Self-Healing Coatings Market by Form (Extrinsic, Intrinsic), End-use industry (Automotive, Building and construction, Aerospace, Marine) and Region (Asia Pacific, Europe, North America, South America, and MEA) – Global Forecast to 2028

Updated on : November 11, 2025

Self-Healing Coatings Market

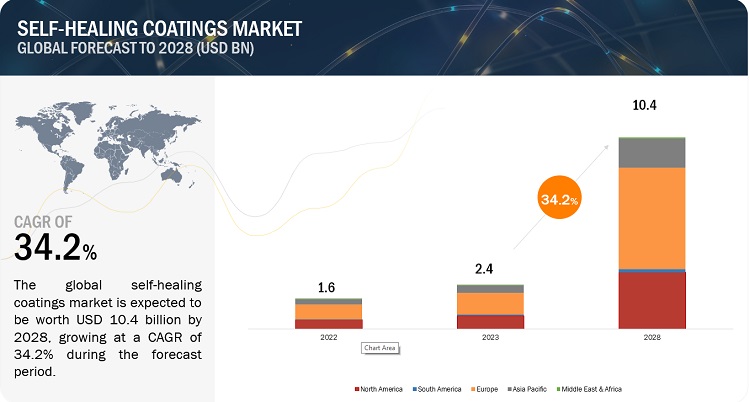

The Self-Healing Coatings Market was valued at USD 2.4 billion in 2023 and is projected to reach USD 10.4 billion by 2028, growing at a cagr 34.2% from 2023 to 2028. Automotive and marine industries make extensive use of self-healing coatings. Its market is increasing rapidly as a result of expanded application areas, technical advancements, and rising demand in Europe. The burgeoning building and construction business, as well as increasingly demanding structural integrity rules, are driving demand for self-healing coatings. The necessity to prolong the lifespan of structures in order to comply with structural integrity rules and to gradually tighten material science regulations on a worldwide basis is driving the rise. However, the high manufacturing costs limit the increase in demand for self-healing coatings.

Attractive Opportunities in Self-Healing Coatings Market

To know about the assumptions considered for the study, Request for Free Sample Report

Self-Healing Coatings Market Dynamics

Driver: Self-healing coatings are frequently used in the automobile industry due to their ability to repair physical damage or restore functional performance with little or no intervention. The capacity of coatings to self-heal is especially important in the automobile sector, where cars are subjected to extreme climatic conditions and mechanical damage. Self-healing coatings can endure tiny scratches and prevent corrosion, lowering maintenance costs and increasing the life of the coating. Furthermore, self-healing coatings may intelligently adapt to mechanical or chemical damage produced by the external environment and replicate their previous qualities, such as adherence to the substrate and integrity. The application of self-healing nanocoating’s in automobiles can make mobility significantly healthier and increase vehicle performance.

Restraints: Self-healing coatings are currently very expensive. Many of the processing production and procedures are experimental. It is not known which approaches will prove to be commercially viable at this stage or which will meet a consumer need. Consumers are skeptical of new technologies, especially at a premium when the functionality is not instantly visible, or the benefits are not obvious. Limited repeatability of encapsulation products is another commercial barrier; consumers would be reluctant to pay a premium for a product that will not keep performance.

The crucial aspect is that the consumer views the technology advantage as value for money at the moment of purchase. As new technologies prepare to reach the market, the application must be adequately planned. It is critical that the scope of application broadens, and that additional cross-disciplinary research be conducted in automotive, building and construction, marine, and even aerospace to investigate the possibilities of self-healing coatings. Due to the intricacy of its production process, intrinsic self-healing coatings are more expensive than extrinsic self-healing coatings. Intrinsic self-healing coatings are designed to have the healing agent integrated into the coating matrix, requiring a more sophisticated manufacturing process than extrinsic self-healing coatings, which have the healing agent added to the coating after it has been applied. Furthermore, intrinsic self-healing coatings need a larger concentration of healing chemicals, which raises their cost. However, intrinsic self-healing coatings have the benefit of being more robust and long-lasting than extrinsic self-healing coatings, making them more appealing for applications requiring long-term protection.

Opportunity: Because of its capacity to repair scratches and resist corrosion, self-healing coatings are gaining popularity in the automobile industry, lowering maintenance costs and increasing the longevity of vehicle coatings. Transparent protective coatings for automobiles that can self-heal in 30 minutes under sunlight have been created by researchers, revealing the potential for self-healing coatings in the automotive sector. Self-healing coatings are also applicable to electrical equipment and building materials, giving them a versatile option for a variety of transportation applications. In vehicles, the application of self-healing nanocoating’s can increase mobility and performance. The development of self-healing polymeric coatings might reduce the amount of money that car operators must spend on maintenance, making them an appealing alternative for the automotive industry.

Challenges: The economics of the self-healing coatings business are extremely complicated due to the large variety of variables in the relatively new value and production chains. Larger firms are more likely to understand the value chain and position themselves than small and medium-sized enterprises (SMEs).

In many circumstances, there are evident economic constraints for self-healing coatings production processes, such as operating expenses, R&D expenditures, and investments. For certain self-healing coatings, the technology does not yet exist (or has not yet been commercialized), or the creation of a self-healing coatings manufacturing method is not cost-effective due to the high costs involved with the manufacture of traditional materials. Self-healing coatings require specialized equipment and knowledge to make, which small businesses may not have. Furthermore, self-healing coatings need stringent quality control methods to guarantee that the healing agents are spread uniformly throughout the coating, which can be difficult for small businesses to do.

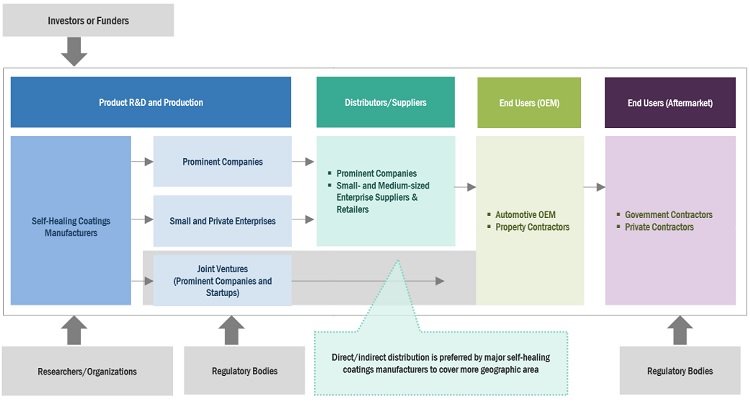

Self-Healing Coatings Market Ecosystem

Based on form, the extrinsic segment is estimated to account for the largest market share of the self-healing coatings market

Because they are more successful, extrinsic self-healing coatings account for a higher part of the market. Despite substantial damage to the substrate, extrinsic self-healing materials can achieve healing efficiencies in excess of 100%. Extrinsic systems segregate healing chemistries from the surrounding polymer in microcapsules or vascular networks, which release their substance into the crack plane, reacting and allowing material functions to be restored. These systems can be further classified into capsule-based and vascular systems.

Based on end-use, the automotive segment is anticipated to dominate the market

Self-healing coatings have several helpful features and applications in the automotive end-use sector. They improve the structural, thermal, and electrical qualities of the substrate and help to imitate a metallic-like look when replacing chrome-plated painted surfaces. Nanoparticles are used as fillers in self-healing coatings and are mixed into a polymeric matrix. Metallic nanoparticles and nanostructured carbons are the most often employed fillers in conductive self-healing coating compositions today. The type of nanomaterial utilized determines the conductive qualities of these coatings, such as electric conductivity, corrosion inhibition, and scratch resistance. Graphene and zinc are common nanoparticles utilized in such coatings because they have low electrical resistance and self-healing capabilities.

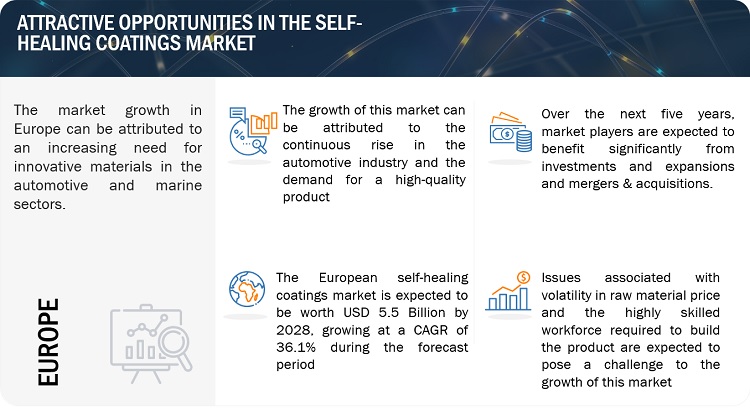

The Europe market is projected to contribute the largest share of the self-healing coatings market.

In terms of self-healing coatings sales, Europe is the largest market, accounting for 49.1% of the worldwide market in terms of value in 2023. The automotive and marine end-use categories fuel the region's need for self-healing coatings. Because of the strong efforts of different regulatory agencies to strengthen the structural integrity of car vehicles, the area is at the forefront of the self-healing coatings industry. The financial crisis has had a huge impact on European manufacturing companies, which are currently recuperating, leading to slower demand for self-healing coatings.

To know about the assumptions considered for the study, download the pdf brochure

Self-Healing Coatings Market Players

Autonomic Materials, Inc (US), Covestro AG (Germany), AkzoNobel N.V. (The Netherlands), BASF SE (Germany), Feynlab Inc (US), GVD Corporation (US), 3M Company (US), Shawcor Ltd (Canada), Winn & Coales (Denso) Ltd (UK), and Revivify Canada, Inc (Canada) are the key players operating in the global market.

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

Self-Healing Coatings Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2021-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Form, By End-Use, By Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Autonomic Materials, Inc (US), Covestro AG (Germany), AkzoNobel N.V. (The Netherlands), BASF SE (Germany), Feynlab Inc (US), GVD Corporation (US), 3M Company (US), Shawcor Ltd (Canada), Winn & Coales (Denso) Ltd (UK), and Revivify Canada, Inc (Canada) |

Based on form, the self-healing coatings industry has been segmented as follows:

- Extrinsic

- Intrinsic

Based on end-use, the self-healing coatings industry has been segmented as follows:

- Automotive

- Aerospace

- Building & Construction

- Marine

- Others

Based on the region, the self-healing coatings industry has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In December 2021, the company launched AMP-UP RB a self-healing, low-VOC protective solution for rebar and structural metals embedded in concrete. Built on Autonomic Materials Inc’s ground-breaking corrosion-inhibiting technology platform, AMP-UP RB was explicitly designed for long-term corrosion protection of structural metals embedded in concrete during new construction and concrete repair.

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the self-healing coatings market in terms of new applications, production, and sales?

Various major, medium-sized, and small-scale business firms operate in the industry on a global basis. Numerous companies are always inventing and producing new items, as well as moving into developing regions where demand is increasing, resulting in increased sales.

Which countries contribute more to the self-healing coatings market?

US, UK, Canada, and Germany are major countries considered in the report.

What is the total CAGR expected to be recorded for the self-healing coatings market during 2023-2028?

The CAGR is expected to record 34.2% from 2023-2028

Does this report cover the different forms of the self-healing coatings market?

Yes, the report covers the different forms of self-healing coatings.

Does this report cover the different end-use of self-healing coatings?

Yes, the report covers different end-use of self-healing coatings. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing automobile production- Technological advancements in self-healing coatingsRESTRAINTS- High cost of self-healing coatings compared to conventional materialsOPPORTUNITIES- Growing investments in various end-use industries in emerging economies- Potential uses in applications requiring reliability and durabilityCHALLENGES- Adoption of new technologies- Securing profitability and competitiveness- Scaling up from pilot scale to industrial scale production

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATOR ANALYSISINTRODUCTIONGDP TRENDS AND FORECASTTRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRYTRENDS IN AUTOMOTIVE INDUSTRYTRENDS IN AEROSPACE INDUSTRY

-

5.6 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHRUSSIA–UKRAINE WARCHINA- China's debt crisis- Australia-China trade war- Environmental commitmentsEUROPE- Energy crisis in Europe

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 SELF-HEALING COATINGS ECOSYSTEM AND INTERCONNECTED MARKETS

- 5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 TRADE ANALYSIS

-

5.11 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTIONTOP APPLICANTS

- 5.12 CASE STUDY ANALYSIS

-

5.13 PRICING ANALYSISAVERAGE SELLING PRICE TREND BY REGIONAVERAGE SELLING PRICE TREND BY FORMAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END USE INDUSTRY, 2022

- 5.14 TECHNOLOGY ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS IN 2023

-

5.16 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 EXTRINSICMOST USED FORM OF SELF-HEALING COATINGS- Capsule-based self-healing coatings- Vascular network self-healing coatings- Dissolved healing agent coatings

-

6.3 INTRINSICEUROPE TO BE FASTEST-GROWING MARKET FOR INTRINSIC SELF-HEALING COATINGS- Reversible polymer networks self-healing coatings- Thermoplastic/thermoset blends self-healing coatings

- 7.1 INTRODUCTION

-

7.2 BUILDING & CONSTRUCTIONSELF-HEALING COATINGS USED TO REDUCE MAINTENANCE COSTS IN BUILDING & CONSTRUCTION INDUSTRY

-

7.3 AUTOMOTIVERESEARCH & DEVELOPMENT IN AUTOMOTIVE INDUSTRY TO BOOST DEMAND FOR SELF-HEALING COATINGS

-

7.4 AEROSPACEINCREASING DEMAND FOR SELF-HEALING COATINGS TO PROTECT AIRCRAFT STRUCTURES

-

7.5 MARINESELF-HEALING COATINGS OFFER GOOD MECHANICAL AND ANTIFOULING PROPERTIES IN MARINE APPLICATIONS

- 7.6 OTHERS

- 8.1 INTRODUCTION

-

8.2 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Adoption of new technologies in automotive industry to increase demand for self-healing coatingsUK- Strong manufacturing sector to drive market for self-healing coatingsFRANCE- Growing aerospace industry to boost self-healing coatings marketITALY- Growing automobile industry to drive demand for self-healing coatingsSPAIN- Prominent automotive and transportation industry to drive demandTURKEY- Rapid urbanization and diversification of consumer goods to provide lucrative opportunitiesREST OF EUROPE

-

8.3 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- High R&D expenditure to increase demand for self-healing coatingsINDIA- Increasing modernization and technological developments to support self-healing coatings marketJAPAN- Presence of well-established automotive industry to boost demandSOUTH KOREA- Consumer electronics to be major end user of self-healing coatingsREST OF ASIA PACIFIC

-

8.4 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Increasing demand from infrastructure & automotive industries to drive marketCANADA- Growing investments in infrastructure and development projects to boost demandMEXICO- Increasing penetration of smart devices & electronics to fuel market growth

-

8.5 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Growing population and improving infrastructure to support market growthREST OF SOUTH AMERICA

-

8.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EASTSAUDI ARABIA- Mega housing projects and oil & gas industry to boost demand for self-healing coatingsUAE- Automotive industry to be significant driver of economic growthREST OF MIDDLE EAST & AFRICA

- 9.1 OVERVIEW

-

9.2 COMPETITIVE LEADERSHIP MAPPING, 2022STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 9.3 STRENGTH OF PRODUCT PORTFOLIO

-

9.4 START-UPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 9.5 COMPETITIVE BENCHMARKING

- 9.6 MARKET SHARE ANALYSIS

- 9.7 MARKET RANKING ANALYSIS

- 9.8 REVENUE ANALYSIS

-

9.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 9.10 STRATEGIC DEVELOPMENTS

-

10.1 MAJOR PLAYERSAUTONOMIC MATERIALS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAKZONOBEL N.V.- Business overview- Products/Solutions/Services offered- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- MnM viewCOVESTRO AG- Business overview- Products/Solutions/Services offered- MnM viewFEYNLAB INC.- Business overview- Products/Solutions/Services offered- MnM viewGVD CORPORATION- Business overview- Products/Solutions/Services offered3M- Business overview- Products/Solutions/Services offeredSHAWCOR LTD.- Business overview- Products/Solutions/Services offeredWINN & COALES (DENSO) LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsREVIVIFY CANADA, INC.- Business overview- Products/Solutions/Services offered

-

10.2 OTHER PLAYERSNATOCO CO., LTD.- Company overview- Products/Solutions/Services offeredADLER COATINGS GROUP- Company overview- Products/Solutions/Services offeredEFFCO FINISHES & TECHNOLOGIES PVT LTD.- Company overview- Products/Solutions/Services offeredNEI CORPORATION- Company overview- Products/Solutions/Services offeredKRISHNA CONCHEM PRODUCTS PVT. LTD.- Company overview- Products/Solutions/Services offeredISHINE AUTO SPA LLC- Company overview- Products/Solutions/Services offered

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 SELF-HEALING COATINGS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 2 SELF-HEALING COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR SELF-HEALING COATINGS

- TABLE 5 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2020–2027

- TABLE 6 AUTOMOTIVE INDUSTRY PRODUCTION IN UNITS (2020–2021)

- TABLE 7 SELF-HEALING COATINGS MARKET: STAKEHOLDERS IN SUPPLY CHAIN

- TABLE 8 COUNTRY-WISE EXPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE IMPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 10 TOP PATENT OWNERS

- TABLE 11 SELF-HEALING COATINGS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 17 EXTRINSIC SELF-HEALING COATINGS MARKET SIZE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 INTRINSIC SELF-HEALING COATINGS MARKET SIZE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 20 SELF-HEALING COATINGS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 SELF-HEALING COATINGS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 SELF-HEALING COATINGS MARKET SIZE IN AEROSPACE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 SELF-HEALING COATINGS MARKET SIZE IN MARINE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 SELF-HEALING COATINGS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 SELF-HEALING COATINGS MARKET SIZE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 EUROPE: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 27 EUROPE: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 28 EUROPE: SELF-HEALING COATINGS MARKET SIZE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 GERMANY: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 30 GERMANY: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 31 UK: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 32 UK: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 33 FRANCE: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 34 FRANCE: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 35 ITALY: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 36 ITALY: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 37 SPAIN: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 38 SPAIN: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 39 TURKEY: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 40 TURKEY: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 41 REST OF EUROPE: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 42 REST OF EUROPE: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: SELF-HEALING COATINGS MARKET SIZE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 CHINA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 47 CHINA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 48 INDIA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 49 INDIA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 50 JAPAN: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 51 JAPAN: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 52 SOUTH KOREA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 53 SOUTH KOREA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 54 REST OF ASIA PACIFIC: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 55 REST OF ASIA PACIFIC: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: SELF-HEALING COATINGS MARKET SIZE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 US: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 60 US: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 61 CANADA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 62 CANADA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 63 MEXICO: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 64 MEXICO: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 65 SOUTH AMERICA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 66 SOUTH AMERICA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 67 SOUTH AMERICA: SELF-HEALING COATINGS MARKET SIZE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 BRAZIL: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 69 BRAZIL: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 70 REST OF SOUTH AMERICA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 71 REST OF SOUTH AMERICA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 72 MIDDLE EAST & AFRICA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 73 MIDDLE EAST & AFRICA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 74 MIDDLE EAST & AFRICA: SELF-HEALING COATINGS MARKET SIZE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 SAUDI ARABIA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 76 SAUDI ARABIA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 77 UAE: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 78 UAE: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 79 REST OF MIDDLE EAST & AFRICA: SELF-HEALING COATINGS MARKET SIZE, BY FORM, 2021–2028 (USD MILLION)

- TABLE 80 REST OF MIDDLE EAST & AFRICA: SELF-HEALING COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 81 OVERVIEW OF STRATEGIES ADOPTED BY KEY SELF-HEALING COATINGS PLAYERS (2017–2023)

- TABLE 82 COMPANY EVALUATION MATRIX: SELF-HEALING COATINGS

- TABLE 83 SELF-HEALING COATINGS MARKET: DEGREE OF COMPETITION, 2022

- TABLE 84 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 85 HIGHEST ADOPTED STRATEGIES

- TABLE 86 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 87 COMPANY INDUSTRY FOOTPRINT

- TABLE 88 COMPANY REGION FOOTPRINT

- TABLE 89 COMPANY OVERALL FOOTPRINT

- TABLE 90 SELF-HEALING COATINGS MARKET: PRODUCT LAUNCHES, 2017–2023

- TABLE 91 SELF-HEALING COATINGS MARKET: DEALS, 2017–2023

- TABLE 92 AUTONOMIC MATERIALS INC: COMPANY OVERVIEW

- TABLE 93 AUTONOMIC MATERIALS INC.: PRODUCT LAUNCHES

- TABLE 94 AKZONOBEL N.V.: BUSINESS OVERVIEW

- TABLE 95 BASF SE: BUSINESS OVERVIEW

- TABLE 96 COVESTRO AG: COMPANY OVERVIEW

- TABLE 97 FEYNLAB INC.: COMPANY OVERVIEW

- TABLE 98 GVD CORPORATION: COMPANY OVERVIEW

- TABLE 99 3M: COMPANY OVERVIEW

- TABLE 100 SHAWCOR LTD.: COMPANY OVERVIEW

- TABLE 101 WINN & COALES (DENSO) LTD.: COMPANY OVERVIEW

- TABLE 102 WINN & COALES (DENSO) LTD.: DEALS

- TABLE 103 REVIVIFY CANADA, INC.: COMPANY OVERVIEW

- FIGURE 1 SELF-HEALING COATINGS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 3 SELF-HEALING COATINGS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 4 SELF-HEALING COATINGS MARKET SIZE ESTIMATION, BY TECHNOLOGY

- FIGURE 5 SELF-HEALING COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF SELF-HEALING COATINGS MARKET

- FIGURE 7 FACTOR ANALYSIS OF SELF-HEALING COATINGS MARKET

- FIGURE 8 SELF-HEALING COATINGS MARKET: DATA TRIANGULATION

- FIGURE 9 EXTRINSIC SEGMENT TO ACCOUNT FOR LARGER SHARE OF SELF-HEALING COATINGS MARKET

- FIGURE 10 AUTOMOTIVE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 11 EUROPE LED SELF-HEALING COATINGS MARKET IN 2022

- FIGURE 12 SELF-HEALING COATINGS MARKET TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

- FIGURE 13 INTRINSIC TO BE FASTER-GROWING SEGMENT BETWEEN 2023 AND 2028

- FIGURE 14 DEVELOPED COUNTRIES TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 15 CHINA ACCOUNTED FOR LARGEST MARKET SHARE

- FIGURE 16 UK TO EMERGE AS LUCRATIVE MARKET FOR SELF-HEALING COATINGS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SELF-HEALING COATINGS MARKET

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS: SELF-HEALING COATINGS MARKET

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 20 KEY BUYING CRITERIA FOR SELF-HEALING COATINGS

- FIGURE 21 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

- FIGURE 22 SELF-HEALING COATINGS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 PAINTS & COATINGS: ECOSYSTEM MAPPING

- FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2018–2023

- FIGURE 25 PATENTS PUBLISHED BY JURISDICTION, 2018–2023

- FIGURE 26 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2018–2023

- FIGURE 27 AVERAGE SELLING PRICE TREND OF SELF-HEALING COATINGS, BY REGION, 2022

- FIGURE 28 AVERAGE SELLING PRICE TREND OF SELF-HEALING COATINGS, BY FORM, 2022

- FIGURE 29 AVERAGE SELLING PRICE TREND OF SELF-HEALING COATINGS, BY END USE, 2022

- FIGURE 30 AVERAGE SELLING PRICE TREND OF SELF-HEALING COATINGS OF KEY PLAYERS, BY END-USE INDUSTRY, 2022

- FIGURE 31 EXTRINSIC SEGMENT TO LEAD SELF-HEALING COATINGS MARKET

- FIGURE 32 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR IN SELF-HEALING COATINGS MARKET

- FIGURE 33 EUROPE TO BE FASTEST-GROWING SELF-HEALING COATINGS MARKET

- FIGURE 34 EUROPE: SELF-HEALING COATINGS MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: SELF-HEALING COATINGS MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: SELF-HEALING COATINGS MARKET SNAPSHOT

- FIGURE 37 SELF-HEALING COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 38 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SELF-HEALING COATINGS MARKET

- FIGURE 39 SELF-HEALING COATINGS MARKET: START-UPS/SME EVALUATION MATRIX, 2022

- FIGURE 40 MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 41 MARKET RANKING ANALYSIS, 2022

- FIGURE 42 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 43 AKZONOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 44 BASF SE: COMPANY SNAPSHOT

- FIGURE 45 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 46 3M: COMPANY SNAPSHOT

- FIGURE 47 SHAWCOR LTD.: COMPANY SNAPSHOT

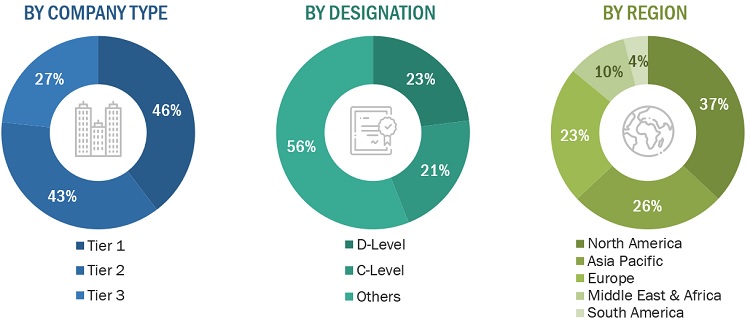

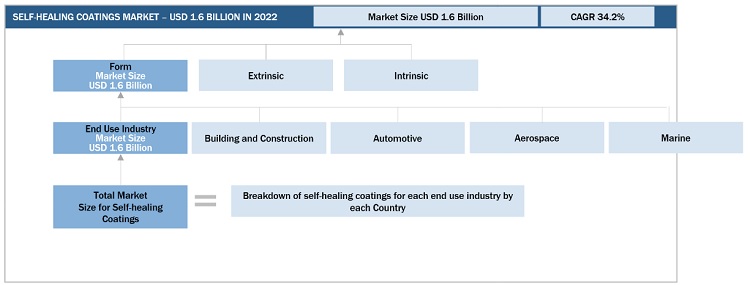

The study involved four major activities in estimating the current size of the self-healing coatings market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering self-healing coatings information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the self-healing coatings market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the self-healing coatings market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from self-healing coatings vendors; raw material suppliers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to form, end-use, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using self-healing coatings were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of self-healing coatings and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION |

|

Autonomic Materials, Inc |

Director |

|

Covestro AG |

Project Manager |

|

AkzoNobel N.V. |

Individual Industry Expert |

|

BASF SE |

Director |

Market Size Estimation

The research methodology used to estimate the size of the self-healing coatings market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the end-use industries at a regional level. Such procurements provide information on the demand aspects of self-healing coatings.

Global Self-Healing Coatings Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Self-Healing Coatings Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Self-healing coatings are a type of coatings that repair their bulk integrity or functional properties without any external physical intervention. The autonomous healing ability is usually achieved by embedding extrinsic polymerizable healing agents in the coating. In this system healing agents are mostly stored in microcapsules and released when the coating is damaged, which then polymerizes to fill the damage or form a protective film that inhibits the electrochemical reactions occurring at the exposed metal substrate.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the self-healing coatings market based on form, end-use, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the self-healing coatings market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the self-healing coatings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the self-healing coatings Market

Growth opportunities and latent adjacency in Self-Healing Coatings Market