makes it a one-stop-shop for M8/M12 cable assemblies for industrial Ethernet communications.

- In January 2020, TE Connectivity (TE) launched the SPEC 55 low fluoride (55 LF) wire and cable insulation system for space and high-altitude environments. The cable is made from a rugged fluoropolymer. Its insulation system has an outgassing rating of less than 10 PPM, which helps to reduce corrosion of other components due to trapped gases escaping in a vacuum or low-pressure environment. The SPEC 55 LF insulation system is designed for avionic systems, C4ISR, guidance & seeker systems, general wire harnessing systems, etc.

Frequently Asked Questions (FAQ):

Which Are the Major Companies in the Satellite Cables and Assemblies Market? What Are Their Major Strategies to Strengthen Their Market Presence?

The Satellite cables and assemblies market is dominated by a few globally established players such as Nexans S.A (France), Amphenol Corporation (US), T.E Connectivity (Switzerland), Huber +Suhner (Switzerland), W.L Gore & Associates (US), among others.

Contracts were the main strategy adopted by leading players to sustain their position in the satellite cables and assemblies market, followed by new product developments with advanced technologies. Many companies also collaborated to set up special centers for the research & development of advanced satellite systems.

What Are the Drivers and Opportunities for the Satellite Cables and Assemblies Market?

The market for satellite cables and assemblies has grown substantially across the globe, and especially in Asia Pacific, where increase in developing new technologies and procurement of new satellite technologies in such as China, India, and South Korea, will offer several opportunities for satellite cables and assemblies industry. The rising R&D activities to develop satellite cables and assemblies are also expected to boost the growth of the market around the world.

Which Region is Expected to Grow at the Highest Rate in the Next Five Years?

The market in Middle East and Africa is projected to grow at the highest CAGR of from 2021 to 2026, showcasing strong demand for satellite internet connectivity in the region.

Which Type of Satellite Cables and Assemblies Systems is Expected to Significantly Lead in the Coming Years?

Medium satellite segment of the satellite cables and assemblies market is projected to witness the highest CAGR due to increasing use of satellite communication and increasing need of the accurate and high-resolution earth observation and satellite imagery services. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

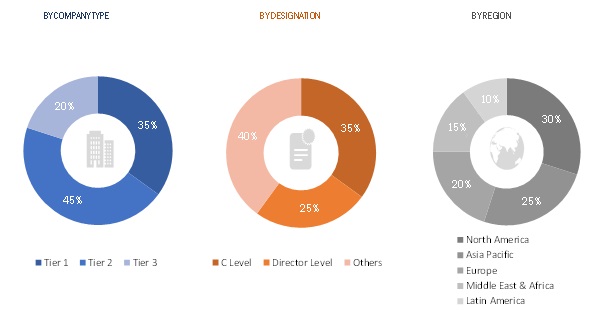

The study involved various activities in estimating the current size of the satellite cables and assemblies market. Exhaustive secondary research was done to collect information on the satellite cables and assemblies market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the satellite cables and assemblies market.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies were rated on the basis of performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to, for this research study include financial statements of companies offering satellite cables and assemblies systems and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the satellite cables and assemblies market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the satellite cables and assemblies market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

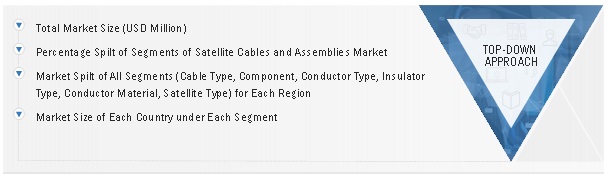

Market Size Estimation

The market sizing of the market was undertaken from the demand side. The market was upsized based on demand for cables and assemblies due to increasing launches of small satellites & space exploration missions and Satellite wiring demand for interconnect solutions

Note: An analysis of technological, military funding, year-on-year launches, and operational cost were carried out to arrive at the CAGR and understand the market dynamics of all countries in the report. The market share for all satellite type, cable type, conductor material, insulation type and component arrived at based on the current and upcoming launches of Satellite cables and assemblies products and services in every country from 2018 to 2026.

Satellite Cables and Assemblies Market Size: Top-Down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Key Requirements for Satellite Connectors and Cables in Satellite Communication Systems

Satellite connectors and satellite cables and assemblies are crucial components in satellite communication systems as they enable the transmission of signals and power between satellite equipment and ground stations.

Satellite communication systems are used for a variety of applications, including telecommunications, broadcasting, remote sensing, and navigation. They require high-performance, reliable components that can withstand the harsh environmental conditions of space, including extreme temperatures, radiation, and vibrations.

Satellite cables and assemblies and connectors are designed to meet these requirements by providing high-quality signals and power transmission while withstanding the rigors of space. They are often used in conjunction with other components such as antennas, amplifiers, and modems to create a complete satellite communication system.

Importance of Satellite Connectors, Cables, and Assemblies in the Satellite Communication Systems

The satellite communication systems market is growing rapidly, driven by increasing demand for high-speed internet services, television broadcasting, and global positioning services. This growth is creating significant opportunities for satellite connector and cable manufacturers as they provide critical components for the construction of these systems.

In addition to meeting the needs of the traditional satellite communication market, the demand for satellite connectors and cables is also increasing in emerging markets such as small satellites, CubeSats, and space exploration missions. These markets require smaller, lighter, and more reliable components that can withstand the harsh environment of space.

As a result, satellite connector and cable manufacturers are investing in research and development to produce advanced products that meet the specific needs of these markets. These investments are driving innovation and creating new growth opportunities in the satellite communication systems market.

Investment in research and development by key players driving innovation in the industry

The satellite communication systems and satellite cables and assemblies markets are experiencing significant growth due to the increasing demand for high-speed connectivity across the globe. Emerging technologies such as High Throughput Satellites (HTS), SmallSats, and Software-Defined Satellites (SDS) are driving this growth by offering improved performance and reduced costs. Additionally, top key players in the satellite communication systems and satellite cables and assemblies markets such as Nexans S.A, Amphenol Corporation, T.E Connectivity, Huber +Suhner, W.L Gore & Associates are developing innovative products and solutions that meet the needs of a rapidly evolving industry. These companies are investing heavily in research and development to create new technologies and products that will provide customers with greater flexibility, efficiency, and reliability. As a result, the satellite communication systems and satellite cables and assemblies markets are expected to continue to grow in the coming years, providing new opportunities for both established and emerging players in the industry.

Report Objectives

- To define, describe, and forecast the size of the satellite cables and assemblies market based on Satellite Type, Cable Type, Conductor Material, Insulation Type, Component, Conductor Type and Region.

- To forecast the size of the various segments of the satellite cables and assemblies market based on five regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America—along with key countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the Satellite Cables and Assemblies Market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Satellite Cables and Assemblies Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Satellite Cables and Assemblies Market