Smart Container Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Hardware, Software, Services), Vertical (Food & Beverages, Chemicals, Oil & Gas, Pharmaceuticals), Technology (GPS, Cellular, Bluetooth Low Energy, LoRaWAN) and Region - Global Forecast to 2027

Updated on : October 22, 2024

Smart Container Market is experiencing robust growth driven by the increasing demand for real-time tracking and monitoring solutions in the logistics and supply chain sectors. As global trade expands, businesses are prioritizing efficiency and transparency, leading to a surge in the adoption of smart containers equipped with IoT technology, GPS, and sensors. Key trends influencing this market include the integration of advanced analytics for predictive maintenance and improved asset management, as well as the growing emphasis on sustainability, with smart containers designed to reduce carbon footprints and optimize shipping routes.

Smart Container Market & Share

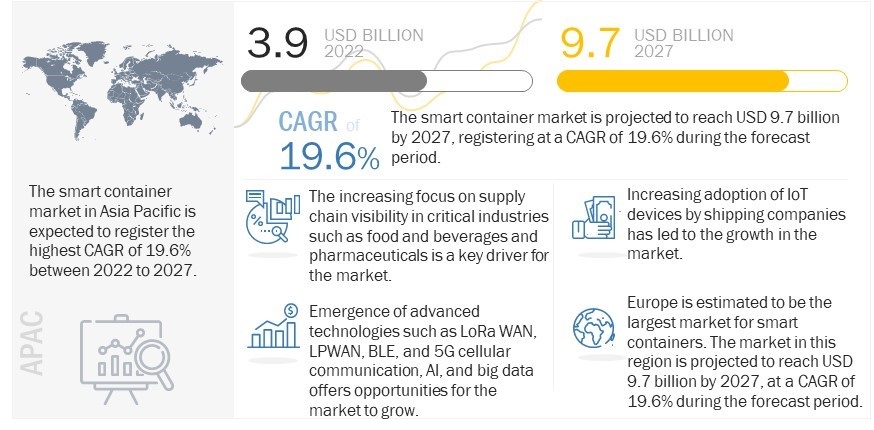

[259 Pages Report] The global Smart Container Market Size is projected to grow from USD 3.9 billion in 2022 to USD 9.7 billion by 2027, growing at a CAGR of 19.6% from 2022 to 2027.

Increasing focus on end-to-end supply chain visibility, high demand for monitoring and control of internal container conditions, and increasing adoption of IoT devices by shipping companies are the key factors expected to boost the growth of the smart container industry in the next five years. However, the lack of interoperability among IoT devices and sensors is expected to be the key challenge for the growth of the market. Increasing adoption of GPS technology to improve tracking and visibility throughout the supply chain has led to higher demand for smart containers.

The objective of the report is to define, describe, and forecast the smart container market based on offering, technology, vertical, and region.

Smart Container Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Smart Container Market Dynamics

Drivers: Increasing adoption of IoT devices by shipping companies

The sea is one of the major modes of transportation. As there is increasing technology adoption across the logistics industry with the emergence of smart logistics, several major logistics shipping companies are implementing IoT devices. IoT devices offer several advantages to these logistics companies. These devices offer benefits such as reliable vehicle tracking, cost reductions, improved supply chain planning and visibility, higher product safety, and improved transportation conditions. Currently, AP Moller-Maersk, MSA, Nippon Express, and Hapag-Lloyd are among the major shipping companies that have implemented IoT devices for logistics operations.

IoT devices used for smart containers include various sensors such as motion detection sensors, vibration sensors, temperature sensors, humidity sensors, and network gateways that improve the connectivity of smart containers. Shipping companies are increasingly implementing these devices for monitoring product conditions, checking container environments, and detecting vessel locations. Furthermore, IoT devices help to enhance the capabilities of shipping companies by offering visibility across the supply chain. The providers of shipping containers benefit from the implementation of IoT devices by making efficient use of transport infrastructure.

Restraints: Shipping industry ill-prepared for cyber threats

The shipping industry has a high risk of cyber-attacks. This is majorly due to the lack of awareness and tools implemented within the shipping industry against such digital threats. The world’s largest shipping companies have suffered cyber-attacks. APM-Maersk suffers a ransomware attack in 2017, COSCO was targeted by a ransomware attack in 2018, and MSC was attacked by malware in 2020. As the shipping industry continues to flourish, it remains a major target for such attacks. It is observed that the industry is not well prepared for the increasing cyber-attacks. In addition, smart containers are continuously connected to the cloud and complex networks of satellites through various sensors to send and receive data. As there are several sensors and devices attached to the smart containers, there is a high risk of cyber-attack and theft of sensitive data. The presence of a large number of connected devices in smart containers makes it easier for security breaches when the industry is ill-prepared. As a result, cyber security threats are viewed as a top restraint to the market’s growth.

Opportunities: Emergence of advanced technologies

There are rapid technological advancements in various fields. These technologies, such as IoT, connectivity, communication, AI, and big data analysis, also support various functions within the smart container market. For instance, communication technologies such as LoRaWan, LPWAN, and cellular communication technology (5G) have enabled long-distance communication to facilitate near real-time monitoring and control in smart containers. With the help of smart sensors, IoT devices are able to share data efficiently and process data faster. Similarly, the implementation of big data and AI has enabled superior predictions of estimated times of delivery, incidents, and delays through advanced data analysis, offering insights into every aspect of smart containers. It is expected that the new technologies will create significant opportunities and use cases for smart containers to enable market expansion.

Challenges: Lack of interoperability among IoT devices and sensors

The smart container market is rapidly growing with advancements in technology. Many players offer hardware, software, and services based on different technologies in the smart container market. Companies are offering connectivity and communication through Bluetooth Low Energy (BLE), Wi-Fi, LoRaWAN, Cellular, and Zigbee, among others. As there are various devices with different communication technologies, discrepancies in interoperability may result in inefficiencies and a lack of monitoring and control. It is observed that devices manufactured by different players are not able to integrate within a system. There is limited connectivity between different transport protocols such as Ethernet, Wi-Fi, and Zigbee. Additionally, a large number of players in the smart container market are offering proprietary IoT platforms for their devices and sensors. The lack of set rules or standards at the application level also causes an inability to combine and complement the collected data from different sensors and devices.

Such gaps in communication among a large number of IoT devices can also lead to the failure of operations as simple as end-to-end location tracking. The current inability of connected devices to effectively communicate immediately when deployed slows the adoption of connected devices, increases costs, and limits the value of many IoT uses for smart containers.

Hardware segment to hold largest market share in Europe

Demand for the hardware segment is estimated to be highest in Europe due to the large number of companies offering IoT hardware in the region. Companies such as Nexxiot AG (Switzerland), SkyCell AG (Switzerland), Traxens (France), SAVVY Telematic Systems AG (Switzerland), and Sensolus (Germany) offer several hardware solutions in the smart container market. The presence of such players is estimated to grow further as the market witnesses growth opportunities in the forecasted period. The European region observes a higher push for technology adoption in the logistics industry, driving the demand for smart containers. Germany and the UK are the largest countries implementing IoT technology in Europe. As these countries are also among the major logistic hubs in the European region, they support the growth of the smart container market.

Food and beverages vertical to grow at the highest rate in Asia Pacific

The Asia Pacific region is the largest importer in the food and beverages industry. Additionally, there are a few countries that export several commodities in the food and beverage industry. Traditionally, the food and beverage industry suffers from major logistical challenges such as poor supply chain visibility, inefficient inventory management, inaccurate delivery scheduling, and growing regulatory challenges, among others. But as the adoption of technologies such as IoT, AI, cellular, and GPS is increasing, the support for smart containers is increasing in the region. Countries such as China, Japan, and South Korea are expected to emerge as the major adopters of smart containers in the region. These countries are also among the major importers in the food and beverages industry and, thus, the focus on improving the food and beverage shipping industry is higher in the region.

GPS has the largest share in smart container market

GPS technology plays a key role in tracking and monitoring container movement across the globe. It is one of the key sensors installed in containers. With the advent of technology, shipping container GPS trackers that operate on satellite platforms are being implemented to generate the real-time location of the shipping container at short intervals. A large number of companies offer GPS tracking technology through different hardware, and software solutions are emerging in the market. There are various benefits of GPS technology to the shipping industry, such as improved security through geofencing solutions that help reduce the risk of theft and damages and increase the probability of recovering lost containers; automation of procedures through improved communication with asset management software; and higher cost efficiency, resulting from the automation of processes such as inventory reporting and notification of ETA. As GPS technology plays a vital role in improving the safety, reliability, visibility, and cost efficiency of the shipping industry, the implementation of this technology is the highest in the smart container market.

Smart Container Market in Asia Pacific to grow at highest rate

Asia Pacific is expected to be the largest container shipping market globally due to China’s dominance in container manufacturing. China has emerged as the largest manufacturer of shipping containers with approximately 85% of containers manufactured in China. Some of the largest container manufacturing companies in China are China International Marine Container Group Co., Ltd. (CIMC), China COSCO Shipping Corporation Limited, and CXIC Group Containers Co., Ltd. The increasing adoption of several technologies such as AI, cloud computing, IoT, smart sensors, blockchain, and big data in the Asia Pacific region has created a great opportunity for the smart container market to grow. The increasing demand for services such as end-to-end visibility in the supply chain, fleet optimization, and asset tracking also led to the smart container market growth in the Asia Pacific region.

Smart Container Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major Players in the Smart Container Companies include MSC (Switzerland), Sealand – A Maersk Company (US), Globe Tracker (Denmark), Traxens (France), ORBCOMM (US), Shenzhen CIMC Technologies Co., Ltd. (China), and Berlinger & Co. AG (Switzerland).

Smart Container Market Report Scope:

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 3.9 Billion |

| Revenue Forecast in 2027 | USD 9.7 Billion |

| Growth Rate | 19.6% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

|

Smart Container Market Highlights

This report categorizes the smart container market based on offering, technology, vertical, and region.

|

Aspect |

Details |

|

Smart container Market, By Offering |

|

|

Smart container Market, By Technology |

|

|

Smart container Market, By Vertical |

|

|

Smart container MARKET, BY Region |

|

Recent Developments

- In March 2022, ORBCOMM Inc. launched the CT 3500 IoT telematics device for smart management of refrigerated containers and their cargoes, enabling end-to-end, remote visibility and control of containerized assets and shipments on land, rail, and sea. This data-driven refrigerated container solution by ORBCOMM Inc. features enhanced functionality, connectivity options, analytics capabilities, and interoperability with third-party telematics devices. CT 3500 provides customers with remote, two-way control of reefers to monitor critical parameters such as temperature, humidity, control atmosphere settings, and cold treatment from a centralized location.

- In March 2022, Phillips Connect introduced three new smart nosebox GPS gateways during a press conference held in conjunction with the TMC ’22 Annual Meeting and Transportation Technology Exhibition. Retrofittable or specified on new equipment, the new Phillips Connect Smart noseboxes transform trailers into managed assets that provide telematics benefits. The Smart S7 Swiveling Nosebox, Smart Q-Box, and Smart iBox are advanced cellular gateways, GPS trackers, and sensor hubs that deliver trailer location, status, and critical trailer conditions to the cloud. All are equipped with a Phillips Quick-Change-Socket (QCS2) Sta-Dry seven-way connection requiring no additional harnessing or electrical connections.

- In April 2022, Nexxiot AG launched Nexxiot Cargo Monitor, a new sensor device that delivers real-time visibility of the location, status, and condition of shipments around the world. The Internet of Things (IoT) device, which is simply attached to the cargo within the shipping container, can be used to monitor the transportation of high-value and sensitive products, such as perishables, pharmaceuticals, textiles, conditions-sensitive industrial products, and electronics.

- In February 2022, Traxens acquired NEXT4, a French supplier of removable and reusable shipping container trackers, for an undisclosed amount. The two companies will combine efforts to develop and market their highly complementary tracking solutions and their software applications to offer the best of their functionalities to their customers, e.g. shipment scheduling, collaborative risk management, and analysis reports.

Key Questions Addressed by the Report

Which are the major companies in the smart container market? What are their key strategies to strengthen their market presence?

MSC (Switzerland), Sealand – A Maersk Company (US), Globe Tracker (Denmark), Traxens (France), ORBCOMM (US), Shenzhen CIMC Technologies Co., Ltd. (China), and Berlinger & Co. AG (Switzerland) are among the key players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to gain a competitive advantage in the market.

Which is the potential market for smart containers in terms of regions?

Pacific has high growth opportunities due to the increased adoption of technology from not only the major countries such as China and Japan but also developing countries such as India.

What are the opportunities for new market entrants?

The demand for compact containers is increasing. These containers are cheaper and would thus result in lower capital investment to enter the market. Furthermore, as IoT technology and sensor manufacturing advances, the cost of each sensor or the effective cost of IoT devices installed in the containers is expected to reduce. This would also result in reducing the capital investment in the smart container market for new entrants.

Which verticals are expected to drive market growth in the next six years?

Food and beverages and pharmaceuticals are the key verticals expected to drive the market’s growth in the next six years. The demand for controlled and monitored logistics is the highest in both these verticals as the products are highly sensitive. Additionally, the presence of regulations on the condition of products in the food and pharmaceutical verticals plays a key role in increasing demand for smart containers in these verticals.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 SMART CONTAINER MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

FIGURE 2 SMART CONTAINER MARKET, BY REGION

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 SMART CONTAINER MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 4 SMART CONTAINER MARKET: RESEARCH DESIGN

2.2 SECONDARY AND PRIMARY RESEARCH

FIGURE 5 SMART CONTAINER MARKET: RESEARCH APPROACH

2.2.1 SECONDARY DATA

2.2.1.1 Major secondary sources

2.2.1.2 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary interviews with experts

2.2.2.2 Breakdown of primaries

2.2.2.3 Key data from primary sources

2.2.2.4 Key industry insights

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach to capture market size by bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach to capture market size by top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 SMART CONTAINER MARKET: DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS FOR RESEARCH STUDY

2.5.2 LIMITATIONS

2.6 RISK ASSESSMENT

FIGURE 10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 11 GPS TECHNOLOGY SEGMENT TO ACCOUNT FOR LARGEST SHARE OF SMART CONTAINER MARKET IN 2022

FIGURE 12 HARDWARE SEGMENT TO REGISTER HIGHEST CAGR IN MARKET, BY OFFERING, FROM 2022 TO 2027

FIGURE 13 PHARMACEUTICALS VERTICAL TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

FIGURE 14 MARKET TO WITNESS FASTEST GROWTH IN ASIA PACIFIC DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES FOR SMART CONTAINER MARKET PLAYERS

FIGURE 15 INCREASED DEMAND FROM COMMERCIAL AND RESIDENTIAL SECTORS TO BOOST DEMAND

4.2 MARKET, BY OFFERING

FIGURE 16 HARDWARE OFFERING SEGMENT TO REGISTER HIGHEST MARKET SHARE IN 2022

4.3 MARKET, BY VERTICAL AND REGION

FIGURE 17 FOOD AND BEVERAGES AND EUROPE ACCOUNTED FOR LARGEST SHARES OF MARKET IN 2021

4.4 MARKET, BY TECHNOLOGY

FIGURE 18 LORA WAN TECHNOLOGY SEGMENT TO WITNESS FASTEST GROWTH RATE DURING FORECAST PERIOD

4.5 MARKET, BY GEOGRAPHY

FIGURE 19 GERMANY TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 GROWTH IN LOGISTICS INDUSTRY TO BE GREAT OPPORTUNITY IN SMART CONTAINER MARKET

5.2.1 DRIVERS

FIGURE 21 IMPACT OF DRIVERS ON SMART CONTAINER MARKET

5.2.1.1 Increased focus on End-to-End (E2E) supply chain visibility

5.2.1.2 Rise in demand for monitoring and controlling internal container conditions

5.2.1.3 Increased adoption of IoT devices by shipping companies

5.2.2 RESTRAINTS

FIGURE 22 IMPACT OF RESTRAINTS ON SMART CONTAINER MARKET

5.2.2.1 Shipping industry ill-prepared for cyber-attacks

5.2.3 OPPORTUNITIES

FIGURE 23 IMPACT OF OPPORTUNITIES ON SMART CONTAINER MARKET

5.2.3.1 Growth in logistics industry leading to increasing demand for containers

5.2.3.2 Emergence of advanced technologies

5.2.4 CHALLENGES

FIGURE 24 IMPACT OF CHALLENGES ON SMART CONTAINER MARKET

5.2.4.1 Lack of interoperability among IoT devices and sensors

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS OF SMART CONTAINER MARKET

5.4 ECOSYSTEM MAPPING

FIGURE 26 SMART CONTAINER ECOSYSTEM

TABLE 1 COMPANIES AND THEIR ROLES IN SMART CONTAINER ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE OF IMPLEMENTATION TYPES, BY KEY PLAYER

FIGURE 27 AVERAGE SELLING PRICES OF KEY IOT HARDWARE PRODUCTS FOR SMART CONTAINER (USD)

5.5.1.1 Average selling price trend for IoT gateways

TABLE 2 AVERAGE SELLING PRICE TREND FOR IOT GATEWAY

5.5.1.2 Average selling price trend for data loggers

TABLE 3 AVERAGE SELLING PRICE TREND FOR DATA LOGGER

5.5.1.3 Average selling price trend for GPS trackers

TABLE 4 AVERAGE SELLING PRICE TRENDS FOR GPS TRACKERS

5.6 TREND ANALYSIS

5.6.1 E-PLATFORMS

5.6.2 IOT DEVICES

5.6.3 BLOCKCHAIN

5.7 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SMART CONTAINER MARKET

FIGURE 28 REVENUE SHIFT IN MARKET

5.8 TECHNOLOGY ANALYSIS

5.8.1 BLUETOOTH LOW ENERGY (BLE)

5.8.2 INTERNET OF THINGS (IOT)

5.8.3 BIG DATA

5.8.4 LORA TECHNOLOGY

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES IMPACT ON SMART CONTAINER MARKET

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 KEY STAKEHOLDERS & BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES (%)

5.10.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR VERTICALS

TABLE 7 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

5.11 CASE STUDY

5.11.1 USE CASE 1: CFL MULTIMODAL

5.11.2 USE CASE 2: AXA XL

5.11.3 USE CASE 3: HAPAG-LLOYD

5.11.4 USE CASE 4: SWEETLIFE

5.12 TRADE ANALYSIS

5.12.1 CONTAINERS

FIGURE 32 EXPORT DATA FOR CONTAINERS, 2017–2021 (USD MILLION)

FIGURE 33 IMPORT DATA FOR CONTAINERS, 2017–2021 (USD MILLION)

5.13 PATENT ANALYSIS

FIGURE 34 TOP COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

FIGURE 35 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

TABLE 8 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

5.13.1 LIST OF MAJOR PATENTS

5.14 KEY CONFERENCES & EVENTS IN 2023–2024

TABLE 9 SMART CONTAINER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS IN SMART CONTAINER MARKET

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 APAC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.2 STANDARDS AND REGULATIONS RELATED TO MARKET

5.15.2.1 North America

5.15.2.1.1 US

5.15.2.1.1.1 Safe Containers Convention Act - R.S.C., 1985, c. S-1

5.15.2.1.2 Radio standard for gateways on vessels

5.15.2.2 Europe

5.15.2.2.1 France

5.15.2.2.1.1 ISO 6346:2022(MAIN)

5.15.2.2.1.2 ISO 6346

5.15.2.2.1.3 ISO 9897:1997/Cor 1:2001

5.15.2.2.2 UK

5.15.2.2.2.1 ISO 20854:2019

5.15.2.2.2.2 ISO 10368:2006

5.15.2.2.3 Belgium

5.15.2.2.3.1 EPCIS & CBV

5.15.2.2.4 Germany

5.15.2.2.4.1 ISO 10374:1991

5.15.2.2.5 Switzerland

5.15.2.2.5.1 ISO 18185-1:2007

5.15.2.2.5.2 ISO 18186:2011

5.15.2.2.5.3 ISO/TS 18625:2017

6 SMART CONTAINER MARKET, BY OFFERING (Page No. - 82)

6.1 INTRODUCTION

FIGURE 36 MARKET, BY OFFERING

FIGURE 37 HARDWARE TO BE LARGEST OFFERING SEGMENT OF MARKET DURING FORECAST PERIOD

TABLE 14 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 15 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 HARDWARE

TABLE 16 MARKET FOR HARDWARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 MARKET FOR HARDWARE, BY REGION, 2022–2027 (USD MILLION)

TABLE 18 MARKET FOR HARDWARE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 19 MARKET FOR HARDWARE, BY COMPONENT, 2022–2027 (USD MILLION)

6.2.1 SENSORS

TABLE 20 MARKET FOR SENSORS, BY SENSOR TYPE, 2018–2021 (USD MILLION)

TABLE 21 MARKET FOR SENSORS, BY SENSOR TYPE, 2022–2027 (USD MILLION)

6.2.1.1 Temperature sensors

6.2.1.1.1 Temperature sensors most widely used type of sensors

6.2.1.2 Pressure sensors

6.2.1.2.1 Pressure sensors adopted in various applications across oil & gas, chemicals, and food & beverages verticals

6.2.1.3 Humidity sensors

6.2.1.3.1 Humidity sensors subsegment to witness high growth

6.2.1.4 Gas sensors

6.2.1.4.1 Gas sensors increasingly being adopted in oil & gas and chemicals verticals

6.2.1.5 Other sensors

6.2.1.5.1 Other sensors include optical, magnetic, shock detection, leakage detection, and position sensors

TABLE 22 MARKET FOR HARDWARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 MARKET FOR HARDWARE, BY REGION, 2022–2027 (USD MILLION)

6.2.2 CONNECTIVITY DEVICES

6.2.2.1 Connectivity devices to witness highest growth in market for hardware

6.2.3 TELEMATICS AND TELEMETRY DEVICES

6.2.3.1 Telematics and telemetry devices enable efficient logistics management

6.3 SOFTWARE

6.3.1 SMART CONTAINER MARKET FOR SOFTWARE TO WITNESS HIGHEST GROWTH IN ASIA PACIFIC

FIGURE 38 ASIA PACIFIC TO WITNESS HIGHEST GROWTH IN MARKET FOR SOFTWARE DURING FORECAST PERIOD

TABLE 24 MARKET FOR SOFTWARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 MARKET FOR SOFTWARE, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 EUROPE TO DOMINATE SMART CONTAINER SERVICES MARKET DURING FORECAST PERIOD

TABLE 26 MARKET FOR SERVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 MARKET FOR SERVICES, BY REGION, 2022–2027 (USD MILLION)

7 SMART CONTAINER MARKET, BY TECHNOLOGY (Page No. - 92)

7.1 INTRODUCTION

FIGURE 39 SMART CONTAINER MARKET, BY TECHNOLOGY

FIGURE 40 LORA WAN TO GROW AT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 28 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 29 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

7.2 GLOBAL POSITIONING SYSTEM (GPS)

7.2.1 GPS TO HOLD MAJOR SHARE OF SMART CONTAINER TECHNOLOGY MARKET

7.3 CELLULAR

7.3.1 CELLULAR TECHNOLOGY EASIEST WAY TO DETECT AND DEFINE LOCATION OF CONTAINERS

7.4 LORA WAN (LONG RANGE WIDE AREA NETWORK)

7.4.1 LORA WAN CAN REACH SENSORS MONITORING ASSETS INSIDE CONTAINERS DUE TO ITS DEEP INDOOR PENETRATION FEATURE

7.5 BLUETOOTH LOW ENERGY (BLE)

7.5.1 BLE CONSIDERED FUTURE OF CONSUMER ENGAGEMENT IN SUPPLY CHAIN OPERATIONS

7.6 OTHERS

7.6.1 BENEFITS OFFERED BY ALTERNATIVE TECHNOLOGIES TO SLOW DOWN MARKET FOR WI-FI IN COMING YEARS

8 SMART CONTAINER MARKET, BY VERTICAL (Page No. - 97)

8.1 INTRODUCTION

FIGURE 41 MARKET, BY VERTICAL

FIGURE 42 FOOD & BEVERAGES LARGEST SEGMENT OF MARKET DURING FORECAST PERIOD

TABLE 30 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 31 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8.2 FOOD & BEVERAGES

8.2.1 EUROPE TO HOLD MAJOR SHARE OF SMART CONTAINER MARKET FOR FOOD & BEVERAGES VERTICAL DURING FORECAST PERIOD

TABLE 32 MARKET FOR FOOD & BEVERAGES, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR FOOD & BEVERAGES, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 MARKET FOR FOOD & BEVERAGES IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 35 MARKET FOR FOOD & BEVERAGES IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 36 MARKET FOR FOOD & BEVERAGES IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR FOOD & BEVERAGES IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 38 MARKET FOR FOOD & BEVERAGES IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 39 MARKET FOR FOOD & BEVERAGES IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 40 MARKET FOR FOOD & BEVERAGES IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 MARKET FOR FOOD & BEVERAGES IN ROW, BY REGION, 2022–2027 (USD MILLION)

8.3 PHARMACEUTICALS

8.3.1 SMART CONTAINER MARKET FOR PHARMACEUTICALS VERTICAL TO WITNESS HIGHEST GROWTH IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 42 MARKET FOR PHARMACEUTICALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR PHARMACEUTICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 44 MARKET FOR PHARMACEUTICALS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR PHARMACEUTICALS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 46 MARKET FOR PHARMACEUTICALS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR PHARMACEUTICALS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 48 MARKET FOR PHARMACEUTICALS IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR PHARMACEUTICALS IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 50 MARKET FOR PHARMACEUTICALS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MARKET FOR PHARMACEUTICALS IN ROW, BY REGION, 2022–2027 (USD MILLION)

8.4 OIL & GAS

8.4.1 US TO ACCOUNT FOR MAJOR SHARE OF NORTH AMERICAN SMART CONTAINER MARKET FOR OIL & GAS VERTICAL DURING FORECAST PERIOD

TABLE 52 MARKET FOR OIL & GAS, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 MARKET FOR OIL & GAS, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 56 MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 58 MARKET FOR OIL & GAS IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR OIL & GAS IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 60 MARKET FOR OIL & GAS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MARKET FOR OIL & GAS IN ROW, BY REGION, 2022–2027 (USD MILLION)

8.5 CHEMICALS

8.5.1 INCREASED TRADE OF CHEMICAL PRODUCTS IN ASIA PACIFIC TO DRIVE MARKET GROWTH

TABLE 62 SMART CONTAINER MARKET FOR CHEMICALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 MARKET FOR CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 64 MARKET FOR CHEMICALS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 MARKET FOR CHEMICALS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 MARKET FOR CHEMICALS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 MARKET FOR CHEMICALS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 MARKET FOR CHEMICALS IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 MARKET FOR CHEMICALS IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 70 MARKET FOR CHEMICALS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARKET FOR CHEMICALS IN ROW, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHERS

8.6.1 RISE IN DEMAND FOR EFFICIENT TRANSPORTATION OF SENSITIVE MATERIALS TO DRIVE MARKET IN DEFENSE AND MINING SECTOR

TABLE 72 SMART CONTAINER MARKET FOR OTHER VERTICALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 MARKET FOR OTHER VERTICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 MARKET FOR OTHER VERTICALS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 75 MARKET FOR OTHER VERTICALS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 76 MARKET FOR OTHER VERTICALS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 MARKET FOR OTHER VERTICALS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 MARKET FOR OTHER VERTICALS IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 79 MARKET FOR OTHER VERTICALS IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 80 MARKET FOR OTHER VERTICALS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 MARKET FOR OTHER VERTICALS IN ROW, BY REGION, 2022–2027 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 119)

9.1 INTRODUCTION

FIGURE 43 GEOGRAPHIC SNAPSHOT: RAPIDLY GROWING ECONOMIES, SUCH AS INDIA, CHINA, AND MEXICO EMERGING AS NEW POTENTIAL MARKETS

FIGURE 44 SMART CONTAINER MARKET, BY REGION

TABLE 82 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA SMART CONTAINER MARKET, BY COUNTRY

FIGURE 46 US LED MARKET IN NORTH AMERICA IN 2021

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT (2021)

TABLE 84 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 MARKET IN NORTH AMERICA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 87 MARKET IN NORTH AMERICA, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 88 MARKET IN NORTH AMERICA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 89 MARKET IN NORTH AMERICA, BY OFFERING, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 US accounted for major share of North American smart container market

TABLE 90 MARKET IN US, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 91 MARKET FOR IN US, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 92 MARKET IN US, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 93 MARKET FOR IN US, BY VERTICAL, 2022–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increased activities in agriculture and food export to drive market growth

TABLE 94 MARKET IN CANADA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 95 MARKET FOR IN CANADA, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 96 MARKET IN CANADA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 97 MARKET FOR IN CANADA, BY VERTICAL, 2022–2027 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Smart container market in Mexico to grow at highest CAGR

TABLE 98 MARKET IN MEXICO, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 99 MARKET FOR IN MEXICO, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 100 MARKET IN MEXICO, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 101 MARKET FOR IN MEXICO, BY VERTICAL, 2022–2027 (USD MILLION)

9.3 EUROPE

FIGURE 48 EUROPE SMART CONTAINER MARKET, BY COUNTRY

FIGURE 49 EUROPE: MARKET SNAPSHOT (2021)

TABLE 102 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 103 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 104 MARKET IN EUROPE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 105 MARKET IN EUROPE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 106 MARKET IN EUROPE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 107 MARKET IN EUROPE, BY OFFERING, 2022–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increased trade activities in regional food & beverages industry to drive market

TABLE 108 MARKET IN GERMANY, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 109 MARKET FOR IN GERMANY, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 110 MARKET IN GERMANY, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 111 MARKET FOR IN GERMANY, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Chemicals and pharmaceuticals verticals to create demand for smart containers

TABLE 112 SMART CONTAINER MARKET IN FRANCE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 113 MARKET FOR IN FRANCE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 114 MARKET IN FRANCE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 115 MARKET FOR IN FRANCE, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.3 UK

9.3.3.1 High demand for smart container solutions in food & beverages vertical to drive market growth

TABLE 116 MARKET IN UK, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 117 MARKET FOR IN UK, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 118 MARKET IN UK, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 119 MARKET FOR IN UK, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Rapid rise in export of chemicals to drive demand

TABLE 120 SMART CONTAINER MARKET IN ITALY, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 121 MARKET FOR IN ITALY, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 122 MARKET IN ITALY, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 123 MARKET FOR IN ITALY, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.5 REST OF EUROPE

9.3.5.1 Rest of Europe to witness high growth in smart container adoption

TABLE 124 MARKET IN REST OF EUROPE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 125 MARKET FOR IN REST OF EUROPE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 126 MARKET IN REST OF EUROPE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 127 MARKET FOR IN REST OF EUROPE, BY VERTICAL, 2022–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 50 ASIA PACIFIC SMART CONTAINER MARKET, BY COUNTRY

FIGURE 51 ASIA PACIFIC: MARKET SNAPSHOT (2021)

TABLE 128 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 129 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 130 MARKET IN ASIA PACIFIC, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 131 MARKET IN ASIA PACIFIC, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 132 MARKET IN ASIA PACIFIC, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 133 MARKET IN ASIA PACIFIC, BY OFFERING, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Proliferation of trade practices to drive market growth

TABLE 134 MARKET IN CHINA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 135 MARKET FOR IN CHINA, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 136 MARKET IN CHINA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 137 MARKET FOR IN CHINA, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Smart container market for oil & gas vertical in Japan to witness rapid growth

TABLE 138 MARKET IN JAPAN, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 139 MARKET FOR IN JAPAN, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 140 MARKET IN JAPAN, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 141 MARKET FOR IN JAPAN, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Rise in trade activities in pharmaceuticals sector to drive market growth

TABLE 142 MARKET IN INDIA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 143 MARKET FOR IN INDIA, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 144 MARKET IN INDIA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 145 MARKET FOR IN INDIA, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Food & beverages vertical to provide growth opportunities for market

TABLE 146 MARKET IN AUSTRALIA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 147 MARKET FOR IN AUSTRALIA, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 148 MARKET IN AUSTRALIA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 149 MARKET FOR IN AUSTRALIA, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

9.4.5.1 Growth in chemicals and pharmaceuticals industries to fuel demand

TABLE 150 MARKET IN REST OF ASIA PACIFIC, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 151 MARKET FOR IN REST OF ASIA PACIFIC, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 152 MARKET IN REST OF ASIA PACIFIC, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 153 MARKET FOR IN REST OF ASIA PACIFIC, BY VERTICAL, 2022–2027 (USD MILLION)

9.5 REST OF THE WORLD (ROW)

FIGURE 52 SMART CONTAINER MARKET IN REST OF THE WORLD, BY COUNTRY

FIGURE 53 REST OF THE WORLD: MARKET SNAPSHOT (2021)

TABLE 154 MARKET IN REST OF THE WORLD, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 155 MARKET IN REST OF THE WORLD, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 156 MARKET IN REST OF THE WORLD, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 157 MARKET IN REST OF THE WORLD, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 158 MARKET IN REST OF THE WORLD, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 159 MARKET IN REST OF THE WORLD, BY OFFERING, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Oil & gas export to drive smart container demand

TABLE 160 MARKET IN MIDDLE EAST & AFRICA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 161 MARKET FOR IN MIDDLE EAST & AFRICA, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 162 MARKET IN MIDDLE EAST & AFRICA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 163 MARKET IN MIDDLE EAST & AFRICA, BY VERTICAL, 2022–2027 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 Market to witness high growth driven by food & beverages vertical

TABLE 164 MARKET IN SOUTH AMERICA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 165 MARKET FOR IN SOUTH AMERICA, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 166 MARKET IN SOUTH AMERICA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 167 MARKET IN SOUTH AMERICA, BY VERTICAL, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 163)

10.1 INTRODUCTION

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.3 MARKET EVALUATION FRAMEWORK

10.3.1 PRODUCT PORTFOLIO

10.3.2 REGIONAL FOCUS

10.3.3 ORGANIC/INORGANIC PLAY

10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2021

TABLE 168 GLOBAL SMART CONTAINER MARKET: MARKET SHARE ANALYSIS

10.5 COMPETITIVE EVALUATION QUADRANT, 2021

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 54 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES): EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 55 MARKET (GLOBAL): SMES EVALUATION QUADRANT, 2021

10.7 SMART CONTAINER MARKET: COMPANY FOOTPRINT

TABLE 169 COMPANY PRODUCT FOOTPRINT (12 COMPANIES)

TABLE 170 COMPANY TECHNOLOGY FOOTPRINT (10 COMPANIES)

TABLE 171 COMPANY INDUSTRY FOOTPRINT (10 COMPANIES)

TABLE 172 COMPANY REGIONAL FOOTPRINT (10 COMPANIES)

TABLE 173 COMPANY FOOTPRINT (10 COMPANIES)

10.8 SMART CONTAINER MARKET: SMES MATRIX

TABLE 174 MARKET: DETAILED LIST OF KEY SMES

TABLE 175 MARKET: COMPETITIVE BENCHMARKING OF KEY SMES

10.9 COMPETITIVE SITUATIONS AND TRENDS

10.9.1 PRODUCT LAUNCHES

TABLE 176 MARKET: PRODUCT LAUNCHES

10.9.2 DEALS

TABLE 177 MARKET: DEALS

10.9.3 OTHERS

TABLE 178 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 182)

11.1 INTRODUCTION

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)*

11.2 KEY PLAYERS

11.2.1 ORBCOMM INC.

TABLE 179 ORBCOMM INC.: BUSINESS OVERVIEW

FIGURE 56 ORBCOMM INC.: COMPANY SNAPSHOT

11.2.2 SKYCELL AG

TABLE 180 SKYCELL AG: BUSINESS OVERVIEW

11.2.3 TRAXENS

TABLE 181 TRAXENS: BUSINESS OVERVIEW

11.2.4 PHILLIPS CONNECT

TABLE 182 PHILLIPS CONNECT: BUSINESS OVERVIEW

11.2.5 GLOBE TRACKER

TABLE 183 GLOBE TRACKER: BUSINESS OVERVIEW

11.2.6 NEXXIOT AG

TABLE 184 NEXXIOT AG: BUSINESS OVERVIEW

11.2.7 SEALAND - A MAERSK COMPANY

TABLE 185 SEALAND – A MAERSK COMPANY: BUSINESS OVERVIEW

FIGURE 57 AP MOLLER - MAERSK: COMPANY SNAPSHOT

11.2.8 MSC

TABLE 186 MSC: BUSINESS OVERVIEW

11.2.9 AMBROSUS

TABLE 187 AMBROSUS: BUSINESS OVERVIEW

11.2.10 ZILLIONSOURCE TECHNOLOGIES

TABLE 188 ZILLIONSOURCE TECHNOLOGIES: BUSINESS OVERVIEW

11.2.11 BERLINGER & CO. AG

TABLE 189 BERLINGER & CO. AG: BUSINESS OVERVIEW

11.2.12 SHENZHEN CIMC TECHNOLOGY CO., LTD. (CIMC HITECH)

TABLE 190 SHENZHEN CIMC TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

*Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11.3 OTHER KEY COMPANIES

11.3.1 LOGINNO

11.3.2 SAVVY TELEMATIC SYSTEMS AG

11.3.3 SENSOLUS

11.3.4 SECURESYSTEM GMBH

11.3.5 IBM

11.3.6 EMERSON ELECTRIC CO.

11.3.7 SENSITECH INC.

11.3.8 ARVIEM AG

11.3.9 AKUA

11.3.10 MONNIT CORPORATION

11.3.11 HYPERTHINGS

11.3.12 PURFRESH TRANSPORT

11.3.13 AELER TECHNOLOGIES SA

12 ADJACENT & RELATED MARKETS (Page No. - 231)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 COLD CHAIN MONITORING MARKET, BY TEMPERATURE TYPE

TABLE 191 COLD CHAIN MONITORING MARKET, BY TEMPERATURE TYPE, 2017–2020 (USD MILLION)

TABLE 192 COLD CHAIN MONITORING MARKET, BY TEMPERATURE TYPE, 2021–2026 (USD MILLION)

12.3.1 FROZEN

12.3.1.1 Frozen segment to continue to hold larger share of cold chain monitoring market during forecast period

12.3.2 CHILLED

12.3.2.1 Chilled segment to grow at higher CAGR during forecast period

12.4 COLD CHAIN MONITORING MARKET, BY OFFERING

TABLE 193 COLD CHAIN MONITORING MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 194 COLD CHAIN MONITORING MARKET, BY OFFERING, 2021–2026 (USD MILLION)

12.4.1 HARDWARE

TABLE 195 COLD CHAIN MONITORING MARKET, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 196 COLD CHAIN MONITORING MARKET, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 197 COLD CHAIN MONITORING HARDWARE MARKET IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 198 COLD CHAIN MONITORING HARDWARE MARKET IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

TABLE 199 COLD CHAIN MONITORING HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 200 COLD CHAIN MONITORING HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 201 COLD CHAIN MONITORING HARDWARE MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 202 COLD CHAIN MONITORING HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 203 COLD CHAIN MONITORING HARDWARE MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 204 COLD CHAIN MONITORING HARDWARE MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 205 COLD CHAIN MONITORING HARDWARE MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 206 COLD CHAIN MONITORING HARDWARE MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

12.4.1.1 Sensors and data loggers

12.4.1.1.1 Sensors and data loggers increasingly being used to gather real-time data across pharmaceuticals industry

TABLE 207 COLD CHAIN MONITORING SENSORS AND DATA LOGGERS MARKET, BY LOGISTICS, 2017–2020 (USD MILLION)

TABLE 208 COLD CHAIN MONITORING SENSORS AND DATA LOGGERS MARKET, BY LOGISTICS, 2021–2026 (USD MILLION)

TABLE 209 COLD CHAIN MONITORING SENSORS AND DATA LOGGERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 210 COLD CHAIN MONITORING SENSORS AND DATA LOGGERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 211 COLD CHAIN MONITORING SENSORS AND DATA LOGGERS MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 212 COLD CHAIN MONITORING SENSORS AND DATA LOGGERS MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 213 COLD CHAIN MONITORING SENSORS AND DATA LOGGERS MARKET FOR FOOD & BEVERAGES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 214 COLD CHAIN MONITORING SENSORS AND DATA LOGGERS MARKET FOR FOOD & BEVERAGES, BY TYPE, 2021–2026 (USD MILLION)

12.4.1.2 RFID devices

12.4.1.2.1 High demand for RFID tags in large warehouses to drive cold chain monitoring market during forecast period

TABLE 215 COLD CHAIN MONITORING MARKET FOR RFID DEVICES, BY LOGISTICS, 2017–2020 (USD MILLION)

TABLE 216 COLD CHAIN MONITORING MARKET FOR RFID DEVICES, BY LOGISTICS, 2021–2026 (USD MILLION)

TABLE 217 COLD CHAIN MONITORING MARKET FOR RFID DEVICES, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 218 COLD CHAIN MONITORING MARKET FOR RFID DEVICES, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 219 RFID DEVICES MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 220 RFID DEVICES MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 221 RFID DEVICES MARKET FOR FOOD & BEVERAGES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 222 RFID DEVICES MARKET FOR FOOD & BEVERAGES, BY TYPE, 2021–2026 (USD MILLION)

12.4.1.3 Telematics & telemetry devices

12.4.1.3.1 Rising need for efficient telematics support to track food products in food & beverages industry to drive demand for telematics & telemetry devices

TABLE 223 COLD CHAIN MONITORING MARKET FOR TELEMATICS & TELEMETRY DEVICES, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 224 COLD CHAIN MONITORING MARKET FOR TELEMATICS & TELEMETRY DEVICES, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 225 TELEMATICS & TELEMETRY DEVICES MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 226 TELEMATICS & TELEMETRY DEVICES MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 227 TELEMATICS & TELEMETRY DEVICES MARKET FOR FOOD & BEVERAGES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 228 TELEMATICS & TELEMETRY DEVICES MARKET FOR FOOD & BEVERAGES, BY TYPE, 2021–2026 (USD MILLION)

12.4.1.4 Networking devices

12.4.1.4.1 Growth of networking devices in cold chain monitoring market attributed to growing internationalization of pharmaceuticals supply chain

TABLE 229 COLD CHAIN MONITORING MARKET FOR NETWORKING DEVICES, BY LOGISTICS, 2017–2020 (USD MILLION)

TABLE 230 COLD CHAIN MONITORING MARKET FOR NETWORKING DEVICES, BY LOGISTICS, 2021–2026 (USD MILLION)

TABLE 231 COLD CHAIN MONITORING MARKET FOR NETWORKING DEVICES, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 232 COLD CHAIN MONITORING MARKET FOR NETWORKING DEVICES, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 233 NETWORKING DEVICES MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 234 NETWORKING DEVICES MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 235 NETWORKING DEVICES MARKET FOR FOOD & BEVERAGES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 236 NETWORKING DEVICES MARKET FOR FOOD & BEVERAGES, BY TYPE, 2021–2026 (USD MILLION)

12.4.2 SOFTWARE

TABLE 237 COLD CHAIN MONITORING SOFTWARE MARKET, BY LOGISTICS, 2017–2020 (USD MILLION)

TABLE 238 COLD CHAIN MONITORING SOFTWARE MARKET, BY LOGISTICS, 2021–2026 (USD MILLION)

TABLE 239 COLD CHAIN MONITORING SOFTWARE MARKET IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 240 COLD CHAIN MONITORING SOFTWARE MARKET IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

TABLE 241 COLD CHAIN MONITORING SOFTWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 242 COLD CHAIN MONITORING SOFTWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 243 COLD CHAIN MONITORING SOFTWARE MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 244 COLD CHAIN MONITORING SOFTWARE MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 245 COLD CHAIN MONITORING SOFTWARE MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 246 COLD CHAIN MONITORING SOFTWARE MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 247 COLD CHAIN MONITORING SOFTWARE MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 248 COLD CHAIN MONITORING SOFTWARE MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

12.4.2.1 On-premises

12.4.2.1.1 On-premises deployment suitable for localized cold chain monitoring

12.4.2.2 Cloud-based

12.4.2.2.1 Market for cloud-based deployment type expected to grow at higher CAGR during forecast period

13 APPENDIX (Page No. - 254)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

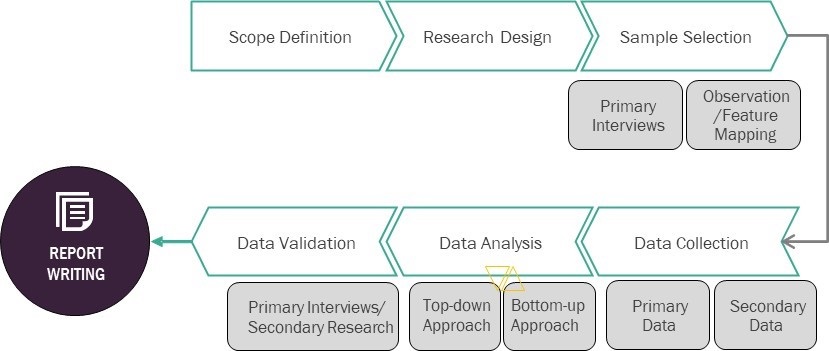

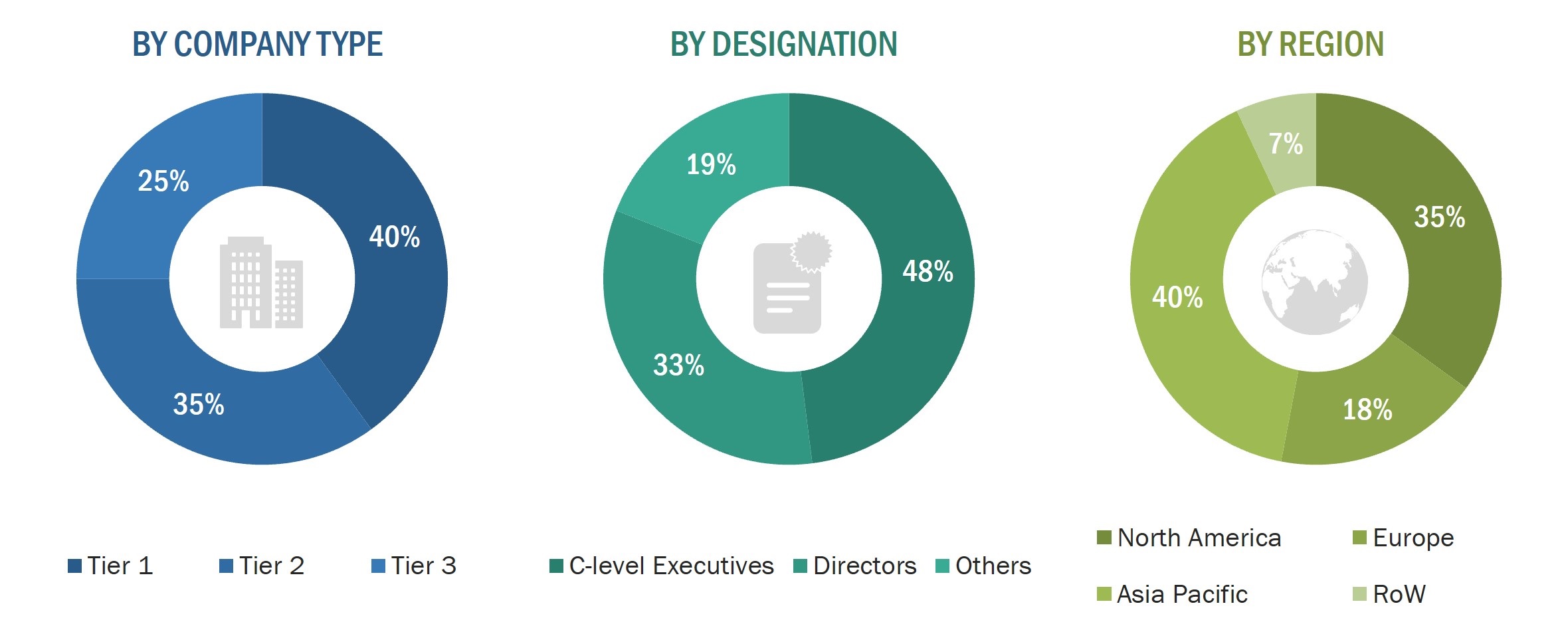

The research process for this study included the systematic gathering, recording, and analysis of data about customers and companies operating in the smart container market. This research study involved the extensive use of secondary sources, directories, and databases (Factiva, OANDA, and OneSource) for identifying and collecting valuable information for this comprehensive, technical, market-oriented, and commercial study of the smart container market. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the smart container market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

In the primary research process, various key correspondents from the supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report. Primary sources from the supply side included CEOs, vice presidents, marketing directors, business development executives, end users, and related executives from various key companies and organizations operating in the smart container market.

Process flow of market size Estimation

Secondary Research

In the secondary research, various sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, smart container products-related journals, and certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, the total pool of key players, market classification and segmentation based on industry trends to the bottom-most level, geographic markets, and key developments from the market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and key executives from major companies and organizations operating in the smart container market.

After going through the entire market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

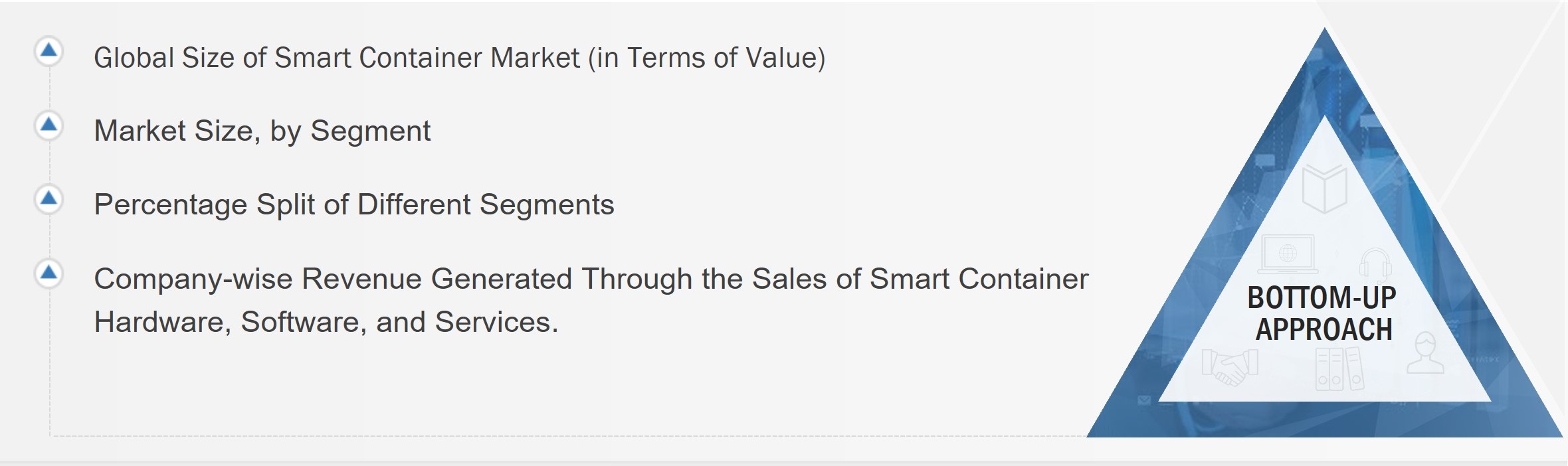

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the smart container market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for both quantitative and qualitative insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Smart Container Market: Bottom-up Approach

Data Triangulation

After arriving at the overall size of the smart container market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the smart container market, in terms of value, segmented by offering, technology, vertical, and region

- To forecast the market size, in terms of value, for North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market’s growth

- To provide a comprehensive overview of the value chain of the smart container ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, and provide a detailed competitive landscape of the market

- To analyze major strategies such as collaborations, acquisitions, product launches, and expansions adopted by the key players to enhance their position in the market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Container Market