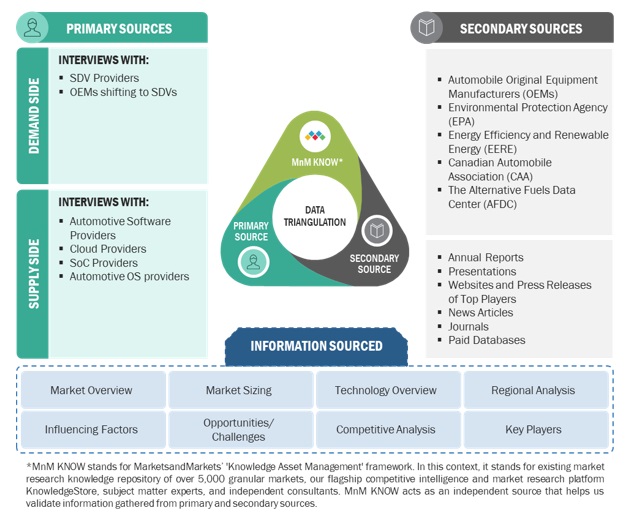

The study involved four major activities to estimate the current size of the Software Defined Vehicle market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up approach was employed to estimate the total market size. After that, market breakdown and data triangulation were used to determine the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study included automotive industry organizations involved with head-up display; publications from government sources [such as country level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

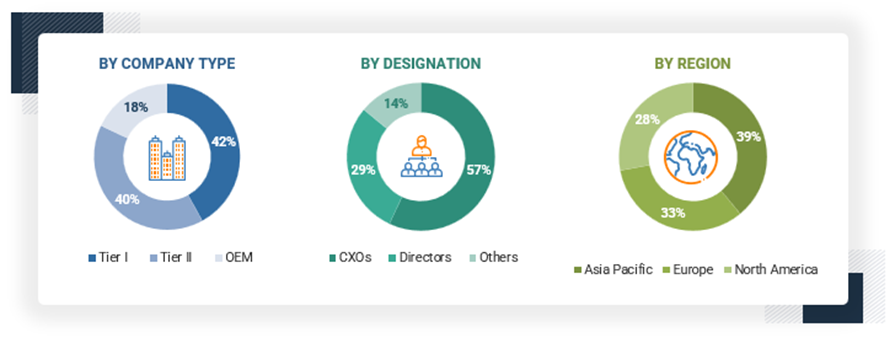

Extensive primary research has been conducted after acquiring an understanding of the SDV market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side vehicle manufacturers [(in terms of component supply), country-level government associations, and trade associations] and supply-side OEMs and component manufacturers across three major regions—North America, Europe, and Asia Pacific. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, efforts have been made to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions with highly experienced independent consultants have been conducted to reinforce the findings from the primaries. This, along with the in-house subject-matter experts’ opinions, has led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

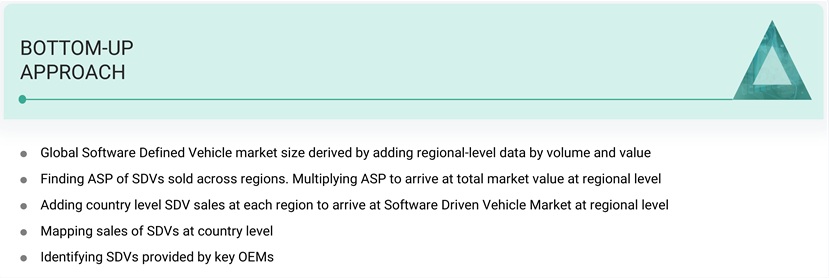

The bottom-up approach has been used to estimate and validate the size of the Software Defined Vehicle market. In this approach, the SDV statistics have been considered at the country level.

A model mapping of the SDVs has been carried out for each country to determine the market size in terms of volume. The number of SDV models varied from country to country. Then, the penetration of SDVs is applied to vehicle sales, giving the volume of the Software Defined Vehicle market. The country-level data has been summed up to arrive at the region-level data in terms of volume. The summation of the country-level market size has given the regional market size, and further summation of the regional market size has provided the global Software Defined Vehicle market size.

-

The key players in the industry and markets have been identified through extensive secondary research.

-

The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Software Defined Vehicle Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

data triangulation

Market Definition

SDV: A software-defined vehicle is one in which the majority of the vehicle's functions and features are controlled, enhanced, and updated through software rather than solely relying on hardware. This approach leverages advanced computing, connectivity, and software technologies to offer a range of benefits, including improved performance, enhanced safety, and greater flexibility in terms of updates and customization.

Key Stakeholders

-

Third-party FOD providers

-

Associations, forums, and alliances related to electric vehicles

-

Automotive blogs

-

Automobile manufacturers

-

Automotive component providers

-

Automotive cybersecurity providers

-

Automotive software providers

-

Autonomous vehicle manufacturers

-

Autonomous vehicle platform providers

-

Government agencies and policymakers

-

Industry associations and experts

-

Software providers for SDVs

Report Objectives

-

To analyze and forecast the SDV market in terms of value (USD billion) and volume (thousand units) from 2024 to 2030

-

To segment the market by vehicle type, SDV type, and region

-

To segment and forecast the market size by volume based on vehicle type (passenger car and light commercial vehicle)

-

To segment and forecast the market size by volume based on SDV type (Semi-SDV and SDV)

-

To segment and forecast the market by value and volume based on region (Asia Pacific, Europe, and North America)

-

To segment the market qualitatively based on E/E architecture (Distributed architecture, domain centralized architecture, zonal control architecture)

-

To provide detailed information about the factors influencing the market growth (drivers, challenges, restraints, and opportunities)

-

To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

-

Ecosystem analysis

-

Technology A\analysis

-

OEM SDV shift strategies

-

E/E architecture plans of OEM’s shifting to SDV

-

Tech enabler developments for SDVs

-

To strategically profile the key players and comprehensively analyze their market share and core competencies

-

To analyze the opportunities for stakeholders and the competitive landscape for market leaders

-

To track and analyze competitive developments such as deals, product launches/developments, expansions, and other activities undertaken by the key industry participants

AVAILABLE CUSTOMIZATIONS

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

-

Software Defined Vehicle market, by Vehicle type, at a regional level

-

Software Defined Vehicmarket, by SDV type, at a regional level

-

Profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Software Defined Vehicle Market