Adhesive Tapes Market

Adhesive Tapes Market by Resin Type (Acrylic, Rubber, Silicone), Technology (Solvent, Hot-Melt, Water-Based), Backing Material (PP, Paper, PVC), End-use Industry (Packaging, Healthcare, Electric & Electronics, Automotive) Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The adhesive tapes market is estimated to grow from USD 85.14 billion in 2024 to USD 111.32 billion by 2030, at a CAGR of 4.70% between 2025 to 2030. This growth is supported by the expansion of the various end-use industries such as automotive, electronics, healthcare and aerospace at global level which requires adhesive solutions. An adhesive tape is a flexible material, typically made from cloth, cotton, fiber, paper, polyethylene (PE), or metal, that is coated on one or both sides with a sticky adhesive. The adhesive may be acrylic, silicone or rubber based. When light pressure (such as finger pressure) is applied, the adhesive tape adheres to a range of surfaces without undergoing any change in phase (from liquid to solid).

KEY TAKEAWAYS

-

BY RESIN TYPEAcrylic resin became the most valuable type of resin in the adhesive tapes market because it works better and can be used in a wider range of industries. People know that acrylic-based adhesives don't break down easily, don't fade in the sun, and stick well in a wide range of temperatures and environments. Because of these qualities, they are great for long-term bonding in fields like automotive, electronics, healthcare, and construction.

-

BY TECHNOLOGYSolvent-based technology held the biggest market share for adhesive tapes worldwide in 2024. This dominance is mostly attributable to solvent-based adhesives' superior bonding performance and durability, which continue to make them the go-to option in demanding industrial applications. Solvent-based tapes work well in harsh environmental conditions like high temperatures, moisture, and chemical exposure. They also offer exceptional adhesion to a wide range of surfaces, including low-energy substrates like metals and plastics.

-

BY BACKING MATERIALThe paper backing segment became the market leader for adhesive tapes worldwide. Growing demand in important end-use sectors like general packaging, painting, automotive aftermarket, and construction is primarily responsible for this growth. Paper-backed tapes are prized for their adaptability, simplicity of use, and clean removability, which makes them perfect for tasks involving surfaces, especially masking and flatback types. Paper tapes are more conformable and frequently work well in a variety of temperatures and conditions than their plastic-backed counterparts, particularly in paint or heat masking applications.

-

BY CATEGORYBased on Category, Commodity segment is the largest volume share in the global adhesive tapes industry. Commodity segment includes the most common tapes such as packaging, masking, and consumer & office tapes—products utilized in mass consumption and daily use industries. The high demand volume in industries such as logistics, retail, e-commerce, and general-purpose consumer usage keeps driving high-volume commodity tape usage.

-

BY REGIONAsia Pacific accounted for the largest share of the overall adhesive tapes market, in terms value, in 2024. The Asia Pacific region holds the largest market share in the global adhesive tapes market. This dominance can be attributed to several factors, including the region's vast industrial base, burgeoning manufacturing activities, and rapid urbanization. Countries like China, Japan, India, and South Korea are major contributors to this market share, driven by their robust economies and extensive use of adhesive tapes across various industries such as automotive, electronics, construction, and packaging. Moreover, the increasing demand for consumer goods, coupled with the growth of e-commerce, is further boosting the usage of adhesive tapes for packaging and shipping purposes. Additionally, ongoing infrastructural development projects in the region are driving the demand for adhesive tapes in the construction sector.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansion, collaborations, partnerships, acquisitions and investments. For instance, Lohmann GmbH & Co. KG. launched DuploCOLL ECO adhesive tape which features innovative biobased adhesives. Solvent-free and delivering Lohmann's hallmark performance standards: initial solid adhesion, exceptional cold-bonding capabilities, and reliable adhesion on both high- and low-energy surfaces. Ideal for sustainable applications demanding high performance.

The adheisve tapes market is growing at a stedy pace which is led by the rising demand for adhesive tapes in various industries like automotive, packaging, electrical & electronics, building & construction and healthcare due to the rapidly expanding population, coupled with rising healthcare expenditure and increasing awareness about healthcare and hygiene, is fueling demand for medical products and devices. Adhesive tapes play a crucial role in medical applications such as wound care, surgical procedures, and medical device assembly and fixation. Advancements in medical technology and innovations in adhesive tape formulations have led to the development of specialized medical tapes with properties like hypoallergenic, breathability, and antimicrobial properties, catering to the specific needs of healthcare professionals and patients. The Asia Pacific region is witnessing rapid urbanization and infrastructure development, leading to the establishment of new healthcare facilities and hospitals, further driving the demand for adhesive tapes for various applications

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Increased demand for ultralight aircraft, future urban mobility, development of new-generation aircraft (automobile), and client imperatives are expected to change the future revenue mix of adhesive tape manufacturers. Manufacturing optimization through new technologies, battery-operated EVs, autonomous vehicles, and the rising demand for unmanned aerial systems (UAS) are expected to fuel the growth of end-use industries and, thereby, the adhesive tapes market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand from packaging industry

-

E-commerce increasing adoption of adhesive tape films for packaging

Level

-

Raw material price volatility in adhesive tape manufacturing

-

Stringent environmental and regulatory policies

Level

-

Technological innovations in high-performance tapes

-

Potential substitute to traditional fastening systems

Level

-

Technological barriers to meeting performance standards

-

Supply chain disruptions and raw material shortage

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand from packaging industry

Over the past few years, the packaging industry has registered a steady growth rate, which has been driven by the addition of new market over the globe, shifts in substrate choices, and changing ownership dynamics. This growth will continue during the next decade, but parallelly there are significant pressures, and disruptive changes can be expected. The majority of the growth is anticipated in less developed markets, as more people are relocating to urban areas and embracing a more westernized culture and lifestyle. This trend has increased the demand for packaged goods, which the global e-commerce industry has further propelled. Online retail businesses are also continuing to increase, majority driven by the penetration of the smartphone and the internet. Most consumers purchase goods online, and this trend is projected fto continue growing until 2030. As a result, the demand for packaging solutions is increasing, particularly corrugated board formats that can safely transport goods through complex distribution channels. More people are consuming food, beverages, and pharmaceuticals.

Restraint: Raw material price volatility in adhesive tape manufacturing

Some of the primary restraints that adversely impact the growth of the global adhesive tapes market are the volatility of raw materials which are required for the manufacturing of adhesive tapes. Fluctuations in the prices of key raw materials used in adhesive tape production, such as petrochemical derivatives, resins, and other chemicals, can significantly impact the manufacturing costs for tape producers. These fluctuations make it challenging for manufacturers to predict and manage their production costs, leading to potential disruptions in supply chains and pricing strategies. Moreover, sudden spikes in raw material prices can exert pressure on profit margins for adhesive tape manufacturers, especially if they are unable to pass on the increased costs to consumers due to competitive market conditions or price sensitivity. This can hinder investment in research and development efforts aimed at improving product quality or developing innovative tape formulations.

Opportunity: Technological innovations in high-performance tapes

The market for adhesive tapes is experiencing high growth opportunities, the reason behind this growth is fast innovation in high-performance tape technologies. With various industries demanding improved efficiency, durability, and sustainability, manufacturers are manufacturing innovative tapes that are perfect solution to these changing needs. High-performance tapes are designed to address the needs like heat resistance, electrical insulation, vibration dampening, and even fire retardance. In industries such as automotive and aerospace, where weight is critical, these tapes are being used to displace conventional fasteners and reduce vehicle weight while improving efficiency. In electronics, the demand for smaller, more powerful products has driven the need for heat management tapes that deliver EMI shielding, too, and continue to perform in harsh environments. And in healthcare, less rigid, more breathable tapes are facilitating improved safety and longer wear—particularly for wound care and wearable medical products.

Challenge: Supply chain disruptions and raw material shortage

One of the biggest issues facing the world adhesive tapes industry is the ongoing raw material supply volatility and general supply chain disruptions. Adhesive tapes are very much reliant on petrochemical-based inputs such as acrylics, rubber, resins, and other backings such as polypropylene and PVC. Instability of the availability or cost of such raw materials can directly influence cost of production and price stability. The recent years have seen international crises such as the COVID-19 pandemic, geo-political tensions, and fluctuating energy prices lay bare the vulnerabilities of the supply chain. Disruptions in shipping, shortages of key chemicals in the supply chain, and increased lead times have prevented producers from maintaining production levels. Inflationary pressures have also caused steep raw material price hikes, squeezed margins and triggered downstream price increases. A second level of complexity is the increasing demand for more sustainable and green raw material, more costly and less accessible than traditional materials. This puts pressure on manufacturers to meet environmental expectations under cost and supply pressures. For companies in this segment, establishing robust supply chains and investing in local sourcing or material innovation has been imperative to meet these challenges.

Adhesive Tapes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses adhesive tapes for manufacturing affordable, lightweight, and durable furniture, cabinets, and home décor products across global retail outlets. | Enables cost-effective mass production, supports sustainable sourcing, enhances product durability, reduces waste, and ensures design flexibility for modern, modular furniture. |

|

Utilizes adhesive tapes in automotive interiors, flooring panels, and transport crates for components. | Reduces vehicle weight, improves noise insulation, enhances strength, supports eco-friendly materials usage, and lowers logistics costs through reusable transport solutions. |

|

Uses adhesive tapes in construction, formwork, and interior infrastructure for residential and commercial projects. | Provides structural stability, reusability in formwork, smooth finishes, and cost efficiency, while reducing material waste in large-scale infrastructure projects. |

|

Employs adhesive tapes in manufacturing durable packaging and base panels for appliances. | Ensures safe appliance transport, enhances product protection, reduces packaging costs, and aligns with eco-friendly packaging practices. |

|

Uses adhesive tapes for interior furnishings, wall paneling, and modular furniture across hotels worldwide. | Offers premium aesthetics, longevity, acoustic comfort, and sustainability, while supporting consistent design standards across global hospitality properties. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent companies in this market include well established, financially stable manufacturers of adhesive tapes. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in the market include 3M Company (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), and Lintec Corporation (Japan).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Adhesive Tapes Market, By Resin Type

The adhesive tapes market has been segmented into four main resin types that make up the total market are silicone, acrylic, rubber, and other resin types. Each of these types serves a variety of consumer and industrial applications. The fastest-growing of these is silicone-based adhesive tape, which is indicative of its growing use in demanding and high-performance settings. Silicone tapes are perfect for applications in the electronics, aerospace, and automotive industries because of their remarkable temperature resistance, superior chemical stability, and strong adherence on difficult surfaces. They differ from traditional resins in that they can continue to function even in the face of severe heat and chemical exposure. The demand for silicone-based tapes has also increased due to growing awareness of process efficiency and reliability in crucial manufacturing operations, making silicone-based tapes a major player in the specialty adhesive tapes market.

Adhesive Tapes Market, By Technology

Adhesive tapes market is segmented by technology: Solvent Based, Hot Melt Based, and Water Based. Solvent Based segment is the largest technology of adhesive tapes in terms of value. solvent-based adhesive tapes offer excellent bonding strength and versatility across a wide range of substrates, including plastics, metals, and composites. This versatility makes them ideal for various applications in industries such as automotive, construction, and packaging, where strong and durable bonding is essential. solvent-based adhesive tapes exhibit superior performance characteristics, including high initial tack, excellent adhesion to irregular surfaces, and resistance to temperature fluctuations and environmental conditions. These properties make them preferred choices for demanding applications where reliability and durability are paramount. solvent-based adhesive tapes are known for their cost-effectiveness and efficiency in large-scale production processes, contributing to their widespread adoption by manufacturers globally. Additionally, the established infrastructure and availability of raw materials for solvent-based adhesive formulations further support their dominance in the market.

Adhesive Tapes Market, By Backing Material

The market for adhesive tapes is divided into several backing material categories, including polypropylene (PP), paper, polyvinyl chloride (PVC), and other backing materials. These materials are used in a variety of industries. Of these, paper-backed adhesive tapes are the one with the biggest market share and the fastest rate of growth. They are ideal for packaging, masking, labeling, and hygiene applications due to their adaptability, affordability, and environmentally friendly qualities. Paper tapes improve operational efficiency by offering dependable adhesion on a range of surfaces, excellent printability, and ease of tearing. The widespread use of paper-backed tapes is being driven by the growing emphasis on environmentally friendly packaging options as well as an increase in industrial and e-commerce activity.

Adhesive Tapes Market, By Category

Adhesive tapes market is segmented by category: Commodity and Specialty. Specialty adhesive tapes segments account for the largest market share of adhesive tapes in terms of values. specialty tapes are specifically designed to meet unique and demanding requirements across a wide range of industries, including automotive, aerospace, healthcare, and electronics. These tapes offer superior performance characteristics such as high temperature resistance, durability, and chemical compatibility, making them indispensable in critical applications where standard tapes may not suffice. Advancements in technology have led to the development of specialty tapes with specialized formulations and innovative features, catering to the evolving needs of end-users. For instance, the growing demand for electric vehicles has spurred the development of specialty tapes for battery assembly and thermal management applications. The increasing focus on lightweighting and miniaturization in industries like electronics has driven the adoption of specialty tapes for bonding and joining applications, further fueling market growth.

REGION

Asia Pacific is expected to be the largest market for adhesive tapes during the forecast period

The Asia Pacific region is expected to have the largest adhesive tape market in terms of value in 2024, Due to a combination of growing manufacturing output, end-use industries, and rapid industrialization. Leading the way in this expansion are nations like China, India, Japan, and South Korea, bolstered by robust demand from industries like electronics, automotive, packaging, construction, and healthcare. China continues to be the region's leading producer and consumer of adhesive tapes. The demand for high-performance and specialty tapes is still being driven by its extensive production of electronics, appliances, and automobiles. In the meantime, India is expanding quickly because of growing e-commerce activity, expanding infrastructure development, and rising use of healthcare and hygiene products. A skilled labor pool, reduced production costs, and rising investments in technology and innovation make Asia Pacific a desirable location for manufacturing. To take advantage of this rapidly growing market, both domestic and foreign companies are growing their operations in the area. Asia Pacific is well-positioned to continue leading the global adhesive tapes market in terms of value due to growing consumer demand, a robust industrial base, and a growing emphasis on sustainable and value-added products.

Adhesive Tapes Market: COMPANY EVALUATION MATRIX

In the Adhesive Tapes Market matrix, 3M Company (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across applications. Avery Dennison Corporation (Emerging Leader) is gaining traction due to its diversified product portfolio and continuous investment in R&D. While 3M Company dominates with scale, Avery Dennison Corporation shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 85.14 BN |

| Revenue Forecast in 2030 | USD 111.32 BN |

| Growth Rate | CAGR of 4.70% from 2025-2030 |

| Actual data | 2020−2030 |

| Base year | 2024 |

| Forecast period | 2025−2030 |

| Units considered | Value (USD Billion) and Volume (Million Square Meters) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Resin Type (Acrylic, Rubber, Silicone, and Other Resin Types), Technology (Solvent-based, Hot-melt based, Water-based), Backing Material (Polypropylene (PP), Paper, Polyvinyl Chloride (PVC), and Other Backing Materials), Category (Commodity and Specialty), End-use Industry (Commodity (Packaging, Masking and Consumer & Office), Specialty (Electrical & Electronics, Healthcare, Automotive, White Goods, Paper & Printing, Building & Construction, Retail and Other End-use Industries) and Region |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Adhesive Tapes Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Adhesive Tapes Manufacturer |

|

|

| Asia Pacific-based Adhesive Tapes Manufacturer |

|

|

RECENT DEVELOPMENTS

- January 2025 : Tesa launched sustainable, solvent-free, paper-based adhesive tape offering high transparency, easy tear by hand, and versatile everyday applications.

- March 2024 : Lohmann GmbH & Co. KG. launched DuploCOLL ECO adhesive tape which features innovative biobased adhesives. Solvent-free and delivering Lohmann's hallmark performance standards: initial solid adhesion, exceptional cold-bonding capabilities, and reliable adhesion on both high- and low-energy surfaces. Ideal for sustainable applications demanding high performance.

- February 2024 : Avery Dennison Corporation launched performance tapes is the latest PSA tape portfolio tailored for the appliance industry. This diverse range of forty specialized solutions enhances ease of assembly, product durability, and NVH damping in commercial and residential appliances like refrigerators, ovens, and washers.

- September 2023 : Intertape Polymer Group Inc., launched the 170e water-based acrylic pressure-sensitive carton sealing tape featuring 30% recycled films. This innovation maintains high performance, UV resistance, and broad application suitability, aligning with IPG's sustainability initiatives.

- February 2023 : 3M launched a medical tape that can last up to four weeks. It is a pressure-sensitive adhesive tape that makes the remote monitoring process easier.

Table of Contents

Methodology

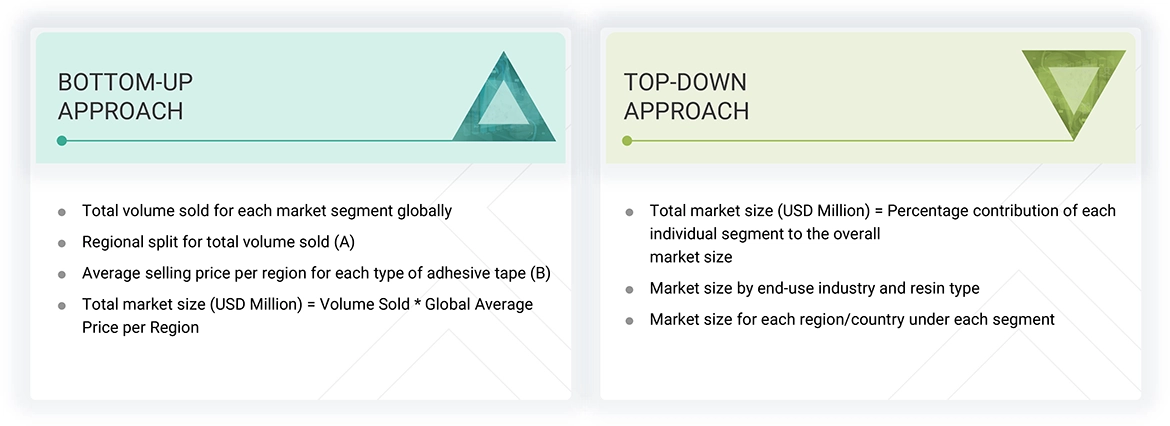

The study involved four major activities in order to estimate the current size of the adhesive tapes market. Exhaustive secondary research was conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with industry experts across the value chain. Both, top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva, and publications and databases from associations, The European Adhesive Tape Association, China Adhesive and Tape Industry Association, and Pressure Sensitive Tape Council.

Primary Research

Extensive primary research was carried out after gathering information about the adhesive tapes market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the adhesive tapes market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated with type, application, and region.

Breakdown of Interviews with Experts

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence. Other designations include consultants and sales, marketing, and procurement managers.

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence. Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| 3M Company | Sales Manager | |

| Nitto Denko Corporation | Project Manager | |

| Tesa SE | Individual Industry Expert | |

| Lintec Corporation | Manager | |

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the adhesive tapes market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both, the top-down and bottom-up approaches.

Market Definition

An adhesive tape is a flexible material, typically made from cloth, cotton, fiber, paper, polyethylene (PE), or metal, which is coated on one or both sides with a sticky adhesive. The adhesive may be acrylic, silicone, or rubber-based. When light pressure (such as finger pressure) is applied, the adhesive tape adheres to a range of surfaces without undergoing any change in phase (from liquid to solid).

Stakeholders

- End Users

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To analyze and forecast the size of the global adhesive tapes market in terms of value and volume

- To provide detailed information about the important drivers, restraints, challenges, and opportunities influencing market growth

- To define, describe, and segment the market based on resin type, backing material, technology, category, end-use industry, and region

- To forecast the size of the market segments based on regions such as Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, partnerships & collaborations, mergers & acquisitions, agreements, and product launches in the market

- To strategically profile the key companies and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What are the growth driving factors of the adhesive tapes market?

Application growth in the packaging industry.

What are the major types in the adhesive category?

The major categories of adhesive tapes are commodity and specialty.

What are the major end-use industries of adhesive tapes?

The major end-use industries of adhesive tapes are healthcare, automotive, packaging, masking, electrical & electronics, and white goods.

Who are the major manufacturers?

3M Company (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), and Lintec Corporation (Japan) are some of the leading players operating in the global adhesive tapes market.

Which is the largest region in the adhesive tapes market?

Asia Pacific is the largest region in the adhesive tapes market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Adhesive Tapes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Adhesive Tapes Market