Bioprocess Containers Market Size, Growth by Type(2D and 3D Bags, Accessories), Application(Process development, Upstream and Downstream Process), End User(Pharma & Biopharma Companies, CMOs & CROs, Academic & Research Institute), & Region – Global Forecast to 2026

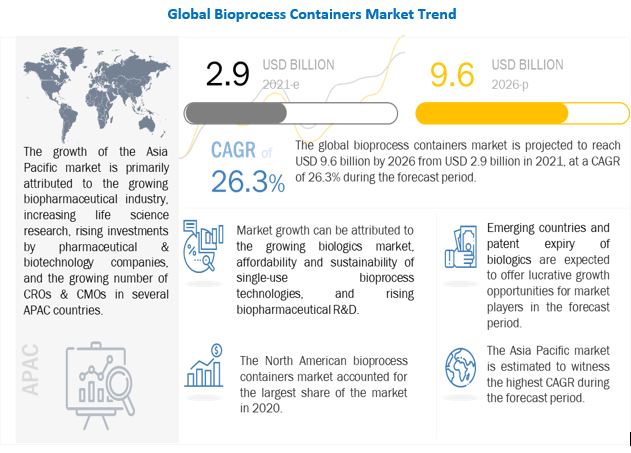

The global bioprocess containers market size is projected to reach USD 9.6 billion by 2026, at a CAGR of 26.3%. Growth in the bioprocess containers market is mainly driven by factors such as the growing biologics market, affordability and sustainability of single-use bioprocess technologies, and rising biopharmaceutical R&D. Emerging countries and the patent expiry of biologics are expected to offer growth opportunities for players operating in the bioprocess containers market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Bioprocess Containers Market Growth Dynamics

Drivers: Growing biologics market

The growth of single-use technologies can be attributed to the growing need for better, cheaper, and faster biologics production. Active development of individualized biologics and personalized medicines, including patient-specific cellular & gene therapies and therapeutic vaccines, demands high sterility and is therefore manufactured using single-use equipment and consumables. The COVID-19 pandemic caused the unprecedented demand for vaccines. The pandemic, in turn, has increased the usage of large-scale and laboratory-scale single-use bioreactors and related consumables such as bioprocess containers, media bags, filtration assemblies, and other consumables.

In recent years, more biologics having higher potency that require smaller production volumes, advancements in biosimilars targeting smaller markets, and ongoing improvements in production yields and efficiencies that create production operations at much smaller scales have increased the use of single-use technologies such as single-use bioprocess containers/bags as they are best suited for small volume productions. However, single-use technologies are now slowly moving towards clinical production and commercial operations.

In 2020, the US FDA approved 53 new medicines and therapeutic biologics (Source: US FDA). Growth in the biologics market is mainly driven by monoclonal antibodies and human insulin, which are among the leading contributors to the bioprocess containers market. Additionally, the Centre for Biologics Evaluation and Research’s (CBER) (2021-25) strategic plan involves various schemes for boosting the growth of the biologics market. With increasing growth in the biologics market, the number of bioprocess containers needed for R&D and biologics manufacturing is also expected to increase in the coming years.

Restraints: Issues related to leachables and extractables

Compared to traditional bio-manufacturing technologies, single-use systems (SUS) have many advantages, such as reduced requirements for process validation and higher manufacturing flexibility, which ultimately results in higher operating efficiency and reduced manufacturing costs. Despite these advantages, there is a possibility that the plastic materials used for SUS may leach organic compounds or inorganic substances into the processing fluid or the final drug product, which remains a major concern. Such an undesired change could eventually compromise bioprocessing and might significantly impact the safety, quality, and purity of the drug product.

Extractables are compounds that can be extracted from source materials using appropriate solvents under vigorous laboratory conditions, while leachables are compounds present in drug products caused by leaching from containers, closures, and processing components. Therefore, leachables can be considered a subset of extractables. Extractables and leachables are commonly associated with polymeric and elastomeric materials due to the use of additives to increase stability and aid in the formation of material components.

According to a survey conducted by BioPlan Associates in 2018, 73.3% of respondents agreed that leachables and extractables are major concerns that may limit the use of bioprocessing in the near future. As single-use assembly products are made of processed plastic materials, they often face the problem of contamination from the container due to leachables. Furthermore, a majority of biopharmaceutical processes frequently require high temperatures during their operation, which results in the generation of unnecessary and unknown chemicals that may contaminate the end product. Thus, concerns regarding extractables and leachables arising from the containers may hinder their adoption to a certain extent in the coming years.

Opportunities: Patent Expiry of biologics

As many patented products are going off-patent in the future, companies are falling short of funds to invest in their R&D pipelines. According to data published in the Generics and Biosimilars Initiative Journal, around twelve biological products with global sales of more than USD 67 billion will be exposed to biosimilar competition by 2020.

The patent expiry of blockbuster drugs has resulted in increased R&D spending by pharmaceutical and biotechnology companies. Patent expiry of biologics leads to increasing R&D of biologics and shifts biologics from the pipeline to commercial production. As the development and manufacturing costs of biologics are very high, companies are now gradually focusing on techniques that are more economical than traditional biomanufacturing methods. As a result, several biopharmaceutical manufacturers are incorporating single-use bioprocessing technologies into their development processes. By using single-use bioprocessing assemblies such as bioprocess containers, biomanufacturing companies can produce innovative products at affordable budgets that meet customer needs and demands

Challenges: Waste disposal

The solid waste generated from single-use assemblies such as bioprocess containers creates several challenges for biomanufacturing companies, such as the disposal of solid waste and an increase in waste management costs. Most single-use assemblies are made of multiple materials or layers, including polyethylene, polypropylene, ethylene vinyl alcohol, or nylon. Such products require extensive efforts to separate components into homogeneous components. As a result, most single-use assemblies and their components are not suited for recycling. This leads to the generation of large volumes of solid waste; its disposal is a challenging prospect for biopharmaceutical companies

By type segment, the 2D bioprocess containers segment accounted for the largest share of the bioprocess containers market in 2020.

On the basis of type, the bioprocess containers market is segmented into 2D bioprocess containers, 3D bioprocess containers, and other containers and accessories. In 2020, the 2D bioprocess containers segment accounted for the largest share of the bioprocess containers market. 2D bioprocess containers are frequently used in cell harvesting and for the transportation of bulk drug products and bulk drug precursors.

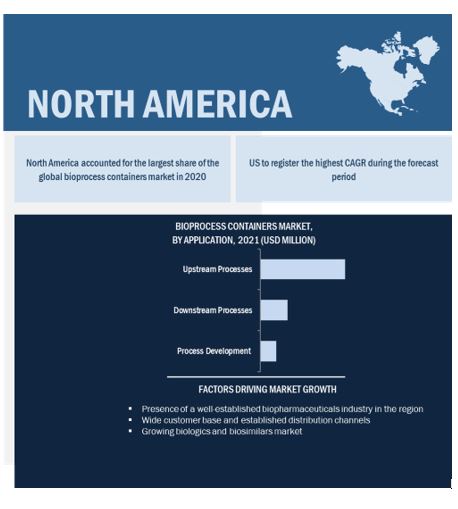

By application, the upstream processes application segment accounted for the largest share of the bioprocess containers market in 2020.

On the basis of application, the bioprocess containers market is segmented into upstream processes, downstream processes, and process development. In 2020, the upstream processes segment accounted for the largest share of the bioprocess containers market. Upstream processes make the highest use of bioprocess containers, especially during fermentation and culture media processing; due to this, this segment holds the largest market share.

By end user, the pharmaceutical & biopharmaceutical companies segment accounted for the largest share of the bioprocess containers market in 2020.

On the basis of end user, the bioprocess containers market is segmented into pharmaceutical & biopharmaceutical companies, CROs & CMOs, and academic & research institutes. In 2020, the pharmaceutical & biopharmaceutical companies segment accounted for the largest share of the bioprocess containers market. The demand for biopharmaceuticals among the senior population is increasing as the elderly are more prone to various diseases/disorders that can be treated using biologics. This has resulted in the increasing focus of biopharmaceutical companies developing affordable biologics at lower costs. As bioprocess containers have wide applications in research & process development, the adoption of BPCs is increasing with the growth in the development and manufacturing of biologics and biosimilars.

North America accounted for the largest share of the bioprocess containers market in 2020.

In 2020, North America accounted for the largest share of the bioprocess containers market. The large share of North America can be attributed to the presence of an established biopharmaceuticals industry and major players in the region.

Bioprocess Containers Market Key Players

The bioprocess containers market is dominated by a few globally established players such as Sartorius Stedim Biotech (France), Thermo Fisher Scientific (US), Danaher Corporation (US), and Merck Millipore (Germany).

Scope of the Bioprocess Containers Market Report

|

Report Metrics |

Details |

|

Market Size value 2026 |

USD 9.6 billion |

|

Growth Rate |

26.3% Compound Annual Growth Rate (CAGR) |

|

Largest Market |

Asia Pacific |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

|

|

Table of Content |

|

|

Market Segmentation |

Type, Application, End User and Region |

|

Bioprocess Containers Market Growth Drivers |

Growing biologics market |

|

Bioprocess Containers Market Growth Opportunities |

Patent Expiry of biologics |

|

Report Highlights |

|

|

Geographies Covered |

North America, Europe, APAC, MEA, and Latin America |

The study categorizes the bioprocess containers market into the following segments and subsegments:

By Type

- 2D bioprocess containers

- 3D bioprocess containers

- Other containers and accessories

By Application

- Upstream Processes

- Downstream Processes

- Process Development

By End User

- Pharmaceutical & Biopharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes.

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- South Korea

- Japan

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments

- In June 2021, Avantor, Inc. (US) acquired RIM Bio, a leading China-based manufacturer of single-use bioprocess bags and assemblies for biopharmaceutical manufacturing applications. This acquisition helped the company expand its bioproduction footprint in China.

- In April 2021, Sartorius Stedim Biotech (France) opened a new Customer Interaction Center (CIC) in Beijing, China, to expand its presence in China and to meet the high demand from the growing biopharmaceuticals market.

- In March 2021, Merck KGaA (Germany) invested ~USD 30 million (EUR 25 million) to add a single-use assembly production unit at its Life Science Center in Molsheim, France. With this expansion, the company is accelerating its European expansion plans for single-use technology, which is used for the production of COVID-19 vaccines and other lifesaving therapies.

- In November 2020, Thermofisher Scientific entered into an agreement with Innoforce Pharmaceuticals to establish a new pharmaceutical services facility in Hangzhou, China, for integrated biologics and sterile drug development and manufacturing. The new facility will become part of Thermo Fisher’s global pharmaceutical services network, which includes leading capabilities for drug product development and biologics manufacturing. The new facility is expected to be completed in 2022.

- In June 2018 Entegris, Inc. (US) acquired Flex Concepts, a manufacturer of bioprocessing single-use bags and fluid transfer solutions for the life sciences industry. The acquisition strengthened Entegris’ bioprocess product portfolio.

Frequently Asked Questions (FAQ):

What is the size of Bioprocess Containers Market?

The global bioprocess containers market size is projected to reach USD 9.6 billion by 2026, growing at a CAGR of 26.3%.

What are the major growth factors of Bioprocess Containers Market?

Growth in the bioprocess containers market is mainly driven by factors such as the growing biologics market, affordability and sustainability of single-use bioprocess technologies, and rising biopharmaceutical R&D. Emerging countries and the patent expiry of biologics are expected to offer growth opportunities for players operating in the bioprocess containers market during the forecast period.

Who all are the prominent players of Bioprocess Containers Market?

The bioprocess containers market is dominated by a few globally established players such as Sartorius Stedim Biotech (France), Thermo Fisher Scientific (US), Danaher Corporation (US), and Merck Millipore (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 BIOPROCESS CONTAINERS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DESIGN

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources: Bioprocess containers market

2.1.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARIES: BIOPROCESS CONTAINERS MARKET

2.1.2.1 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BIOPROCESS CONTAINERS MARKET

2.2.2 PRIMARY RESEARCH VALIDATION

FIGURE 6 BIOPROCESS CONTAINERS MARKET: CAGR PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 9 BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 10 BIOPROCESS CONTAINERS MARKET SHARE, BY END USER, 2020

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE BIOPROCESS CONTAINERS MARKET

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 BIOPROCESS CONTAINERS MARKET OVERVIEW

FIGURE 12 GROWING BIOLOGICS MARKET TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET, BY TYPE & COUNTRY (2020)

FIGURE 13 2D BIOPROCESS CONTAINERS ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.3 BIOPROCESS CONTAINERS MARKET, BY END USER

FIGURE 14 CMOS & CROS SEGMENT TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 BIOPROCESS CONTAINERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing biologics market

FIGURE 16 GLOBAL BIOLOGICS MARKET, 2014-2023 (USD BILLION)

5.2.1.2 Affordability and sustainability of single-use bioprocess technologies

FIGURE 17 ADOPTION OF SINGLE-USE PRODUCTS IN BIOPHARMACEUTICAL MANUFACTURING, 2019

5.2.1.3 Rising biopharmaceutical R&D

FIGURE 18 GLOBAL R&D INVESTMENTS BY PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, 2010−2025 (USD BILLION)

5.2.2 RESTRAINTS

5.2.2.1 Issues related to leachables and extractables

TABLE 1 TYPICAL EXTRACTABLES FOR ACCEPTABLE MATERIALS USED IN DISPOSABLE BIOPROCESS MANUFACTURING SYSTEMS

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging countries

5.2.3.2 Patent expiry of biologics

TABLE 2 US: BIOLOGICS GOING OFF-PATENT DURING 2018–2025

5.2.4 CHALLENGES

5.2.4.1 Waste disposal

TABLE 3 COMPARISON OF DISPOSAL OPTIONS FOR SINGLE-USE ASSEMBLY PRODUCTS

5.3 IMPACT OF COVID-19 ON THE BIOPROCESS CONTAINERS MARKET

FIGURE 19 COVID-19 IMPACT ON THE BIOPROCESS CONTAINERS MARKET, 2019-2021, (USD MILLION)

6 BIOPROCESS CONTAINERS MARKET, BY TYPE (Page No. - 61)

6.1 INTRODUCTION

TABLE 4 BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 5 BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 2D BIOPROCESS CONTAINERS

6.2.1 WIDE USE OF 2D BAGS IN BIOPRODUCTION APPLICATIONS TO DRIVE MARKET GROWTH

TABLE 6 EXAMPLES OF 2D BIOPROCESS CONTAINERS AVAILABLE IN THE MARKET

TABLE 7 2D BIOPROCESS CONTAINERS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 8 2D BIOPROCESS CONTAINERS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 9 NORTH AMERICA: 2D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 10 NORTH AMERICA: 2D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 11 EUROPE: 2D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 12 EUROPE: 2D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 13 ASIA PACIFIC: 2D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 14 ASIA PACIFIC: 2D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

6.3 3D BIOPROCESS CONTAINERS

6.3.1 SIGNIFICANT REDUCTIONS IN LABOR COSTS AND FASTER BATCH TURNAROUND ACHIEVED USING THESE CONTAINERS TO PROPEL MARKET GROWTH

TABLE 15 EXAMPLES OF 3D BIOPROCESS CONTAINERS AVAILABLE IN THE MARKET

TABLE 16 3D BIOPROCESS CONTAINERS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 3D BIOPROCESS CONTAINERS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 NORTH AMERICA: 3D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 19 NORTH AMERICA: 3D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 20 EUROPE: 3D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 21 EUROPE: 3D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 22 ASIA PACIFIC: 3D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 23 ASIA PACIFIC: 3D BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

6.4 OTHER CONTAINERS & ACCESSORIES

TABLE 24 OTHER BIOPROCESS CONTAINERS & ACCESSORIES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 OTHER BIOPROCESS CONTAINERS & ACCESSORIES MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 NORTH AMERICA: OTHER BIOPROCESS CONTAINERS & ACCESSORIES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 27 NORTH AMERICA: OTHER BIOPROCESS CONTAINERS & ACCESSORIES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 28 EUROPE: OTHER BIOPROCESS CONTAINERS & ACCESSORIES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 29 EUROPE: OTHER BIOPROCESS CONTAINERS & ACCESSORIES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 30 ASIA PACIFIC: OTHER BIOPROCESS CONTAINERS & ACCESSORIES MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 31 ASIA PACIFIC: OTHER BIOPROCESS CONTAINERS & ACCESSORIES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

7 BIOPROCESS CONTAINERS MARKET, BY APPLICATION (Page No. - 75)

7.1 INTRODUCTION

TABLE 32 BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 33 BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 UPSTREAM PROCESSES

7.2.1 FREQUENT USE OF BIOPROCESS CONTAINERS DURING FERMENTATION AND CULTURE MEDIA PROCESSING IS A MAJOR FACTOR DRIVING THE MARKET

TABLE 34 BIOPROCESS CONTAINERS MARKET FOR UPSTREAM PROCESSES, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 BIOPROCESS CONTAINERS MARKET FOR UPSTREAM PROCESSES, BY REGION, 2021–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR UPSTREAM PROCESSES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 37 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR UPSTREAM PROCESSES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 38 EUROPE: BIOPROCESS CONTAINERS MARKET FOR UPSTREAM PROCESSES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 39 EUROPE: BIOPROCESS CONTAINERS MARKET FOR UPSTREAM PROCESSES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 40 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR UPSTREAM PROCESSES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 41 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR UPSTREAM PROCESSES, BY COUNTRY, 2021–2026 (USD MILLION)

7.3 DOWNSTREAM PROCESSES

7.3.1 WIDE USAGE OF BPC ASSEMBLY FOR PURIFICATION APPLICATIONS TO DRIVE MARKET GROWTH

TABLE 42 BIOPROCESS CONTAINERS MARKET FOR DOWNSTREAM PROCESSES, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 BIOPROCESS CONTAINERS MARKET FOR DOWNSTREAM PROCESSES, BY REGION, 2021–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR DOWNSTREAM PROCESSES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 45 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR DOWNSTREAM PROCESSES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 46 EUROPE: BIOPROCESS CONTAINERS MARKET FOR DOWNSTREAM PROCESSES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 47 EUROPE: BIOPROCESS CONTAINERS MARKET FOR DOWNSTREAM PROCESSES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 48 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR DOWNSTREAM PROCESSES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 49 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR DOWNSTREAM PROCESSES, BY COUNTRY, 2021–2026 (USD MILLION)

7.4 PROCESS DEVELOPMENT

7.4.1 REDUCED RISK OF CROSS-CONTAMINATION AND REDUCED OPERATIONAL COSTS MAKE BPCS THE MOST PREFERRED SOLUTION FOR PROCESS DEVELOPMENT

TABLE 50 BIOPROCESS CONTAINERS MARKET FOR PROCESS DEVELOPMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 BIOPROCESS CONTAINERS MARKET FOR PROCESS DEVELOPMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR PROCESS DEVELOPMENT, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR PROCESS DEVELOPMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 54 EUROPE: BIOPROCESS CONTAINERS MARKET FOR PROCESS DEVELOPMENT, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 55 EUROPE: BIOPROCESS CONTAINERS MARKET FOR PROCESS DEVELOPMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 56 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR PROCESS DEVELOPMENT, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 57 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR PROCESS DEVELOPMENT, BY COUNTRY, 2021–2026 (USD MILLION)

8 BIOPROCESS CONTAINERS MARKET, BY END USER (Page No. - 90)

8.1 INTRODUCTION

TABLE 58 BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 59 BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

8.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

8.2.1 BPCS HAVE FOUND WIDE USE IN BIOPHARMACEUTICAL MANUFACTURING DUE TO THEIR COST-EFFECTIVENESS

TABLE 60 BIOPROCESS CONTAINERS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 BIOPROCESS CONTAINERS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2017–2020 (USD MILLION) 93

TABLE 63 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2026 (USD MILLION) 93

TABLE 64 EUROPE: BIOPROCESS CONTAINERS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 65 EUROPE: BIOPROCESS CONTAINERS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 66 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2017–2020 (USD MILLION) 95

TABLE 67 APAC: BIOPROCESS CONTAINERS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2026 (USD MILLION)

8.3 CONTRACT RESEARCH ORGANIZATIONS & CONTRACT MANUFACTURING ORGANIZATIONS

8.3.1 INCREASING OUTSOURCING OF R&D SERVICES BY PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES TO SUPPORT MARKET GROWTH

TABLE 68 BIOPROCESS CONTAINERS MARKET FOR CROS & CMOS, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 BIOPROCESS CONTAINERS MARKET FOR CROS & CMOS, BY REGION, 2021–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR CROS & CMOS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 71 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR CROS & CMOS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 72 EUROPE: BIOPROCESS CONTAINERS MARKET FOR CROS & CMOS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 73 EUROPE: BIOPROCESS CONTAINERS MARKET FOR CROS & CMOS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 74 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR CROS & CMOS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 75 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR CROS & CMOS, BY COUNTRY, 2021–2026 (USD MILLION)

8.4 ACADEMIC & RESEARCH INSTITUTES

8.4.1 GROWING COLLABORATIONS BETWEEN PHARMACEUTICAL & BIOPHARMACEUTICAL MANUFACTURERS AND RESEARCH INSTITUTES TO DRIVE MARKET GROWTH

TABLE 76 BIOPROCESS CONTAINERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 BIOPROCESS CONTAINERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 80 EUROPE: BIOPROCESS CONTAINERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 81 EUROPE: BIOPROCESS CONTAINERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 82 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 83 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2026 (USD MILLION)

9 BIOPROCESS CONTAINERS MARKET, BY REGION (Page No. - 104)

9.1 INTRODUCTION

TABLE 84 BIOPROCESS CONTAINERS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 BIOPROCESS CONTAINERS MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET SNAPSHOT

TABLE 86 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 The US dominates the North American bioprocess containers market

TABLE 94 US: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 95 US: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 96 US: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 97 US: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 98 US: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 99 US: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growing number of biopharmaceutical manufacturing facilities is supporting the growth of the market in Canada

FIGURE 21 CANADA: BIOLOGICS SALES, 2009-2018 (USD BILLION)

TABLE 100 CANADA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 101 CANADA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 102 CANADA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 103 CANADA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 104 CANADA: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 105 CANADA: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3 EUROPE

TABLE 106 EUROPE: BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 107 EUROPE: BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 108 EUROPE: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 109 EUROPE: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 110 EUROPE: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 111 EUROPE: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 112 EUROPE: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 113 EUROPE: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing adoption of single-use bioprocess systems by biopharmaceutical and CDMO companies to drive market growth

TABLE 114 GERMANY: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 115 GERMANY: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 116 GERMANY: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 117 GERMANY: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 118 GERMANY: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 119 GERMANY: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Rising government support for biotechnology companies to propel the demand for advanced technologies in the UK

TABLE 120 UK: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 UK: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 122 UK: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 123 UK: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 124 UK: BIOPROCESS CONTAINERS MARKET, BY END USER,2017–2020 (USD MILLION)

TABLE 125 UK: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Increasing investments in life science R&D infrastructure development to support market growth

TABLE 126 FRANCE: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 127 FRANCE: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 128 FRANCE: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 129 FRANCE: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 130 FRANCE: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 131 FRANCE: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 High R&D investments in the field of biotechnology research to support market growth in Italy

TABLE 132 ITALY: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 133 ITALY: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 134 ITALY: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 135 ITALY: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 136 ITALY: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 137 ITALY: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.5 ROE

TABLE 138 ROE: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 139 ROE: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 140 ROE: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 141 ROE: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 142 ROE: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 143 ROE: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 22 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET SNAPSHOT

TABLE 144 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 148 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 149 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 150 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 151 ASIA PACIFIC: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China to witness the highest growth in the global bioprocess containers market

TABLE 152 CHINA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 153 CHINA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 154 CHINA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 155 CHINA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 156 CHINA: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 157 CHINA: BIOPROCESS CONTAINERS MARKET, BY END USER,2021–2026 (USD MILLION)

9.4.2 SOUTH KOREA

9.4.2.1 Government support to boost the production of biological to drive market growth

TABLE 158 SOUTH KOREA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 159 SOUTH KOREA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 160 SOUTH KOREA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 161 SOUTH KOREA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 162 SOUTH KOREA: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 163 SOUTH KOREA: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4.3 JAPAN

9.4.3.1 Expansion of biopharmaceutical manufacturing plants in Japan has created growth opportunities for BPC companies

TABLE 164 JAPAN: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 165 JAPAN: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 166 JAPAN: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 167 JAPAN: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 168 JAPAN: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 169 JAPAN: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4.4 INDIA

9.4.4.1 COVID-19 vaccines production has created significant demand for single-use bioprocess containers

TABLE 170 INDIA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 171 INDIA: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 172 INDIA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION,2017–2020 (USD MILLION)

TABLE 173 INDIA: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 174 INDIA: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 175 INDIA: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4.5 ROAPAC

TABLE 176 ROAPAC: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 177 ROAPAC: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 178 ROAPAC: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 179 ROAPAC: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 180 ROAPAC: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 181 ROAPAC: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 182 ROW: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 183 ROW: BIOPROCESS CONTAINERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 184 ROW: BIOPROCESS CONTAINERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 185 ROW: BIOPROCESS CONTAINERS MARKET, BY APPLICATION,2021–2026 (USD MILLION)

TABLE 186 ROW: BIOPROCESS CONTAINERS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 187 ROW: BIOPROCESS CONTAINERS MARKET, BY END USER, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 153)

10.1 INTRODUCTION

10.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

FIGURE 23 BIOPROCESS CONTAINERS MARKET: RIGHT-TO-WIN STRATEGIES ADOPTED BY KEY PLAYERS

10.3 MARKET SHARE ANALYSIS

FIGURE 24 BIOPROCESS CONTAINERS: MARKET SHARE ANALYSIS, 2020

10.4 COMPANY EVALUATION QUADRANT

FIGURE 25 BIOPROCESS CONTAINERS MARKET: COMPANY EVALUATION MATRIX, 2020

10.4.1 STARS

10.4.2 PERVASIVE PLAYERS

10.4.3 EMERGING LEADERS

10.4.4 PARTICIPANTS

10.5 COMPETITIVE SCENARIO

10.5.1 DEALS

TABLE 188 BIOPROCESS CONTAINERS MARKET: DEALS, JANUARY 2018-MAY 2021

10.5.2 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 160)

11.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 SARTORIUS STEDIM BIOTECH

TABLE 189 SARTORIUS STEDIM BIOTECH: BUSINESS OVERVIEW

FIGURE 26 SARTORIUS STEDIM BIOTECH: COMPANY SNAPSHOT (2020)

TABLE 190 SARTORIUS STEDIM BIOTECH: PRODUCT OFFERINGS

TABLE 191 SARTORIUS STEDIM BIOTECH: DEALS

TABLE 192 SARTORIUS STEDIM BIOTECH: OTHER DEVELOPMENTS

11.1.2 THERMO FISHER SCIENTIFIC INC.

TABLE 193 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 27 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2020)

TABLE 194 THERMO FISHER SCIENTIFIC INC.: PRODUCT OFFERINGS

TABLE 195 THERMO FISHER SCIENTIFIC INC.: DEALS

TABLE 196 THERMO FISHER SCIENTIFIC INC.: OTHER DEVELOPMENTS

11.1.3 DANAHER CORPORATION

TABLE 197 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 28 DANAHER CORPORATION: COMPANY SNAPSHOT (2020)

TABLE 198 DANAHER CORPORATION: PRODUCT OFFERINGS

TABLE 199 DANAHER CORPORATION: DEALS

TABLE 200 DANAHER CORPORATION: OTHER DEVELOPMENTS

11.1.4 MERCK KGAA

TABLE 201 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 29 MERCK KGAA: COMPANY SNAPSHOT (2020)

TABLE 202 MERCK KGAA: PRODUCT OFFERINGS

TABLE 203 MERCK KGAA: OTHER DEVELOPMENTS

11.1.5 SAINT-GOBAIN

TABLE 204 SAINT-GOBAIN: BUSINESS OVERVIEW

FIGURE 30 SAINT-GOBAIN: COMPANY SNAPSHOT (2020)

TABLE 205 SAINT-GOBAIN: PRODUCT OFFERINGS

TABLE 206 SAINT-GOBAIN: DEALS

TABLE 207 SAINT-GOBAIN: OTHER DEVELOPMENTS

11.1.6 AVANTOR, INC.

TABLE 208 AVANTOR, INC.: BUSINESS OVERVIEW

FIGURE 31 AVANTOR, INC.: COMPANY SNAPSHOT (2020)

TABLE 209 AVANTOR, INC.: PRODUCT OFFERINGS

TABLE 210 AVANTOR, INC.: DEALS

TABLE 211 AVANTOR, INC.: OTHER DEVELOPMENTS

11.1.7 PARKER HANNIFIN CORPORATION

TABLE 212 PARKER HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 32 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT (2020)

TABLE 213 PARKER HANNIFIN: PRODUCT OFFERINGS

TABLE 214 PARKER HANNIFIN: OTHER DEVELOPMENTS

11.1.8 CORNING INCORPORATED

TABLE 215 CORNING INCORPORATED: BUSINESS OVERVIEW

FIGURE 33 CORNING INCORPORATED: COMPANY SNAPSHOT (2020)

TABLE 216 CORNING INCORPORATED: PRODUCT OFFERINGS

11.1.9 ENTEGRIS, INC.

TABLE 217 ENTEGRIS, INC.: BUSINESS OVERVIEW

FIGURE 34 ENTEGRIS, INC.: COMPANY SNAPSHOT (2020)

TABLE 218 ENTEGRIS, INC.: PRODUCT OFFERINGS

TABLE 219 ENTEGRIS, INC.: DEALS

TABLE 220 ENTEGRIS, INC.: OTHER DEVELOPMENTS

11.1.10 MEISSNER FILTRATION PRODUCTS, INC.

TABLE 221 MEISSNER FILTRATION PRODUCTS, INC.: BUSINESS OVERVIEW

TABLE 222 MEISSNER FILTRATION PRODUCTS, INC.: PRODUCT OFFERINGS

11.1.11 LONZA AG

TABLE 223 LONZA AG: BUSINESS OVERVIEW

FIGURE 35 LONZA AG: COMPANY SNAPSHOT (2020)

TABLE 224 LONZA AG: PRODUCT OFFERINGS

11.1.12 ANTYLIA SCIENTIFIC

TABLE 225 ANTYLIA SCIENTIFIC: BUSINESS OVERVIEW

TABLE 226 ANTYLIA SCIENTIFIC: PRODUCT OFFERINGS

11.1.13 FLEXBIOSYS INC.

TABLE 227 FLEXBIOSYS INC.: BUSINESS OVERVIEW

TABLE 228 FLEXBIOSYS INC.: PRODUCT OFFERINGS

11.1.14 MICHELIN GROUP

TABLE 229 MICHELIN GROUP: BUSINESS OVERVIEW

TABLE 230 MICHELIN GROUP: PRODUCT OFFERINGS

TABLE 231 MICHELIN GROUP: PRODUCT APPROVALS

TABLE 232 MICHELIN GROUP: DEALS

11.1.15 ABEC, INC.

TABLE 233 ABEC, INC.: BUSINESS OVERVIEW

TABLE 234 ABEC, INC.: PRODUCT OFFERINGS

TABLE 235 ABEC, INC.: DEALS

TABLE 236 ABEC, INC.: OTHER DEVELOPMENTS

11.1.16 CELLEXUS

TABLE 237 CELLEXUS: BUSINESS OVERVIEW

TABLE 238 CELLEXUS: PRODUCT OFFERINGS

TABLE 239 CELLEXUS: DEALS

11.2 OTHER COMPANIES

11.2.1 KEOFITT A/S

TABLE 240 KEOFITT A/S: COMPANY OVERVIEW

11.2.2 FUJIMORI KOGYO CO., LTD.

TABLE 241 FUJIMORI KOGYO CO., LTD.: COMPANY OVERVIEW

11.2.3 CESCO BIOENGINEERING CO., LTD.

TABLE 242 CESCO BIOENGINEERING CO., LTD.: COMPANY OVERVIEW

11.2.4 SOLIDA BIOTECH GMBH

TABLE 243 SOLIDA BIOTECH GMBH: COMPANY OVERVIEW

11.2.5 SATAKE CHEMICAL EQUIPMENT MFG., LTD.

TABLE 244 SATAKE CHEMICAL EQUIPMENT MFG., LTD.: COMPANY OVERVIEW

11.2.6 STOBBE PHARMA GMBH

TABLE 245 STOBBE PHARMA GMBH: COMPANY OVERVIEW

11.2.7 CELLTAINER BIOTECH BV

TABLE 246 CELLTAINER BIOTECH BV: COMPANY OVERVIEW

11.2.8 FOXX LIFE SCIENCES

TABLE 247 FOXX LIFE SCIENCES: COMPANY OVERVIEW

11.2.9 SHANGHAI LEPURE BIOTECH CO., LTD.

TABLE 248 SHANGHAI LEPURE BIOTECH CO., LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 210)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources, directories, and databases, such as Bloomberg Business, Factiva, and D&B, to identify and collect information useful for this technical, market-oriented, and commercial study of the global bioprocess containers market. The primary sources are mainly industry experts from core and related industries and preferred suppliers, manufacturers, distributors, bioprocess engineers, service providers, reimbursement providers, technology developers, and organizations related to all segments of this industry’s value chain.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects

Secondary Research

The secondary sources referred to for this research study include publications from government sources; corporate & regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines & research journals; press releases; and trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the global bioprocess containers market, which was validated by primary research

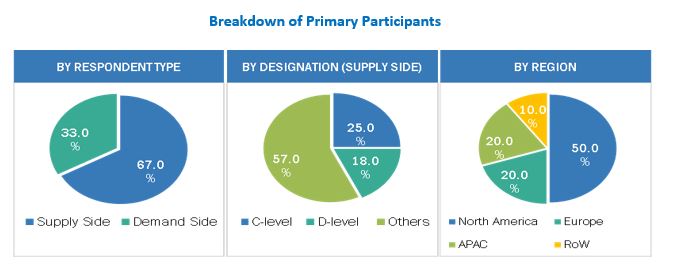

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (biopharmaceutical manufacturing units, CROs & CMOs, research institutes, etc.) and supply sides (manufacturers and distributors of bioprocess containers). The primaries interviewed for this study included experts from the industry, such as CEOs, VPs, directors, sales heads, and marketing managers of tier 1 and tier 2 companies engaged in offering single-use bioprocess containers across the globe, and administrators and purchase managers of biopharmaceutical companies and research institutions. Approximately 67% of the primary interviews were conducted from the supply side, while 33% were conducted from the demand side. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size, the global bioprocess containers market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedure was employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the global bioprocess containers market was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the global bioprocess containers market by type, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, challenges, and opportunities)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, the Asia Pacific, and the Rest of the World (RoW2)

- To profile the key players and analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments such as partnerships, agreements, collaborations, expansions, and acquisitions in the global bioprocess containers market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the European bioprocess containers market into RoE countries

- Further breakdown of the Asia Pacific bioprocess containers market into RoAPAC countries

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bioprocess Containers Market