Single Use Consumables Market Size, Share & Trends by Product (Tubing, Connectors, Disconnectors, Adapters, Valves, Capsule Filter, Sensors), Application (Filtration, Storage, Cell Culture, Sampling), End User (Biotech, Pharma, CROs & CMOs, OEMs) - Global Forecast to 2027

Single Use Consumables Market Size, Share & Trends

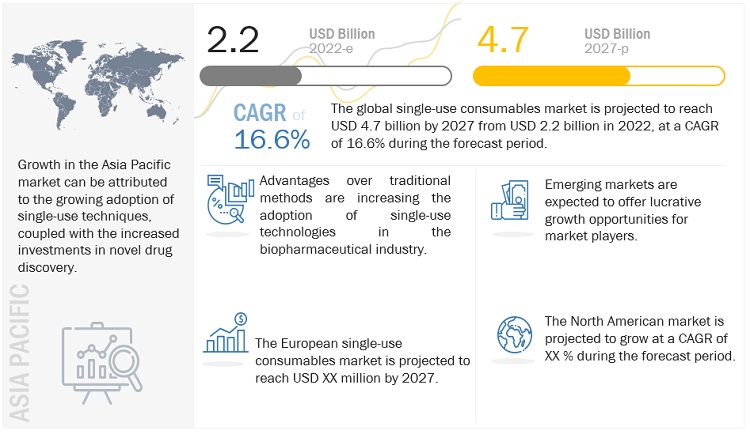

The size of global single use consumables market in terms of revenue was estimated to be worth $2.2 billion in 2022 and is poised to reach $4.7 billion by 2027, growing at a CAGR of 16.6% from 2022 to 2027. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Launch of novel consumables in the market coupled with increasing adoption of single use technologies in the biopharmaceutical industry. Furthermore, increased adoption of biopharmaceuticals and use of single use bioprocessing in vaccine production is likely to have positive impact on market growth.

Attractive Opportunities in the Single-use consumables Market

To know about the assumptions considered for the study, Request for Free Sample Report

Single Use Consumables Market Dynamics

Driver: Lower operational cost and increased productivity

Single-use technologies help biopharmaceutical companies increase their productivity. Traditionally, complex steps like the cleaning (CIP) and sterilization (SIP) of products were mandatory to avoid cross-contamination, thus resulting in increased costs for manufacturers. However, with the help of single-use technologies, these steps have been eliminated. One of the major advantages of single-use technologies in pilot and full-scale manufacturing is the direct savings in terms of labor and material costs. Single-use consumables reduce initial investments and R&D costs. Compared to traditional stainless-steel facilities, facilities using single-use systems require 40% lower initial investments. Thus, the lower operational costs and increased productivity are expected to propel the use of single-use consumables such as tubes, connectors, and disconnectors, among other consumables, in the coming years.

Restraint: Issues related to extractables and leachable

Even though extractables and leachable can contaminate single-use systems, no specific rules or recommendations have been established in this area. The Bio-Process Systems Alliance, however, has provided a comprehensive set of tests that can be run for single-use systems. Under demanding laboratory settings, extractables from source materials can be extracted using the proper solvents. Leachable, on the other hand, are substances that get into drug products through containers, closures, and manufacturing processes. Leachable can therefore be viewed as a subset of extractables. Due to additives used to promote stability and facilitate the creation of material components, extractables and leachable are frequently linked to polymeric and elastomeric materials.

Opportunity: Emerging Countries

The market is witnessing growth in emerging countries such as China, India, South Korea, Singapore, Vietnam, Japan, and Brazil. These markets have huge development potential for providers who are unable to adhere to the strict regulatory standards in the US and EU as they lack appropriate standards and governmental laws. In the Asian region, China and India are the two countries with the highest potential markets for single-use consumables. As of April 2022, Merck and the Administrative Management Committee of Wuxi National High-Tech Industrial Development Zone entered into an agreement to significantly expand Merck’s first Asia Pacific Mobius Single-Use manufacturing center in China. Merck plans to invest USD 110 million over six years by expanding its existing Wuxi production site to significantly increase its biopharma single-use assemblies and custom design capabilities.

Biopharmaceuticals & Pharmaceutical companies held a dominant share in end user segment in single use consumables industry

Based on end user, the single use consumables market is segmented into biopharmaceuticals and pharmaceutical companies, contract research organizations & contract manufacturing organizations, and academic and research institutes. The biopharmaceuticals and pharmaceutical companies segment accounted for the largest market share in 2021. The adoption of biopharmaceuticals and pharmaceutical companies on vaccine manufacturing and aseptic manufacturing process drives the demand for single-use consumables products in this end user segment. Additionally, growing investments by pharmaceutical companies in research activity to spur the market growth.

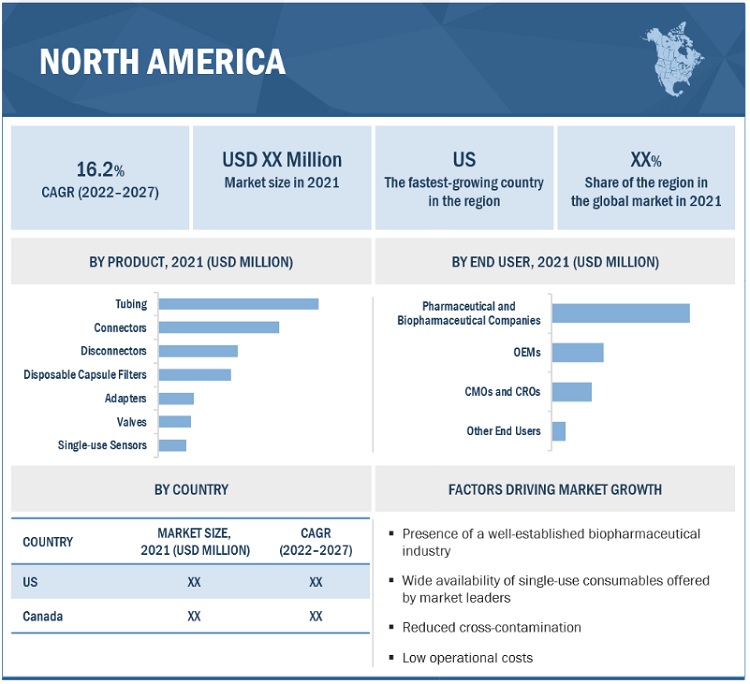

North America accounted for largest share in single use consumables industry

Geographically, the single use consumables market is segmented into North America, Europe, Asia Pacific and ROW. North America held dominant share followed by Europe. The major players operating in the market, such as Danaher Corporation (US) and Thermo Fisher Scientific (US), have a strong presence in North America, with a wide customer base and established distribution channels. Increasing demand for biopharmaceuticals is one of the major factors driving market growth in this region. The growing demand for biopharmaceuticals is due to the rising prevalence of chronic diseases across the region. Asia Pacific market is expected to grow at faster pace owing to increasing demand for generic drugs and biosimilars and the significant investments by biopharmaceutical companies and CMOs in emerging Asia Pacific countries.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the global single use consumables market Thermo Fisher Scientific, Inc. (US), Sartorius Stedim Biotech (France), Danaher Corporation (US), Merck KGaA (Germany), Avantor Inc. (US) and among others.

Scope of the Single Use Consumables Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$2.2 billion |

|

Projected Revenue Size by 2027 |

$4.7 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 16.6% |

|

Market Driver |

Lower operational cost and increased productivity |

|

Market Opportunity |

Emerging Countries |

This report categorizes the single use consumables market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Tubing’s

- Connectors

- Disconnector

- Adapters

- Valves

- Disposable Capsule Filter

- Single Use Sensors

By Application

- Filtration

- Cell culture & Mixing

- Storage

- Sampling

- Other Application

By End User

- Biopharmaceutical & Pharmaceutical Companies

- OEMs (Original Equipment Manufacturers)

- Contract Research Organizations & Contract Manufacturing Organizations

- Academic & Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- South Korea

- Japan

- India

- Rest of Asia Pacific

- ROW (Rest of World)

Recent Developments of Single Use Consumables Industry

- In September 2021, CPC launched the industry’s first aseptic connectors designed to provide a simple, efficient method of connecting tubing in small-format assemblies.

- In September 2021, Cytiva, in collaboration with Wego Pharmaceutical Co. Ltd., expanded its manufacturing capacity by launching three new manufacturing lines in under ten months, with an additional eight new lines planned to launch in Q3 2022. These newly added manufacturing lines will triple the supply capacity of single-use consumables in the Asia Pacific region.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the single use consumables market?

The single use consumables market boasts a total revenue value of $4.7 billion by 2027.

What is the estimated growth rate (CAGR) of the single use consumables market?

The global single use consumables market has an estimated compound annual growth rate (CAGR) of 16.6% and a revenue size in the region of $2.2 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 SINGLE USE CONSUMABLES INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY RESEARCH

FIGURE 2 SINGLE USE CONSUMABLES MARKET: PRIMARY RESPONDENTS

2.2 MARKET ESTIMATION METHODOLOGY

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: REVENUE-BASED ESTIMATION METHODOLOGY

2.2.2 AVERAGE MARKET SIZE ESTIMATION (2021)

2.3 DATA TRIANGULATION APPROACH

FIGURE 1 DATA TRIANGULATION METHODOLOGY

2.4 GROWTH RATE ASSUMPTIONS

2.5 RISK ASSESSMENT

2.6 GROWTH FORECAST

2.6.1 SUPPLY-SIDE ANALYSIS

2.6.2 DEMAND-SIDE ANALYSIS

2.6.3 INSIGHTS FROM PRIMARY EXPERTS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 2 SINGLE USE CONSUMABLES INDUSTRY, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 3 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 4 MARKET, BY END USER, 2021

FIGURE 5 SINGLE USE CONSUMABLES INDUSTRY: GEOGRAPHICAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 SINGLE USE CONSUMABLES MARKET OVERVIEW

FIGURE 6 ADVANTAGES OF SINGLE-USE CONSUMABLES OVER TRADITIONAL METHODS TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET SHARE, BY PRODUCT AND COUNTRY (2021)

FIGURE 7 TUBING SEGMENT ACCOUNTED FOR LARGEST SHARE OF APAC MARKET IN 2021

4.3 MARKET SHARE, BY END USER, 2022 VS. 2027

FIGURE 8 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 9 REST OF ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 10 SINGLE USE CONSUMABLES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for biopharmaceuticals

5.2.1.2 Lower operational cost and increased productivity

TABLE 1 SINGLE-USE PRODUCTS VS. STAINLESS STEEL PRODUCTS

5.2.1.3 Faster installation and lower risk of product cross-contamination

5.2.2 RESTRAINTS

5.2.2.1 Issues related to leachables and extractables

TABLE 2 KEY EXTRACTABLES FOR ACCEPTABLE MATERIALS USED IN DISPOSABLE SINGLE-USE CONSUMABLE MANUFACTURING SYSTEMS

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.4 CHALLENGES

5.2.4.1 Waste disposal

TABLE 3 COMPARISON OF SINGLE-USE CONSUMABLE DISPOSAL OPTIONS

5.2.4.2 Gaps in global supply chain

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S FIVE FORCES ANALYSIS (2021): MARKET

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 5 MARKET: DETAILED LIST OF EVENTS AND CONFERENCES

5.5 VALUE CHAIN ANALYSIS

FIGURE 11 VALUE CHAIN ANALYSIS: R&D AND MANUFACTURING PHASES ADD MAXIMUM VALUE

5.6 TECHNOLOGY ANALYSIS

5.7 ECOSYSTEM ANALYSIS OF MARKET

FIGURE 12 MARKET ECOSYSTEM

5.7.1 ROLE IN ECOSYSTEM

5.8 PATENT ANALYSIS

5.8.1 LIST OF KEY PATENTS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

FIGURE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS IN MARKETS

FIGURE 14 KEY BUYING CRITERIA FOR SINGLE-USE CONSUMABLES AMONG END USERS

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 15 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

5.11 PRICING ANALYSIS

TABLE 6 PRICING FOR SINGLE-USE CONNECTORS FROM CYTIVA

TABLE 7 PRICING FOR SINGLE-USE PRODUCTS FROM VWR INTERNATIONAL, LLC (AVANTOR)

6 SINGLE USE CONSUMABLES MARKET, BY PRODUCT (Page No. - 71)

6.1 INTRODUCTION

TABLE 8 SINGLE USE CONSUMABLES INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 TUBING

TABLE 9 SINGLE-USE TUBING MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 10 NORTH AMERICA: SINGLE-USE TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 11 EUROPE: SINGLE-USE TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 12 ASIA PACIFIC: SINGLE-USE TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1 TUBING MARKET, BY MATERIAL

TABLE 13 SINGLE-USE TUBING MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 14 SINGLE-USE TUBING MATERIALS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 15 NORTH AMERICA: SINGLE-USE TUBING MATERIALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 16 EUROPE: SINGLE-USE TUBING MATERIALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 17 ASIA PACIFIC: SINGLE-USE TUBING MATERIALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.1 Silicone tubing

6.2.1.1.1 Silicone tubing segment to dominate market

TABLE 18 SINGLE-USE SILICONE TUBING MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 19 NORTH AMERICA: SINGLE-USE SILICONE TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 20 EUROPE: SINGLE-USE SILICONE TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 21 ASIA PACIFIC: SINGLE-USE SILICONE TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.2 Elastomer tubing

6.2.1.2.1 Thermoplastic elastomer biocompatible tubing is ideal for use in peristaltic pumps

TABLE 22 SINGLE-USE ELASTOMER TUBING MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 NORTH AMERICA: SINGLE-USE ELASTOMER TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 24 EUROPE: SINGLE-USE ELASTOMER TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 25 ASIA PACIFIC: SINGLE-USE ELASTOMER TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.3 Other materials

TABLE 26 SINGLE-USE OTHER MATERIAL TUBING MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 NORTH AMERICA: SINGLE-USE OTHER MATERIAL TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 28 EUROPE: SINGLE-USE OTHER MATERIAL TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 29 ASIA PACIFIC: SINGLE-USE OTHER MATERIAL TUBING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2 TUBING MARKET, BY TYPE

TABLE 30 SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2.2.1 Tubing assemblies

6.2.2.1.1 Advantages over traditional tubing to drive demand

TABLE 31 SINGLE-USE TUBING ASSEMBLIES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: SINGLE-USE TUBING ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 33 EUROPE: SINGLE-USE TUBING ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 34 ASIA PACIFIC: SINGLE-USE TUBING ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.2 Tubing components

6.2.2.2.1 Launch of new and advanced products to drive growth

TABLE 35 SINGLE-USE TUBING COMPONENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: SINGLE-USE TUBING COMPONENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 37 EUROPE: SINGLE-USE TUBING COMPONENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 ASIA PACIFIC: SINGLE-USE TUBING COMPONENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 CONNECTORS

TABLE 39 SINGLE-USE CONNECTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 40 SINGLE-USE CONNECTORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: SINGLE-USE CONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 42 EUROPE: SINGLE-USE CONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 ASIA PACIFIC: SINGLE-USE CONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.1 ASEPTIC CONNECTORS

6.3.1.1 Increasing investments in cell and gene therapy to drive growth

TABLE 44 SINGLE-USE ASEPTIC CONNECTORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: SINGLE-USE ASEPTIC CONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 46 EUROPE: SINGLE-USE ASEPTIC CONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 47 ASIA PACIFIC: SINGLE-USE ASEPTIC CONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.2 SANITARY FITTINGS

6.3.2.1 Launch of supporting components for sanitary fittings to drive growth

TABLE 48 SINGLE-USE SANITARY FITTINGS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: SINGLE-USE SANITARY FITTINGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 50 EUROPE: SINGLE-USE SANITARY FITTINGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 51 ASIA PACIFIC: SINGLE-USE SANITARY FITTINGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.3 OTHER CONNECTORS

TABLE 52 OTHER SINGLE-USE CONNECTORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: OTHER SINGLE-USE CONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 54 EUROPE: OTHER SINGLE-USE CONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: OTHER SINGLE-USE CONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.4 DISCONNECTORS

6.4.1 ADVANTAGES SUCH AS REDUCED DOWNTIME AND TURNAROUND TIME TO BOOST DEMAND

TABLE 56 SINGLE-USE DISCONNECTORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: SINGLE-USE DISCONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 58 EUROPE: SINGLE-USE DISCONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: SINGLE-USE DISCONNECTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.5 ADAPTERS

6.5.1 FLEXIBILITY IN MULTIPRODUCT MANUFACTURING TO DRIVE ADOPTION

TABLE 60 SINGLE-USE ADAPTERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: SINGLE-USE ADAPTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: SINGLE-USE ADAPTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 63 ASIA PACIFIC: SINGLE-USE ADAPTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.6 VALVES

6.6.1 ADVANTAGES OF SINGLE-USE VALVES TO DRIVE GROWTH

TABLE 64 SINGLE-USE VALVES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: SINGLE-USE VALVES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: SINGLE-USE VALVES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 67 ASIA PACIFIC: SINGLE-USE VALVES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.7 DISPOSABLE CAPSULE FILTERS

6.7.1 CAPSULE FILTERS REDUCE TIME AND EXPENSE ASSOCIATED WITH ASSEMBLING, CLEANING, AND VALIDATION

TABLE 68 DISPOSABLE CAPSULE FILTERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: DISPOSABLE CAPSULE FILTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 EUROPE: DISPOSABLE CAPSULE FILTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 71 ASIA PACIFIC: DISPOSABLE CAPSULE FILTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 72 SINGLE-USE SENSORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.8 SINGLE-USE SENSORS

TABLE 73 SINGLE-USE SENSORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: SINGLE-USE SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 75 EUROPE: SINGLE-USE SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 76 ASIA PACIFIC: SINGLE-USE SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.8.1 PH SENSORS

6.8.1.1 Single-use pH sensors ensure significantly longer shelf life for up- and downstream devices

TABLE 77 SINGLE-USE PH SENSORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: SINGLE-USE PH SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 79 EUROPE: SINGLE-USE PH SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 80 ASIA PACIFIC: SINGLE-USE PH SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.8.2 O2 SENSORS

6.8.2.1 Single-use dissolved oxygen sensors ensure long-term stability for use throughout entire batch process

TABLE 81 SINGLE-USE O2 SENSORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: SINGLE-USE O2 SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 EUROPE: SINGLE-USE O2 SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 84 ASIA PACIFIC: SINGLE-USE O2 SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.8.3 CELL DENSITY SENSORS

6.8.3.1 Advantages of cell density sensors include increased yield and lower production costs

TABLE 85 SINGLE-USE CELL DENSITY SENSORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: SINGLE-USE CELL DENSITY SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 87 EUROPE: SINGLE-USE CELL DENSITY SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 88 ASIA PACIFIC: SINGLE-USE CELL DENSITY SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.8.4 OTHER SENSORS

TABLE 89 OTHER SINGLE-USE SENSORS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: OTHER SINGLE-USE SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 91 EUROPE: OTHER SINGLE-USE SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 92 ASIA PACIFIC: OTHER SINGLE-USE SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 SINGLE USE CONSUMABLES MARKET, BY APPLICATION (Page No. - 115)

7.1 INTRODUCTION

TABLE 93 SINGLE USE CONSUMABLES INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 FILTRATION

7.2.1 ADVANTAGES OF SINGLE-USE FILTRATION CONSUMABLES TO DRIVE GROWTH

TABLE 94 MARKET FOR FILTRATION APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET FOR FILTRATION APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET FOR FILTRATION APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET FOR FILTRATION APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 CELL CULTURE AND MIXING

7.3.1 LOWER RISK OF CONTAMINATION TO INCREASE DEMAND

TABLE 98 MARKET FOR CELL CULTURE AND MIXING APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET FOR CELL CULTURE AND MIXING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 100 EUROPE: MARKET FOR CELL CULTURE AND MIXING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET FOR CELL CULTURE AND MIXING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 STORAGE

7.4.1 VARIOUS SINGLE-USE CONSUMABLES FIND USE IN STORAGE APPLICATIONS

TABLE 102 MARKET FOR STORAGE APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET FOR STORAGE APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET FOR STORAGE APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET FOR STORAGE APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 SAMPLING

7.5.1 INCREASING ADOPTION OF CELL AND GENE THERAPY TO DRIVE GROWTH

TABLE 106 MARKET FOR SAMPLING APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET FOR SAMPLING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET FOR SAMPLING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET FOR SAMPLING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.6 OTHER APPLICATIONS

TABLE 110 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8 SINGLE USE CONSUMABLES MARKET, BY END USER (Page No. - 127)

8.1 INTRODUCTION

TABLE 114 SINGLE USE CONSUMABLES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

8.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

8.2.1 RISING DEMAND FOR BIOLOGICS TO DRIVE GROWTH

TABLE 115 LIST OF FDA-APPROVED BIOLOGICS, 2021

TABLE 116 MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 118 EUROPE: MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 CONTRACT RESEARCH ORGANIZATIONS AND CONTRACT MANUFACTURING ORGANIZATIONS

8.3.1 INCREASING OUTSOURCING TO CROS AND CMOS EXPECTED TO DRIVE GROWTH

TABLE 120 MARKET FOR CROS AND CMOS, BY REGION, 2020–2027 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET FOR CROS AND CMOS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 122 EUROPE: MARKET FOR CROS AND CMOS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET FOR CROS AND CMOS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 ORIGINAL EQUIPMENT MANUFACTURES

8.4.1 INCREASING DEMAND FOR SINGLE-USE ASSEMBLIES TO DRIVE GROWTH

TABLE 124 MARKET FOR OEMS, BY REGION, 2020–2027 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET FOR OEMS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 126 EUROPE: MARKET FOR OEMS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET FOR OEMS, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 OTHER END USERS

TABLE 128 MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 130 EUROPE: MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

9 SINGLE USE CONSUMABLES MARKET, BY REGION (Page No. - 138)

9.1 INTRODUCTION

TABLE 132 SINGLE USE CONSUMABLES INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 16 NORTH AMERICA: SINGLE USE CONSUMABLES MARKET SNAPSHOT

TABLE 133 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 134 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 135 NORTH AMERICA: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 136 NORTH AMERICA: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 138 NORTH AMERICA: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 139 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 140 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Growing biologics and biosimilars markets to drive growth

TABLE 141 US: SINGLE USE CONSUMABLES INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 142 US: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 143 US: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 US: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 145 US: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 146 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 147 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increasing demand for biopharmaceuticals to support growth

TABLE 148 CANADA: SINGLE USE CONSUMABLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 149 CANADA: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 150 CANADA: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 CANADA: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 152 CANADA: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 153 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 154 CANADA: SINGLE USE CONSUMABLES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 155 EUROPE: SINGLE USE CONSUMABLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 156 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 157 EUROPE: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 158 EUROPE: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 EUROPE: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 160 EUROPE: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 161 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 162 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing adoption of single-use bioprocessing equipment to drive growth

TABLE 163 GERMANY: SINGLE USE CONSUMABLES INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 164 GERMANY: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 165 GERMANY: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 GERMANY: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 167 GERMANY: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 168 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 169 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Rising government support for biotechnology companies to drive growth

TABLE 170 UK: SINGLE USE CONSUMABLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 171 UK: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 172 UK: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 UK: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 174 UK: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 175 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 176 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Increase in biopharmaceutical manufacturing to drive demand for single-use consumables

TABLE 177 FRANCE: SINGLE USE CONSUMABLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 178 FRANCE: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 179 FRANCE: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 FRANCE: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 181 FRANCE: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 182 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 183 FRANCE: SINGLE USE CONSUMABLES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.4 REST OF EUROPE

TABLE 184 REST OF EUROPE: SINGLE USE CONSUMABLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 185 REST OF EUROPE: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 186 REST OF EUROPE: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 187 REST OF EUROPE: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 188 REST OF EUROPE: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 189 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 190 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 17 ASIA PACIFIC: SINGLE USE CONSUMABLES INDUSTRY SNAPSHOT

TABLE 191 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 193 ASIA PACIFIC: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 194 ASIA PACIFIC: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 195 ASIA PACIFIC: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 196 ASIA PACIFIC: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 197 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 198 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Expansion of biopharmaceutical manufacturing plants to create growth opportunities

TABLE 199 JAPAN: SINGLE USE CONSUMABLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 200 JAPAN: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 201 JAPAN: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 202 JAPAN: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 203 JAPAN: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 204 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 205 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 SOUTH KOREA

9.4.2.1 Government investments to drive market growth

TABLE 206 SOUTH KOREA: SINGLE USE CONSUMABLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 207 SOUTH KOREA: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 208 SOUTH KOREA: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 209 SOUTH KOREA: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 210 SOUTH KOREA: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 211 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 212 SOUTH KOREA: SINGLE USE CONSUMABLES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 COVID-19 vaccine production to create significant demand for single-use consumables

TABLE 213 INDIA: SINGLE USE CONSUMABLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 214 INDIA: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 215 INDIA: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 216 INDIA: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 217 INDIA: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 218 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 219 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 220 REST OF ASIA PACIFIC: SINGLE USE CONSUMABLES INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 221 REST OF ASIA PACIFIC: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 222 REST OF ASIA PACIFIC: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 223 REST OF ASIA PACIFIC: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 224 REST OF ASIA PACIFIC: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 225 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 226 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 227 ROW: SINGLE USE CONSUMABLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 228 ROW: SINGLE-USE TUBING MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 229 ROW: SINGLE-USE TUBING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 230 ROW: MARKET, BY SENSOR, 2020–2027 (USD MILLION)

TABLE 231 ROW: MARKET, BY CONNECTOR, 2020–2027 (USD MILLION)

TABLE 232 ROW: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 233 ROW: SINGLE USE CONSUMABLES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 194)

10.1 INTRODUCTION

10.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

FIGURE 18 SINGLE USE CONSUMABLES MARKET: STRATEGIES ADOPTED

10.3 REVENUE ANALYSIS

FIGURE 19 REVENUE ANALYSIS FOR KEY COMPANIES (OEMS) (2019–2021)

10.4 MARKET SHARE ANALYSIS

FIGURE 20 MARKET SHARE ANALYSIS,BY KEY PLAYER (OEMS), 2021

TABLE 234 SINGLE USE CONSUMABLES INDUSTRY: DEGREE OF COMPETITION

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 21 SINGLE USE CONSUMABLES INDUSTRY: COMPETITIVE LEADERSHIP MAPPING, 2021

10.6 COMPETITIVE BENCHMARKING

10.6.1 COMPANY FOOTPRINT

TABLE 235 PRODUCT FOOTPRINT OF COMPANIES

TABLE 236 REGIONAL FOOTPRINT OF COMPANIES

10.7 COMPETITIVE SCENARIO AND TRENDS

TABLE 237 SINGLE USE CONSUMABLES MARKET: PRODUCT LAUNCHES, JANUARY 2019–SEPTEMBER 2022

TABLE 238 SINGLE USE CONSUMABLES INDUSTRY: DEALS, JANUARY 2019–SEPTEMBER 2022

TABLE 239 SINGLE USE CONSUMABLES INDUSTRY: OTHER DEVELOPMENTS, JANUARY 2019–SEPTEMBER 2022

11 COMPANY PROFILES (Page No. - 204)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 DANAHER CORPORATION

TABLE 240 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 22 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

11.1.2 MERCK KGAA

TABLE 241 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 23 MERCK KGAA: COMPANY SNAPSHOT (2021)

11.1.3 THERMO FISHER SCIENTIFIC, INC.

TABLE 242 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 24 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2021)

11.1.4 SARTORIUS AG

TABLE 243 SARTORIUS STEDIM BIOTECH: BUSINESS OVERVIEW

FIGURE 25 SARTORIUS STEDIM BIOTECH: COMPANY SNAPSHOT (2021)

11.1.5 REPLIGEN CORPORATION

TABLE 244 REPLIGEN CORPORATION: BUSINESS OVERVIEW

FIGURE 26 REPLIGEN CORPORATION: COMPANY SNAPSHOT (2021)

11.1.6 SAINT-GOBAIN

TABLE 245 SAINT-GOBAIN: BUSINESS OVERVIEW

FIGURE 27 SAINT-GOBAIN: COMPANY SNAPSHOT (2021)

11.1.7 AVANTOR, INC.

TABLE 246 AVANTOR, INC.: BUSINESS OVERVIEW

FIGURE 28 AVANTOR, INC.: COMPANY SNAPSHOT (2021)

11.1.8 SENTINEL PROCESS SYSTEMS, INC.

TABLE 247 SENTINEL PROCESS SYSTEMS, INC.: BUSINESS OVERVIEW

11.1.9 VENAIR IBÉRICA SAU

TABLE 248 VENAIR IBÉRICA SAU: BUSINESS OVERVIEW

11.1.10 ESI TECHNOLOGIES GROUP

TABLE 249 ESI TECHNOLOGIES GROUP: BUSINESS OVERVIEW

11.1.11 CORNING INCORPORATED

TABLE 250 CORNING INCORPORATED: BUSINESS OVERVIEW

FIGURE 29 CORNING INCORPORATED: COMPANY SNAPSHOT (2021)

11.1.12 MEISSNER FILTRATION PRODUCTS, INC.

TABLE 251 MEISSNER FILTRATION PRODUCTS, INC.: BUSINESS OVERVIEW

11.1.13 NEWAGE INDUSTRIES

TABLE 252 NEWAGE INDUSTRIES: BUSINESS OVERVIEW

11.1.14 COLDER PRODUCTS COMPANY (DOVER COMPANY)

TABLE 253 COLDER PRODUCTS COMPANY (DOVER COMPANY): BUSINESS OVERVIEW

FIGURE 30 DOVER COMPANY: COMPANY SNAPSHOT (2021)

11.1.15 METTLER TOLEDO

TABLE 254 METTLER TOLEDO: BUSINESS OVERVIEW

FIGURE 31 METTLER TOLEDO: COMPANY SNAPSHOT (2021)

11.1.16 PARKER-HANNIFIN CORPORATION

TABLE 255 PARKER-HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 32 PARKER-HANNIFIN CORPORATION: COMPANY SNAPSHOT (2021)

11.1.17 HAMILTON COMPANY

TABLE 256 HAMILTON COMPANY: BUSINESS OVERVIEW

11.1.18 PRESENS PRECISION SENSING GMBH

TABLE 257 PRESENS PRECISION SENSING GMBH: BUSINESS OVERVIEW

11.1.19 BROADLEY-JAMES CORPORATION

TABLE 258 BROADLEY-JAMES CORPORATION: BUSINESS OVERVIEW

11.1.20 GEMÜ GROUP

TABLE 259 GEMÜ GROUP: BUSINESS OVERVIEW

11.1.21 STERLITECH CORPORATION

TABLE 260 STERLITECH CORPORATION: BUSINESS OVERVIEW

11.1.22 MDI MEMBRANE TECHNOLOGIES INC.

TABLE 261 MDI MEMBRANE TECHNOLOGIES INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 261)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

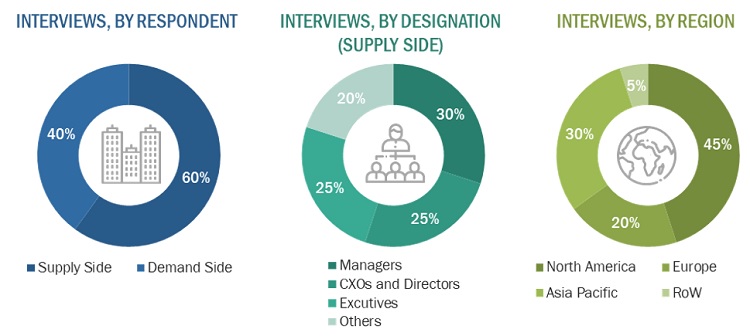

This study involved four major activities in estimating the current size of the single use consumables market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the single use consumables market. The secondary sources used for this study include World Health Organization (WHO), National Institutes of Health (NIH), National Institute for Bioprocessing Research and Training (NIBRT), Society for Biological Engineering (SBE), Canadian Cancer Statistics (CCS), Germany Trade and Invest (GTAI), Bio-Process Systems Alliance (BPSA), European Patent Office (EPO), Pharmaceuticals Export Promotion Council of India (Pharmexcil), India Brand Equity Foundation (IBEF), Biotechnology Innovation Organization (BIO), National Center for Biotechnology Information (NCBI), World Bank, United States Food and Drug Administration (US FDA), US Census Bureau, Eurostat, Statistics Canada, Factiva, BioProcess International Magazine, BioPharm International, EvaluatePharma, Pharma Vision 2021, PharmaVOICE, Journal of Bioprocessing and Biotechniques, BioPlan Associates, The Scientist Magazine, ScienceDirect, corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; research journals; press releases; and trade, business, professional associations and among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the single use consumables market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the single-use consumables business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global single use consumables market based on the product, application, end user and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall single use consumables market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, and ROW.

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, and R&D activities in the single use consumables market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Single Use Consumables Market