Soft Gelatin Market by Source (Bovine, Pork, and Marine & Poultry), Application (Soft Gel Capsules, Soft Gel Suppositories, Gummies, Cosmetics, and Other Applications) and Region - Global Forecast to 2027

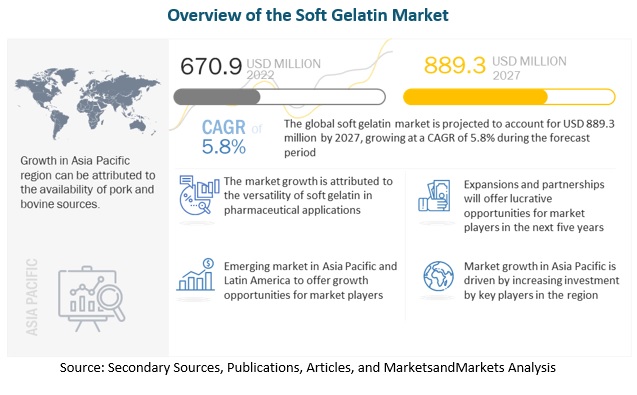

According to MarketsandMarkets, the global soft gelatin market is estimated to be valued at USD 670.9 million in 2022 and is projected to reach USD 889.3 million by 2027. The market is expected to grow with a CAGR of 5.8%, in terms of value between 2022 and 2027. Properties associated with soft gelatin and its growing application in pharmaceutical and nutraceutical industries are expected to drive the global soft gelatin market.

Soft Gelatin Market Dynamics

Drivers: Versatility of soft gelatin

Gelatin is enriched with functional capabilities making it appropriate for pharmaceutical applications. Gelatin coating on soft gel capsules masks the odour of medicine and also facilitates in swallowing. It also provides protection from environmental changes due to oxygen or moisture.

Restraints: Growing trend of veganism

In recent years, veganism is growing as a trend globally. Veganism is defined as abstinence from animal-based products. These trends are not only limited to food & beverage industry, but also making its space in pharmaceutical and nutraceutical industries. The increasing demand for plant-based pharmaceutical products is to restrain the growth of soft gelatin market.

Opportunities: Increasing usage of soft gelatin in the pharmaceutical industry in emerging countries

Emerging regions such as Latin America and Asia Pacific offer significant growth opportunities. Key players operating in the market are taking the first mover advantage by establishing themselves in these regions by investing. The raw material cost and labor costs are quite low in these emerging economies.

Challenges: Poor availability of raw materials and rising prices

The major challenge faced by end-user industries in the soft gelatin market is procurement of raw materials. The main factor affecting the availability is functional capacity is slaughterhouses to extract gelatin. Along with this, the handling of raw material and production of soft gelatin is governed by strict rules.

By application, soft gel capsules segment is expected to grow with the highest CAGR in the forecast period

Soft gel capsules are preferred by patients because they are formulated for rapid or slow release and has high degree of reproducibility. These factors are majorly driving the demand for soft gel capsules in the soft gelatin market.

By source, pork segment is likely to account for the largest market share

On the basis of source, pork is preferred by soft gelatin manufacturers. Factors that are driving the demand for pork as a source include low cost of production and shorter manufacturing cycles.

Asia Pacific region is expected to grow with a high CAGR in the forecast period. The growth of the Asia Pacific soft gelatin market can be attributed to the ample availability of bovine and pork as source of raw material. Also, the region has low-cost labor and capital investment.

Key Market Players:

Key players in this market include Darling Ingredients (US), Nitta Gelatin Inc. (Japan), Tessenderlo Group (Belgium), Gelita AG (Germany), Weishardt (France), Lapi Gelatine S.pa. (Italy), Trobas Gelatine B.V (Netherlands), Gelco International (Brazil), Xiamen Gelken Gelatin Co. Ltd. (China), and Junca Gelatines (Spain).

FAQs:

- Which are the major sources of soft gelatin considered in this study and which segments are projected to have promising growth rates in the future?

- I am interested in the Asia Pacific market for soft gel capsules segment and gummies segment. Is the customization available for the same? What all information would be included in the same?

- What are some of the drivers fuelling the growth of the soft gelatin market?

- I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

- What kind of information is provided in the competitive landscape section?

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

6.5 ECOSYSTEM/ MARKET MAP

6.6 TRENDS/ DISRUPTION IMPACTING THE CUSTOMER’S BUSINESS

6.7 PATENT ANALYSIS

6.8 TRADE ANALYSIS

6.9 KEY CONFERENCES AND EVENTS IN 222-223

6.10 TARIFF AND REGULATORY LANDSCAPE

6.11 PORTER’S FIVE FORCES ANALYSIS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.13 CASE STUDY ANALYSIS

7 SOFT GELATIN MARKET, BY SOURCE

7.1 INTRODUCTION

7.2 BOVINE

7.3 PORK

7.4 MARINE & POULTRY

8 SOFT GELATIN MARKET, BY APPLICATION

8.1 INTRODUCTION

8.2 SOFT GEL CAPSULES

8.3 SOFT GEL SUPPOSITORIES

8.4 GUMMIES

8.5 OTHER APPLICATIONS

9 SOFT GELATIN MARKET, BY REGION

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.2.3 MEXICO

9.3 EUROPE

9.3.1 GERMANY

9.3.2 FRANCE

9.3.3 UK

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.2 INDIA

9.4.3 JAPAN

9.4.4 AUSTRALIA & NEW ZEALAND

9.4.5 REST OF ASIA PACIFIC

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 REST OF THE WORLD

9.6.1 AFRICA

9.6.2 MIDDLE EAST

1 COMPETITIVE LANDSCAPE

1.1 OVERVIEW

1.2 MARKET SHARE ANALYSIS

1.3 KEY PLAYERS STRATEGIES

1.4 COMPANY REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

1.5 COMPANY EVALUATION QUADRANT

1.5.1 STARS

1.5.2 EMERGING LEADERS

1.5.3 PERVASIVE PLAYERS

1.5.4 PARTICIPANTS

1.5.5 COMPETITIVE BENCHMARKING

1.6 PRODUCT FOOTPRINTS

1.7 STARTUP/SME EVALUATION QUADRANT

1.7.1 PROGRESSIVE COMPANIES

1.7.2 STARTING BLOCKS

1.7.3 RESPONSIVE COMPANIES

1.7.4 DYNAMIC COMPANIES

1.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

1.8.1 NEW PRODUCT LAUNCHES

1.8.2 DEALS

1.8.3 OTHER DEVELOPMENTS

1.8.4 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

11 COMPANY PROFILES

11.1 DARLING INGREDIENTS

11.2 NITTA GELATIN INC.

11.3 TESSENDERLO GROUP

11.4 GELITA AG

11.5 WEISHARDT

11.6 LAPI GELATINE S.P.A

11.7 TROBAS GELATINE B.V

11.8 GELCO INTERNATIONAL

11.9 XIAMEN GELKEN GELATIN CO. LTD.

11.10 JUNCA GELATINES

Note: Currently, list of only 1 companies have been provided. However, this section covers 12-15 key company profiles which include business overview, recent financials, product offerings, key strategies, and swot analysis. recent financials can be provided based on data/information availability in public domain. The list of companies mentioned above can be altered depending upon client’s interest

12 APPENDIX

Note: The TOC prepared above is tentative and may subject to change, based on the research progress

Growth opportunities and latent adjacency in Soft Gelatin Market