Flat Glass Market

Flat Glass Market by Technology (Float, Rolled, Sheet), Type (Basic Float Glass, Toughened, Coated, Laminated, Extra Clear), End-Use Industry (Construction & Infrastructure, Automotive & Transportation, Solar Energy) - Global Forecast to 2030

Updated on : December 11, 2025

FLAT GLASS MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global flat glass market was valued at USD 179.80 billion in 2025 and is projected to reach USD 280.64 billion by 2030, growing at 9.3% cagr from 2025 to 2030. A high demand for flat glass is witnessed in various sectors and industries, such as construction, infrastructure, automotive, transportation, and solar energy, attributed to increasing urbanization and infrastructure development. The push for modern architecture and energy-efficient construction has driven industries to adopt more glass facades and windows as well as insulated and low-emissivity (Low-E) glass because they minimize energy usage. The automotive & transportation industry is the second largest growing market in 2024, due to the rising EV and vehicle production demand high-quality windshields, sunroofs, and safety glass. Solar energy project development throughout Asia Pacific, North America, and Europe has substantially increased the demand for flat glass in photovoltaic PV panels. Flat glass applications have expanded across different industries due to technical advancements, which led to the production of smart glass products, self-cleaning glass solutions, and anti-reflective coating technology. Government support for sustainable construction worldwide provides essential status for flat glass in building the infrastructure of future generations.

KEY TAKEAWAYS

-

BY END USE INDUSTRYFlat glass are Increasingly being adopted in Construction & Infrastructure, Automotive & Transportation, Solar Energy, and Other end use Industries. Building, windows, facades, and smart interior solutions are in great demand, while vehicle safety and energy efficiency are becoming increasingly important. In addition to supporting a variety of specialized applications in electronics and appliances, flat glass is also being used in solar panels.

-

BY TECHNOLOGYFlat glass market in terms of technology is divided into Float glass, Rolled glass and Sheet glass. Float glass technology is a modern manufacturing process used to manufacture high quality flat glass. The float glass technology is expected to hold the fastest growing technology segment due factors such as Increased demand in commercial buildings, expansions in automotive Industry, and technological advancements.

-

BY PRODUCTFlat glass by product includes basic float glass, toughened glass, laminated glass, coated glass, extra-clear glass and other product types. The basic float glass market is growing rapidly in the flat glass market owing to its cost-saving nature, flexibility, and extensive applications. Being the cheapest form of flat glass, it is the starting point for other processed glass products such as tempered, laminated, and coated glass, rendering it indispensable to industries. The growth in urbanization and infrastructure development, especially in developing economies such as China and India, is creating tremendous demand for float glass in construction, such as windows, facades, and interior use.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 9.7%, due to presence of well-established flat glass manufacturers, fueled by defense modernization, new energy programs, and increasing automotive & solar energy manufacturing in China, Japan, and India followed by Europe, North America, Middle East & Africa, and Latin America.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as TAIWAN GLASS IND. CORP., Nippon Sheet Glass Co., Ltd, AGC Inc. and Innovate smaller firms. Businesses are concentrating on improving durability, cutting expenses, and introducing advanced solar, automotive, products to maintain their competitive edge. Current trends include industry consolidation and partnerships aimed at advancing technology.

The market for flat glass is expected to grow due to several factors, such as Increasing urbanization and infrastructure requirements are boosting construction, where flat glass is vital for windows, facades, and interior spaces. Automakers are using more flat glass for lighter, safer, and energy-efficient vehicles as both electric and conventional models advance. The rapid uptake of solar energy solutions requires large volumes of high-quality flat glass for photovoltaic panels. Modern buildings and vehicles also demand improved energy savings, noise insulation, and greater natural lighting goals. Ongoing trends in green architecture, smart cities, and design aesthetics continue to make flat glass a preferred material for diverse applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of flat glass suppliers, which, in turn, impacts the revenues of flat glass manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

FLAT GLASS MARKET DYNAMICS

Level

-

Growth in construction and infrastructure activities

-

Rising automotive industry

Level

-

High production costs

-

Stringent carbon emission regulation

Level

-

Growing adoption of sustainable and energy-efficient solutions

-

Rapid urbanization in emerging economies.

Level

-

High cost of advanced technologies

-

Growing environmental concerns and regulatory pressures

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in construction and infrastructure activities

The increased construction and infrastructure development activities primarily drive the growth of the flat glass market. The fast-growing urbanization throughout Asia Pacific, North America, and Europe has created a high demand for high-rise buildings, commercial complexes, and smart cities, which need glass facades with curtain walls, windows, and partitions. Government-led investments in city development schemes and industrial building infrastructure construction add to the requirement for flat glass solutions for architectural construction. The construction of buildings for sustainability based on green movements creates a high demand for low-E glass and insulated glass solutions as they can reduce energy transfer and make buildings consume less power. Projects throughout airports, metro stations, shopping malls, and highways need sturdy glass components that enhance safety, deliver sound reduction, and improve visibility. The growing emphasis on modern architecture, sustainable construction, and technological advancements in glass coatings and treatments are further supporting market growth.

Restraint: High production cost

The high cost of flat glass manufacturing is expected to hamper market expansion. Flat glass production requires high-temperature procedures that use considerable energy to melt raw materials from silica soda ash and limestone. The volatility in energy prices of fossil fuels impacts production expenses, thus making flat glass manufacturing costly for regions that depend on these fuels. Manufacturers face increased expenses because raw material prices and transportation expenses continue to rise, reducing their profit margins. Enforcing carbon emission standards and energy efficiency regulations elevates manufacturing costs because companies need to acquire state-of-the-art production technologies and eco-friendly manufacturing procedures to satisfy regulatory requirements. Manufacturers face elevated production costs and increased complexity because of incorporating specialized coatings along with treatments and advanced glass processing methods that involve Low-E coatings, anti-reflective coatings, tempered glass, and other glass production. These high capital investments create barriers for smaller manufacturers operating in emerging markets that wish to participate in the flat glass market.

Opportunity: Rapid urbanization in emerging economies.

Rapid urbanization in emerging economies is expected to create growth potential for the market players due to the needs arising from expanding infrastructure development and developing real estate sector projects. The rise of urbanization creates the sustained need for flat glass applications across windows and facades alongside skylight partitions and balcony enclosures because modern architecture pursues open and energy-efficient designs and attractive visuals. The governments in these regions finance substantial investments to develop smart city projects and sustainable urban planning and transport infrastructure, strengthening their market for high-performance glass solutions. The development of metro stations, airports, and high-rise commercial buildings drives the adoption of coated laminated and insulated glass products because these buildings need soundproof and energy-efficient glass. The trend toward green construction combined with emerging energy efficiency standards drives increased demand for Low-E glass and solar control glass to decrease building energy usage.

Challenge: Growing environmental concerns and regulatory pressure

The growing environmental concerns and related regulations are expected to be the major challenges for the market players. These factors contribute to rising costs and difficult conditions for future market growth. Flat glass production consumes a high amount of energy. Raw materials such as silica, soda ash, and limestone must be melted at extremely high temperatures, resulting in heavy carbon emissions. Due to changes in climate and the need for sustainability, governments worldwide are now enforcing more stringent regulations on industries to lower their carbon emissions. Most countries in Europe and North America have adopted emission-reduction carbon levels and energy efficiency standards, which require glass producers to utilize green production methods and renewable energy. Meeting these regulations requires expensive renovation of existing manufacturing plants, which is difficult for small and medium-sized businesses

Flat Glass Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of flat glass in panoramic sunroofs and side glazing. | Enhanced passenger safety, UV protection, improved cabin acoustics, and premium comfort. |

|

Flat glass in solar photovoltaic panels and solar control windows. | Enhanced light transmission, energy harvesting, reduced reflection, extended panel life. |

|

Application of flat glass in EV windshields and side windows. | Lower cabin noise, improved energy efficiency for HVAC systems, and increased passenger safety. |

|

Flat glass as screens and surfaces for appliances, displays, and integrated smart panels. | High transparency, scratch resistance, thermal stability, improved product lifespan. |

|

Use of flat glass in passenger windows with solar/UV control interlayers. | Reduced cabin heat load, lower fuel consumption via reduced AC load, enhanced passenger comfort. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

FLAT GLASS MARKET ECOSYSTEM

The flat glass ecosystem comprises raw material manufacturers/suppliers (Carmeuse, US Silica, and Lhoist) who provide raw materials such as silica sand, limestone, soda ash, and others to flat glass manufacturers (Nippon Sheet Glass Co., Ltd, AGC Inc., and SCHOTT). The manufacturers offer flat glass to intermediaries such as PressGlass, TriStar, and Viracon, who further provide it to end users such as Toyota, First Solar, and General Motors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Laminated Glass Market, By Technology

The float glass segment is projected to lead the flat glass market due to its high quality and extensive application scope. The float glass manufacturing process, which was invented in the 20th century, uses molten tin as a base for glass, enabling it to float to form a glass block. The outcome is glass with uniform thickness, smooth surface, and high optical clarity, which does not require extensive polishing and grinding. Solar energy, architectural, automotive, and many other industries are able to benefit from this process since precision and clarity are essential during these tasks. One of the key reasons for the dominance of this segment is the extraordinary scalability and efficiency of float glass in mass production. Compared to traditional methods, the float process is cheaper for producing large sheets of high-quality glass, making it cost-competitive. Furthermore, coating technologies such as (reflective and Low-E solar control coatings) have made it more energy efficient and enhanced its functionality, making it more appropriate for green buildings and automobiles. The float glass segment is set to sustain its leadership in the flat glass market with continuous advancements in smart glass and energy-efficient high-performance glazing systems.

REGION

Asia Pacific to be fastest-growing region in global Ceramic matrix composite market during forecast period

Asia Pacific is projected to be the fastest-growing market for flat glass due to rapid urbanization, industrialization, and increasing infrastructure development. China, alongside India, Japan, South Korea, and Southeast Asian countries, is reporting substantial economic growth. The construction industry has experienced drastic expansion across the residential, commercial, and industrial sectors. The glass market is witnessing increased demand due to public support for smart city development, sustainable city planning, and energy-efficient property requirements. Several energy-saving glass products, including Low-E glass, insulated glass, and solar control glass, are witnessing a high demand as countries enforce strict carbon footprint reduction regulations through energy efficiency standards. China leads flat glass production at the global level as it possesses a booming domestic market, advanced manufacturing operations, and strong overseas export capabilities. Real estate, industrial corridors, and infrastructure projects are witnessing high foreign direct investments in India, which is positioning the country as a key player in the global market. The growing automotive sector in Asia Pacific is creating a significant demand for safety glass products, including tempered and laminated glass used in windshields and sunroofs, and chemical-strengthened glass for automobile components. Lightweight, durable smart glass solutions are essential because of the expanding electric vehicle industry and autonomous transportation needs. Solar energy projects backed by government-led investments are also creating a strong demand for solar glass used in the production of photovoltaic panels.

Flat Glass Market: COMPANY EVALUATION MATRIX

In the Flat glass market matrix, Saint Gobain (Star) leads with a strong market share and extensive product footprint, driven by its advanced products used by various end use Industries. TAIWAN GLASS IND. CORP. (Emerging Leader) due to its technological innovation, diverse product portfolio, and strong presence in the Asia-Pacific region. The company’s focus on high-quality manufacturing and strategic capacity expansion supports its competitive position and market leadership. While Saint-Gobain dominates through scale and diversified portfolio, TAIWAN GLASS IND. CORP. shows significant potential to move toward the leaders’ quadrant as demand for high-strength alloys continues to rise

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 166.43 Billion |

| Revenue Forecast in 2030 | USD 280.64 Billion |

| Growth Rate | CAGR of 9.3% from 2025-2030 |

| Actual data | 2021-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | BY TECHNOLOGY (FLOAT,ROLLED,SHEET), PRODUCT (BASIC FLOAT GLASS, TOUGHENED, COATED, LAMINATED, EXTRA CLEAR, OTHER PRODUCTS), END-USE INDUSTRY (CONSTRUCTION & INFRASTRUCTURE, AUTOMOTIVE & TRANSPORTATION, SOLAR ENERGY, OTHER END-USE INDUSTRIES), AND REGION |

| Regional Scope | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Flat Glass Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive Manufacturer |

|

|

| Building & Construction Company |

|

|

| Raw Material Supplier |

|

|

| Defense & Specialty Vehicle OEM |

|

|

RECENT DEVELOPMENTS

- February 2025 : AGC and Saint-Gobain have officially inaugurated the Volta production line. At the AGC Barevka plant in Teplice, Volta is a breakthrough pilot project aiming to significantly reduce CO2 emissions and support the transition to sustainable flat glass production.

- March 2025 : Sisecam has announced a USD 470 million investment to establish new float glass production lines to enhance capacity and meet growing demand

- March 2025 : Nippon Sheet Glass Co., Ltd. has converted an existing float glass production line at its Rossford, Ohio facility to manufacture TCO (transparent conductive oxide) glass. The conversion will enhance production capabilities for solar applications

- October 2024 : AGC Glass Europe, a subsidiary of AGC Inc., partnered with ROSI, a photovoltaic recycling pioneer, to create a circular value chain for solar panels. ROSI's technology will recycle solar panels into high-purity raw materials, including glass cullet from cover glass, which AGC Glass Europe will use in its glass manufacturing

- September 2024 : Saint-Gobain launched the COOL-LITE SKN 175. It is a highly selective solar control glass designed for commercial buildings, offering a neutral aesthetic while providing effective solar control and energy efficiency

Table of Contents

Methodology

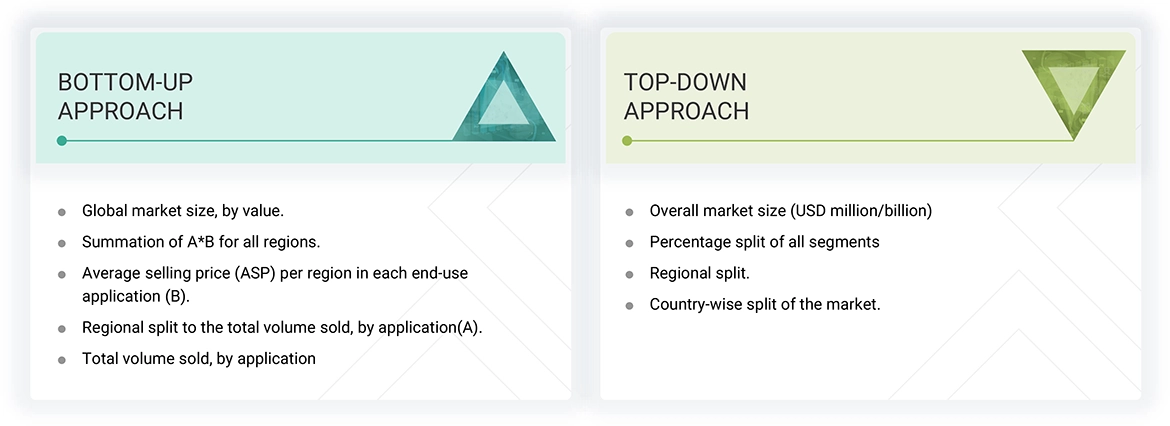

The study involves two major activities in estimating the current market size for the flat glass market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering flat glass and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the flat glass market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the flat glass market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from flat glass industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product, technology, end use Industry and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and production teams of the customer/end users who are using flat glass, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of flat glass and future outlook of their business which will affect the overall market.

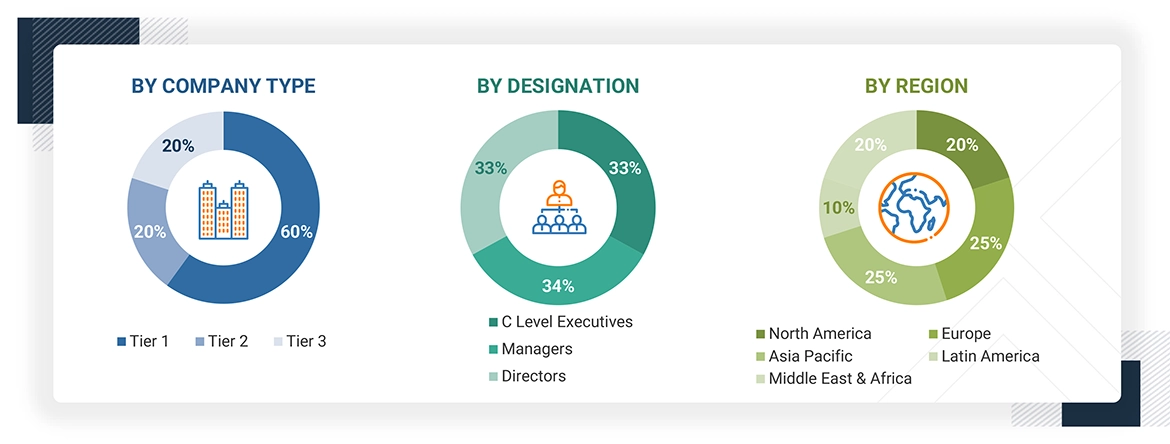

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the flat glass market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in flat glass in different end-use applications at a regional level. Such procurements provide information on the demand aspects of the flat glass industry for each application. For each application, all possible segments of the flat glass market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Flat glass is a type of glass produced in the plane form. It is mainly produced from soda lime, dolomite, and recycled glass by the float glass technology. Flat glass is commonly used for windows, doors, facades, and mirrors. Major properties of flat glass include solar control, sound & temperature insulation, and UV protection.

Stakeholders

- Flat glass manufacturers

- Raw material suppliers

- Distributors and suppliers

- Industry associations

- Universities, governments & research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environmental support agencies

- Investment banks and private equity firms

Report Objectives

- To define, describe, and forecast the flat glass market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global flat glass market by product, technology, end-use Industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Flat Glass Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Flat Glass Market