2

RESEARCH METHODOLOGY

48

5

MARKET OVERVIEW

Surging IoT and AI advancements revolutionize medical device connectivity and predictive healthcare analytics.

74

5.2.1.1

Increasing adoption of sensors in portable and connected medical devices

5.2.1.2

Growing geriatric population and increasing life expectancy

5.2.1.3

Rising demand for wearable medical devices

5.2.1.4

Surging adoption of IoT-based medical devices

5.2.1.5

Burgeoning healthcare expenditure

5.2.2.1

Low penetration of medical devices in emerging economies

5.2.2.2

Complexity in designing compatible medical sensors

5.2.3.1

Expanding telehealth and remote patient monitoring ecosystem

5.2.3.2

Growth of smart hospitals and digital health infrastructure

5.2.3.3

Innovations in implantable medical sensors

5.2.3.4

Rising adoption of flexible electronics and MEMS technology

5.2.4.1

Stringent regulatory requirements for product approvals

5.2.4.2

Lack of data security and patient privacy in IoT-enabled and wireless medical devices

5.3

TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.4.1

MINIATURIZATION AND WEARABLE SENSOR DEVELOPMENT FOR REMOTE PATIENT MONITORING

5.4.2

AI-ENHANCED SENSOR ANALYTICS AND PREDICTIVE DIAGNOSTICS

5.4.3

REGULATORY PUSH TOWARD INTEROPERABILITY AND CONNECTED MEDICAL SENSOR ECOSYSTEMS

5.7.1.1

Sensor element technologies

5.7.1.2

Signal processing & conditioning electronics

5.7.1.3

Sensor materials & packaging technologies

5.7.2

COMPLEMENTARY TECHNOLOGIES

5.7.2.1

Wireless communication & connectivity solutions

5.7.2.2

Power management & energy harvesting

5.7.3

ADJACENT TECHNOLOGIES

5.7.3.1

AI and ML-based sensor data analytics

5.7.3.2

Sensor fusion & contextual awareness systems

5.7.3.3

Cloud & edge computing

5.8

TARIFF & REGULATORY ANALYSIS

5.8.2

REGULATORY ANALYSIS

5.8.2.1

Regulatory bodies, government agencies, and other organizations

5.8.2.2

Regulatory framework

5.9

TRADE ANALYSIS, 2020–2024

5.9.1

IMPORT DATA FOR HSN CODE 901813, 2020–2024

5.9.2

EXPORT DATA FOR HSN CODE 901813, 2020–2024

5.10.1

AVERAGE SELLING PRICE TREND OF MEDICAL SENSORS, BY SENSOR TYPE, 2020–2029

5.10.2

AVERAGE SELLING PRICE OF MEDICAL SENSORS, BY KEY PLAYER, 2024

5.10.3

INDICATIVE PRICING OF MEDICAL SENSORS, BY REGION, 2024

5.11

PORTER’S FIVE FORCES ANALYSIS

5.11.1

THREAT OF NEW ENTRANTS

5.11.2

THREAT OF SUBSTITUTES

5.11.3

BARGAINING POWER OF SUPPLIERS

5.11.4

BARGAINING POWER OF BUYERS

5.11.5

INTENSITY OF COMPETITIVE RIVALRY

5.12

KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.12.2

KEY BUYING CRITERIA

5.13.1

PATENT PUBLICATION TRENDS FOR MEDICAL SENSORS

5.13.2

JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR MEDICAL SENSORS

5.13.3

KEY PATENTS IN MEDICAL SENSORS MARKET

5.13.4

LIST OF KEY PATENTS/PATENT APPLICATIONS

5.14

UNMET NEEDS & END-USER EXPECTATIONS

5.14.2

END-USER EXPECTATIONS

5.15

KEY CONFERENCES & EVENTS, 2025–2026

5.16.1

PROMET OPTICS TO DEVELOP FLEXIBLE OPTICAL SENSING SOLUTION FOR INTERNATIONAL CORPORATION

5.16.2

ZOLL MEDICAL TO DEVELOP PALM-SIZED CPR DEVICE USING MOTION SENSORS BY ANALOG DEVICES

5.16.3

PEAK SENSORS TO OFFER ERROR-FREE TEMPERATURE SENSORS TO UNDISCLOSED INTERNATIONAL MEDICAL COMPANY

5.17

INVESTMENT & FUNDING SCENARIO

5.18.1

B2B OEM INTEGRATION MODEL

5.18.2

SUBSCRIPTION-BASED MODEL (SAAS)

5.18.3

VALUE-BASED/OUTCOME-BASED MODEL

5.19

IMPACT OF AI/GEN AI ON MEDICAL SENSORS MARKET

5.19.1

TOP USE CASES & MARKET POTENTIAL

5.19.3

CASE STUDIES OF AI/GEN AI IMPLEMENTATION

5.19.3.1

AI-powered predictive analytics to enhance medical sensor performance and patient monitoring

5.19.4

IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

5.19.4.1

Disposable medical device sensors market

5.19.4.2

Wearable sensors market

5.19.4.3

Medical electronics market

5.19.5

USER READINESS & IMPACT ASSESSMENT

5.19.5.2

Impact assessment

5.20

IMPACT OF 2025 US TARIFF ON MEDICAL SENSORS MARKET

5.20.3

PRICE IMPACT ANALYSIS

5.20.3.1

Sensor hardware & components

5.20.3.2

AI & analytics integration

5.20.3.3

Firmware updates

5.20.3.4

Offshore development & support

5.20.4

IMPACT ON COUNTRY/REGION

5.20.5

IMPACT ON END-USE INDUSTRIES

5.20.5.1

Hospitals & clinics

5.20.5.2

Nursing homes, assisted living, long-term care, and home care settings

6

MEDICAL SENSORS MARKET, BY SENSOR TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million and Units | 36 Data Tables

126

6.2.1.1

Rising demand for remote patient monitoring and AI-integrated wearable technology among cardiovascular patients to drive market

6.2.2.1

Application in neurofeedback therapy, cognitive enhancement, and brain-computer interface research to aid market growth

6.2.3.1

Growing adoption for physical rehabilitation, neuroprosthetics, robotics, and sports medicine to augment segment growth

6.2.4

OTHER BIOPOTENTIAL SENSORS

6.3.1

TEMPERATURE SENSORS

6.3.1.3

Other temperature sensors

6.3.2.1

Blood pressure sensors

6.3.2.2

Intracranial pressure sensors

6.3.2.3

Other pressure sensors

6.3.3

BLOOD OXYGEN SENSORS

6.3.3.1

Blood oxygen sensors to detect respiratory deterioration and fuel proactive, home-based disease management

6.4.1.1

Digital radiography and AI-powered screening to bolster demand for X-ray sensors

6.4.2.1

High-fidelity and non-ionizing imaging to expand MRI sensor integration in neuro and cardiac care

6.4.3.1

Miniaturized piezoelectric arrays to empower ultrasound sensors in point-of-care and wearable imaging

6.5.1

BLOOD GLUCOSE SENSORS

6.5.1.1

Rising diabetes prevalence and non-invasive CGM innovations to fuel adoption in home and clinical settings

6.5.2

ENZYME-BASED SENSORS

6.5.2.1

Multi-analyte detection and wearable integration to position enzyme-based sensors as core components of next-gen diagnostics

6.6

MOTION/POSITION SENSORS

6.6.1.1

Accelerometers to enable accurate activity monitoring and fall detection in wearable devices

6.6.2.1

Gyroscopes to support balance assessment and surgical precision in connected medical systems

6.7.1

FLOW SENSORS TO POWER PRECISION DOSING AND CONNECTED RESPIRATORY CARE ACROSS CLINICAL AND HOME SETTINGS

7

MEDICAL SENSORS MARKET, BY PRODUCT TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 5 Data Tables

151

7.2.1

ADVANCED, MINIATURIZED, AND SWALLOWABLE SENSORS TO GAIN TRACTION IN PERSONALIZED AND PREVENTIVE HEALTHCARE

7.3.1

IMPLANTABLE SENSORS TO IMPROVE PRECISION DIAGNOSTICS THROUGH REAL-TIME MONITORING OF INTERNAL PHYSIOLOGICAL PARAMETERS

7.4

EXTERNAL (NON-INVASIVE) SENSORS

7.4.1

EASE OF USE, HIGH PATIENT COMPLIANCE, AND EXPANDING DEMAND FOR REMOTE MONITORING TO SPUR MARKET GROWTH

8

MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 4 Data Tables

156

8.2

CLASS I MEDICAL SENSORS

8.2.1

RISING ADOPTION OF LOW-RISK SENSORS IN PREVENTIVE AND HOME-BASED CARE TO SUPPORT MARKET GROWTH

8.3

CLASS II MEDICAL SENSORS

8.3.1

EXPANDING WEARABLES ECOSYSTEM AND CHRONIC DISEASE MONITORING TO PROPEL MARKET GROWTH

8.4

CLASS III MEDICAL SENSORS

8.4.1

ADVANCEMENTS IN IMPLANTABLE AND LIFE-SUSTAINING TECHNOLOGIES TO AID MARKET GROWTH

9

MEDICAL SENSORS MARKET, BY APPLICATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 5 Data Tables

160

9.2.1

RISING DEMAND FOR EARLY & ACCURATE DISEASE DETECTION AND PERSONALIZED HEALTH INSIGHTS TO FUEL MARKET GROWTH

9.3.1

GROWTH IN SENSOR-ENABLED DRUG DELIVERY AND IMPLANTS TO DRIVE MARKET

9.4.1

SURGING ADOPTION OF WEARABLES AND REMOTE PATIENT MONITORING PLATFORMS TO ACCELERATE MARKET GROWTH

10

MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 3 Data Tables

165

10.2.1

UNINTERRUPTED, REAL-TIME, AND HIGH-PRECISION PHYSIOLOGICAL MONITORING IN HIGH-ACUITY SETTINGS TO FAVOR MARKET GROWTH

10.3.1

SEAMLESS, REAL-TIME MONITORING OF VITAL PHYSIOLOGICAL PARAMETERS WITHOUT PHYSICAL CONNECTIONS TO DRIVE MARKET

11

MEDICAL SENSORS MARKET, BY TECHNOLOGY

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 7 Data Tables

169

11.2

MICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS)

11.2.1

COMPACT SIZE, LOW POWER CONSUMPTION, AND HIGH SENSITIVITY TO AID ADOPTION IN RESPIRATORY AND CARDIOVASCULAR MONITORING

11.3

COMPLEMENTARY METAL-OXIDE-SEMICONDUCTOR (CMOS)

11.3.1

EFFECIENT REAL-TIME IMAGING AND DIAGNOSTICS IN PORTABLE MEDICAL EQUIPMENT TO AID MARKET GROWTH

11.4

NANO/GRAPHENE-BASED SENSORS

11.4.1

NANO AND GRAPHENE-BASED SENSORS TO DRIVE PRECISION IN MOLECULAR AND BIOMARKER DETECTION

11.5.1

FIBER OPTIC SENSORS TO OFFER HIGH SENSITIVITY FOR REMOTE AND IMPLANTABLE HEALTH MONITORING

11.6

PIEZOELECTRIC SENSORS

11.6.1

BETTER REAL-TIME BIOMECHANICAL AND BIOSIGNAL MONITORING TO AUGMENT ADOPTION IN NEXT-GENERATION SENSOR PLATFORMS

12

MEDICAL SENSORS MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 4 Data Tables

176

12.2.1

INTEGRATION OF SENSOR-ENABLED DEVICES TO MANAGE PATIENT DATA AND ENHANCE CARE DELIVERY

12.3

NURSING HOMES, ASSISTED LIVING FACILITIES, LONG-TERM CARE CENTERS, AND HOME CARE SETTINGS

12.3.1

HIGH COST OF HOSPITAL-BASED CARE AND NEED FOR LONG-TERM PREVENTIVE AND PARTICIPATORY CARE TO PROPEL MARKET GROWTH

13

MEDICAL SENSORS MARKET, BY REGION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 385 Data Tables

181

13.2.1

MACROECONOMIC OUTLOOK FOR NORTH AMERICA

13.2.2.1

US to dominate global medical sensors market during study period

13.2.3.1

Strong government support and digital health adoption to propel market growth

13.3.1

MACROECONOMIC OUTLOOK FOR EUROPE

13.3.2.1

Digital health infrastructure and clinical innovation to fuel sensor integration

13.3.3.1

Favorable government reimbursement and increased focus on industrial innovation to accelerate sensor-based care

13.3.4.1

Strong emphasis on hospital modernization and home-based chronic disease management to drive biosensor use

13.3.5.1

Expansion of telemedicine and enhanced focus on regional pilot programs to boost market growth

13.3.6.1

Proactive chronic disease management and regional innovation to propel sensor adoption

13.4.1

MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

13.4.2.1

High geriatric population to spur adoption of medical sensors in advanced diagnostics and minimally invasive surgical equipment

13.4.3.1

Surging adoption of advanced sensor-enabled diagnostic, monitoring, and therapeutic devices to propel market growth

13.4.4.1

High private healthcare investment and affordability-focused innovation to accelerate market growth

13.4.5.1

Innovation-led ecosystem to support medical sensor adoption

13.4.6.1

Need to enhance healthcare delivery in remote, rural, and indigenous communities to aid sensor demand

13.4.7

REST OF ASIA PACIFIC

13.5.1

MACROECONOMIC OUTLOOK FOR LATIN AMERICA

13.5.2.1

Extensive healthcare infrastructure, regulatory modernization, and domestic manufacturing base to spur market growth

13.5.3.1

Increased integration into global supply chain and robust regional manufacturing capabilities to drive market

13.5.4

REST OF LATIN AMERICA

13.6

MIDDLE EAST & AFRICA

13.6.1

MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

13.6.3.1

Regulatory reforms and Vision 2030 investments to make Saudi Arabia regional leader in medical sensors

13.6.4.1

Digital-first ecosystem to drive medical sensor adoption in digital health and smart healthcare devices

13.6.5

REST OF GCC COUNTRIES

13.6.6

REST OF MIDDLE EAST & AFRICA

14

COMPETITIVE LANDSCAPE

Discover strategic insights and market positioning of key players and startups in medical sensors.

332

14.2

KEY PLAYER STRATEGIES/RIGHT TO WIN

14.2.1

OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL SENSORS MARKET

14.3

REVENUE ANALYSIS, 2020–2024

14.4

MARKET SHARE ANALYSIS, 2024

14.5

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

14.5.5

COMPANY FOOTPRINT: KEY PLAYERS, 2024

14.5.5.1

Company footprint

14.5.5.2

Region footprint

14.5.5.3

Sensor type footprint

14.5.5.4

Product type footprint

14.5.5.5

Application footprint

14.5.5.6

Connectivity/Integration footprint

14.6

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

14.6.1

PROGRESSIVE COMPANIES

14.6.2

RESPONSIVE COMPANIES

14.6.5

COMPETITIVE BENCHMARKING: STARTUPS/SME PLAYERS, 2024

14.6.5.1

Detailed list of key startups/SMEs

14.6.5.2

Competitive benchmarking of startups/SMEs

14.7

COMPANY VALUATION & FINANCIAL METRICS

14.8

BRAND/PRODUCT COMPARISON

14.9

COMPETITIVE SCENARIO

14.9.1

PRODUCT LAUNCHES & APPROVALS

14.9.4

OTHER DEVELOPMENTS

15.1.1.1

Business overview

15.1.1.2

Products/Services/Solutions offered

15.1.1.3

Recent developments

15.1.2.1

Business overview

15.1.2.2

Products/Services/Solutions offered

15.1.2.3

Recent developments

15.1.3

ANALOG DEVICES, INC.

15.1.3.1

Business overview

15.1.3.2

Products/Services/Solutions offered

15.1.3.3

Recent developments

15.1.4

HONEYWELL INTERNATIONAL INC.

15.1.4.1

Business overview

15.1.4.2

Products/Services/Solutions offered

15.1.4.3

Recent developments

15.1.5

TEXAS INSTRUMENTS INCORPORATED

15.1.5.1

Business overview

15.1.5.2

Products/Services/Solutions offered

15.1.5.3

Recent developments

15.1.6

AMPHENOL CORPORATION

15.1.6.1

Business overview

15.1.6.2

Products/Services/Solutions offered

15.1.6.3

Recent developments

15.1.7.1

Business overview

15.1.7.2

Products/Services/Solutions offered

15.1.7.3

Recent developments

15.1.8

STMICROELECTRONICS

15.1.8.1

Business overview

15.1.8.2

Products/Services/Solutions offered

15.1.8.3

Recent developments

15.1.9.1

Business overview

15.1.9.2

Products/Services/Solutions offered

15.1.9.3

Recent developments

15.1.10

EXCELITAS TECHNOLOGIES CORP.

15.1.10.1

Business overview

15.1.10.2

Products/Services/Solutions offered

15.1.10.3

Recent developments

15.1.11.1

Business overview

15.1.11.2

Products/Services/Solutions offered

15.1.11.3

Recent developments

15.1.12

NXP SEMICONDUCTORS

15.1.12.1

Business overview

15.1.12.2

Products/Services/Solutions offered

15.1.12.3

Recent developments

15.1.13

SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

15.1.13.1

Business overview

15.1.13.2

Products/Services/Solutions offered

15.1.13.3

Recent developments

15.1.14.1

Business overview

15.1.14.2

Products/Services/Solutions offered

15.1.14.3

Recent developments

15.1.15

NIHON KOHDEN CORPORATION

15.1.15.1

Business overview

15.1.15.2

Products/Services/Solutions offered

15.1.15.3

Recent developments

15.1.16

INNOVATIVE SENSOR TECHNOLOGY IST AG

15.1.16.1

Business overview

15.1.16.2

Products/Services/Solutions offered

15.1.17.1

Business overview

15.1.17.2

Products/Services/Solutions offered

15.1.17.3

Recent developments

15.1.18.1

Business overview

15.1.18.2

Products/Services/Solutions offered

15.1.18.3

Recent developments

15.1.19

MURATA MANUFACTURING CO., LTD.

15.1.19.1

Business overview

15.1.19.2

Products/Services/Solutions offered

15.1.19.3

Recent developments

15.1.20.1

Business overview

15.1.20.2

Products/Services/Solutions offered

15.1.20.3

Recent developments

15.2.2

SUPERIOR SENSORS TECHNOLOGY

15.2.4

ALTHEN SENSORS AND CONTROLS

16.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3

CUSTOMIZATION OPTIONS

TABLE 1

MEDICAL SENSORS MARKET: INCLUSIONS & EXCLUSIONS

TABLE 2

EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

TABLE 3

MEDICAL SENSORS MARKET: FACTOR ANALYSIS

TABLE 4

MEDICAL SENSORS MARKET SIZING ASSUMPTIONS

TABLE 5

MEDICAL SENSORS MARKET: RISK ANALYSIS

TABLE 6

MEDICAL SENSORS MARKET: IMPACT ANALYSIS

TABLE 7

MEDICAL SENSORS MARKET: ROLE IN ECOSYSTEM

TABLE 8

MFN TARIFFS FOR HS CODE 901813-COMPLIANT PRODUCTS EXPORTED BY US, 2024

TABLE 9

MFN TARIFFS FOR HS CODE 901813-COMPLIANT PRODUCTS EXPORTED BY JAPAN, 2024

TABLE 10

MFN TARIFFS FOR HS CODE 901813-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

TABLE 11

MFN TARIFFS FOR HS CODE 901813-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2024

TABLE 12

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15

LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16

MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17

REGULATORY SCENARIO OF NORTH AMERICA

TABLE 18

REGULATORY SCENARIO OF EUROPE

TABLE 19

REGULATORY SCENARIO OF ASIA PACIFIC

TABLE 20

REGULATORY SCENARIO OF MIDDLE EAST & AFRICA

TABLE 21

REGULATORY SCENARIO OF LATIN AMERICA

TABLE 22

IMPORT DATA FOR HSN CODE 901813, BY COUNTRY, 2024 (USD THOUSAND)

TABLE 23

EXPORT DATA FOR HSN CODE 901813, BY COUNTRY, 2024 (USD THOUSAND)

TABLE 24

AVERAGE SELLING PRICE TREND OF MEDICAL SENSORS, BY SENSOR TYPE, 2020–2029 (USD)

TABLE 25

AVERAGE SELLING PRICE OF MEDICAL SENSORS, BY KEY PLAYER, 2024

TABLE 26

INDICATIVE PRICING OF MEDICAL SENSORS, BY REGION, 2024

TABLE 27

MEDICAL SENSORS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 28

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

TABLE 29

KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 30

JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR MEDICAL SENSOR PATENTS

TABLE 31

MEDICAL SENSORS MARKET: LIST OF KEY PATENTS/PATENT APPLICATIONS

TABLE 32

UNMET NEEDS IN MEDICAL SENSORS MARKET

TABLE 33

END-USER EXPECTATIONS IN MEDICAL SENSORS MARKET

TABLE 34

LIST OF KEY CONFERENCES & EVENTS IN MEDICAL SENSORS MARKET, JANUARY 2025–DECEMBER 2026

TABLE 35

CASE STUDY 1: PROMET OPTICS TO DEVELOP FLEXIBLE OPTICAL SENSING SOLUTION FOR INTERNATIONAL CORPORATION

TABLE 36

CASE STUDY 2: ZOLL MEDICAL TO DEVELOP PALM-SIZED CPR DEVICE USING MOTION SENSORS BY ANALOG DEVICES

TABLE 37

CASE STUDY 3: PEAK SENSORS TO OFFER ERROR-FREE TEMPERATURE SENSORS TO UNDISCLOSED INTERNATIONAL MEDICAL COMPANY

TABLE 38

CASE STUDY: AI-POWERED PREDICTIVE ANALYTICS TO ENHANCE MEDICAL SENSOR PERFORMANCE AND PATIENT MONITORING

TABLE 39

US ADJUSTED RECIPROCAL TARIFF RATES

TABLE 40

MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 41

BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 42

BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (MILLION UNITS)

TABLE 43

BIOPOTENTIAL MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 44

ECG SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 45

EEG SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 46

EMG SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 47

OTHER BIOPOTENTIAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 48

BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 49

BIOPHYSICAL MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 50

TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 51

TEMPERATURE SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 52

THERMISTORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 53

INFRARED SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 54

OTHER TEMPERATUE SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 55

PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 56

PRESSURE SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 57

BLOOD PRESSURE SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 58

INTRACRANIAL PRESSURE SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 59

OTHER PRESSURE SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 60

BLOOD OXYGEN SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 61

MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 62

MEDICAL IMAGE SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 63

X-RAY SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 64

MRI SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 65

ULTRASOUND SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 66

BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 67

BIOCHEMICAL MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 68

BLOOD GLUCOSE SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 69

ENZYME-BASED SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 70

MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 71

MOTION/POSITION MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 72

ACCELEROMETERS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 73

GYROSCOPES MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 74

MEDICAL FLOW SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 75

OTHER MEDICAL SENSOR TYPES MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 76

MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 77

INGESTIBLE MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 78

IMPLANTABLE MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 79

EXTERNAL (NON-INVASIVE) MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 80

OTHER MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 81

MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 82

CLASS I MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 83

CLASS II MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 84

CLASS III MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 85

MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 86

MEDICAL SENSORS MARKET FOR DIAGNOSTICS, BY REGION, 2023–2030 (USD MILLION)

TABLE 87

MEDICAL SENSORS MARKET FOR THERAPEUTICS, BY REGION, 2023–2030 (USD MILLION)

TABLE 88

MEDICAL SENSORS MARKET FOR MONITORING, BY REGION, 2023–2030 (USD MILLION)

TABLE 89

MEDICAL SENSORS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023–2030 (USD MILLION)

TABLE 90

MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 91

WIRED MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 92

WIRELESS MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 93

MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 94

MEDICAL SENSORS MARKET FOR MICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS), BY REGION, 2023–2030 (USD MILLION)

TABLE 95

MEDICAL SENSORS MARKET FOR COMPLEMENTARY METAL-OXIDE SEMICONDUCTOR (CMOS), BY REGION, 2023–2030 (USD MILLION)

TABLE 96

MEDICAL SENSORS MARKET FOR NANO/GRAPHENE-BASED SENSORS, BY REGION, 2023–2030 (USD MILLION)

TABLE 97

MEDICAL SENSORS MARKET FOR FIBER-OPTIC SENSORS, BY REGION, 2023–2030 (USD MILLION)

TABLE 98

MEDICAL SENSORS MARKET FOR PIEZOELECTRIC SENSORS, BY REGION, 2023–2030 (USD MILLION)

TABLE 99

MEDICAL SENSORS MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2023–2030 (USD MILLION)

TABLE 100

MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 101

MEDICAL SENSORS MARKET FOR HOSPITALS & CLINICS, BY REGION, 2023–2030 (USD MILLION)

TABLE 102

MEDICAL SENSORS MARKET FOR NURSING HOMES, ASSISTED LIVING FACILITIES, LONG-TERM CARE CENTERS, AND HOME CARE SETTINGS, BY REGION, 2023–2030 (USD MILLION)

TABLE 103

MEDICAL SENSORS MARKET FOR OTHER END USERS, BY REGION, 2023–2030 (USD MILLION)

TABLE 104

MEDICAL SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 105

NORTH AMERICA: MEDICAL SENSORS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 106

NORTH AMERICA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 107

NORTH AMERICA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 108

NORTH AMERICA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 109

NORTH AMERICA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 110

NORTH AMERICA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 111

NORTH AMERICA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 112

NORTH AMERICA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 113

NORTH AMERICA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 114

NORTH AMERICA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 115

NORTH AMERICA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 116

NORTH AMERICA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 117

NORTH AMERICA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 118

NORTH AMERICA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 119

NORTH AMERICA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 120

US: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 121

US: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 122

US: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 123

US: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 124

US: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 125

US: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 126

US: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 127

US: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 128

US: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 129

US: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 130

US: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 131

US: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 132

US: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 133

US: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 134

CANADA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 135

CANADA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 136

CANADA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 137

CANADA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 138

CANADA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 139

CANADA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 140

CANADA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 141

CANADA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 142

CANADA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 143

CANADA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 144

CANADA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 145

CANADA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 146

CANADA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 147

CANADA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 148

EUROPE: MEDICAL SENSORS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 149

EUROPE: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 150

EUROPE: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 151

EUROPE: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 152

EUROPE: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 153

EUROPE: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 154

EUROPE: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 155

EUROPE: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 156

EUROPE: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 157

EUROPE: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 158

EUROPE: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 159

EUROPE: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 160

EUROPE: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 161

EUROPE: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 162

EUROPE: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 163

UK: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 164

UK: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 165

UK: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 166

UK: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 167

UK: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 168

UK: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 169

UK: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 170

UK: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 171

UK: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 172

UK: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 173

UK: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 174

UK: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 175

UK: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 176

UK: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 177

GERMANY: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 178

GERMANY: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 179

GERMANY: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 180

GERMANY: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 181

GERMANY: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 182

GERMANY: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 183

GERMANY: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 184

GERMANY: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 185

GERMANY: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 186

GERMANY: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 187

GERMANY: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 188

GERMANY: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 189

GERMANY: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 190

GERMANY: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 191

FRANCE: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 192

FRANCE: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 193

FRANCE: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 194

FRANCE: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 195

FRANCE: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 196

FRANCE: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 197

FRANCE: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 198

FRANCE: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 199

FRANCE: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 200

FRANCE: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 201

FRANCE: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 202

FRANCE: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 203

FRANCE: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 204

FRANCE: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 205

ITALY: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 206

ITALY: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 207

ITALY: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 208

ITALY: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 209

ITALY: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 210

ITALY: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 211

ITALY: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 212

ITALY: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 213

ITALY: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 214

ITALY: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 215

ITALY: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 216

ITALY: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 217

ITALY: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 218

ITALY: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 219

SPAIN: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 220

SPAIN: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 221

SPAIN: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 222

SPAIN: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 223

SPAIN: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 224

SPAIN: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 225

SPAIN: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 226

SPAIN: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 227

SPAIN: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 228

SPAIN: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 229

SPAIN: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 230

SPAIN: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 231

SPAIN: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 232

SPAIN: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 233

REST OF EUROPE: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 234

REST OF EUROPE: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 235

REST OF EUROPE: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 236

REST OF EUROPE: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 237

REST OF EUROPE: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 238

REST OF EUROPE: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 239

REST OF EUROPE: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 240

REST OF EUROPE: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 241

REST OF EUROPE: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 242

REST OF EUROPE: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 243

REST OF EUROPE: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 244

REST OF EUROPE: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 245

REST OF EUROPE: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 246

REST OF EUROPE: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 247

ASIA PACIFIC: MEDICAL SENSORS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 248

ASIA PACIFIC: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 249

ASIA PACIFIC: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 250

ASIA PACIFIC: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 251

ASIA PACIFIC: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 252

ASIA PACIFIC: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 253

ASIA PACIFIC: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 254

ASIA PACIFIC: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 255

ASIA PACIFIC: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 256

ASIA PACIFIC: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 257

ASIA PACIFIC: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 258

ASIA PACIFIC: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 259

ASIA PACIFIC: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 260

ASIA PACIFIC: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 261

ASIA PACIFIC: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 262

JAPAN: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 263

JAPAN: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 264

JAPAN: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 265

JAPAN: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 266

JAPAN: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 267

JAPAN: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 268

JAPAN: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 269

JAPAN: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 270

JAPAN: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 271

JAPAN: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 272

JAPAN: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 273

JAPAN: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 274

JAPAN: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 275

JAPAN: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 276

CHINA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 277

CHINA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 278

CHINA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 279

CHINA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 280

CHINA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 281

CHINA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 282

CHINA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 283

CHINA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 284

CHINA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 285

CHINA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 286

CHINA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 287

CHINA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 288

CHINA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 289

CHINA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 290

INDIA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 291

INDIA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 292

INDIA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 293

INDIA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 294

INDIA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 295

INDIA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 296

INDIA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 297

INDIA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 298

INDIA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 299

INDIA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 300

INDIA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 301

INDIA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 302

INDIA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 303

INDIA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 304

SOUTH KOREA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 305

SOUTH KOREA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 306

SOUTH KOREA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 307

SOUTH KOREA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 308

SOUTH KOREA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 309

SOUTH KOREA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 310

SOUTH KOREA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 311

SOUTH KOREA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 312

SOUTH KOREA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 313

SOUTH KOREA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 314

SOUTH KOREA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 315

SOUTH KOREA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 316

SOUTH KOREA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 317

SOUTH KOREA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 318

AUSTRALIA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 319

AUSTRALIA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 320

AUSTRALIA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 321

AUSTRALIA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 322

AUSTRALIA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 323

AUSTRALIA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 324

AUSTRALIA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 325

AUSTRALIA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 326

AUSTRALIA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 327

AUSTRALIA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 328

AUSTRALIA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 329

AUSTRALIA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 330

AUSTRALIA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 331

AUSTRALIA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 332

REST OF ASIA PACIFIC: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 333

REST OF ASIA PACIFIC: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 334

REST OF ASIA PACIFIC: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 335

REST OF ASIA PACIFIC: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 336

REST OF ASIA PACIFIC: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 337

REST OF ASIA PACIFIC: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 338

REST OF ASIA PACIFIC: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 339

REST OF ASIA PACIFIC: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 340

REST OF ASIA PACIFIC: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 341

REST OF ASIA PACIFIC: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 342

REST OF ASIA PACIFIC: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 343

REST OF ASIA PACIFIC: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 344

REST OF ASIA PACIFIC: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 345

REST OF ASIA PACIFIC: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 346

LATIN AMERICA: MEDICAL SENSORS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 347

LATIN AMERICA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 348

LATIN AMERICA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 349

LATIN AMERICA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 350

LATIN AMERICA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 351

LATIN AMERICA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 352

LATIN AMERICA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 353

LATIN AMERICA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 354

LATIN AMERICA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 355

LATIN AMERICA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 356

LATIN AMERICA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 357

LATIN AMERICA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 358

LATIN AMERICA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 359

LATIN AMERICA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 360

LATIN AMERICA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 361

BRAZIL: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 362

BRAZIL: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 363

BRAZIL: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 364

BRAZIL: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 365

BRAZIL: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 366

BRAZIL: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 367

BRAZIL: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 368

BRAZIL: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 369

BRAZIL: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 370

BRAZIL: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 371

BRAZIL: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 372

BRAZIL: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 373

BRAZIL: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 374

BRAZIL: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 375

MEXICO: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 376

MEXICO: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 377

MEXICO: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 378

MEXICO: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 379

MEXICO: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 380

MEXICO: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 381

MEXICO: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 382

MEXICO: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 383

MEXICO: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 384

MEXICO: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 385

MEXICO: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 386

MEXICO: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 387

MEXICO: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 388

MEXICO: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 389

REST OF LATIN AMERICA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 390

REST OF LATIN AMERICA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 391

REST OF LATIN AMERICA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 392

REST OF LATIN AMERICA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 393

REST OF LATIN AMERICA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 394

REST OF LATIN AMERICA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 395

REST OF LATIN AMERICA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 396

REST OF LATIN AMERICA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 397

REST OF LATIN AMERICA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 398

REST OF LATIN AMERICA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 399

REST OF LATIN AMERICA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 400

REST OF LATIN AMERICA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 401

REST OF LATIN AMERICA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 402

REST OF LATIN AMERICA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 403

MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 404

MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 405

MIDDLE EAST & AFRICA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 406

MIDDLE EAST & AFRICA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 407

MIDDLE EAST & AFRICA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 408

MIDDLE EAST & AFRICA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 409

MIDDLE EAST & AFRICA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 410

MIDDLE EAST & AFRICA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 411

MIDDLE EAST & AFRICA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 412

MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 413

MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 414

MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 415

MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 416

MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 417

MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 418

GCC COUNTRIES: MEDICAL SENSORS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 419

GCC COUNTRIES: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 420

GCC COUNTRIES: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 421

GCC COUNTRIES: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 422

GCC COUNTRIES: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 423

GCC COUNTRIES: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 424

GCC COUNTRIES: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 425

GCC COUNTRIES: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 426

GCC COUNTRIES: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 427

GCC COUNTRIES: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 428

GCC COUNTRIES: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 429

GCC COUNTRIES: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 430

GCC COUNTRIES: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 431

GCC COUNTRIES: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 432

GCC COUNTRIES: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 433

SAUDI ARABIA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 434

SAUDI ARABIA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 435

SAUDI ARABIA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 436

SAUDI ARABIA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 437

SAUDI ARABIA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 438

SAUDI ARABIA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 439

SAUDI ARABIA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 440

SAUDI ARABIA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 441

SAUDI ARABIA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 442

SAUDI ARABIA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 443

SAUDI ARABIA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 444

SAUDI ARABIA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 445

SAUDI ARABIA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 446

SAUDI ARABIA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 447

UAE: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 448

UAE: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 449

UAE: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 450

UAE: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 451

UAE: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 452

UAE: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 453

UAE: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 454

UAE: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 455

UAE: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 456

UAE: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 457

UAE: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 458

UAE: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 459

UAE: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 460

UAE: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 461

REST OF GCC COUNTRIES: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 462

REST OF GCC COUNTRIES: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 463

REST OF GCC COUNTRIES: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 464

REST OF GCC COUNTRIES: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 465

REST OF GCC COUNTRIES: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 466

REST OF GCC COUNTRIES: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 467

REST OF GCC COUNTRIES: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 468

REST OF GCC COUNTRIES: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 469

REST OF GCC COUNTRIES: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 470

REST OF GCC COUNTRIES: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 471

REST OF GCC COUNTRIES: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 472

REST OF GCC COUNTRIES: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 473

REST OF GCC COUNTRIES: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 474

REST OF GCC COUNTRIES: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 475

REST OF MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2023–2030 (USD MILLION)

TABLE 476

REST OF MIDDLE EAST & AFRICA: BIOPOTENTIAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 477

REST OF MIDDLE EAST & AFRICA: BIOPHYSICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 478

REST OF MIDDLE EAST & AFRICA: TEMPERATURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 479

REST OF MIDDLE EAST & AFRICA: PRESSURE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 480

REST OF MIDDLE EAST & AFRICA: MEDICAL IMAGE SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 481

REST OF MIDDLE EAST & AFRICA: BIOCHEMICAL MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 482

REST OF MIDDLE EAST & AFRICA: MOTION/POSITION MEDICAL SENSORS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 483

REST OF MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION)

TABLE 484

REST OF MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2023–2030 (USD MILLION)

TABLE 485

REST OF MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 486

REST OF MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2023–2030 (USD MILLION)

TABLE 487

REST OF MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

TABLE 488

REST OF MIDDLE EAST & AFRICA: MEDICAL SENSORS MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 489

OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MEDICAL SENSORS MARKET, JANUARY 2022–JULY 2025

TABLE 490

MEDICAL SENSORS MARKET: DEGREE OF COMPETITION

TABLE 491

MEDICAL SENSORS MARKET: REGION FOOTPRINT

TABLE 492

MEDICAL SENSORS MARKET: SENSOR TYPE FOOTPRINT

TABLE 493

MEDICAL SENSORS MARKET: PRODUCT TYPE FOOTPRINT

TABLE 494

MEDICAL SENSORS MARKET: APPLICATION FOOTPRINT

TABLE 495

MEDICAL SENSORS MARKET: CONNECTIVITY/INTEGRATION FOOTPRINT

TABLE 496

MEDICAL SENSORS MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

TABLE 497

MEDICAL SENSORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, BY REGION AND CONNECTIVITY/INTEGRATION

TABLE 498

MEDICAL SENSORS MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022–JULY 2025

TABLE 499

MEDICAL SENSORS MARKET: DEALS, JANUARY 2022–JULY 2025

TABLE 500

MEDICAL SENSORS MARKET: EXPANSIONS, JANUARY 2022–JULY 2025

TABLE 501

MEDICAL SENSORS MARKET: OTHER DEVELOPMENTS, JANUARY 2022–JULY 2025

TABLE 502

TE CONNECTIVITY: COMPANY OVERVIEW

TABLE 503

TE CONNECTIVITY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 504

TE CONNECTIVITY: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 505

TE CONNECTIVITY: DEALS, JANUARY 2022–JULY 2025

TABLE 506

TE CONNECTIVITY: EXPANSIONS, JANUARY 2022–JULY 2025

TABLE 507

TE CONNECTIVITY: OTHER DEVELOPMENTS, JANUARY 2022–JULY 2025

TABLE 508

MEDTRONIC: COMPANY OVERVIEW

TABLE 509

MEDTRONIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 510

MEDTRONICS: PRODUCT APPROVALS, JANUARY 2022–JULY 2025

TABLE 511

MEDTRONIC: DEALS, JANUARY 2022–JULY 2025

TABLE 512

ANALOG DEVICES, INC.: COMPANY OVERVIEW

TABLE 513

ANALOG DEVICES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 514

ANALOG DEVICES, INC.: DEALS, JANUARY 2022–JULY 2025

TABLE 515

ANALOG DEVICES, INC.: EXPANSIONS, JANUARY 2022–JULY 2025

TABLE 516

ANALOG DEVICES, INC.: OTHER DEVELOPMENTS, JANUARY 2022–JULY 2025

TABLE 517

HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

TABLE 518

HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 519

HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 520

HONEYWELL INTERNATIONAL INC.: DEALS, JANUARY 2022–JULY 2025

TABLE 521

TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

TABLE 522

TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 523

TEXAS INSTRUMENTS INCORPORATED: EXPANSIONS, JANUARY 2022–JULY 2025

TABLE 524

AMPHENOL CORPORATION: COMPANY OVERVIEW

TABLE 525

AMPHENOL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 526

AMPHENOL CORPORATION: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 527

AMPHENOL CORPORATION: DEALS, JANUARY 2022–JULY 2025

TABLE 528

SENSIRION AG: COMPANY OVERVIEW

TABLE 529

SENSIRION AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 530

SENSIRION AG: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022–JULY 2025

TABLE 531

SENSIRION AG: DEALS, JANUARY 2022–JULY 2025

TABLE 532

SENSIRION AG: EXPANSIONS, JANUARY 2022–JULY 2025

TABLE 533

STMICROELECTRONICS: COMPANY OVERVIEW

TABLE 534

STMICROELECTRONICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 535

STMICROELECTRONICS: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 536

STMICROELECTRONICS: DEALS, JANUARY 2022–JULY 2025

TABLE 537

AMS-OSRAM AG: COMPANY OVERVIEW

TABLE 538

AMS-OSRAM AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 539

AMS-OSRAM AG: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 540

AMS-OSRAM AG: DEALS, JANUARY 2022–JULY 2025

TABLE 541

AMS-OSRAM AG: OTHER DEVELOPMENTS, JANUARY 2022–JULY 2025

TABLE 542

EXCELITAS TECHNOLOGIES CORP.: COMPANY OVERVIEW

TABLE 543

EXCELITAS TECHNOLOGIES CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 544

EXCELITAS TECHNOLOGIES CORP.: OTHER DEVELOPMENTS, JANUARY 2022–JULY 2025

TABLE 545

TEKSCAN, INC.: COMPANY OVERVIEW

TABLE 546

TEKSCAN, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 547

TEKSCAN, INC.: DEALS, JANUARY 2022–JULY 2025

TABLE 548

TEKSCAN, INC.: OTHER DEVELOPMENTS, JANUARY 2022–JULY 2025

TABLE 549

NXP SEMICONDUCTORS: COMPANY OVERVIEW

TABLE 550

NXP SEMICONDUCTORS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 551

NXP SEMICONDUCTORS: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 552

SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY OVERVIEW

TABLE 553

SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 554

SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 555

OMNIVISION: COMPANY OVERVIEW

TABLE 556

OMNIVISION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 557

OMNIVISION: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 558

OMNIVISION: DEALS, JANUARY 2022–JULY 2025

TABLE 559

NIHON KOHDEN CORPORATION: COMPANY OVERVIEW

TABLE 560

NIHON KOHDEN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 561

NIHON KOHDEN CORPORATION: DEALS, JANUARY 2022–JULY 2025

TABLE 562

INNOVATIVE SENSOR TECHNOLOGY IST AG: COMPANY OVERVIEW

TABLE 563

INNOVATIVE SENSOR TECHNOLOGY IST AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 564

CTS CORPORATION: COMPANY OVERVIEW

TABLE 565

CTS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 566

CTS CORPORATION: DEALS, JANUARY 2022–JULY 2025

TABLE 567

ROHM CO., LTD.: COMPANY OVERVIEW

TABLE 568

ROHM CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 569

ROHM CO., LTD.: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 570

MURATA MANUFACTURING CO., LTD.: COMPANY OVERVIEW

TABLE 571

MURATA MANUFACTURING CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 572

MURATA MANUFACTURING CO., LTD.: EXPANSIONS, JANUARY 2022–JULY 2025

TABLE 573

MURATA MANUFACTURING CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2022–JULY 2025

TABLE 574

ANGST+PFISTER: COMPANY OVERVIEW

TABLE 575

ANGST+PFISTER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 576

ANGST+PFISTER: PRODUCT LAUNCHES, JANUARY 2022–JULY 2025

TABLE 577

VIVALNK, INC.: COMPANY OVERVIEW

TABLE 578

SUPERIOR SENSORS TECHNOLOGY: COMPANY OVERVIEW

TABLE 579

XSENSIO: COMPANY OVERVIEW

TABLE 580

ALTHEN SENSORS AND CONTROLS: COMPANY OVERVIEW

TABLE 581

PROFUSA, INC.: COMPANY OVERVIEW

FIGURE 1

MEDICAL SENSORS MARKET SEGMENTATION & REGIONAL SCOPE

FIGURE 2

MEDICAL SENSORS MARKET: YEARS CONSIDERED

FIGURE 3

MEDICAL SENSORS MARKET: RESEARCH DESIGN

FIGURE 4

MEDICAL SENSORS MARKET: KEY DATA FROM SECONDARY SOURCES

FIGURE 5

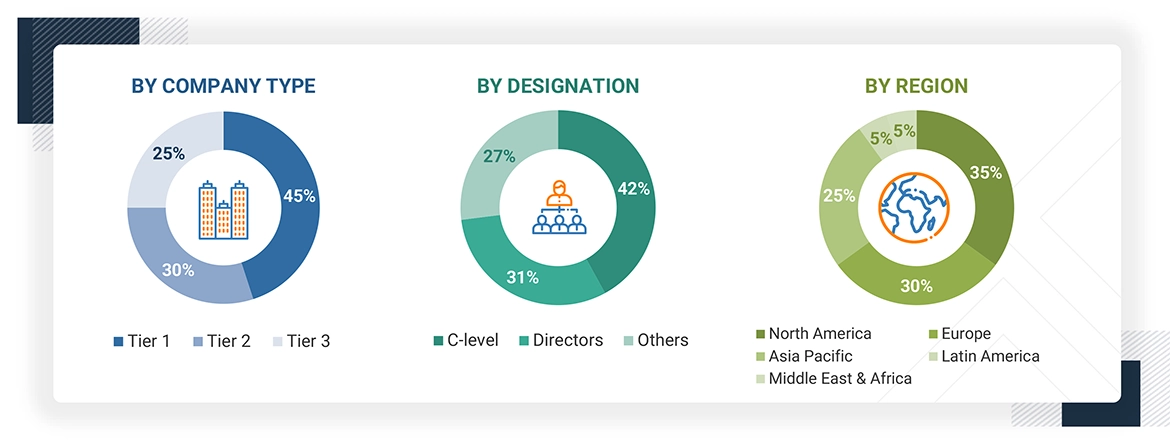

MEDICAL SENSORS MARKET: KEY PRIMARY SOURCES

FIGURE 6

MEDICAL SENSORS MARKET: KEY DATA FROM PRIMARY SOURCES

FIGURE 7

KEY INSIGHTS FROM INDUSTRY EXPERTS IN MEDICAL SENSORS MARKET

FIGURE 8

BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 9

RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 10

MEDICAL SENSORS SUPPLY-SIDE MARKET ESTIMATION

FIGURE 11

MEDICAL SENSORS MARKET: REVENUE ESTIMATION FOR TE CONNECTIVITY (2024)

FIGURE 12

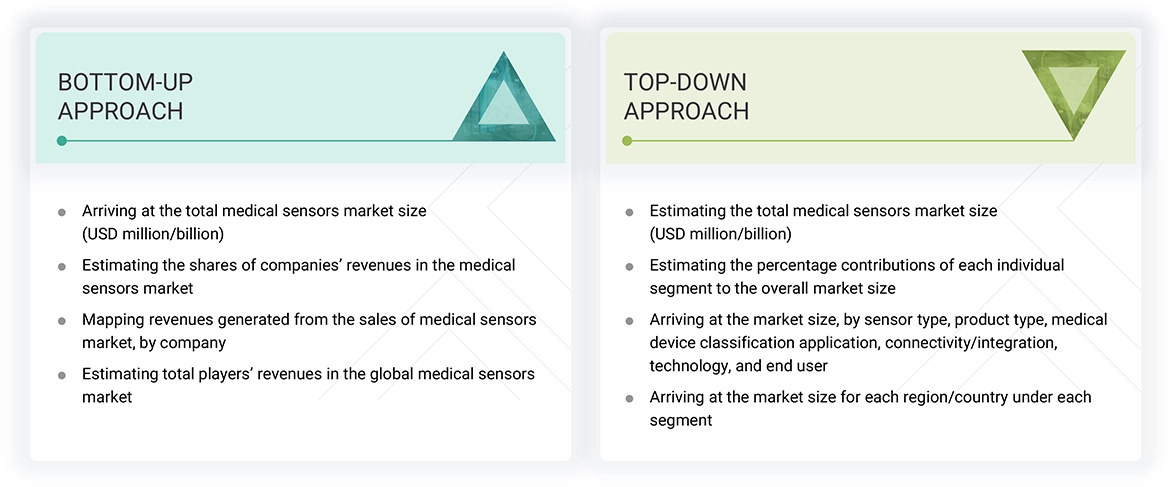

MEDICAL SENSORS MARKET: BOTTOM-UP APPROACH

FIGURE 13

MEDICAL SENSORS MARKET: TOP-DOWN APPROACH

FIGURE 14

CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025–2030)

FIGURE 15

CAGR PROJECTIONS (SUPPLY-SIDE ANALYSIS) IN MEDICAL SENSORS MARKET

FIGURE 16

MEDICAL SENSORS MARKET: DATA TRIANGULATION METHODOLOGY

FIGURE 17

MEDICAL SENSORS MARKET, BY SENSOR TYPE, 2025 VS. 2030 (USD MILLION)

FIGURE 18

MEDICAL SENSORS MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

FIGURE 19

MEDICAL SENSORS MARKET, BY MEDICAL DEVICE CLASSIFICATION, 2025 VS. 2030 (USD MILLION)

FIGURE 20

MEDICAL SENSORS MARKET, BY APPLICATION , 2025 VS. 2030 (USD MILLION)

FIGURE 21

MEDICAL SENSORS MARKET, BY CONNECTIVITY/INTEGRATION, 2025 VS. 2030 (USD MILLION)

FIGURE 22

MEDICAL SENSORS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

FIGURE 23

MEDICAL SENSORS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

FIGURE 24

MEDICAL SENSORS MARKET: REGIONAL SNAPSHOT

FIGURE 25

INCREASING DEMAND FOR REAL-WORLD EVIDENCE, INTEROPERABILITY, AND REGULATORY COMPLIANCE TO DRIVE MARKET

FIGURE 26

US AND WIRELESS SENSORS TO COMMAND LARGER NORTH AMERICAN MARKET SHARES IN 2025

FIGURE 27

INDIA TO REGISTER HIGHEST CAGR DURING STUDY PERIOD

FIGURE 28

EMERGING ECONOMIES TO PROJECT HIGHER GROWTH RATES DURING FORECAST PERIOD

FIGURE 29

MEDICAL SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 30

HEALTHCARE EXPENDITURE AS PERCENTAGE OF GDP (1995 VS. 2005 VS. 2014 VS. 2024)

FIGURE 31

MEDICAL SENSORS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 32

MEDICAL SENSORS MARKET: ECOSYSTEM ANALYSIS

FIGURE 33

MEDICAL SENSORS MARKET: VALUE CHAIN ANALYSIS

FIGURE 34

AVERAGE SELLING PRICE TREND OF MEDICAL SENSORS, BY SENSOR TYPE, 2020–2029 (USD)

FIGURE 35

MEDICAL SENSORS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 36

INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

FIGURE 37

KEY BUYING CRITERIA FOR TOP THREE END USERS

FIGURE 38

GLOBAL PATENT PUBLICATIONS IN MEDICAL SENSORS MARKET, 2015–2025

FIGURE 39

JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR MEDICAL SENSOR PATENTS (JANUARY 2015–JUNE 2025)

FIGURE 40

TOP PATENT APPLICANTS/OWNERS AND NUMBER OF PATENTS GRANTED IN MEDICAL SENSORS MARKET (JANUARY 2015–JUNE 2025)

FIGURE 41

FUNDING AND NUMBER OF DEALS IN MEDICAL SENSORS MARKET, 2021–2024

FIGURE 42

MARKET POTENTIAL OF AI/GEN AI IN ENHANCING MEDICAL SENSORS ACROSS INDUSTRIES

FIGURE 43

IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

FIGURE 44

NORTH AMERICA: MEDICAL SENSORS MARKET SNAPSHOT

FIGURE 45

ASIA PACIFIC: MEDICAL SENSORS MARKET SNAPSHOT

FIGURE 46

REVENUE ANALYSIS OF KEY PLAYERS IN MEDICAL SENSORS MARKET, 2020–2024 (USD MILLION)

FIGURE 47

MARKET SHARE ANALYSIS OF KEY PLAYERS IN MEDICAL SENSORS MARKET (2024)

FIGURE 48

MEDICAL SENSORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 49

MEDICAL SENSORS MARKET: COMPANY FOOTPRINT

FIGURE 50

MEDICAL SENSORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

FIGURE 51

EV/EBITDA OF KEY VENDORS

FIGURE 52

YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

FIGURE 53

MEDICAL SENSORS MARKET: BRAND/PRODUCT COMPARITIVE ANALYSIS

FIGURE 54

TE CONNECTIVITY: COMPANY SNAPSHOT

FIGURE 55

MEDTRONIC: COMPANY SNAPSHOT

FIGURE 56

ANALOG DEVICES, INC.: COMPANY SNAPSHOT

FIGURE 57

HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 58

TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

FIGURE 59

AMPHENOL CORPORATION: COMPANY SNAPSHOT

FIGURE 60

SENSIRION AG: COMPANY SNAPSHOT

FIGURE 61

STMICROELECTRONICS: COMPANY SNAPSHOT

FIGURE 62

AMS-OSRAM AG: COMPANY SNAPSHOT

FIGURE 63

NXP SEMICONDUCTORS: COMPANY SNAPSHOT

FIGURE 64

SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY SNAPSHOT

FIGURE 65

NIHON KOHDEN CORPORATION: COMPANY SNAPSHOT

FIGURE 66

CTS CORPORATION: COMPANY SNAPSHOT

FIGURE 67

ROHM CO., LTD.: COMPANY SNAPSHOT

FIGURE 68

MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

IBRAHIM

Jan, 2019

I am collecting information on medical sensor industry for a case study on the industry and not a particular company to use the info. Would be interested in receiving sample and brochure for this report. .

Syed

Feb, 2019

Interested in knowing about sensors in medical industry like tempertaure sensors, pressure sensors, ingestible sensors, and blood monitoring sensors..

Syed

Feb, 2019