Squalene Market by Source (Animal Source (Shark Liver Oil), Vegetable Source (Olive Oil, Palm Oil, Amaranth Oil), Biosynthetic (GM Yeast]), End-use Industry (Cosmetics, Food, and Pharmaceuticals), and Region - Global Forecast to 2028

Squalene Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing demand for cosmetic products

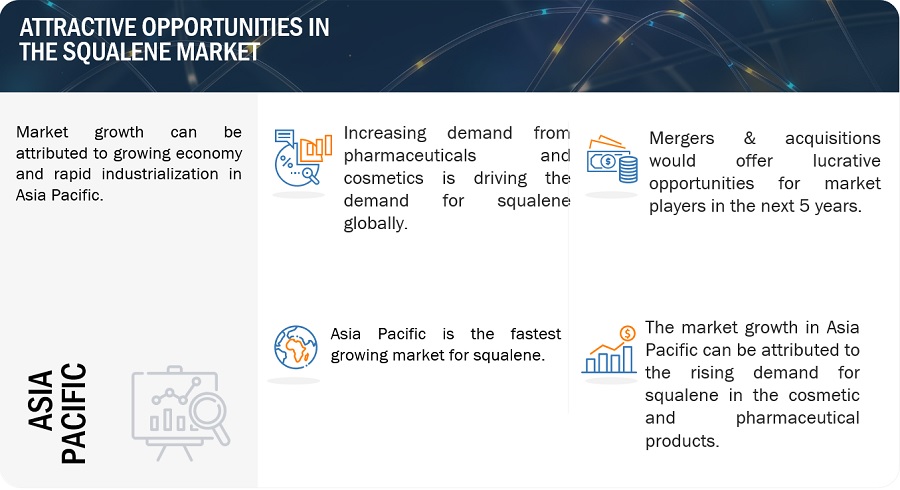

The cosmetics industry has been evolving to be more inclusive and diverse. Brands are expanding their shade ranges for makeup products to cater to a wider range of skin tones, reflecting the demand for products that cater to all ethnicities. The convenience of online shopping has led to a significant increase in cosmetic sales through e-commerce platforms. Consumers can easily browse and purchase products online, which has expanded market access. Personalized and customizable cosmetics are also gaining popularity. Consumers appreciate the ability to tailor products to their specific needs and preferences. All these factor drive the market for squalene used in cosmetic products.

Restraints: Consumer skepticism about animal-sourced products and limitations on shark killing

The traditional source of squalene, shark liver oil, has faced restrictions due to concerns about overfishing and the conservation of shark populations. Some regions have imposed bans or limitations on the extraction of squalene from shark liver oil. Several regulatory bodies such as the General Fisheries Commission of the Mediterranean, Northeast Atlantic Fisheries Commission (NEAFC), Commission for Conservation of Antarctic Marine Living Resources, and North Atlantic Fisheries Organization (NAFO) have imposed restrictions such as fixed quotas for shark fishing, which, in turn, has resulted in supply shortage of shark liver and, thereby squalene. This is expected to restrict the market for animal sourced squalene during the forecast period.

Opportunities: New renewable sources for production

With the restrictions and concern about shark liver oil sourced from sharks and low concentration of squalene in vegetable oils, the supply is volatile, and the prices are fluctuating. Due to various regulations imposed on shark killing the supply of squalene is majorly affected across various regions. The squalene content vegetable oils is very low, and therefore, tons of olives and amaranth are required to produce a small quantity of squalene. This has led to high squalene retail prices. This creates new opportunity for the players to come up with new technologies to develop squalene from alternative sources. Sugarcane and other sugar-containing biomaterials are identified as the sources of producing squalane (hydrogenated squalene).

Challenges: Fluctuating costs of raw materials

With the increasing regulations introduced by various governing bodies, there has been a decline in the shark fishing activities in various regions over the past years. This has resulted in the decline of the supply of shark livers and shark fins over the years. Due to this scenario, companies are trying to shift to vegetable-sourced squalene. Europe leads the market for squalene which is sourced from vegetable oils. For the past few years, there has been an irregular supply of olives in Europe. All these factors are affecting the raw material availability for squalene production, thereby resulting in fluctuation of prices. The raw materials are subject to continuously varying prices, which affect the overall squalene market. This volatility is expected to harm the industry growth, thereby leading to the development of alternative products and challenging the squalene market.

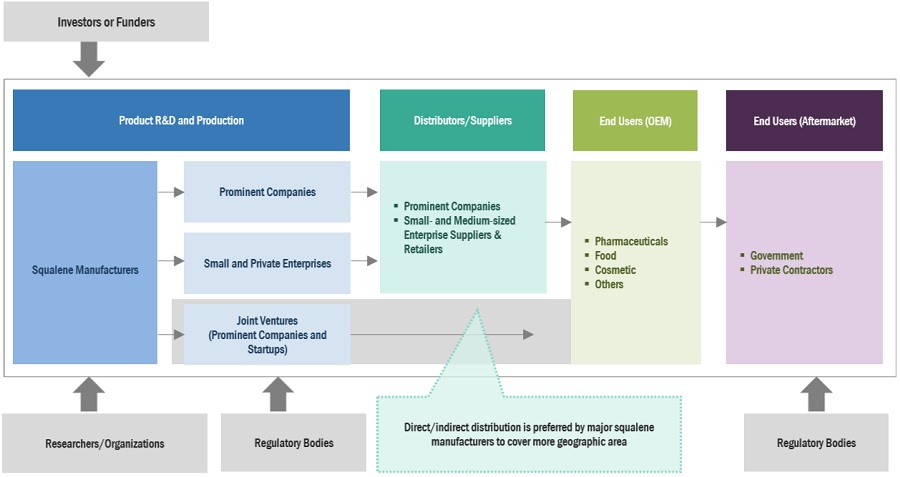

SQUALENE MARKET ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of squalene. These companies have been in business for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Prominent companies in this market include Amyris, Inc (US), SOPHIM (France), Merck KGaA (Germany), Kishimoto Special Liver Oil Co., Ltd. (Japan), Empresa Figueirense De Pesca (Portugal), Arbee (India), Cibus (US), Otto Chemie Pvt. Ltd. (India), Arista Industries (US), and Oleicfat s.l. (Spain).

Based on source, biosynthetic is projected to register highest CAGR, in terms of value, during the forecast period.

Biosynthetic production allows for better control over the quality and purity of squalene. Manufacturers can ensure that the product meets specific quality standards, making it attractive to industries like cosmetics and pharmaceuticals. Biosynthetic squalene is highly stable and pure, which makes it suitable for use in various industries, including cosmetics, skincare, and pharmaceuticals. The growth of biosynthetic squalene is expected to continue, especially as more industries recognize the benefits of sustainable and high-quality squalene sourced through biotechnological methods.

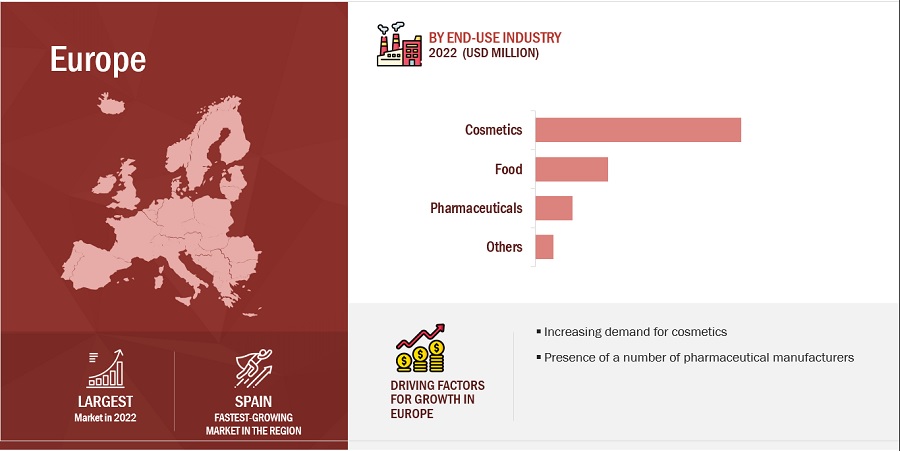

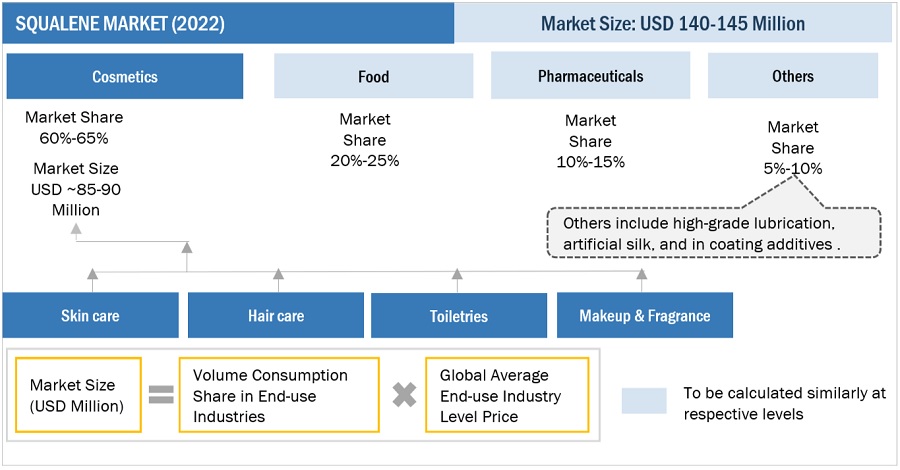

Based on end-use industry, cosmetics was the largest segment for squalene market, in terms of value, in 2022.

Cosmetics end-use industry dominated the squalene market, in terms of both value and volume, in 2022. Antioxidant properties of squalene can aid in shielding the skin from oxidative stress and free radical harm. This makes it a valuable ingredient in anti-aging skincare products, as it can help reduce the appearance of fine lines and wrinkles. Squalene is adaptable and can be blended with other substances in skincare products to increase its potency. It can be found in skincare products that address particular skin issues including hydration, brightness, or acne avoidance. Increasing demand for cosmetic products drives the market for squalene.

“Europe accounted for the largest market share for squalene market, in terms of value, in 2022”

The pharmaceutical industry in Europe may use squalene in the production of vaccines, immunotherapies, and pharmaceutical formulations. The demand for squalene can increase if there is a focus on vaccine development, immunotherapy research, or the use of squalene as an adjuvant in vaccines.The European Union (EU) is home to several pharmaceutical companies and vaccine manufacturers. The development and production of vaccines, especially in response to emerging infectious diseases, can lead to a higher demand for squalene-based adjuvants. Also, the consumers are often well-informed and health-conscious. They may seek products that include squalene for its potential health and skincare benefits, further driving demand in cosmetics end-use industry. All these factors are driving the market for squalene in Europe region majorly in cosmetics and pharmaceutical end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players profiled in the report include Amyris, Inc (US), SOPHIM (France), Merck KGaA (Germany), Kishimoto Special Liver Oil Co., Ltd. (Japan), Empresa Figueirense De Pesca (Portugal), Arbee (India), Cibus (US), Otto Chemie Pvt. Ltd. (India), Arista Industries (US), and Oleicfat s.l. (Spain).among others, these are the key manufacturers that secured major market share in the last few years.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Ton) and Value (USD Thousand/Million) |

|

Segments covered |

Source, End-use Industry, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The key players profiled in the report include Amyris, Inc (US), SOPHIM (France), Merck KGaA (Germany), Kishimoto Special Liver Oil Co., Ltd. (Japan), Empresa Figueirense De Pesca (Portugal), Arbee (India), Cibus (US), Otto Chemie Pvt. Ltd. (India), Arista Industries (US), and Oleicfat s.l. (Spain) among others. |

This report categorizes the global Squalene market based on type, application, and region.

On the basis of source, the squalene market has been segmented as follows:

- Vegetable

- Animal

- Biosynthetic

On the basis of end-use industry, the squalene market has been segmented as follows:

- Cosmetics

- Food

- Pharmaceuticals

- Others

On the basis of region, the pastic injection molding machine market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In August 2021, Amyris, Inc. launched Rose Inc., a clean color cosmetics brand. The products’ non-comedogenic formulas are developed with proprietary bioengineered and sustainably-sourced ingredients, including squalene and hemisqualane.

- In April 2020, Amyris, Inc. launched the squalene-based hand sanitizer named Pipette under its No Compromise Pipette baby care branded products. The hand sanitizer contains 65% USP plant-based ethyl alcohol, glycerin, and Amyris, Inc.’s sugarcane-derived squalene (for moisturizing benefit).

- In May 2023, Amyris, Inc. signed an exclusive license agreement with British specialty chemicals company Croda International Plc, ("Croda") for the supply of sustainable squalene.

- In July 2023, SOPHIM launched a moisturizing and soothing massage oil. It helps in restoring the skin’s lipidic film, creating a protective barrier that preserves your epidermis from external aggression.

- In June 2023, SOPHIM launched a moisturizing foot mask. The ingredients in this formulation restores the lipid barrier for long-lasting protection against external aggressors and dryness.

Frequently Asked Questions (FAQ):

Which are the major players in squalene market?

The key players profiled in the report include Amyris, Inc (US), SOPHIM (France), Merck KGaA (Germany), Kishimoto Special Liver Oil Co., Ltd. (Japan), Empresa Figueirense De Pesca (Portugal), Arbee (India), Cibus (US), Otto Chemie Pvt. Ltd. (India), Arista Industries (US), and Oleicfat s.l. (Spain).

What are the drivers and opportunities for the squalene market?

The increasing demand from cosmetic and pharmaceutical industries are the major drives for squalene market. Also, new renewable sources for production is expected to create new opportunities for the market.

What are the various strategies key players are focusing within squalene market?

New product launches, expansion and partnership are some of the strategies atoped by key players to expand their global presence.

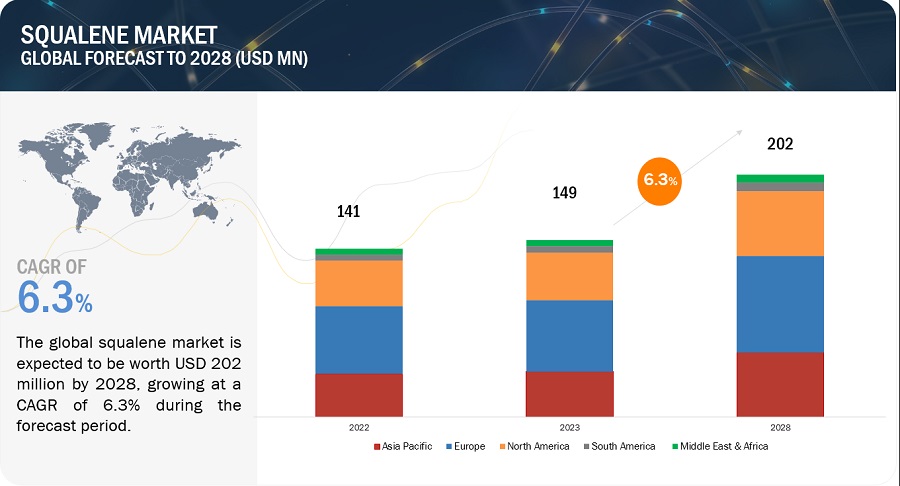

What is the CAGR of the Squalene Market?

The market is projected to grow at a CAGR of 6.34%, in terms of value, during the forecast period.

What are the major factors restraining squalene market growth during the forecast period?

Consumer skepticism about animal-sourced products and limitations on shark fishing is expected to restrict the market demand. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size for squalene. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

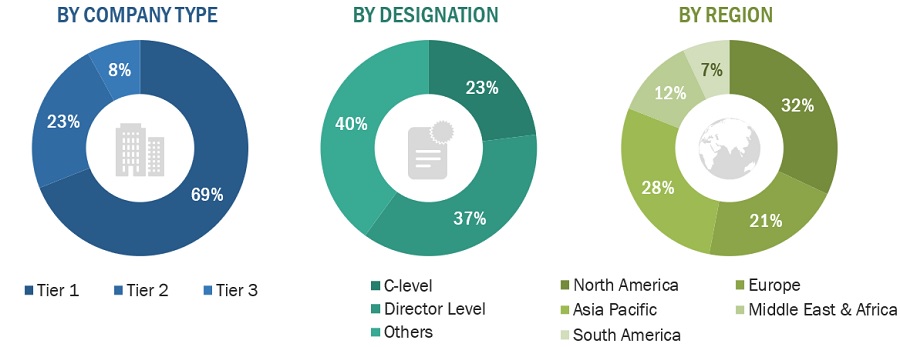

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The squalene market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the cosmetics, pharmaceuticals, food and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

|

COMPANY NAME |

DESIGNATION |

|

Amyris, Inc. |

Senior Manager |

|

SOPHIM |

Innovation Manager |

|

Arbee |

Sales Manager |

|

Merck KGaA |

Production Supervisor |

|

Cibus |

Vice-President |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the squalene market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Squalene Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Squalene Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the squalene industry.

Market Definition

Squalene is a natural organic compound in the form of an oil; it helps to hydrate and maintain the barrier of the skin. Squalene has also been found to have an antioxidant effect. Traditional squalene is been sourced from shark liver oil, which is known to contain about 40-60% of squalene. Vegetable is another source for squalene, such as olive oil, rice bran oil, wheat germ oil, and amaranth oil. It is used as an emollient or moisturizer in cosmetic products that are required for softening the skin. Squalene is also used in food and pharmaceutical products (vaccines).

Key Stakeholders

- Squalene manufacturers

- Squalene suppliers

- Raw material suppliers

- Service providers

- End users, such as cosmetics, pharamceuticals, food and other companies

- Government bodies

Report Objectives

- To define, describe, and forecast the Squalene market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by force, end-use industry, and region

- To forecast the size of the market for five main regions: Europe, North America, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To analyze the impact of COVID-19 on the market and end-use industries

- To strategically profile key players and comprehensively analyze their growth strategies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Squalene Market

Historic and current market analysis for squalane

Market data for the global Squalene market

Looking for information on Squalene market

General information on payment method of report