Drug Screening Market Size, Growth, Share & Trends Analysis

Drug Screening Market by Offering [On-site Testing, Rapid Testing (Urine, Oral), Analytical (Breathalyzer, Immunoassay, Chromatography)], Sample (Blood, Urine, Hair), Drug (Cannabis, Alcohol), End User (Workplace, Law, Hospitals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

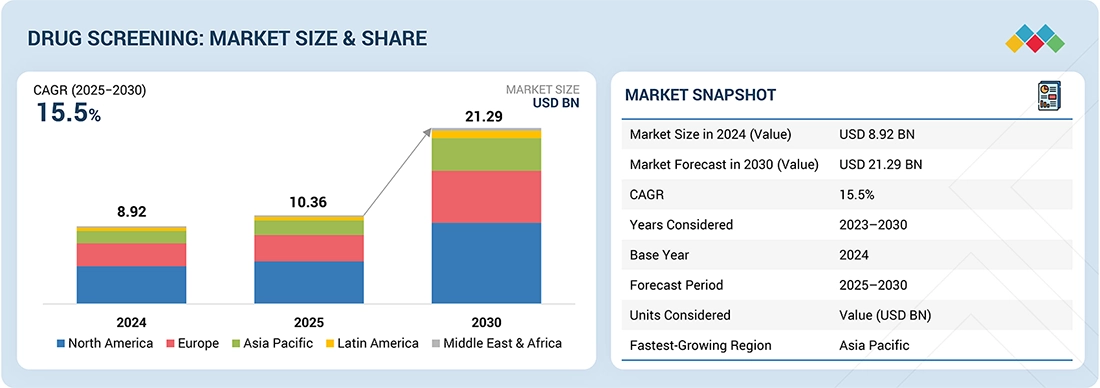

The global drug screening market, valued at US$8.92 billion in 2024, stood at US$10.36 billion in 2025 and is projected to advance at a resilient CAGR of 15.5% from 2025 to 2030, culminating in a forecasted valuation of US$21.29 billion by the end of the period.

KEY TAKEAWAYS

-

By RegionNorth America accounted for the largest share of 48.0% of the global drug screening market in 2024.

-

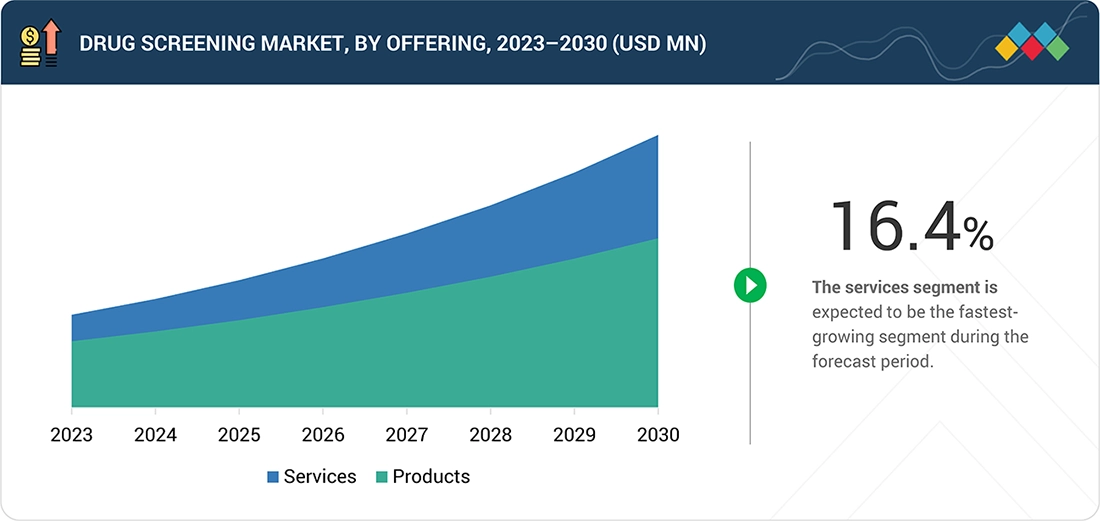

By OfferingIn 2024, the services segment accounted for 58.8% of the drug screening market.

-

By Sample TypeThe oral fluid samples segment is projected to register the highest CAGR of 17.1% during the forecast period.

-

By Drug TypeThe cannabis segment is projected to register the highest growth in the drug screening market.

-

By End UserDrug Testing Laboratories accounted for the largest share of the drug screening market in 2024.

-

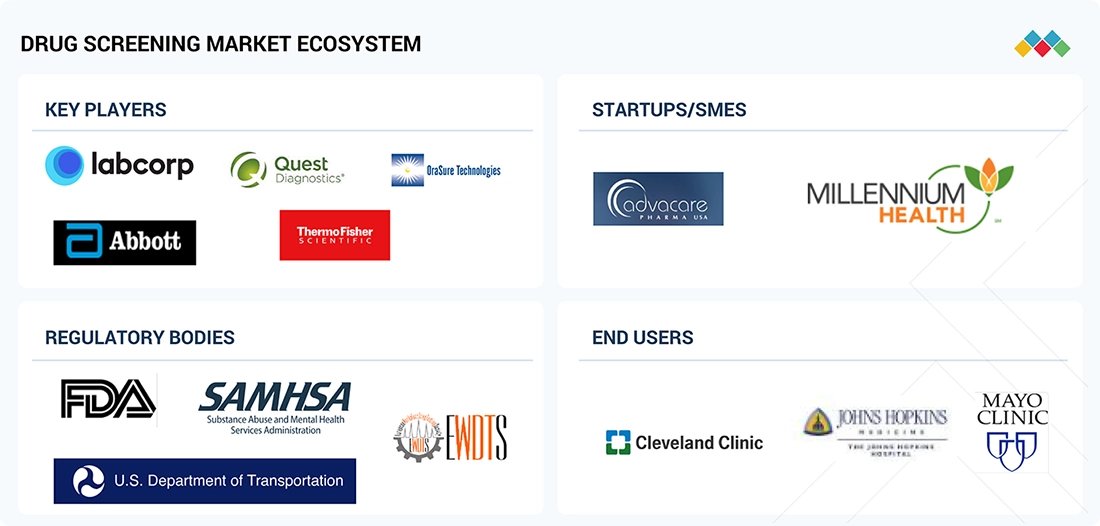

Competitive LandscapeLabcorp, Quest Diagnostic Incorporated, and Abbott were identified as some of the star players in the drug screening market (global), given their strong market share and product footprint.

-

Competitive LandscapeACM Global Laboratories has distinguished itself among startups and SMEs by securing strong footholds in specialized niche areas, underscoring its potential as an emerging market leader.

The market for drug screening is being fueled by growing workplace and clinical testing programs, an increased need for opioid/polysubstance monitoring, and an increased use of rapid point-of-care technologies and advanced confirmatory testing (LC MS/MS) systems. However, factors such as false positives, chain-of-custody issues, and privacy concerns may hinder the marketplace.

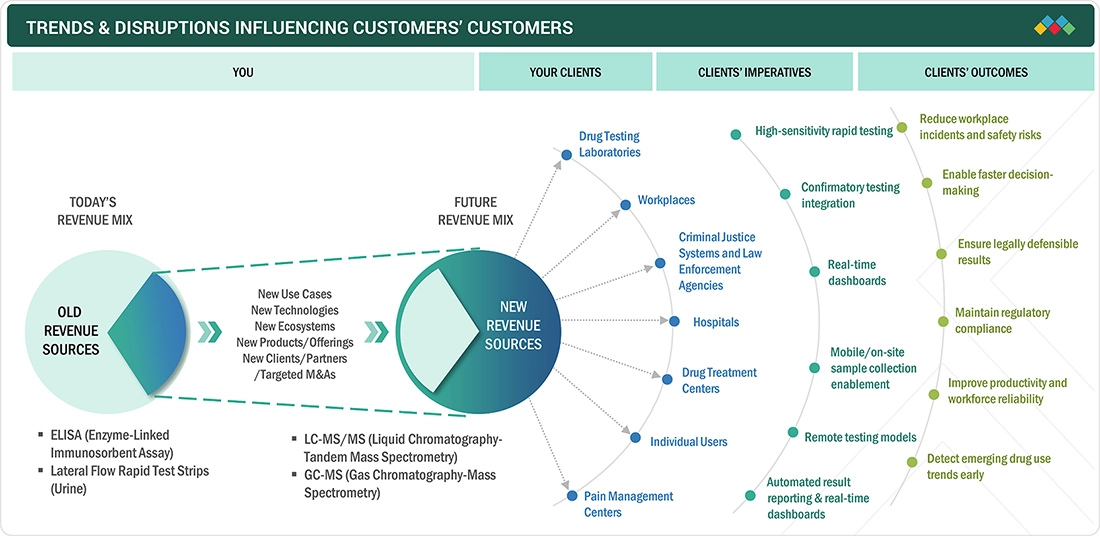

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The drug screening industry is currently undergoing a paradigm shift driven by the incorporation of rapid point-of-care analysis, highly sensitive confirmation procedures (LC-MS/MS technology), and automation in laboratory processing for drug screenings carried out at the workplace and in health and forensic settings. Some of the new trends, namely oral fluid testing, expanded opiate drug panels for fentanyl variants, and cloud-assisted chain-of-custody solutions for reporting, are working to increase the speed & scalability of the process while also eliminating the risks associated with tampering with results. There also appears to be a rising emphasis on the aspect of compliance, privacy, and result integrity, which requires laboratories and service deliverers to upgrade their infrastructure and quality processes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing consumption of illicit drugs and alcohol

-

Enforcement of stringent laws mandating drug and alcohol testing

Level

-

Ban on alcohol consumption in Islamic countries

-

Prohibition on workplace drug testing

Level

-

Popularity of oral fluid testing

-

Introduction of fingerprint-based drug testing at workplaces

Level

-

Accuracy and specificity concerns in breathalyzers

-

False positive and negative results in drug screening

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing consumption of illicit drugs and alcohol

With the increase in drug abuse and the overall health concern that comes with addiction, more screening for drug and alcohol abuse is being conducted by the government, the business community, and the healthcare industry. The main driver for the growth of the drug screening industry is the overall rise in the abuse of illicit drugs and alcohol, which means that more screenings are being conducted in hospitals, rehab facilities, and law enforcement organizations for rapid clinical decision-making and risk prevention. Furthermore, the overall rise in the abuse of many substances and the potency of the substances being used is resulting in the overall need for extended drug panels and more screenings for the accurate identification of abuse cases. Overall, the drug screening industry is driven by the overall need for the monitoring of abuse and the overall prevention of accidents and the effects associated with drug and alcohol abuse that affect the community as a whole.

Restraint: Ban on alcohol consumption in Islamic countries

As consumption of alcohol is forbidden or restricted in many Islamic countries, the demand for alcohol screening and related testing services is substantially limited. The implementation of government policies to enforce a ban on alcohol production, sale, and consumption reduces the need for routine alcohol screenings across workplaces, healthcare facilities, and law enforcement settings. In addition, lower reported alcohol usage limits large-scale preventive screening programs, especially in occupational health and public safety applications. Accordingly, the overall scope for alcohol testing under drug screening panels is limited.

Opportunity: Popularity of oral fluid testing

The increasing use of oral fluid testing creates a strong opportunity for the drug screening industry, as there is a greater demand from organizations for rapid, non-invasive & efficient procedures for screening. Oral fluid collection facilitates direct observation, making it less vulnerable to adulteration or substitution than urine tests. Moreover, rapid testing for recent use through oral fluid testing is also important for post-incident, reasonable suspicion, or roadside testing, which require decision support in near-real-time environments. The growing adoption of advanced oral fluid tests is also making this product more attractive, driving greater use and, in turn, fueling industry growth.

Challenge: Accuracy and specificity concerns in breathalyzers

One of the major challenges in the drug screening industry concerns the accuracy, specificity, and legal defensibility of breath analyzers, particularly those tests that must be legally defensible in court. Breath alcohol, in fact, can be affected in a variety of ways, including device calibration errors, sample collection techniques, environmental factors, and individual physiology, which can all contribute to questionable results. Further, breath alcohol detectors are only effective at detecting use of the substance short of a test period prior to analysis, as opposed to levels of intoxication, thereby restricting use in a variety of applications that require high-level enforcement action. These issues require more frequent confirmatory laboratory testing and more stringent quality control, thereby increasing time and operational complexity. Limitations in accuracy and challenges with specificity can restrain the wider acceptance and confidence in screening programs based on breathalyzers.

DRUG SCREENING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Comprehensive drug screening + confirmatory testing services supporting workplace compliance and clinical monitoring | Broad test menu, consistent chain-of-custody, improved compliance readiness |

|

Large-scale drug testing services for employers, healthcare providers, and government agencies (pre-employment, random, post-accident) | Nationwide access, reliable reporting, scalable testing volumes |

|

Rapid drug-of-abuse screening solutions used in emergency departments, clinics, and workplace programs for quick preliminary detection | Faster decision-making, immediate triage support, reduced delays in care and safety actions |

|

Oral fluid-based collection devices and screening solutions for workplace and forensic testing | Non-invasive collection, reduced tampering, easier on-site sample capture |

|

LC-MS/MS confirmatory drug testing platforms for forensic and clinical toxicology labs (high sensitivity drug identification) | Higher specificity, reduced false positives, legally defensible results |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The drug screening market ecosystem comprises leading testing technology and service providers such as Labcorp, Quest Diagnostics, Abbott, Thermo Fisher Scientific, Roche, Siemens Healthineers, Shimadzu, OraSure Technologies, Dräger, Premier Biotech, Psychemedics, and Omega Laboratories, which deliver rapid screening kits, oral fluid collection systems, confirmatory LC-MS/MS platforms, and high-throughput laboratory testing services. Workplace- and compliance-focused players such as CareHealth America and AccuSourceHR, along with specialized providers such as LifeLoc Technologies and Intoximeters, support program execution through breath alcohol testing and field-ready screening solutions. Regulatory bodies such as the US FDA, SAMHSA, and the US Department of Transportation (DOT) ensure testing standardization, result integrity, and compliance across applications. End users, including drug testing laboratories, workplaces, hospitals, pain management centers, and criminal justice and law enforcement agencies, adopt these solutions to improve workplace safety, enable clinical monitoring, and strengthen regulatory enforcement. Collaboration across manufacturers, labs, and regulators is accelerating innovation in oral fluid testing, expanded drug panels, and digital chain-of-custody reporting, driving overall market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drug Screening Market, By Offering

The services segment dominates the drug screening market because employers, healthcare organizations, and forensic departments are increasingly outsourcing end-to-end drug testing operations to achieve quicker turnaround times and consistent reporting and compliance requirements. There is an increasing tendency among organizations to outsource specialized drug testing services, which in turn eliminates internal logistical requirements and ensures that accuracy and quality standards are maintained in drug test results. The increasing trend of drug testing in the workplace, particularly in safety-sensitive work environments, and also in response to increasing demand for drug testing in a random and post-incident manner, is also boosting service adoption. The inclusion of reporting technology and program management functionality is also making drug screening operations more efficient.

Drug Screening Market, By Sample Type

The urine samples segment accounted for the leading share of the drug screening market in 2024, thanks to its widespread acceptance as the preferred biological specimen for workplace, clinical, and forensic applications. This type of test is widely preferred for its excellent cost-effectiveness and high detectability. It is also much less complex than blood or saliva tests, which involve the use of highly sophisticated systems to conduct testing. The results offer an excellent cost-versus-performance ratio. The segment also benefits from standardized procedures for testing and confirmation. This makes it simpler to implement on a mass scale. Additionally, it provides rapid point-of-care test kits and laboratory confirmation tests.

Drug Screening Market, By Drug Type

The cannabis segment is projected to witness significant growth in the drug screening market because of its high usage rate among people from different age groups and its increased relevance in workplace, clinical, and forensic drug screening programs. Moreover, despite changes in drug legalization policies in different regions and countries, cannabis remains a substance that is largely monitored because it can affect cognitive functions and reaction times, especially in safety-sensitive jobs. Additionally, the increased popularity of workplace drug screening and drug screening in emergency and rehabilitation centers continues to ensure its position in the overall market. The easy availability and use of proven drug screening techniques, including immunoassays and confirmatory laboratory tests in urine, continue to ensure that this category holds a leading share in the market.

Drug Screening Market, By End User

The drug testing laboratories segment accounted for the largest share of the drug screening market due to their ability to generate high-throughput, standardized, legally defensible results in the workplace and in clinical & forensic environments. These laboratories remain highly in demand due to their easy access to sophisticated analytical instruments and confirmatory testing, which help accurately detect drugs, even at trace levels. Moreover, drug testing laboratories remain at the forefront in dealing with the management of drug screening programs on a larger scale in the workplace, government, and medical settings, providing comprehensive services such as sample processing, chain-of-custody management, medical review support, and secure web reporting through their overall expertise in drug testing and safety profiling.

REGION

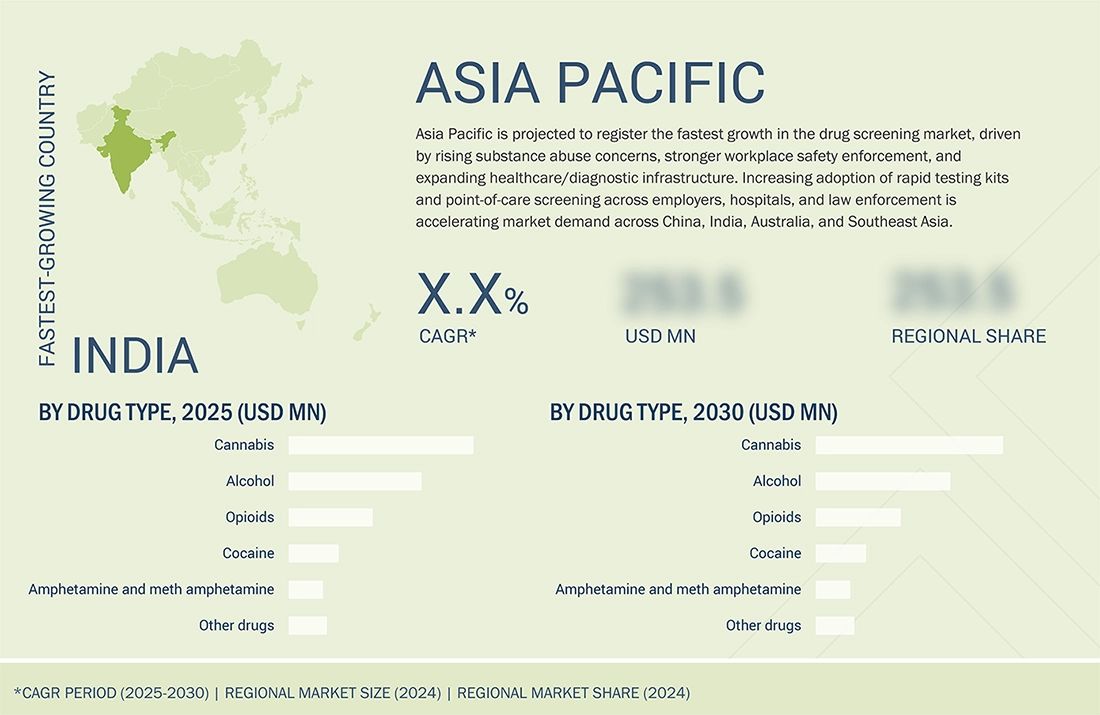

Asia Pacific to register highest CAGR in drug screening market during forecast period (2024-2029)

Asia Pacific is expected to register the highest growth in the drug screening market due to rising concerns about drug abuse, strengthened workplace safety regulations, and increased healthcare infrastructure spending in major emerging nations, such as China, India, Japan, South Korea, and Southeast Asia. The rapid pace of industrialization in Asia, along with the growing focus on workplace safety in industries such as manufacturing, mining, construction, logistics, and air transport, is also driving companies to implement drug testing.

DRUG SCREENING MARKET: COMPANY EVALUATION MATRIX

Labcorp (Star) is one of the major players in the market for drug testing, mainly because of its scope of laboratory testing and toxicology services. Another major player entering the drug testing realm is F. Hoffmann-La Roche Ltd. (Emerging Player). These companies are poised to enhance their positions by leveraging new technologies to use immunoassays as a platform for speedy, accurate drug testing. Even though Labcorp is a major player in the drug screening segment of the testing industry due to its scale and scope, it can face competition from other players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- LabCorp (US)

- Quest Diagnostics Incorporated (US)

- Abbott (US)

- OraSure Technologies Inc. (US)

- Thermo Fisher Scientific Inc. (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Drägerwerk AG & Co. KGaA (Germany)

- Lifeloc Technologies, Inc. (US)

- MPD Inc. (US)

- Omega Laboratories, Inc. (US)

- Premier Biotech, Inc. (US)

- Psychemedics Corporation (US)

- Alfa Scientific Designs Inc. (US)

- Shimadzu Corporation (Japan)

- Siemens Healthineers AG (Germany)

- Bio-Rad Laboratories, Inc. (US)

- Carehealth America Corp (US)

- AccusourceHR Inc. (US)

- Cordant Health Solutions (Australia)

- Advacare Pharma (US)

- Millennium Health (US)

- Clinical Reference Laboratory Inc. (US)

- Intoximeters Inc. (US)

- Intoxalock (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.92 BN |

| Market Forecast in 2030 (Value) | USD 21.9 BN |

| Growth Rate | 15.50% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

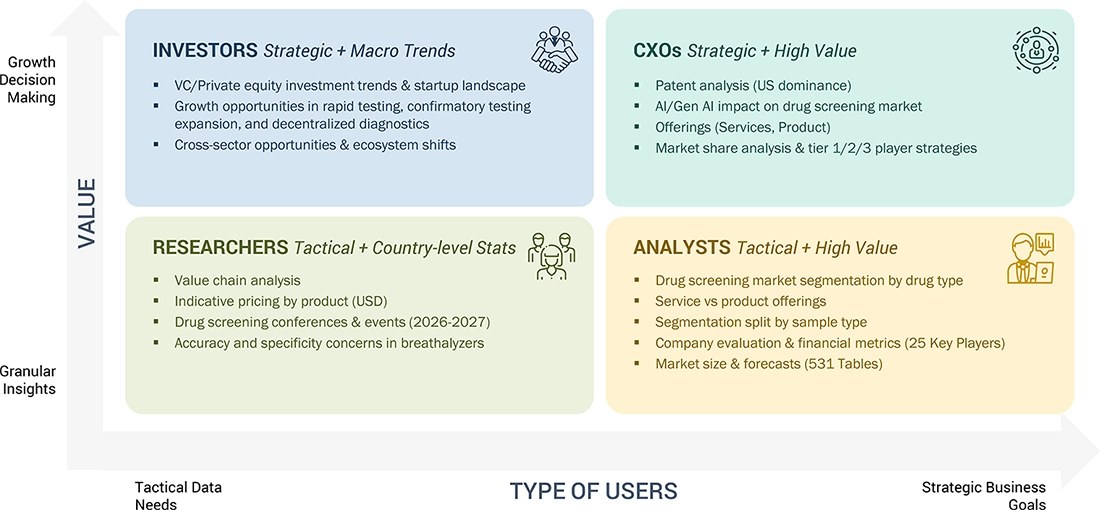

WHAT IS IN IT FOR YOU: DRUG SCREENING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Region-Specific Drug Screening Market Scope (Australia and New Zealand) | Delivered an integrated customization covering rapid testing devices market sizing (Australia & New Zealand), regulatory landscape assessment, and competitive analysis of 3–5 key players operating across Australia and New Zealand | Enabled focused investment decisions, improved vendor benchmarking and partnership strategy, and supported market-entry prioritization based on opportunity size and regulatory requirements |

RECENT DEVELOPMENTS

- September 2025 : LabCorp announced a collaboration with Roche to adopt FDA-cleared digital pathology slide scanners, advancing digital pathology workflows that improve diagnostic efficiency, accuracy, and AI integration across LabCorp’s laboratory services.

- March 2025 : LabCorp (US) acquired select oncology and related clinical testing service assets from BioReference Health, enhancing its laboratory services network and expanding customers’ access to comprehensive diagnostic testing.

- November 2024 : Quest Diagnostic Incorporated introduced definitive urine drug monitoring panels that detect 113 drugs and volatile compounds, respectively, improving clinical toxicology workflows in emergency and baseline assessments and supporting acute poisoning identification with high specificity and confirmatory precision.

Table of Contents

Methodology

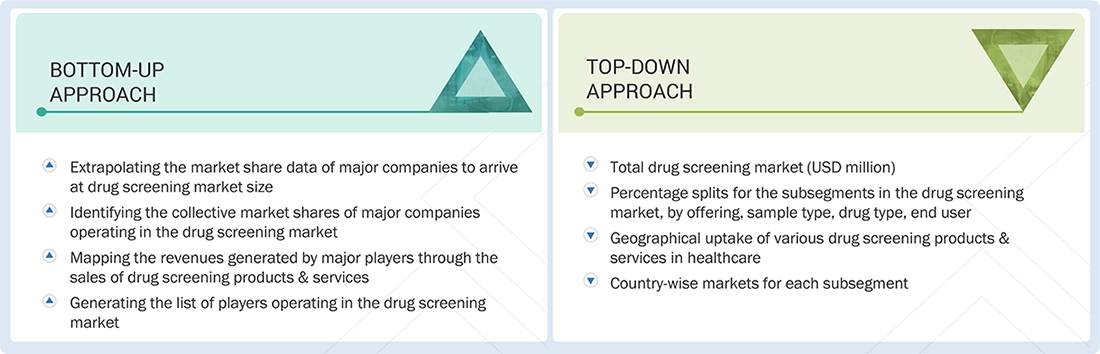

The study involved five major activities to estimate the current size of the drug screening market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for the study of the drug screening market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

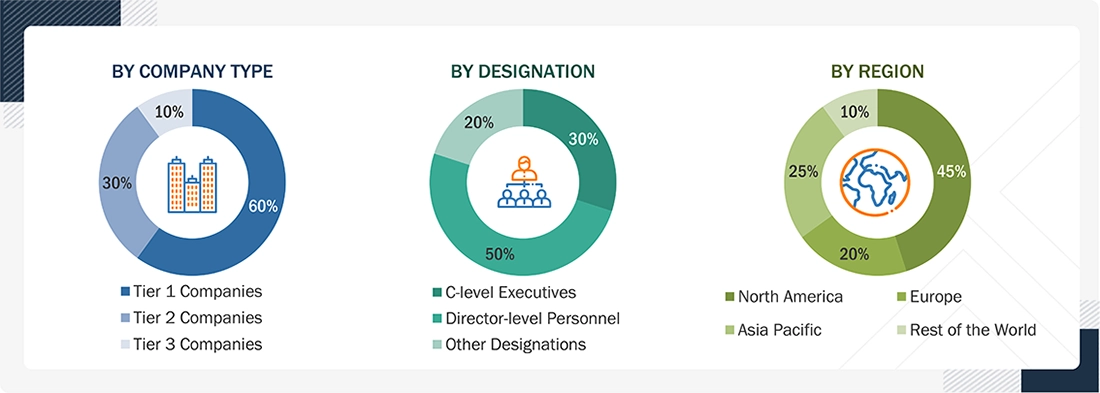

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global drug screening market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

BREAKDOWN OF PRIMARY PARTICIPANTS:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the drug screening market. These methods were also used extensively to estimate the size of various subsegments in the market.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the drug screening market.

Market Definition

Drug and alcohol testing or drug screening refers to testing individuals for illegal abuse of drugs (including legal drugs such as prescription drugs) through the use of biological samples, such as urine, oral fluids/saliva, hair, blood, and sweat.

Key Stakeholders

- Drug screening product & solution providers (Including immunoassay kit manufacturers, confirmatory testing technology providers, breathalyzer and oral fluid testing device developers, rapid test and POCT vendors)

- Drug screening service providers (including Clinical laboratories, reference labs, forensic toxicology labs, workplace testing providers, on-site/mobile testing service companies)

- Healthcare providers (Hospitals, emergency departments, trauma centers, outpatient clinics, rehabilitation centers, pain management clinics, mental health and addiction treatment facilities)

- Workplace & employer organizations

- Law enforcement & public safety agencies

- Research & development (R&D) companies

- Judicial & legal system stakeholders

- Government & regulatory authorities

- Sports organizations & anti-doping agencies

- Payers & insurers

- Patients, employees & tested individuals

- Substance abuse treatment & rehabilitation providers

- Research & development (R&D) organizations

- Venture capitalists & private equity firms

- Advocacy groups & professional associations

- Investors & financial institutions

- Medical research laboratories & clinical trial organizations

- Academic institutions & training centers

- Technology & instrumentation providers

- Laboratory information & data management providers

- Sample collection & logistics providers

- Quality assurance, accreditation & certification bodies

- Consulting, training & compliance service provider

- Data analytics & emerging technology developers

Report Objectives

- To define, describe, and forecast the global drug screening market based on offering, sample type, drug type, end user, and region

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall drug screening market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze the market structure profile of the key players of the drug screening market and comprehensively analyze their core competencies

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To track and analyze competitive developments such as product launches and enhancements, investments, partnerships, collaborations, acquisitions, expansions, product approval, and alliances in the drug screening market during the forecast period.

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company.

- Geographic Analysis: Further breakdown of Latin America, Europe, and the Middle East & Africa drug screening into specific countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Drug Screening Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Drug Screening Market