Self-Cleaning Glass Market by Coating Type (Hydrophilic, Hydrophobic), Application (Residential Construction, Non-Residential Construction, Solar Panels, Automotive), and Region (Europe, Asia Pacific, North America) - Global Forecast to 2023

Self-Cleaning Glass Market is projected to grow from USD 94.9 million in 2017 to USD 122.7 million by 2023, at a cagr 4.4% from 2018 to 2023.

Objectives of this study are:

- To analyze and forecast the size of the self-cleaning glass market, in terms of value

- To define, segment, and estimate the self-cleaning glass market based on coating type and application

- To forecast the size of market segments, in terms of value, with respect to 5 main regions, namely, Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To provide detailed information regarding key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the self-cleaning glass market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the self-cleaning glass market for stakeholders and provide a competitive landscape of the market

- To track and analyze competitive developments, such as new product developments/launches, acquisitions, expansions, partnerships, and collaborations in the self-cleaning glass market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

The years considered for the study are:

- Base Year – 2017

- Estimated Year – 2018

- Projected Year – 2023

- Forecast Period – 2018 to 2023

For company profiles in the report, 2017 has been considered the base year. In cases wherein information is unavailable for the base year, the years prior to it have been considered.

Research Methodology

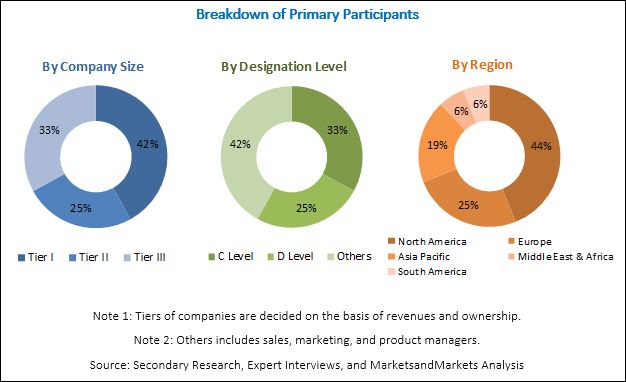

The research methodology used to estimate and forecast the global self-cleaning glass market began with capturing data on key vendor revenues through secondary sources, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and various other government and private websites. Vendor offerings have also been taken into consideration to determine market segmentation. After arriving at the overall market size, the total market was split into several segments and subsegments, which were later verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments of the market. The breakdown of profiles of primaries is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The self-cleaning glass market has a diversified ecosystem of upstream players, including raw material suppliers, along with downstream stakeholders, vendors, and government organizations. Companies operating in the self-cleaning glass market include Nippon Sheet Glass (Japan), Saint-Gobain (France), Guardian Industries (US), Cardinal Glass Industries (US), and Asahi Glass Co. (Japan), among others.

Target Audience

- Manufacturers, Dealers, and Suppliers of Self-cleaning Glass

- End Users of Self-cleaning Glass

- Government and Research Organizations

- Companies Operational in Material R&D

- Associations and Industrial Bodies

- Investment Banks

- Consulting Companies/Consultants in Chemical and Material Sectors

“This study answers several questions for stakeholders, primarily the market segments, which they need to focus upon during the next 2 to 5 years so that they may prioritize their efforts and investments accordingly.”

Scope of the Report:

This research report categorizes the self-cleaning glass market based on coating type, application, and region, and forecasts revenues as well as analyzes trends in each of the submarkets.

Self-Cleaning Glass Market, On the Basis of Coating Type:

- Hydrophilic

- Hydrophobic

Self-Cleaning Glass Market, On the Basis of Application:

- Residential Construction

- Non-residential Construction

- Solar Panels

- Automotive

- Others

Self-Cleaning Glass Market, On the Basis of Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

The following customization options are available for the report:

Along with the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific, Rest of the Middle East & Africa, Rest of Europe, and Rest of South America self-cleaning glass markets

Company Information

- Detailed analysis and profiles of additional market players (up to 5 companies)

The global self-cleaning glass market is projected to grow from an estimated USD 99.1 million in 2018 to USD 122.7 million by 2023, at a CAGR of 4.4% from 2018 to 2023. The growth of the construction industry is a major factor driving the self-cleaning glass market. The low lifetime-cost of self-cleaning glass is another factor fueling the growth of this market; cost-cutting on labor and detergent otherwise required to wash the glass reduces the lifetime-cost of self-cleaning glass.

The hydrophilic segment is projected to be the largest coating type segment of the self-cleaning glass market from 2018 to 2023. The hydrophilic self-cleaning glass has a film of titanium dioxide coating. This coating self-cleans glass in 2 stages, the photocatalytic stage and the hydrophilic sheathing stage. In the photocatalytic stage, ultraviolet light from the sun breaks down the organic dirt present on the glass. In the hydrophilic sheathing stage, rain washes away the dirt, and does not leave any streaks behind, as hydrophilic glass spreads the water evenly on the surface. This glass is more of use in regions with frequent rainfall or if the glass is hosed down regularly.

The residential construction segment is estimated to be the largest application segment of the self-cleaning glass market in 2018. In residential construction, self-cleaning glass is used in roof windows, bay windows, conservatories, roofs, patio doors, and glazed facades. Generally, a hydrophilic coating is applied on solar control glass to provide both, high energy-efficiency and self-cleaning properties. Rapid urbanization in emerging countries and the increasing number of building codes in developed countries have increased the demand for self-cleaning glass in residential construction.

The Asia Pacific is expected to be the fastest-growing market for self-cleaning glass during the forecast period. The growing middle-class populations with high disposable incomes and increasing demand for sustainable construction are major factors contributing to the growth of the self-cleaning glass market in this region.

Low effectiveness of self-cleaning glass in areas with low rainfall and less sun exposure is a major factor restraining the market. Self-cleaning glass is also more expensive than conventional, non-coated construction glass by 15-20%, leading to low demand for self-cleaning glass in emerging countries.

Key players operating in the self-cleaning glass market include Nippon Sheet Glass (Japan), Saint-Gobain (France), Guardian Industries (US), Cardinal Glass Industries (US), and Asahi Glass Co. (Japan), among others. These companies focus on enhancing their product portfolios to grow in the self-cleaning glass market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in Self-Cleaning Glass Market

4.2 Self-Cleaning Glass Market, By Region

4.3 Europe Self-Cleaning Glass Market, By Country & Application

4.4 Self-Cleaning Glass Market, By Coating Type & Region

4.5 Top Countries in Self-Cleaning Glass Market

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of the Construction Industry

5.2.1.2 Reduction in Maintenance Time and Cost

5.2.2 Restraints

5.2.2.1 Low Efficiency of Self-Cleaning Glass

5.2.3 Opportunities

5.2.3.1 Rising Demand for Value-Added Glass Products

5.2.3.2 Increasing Demand for Self-Cleaning Glass in Solar Panels

5.2.4 Challenges

5.2.4.1 Nomenclature of Self-Cleaning Glass

5.2.4.2 Low Penetration in Emerging Countries

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Annual GDP Growth Rate of Major Economies

5.4.2 Construction

5.4.3 Automotive Industry

6 Self-Cleaning Glass Market, By Coating Type (Page No. - 39)

6.1 Introduction

6.2 Hydrophilic

6.3 Hydrophobic

7 Self-Cleaning Glass Market, By Application (Page No. - 43)

7.1 Introduction

7.2 Residential Construction

7.3 Non-Residential Construction

7.4 Solar Panels

7.5 Automotive

7.6 Others

8 Regional Analysis (Page No. - 51)

8.1 Introduction

8.2 Europe

8.2.1 Germany

8.2.2 France

8.2.3 UK

8.2.4 Italy

8.2.5 Rest of Europe

8.3 Asia Pacific

8.3.1 China

8.3.2 Japan

8.3.3 India

8.3.4 Australia

8.3.5 Rest of Asia Pacific

8.4 North America

8.4.1 US

8.4.2 Canada

8.4.3 Mexico

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Rest of South America

9 Competitive Landscape (Page No. - 86)

9.1 Overview

9.2 Market Ranking Analysis

9.3 Competitive Situation & Trends

9.3.1 New Product Launches/Developments

10 Company Profiles (Page No. - 89)

Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View

10.1 Nippon Sheet Glass

10.2 Saint-Gobain

10.3 Guardian Industries

10.4 Cardinal Glass Industries, Inc.

10.5 Asahi Glass Co.

10.6 Viridian Glass

10.7 Atis Group

10.8 Kneer-Südfenster

10.9 Australian Insulated Glass

10.10 Roof-Maker Limited

10.11 Other Leading Players

10.11.1 Wuxi Yaopi Glass Engineering Co., Ltd.

10.11.2 Foshan Qunli Glass Co., Ltd.

10.11.3 Dependable Glass Works

10.11.4 Olympic Glass

10.11.5 Polypane Glasindustrie

10.11.6 Tuff-X Processed Glass

10.11.7 Semco

10.11.8 Weihai Blue Star Glass Holding

10.11.9 H.K. Taixing Glass Stone Material Limited

10.11.10 Prefix Systems

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 108)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (92 Tables)

Table 1 Annual GDP Growth Rate of Major Economies, 2012-2016

Table 2 GDP Contribution By Sector, 2016 (%)

Table 3 Motor Vehicle Production, By Country, 2015 & 2016

Table 4 Self-Cleaning Glass Market, By Coating Type, 2016–2023 (USD Million)

Table 5 Self-Cleaning Glass Market, By Coating Type, 2016–2023 (Thousand Square Meters)

Table 6 Hydrophilic Self-Cleaning Glass Market, By Region, 2016–2023 (USD Million)

Table 7 Hydrophilic Self-Cleaning Glass Market, By Region, 2016–2023 (Thousand Square Meters)

Table 8 Hydrophobic Self-Cleaning Glass Market, By Region, 2016–2023 (USD Million)

Table 9 Hydrophobic Self-Cleaning Glass Market, By Region, 2016–2023 (Thousand Square Meters)

Table 10 Self-Cleaning Glass Market, By Application, 2016–2023 (USD Million)

Table 11 Self-Cleaning Glass Market, By Application, 2016–2023 (Thousand Square Meters)

Table 12 Market in Residential Construction, By Region, 2016–2023 (USD Thousand)

Table 13 Market in Residential Construction, By Region, 2016–2023 (Thousand Square Meters)

Table 14 Market in Non-Residential Construction, By Region, 2016–2023 (USD Thousand)

Table 15 Market in Non-Residential Construction, By Region, 2016–2023 (Thousand Square Meters)

Table 16 Self-Cleaning Glass Market in Solar Panels, By Region, 2016–2023 (USD Thousand)

Table 17 Self-Cleaning Glass Market in Solar Panels, By Region, 2016–2023 (Thousand Square Meters)

Table 18 Market in Automotive, By Region, 2016–2023 (USD Thousand)

Table 19 Market in Automotive, By Region, 2016–2023 (Thousand Square Meters)

Table 20 Market in Others, By Region, 2016–2023 (USD Thousand)

Table 21 Market in Others, By Region, 2016–2023 (Thousand Square Meters)

Table 22 Self-Cleaning Glass Market, By Region, 2016–2023 (USD Million)

Table 23 Self-Cleaning Glass Market, By Region, 2016-2023 (Thousand Square Meters)

Table 24 Market, By Coating Type, 2016-2023 (USD Million)

Table 25 Market, By Coating Type, 2016-2023 (Thousand Square Meter)

Table 26 Market, By Application, 2016-2023 (USD Million)

Table 27 Market, By Application, 2016-2023 (Thousand Square Meter)

Table 28 Europe Self-Cleaning Glass Market, By Country, 2016-2023 (USD Million)

Table 29 Europe Market, By Country, 2016-2023 (Thousand Square Meters)

Table 30 Europe Market, By Coating Type, 2016-2023 (USD Million)

Table 31 Europe Market, By Coating Type, 2016-2023 (Thousand Square Meters)

Table 32 Europe Market, By Application, 2016-2023 (USD Million)

Table 33 Europe Market, By Application, 2016-2023 (Thousand Square Meters)

Table 34 Germany Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 35 Germany Market, By Application, 2016-2023 (Thousand Square Meters)

Table 36 France Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 37 France Market, By Application, 2016-2023 (Thousand Square Meters)

Table 38 UK Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 39 UK Market, By Application, 2016-2023 (Thousand Square Meters)

Table 40 Italy Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 41 Italy Market, By Application, 2016-2023 (Thousand Square Meters)

Table 42 Rest of Europe Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 43 Rest of Europe Glass Market, By Application, 2016-2023 (Thousand Square Meters)

Table 44 Asia Pacific Self-Cleaning Glass Market, By Country, 2016-2023 (USD Million)

Table 45 Asia Pacific Market, By Country, 2016-2023 (Thousand Square Meters)

Table 46 Asia Pacific Market, By Coating Type, 2016-2023 (USD Million)

Table 47 Asia Pacific Market, By Coating Type, 2016-2023 (Thousand Square Meters)

Table 48 Asia Pacific Market, By Application, 2016-2023 (USD Million)

Table 49 Asia Pacific Market, By Application, 2016-2023 (Thousand Square Meters)

Table 50 China Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 51 China Market, By Application, 2016-2023 (Thousand Square Meters)

Table 52 Japan Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 53 Japan Market, By Application, 2016-2023 (Thousand Square Meters)

Table 54 India Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 55 India Market, By Application, 2016-2023 (Thousand Square Meters)

Table 56 Australia Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 57 Australia Self-Cleaning Glass Market, By Application, 2016-2023 (Thousand Square Meters)

Table 58 Rest of Asia Pacific Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 59 Rest of Asia Pacific Glass Market, By Application, 2016-2023 (Thousand Square Meters)

Table 60 North America Self-Cleaning Glass Market, By Country, 2016-2023 (USD Million)

Table 61 North America Market, By Country, 2016-2023 (Thousand Square Meters)

Table 62 North America Market, By Coating Type, 2016-2023 (USD Million)

Table 63 North America Market, By Coating Type, 2016-2023 (Thousand Square Meters)

Table 64 North America Market, By Application, 2016-2023 (USD Million)

Table 65 North America Market, By Application, 2016-2023 (Thousand Square Meters)

Table 66 US Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 67 US Market, By Application, 2016-2023 (Thousand Square Meters)

Table 68 Canada Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 69 Canada Market, By Application, 2016-2023 (Thousand Square Meters)

Table 70 Mexico Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 71 Mexico Market, By Application, 2016-2023 (Thousand Square Meters)

Table 72 Middle East & Africa Self-Cleaning Glass Market, By Country, 2016-2023 (USD Million)

Table 73 Middle East & Africa Market, By Country, 2016-2023 (Thousand Square Meters)

Table 74 Middle East & Africa Market, By Coating Type, 2016-2023 (USD Million)

Table 75 Middle East & Africa Market, By Coating Type, 2016-2023 (Thousand Square Meters)

Table 76 Middle East & Africa Market, By Application, 2016-2023 (USD Million)

Table 77 Middle East & Africa Market, By Application, 2016-2023 (Thousand Square Meters)

Table 78 Saudi Arabia Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 79 Saudi Arabia Market, By Application, 2016-2023 (Thousand Square Meters)

Table 80 Rest of Middle East & Africa Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 81 Rest of Middle East & Africa Market, By Application, 2016-2023 (Thousand Square Meters)

Table 82 South America Self-Cleaning Glass Market, By Country, 2016-2023 (USD Million)

Table 83 South America Market, By Country, 2016-2023 (Thousand Square Meters)

Table 84 South America Market, By Coating Type, 2016-2023 (USD Million)

Table 85 South America Market, By Coating Type, 2016-2023 (Thousand Square Meters)

Table 86 South America Market, By Application, 2016-2023 (USD Million)

Table 87 South America Market, By Application, 2016-2023 (Thousand Square Meters)

Table 88 Brazil Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 89 Brazil Market, By Application, 2016-2023 (Thousand Square Meters)

Table 90 Rest of South America Self-Cleaning Glass Market, By Application, 2016-2023 (USD Thousand)

Table 91 Rest of South America Market, By Application, 2016-2023 (Thousand Square Meters)

Table 92 New Product Launches/Developments, 2013-2018

List of Figures (26 Figures)

Figure 1 Self-Cleaning Glass Market Segmentation

Figure 2 Self-Cleaning Glass Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Hydrophilic Segment Projected to Lead Self-Cleaning Glass Market Between 2018 and 2023

Figure 7 Residential Construction Segment Expected to Lead Self-Cleaning Glass Market During Forecast Period

Figure 8 Europe Estimated to Lead Self-Cleaning Glass Market in 2018

Figure 9 Increasing Use of Self-Cleaning Glass in Residential Construction Application Expected to Drive Self-Cleaning Glass Market From 2018 to 2023

Figure 10 Self-Cleaning Glass Market in Asia Pacific Projected to Grow at Highest CAGR During the Forecast Period

Figure 11 Residential Construction Application Segment Estimated to Lead Europe Self-Cleaning Glass Market in 2018

Figure 12 Hydrophilic Coating Type Segment Estimated to Lead Self-Cleaning Glass Market Across All Regions in 2018

Figure 13 The US Projected to Lead Self-Cleaning Glass Market Between 2018 and 2023

Figure 14 Drivers, Restraints, Opportunities, and Challenges: Self-Cleaning Glass Market

Figure 15 Self-Cleaning Glass Market: Porter’s Five Forces Analysis

Figure 16 Hydrophilic Coating Type Segment Projected to Lead Self-Cleaning Glass Market During Forecast Period

Figure 17 Residential Construction Application Segment Projected to Lead Self-Cleaning Glass Market During Forecast Period

Figure 18 Self-Cleaning Glass Market: Country-Wise Growth

Figure 19 Europe Self-Cleaning Glass Market Snapshot

Figure 20 Asia Pacific Self-Cleaning Glass Market Snapshot

Figure 21 North America Self-Cleaning Glass Market Snapshot

Figure 22 Organic Growth Strategy Majorly Adopted By Key Companies in the Self-Cleaning Glass Market Between 2013 and 2018

Figure 23 Self-Cleaning Glass Market Ranking, By Company, 2018

Figure 24 Nippon Sheet Glass: Company Snapshot

Figure 25 Saint-Gobain: Company Snapshot

Figure 26 Asahi Glass Co.: Company Snapshot

Growth opportunities and latent adjacency in Self-Cleaning Glass Market