Substrate-Like PCB Market by Line/Spacing (25/25 & 30/30 µm and Less than 25/25 µm), Inspection Technology (Automated Optical Inspection, Direct Imaging, Automated Optical Shaping), Application, and Geography - Global Forecast to 2024

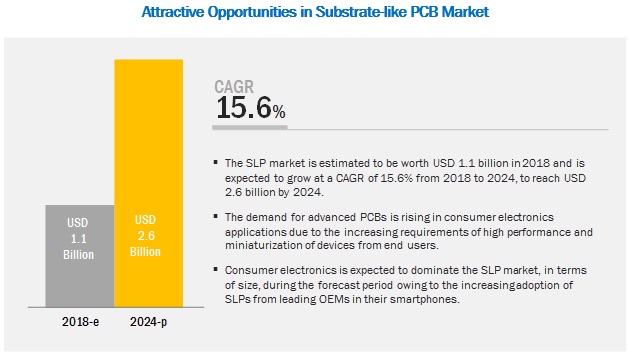

The substrate-like PCB market size is expected to grow from USD 1.1 billion in 2018 to USD 2.6 billion by 2024, at a compound annual growth rate (CAGR) of 15.6% during the forecast period.

The high adoption of SLPs by leading OEMs, surge in demand for smart consumer electronics and wearable devices, and impactful benefits of SLPs are the major factors driving the growth of the substrate-like PCB market.

Substrate-Like PCB Market Segment Overview

By line/space (L/S), 25/25 and 30/30 µm line/space to be largest contributor in substrate-like PCB market during forecast period

As there is an increasing demand from end users for thinner/compact but more functional smartphones, it requires to reduce board area. Hence, it is necessary to maintain minimum line spacing (i.e., the minimum distance between lines, vias, components, layers, etc.), which would allow implementing a larger battery.

Smartphone manufacturers such as Apple and Samsung have adopted SLP with 25/25 & 30/30 µm line/space in their smartphones. Other than consumer electronics applications, these SLPs can be used in computing and telecommunications, automotive, and medical devices.

Automated optical inspection (AOI) to account for largest market during forecast period

AOI is an automated vision inspection of PCB during the manufacturing process. It is used to scan the inner and outer layers of PCBs after the processes of etching and stripping. After the circuit patterns on inner layers and outer layers are formed, there may be defects on them such as open circuit, short circuit, missing copper, and excess copper. AOI systems identify defects accurately.

Consumer electronics application expected to hold largest market share during forecast period

Consumer electronics includes smartphones, tablets, smart bands, fitness bands, wearables, and others. Increasing demand for consumer electronics expected to provide opportunities to players in the SLP market.

There will be more space for the battery with use of SLP in a smartphone as SLP will allow for thinner connections between key components such as the DRAM, NAND flash memory, and application processor. With the use of SLP, the number of layers can be increased, thereby reducing the board area and width by 30% compared to the existing one. Major SLP suppliers include AT&S, TTM, Unimicron, Compeq, ZD Tech, Ibiden, and Samsung Electro-Mechanics, among others. Major Smartphone players, including Apple and Samsung, have adopted SLPs for their smartphones.

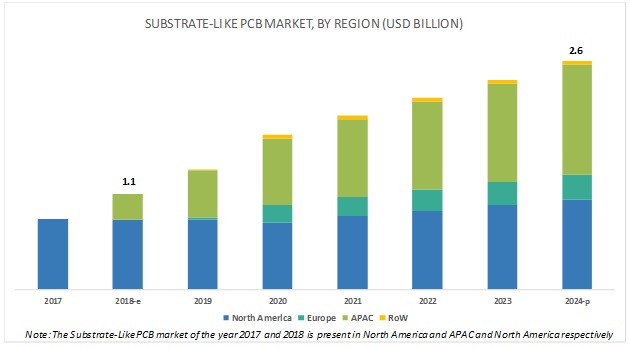

APAC to grow at highest CAGR during forecast period

The substrate-like PCB market in APAC is growing at the highest, and the same trend is expected to continue in the coming years.

Key factors that provide opportunities for the SLP market to grow in APAC include the increasing adoption of smartphones, a growing number of internet users, rising demand for connectivity solutions, expansion of telecommunications infrastructure, and expanding bandwidth-intensive applications in the region. Taiwan has become one of the center places for the development of SLP technology.

Key Market Players in Substrate-Like PCB Industry

AT & S (Austria); TTM Technologies (US); Samsung Electro-Mechanics (South Korea); Korea Circuit (South Korea); Kinsus Interconnect Technology (Taiwan); Zhen Ding Technology (Taiwan); Unimicron (Taiwan); Compeq (Taiwan); Ibiden (Japan); Daeduck (South Korea); ISU Petasys (South Korea); Tripod Technology Corporation (Taiwan); and LG Innotek (South Korea) are among the major players in the substrate-like PCB market.

Kinsus (Taiwan) Interconnect Technology is ranked first in the substrate-like PCB market in 2017. Established in September 2000 and headquartered in Taoyuan City, Taiwan, Kinsus Interconnect Technology manufactures electronic products and materials. The company specializes in a plastic ball grid array, wire bond chip-scale package, cavity down, system-in-package, flip chip, radio frequency module, chip on board light-emitting diode, and chip-on-film. Kinsus has two operating segments, namely, Integrated Circuit Substrate (ICS) and Printed Circuit Board (PCB). The company’s ICS segment manufactures, produces and sells BGA substrates while the PCB segment manufactures and sells PCBs such as flex, rigid flex, HDI, and SLP. For the SLP market, Kinsus is an IC substrate provider and a major supplier of substrate-like PCBs for an iPhone i8 manufactured by Apple. Apart from Apple, Kinsus is also a supplier for Qualcomm, Broadcom, and Nvidia.

Ibiden (Japan) held the second position in the substrate-like PCB market. Established in 1912 as an electronic power company and headquartered in Ogaki City, Japan, Ibiden is engaged in R&D, manufacturing, and distributing PCBs. The company engages in the manufacture and sale of electronics, ceramics, housing materials, and resin products. It operates through the following segments: Electronics, Ceramics, and Others. The Electronics segment covers printed wiring boards, package substrates, and pattern design for printed wiring boards. The Ceramics segment manufactures and sells environment-related ceramic products, graphite specialty products, ceramics fiber, and fine ceramic products. The others segment processes synthetic resin, agricultural, and marine products; sells petroleum products, and provides information services. The company has 33 subsidiaries; 14 of them are in Japan and 19 in overseas. The company has strong presence in Asia, Europe, and North America. Ibiden is one of the major suppliers for Apple. Apart from Apple and Samsung – who have already adopted SLP, other smartphone providers such as Huawei, Oppo, and Xiaomi are also expected to adopt SLP.

Substrate-Like PCB Market Report Scope

|

Report Metric |

Detail |

| Market Size Value in 2028 | USD 1.1 billion |

| Revenue Forecast in 2024 | USD 2.6 billion |

| Growth Rate | 15.6% |

|

Market Size Available for Years |

2017–2024 |

|

Base Year |

2017 |

|

Forecast Period |

2018–2024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Line/Space, Inspection Technology, Application, Region |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

Kinsus (Taiwan), Ibiden (Japan), Compeq (Taiwan), Unimicron (Taiwan), AT&S (Austria), TTM Technologies (US) |

This research report categorizes the substrate-like PCB market by line/space, inspection technology, application, and region.

On the basis of Line/Space, the substrate-like PCB market has been classified into the following segments:

- 25/25 & 30/30 ìm

- Less than 25/25 ìm

On the basis of Application, the substrate-like PCB market has been classified into the following segments:

- Consumer Electronics

- Computing & Telecommunications

- Automotive

- Medical

- Industrial

- Military, Defense, & Aerospace

On the basis of Inspection Technologies, the substrate-like PCB market has been classified into the following segments:

- Automated Optical Inspection

- Direct Imaging

- Automated Optical Shaping

On the basis of Region, the substrate-like PCB market has been classified into the following segments:

- North America

- Europe

- APAC

- RoW

Recent Developments in Substrate-Like PCB Industry

- In May 2018, AT&S showcased various products at the 14th AT&S Technology Forum. One of them was mSAP (modified semi-additive process) technology, in other words, substrate-like PCBs, through which the company can achieve highly miniaturized and precise PCB structures.

- In March 2018, TTM Technologies signed a contract with Apple for the supply of HDI, flexible, mSAP, and substrate PCBs that are used in iPhones/smartphones manufactured by Apple.

- In April 2017, Unimicron, as a part of its expansion, invested USD 49 million for the development of SLP using mSAP technology.

Key questions addressed by the report

- Which are major applications of substrate-like PCBs?

- Which region would lead the SLP market during the forecast period

- What are strategies followed by substrate-like PCB providers to stay ahead in the substrate-like PCB market?

- What are the growth perspectives of this market in different regions?

- What are drivers, opportunities, and challenges in the substrate-like PCB market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Years Considered

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.2.4 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in Substrate-Like PCB Market

4.2 Substrate Like PCB Market in APAC, By Application and Country

4.3 Country-Wise Substrate-Like PCB Market Growth Rate

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Adoption of SLPs By Leading Oems

5.2.1.2 Surge in Demand for Smart Consumer Electronics and Wearable Devices

5.2.1.3 Impactful Benefits of SLPs

5.2.2 Restraints

5.2.2.1 Higher Setup Costs Associated With SLPs

5.2.3 Opportunities

5.2.3.1 Increasing Use of Advanced Printed Circuit Boards in High-End Technology-Based Products

5.2.3.2 Rising Adoption of SLP Technology By Smartphone Players Owing to Transition From 4G to 5G Technology

5.2.3.3 Growing Use of Msap and Sap Processes in PCB Manufacturing

5.2.4 Challenges

5.2.4.1 Increasing Complexity of Printed Circuit Boards

6 Substrate-Like PCB Market, By Line/Space (Page No. - 38)

6.1 Introduction

6.2 25/25µm and 30/30µm Line/Space

6.2.1 25/25µm & 30/30µm Line/Space Segment Dominate SLP Market, in Terms of Size, Owing to the Rising Adoption of Miniature Devices

6.3 Less Than 25/25 µm Line/Space

6.3.1 Substantial Growth Rate of Market for SLPs With Less Than 25/25 µm Line/Space Due to Adoption of Additive Process in Manufacturing These SLPs

7 Substrate-Like PCB Market, By Application (Page No. - 45)

7.1 Introduction

7.2 Consumer Electronics

7.2.1 Consumer Electronics Expected to Hold Largest Size of SLP Market Owing to Adoption of SLP By Leading Original Equipment Manufacturers in Their Smartphones

7.3 Computing and Communications

7.3.1 Increasing Adoption of Advanced Communication Technologies Would Lead to High Demand for SLP for Computing and Communications Applications

7.4 Automotive

7.4.1 Increasing Demand for Multilayer Printed Circuit Boards in Automotive Electronics Will Spur SLP Market Growth

7.5 Medical

7.5.1 Rising Trend of Miniaturization of Advanced Medical Equipment and Devices Expected to Provide Opportunities for SLP Market Players

7.6 Industrial

7.6.1 Growing Trend of Iiot and Industry 4.0 to Drive Demand for SLP in Industrial Applications

7.7 Military, Defense, and Aerospace

7.7.1 North America to Lead SLP Market for Military, Defense and Aerospace Applications Due to Increasing Demand for High-Performance Printed Circuit Boards

8 Substrate-Like PCB Market, By Inspection Technology (Page No. - 59)

8.1 Introduction

8.2 Automated Optical Inspection (AOI)

8.2.1 AOI Technology to Hold Largest Share of SLP Market Owing to Increased Interest of SLP Manufacturers in Adopting Advanced Inspection Technologies

8.3 Direct Imaging (DI) Or Laser Direct Imaging (LDI)

8.3.1 Sturdy Growth of Di in SLP Market Based on Inspection Technology as It Offers Optimal Quality at High Speed

8.4 Automated Optical Shaping (AOS)

8.4.1 SLP Market for AOS Technology to Grow at Highest CAGR Due to Its High Potential for Findings Faults and Shaping Copper Tracks

9 Geographic Analysis (Page No. - 67)

9.1 Introduction

9.2 North America

9.2.1 Us

9.2.1.1 High Adoption of SLPs in Consumer Electronics Applications to Boost Market Growth in Us

9.2.2 Canada

9.2.2.1 Automotive and Healthcare Segments Expected to Provide Opportunity for SLP Market

9.2.3 Mexico

9.2.3.1 Mexican Market Expected to Grow at Steady Rate Due to Increasing Government Initiatives in Industrial Sector

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Expected to Dominate European SLP Market Owing to Growing Automotive Industry in Country

9.3.2 UK

9.3.2.1 Increasing Importance of Smart Manufacturing Would Augment SLP Market Growth in UK

9.3.3 France

9.3.3.1 Steady Market Growth in France Owing to Rising Demand for SLPs in Computing and Communications Applications

9.3.4 Italy

9.3.4.1 Strong Market Growth in Italy Owing to High Adoption of SLPs By Manufacturers of Premium Cars

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 China Would Witness Highest Growth Rate in SLP Market in APAC Due to Rising Demand for Consumer Electronics in the Country

9.4.2 Japan

9.4.2.1 Growth of SLP Market in Japan Will Be Driven By Rising Adoption of SLPs in Communications, Automotive, and Medical Applications

9.4.3 South Korea

9.4.3.1 SLP Market in South Korea Would Grow Due to Presence of Oems Such as Samsung in Country

9.4.4 Taiwan

9.4.4.1 Taiwan has Strong Presence of PCB Providers Who are Likely to Enter in SLP Market

9.4.5 Rest of APAC

9.5 RoW

9.5.1 Middle East and Africa

9.5.1.1 SLP Market Growth in Middle East and Africa Would Be Driven By Rising Adoption of SLPs in Computing and Communications Applications

9.5.2 South America

9.5.2.1 South American Market to Witness Highest CAGR in Substrate-Like PCB Market in RoW

10 Competitive Landscape (Page No. - 85)

10.1 Overview

10.2 Ranking Analysis of Market Players

10.2.1 Product Launches/Developments

10.2.2 Agreements, Collaborations, Partnerships, and Contracts

10.2.3 Acquisitions

10.2.4 Expansions

11 Company Profiles (Page No. - 89)

11.1 Overview

11.2 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.2.1 Kinsus Interconnect Technology

11.2.2 Ibiden

11.2.3 Compeq

11.2.4 Unimicron

11.2.5 AT&S

11.2.6 TTM Technologies

11.2.7 Samsung Electro-Mechanics

11.2.8 Korea Circuit

11.2.9 Zhen Ding Technology

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11.3 Other Players

11.3.1 Daeduck Gds Company

11.3.2 Isu Petasys

11.3.3 Tripod Technology Corp

11.3.4 LG Innotek

12 Appendix (Page No. - 114)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Related Reports

12.4 Author Details

List of Tables (36 Tables)

Table 1 Substrate-Like PCB Market, By Line/Space, 2017–2024 (USD Million)

Table 2 Substrate Like PCB Market for 25/25 and 30/30 µm Line/Space, By Inspection Technology, 2017–2024 (USD Million)

Table 3 SLP Market for 25/25 and 30/30 µm Line/Space, By Application, 2017–2024 (USD Million)

Table 4 Substrate-Like PCB Market for Less Than 25/25 Line/Space, By Inspection Technology, 2020–2024 (USD Million)

Table 5 SLP Market for Less Than 25/25 µm Line/Space, By Application, 2020–2024 (USD Million)

Table 6 Substrate-Like PCB Market, By Application, 2017–2024 (USD Million)

Table 7 Substrate-Like PCB Market for Consumer Electronics Application, By Region, 2017–2024 (USD Million)

Table 8 Substrate-Like PCB Market for Consumer Electronics Application, By Line/Space, 2017–2024 (USD Million)

Table 9 Substrate-Like PCB Market for Computing and Communications Application, By Region, 2019–2024 (USD Million)

Table 10 Substrate-Like PCB Market for Computing & Communications Application, By Line/Space, 2019–2024 (USD Million)

Table 11 Substrate-Like PCB Market for Automotive Application, By Region, 2019–2024 (USD Million)

Table 12 Substrate-Like PCB Market for Automotive Application, By Line/Space, 2019–2024 (USD Million)

Table 13 Substrate-Like PCB Market for Medical Application, By Region, 2020–2024 (USD Million)

Table 14 Substrate-Like PCB Market for Medical Application, By Line/Space, 2020–2024 (USD Million)

Table 15 Substrate-Like PCB Market for Industrial Application, By Region, 2020–2024 (USD Million)

Table 16 Substrate-Like PCB Market for Industrial Application, By Line/Space, 2020–2024 (USD Million)

Table 17 Substrate-Like PCB Market for Military, Defense, and Aerospace Application, By Region, 2020–2024 (USD Million)

Table 18 Substrate-Like PCB Market for Military, Defense, and Aerospace Application, By Line/Space, 2020–2024 (USD Million)

Table 19 Substrate-Like PCB Market, By Inspection Technology, 2017–2024 (USD Million)

Table 20 Substrate-Like PCB Market for Automatic Optical Inspection, By Line/Space, 2017–2024 (USD Million)

Table 21 Substrate-Like PCB Market for Direct Imaging, By Line/Space, 2017–2024 (USD Million)

Table 22 Substrate-Like PCB Market for Automated Optical Shaping, By Line/Space, 2017–2024 (USD Million)

Table 23 Substrate-Like PCB Market, By Region, 2017–2024 (USD Million)

Table 24 Substrate-Like PCB Market in North America, By Country, 2017–2024 (USD Million)

Table 25 Substrate-Like PCB Market in North America, By Application, 2017–2024 (USD Million)

Table 26 Substrate-Like PCB Market in Europe, By Country, 2019–2024 (USD Million)

Table 27 Substrate-Like PCB Market in Europe, By Application, 2019–2024 (USD Million)

Table 28 Substrate-Like PCB Market in APAC, By Country, 2018–2024 (USD Million)

Table 29 Substrate-Like PCB Market in APAC, By Application, 2018–2024 (USD Million)

Table 30 Substrate-Like PCB Market in RoW, By Region, 2019–2024 (USD Million)

Table 31 Substrate-Like PCB Market in RoW, By Application, 2019–2024 (USD Million)

Table 32 Ranking Analysis of Market Players, 2017

Table 33 Product Launches, 2016–2018

Table 34 Agreements, Collaborations, Partnerships, and Contracts, 2017–2018

Table 35 Acquisitions, 2018

Table 36 Expansions, 2017–2018

List of Figures (49 Figures)

Figure 1 Substrate-Like PCB Market: Process Flow of Market Size Estimation

Figure 2 Substrate-Like PCB Market: Research Design

Figure 3 Substrate-Like PCB Market: Bottom-Up Approach

Figure 4 Top-Down Approach to Arrive at Market Size

Figure 5 Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 25/25 and 30/30 µm Line/Space Segment Expected to Hold Larger Size of Substrate-Like PCB Market By 2024

Figure 8 Automotive Application to Witness Highest CAGR in SLP Market During Forecast Period

Figure 9 Automated Optical Inspection Technology Expected to Hold Largest Share of Substrate-Like PCB Market By 2024

Figure 10 APAC to Account for Largest Share in the SLP Market By 2024

Figure 11 Growing Adoption of SLP in Consumer Electronics Applications to Surge Market Growth During Forecast Period

Figure 12 Consumer Electronics and China are Expected to Account for Largest Share of SLP Market in APAC in 2024

Figure 13 Substrate-Like PCB Market in China to Grow at Fastest Rate During Forecast Period

Figure 14 Surge in Demand for Smart Consumer Electronics and Wearable Devices Drives the SLP Market Growth

Figure 15 Substrate-Like PCB Market Segmentation, By Line/Space (L/S)

Figure 16 25/25 & 30/30 µm Line/Space Segment Expected to Dominate SLP Market, in Terms of Size, During Forecast Period

Figure 17 Automated Optical Inspection Technology to Account for Largest Size of Market for SLP Having 25/25 and 30/30 µm Line/Space in 2024

Figure 18 Automated Optical Inspection Technology-Based SLP With Less Than 25/25 µm Line/Space to Account for Largest Market Size During 2020–2024

Figure 19 Substrate-Like PCB Market, By Application

Figure 20 Consumer Electronics Application to Account for Largest Size of SLP Market in 2024

Figure 21 APAC to Dominate SLP Market for Consumer Electronics Application During Forecast Period

Figure 22 25/25 & 30/30 µm Line/Space Segment to Command SLP Market for Computing and Communications Applications During Forecast Period

Figure 23 APAC to Lead SLP Market for Automotive Applications in Coming Years

Figure 24 North America to Hold Largest Size of SLP Market for Medical Applications During Forecast Period

Figure 25 25/25 & 30/30 µm Line/Space Segment to Hold Larger Size of Spl Market for Industrial Application in 2024

Figure 26 North America to Rule SLP Market for Military, Defense, and Aerospace Application During Forecast Period

Figure 27 Substrate-Like PCB Market Segmentation, By Inspection Technology

Figure 28 SLP Market Based on AOI Technology to Lead the Market By 2024

Figure 29 AOI in Manufacturing Process

Figure 30 25/25 & 30/30 µm Line/Space Segment to Hold Larger Size of SLP Market for AOI During Forecast Period

Figure 31 Schematic LDI System

Figure 32 APAC to Lead Substrate Like PCB Market By 2024

Figure 33 Substrate-Like PCB Market Snapshot in North America

Figure 34 US to Lead Substrate-Like PCB Market in North America During Forecast Period

Figure 35 Substrate-Like PCB Market Snapshot in Europe

Figure 36 Germany to Hold Largest Size of Substrate-Like PCB Market in Europe During Forecast Period

Figure 37 Substrate-Like PCB Market Snapshot in APAC

Figure 38 China to Command Substrate-Like PCB Market in APAC With Largest Size During Forecast Period

Figure 39 South America to Lead Substrate-Like PCB Market in RoW During Forecast Period

Figure 40 Organic and Inorganic Strategies Adopted By Companies Operating in Substrate-Like PCB Market

Figure 41 Kinsus Interconnect Technology: Company Snapshot

Figure 42 Ibiden: Company Snapshot

Figure 43 Compeq: Company Snapshot

Figure 44 Unimicron: Company Snapshot

Figure 45 AT&S: Company Snapshot

Figure 46 TTM Technologies: Company Snapshot

Figure 47 Samsung Electro-Mechanics: Company Snapshot

Figure 48 Korea Circuit: Company Snapshot

Figure 49 Zhen Ding Technology: Company Snapshot

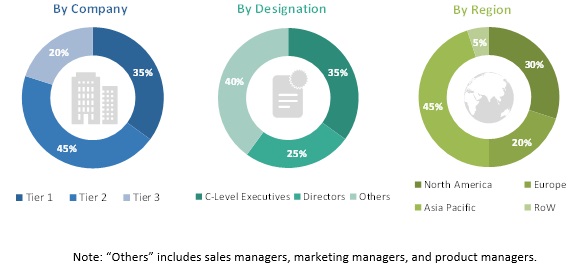

The study involved 4 major activities to estimate the market size for substrate-like PCBs. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market. After that, market breakdown and data triangulation methods were used to estimate the market for segments and subsegments.

Secondary research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary research

The substrate-like PCB market comprises several stakeholders, such as PCB manufacturers, substrate providers, OEMs, and regulatory organizations in the supply chain. The demand side of this market includes consumer electronics, computing and communications, automotive, medical, industrial, and military, defense, & aerospace applications. The supply side is characterized by advancements in advanced PCB technologies. Various primary sources from both supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the substrate-like PCB market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides in consumer electronics, computing & telecommunications, automotive, medical, industrial, military, defense, & aerospace applications.

Report objectives

- To define, segment, and project the global substrate-like PCB market

- To understand the structure of the substrate-like PCB market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the market size and its submarkets, in terms of value, with respect to 4 regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze competitive developments such as expansions and investments, product launches, mergers and acquisitions, joint ventures, and agreements in the substrate-like PCB market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Substrate-Like PCB Market

Which are major applications of substrate-like PCBs? Which region would lead the SLP market during the forecast period What are strategies followed by substrate-like PCB providers to stay ahead in the substrate-like PCB market? What are the growth perspectives of this market in different regions? What are drivers, opportunities, and challenges in the substrate-like PCB market?

It is the maker of BT substrate in our company. I would like to find some new technologies for future businesses. I would like to understand further the trends in the market and the application areas of the same for substrate-like PCBs.

At Method Inc., we purchase a substantial amount of PCBs mainly for automotive. As a Commodity manager, I would like to know more so I can inform my team and purchase the substrate like PCBs as per the trend in the market mainly for automotive PCBs