Specimen Validity Testing Market by Product (Reagent, Controls, Assay Kits, Disposables), Type (Laboratory, POC Testing), End User (Workplace, Drug Screening, Pain Management, Drug Rehabilitation Centers) - Global Forecast to 2023

[121 Pages Report] The specimen validity testing market was valued at USD 1.04 Billion in 2017 and is expected to reach USD 1.49 Billion by 2023, growing at a CAGR of 6.3%. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

The objectives of this study are as follows:

- To define, describe, and forecast the global market by product & service, type, end user, and region

- To provide detailed information about factors influencing market growth (drivers, restraints, opportunities, and market-specific trends)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW).

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions; product launches; expansions; agreements, partnerships, and collaborations; and R&D activities in the market

Research Methodology

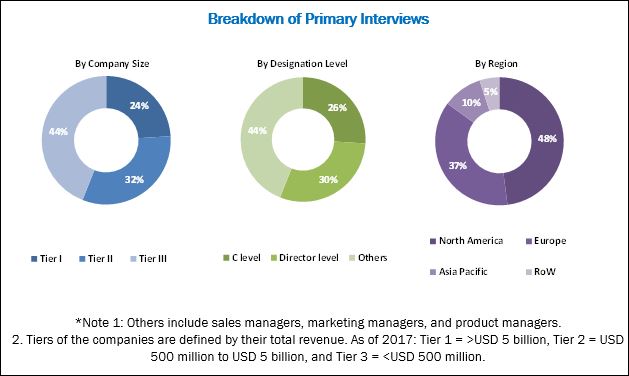

The study estimates the specimen validity testing market size for 2018 and projects its demand till 2023. In the primary research process, various sources from both demand side and supply side were interviewed to obtain qualitative and quantitative information for the report. Primary sources from the demand side include various industry CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from the various players in the market. For the market estimation process, both top-down and bottom-up approaches were used to estimate and validate the market size of the market as well as to estimate the market size of various other dependent submarkets. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The specimen validity testing market is marked by the presence of several big and small players. Prominent players offering specimen validity testing products include Thermo Fisher (US), Sciteck. (US), American Bio Medica Corporation (ABMC), Alere (US), Express Diagnostics (US), and Premier Biotech (US). While, LabCorp (US), Quest Diagnostics (US), Alere Toxicology (US), ACM Global Laboratories (US), Clinical Reference Laboratory (CRL) (US), SureHire (Canada), and CannAmm (Canada) are some of the leading service providers.

Target Audience for this Report:

- Drug and alcohol testing laboratories

- Rapid drug screening device manufacturers

- Specimen validity testing reagent manufacturers

- Workplace drug testing

- Law enforcement agencies

- Government agencies

- Research and consulting firms

- Venture capitalists

Scope of the Report

This report categorizes the market into following segments and subsegments:

By Product & Service

-

Products

- Reagent, Calibrators, and Controls

- Assay Kits

- Disposables

- Services

By Type

- Laboratory Testing

- Rapid/POC Testing

By End User

- Workplaces

- Drug Screening Laboratories

- Criminal Justice and Law Enforcement Agencies

- Pain Management Centers

- Drug Rehabilitation Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe (RoE)

- Asia Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for this report.

Company Information

Detailed analysis and profiling of additional market players (up to 5)

Product Analysis

Product Matrix, which gives a detailed comparison of product portfolios of the top companies

The global specimen validity testing market is projected to reach USD 1.49 Billion by 2023 from USD 1.10 Billion in 2018, at a CAGR of 6.3%. The growth of the market is primarily driven by the growth in drug screening market and increase in workplace drug testing.

The report segments the global market by product and service, type, end user, and region.

The market is broadly segmented into products and services. The services segment is expected to register the highest growth rate during the forecast period. The high growth in this segment is attributed to the implementation of workplace drug testing in several countries, increase in the number of drug screening tests, and growing number of drug screening laboratories across the globe.

Based on product, the market is categorized into reagents, calibrators, & controls; assay kits; and disposables. In 2018, the reagents, calibrators, and controls segment is expected to account for the largest share of the market, owing to the repeated purchase of these products.

The global market by type is segmented into laboratory testing and rapid/POC testing. In 2018, the laboratory testing segment is expected to account for the largest share of the market. However, the rapid/POC testing segment is expected to register the highest growth during the forecast period. The high growth of the rapid/POC testing segment can be attributed benefits such as instant results, ability to detect multiple drugs at once, and the recurrent & repetitive usage of rapid/POC drug testing products.

Based on end user, the market is segmented into workplaces, drug screening laboratories, criminal justice and law enforcement agencies, pain management centers, drug rehabilitation centers, and other end users. In 2018, the workplaces segment is expected to account for the largest share of the market. The growth in this segment can be attributed to the increasing incidence of substance abuse in the workplace and the growing number of organizations that have made regular drug screening mandatory.

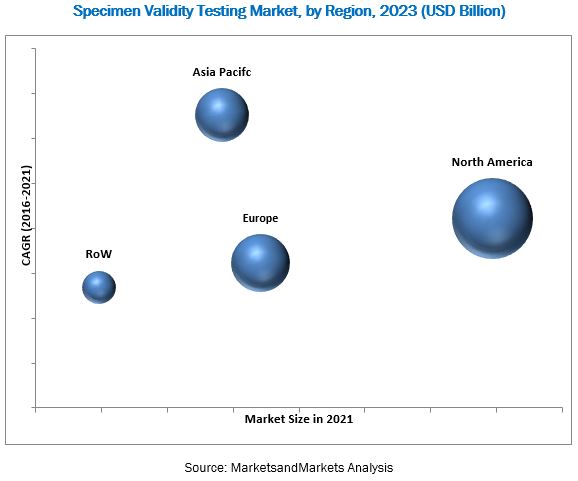

The market is dominated by North America, followed by Europe. The dominance of the North American market is attributed to factors such as the growing consumption of illicit drugs, the presence of stringent laws mandating drug screening, availability of government funding (to help curb drug abuse), and the presence of key players in the region.

While the specimen validity testing market represents significant growth opportunities, market growth may be hindered due to the emergence of alternative drug screening tests.

The market is marked by the presence of several big and small players. Prominent players offering specimen validity testing products include Thermo Fisher (US), Sciteck (US), American Bio Medica Corporation (ABMC), Alere (US), Express Diagnostics (US), and Premier Biotech. While, LabCorp (US), Quest Diagnostics (US), Alere Toxicology (US), ACM Global Laboratories (US), Clinical Reference Laboratory (CRL) (US), SureHire (Canada), and CannAmm (Canada) are some of the leading service providers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.2 Secondary Data

2.2.1 Secondary Sources

2.3 Primary Data

2.3.1 Primary Sources

2.3.2 Key Industry Insights

2.4 Market Estimation

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Specimen Validity Testing Market Overview

4.2 Market, By Type (2018 vs 2023)

4.3 Specimen Validity Testing Products Market, By Type (2018 vs 2023)

4.4 Geographic Analysis: European Market, By End User and Region (2018)

4.5 Geographic Snapshot: Market (2018–2023)

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in the Drug Screening Market

5.2.1.2 Increase in Workplace Drug Testing

5.2.2 Restraints

5.2.2.1 Emergence of Alternative Drug Screening Tests

5.2.3 Market Opportunities

5.2.3.1 Rapid/Point-Of-Care Specimen Validity Testing

5.2.4 Market Trends

5.2.4.1 Market Consolidation

5.2.4.2 Regulatory Approvals for Rapid Testing Products

6 Market, By Product & Service (Page No. - 36)

6.1 Introduction

6.2 Products

6.2.1 Reagents, Calibrators, and Controls

6.2.2 Assay Kits

6.2.3 Disposables

6.3 Services

7 Market, By Type (Page No. - 45)

7.1 Introduction

7.2 Laboratory Testing

7.3 Rapid/PoC Testing

8 Market, By End User (Page No. - 51)

8.1 Introduction

8.2 Workplaces

8.3 Drug Screening Laboratories

8.4 Criminal Justice and Law Enforcement Agencies

8.5 Pain Management Centers

8.6 Drug Rehabilitation Centers

8.7 Other End Users

9 Market, By Region (Page No. - 63)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Rest of Europe (RoE)

9.4 Asia Pacific

9.5 Rest of the World (RoW)

10 Competitive Landscape (Page No. - 92)

10.1 Introduction

10.2 Market Ranking Analysis, By Key Player

10.3 Competitive Scenario

10.3.1 Product Launches and Approvals

10.3.2 Acquisitions

10.3.3 Partnership, Agreements, and Collaboration

10.3.4 Expansions

11 Company Profiles (Page No. - 96)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Alere (Subsidiary of Abbott Laboratories)

11.2 Thermo Fisher Scientific

11.3 LabCorp

11.4 Quest Diagnostics

11.5 American Bio Medica Corporation (ABMC)

11.6 Sciteck

11.7 Premier Biotech

11.8 Alfa Scientific Designs

11.9 ACM Global Laboratories

11.10 Express Diagnostic International

11.11 Clinical Reference Laboratory

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 113)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (89 Tables)

Table 1 Recent Product Launches (2015–2017)

Table 2 Recent Acquisitions (2017)

Table 3 Recent FDA Approvals for Rapid Testing Products (2017–2018)

Table 4 Market, By Type, 2016–2023 (USD Million)

Table 5 Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 6 Market for Reagents, Calibrators, and Controls, By Region, 2016–2023 (USD Million)

Table 7 North America: Market for Reagents, Calibrators, and Controls, By Country, 2016–2023 (USD Million)

Table 8 Europe: Market for Reagents, Calibrators, and Controls, By Country, 2016–2023 (USD Million)

Table 9 Market for Assay Kits, By Region, 2016–2023 (USD Million)

Table 10 North America: Market for Assay Kits, By Country, 2016–2023 (USD Million)

Table 11 Europe: Market for Assay Kits, By Country, 2016–2023 (USD Million)

Table 12 Specimen Validity Testing: Market for Disposables, By Region, 2016–2023 (USD Million)

Table 13 North America: Market for Disposables, By Country, 2016–2023 (USD Million)

Table 14 Europe: Specimen Validity Testing: Market for Disposables, By Country, 2016–2023 (USD Million)

Table 15 Specimen Validity Testing Services Market, By Region, 2016–2023 (USD Million)

Table 16 North America: Specimen Validity Testing Services Market, By Country, 2016–2023 (USD Million)

Table 17 Europe: Specimen Validity Testing Services Market, By Country, 2016–2023 (USD Million)

Table 18 Specimen Validity Testing: Market, By Type, 2016-2023 (USD Million)

Table 19 Laboratory Testing Market, By Region, 2016-2023 (USD Million)

Table 20 North America: Laboratory Testing Market, By Country, 2016-2023 (USD Million)

Table 21 Europe: Laboratory Testing Market, By Country, 2016-2023 (USD Million)

Table 22 Rapid/PoC Testing Market, By Region, 2016-2023 (USD Million)

Table 23 North America: Rapid/PoC Testing Market, By Country, 2016-2023 (USD Million)

Table 24 Europe: Rapid/PoC Testing Market, By Country, 2016-2023 (USD Million)

Table 25 Specimen Validity Testing: Market, By End User, 2016–2023 (USD Million)

Table 26 Specimen Validity Testing: Market for Workplaces, By Region, 2016–2023 (USD Million)

Table 27 North America: Market for Workplaces, By Country, 2016–2023 (USD Million)

Table 28 Europe: Market for Workplaces, By Country, 2016–2023 (USD Million)

Table 29 Specimen Validity Testing: Market for Drug Screening Laboratories, By Region, 2016–2023 (USD Million)

Table 30 North America: Market for Drug Screening Laboratories, By Country, 2016–2023 (USD Million)

Table 31 Europe: Market for Drug Screening Laboratories, By Country, 2016–2023 (USD Million)

Table 32 Specimen Validity Testing: Market for Criminal Justice and Law Enforcement Agencies, By Region, 2016–2023 (USD Million)

Table 33 North America: Specimen Validity Testing: Market for Criminal Justice and Law Enforcement Agencies, By Country, 2016–2023 (USD Million)

Table 34 Europe: Specimen Validity Testing: Market for Criminal Justice and Law Enforcement Agencies, By Country, 2016–2023 (USD Million)

Table 35 Specimen Validity Testing: Market for Pain Management Centers, By Region, 2016–2023 (USD Million)

Table 36 North America: Market for Pain Management Centers, By Country, 2016–2023 (USD Million)

Table 37 Europe: Market for Pain Management Centers, By Country, 2016–2023 (USD Million)

Table 38 Specimen Validity Testing: Market for Drug Rehabilitation Centers, By Region, 2016–2023 (USD Million)

Table 39 North America: Market for Drug Rehabilitation Centers, By Country, 2016–2023 (USD Million)

Table 40 Europe: Specimen Validity Testing: Market for Drug Rehabilitation Centers, By Country, 2016–2023 (USD Million)

Table 41 Specimen Validity Testing: Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 42 North America: Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 43 Europe: Specimen Validity Testing: Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 44 Specimen Validity Testing: Market, By Region, 2016–2023 (USD Million)

Table 45 North America: Market, By Country, 2016–2023 (USD Million)

Table 46 North America: Market, By Type, 2016–2023 (USD Million)

Table 47 North America: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 48 North America: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 49 North America: Market, By End User, 2016–2023 (USD Million)

Table 50 US: Market, By Type, 2016–2023 (USD Million)

Table 51 US: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 52 US: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 53 US: Market, By End User, 2016–2023 (USD Million)

Table 54 Canada: Market, By Type, 2016–2023 (USD Million)

Table 55 Canada: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 56 Canada: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 57 Canada: Market, By End User, 2016–2023 (USD Million)

Table 58 Europe: Market, By Country, 2016–2023 (USD Million)

Table 59 Europe: Market, By Type, 2016–2023 (USD Million)

Table 60 Europe: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 61 Europe: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 62 Europe: Market, By End User, 2016–2023 (USD Million)

Table 63 Germany: Specimen Validity Testing: Market, By Type, 2016–2023 (USD Million)

Table 64 Germany: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 65 Germany: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 66 Germany: Market, By End User, 2016–2023 (USD Million)

Table 67 France: Market, By Type, 2016–2023 (USD Million)

Table 68 France: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 69 France: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 70 France: Market, By End User, 2016–2023 (USD Million)

Table 71 UK: Market, By Type, 2016–2023 (USD Million)

Table 72 UK: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 73 UK: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 74 UK: Market, By End User, 2016–2023 (USD Million)

Table 75 RoE: Market, By Type, 2016–2023 (USD Million)

Table 76 RoE: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 77 RoE: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 78 RoE: Market, By End User, 2016–2023 (USD Million)

Table 79 Asia Pacific: Market, By Type, 2016–2023 (USD Million)

Table 80 Asia Pacific: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 81 Asia Pacific: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 82 Asia Pacific: Market, By End User, 2016–2023 (USD Million)

Table 83 RoW: Market, By Type, 2016–2023 (USD Million)

Table 84 RoW: Specimen Validity Testing Products & Services Market, By Type, 2016–2023 (USD Million)

Table 85 RoW: Specimen Validity Testing Products Market, By Type, 2016–2023 (USD Million)

Table 86 RoW: Market, By End User, 2016–2023 (USD Million)

Table 87 Market Ranking (2017), By Key Player

Table 88 Product Launches and Approvals

Table 89 Mergers and Acquisitions

List of Figures (32 Figures)

Figure 1 Specimen Validity Testing Market

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Market Snapshot: Laboratory Testing vs Rapid/PoC Testing (2018 vs 2023)

Figure 8 Specimen Validity Testing Services to Register the Highest CAGR During the Forecast Period

Figure 9 Reagents, Calibrators, & Controls to Dominate the Specimen Validity Testing Products Market in 2018

Figure 10 Workplaces Segment to Dominate the Market in 2018

Figure 11 Asia Pacific to Witness Highest Growth Rate During the Forecast Period

Figure 12 Increase in Workplace Drug Testing is Driving the Growth of the Market

Figure 13 Laboratory Testing Segment Will Continue to Dominate the Market in 2023

Figure 14 Reagents, Calibrators, and Controls Segment to Dominate the Market During the Forecast Period (2018–2023)

Figure 15 Workplaces Segment to Dominate the European Market in 2018

Figure 16 Market: Drivers, Restraints, Opportunities, & Trends

Figure 17 Market, By Type, 2018 vs 2023 (USD Million)

Figure 18 Reagents, Calibrators, and Controls to Dominate the Specimen Validity Testing Products Market in 2018

Figure 19 Rapid/PoC Testing Segment to Grow at the Highest CAGR During the Forecast Period

Figure 20 Workplace Drug Testing to Dominate the Market During the Forecast Period

Figure 21 North America to Dominate the Market During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 Europe: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Rest of the World: Market Snapshot

Figure 26 Key Developments in the Specimen Validity Market Between 2015 and 2018

Figure 27 Market Evolution Framework

Figure 28 Abbott Laboratories: Company Snapshot (2017)

Figure 29 Thermo Fisher Scientific: Company Snapshot (2017)

Figure 30 LabCorp: Company Snapshot (2017)

Figure 31 Quest Diagnostics: Company Snapshot (2017)

Figure 32 American Bio Medica Corporation (ABMC): Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Specimen Validity Testing Market