Secondary Refrigerants Market by Type (Glycols, Salt Brines, Carbon Dioxide), Application (Commercial Refrigeration, Industrial Refrigeration, Heat Pumps, Air Conditioning), and Region (North America, Europe, APAC, MEA) - Global Forecast to 2022

[112 Pages Report] secondary refrigerants market was valued at USD 470.9 Million in 2016 and is projected to reach USD 710.7 Million by 2022, at a CAGR of 7.3% between 2017 and 2022. The base year considered for this study is 2016 while the forecast period considered is 2017-2022.

The objectives of the study include:

- To analyze and forecast the size of the secondary refrigerants market in terms value and volume

- To define, describe, and segment the secondary refrigerants market on the basis of type and application

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments, such as expansions, partnerships, agreements, joint ventures, and new product developments in the secondary refrigerants market

- To strategically profile key players and comprehensively analyze their core competencies

Research Methodology

In this report, market sizes were derived using both, the bottom-up and top-down approaches. First, the market size for types (glycols, salt brines, carbon dioxide, and others), applications (commercial refrigeration, industrial refrigeration, heat pumps, air conditioning, and others), and regions (APAC, North America, South America, Europe, and the Middle East & Africa) were identified through secondary and primary research. The overall secondary refrigerants market size for various regions and countries was then calculated by adding these individual market sizes.

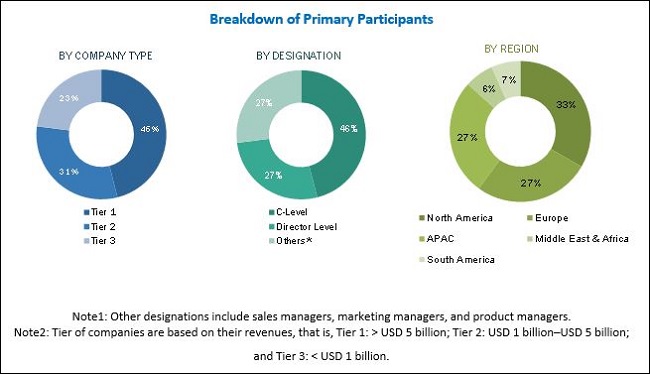

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key market players profiled in the report include The Linde Group (Germany), A-Gas International (UK), TAZZETTI S.P.A (Italy), The Dow Chemical Company (US), Eastman Chemical Company (US), Clariant AG (Switzerland), Arteco Coolants (Belgium), Temper Technology AB (Sweden), SRS Frigadon (UK), Hydratech (UK), Dynalene (US), Environmental Process Systems (UK), Gas Servei SA (Spain), Climalife Groupe Dehon (France), and Nisso Shoji Co. Ltd. (Japan).

Target Audience

- Secondary Refrigerants Manufacturers, Dealers, and Suppliers

- Government Bodies

- Raw Material Suppliers

- Industry Associations

- Consulting Companies/Consultants in Chemical and Material Sectors

- Distributors

This study answers several questions for stakeholders, primarily, which market segments they need to focus on during the next two to five years to prioritize their efforts and investments.

Scope of the Report

This report categorizes the global secondary refrigeration market based on type, application, and region.

Secondary Refrigerants Market, By Type:

- Glycols

- Salt Brines

- Carbon Dioxide

- Others

Secondary Refrigerants Market, By Application:

- Commercial Refrigeration

- Industrial Refrigeration

- Heat Pumps

- Air Conditioning

Secondary Refrigerants Market, By Region:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

The secondary refrigerants market is estimated to be USD 499.7 Million in 2017 and is projected reach USD 710.7 Million by 2022, at a CAGR of 7.3% between 2017 and 2022. The growth of the market is driven by the low environmental impact of secondary refrigerants, phasing out of HCFCs, CFCs, and HFCs refrigerants, and the rising demand for reduction in the primary refrigerant.

On the basis of type, the secondary refrigerants market has been segmented into glycols, salt brines, carbon dioxide, and others. The glycols type segment is estimated to lead the secondary refrigerants market in 2017 in terms of value. This can be attributed to the ability of glycols to provide freeze protection for closed loop refrigeration systems, water-based heating, ventilation, and air conditioning (HVAC), and cooling systems. They help in lowering the freezing point of water.

On the basis of application, the secondary refrigerants market has been segmented into commercial refrigeration, industrial refrigeration, heat pumps, air conditioning, and others. The industrial refrigeration application segment is estimated to lead the secondary refrigerants market in 2017. This can be attributed to the adoption of more environment-friendly refrigerants and the need for reducing carbon emissions in developed and developing regions.

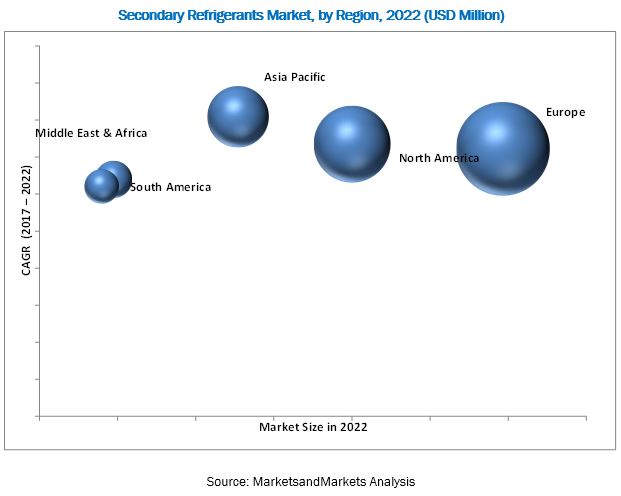

Europe is estimated to be the largest secondary refrigerants market in 2017 in terms of both, value and volume. This market in Europe is estimated to witness the highest growth during the forecast period. The secondary refrigerant market in Europe is projected to grow due to environmental legislation and government support initiatives. The secondary refrigerant market in Europe is driven by strong demand for secondary refrigerants from food processing, chemical and pharmaceutical, dairy and ice-cream processing, and supermarkets.

The use of secondary refrigerants in indirect refrigeration systems is relatively expensive as compared to direct refrigeration systems. Relatively high investment cost is the major restraint for the growth of the secondary refrigerants market.

New product launches, agreements, and expansions were the key strategies adopted by the players in the secondary refrigerants market. Major players in the secondary refrigerants market include The Linde Group (Germany), A-Gas International (UK), TAZZETTI S.P.A (Italy), The Dow Chemical Company (US), Eastman Chemical Company (US), Clariant AG (Switzerland), Arteco Coolants (Belgium), Temper Technology AB (Sweden), SRS Frigadon (UK), Hydratech (UK), Dynalene (US), Environmental Process Systems (UK), Gas Servei SA (Spain), Climalife Groupe Dehon (France), and Nisso Shoji Co. Ltd. (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in Secondary Refrigerants Market

4.2 Secondary Refrigerants Market, By Type

4.3 Secondary Refrigerants Market in Europe, By Application and Country

4.4 Secondary Refrigerants Market, By Region and Application

4.5 Secondary Refrigerants Market, By Region

4.6 Secondary Refrigerants Market, By Key Countries

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Low Environmental Impact

5.2.1.2 Phasing Out of CFCS, HCFCS, and HFCS Refrigerants

5.2.1.3 Rising Demand for Reduction in Primary Refrigerants Charge

5.2.2 Restraints

5.2.2.1 High Investment Cost

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Natural Refrigerants

5.2.3.2 Effects of Global Warming

5.2.4 Challenges

5.2.4.1 Safety Issues

5.3 Porters Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 GDP Forecast of Major Economies

5.5 Policies and Regulations

5.5.1 Europe

5.5.1.1 Eu F-Gas Regulations

5.5.1.2 Montreal Protocol

5.5.1.3 Mac Directive

5.5.1.4 Denmark

5.5.1.5 Austria

5.5.1.6 Switzerland

5.5.2 North America

5.5.2.1 Significant New Alternative Policy

5.5.3 APAC

5.5.3.1 Japan: Revised F-Gas Law

5.5.3.2 China- Feco: First Catalogue of Recommended Substitutes for HCFC

5.5.3.3 China: Room Air-Conditioning Industry HCFC Phase-Out Management Action Plan

5.5.4 South America

5.5.4.1 Chile: New Meps for Domestic Refrigeration By 2016

6 Secondary Refrigerants Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Glycol

6.2.1 Propylene Glycol

6.2.2 Ethylene Glycol

6.3 Salt Brines

6.3.1 Calcium Chloride

6.3.2 Potassium Formate

6.3.3 Potassium Acetate

6.4 Carbon Dioxide

6.5 Others

7 Secondary Refrigerants Market, By Application (Page No. - 46)

7.1 Introduction

7.2 Industrial Refrigeration

7.3 Commercial Refrigeration

7.4 Heat Pumps

7.5 Air Conditioning

7.6 Others

8 Secondary Refrigerants Market, By Region (Page No. - 54)

8.1 Introduction

8.2 Europe

8.2.1 Germany

8.2.2 UK

8.2.3 France

8.3 North America

8.3.1 US

8.3.2 Canada

8.3.3 Mexico

8.4 APAC

8.4.1 Australia & New Zealand

8.4.2 Japan

8.4.3 China

8.4.4 India

8.5 Middle East & Africa

8.5.1 UAE

8.5.2 Saudi Arabia

8.6 South America

8.6.1 Brazil

9 Competitive Landscape (Page No. - 82)

9.1 Overview

9.2 Major Market Players

9.2.1 The Linde Group

9.2.2 A-Gas International

9.2.3 The DOW Chemical Company

9.2.4 Eastman Chemical Company

9.2.5 Clariant Ag

9.3 Competitive Scenario

9.3.1 Expansion

9.3.2 New Product Launch

9.3.3 Acquisition

9.3.4 Partnership & Agreement

10 Company Profiles (Page No. - 87)

Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View

10.1 The Linde Group

10.2 A-Gas International

10.3 The DOW Chemical Company

10.4 Eastman Chemical Company

10.5 Clariant AG

10.6 Tazzetti S.P.A

10.7 Arteco Coolants

10.8 Temper Technology Ab

10.9 Srs Frigadon

10.10 Hydratech

10.11 Other Key Players

10.11.1 Dynalene Inc.

10.11.2 Environmental Process Systems Limited

10.11.3 Gas Servei Sa

10.11.4 Climalife Groupe Dehon

10.11.5 Nisso Shoji Co. Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 106)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (75 Tables)

Table 1 GWP and ODP of Major Refrigerants

Table 2 Schedule for Eliminating HCFC: Non-Article 5 Parties

Table 3 Schedule for Eliminating HCFC: Article 5 Parties

Table 4 Schedule for Eliminating Hfc

Table 5 Factors Governing the Demand for Natural Refrigerants

Table 6 Refrigerants With Low GWP and Zero ODP

Table 7 Properties of Various Refrigerants

Table 8 Trends and Forecast of GDP, By Key Countries, 20172022 (USD Billion)

Table 9 Advantages and Disadvantages of Secondary Refrigerants

Table 10 Secondary Refrigerants Market Size, By Type, 20152022 (USD Million)

Table 11 Secondary Refrigerants Market Size, By Type, 20152022 (Kiloton)

Table 12 Secondary Refrigerants Market Size, By Application, 20152022 (USD Million)

Table 13 Secondary Refrigerants Market Size, By Application, 20152022 (Kiloton)

Table 14 Secondary Refrigerants Market Size in Industrial Refrigeration, By Region, 20152022 (USD Million)

Table 15 Secondary Refrigerants Market Size in Industrial Refrigeration, By Region, 20152022 (Kiloton)

Table 16 Secondary Refrigerants Market Size in Commercial Refrigeration, By Region, 20152022 (USD Million)

Table 17 Secondary Refrigerants Market Size in Commercial Refrigeration, By Region, 20152022 (Kiloton)

Table 18 Secondary Refrigerants Market Size in Heat Pumps, By Region, 20152022 (USD Million)

Table 19 Secondary Refrigerants Market Size in Heat Pumps, By Region, 20152022 (Kiloton)

Table 20 Secondary Refrigerants Market Size in Air Conditioning, By Region, 20152022 (USD Million)

Table 21 Secondary Refrigerants Market Size in Air Conditioning, By Region, 20152022 (Kiloton)

Table 22 Secondary Refrigerants Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 23 Secondary Refrigerants Market Size in Other Applications, By Region, 20152022 (Kiloton)

Table 24 Secondary Refrigerants Market Size, By Region, 20152022 (USD Million)

Table 25 Secondary Refrigerants Market Size, By Region, 20152022 (Kiloton)

Table 26 Europe: Market Size, By Country, 20152022 (USD Million)

Table 27 Europe: Market Size, By Country, 20152022 (Kiloton)

Table 28 Europe: Market Size, By Application, 20152022 (USD Million)

Table 29 Europe: Market Size, By Application, 20152022 (Kiloton)

Table 30 Germany: Market Size, By Application, 20152022 (USD Million)

Table 31 Germany: Market Size, By Application, 20152022 (Kiloton)

Table 32 UK: Market Size, By Application, 20152022 (USD Million)

Table 33 UK: Market Size, By Application, 20152022 (Kiloton)

Table 34 France: Market Size, By Application, 20152022 (USD Million)

Table 35 France: Market Size, By Application, 20152022 (Kiloton)

Table 36 North America: Market Size, By Country, 20152022 (USD Million)

Table 37 North America: Market Size, By Country, 20152022 (Kiloton)

Table 38 North America: Market Size, By Application, 20152022 (USD Million)

Table 39 North America: Market Size, By Application, 20152022 (Kiloton)

Table 40 US: Market Size, By Application, 20152022 (USD Million)

Table 41 US: Secondary Refrigerants Market Size, By Application, 20152022 (Kiloton)

Table 42 Canada: Secondary Refrigerants Market Size, By Application, 20152022 (USD Million)

Table 43 Canada: Secondary Refrigerants Market Size, By Application, 20152022 (Kiloton)

Table 44 Mexico: Market Size, By Application, 20152022 (USD Million)

Table 45 Mexico: Market Size, By Application, 20152022 (Kiloton)

Table 46 APAC: Market Size, By Country, 20152022 (USD Million)

Table 47 APAC: Market Size, By Country, 20152022 (Kiloton)

Table 48 APAC: Secondary Refrigerants Market Size, By Application, 20152022 (USD Million)

Table 49 APAC: Secondary Refrigerants Market Size, By Application, 20152022 (Kiloton)

Table 50 Australia & New Zealand: Secondary Refrigerants Market Size, By Application, 20152022 (USD Million)

Table 51 Australia & New Zealand: Secondary Refrigerants Market Size, By Application, 20152022 (Kiloton)

Table 52 Japan: Market Size, By Application, 20152022 (USD Million)

Table 53 Japan: Market Size, By Application, 20152022 (Kiloton)

Table 54 China: Market Size, By Application, 20152022 (USD Million)

Table 55 China: Market Size, By Application, 20152022 (Kiloton)

Table 56 India: Market Size, By Application, 20152022 (USD Million)

Table 57 India: Market Size, By Application, 20152022 (Kiloton)

Table 58 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

Table 59 Middle East & Africa: Market Size, By Country, 20152022 (Kiloton)

Table 60 Middle East & Africa: Market Size, By Application, 20152022 (USD Million)

Table 61 Middle East & Africa: Secondary Refrigerants Market Size, By Application, 20152022 (Kiloton)

Table 62 UAE: Secondary Refrigerants Market Size, By Application, 20152022 (USD Million)

Table 63 UAE: Secondary Refrigerants Market Size, By Application, 20152022 (Kiloton)

Table 64 Saudi Arabia: Secondary Refrigerants Market Size, By Application, 20152022 (USD Million)

Table 65 Saudi Arabia: Market Size, By Application, 20152022 (Kiloton)

Table 66 South America: Market Size, By Country, 20152022 (USD Million)

Table 67 South America: Market Size, By Country, 20152022 (Kiloton)

Table 68 South America: Market Size, By Application, 20152022 (USD Million)

Table 69 South America: Market Size, By Application, 20152022 (Kiloton)

Table 70 Brazil: Market Size, By Application, 20152022 (USD Million)

Table 71 Brazil: Secondary Refrigerants Market Size, By Application, 20152022 (Kiloton)

Table 72 Expansion, 20122017

Table 73 New Product Launch, 20122017

Table 74 Acquisition, 20122017

Table 75 Partnership & Agreement, 20122017

List of Figures (25 Figures)

Figure 1 Secondary Refrigerants Market Segmentation

Figure 2 Secondary Refrigerants Market: Research Design

Figure 3 Secondary Refrigerants Market: Data Triangulation

Figure 4 Glycol Segment to Lead the Secondary Refrigerants Market

Figure 5 Industrial Refrigeration Segment to Lead the Secondary Refrigeration Market

Figure 6 Europe Led the Secondary Refrigerants Market in 2016

Figure 7 APAC to Be the Fastest Growing Secondary Refrigerants Market

Figure 8 Glycol Segment to Account for the Largest Market Share

Figure 9 Germany Accounted for the Largest Market Share in 2016

Figure 10 Industrial Refrigeration Segment Accounted for the Largest Market Share in Europe in 2016

Figure 11 Europe to Account for the Largest Market Share

Figure 12 China to Be the Fastest-Growing Secondary Refrigerants Market

Figure 13 Overview of Factors Governing the Secondary Refrigerants Market

Figure 14 Secondary Refrigerants Market: Porters Five Forces Analysis

Figure 15 Carbon Dioxide Segment to Register the Highest CAGR in the Market

Figure 16 Commercial Refrigeration Segment to Register the Highest CAGR in the Market

Figure 17 APAC Market to Register Highest CAGR During the Forecast Period

Figure 18 Europe: Secondary Refrigerants Market Snapshot

Figure 19 North America: Secondary Refrigerants Market Snapshot

Figure 20 APAC: Secondary Refrigerants Market Snapshot

Figure 21 Companies Adopted Expansion as the Key Growth Strategy Between 2012 and 2017

Figure 22 The Linde Group: Company Snapshot

Figure 23 The DOW Chemical Company: Company Snapshot

Figure 24 Eastman Chemical Company: Company Snapshot

Figure 25 Clariant AG: Company Snapshot

Growth opportunities and latent adjacency in Secondary Refrigerants Market