Nonwoven Fabrics Market

Nonwoven Fabrics Market by Type, Layer, Function, Technology (Dry Laid, Spunbond, Wet Laid), End-use Industry (Hygiene, Medical, Filtration, Automation, Building & Construction, Consumer Products), and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The nonwoven fabrics market is projected to attain a valuation of USD 72.2 billion by the year 2030, increasing from USD 54.7 billion in 2025, with a CAGR of 5.7% throughout the forecast period (2025-2030). Nonwoven fabrics are distinctive materials that are not produced through weaving or knitting processes. They consist of engineered sheets or webs of fibers bonded by various techniques. Numerous international standards and industry associations offer their definitions of what constitutes a nonwoven fabric, reflecting the diverse range of compositions and manufacturing methods. The demand for nonwoven fabrics is experiencing substantial growth, predominantly propelled by the rapid expansion of the construction, filtration, automotive, healthcare, and hygiene sectors.

KEY TAKEAWAYS

-

BY TECHNOLOGYThe nonwoven fabrics market by technology includes dry laid, spunbond, wet laid, and other technologies. the spunbond emerged as the leading segment in the nonwoven fabrics market, driven by its superior manufacturing efficiency, cost-effectiveness, and versatile applications.

-

BY END-USE INDUSTRYThe nonwoven fabrics market by end-use industry includes hygiene, medical, automotive, filtration, consumer products, building & construction, and other end-use industries. Flooring is the fastest-growing segment because of its superior strength, water resistance, and low maintenance requirements. The hygiene segment dominates the nonwovens market, driven primarily by the rising demand for disposable products such as baby diapers, feminine hygiene items, and adult incontinence solutions.

-

BY REGIONThe Asia Pacific region emerged as the largest segment within the nonwoven fabrics market in 2024, driven by rapid industrialization, a large growing population, and an increasing demand for hygiene and medical solutions.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic product launches, collaborations, acquisitions, and expansions undertaken by leading companies such as Berry Global Inc., Freudenberg Group, Ahlstrom, Kimberly-Clark, Fitesa S.A. and Affiliates, DuPont, Toray Industries, Inc., Alkegen, Avgol Industries 1953 Ltd, Zhejiang Kingsafe Hygiene Material Technology Co., Ltd., Suominen Corporation, and Johns Manville. These firms are strong in their local regions and are exploring geographic diversification options to expand their businesses.

The nonwoven fabrics market has experienced steady growth due to its essential role in the hygiene, medical, automotive, and construction sectors. Regulatory pressures on plastic-based variants and volatile raw material prices act as market barriers. The increasing demand for biodegradable options and advanced filtration technologies in air and water purification presents opportunities for market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Rapid growth in sustainability (biodegradable polymers, recycled content), rising demand for advanced functionality (filtration, smart textiles, lightweight performance), plus pressure from volatile raw material costs and supply chain fragility are disrupting traditional nonwoven fabrics markets globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging demand in hygiene and medical applications

-

Increasing use of lightweight nonwoven fabrics in automotive industry

Level

-

Regulatory pressures restricting use of plastic-based nonwovens

-

Volatile raw material prices

Level

-

Growing demand for advanced filtration across air and water purification applications

-

Rising demand for biodegradable nonwovens driven by sustainability regulations and circular economy goals

Level

-

High investment requirements

-

Competitive pressure from woven and knitted fabrics

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging demand in hygiene and medical applications

The global nonwoven fabrics market is experiencing rapid growth, driven by increased hygiene awareness and rising demand in the personal care, hygiene, and healthcare sectors. Nonwovens are commonly used in products such as diapers, sanitary napkins, and adult incontinence items, providing cost-effective, breathable, and sanitary single-use options. Notably, nonwoven diapers play a key role in preventing diaper dermatitis, which affects between 50% and 65% of infants. In gerontological care, over 50% of patients aged 65 and older report incontinence, with even higher rates in nursing facilities. The US Department of Health and Human Services (HHS) has prioritized local manufacturing of essential nonwoven medical disposables to strengthen supply chain resilience. Due to their hygienic properties, breathability, and barrier performance, nonwovens are critical for many healthcare applications, including surgical gowns, masks, drapes, and wound dressings.

Restraint: Regulatory pressures restricting use of plastic-based nonwovens

The global nonwoven fabrics market, particularly within the hygiene, healthcare, and cleaning sectors, is currently facing increased regulatory scrutiny stemming from environmental concerns associated with plastic waste and microplastic contamination. Disposable wipes represent a significant area of concern, as regulations like the UK’s ban on plastic-containing wet wipes under the Environmental Protection Act 1990 require manufacturers to transition to more costly biodegradable alternatives, such as cotton, bamboo, or cellulose. While medical exemptions exist, this ban is reshaping the procurement of raw materials and the structure of supply chains across the industry. In the US, the proposed WIPPES Act aims to establish national standards for “Do Not Flush” labeling on non-flushable wipes, addressing an estimated annual sewer system damage of approximately USD 400 million. Concurrently, international efforts to phase out PFAS, chemicals commonly utilized in nonwovens for their stain, water, and oil resistance are introducing additional market complexities due to their environmental persistence and associated health risks.

Opportunity: Growing demand for advanced filtration in air and water purification applications

The filtration industry presents substantial growth opportunities for nonwoven fabrics, driven by increasing environmental awareness, enhanced regulatory standards, and a heightened focus on air and water quality. Nonwovens are widely utilized in air, water, and liquid filtration applications due to their superior efficiency, breathability, and cost-effectiveness. HEPA and pulse-jet cartridge filters that incorporate nonwovens are anticipated to achieve up to 99.999% efficiency for the capture of fine particulate matter. Advanced research is further enhancing performance; for instance, nanofiber nonwovens (20–200 nm) effectively trap sub-3 µm particles and volatile organic compounds (VOCs) while minimizing pressure drop. Pleated nonwoven cartridges offer three to four times the surface area compared to traditional alternatives, optimizing filtration efficiency. In water treatment, EPA-supported electrospun mats infused with TiO2, carbon, or metal oxides have been shown to effectively eliminate micropollutants and heavy metals, thus meeting stricter EU water regulations.

Challenge: Limited investment in installation of recycling infrastructure

The availability of recycling technologies for nonwoven fabrics remains a critical concern within the market, particularly for synthetic materials such as polypropylene and polyester. Numerous nonwoven products like medical wipes, hygiene pads, geotextiles, and automotive components ultimately contribute to landfill waste due to insufficient facilities for collection and recycling. According to the US Environmental Protection Agency (EPA), approximately 14.7% of textiles are recycled, while the majority are either sent to landfills or incinerated. The EPA’s 2023 infrastructure map and National Recycling Strategy underscore the imperative need to develop robust systems for collecting and sorting textiles at the end of their life cycle. In the hygiene and medical sectors, recycling contaminated products, such as masks and gowns, poses significant challenges, as these items frequently lack secure recycling pathways and are predominantly incinerated. Moreover, the post-use collection of construction materials, including roofing underlays and geotextiles, presents notable obstacles. The presence of microfibers in filtration systems further complicates the recovery process. Insulation and carpets made from composite materials in the automotive sector pose substantial recycling difficulties.

Nonwoven Fabrics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

JOFO NonWovens used ExxonMobil’s Vistamaxx propylene-based elastomers to produce a new “soft” nonwoven fabric (branded “SilkSoft”) for hygiene products, that balances softness, drape, and mechanical performance. | The new fabric offers enhanced softness without compromising strength or processability, enabling downgauging and cost-effective manufacture of premium hygiene products. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The nonwoven fabrics market ecosystem is made up of several players. It comprises raw material providers (polypropylene, polyester, viscose, and biopolymer producers), manufacturers (nonwoven fabric converters and machinery suppliers), distributors and converters (handling logistics and customized processing), and end users across industries such as hygiene, medical, automotive, construction, and filtration.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Nonwoven Fabrics Market, By Technology

Spunbond emerged as the predominant segment in the nonwoven fabrics market in 2024. This prominence is attributed to the technique's superior manufacturing efficiency, cost-effectiveness, and versatile applications. It produces durable, lightweight, and breathable fabrics that are extensively used in hygiene products, medical textiles, agriculture, and packaging sectors. The capability to blend spunbond with polypropylene and other thermoplastics enables the large-scale production of long-lasting materials at competitive prices. Furthermore, the increasing demand for disposable hygiene products, especially in emerging markets, coupled with expanding applications in medical and industrial personal protective equipment (PPE), has further propelled the adoption of spunbond technology.

Nonwoven Fabrics Market, By End-use industry

The hygiene segment led the nonwoven fabrics market, mainly driven by the growing demand for disposable products like baby diapers, feminine hygiene items, and adult incontinence solutions. Nonwoven fabrics are known for their softness, breathability, and good fluid management, making them ideal for personal care uses. The demand for these disposable items is expected to keep rising, influenced by global trends such as faster urbanization and increased consumer awareness about hygiene. Additionally, a growing aging population will support this growth. Government efforts to improve public hygiene and sanitation, especially in developing countries, have also significantly contributed to this segment’s growth.

REGION

Asia Pacific to be major regional segment in global nonwoven fabrics market

The Asia Pacific region emerged as the largest segment in the nonwoven fabrics market in 2024. This growth is driven by rapid industrialization, a growing population, and rising demand for hygiene and medical products. Major markets like China, India, and Japan benefit from expanding healthcare infrastructure, increased awareness of personal hygiene, and government health initiatives. The region’s competitive edge is boosted by low manufacturing costs, a strong industrial base, and rising foreign investments. Additionally, the booming e-commerce and automotive sectors play a significant role in increasing nonwoven fabric consumption.

Nonwoven Fabrics Market: COMPANY EVALUATION MATRIX

In the nonwoven fabrics market landscape, Berry Global, Inc. (Star) leads the industry. It merged its Health, Hygiene & Specialties nonwovens and films division with Glatfelter to create Magnera. Alkegen (Emerging Leader) is gaining momentum. Alkegen, formed from the merger of Unifrax and Lydall, is an up-and-coming nonwovens leader focusing on high-performance filtration, insulation, and sustainable material solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 51.8 Billion |

| Market Forecast in 2030 (Value) | USD 72.2 Billion |

| Growth Rate | CAGR of 5.7% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Square Meters) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Nonwoven Fabrics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Detailed Nonwoven Fabrics Market Analysis for APAC Countries | Market sizing and demand forecasting for nonwoven fabrics across major Asia Pacific countries, segmented by technology, type, and end-use industry | Provided country-specific insights on hygiene, medical, and industrial applications; analyzed regulatory policies, capacity expansions, and sustainability initiatives driving regional demand |

| Sub-Segmentation within Nonwoven Fabrics Market | Additional sub segmentation by manufacturing technology | Enabled granular analysis of material trends, product innovations, and cost-performance advantages for high-growth end-use categories such as hygiene and filtration |

RECENT DEVELOPMENTS

- April 2025 : Freudenberg Performance Materials, a part of Freudenberg Group, launched a new range of fine spunbond nonwovens, offering high customization and versatility across industries.

- January 2025 : Kimberly-Clark is investing USD 2 billion over the next five years in its largest North American expansion. The plan includes a new advanced manufacturing facility in Warren, Ohio, and an automated distribution center in South Carolina.

- September 2024 : Freudenberg Performance Materials announced the acquisition of major parts of the Heytex Group, a global leader in high-quality coated technical textiles.

- June 2024 : Berry Global and Glatfelter announced the creation of Magnera, formed through the proposed merger of Berry’s Health, Hygiene, and Specialties Global Nonwovens and Films business with Glatfelter.

- September 2022 : Berry Global launched the Endura nonwovens product line, featuring up to 90% recycled content made through a closed-loop recycling ecosystem.

Table of Contents

Methodology

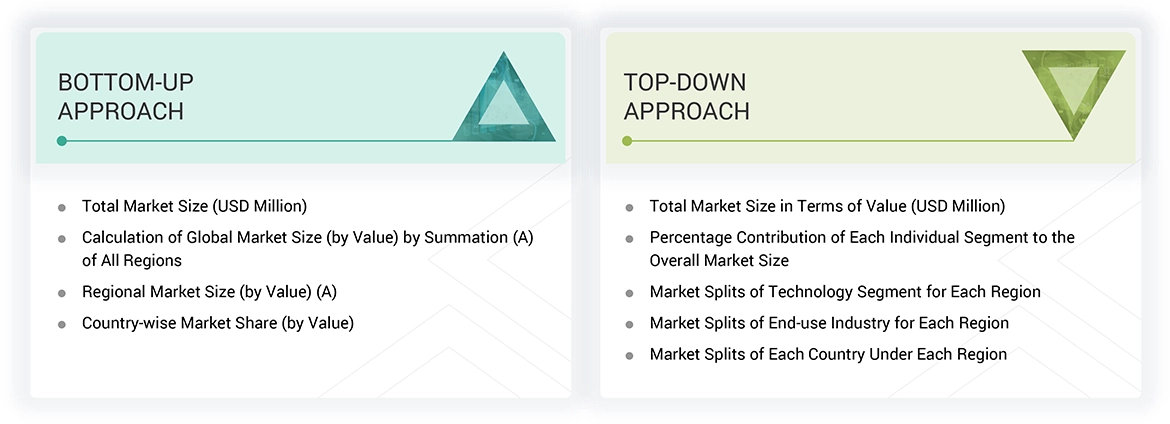

The study involved four major activities to estimate the current size of the global nonwoven fabrics market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of nonwoven fabrics through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the nonwoven fabrics market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering nonwoven fabrics is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the nonwoven fabrics market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of nonwoven fabrics vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the nonwoven fabrics market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of nonwoven fabrics offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

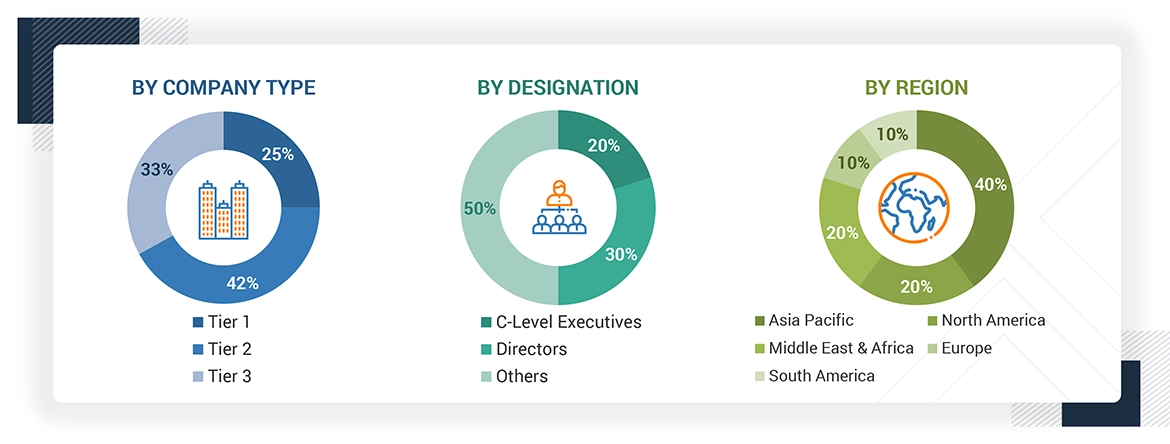

Following is the breakdown of primary respondents:

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the global market size. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Nonwoven fabrics are engineered sheets of fibrous material, distinct from paper or traditional textiles, and are created through mechanical, thermal, or chemical bonding processes. Various international standards provide distinct definitions of nonwoven fabrics, primarily to account for the differences in composition and manufacturing methods. The ISO 9092 defines nonwoven fabrics as a web of fibers that can be oriented deliberately or arranged randomly, bonded through mechanisms such as friction, cohesion, or adhesion. ISO standards clearly delineate nonwoven fabrics from paper and textiles, outlining specific criteria for fiber characteristics, including length, diameter ratio, and material density. Several entities recognize this definition, including CEN and national standard organizations such as EDANA, DIN, and AFNOR.

The American Society of Testing and Materials (ASTM) also categorizes nonwoven fabrics as textile structures where fibers are bonded or interlocked through various nonwoven processes, explicitly excluding woven, knitted, or felted fabrics. INDA provides a similar definition, identifying nonwoven fabrics as flat, porous sheets produced directly from fibers, filaments, or plastic films, eliminating the need for yarn creation or weaving processes.

Stakeholders

- Nonwoven fabric manufacturers

- Raw material suppliers

- Converters & processors

- Distributors and traders

- Industry associations and regulatory bodies

- End users

Report Objectives

- To define, describe, and forecast the size of the global nonwoven fabrics market based on type, layer, function, technology, end-use industry, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, mergers, acquisitions, expansions, collaborations, and partnerships in the nonwoven fabrics market

- To provide the impact of AI/Gen AI on the market

Key Questions Addressed by the Report

Which factors are propelling the growth of the nonwoven fabrics market?

The growth is driven by surging demand in hygiene and medical applications, increased use in the automotive industry, and growing adoption in sustainable building and construction projects.

What are the major challenges to the growth of the nonwoven fabrics market?

Major challenges include the high investment requirement for recycling technologies and competitive pressure from woven and knitted fabrics.

What are the major opportunities in the nonwoven fabrics market?

Key opportunities lie in the growing demand for advanced filtration in air and water purification, and the rising demand for biodegradable nonwovens aligned with sustainability regulations and circular economy initiatives.

What are the major factors restraining the growth of the nonwoven fabrics market?

The market faces restraints due to regulatory pressures on plastic-based nonwovens and volatile raw material prices.

Who are the major players in the nonwoven fabrics market?

Major players include Berry Global Inc. (US), Freudenberg Group (Germany), Ahlstrom (Finland), Kimberly-Clark Worldwide, Inc. (US), and Fitesa S.A. and Affiliates (Brazil).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Nonwoven Fabrics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Nonwoven Fabrics Market