Smart Diapers Market by End-Use (Babies, Adults), Technology (RFID Tags, Bluetooth Sensors), and Geography (North America, Asia Pacific, Europe, and Rest of World) (2022 - 2026)

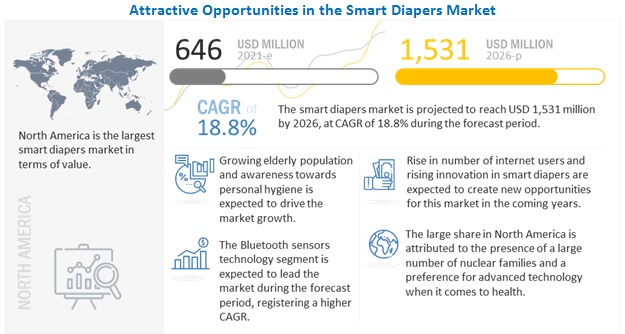

The Smart diapers market is estimated to be USD 646 million in 2021 and is projected to reach USD 1,531 million by 2026, at a cagr 18.8 % from 2021 to 2026. Technological advancements in developing nations and increase in per capita income across the globe are expected to drive the demand for smart diapers during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Smart Diapers Market

The COVID-19 pandemic had a secondary impact on the smart diapers market. The impact of Covid-19 was seen all over the world and it was respond through social protection and medical infrastructure. There was economical crises and the most affected consumers were the poorest. Many major manufacturing companies in diapers market was facing supply chain isuues and labour stortage which has lead to rise in commodity prices. Some of the leading producers of diapers has begun raising prices on baby care goods, including diapers, to counteract the impact rising commodity costs. Even a little rise in the price of a product can make it expensive for low-income households to buy necessities like diapers. The hike will impact families that require diapers. Some families relied on government aid to cover the costs of necessities such as diapers

Smart Diapers Market Dynamics

Driver: Growing awareness towards personal hygiene

It is very important to maintain a good personal hygiene and is a best way to get protection from various infectious diseases. People are getting aware about the hygiene specially when it is related to babies. A smart diaper is a personal hygiene product used for babies and adults to monitor their health. It lets the caretaker know when to change the diaper, thereby immediately removing the wet diaper, ultimately improving personal hygiene and skin health.

Restraint: Low penetration in developing countries

The expenditure on healthcare depends on factors such as the elderly population, per capita disposable income, and lifestyle. Developing countries are not economilically strong. The cost of medical devices such as smart diapers are comparatively higher which make its purchase difficult for the people with low income. The penetration and adoption of the internet in developing countries are lower than that of developed countries. Hence, medical devices such as smart diaper sensors are not accessible to most of the population in developing countries. Inferior economic conditions and technology penetration reduces the accessibility of smart diaper sensors in developing countries, thereby impeding the growth of the smart diaper market.

Opportunity: Increasing innovation in the smart diapers market

Many leading companies such as Kimberly-Clark, Pampers and others are working on making new products and innovation in diapers segment. Kimberly-Clark first launched in October 2018 under their diaper's brand "Huggies." The company has rallied an obscure invention—a Bluetooth sensor that texts parents about their babies' bowel movements. Resercher from MIT has developed a moisture sensor technology in smart diapers

Challenges: High cost of smart diapers

Smart diapers are comparatively expensive and it is build with bluetooth sensor which needs to charged and cleaned regularly, this increases its maintainess cost. This smart diaper technology is almost 20,000 times costlier than a regular diapers. Hence the high cost of smart diapers poses a major challenge in their adoption, especially in developing nations.

Smart Diapers Market: Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

RFID tags is the fastest growing technology segment of the Smart diapers market

The RFID tags technology segment is projected to grow at the highest CAGR from 2021 to 2026. RFID tags can be smart diapers markets which helps to detect diper dampness. For diapers, the technology is comparatively new and hasn't been fully commercialized yet. But it is less expensive than Bluetooth sensors and is expected to grow rapidly in the coming years.

Babies is projected to be the largest end-user segment of the Smart Diapers market

Babies is estimated to be the largest end-use industry segment of the market in 2020. Smart dipers helps caretaker to know the condition of diapers and when it should be removed. It is embedded with a chip or a sensor connected to a device, usually the smartphone, via Bluetooth. The sensors detect and trigger the alarming message to the connected device as soon as it spots any change in the diaper regarding its smell, moisture content, and temperature. Th This process improves skin health and reduces any skin irritation in babies.

Asia Pacific regional segment is expected to be the fastest-growing market for Smart diapers

Asia pacific region is expected to be the fastest growing market for smart diapers as majorly of the global population belongs to Asia and it is expected to hold highest urban population in coming years. The demand of smart diapers is increasing in countries such as China, India, Japan, and South Korea. Innovation, price deflation, increasing population and rising household incomes, especially in emerging Asian markets, have resulted in the high demand for Smart diapers, thereby contributing to the growth of the smart diapers market in this region

Smart Diapers Market Players

Some of the key players in the market Procter & Gamble (US), Kimberly-Clark (US), Simavita (Australia), Ontex (Belgium), Essity Aktiebolag (publ) (Sweden), Abena (Denmark), Sinopulsar (Taiwan), Wonderkin Co. (Honk Kong), Vandrico Solutions Inc (Canada), ATZ Global Co., Ltd. (Bangkok) and DigiSense (Israel).

Smart Diapers Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 646 Million |

|

Revenue Forecast in 2026 |

USD 1,531 Million |

|

CAGR |

18.8% |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Technology, End-use, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Procter & Gamble (US), Kimberly-Clark (US), Simavita (Australia), Ontex (Belgium), Essity Aktiebolag (publ) (Sweden), Abena (Denmark), Sinopulsar (Taiwan), Wonderkin Co. (Honk Kong), Vandrico Solutions Inc (Canada), ATZ Global Co., Ltd. (Bangkok), and DigiSense (Israel), IMEC (Belgium), Shanghai HuaYuan Electronic Co., Ltd (China), Smardii Inc. (US), CviCloud Corporation (Taiwan), and ElderSens (US). |

This research report categorizes the smart diapers market, based on technology, end-user and region, forecasting revenues as well as analyzing trends in each of these submarkets.

Based on Technology:

- RFID Tags

- Bluetooth Sensors

Based on End-use:

- Babies

- Adults

Based on Region:

- Asia Pacific

- North America

- Europe

- RoW

Recent Developments

- In March 2021, Ontex partnered with Woosh to enable the recycling of used disposable diapers. Woosh and Ontex aim to enable the first diaper recycling site in Belgium.

- In October 2020, Kimberly-Clark acquired Softex Indonesia to accelerate growth in the personal care business segment across Southeast Asia.

- In April 2020, Wonderkin Co. launched Wondermom, a smart diaper made for babies with installed sensors, which measures temperature, humidity, and wetness.

Frequently Asked Questions (FAQ):

What are Smart Diapers?

A smart diaper is integrated with sensors connected with mobile applications that alert if the diaper is wet and needs to be changed. The sensors trigger the alarm as soon as they detect any leak. The smart diapers let the caretaker know when to change the diaper.

What are the different technologies of Smart diapers?

Two kind of technologies are used in Smart Diapers which are;

- RFID tags

- Bluetooth sensors

What are the key driving factors for the growth of the global smart diapers market?

The global smart diapers market is expected to witness growth due to the increasing aging population, rapid urbanization, and growing awareness towards personal hygiene.

What is the biggest challenge for the growth of the global smart diapers market?

High cost of smart diapers is expected to act as the market’s biggest challenge in terms of growth.

What are the key regions in the global Smart diapers market?

In terms of region, North America and Europe are the key consumers. This is primarily due to the presence of developed countries like US, Canada, UK, Germany, among others in the region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 SMART DIAPERS MARKET, BY END-USE: INCLUSIONS & EXCLUSIONS

TABLE 2 SMART DIAPERS MARKET, BY TECHNOLOGY: INCLUSIONS & EXCLUSIONS

1.3 SCOPE OF THE STUDY

1.3.1 MARKETS COVERED

FIGURE 1 SMART DIAPERS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION (DEMAND SIDE): SMART DIAPERS MARKET

FIGURE 5 MARKET SIZE ESTIMATION (SUPPLY SIDE): SMART DIAPERS MARKET

2.3 MARKET ENGINEERING PROCESS

FIGURE 6 BOTTOM-UP APPROACH

FIGURE 7 TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 8 SMART DIAPERS MARKET: DATA TRIANGULATION

2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

TABLE 3 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 RISK ASSESSMENT

2.7.1 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

TABLE 4 SMART DIAPERS MARKET SNAPSHOT, 2021 & 2026

FIGURE 9 BABY END-USE SEGMENT ACCOUNTED FOR LARGEST SHARE OF SMART DIAPERS MARKET IN 2020

FIGURE 10 BLUETOOTH SENSORS TECHNOLOGY SEGMENT ACCOUNTED FOR LARGER SHARE OF SMART DIAPERS MARKET IN 2020

FIGURE 11 NORTH AMERICA DOMINATED THE SMART DIAPERS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN SMART DIAPERS MARKET

FIGURE 12 GROWING ELDERLY POPULATION IS A MAJOR FACTOR DRIVING SMART DIAPERS MARKET

4.2 SMART DIAPERS MARKET, BY REGION

FIGURE 13 SMART DIAPERS MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.3 NORTH AMERICA SMART DIAPERS MARKET, BY END-USE AND COUNTRY

FIGURE 14 BABY END-USE SEGMENT AND US ACCOUNTED FOR LARGEST SHARES OF MARKET IN NORTH AMERICA IN 2020

4.4 SMART DIAPERS MARKET: MAJOR COUNTRIES

FIGURE 15 SMART DIAPERS MARKET IN INDIA IS PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 38)

5.1 MARKET DYNAMICS

FIGURE 16 SMART DIAPERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Increasing population & rapid urbanization

FIGURE 17 GLOBAL POPULATION, 2010–2020

5.1.1.2 Growing elderly population

5.1.1.3 Growing awareness toward personal hygiene

5.1.2 RESTRAINTS

5.1.2.1 Low penetration in developing countries

5.1.3 OPPORTUNITIES

5.1.3.1 Rising number of internet users

5.1.3.2 Increasing innovation in the smart diapers market

5.1.4 CHALLENGES

5.1.4.1 High cost of smart diapers

5.1.4.2 Stringent regulatory environment and requirement of product approvals

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 18 PORTER'S FIVE FORCES ANALYSIS: SMART DIAPERS MARKET

TABLE 5 PORTER'S FIVE FORCES ANALYSIS: IMPACT OF EACH FORCE ON SMART DIAPERS MARKET

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF RIVALRY

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM FOR SMART DIAPERS MARKET

FIGURE 20 ECOSYSTEM MARKET MAP FOR SMART DIAPERS MARKET

TABLE 6 SMART DIAPERS MARKET: ECOSYSTEM

5.5 PATENT ANALYSIS

5.5.1 INTRODUCTION

FIGURE 21 PUBLICATION TRENDS (2013–2021)

5.5.2 INSIGHTS

FIGURE 22 TREND ANALYSIS OF PATENTS FILED FOR SMART DIAPERS

FIGURE 23 TOP PATENT HOLDERS

TABLE 7 LIST OF A FEW PATENTS PERTAINING TO SMART DIAPERS, 2017–2021

5.6 PRICING ANALYSIS

TABLE 8 AVERAGE PRICES OF SMART DIAPERS, BY REGION (USD)

5.7 REGULATORY LANDSCAPE

5.7.1 US

5.7.2 EUROPE

5.7.2.1 Germany

5.7.2.2 NORDIC Countries

5.7.3 CHINA

5.7.4 JAPAN

5.8 COVID-19 IMPACT ANALYSIS

5.8.1 COVID-19 HEALTH ASSESSMENT

FIGURE 24 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 25 IMPACT OF COVID-19 ON DIFFERENT COUNTRIES IN 2020 (Q4)

FIGURE 26 THREE SCENARIO-BASED ANALYSES OF COVID-19 IMPACT ON GLOBAL ECONOMY

5.8.2 COVID-19 IMPACT ON SMART DIAPERS MARKET

5.9 CASE STUDIES

5.9.1 LOW-COST "SMART" DIAPER THAT CAN NOTIFY CAREGIVER WHEN DIAPER IS WET

6 SMART DIAPERS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 60)

6.1 INTRODUCTION

6.2 SUPERMARKET & HYPERMARKET

6.3 E-COMMERCE

6.4 DEPARTMENT STORE

6.5 CONVENIENCE STORE

6.6 RETAIL PHARMACIES

7 SMART DIAPERS PRODUCT MARKET, BY TECHNOLOGY (Page No. - 62)

7.1 INTRODUCTION

FIGURE 27 SMART DIAPERS MARKET, BY TECHNOLOGY, 2021 & 2026 (USD MILLION)

TABLE 9 SMART DIAPERS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

7.2 RFID TAGS

TABLE 10 RFID TAGS SMART DIAPERS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 BLUETOOTH SENSORS

TABLE 11 BLUETOOTH SENSORS SMART DIAPERS MARKET, BY REGION, 2019–2026 (USD MILLION)

8 SMART DIAPERS MARKET, BY END-USE (Page No. - 66)

8.1 INTRODUCTION

FIGURE 28 SMART DIAPERS MARKET, BY END-USE, 2021–2026 (USD MILLION)

TABLE 12 SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

8.2 BABIES

TABLE 13 BABIES SMART DIAPERS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 ADULTS

TABLE 14 ADULTS SMART DIAPERS MARKET, BY REGION, 2019–2026 (USD MILLION)

9 SMART DIAPERS MARKET, BY REGION (Page No. - 70)

9.1 INTRODUCTION

FIGURE 29 SMART DIAPERS MARKET, BY MAJOR COUNTRIES, 2021–2026

TABLE 15 SMART DIAPERS MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA SMART DIAPERS MARKET SNAPSHOT

TABLE 16 NORTH AMERICA: SMART DIAPERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 17 NORTH AMERICA: SMART DIAPERS MARKET, BY END USE, 2019–2026 (USD MILLION)

TABLE 18 NORTH AMERICA: SMART DIAPERS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 US is the largest market in North America

TABLE 19 US: SMART DIAPERS MARKET, BY END USE, 2019–2026 (USD MILLION)

9.2.2 MEXICO

9.2.2.1 Increase in the aging population to spur the demand for smart diapers

TABLE 20 MEXICO: SMART DIAPERS MARKET, BY END USE, 2019–2026 (USD MILLION)

9.2.3 CANADA

9.2.3.1 Increase in population facing incontinence

TABLE 21 CANADA: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: SMART DIAPERS MARKET SNAPSHOT

TABLE 22 ASIA PACIFIC: SMART DIAPERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 23 ASIA PACIFIC: SMART DIAPERS MARKET, BY END USE, 2019–2026 (USD MILLION)

TABLE 24 ASIA PACIFIC: SMART DIAPERS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.1 CHINA

9.3.1.1 China is the largest market for smart diapers in Asia Pacific

TABLE 25 CHINA: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.3.2 INDIA

9.3.2.1 Fastest-growing market for smart diapers in Asia Pacific

TABLE 26 INDIA: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.3.3 JAPAN

9.3.3.1 Increased aging population to fuel the demand for smart diapers

TABLE 27 JAPAN: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.3.4 SOUTH KOREA

9.3.4.1 Early adoption of smart diapers

TABLE 28 SOUTH KOREA: SMART DIAPERS MARKET, BY END USE, 2019–2026 (USD MILLION)

9.3.5 SINGAPORE

9.3.5.1 High consumer spending power

TABLE 29 SINGAPORE: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.3.6 AUSTRALIA

9.3.6.1 Hike in urban population

TABLE 30 AUSTRALIA: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.3.7 REST OF ASIA PACIFIC

TABLE 31 REST OF ASIA PACIFIC: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.4 EUROPE

FIGURE 32 EUROPE: SMART DIAPERS MARKET SNAPSHOT

TABLE 32 EUROPE: SMART DIAPERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 33 EUROPE: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

TABLE 34 EUROPE: SMART DIAPERS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Germany is the largest market for smart diapers in Europe

TABLE 35 GERMANY: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.4.2 UK

9.4.2.1 High average income per capita

TABLE 36 UK: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.4.3 FRANCE

9.4.3.1 High birth rates and disposable income

TABLE 37 FRANCE: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.4.4 SPAIN

9.4.4.1 Rising awareness regarding smart diapers

TABLE 38 SPAIN: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.4.5 ITALY

9.4.5.1 Aging population and literacy are expected to drive the market

TABLE 39 ITALY: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.4.6 REST OF EUROPE

TABLE 40 REST OF EUROPE: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

9.5 REST OF THE WORLD (ROW)

TABLE 41 REST OF THE WORLD: SMART DIAPERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 42 REST OF THE WORLD: SMART DIAPERS MARKET, BY END-USE, 2019–2026 (USD MILLION)

TABLE 43 REST OF THE WORLD: SMART DIAPERS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Growing dual-income households to spur the demand for smart diapers

TABLE 44 BRAZIL: SMART DIAPERS MARKET, BY END USE, 2019–2026 (USD MILLION)

9.5.2 UAE

9.5.2.1 High GDP per capita of the country to spur the demand for smart diapers

TABLE 45 UAE: SMART DIAPERS MARKET, BY END USE, 2019–2026 (USD MILLION)

9.5.3 SAUDI ARABIA

9.5.3.1 Increased urban population and decreased infant mortality rate to spur the demand for smart diapers

TABLE 46 SAUDI ARABIA: SMART DIAPERS MARKET, BY END USE, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 90)

10.1 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

TABLE 47 OVERVIEW OF STRATEGIES ADOPTED BY SMART DIAPERS VENDORS

10.2 REVENUE ANALYSIS

FIGURE 33 HISTORICAL REVENUE ANALYSIS OF TOP 5 COMPANIES IN SMART DIAPERS MARKET, 2016-2020 (USD BILLION)

10.3 MARKET SHARE ANALYSIS

FIGURE 34 SMART DIAPERS: MARKET SHARE ANALYSIS

TABLE 48 SMART DIAPERS: DEGREE OF COMPETITION

10.4 COMPANY EVALUATION MATRIX

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE

10.4.4 PARTICIPANTS

FIGURE 35 SMART DIAPERS MARKET: COMPANY EVALUATION MATRIX, 2021

10.5 COMPETITIVE BENCHMARKING

FIGURE 36 COMPANY PRODUCT OFFERINGS

10.5.1 COMPANY TECHNOLOGY FOOTPRINT

10.5.2 COMPANY END-USE FOOTPRINT

10.5.3 COMPANY REGION FOOTPRINT

10.6 COMPETITIVE SCENARIO AND TRENDS

10.6.1 PRODUCT LAUNCHES

TABLE 49 SMART DIAPERS MARKET: PRODUCT LAUNCHES, JANUARY 2016–JULY 2021

10.6.2 DEALS

TABLE 50 SMART DIAPERS MARKET: DEALS, JANUARY 2016–JULY 2021

10.6.3 OTHERS

TABLE 51 SMART DIAPERS MARKET: OTHER DEVELOPMENT, JANUARY 2016–JULY 2021

11 COMPANY PROFILES (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1 PROCTER & GAMBLE

TABLE 52 PROCTER & GAMBLE: BUSINESS OVERVIEW

FIGURE 37 PROCTER & GAMBLE: COMPANY SNAPSHOT

11.2 KIMBERLY-CLARK

TABLE 53 KIMBERLY-CLARK: COMPANY OVERVIEW

FIGURE 38 KIMBERLY-CLARK: COMPANY SNAPSHOT

11.3 SIMAVITA

TABLE 54 SIMAVITA: BUSINESS OVERVIEW

FIGURE 39 SIMAVITA: COMPANY SNAPSHOT

11.4 ONTEX

TABLE 55 ONTEX: BUSINESS OVERVIEW

FIGURE 40 ONTEX: COMPANY SNAPSHOT

11.5 ESSITY AKTIEBOLAG (PUBL)

TABLE 56 ESSITY AKTIEBOLAG (PUBL): COMPANY OVERVIEW

FIGURE 41 ESSITY AKTIEBOLAG (PUBL): COMPANY SNAPSHOT

11.6 ABENA

TABLE 57 ABENA: BUSINESS OVERVIEW

11.7 DIGISENSE

TABLE 58 DIGISENSE: BUSINESS OVERVIEW

11.8 ELDERSENS

TABLE 59 ELDERSENS: BUSINESS OVERVIEW

11.9 SMARDII INC.

TABLE 60 SMARDII INC.: BUSINESS OVERVIEW

11.10 SINOPULSAR

TABLE 61 SINOPULSAR: BUSINESS OVERVIEW

11.11 WONDERKIN CO.

TABLE 62 WONDERKIN CO.: BUSINESS OVERVIEW

11.12 CVICLOUD CORPORATION

TABLE 63 CVICLOUD CORPORATION: BUSINESS OVERVIEW

11.13 VANDRICO SOLUTIONS INC

TABLE 64 VANDRICO SOLUTIONS INC: BUSINESS OVERVIEW

11.14 ATZ GLOBAL CO., LTD.

TABLE 65 ATZ GLOBAL CO., LTD.: BUSINESS OVERVIEW

11.15 IMEC

TABLE 66 IMEC: BUSINESS OVERVIEW

11.16 SHANGHAI HUAYUAN ELECTRONIC CO., LTD

TABLE 67 SHANGHAI HUAYUAN ELECTRONIC CO., LTD: BUSINESS OVERVIEW

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 129)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

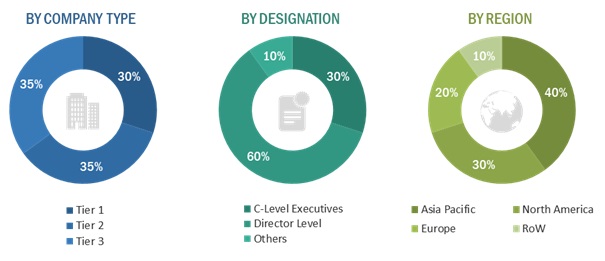

The study involved 4 major activities in estimating the current smart diapers market size. Exhaustive secondary research was undertaken to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market sizes of segments and subsegments.

Secondary Research

As a part of the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, market’s monetary chain, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

As a part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the polyimide films market. Primary sources from the demand side included directors, marketing heads, and purchase managers from end-use industries. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the smart diapers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through the primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process, and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were used, wherever applicable. The data were triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market was validated using both, top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the smart diapers market based on end-use, technology, and region

- To forecast the market size in terms of value concerning the main regions, namely, Asia Pacific, North America, Europe, and the Rest of the World, along with key countries in each of the regions

- To provide detailed information about key factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape of the market

- To strategically profile key players and comprehensively analyze their core competencies1

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) activities in the smart diapers market

The following customization options are available for the report:

Product matrix, which gives a detailed comparison of the product portfolio of each company

- Further breakdown of a region concerning a particular country

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Diapers Market