Seam Sealing Tapes Market by Type (Single-layered, Multi-layered), Backing Material (Polyurethane, Polyvinyl Chloride), and Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) - Global Forecast to 2023

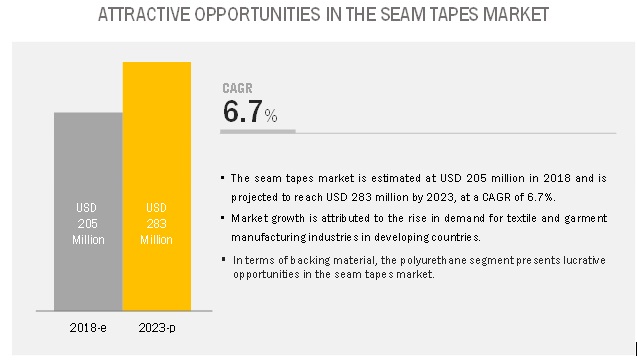

[109 Pages Report] The seam sealing tapes market is expected to grow from USD 205 million in 2018 to USD 283 million by 2023, at a CAGR of 6.7% from 2018. The growth in the sports and outdoor apparel industry, owing to the growing health awareness among consumers and increasing fitness activities, is driving the growth of the seam sealing tapes market during the forecast period. In addition, increase in demand for protective clothing and accessories such as military, surgical/medical, and chemical protection garments are influencing the growth of the market.

The polyurethane segment is expected to dominate the seam sealing tapes market through 2023

The polyurethane segment is projected to account for the largest share of the seam sealing tapes market, in terms of value and volume, from 2018 to 2023. This dominance is attributed to its properties such as high abrasion, impact resistance, water resistance, and high flexibility. These properties of polyurethane have led to an increasing preference for polyurethane in adhesives and membranes of two- and three-layered seam sealing tapes. The polyvinyl chloride is expected to be the second-largest segment, in terms of value and volume, from 2018 to 2023, owing to its various properties such as flexibility, transparency, light, and oxygen & water barrier properties.

The multi-layered segment to register higher growth in the seam sealing tapes market during the forecast period

The numerous advantages of multi-layered seam sealing tapes-in terms of superior waterproofing, excellent adhesion and a wide range of applicationshave contributed to the high growth of the multi-layered segment in the seam sealing tapes market. Its numerous applications include apparels, tents, tarpaulins, footwear, and backpacks, among others. The single-layered segment is projected to register lesser growth during the forecast period, owing to the limited applications of single-layered seam sealing tapes.

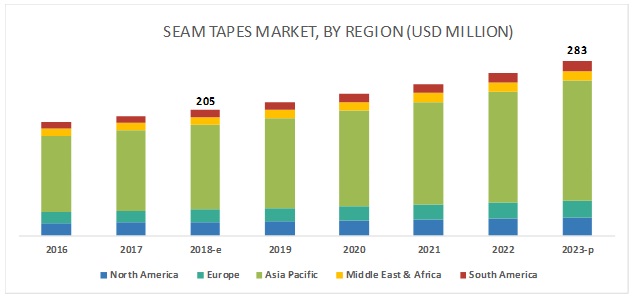

The Asia Pacific seam sealing tapes market is projected to register the highest CAGR during the forecast period

Asia Pacific is projected to be the fastest-growing region in the seam sealing tapes market, in terms of value. This high growth is attributed to the presence of huge garment manufacturing hotspots such as China, India, Vietnam, Indonesia, and Bangladesh in the Asia Pacific region. Also, these countries are the largest exporters of textile and apparels globally. Cheap labor cost and availability of domestically produced raw material place Asia Pacific as the preferable region to manufacture textile and apparels.

Key Market Players

The seam sealing tapes market is dominated by large players such as Bemis Associates (US), Toray Industries (Japan), Himel Corp. (Korea), Sealon (Korea), Loxy AS (Norway), Gerlinger Industries (Germany), DingZing (Taiwan), Adhesive Films (US), San Chemicals (Japan), and Essentra (UK). These players have established brands, a wide product portfolio, and a strong geographical presence.

Bemis Associate is a global manufacturer of thermoplastic adhesives, films, and coatings. Its wide range of products caters to a variety of applications across apparel, soft goods, handbags & wallets, intimate fabrics, and other markets. Strong global presence and specialization in seam sealing tapes manufacturing ensured its key position in the market. The company has a strong focus on sustainability; for instance, it uses water-based and UV-cured inks for its printed seam sealing tapes, and most of its products contain almost no VOC.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value (USD) and Volume (Million Meter) |

|

Segments covered |

Type, Backing Material, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies covered |

Bemis Associates (US), Toray Industries (Japan), Himel Corp. (Korea), Sealon (Korea), Loxy AS (Norway), and Gerlinger Industries (Germany) Total 13 major players and 12 end-users covered |

This research report categorizes the seam sealing tapes market based on type, backing material, and region.

On the basis of type, the seam sealing tapes market has been categorized as follows:

- Single-layered

- Multi-layered

On the basis of backing material, the seam sealing tapes market has been categorized as follows:

- Polyurethane (PU)

- Polyvinyl chloride (PVC)

On the basis of region, the seam sealing tapes market has been categorized as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Key Questions Addressed by the Report:

- Which regions offers immense opportunities in the seam sealing tapes market?

- What are the upcoming industry trends for seam sealing tapes?

- What are the high-growth segments in the seam sealing tapes market?

- What are the factors driving the growth of the market?

- What are the substitutes of seam sealing tapes in various applications?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.1 Periodization Considered

1.2 Currency Considered

1.3 Unit Considered

1.4 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Developing Economies to Register High Growth in the Demand for Seam Sealing Tapes

4.2 Seam Sealing Tapes Market, By Type

4.3 Seam Sealing Tapes Market, By Backing Material

4.4 Asia Pacific Seam Sealing Tapes Market, By Backing Material and Country

4.5 Seam Sealing Tapes Market: Key Countries

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Sports and Outdoor Apparel Industry

5.2.1.2 Increase in Demand for Protective Clothing and Accessories

5.2.2 Opportunities

5.2.2.1 Emerging Economies in the Asia Pacific

5.2.3 Challenges

5.2.3.1 Volatile Raw Material Prices

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Seam Sealing Tapes Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Single-Layered

6.2.1 Single-Layered Seam Sealing Tapes Find Application in Polyvinyl Chloride and Polyurethane Garments

6.3 Multi-Layered

6.3.1 Multi-Layered Segment to Be the Largest Segment of the Seam Sealing Tapes Market

7 Seam Sealing Tapes Market, By Backing Materials (Page No. - 39)

7.1 Introduction

7.2 Polyurethane

7.2.1 Polyurethane to Be the Leading Backing Material in the Seam Sealing Tapes Market

7.3 Polyvinyl Chloride

7.3.1 Polyvinyl Chloride is Flexible, Transparent, Light, and Resistant to Water

7.4 Others

7.4.1 The Others Segment is Projected to Record the Lowest Growth Rate During the Forecast Period

8 Seam Sealing Tapes Market, By Region (Page No. - 43)

8.1 Introduction

8.2 Asia Pacific

8.2.1 China

8.2.1.1 China is the Largest Country-Level Market for Seam Sealing Tapes

8.2.2 India

8.2.2.1 India to Be the Second-Largest Market for Seam Sealing Tapes in the Asia Pacific

8.2.3 Vietnam

8.2.3.1 The Growth of The Textile & Apparel Manufacturing Industry is Driving The Seam Sealing Tapes Market in Vietnam

8.2.4 Indonesia

8.2.4.1 The Increased Demand for Seam Sealing Tapes in The Textile & Garment Industry is The Major Driving Force for Growth in Indonesia

8.2.5 Cambodia

8.2.5.1 Lack of Upstream Suppliers of Raw Materials for Garments in Cambodia May Hinder The Apparel Industry, Further Impacting The Seam Sealing 55

8.2.6 Bangladesh

8.2.6.1 Bangladesh is The Fastest-Growing Country-Level Market for Seam Sealing Tapes in The Asia Pacific

8.2.7 Pakistan

8.2.7.1 Huge and Cheap Workforce in Pakistan Present Immense Opportunities for The Garment Manufacturing Industry, in Turn, Driving The Demand for Tapes57

8.2.8 Rest of Asia Pacific

8.2.8.1 Rise in Income Levels, Rapid Urbanization, and Trade Liberalization Drive The Seam Sealing Tapes Market in The Rest of Asia Pacific

8.3 North America

8.3.1 US

8.3.1.1 US to Be The Largest Country-Level Market for Seam Sealing Tapes in North America

8.3.2 Mexico

8.3.2.1 Favorable Government Policies Support The Apparel Industry, in Turn Driving The Mexican Seam Sealing Tapes Market Growth

8.3.3 Canada

8.3.3.1 The Canadian Seam Sealing Tapes Market is Characterized By Technological Advancements in Textile Manufacturing

8.4 Europe

8.4.1 Germany

8.4.1.1 Demand for Seam Sealing Tapes in Germany is Driven By The Growing Automobile Industries

8.4.2 Italy

8.4.2.1 Italy to Be The Fastest-Growing Seam Sealing Tapes Market in Europe

8.4.3 Spain

8.4.3.1 Growth in The Apparel and Sportswear Industries to Drive The Spanish Seam Sealing Tapes Market

8.4.4 Rest of Europe

8.4.4.1 Rest of Europe is Projected to Grow at A Steady Rate During The Forecast Period

8.5 Middle East & Africa

8.5.1 Turkey

8.5.1.1 Growth of The Turkish Footwear Industry is Expected to Drive The Demand for Waterproof Footwear Which Require Seam Sealing Tapes

8.5.2 South Africa

8.5.2.1 South Africa to Account for The Second-Largest Share in The Mea Seam Sealing Tapes Market Through 2023

8.5.3 Rest of The Middle East & Africa

8.5.3.1 Growth of The Garment Industry to Boost The Demand for Seam Sealing Tapes in The Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Brazil to Account for The Largest Share in The South American Seam Sealing Tapes Market

8.6.2 Argentina

8.6.2.1 The Seam Sealing Tapes Market in Argentina is Projected to Grow in Accordance With The Growth of The Sports & Outdoor Apparel Manufacturing Sector78

8.6.3 Rest of South America

8.6.3.1 Rest of South America to Show High Prospects in The Demand for Seam Sealing Tapes

9 Competitive Landscape (Page No. - 80)

9.1 Overview

9.2 Market Ranking

10 Company Profiles (Page No. - 82)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

10.1 Bemis Associates

10.2 Toray Industries

10.3 Sealon

10.4 Himel Corp.

10.5 Loxy as

10.6 Gerlinger Industries

10.7 Essentra

10.8 Ding Zing

10.9 Adhesive Films, Inc.

10.1 San Chemicals

10.11 Geo-Synthetics

10.12 GCP Applied Technologies

10.13 Traxx Corp.

10.14 End-Users of Seam Sealing Tapes

10.14.1 Adidas Ag

10.14.2 The North Face

10.14.3 Ralph Lauren Corporation

10.14.4 Under Armour

10.14.5 Columbia Sportwear Company

10.14.6 The Dishang Group

10.14.7 Admiral Sportswear

10.14.8 Ksa Polymer

10.14.9 Heartland Textile

10.14.10 Sattler Ag

10.14.11 Dick's Sporting Goods

10.14.12 Mountain Warehouse Limited

*Details on Business Overview, Products Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 103)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (79 Tables)

Table 1 USD Conversion Rates, 20142017

Table 2 Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 3 Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 4 Seam Sealing Tapes Market Size, By Backing Material, 20162023 (USD Million)

Table 5 Seam Sealing Tapes Market Size, By Backing Materials, 20162023 (Million Meter)

Table 6 Seam Sealing Tapes Market Size, By Region, 20162023 (USD Million)

Table 7 Seam Sealing Tapes Market Size, By Region, 20162023 (Million Meter)

Table 8 Asia Pacific: Seam Sealing Tapes Market Size, By Country, 20162023 (USD Million)

Table 9 Asia Pacific: Seam Sealing Tapes Market Size, By Country, 20162023 (Million Meter)

Table 10 Asia Pacific: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 11 Asia Pacific: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 12 Asia Pacific: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (USD Million)

Table 13 Asia Pacific: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (Million Meter)

Table 14 China: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 15 China: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 16 India: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 17 India: Seam Sealing Tapes Market Size, By Type,20162023 (Million Meter)

Table 18 Vietnam: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 19 Vietnam: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 20 Indonesia: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 21 Indonesia: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 22 Cambodia: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 23 Cambodia: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 24 Bangladesh: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 25 Bangladesh: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 26 Pakistan: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 27 Pakistan: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 28 Rest of Asia Pacific: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 29 Rest of Asia Pacific: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 30 North America: Seam Sealing Tapes Market Size, By Country, 20162023 (USD Million)

Table 31 North America: Seam Sealing Tapes Market Size, By Country, 20162023 (Million Meter)

Table 32 North America: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 33 North America: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 34 North America: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (USD Million)

Table 35 North America: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (Million Meter)

Table 36 US: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 37 US: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 38 Mexico: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 39 Mexico: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 40 Canada: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 41 Canada: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 42 Europe: Seam Sealing Tapes Market Size, By Country, 20162023 (USD Million)

Table 43 Europe: Seam Sealing Tapes Market Size, By Country, 20162023 (Million Meter)

Table 44 Europe: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 45 Europe: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 46 Europe: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (USD Million)

Table 47 Europe: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (Million Meter)

Table 48 Germany: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 49 Germany: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 50 Italy: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 51 Italy: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 52 Spain: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 53 Spain: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 54 Rest of Europe: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 55 Rest of Europe: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 56 Middle East & Africa: Seam Sealing Tapes Market Size, By Country, 20162023 (USD Million)

Table 57 Middle East & Africa: Seam Sealing Tapes Market Size, By Country, 20162023 (Million Meter)

Table 58 Middle East & Africa: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 59 Middle East & Africa: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 60 Middle East & Africa: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (USD Million)

Table 61 Middle East & Africa: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (Million Meter)

Table 62 Turkey: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 63 Turkey: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 64 South Africa: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 65 South Africa: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 66 Rest of The Middle East & Africa: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 67 Rest of The Middle East & Africa: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 68 South America: Seam Sealing Tapes Market Size, By Country, 20162023 (USD Million)

Table 69 South America: Seam Sealing Tapes Market Size, By Country, 20162023 (Million Meter)

Table 70 South America: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 71 South America: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 72 South America: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (USD Million)

Table 73 South America: Seam Sealing Tapes Market Size, By Backing Material, 20162023 (Million Meter)

Table 74 Brazil: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 75 Brazil: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 76 Argentina: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 77 Argentina: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

Table 78 Rest of South America: Seam Sealing Tapes Market Size, By Type, 20162023 (USD Million)

Table 79 Rest of South America: Seam Sealing Tapes Market Size, By Type, 20162023 (Million Meter)

List of Figures (24 Figures)

Figure 1 Seam Sealing Tapes Market Segmentation

Figure 2 Seam Sealing Tapes Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Seam Sealing Tapes Market: Data Triangulation

Figure 6 Multi-Layered Seam Sealing Tapes to Dominate The Market Through The Forecast Period

Figure 7 Polyurethane, as A Backing Material for Seam Sealing Tape, to Grow at The Highest Cagr During The Forecast Period

Figure 8 Asia Pacific Dominated The Seam Sealing Tapes Market in 2017

Figure 9 Growing Garment Manufacturing Industry in Developing Economies Presents Attractive Opportunities for The Seam Sealing Tapes Market

Figure 10 Multi-Layered Segment to Grow at A Higher Rate During The Forecast Period

Figure 11 Polyurethane to Dominate The Seam Sealing Tapes Market Through 2023

Figure 12 China Was The Largest Market for Seam Sealing Tapes in 2017

Figure 13 Bangladesh to Grow at The Highest Cagr From 2018 to 2023

Figure 14 Growing Sportswear and Outdoor Apparel Industry Results in Increased Demand for Seam Sealing Tapes

Figure 15 Porters Five Forces Analysis

Figure 16 Seam Sealing Tapes Market Size, By Type, 2018 vs. 2023 (USD Million)

Figure 17 Seam Sealing Tapes Market Size, By Backing Material, 2018 vs. 2023 (USD Million)

Figure 18 Geographic Snapshot (20182023): Bangladesh Projected to Register Highest Growth Rate

Figure 19 Asia Pacific Seam Sealing Tapes Market Snapshot

Figure 20 Asia Pacific Seam Sealing Tapes Packaging Market: Key Countries (2017)

Figure 21 Market Ranking of Key Players, 2017

Figure 22 Toray Industries: Company Snapshot

Figure 23 Essentra: Company Snapshot

Figure 24 GCP Applied Technologies: Company Snapshot

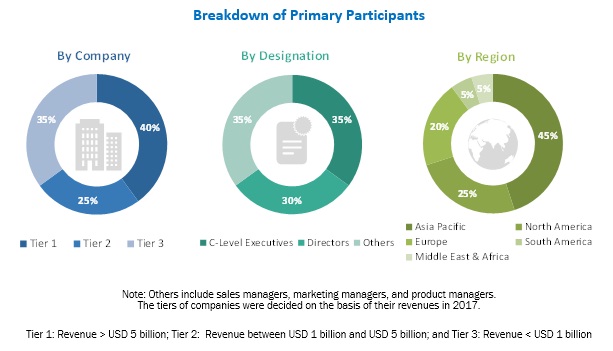

The study involved four major activities in estimating the current market size for seam sealing tapes. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, adhesive tape associations, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, sales professionals, and related key executives from various key companies and organizations operating in the seam sealing tapes market. The primary sources from the demand side include key executives from the end-user industries of seam sealing tapes such as sports and outdoor apparel manufacturers. Seen here is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the global seam sealingtapes market. These approaches were also used extensively to estimate the size of various dependent subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Research Objectives

- To define, analyze, and project the size of the global seam sealing tapes market in terms of type, backing material, and region

- To project the size of the market and its subsegments, in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors such as drivers, opportunities, and industry-specific challenges, influencing market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the market leaders

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies2

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the seam sealing tapes report:

Product Analysis

- Product matrix, which offers a detailed comparison of product portfolio of each company

Regional Analysis

- Further analysis of the seam sealing tapes market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Seam Sealing Tapes Market