Surgical Tourniquets Market by Type (Tourniquets Systems, Tourniquet Cuffs, Tourniquets Accessories), Applications, End User (Hospitals and Trauma Centers, Ambulatory Surgery Centers, Military) & Region - Global Forecasts to 2024

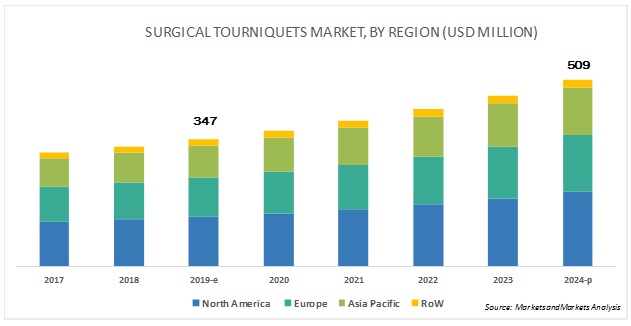

The surgical tourniquets market is projected to reach USD 509 million by 2024, growing at a CAGR of 8.0%. The increasing incidence of road accidents and falls has resulted in driving the demand for surgical tourniquets. Moreover, rising aging population, and the growing number of joint replacement surgeries are the major factors responsible for the growth of this market. Emerging markets such as China, India, and Japan are the key areas of opportunity for players in this market. However, a dearth of trained professionals will limit market growth to a certain extent.

The tourniquets systems segment dominated the surgical tourniquets market in 2019

By type, the surgical tourniquets market is segmented into tourniquet systems, tourniquet cuffs, and tourniquet accessories. The tourniquets systems segment dominated the surgical tourniquets market in 2019. The tourniquet systems help control the limb occlusion pressure through an automated electric system to create a bloodless field during orthopedic surgery. Moreover, the rising number of joint replacement surgeries and high incidence of road accidents and falls are the factors driving the growth of this market.

Hospitals and trauma centers to account for the largest share of the surgical tourniquets market, by end user, in 2019

Hospitals and trauma centers accounted for the largest share of the market in 2019. The rising need for joint replacement surgeries is the major driver in the growth of this market. Moreover, increasing growth in the geriatric population across the globe, coupled with a high rise in the number of road accidents are some of the key factors driving the growth of this end user segment. In 2018, the US accounted for the largest share of the surgical tourniquets market for hospitals and trauma centers. This is mainly due to the subsequent growth in the number of emergency procedures that require the use of surgical tourniquets to control bleeding in accident victims.

The APAC market is expected to grow at the highest CAGR during the forecast period

North America dominated the surgical tourniquets market in 2019. Though, the APAC region is expected to witness the highest CAGR during the forecast period. A large population base is a major driving factor in the APAC. Additionally, a growing number of hospitals and rising geriatric population are some of the other key factors driving the growth of this regional segment. Furthermore, the strong presence of global and local players to support market growth in China and the rising number of joint replacement surgeries in the rest of Asia Pacific are the factors driving the growth of the market in this region.

Key Market Players

Prominent players in the surgical tourniquets market are Stryker Corporation (US), Zimmer Biomet (US), Hammarplast Medical (Sweden), ulrich medical (Germany), VBM Medizintechnik (Germany), AneticAid (UK), Delfi Medical Innovations (Canada), Pyng Medical (Canada), OHK Medical Devices (Israel), Zhangjiagang Huaxin Medical Equipment Factory (China), Hangzhou Zhengda Medical Co. (China), Dessillons & Dutrillaux (France), and Daesung Maref (Korea).

Zimmer Biomet (US) offers orthopedic reconstructive products; biologics, extremities, sports medicine, and trauma products; dental implants; office based technologies; spine and CMF products; and other related surgical products. The company offers surgical tourniquet devices under its brand name ‘A.T.S 4000 Tourniquet System’. Along with tourniquet systems, the company offers both disposable & reusable tourniquet cuffs and tourniquet accessories including table or pole mounts, cuff sleeves, and lithium-ion batteries, among others.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Application, End User, and Region |

|

Geographies covered |

North America, Europe, the Asia Pacific, and the Rest of the World |

|

Companies covered |

Zimmer Biomet (US), Stryker Corporation (US), Delfi Medical Innovations (Canada), Hammarplast Medical (Sweden), VBM Medizintechnik (Germany), ulrich medical (Germany), Pyng Medical (Canada), OHK Medical Devices (Israel), Huaxin Medical Equipment Factory (China), Sam Medical (US), and C.A.T Resources (US). |

The research report categorizes the market into the following segments and subsegments:

Surgical Tourniquets Market, by Type

- Tourniquet Systems

- Tourniquet Cuffs

- Tourniquet Accessories

Surgical Tourniquets Market, by Applications

- Lower-limb surgery

- Upper-limb surgery

Surgical Tourniquets Market, by End User

- Hospitals and Trauma Centers

- Ambulatory Surgery Centers

- Military

- Other End Users (law enforcement personnel or first responders, civilian emergency medical services (EMS)/fire/rescue personnel, marine users)

Surgical Tourniquets Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments

- In July 2016, Zimmer Biomet Holdings, Inc. (UK) entered into a multi-year collaboration with the Indo UK Institutes of Health. The initial stage of the collaboration includes the establishment of the Zimmer Biomet Institute of India, a 30,000 square-foot state-of-the-art medical training and education facility on the campus of King's College Hospital in Amaravati, Andhra Pradesh. The institute was established to train more than 1,000 orthopedic surgeons per annum on the latest developments in orthopedic procedures and the safe and effective use of Zimmer-Biomet medical technologies, including surgical tourniquets.

Critical questions answered in the report:

- How will the current technological trends affect the surgical tourniquets market in the long term?

- What are the reasons contributing to the growth of the tourniquet cuffs market?

- Which regions are likely to grow at the highest CAGR?

- What are the challenges hindering the adoption of surgical tourniquets devices?

- What are the growth strategies being implemented by major market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Market Data Validation and Triangulation

2.3 Assumptions for the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Surgical Tourniquets: Market Overview

4.2 North America: Surgical Tourniquets Market, By Type, 2018

4.3 Europe: Surgical Tourniquets Market, By Type, 2018

4.4 Surgical Tourniquets Market: Geographic Snapshot

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Incidence of Road Accidents and Falls

5.2.1.2 Rising Number of Joint Replacement Surgeries

5.2.1.3 Rising Geriatric Population and the Subsequent Growth in the Prevalence of Degenerative Bone Diseases

5.2.2 Restraints

5.2.2.1 Dearth of Trained Professionals

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.4 Challenges

5.2.4.1 Complications Associated With the Use of Surgical Tourniquets

5.2.4.2 Risk of Infection Transmission Associated With the Use of Reusable Tourniquets

6 Surgical Tourniquets Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Tourniquet Systems

6.2.1 Tourniquet Systems to Account for the Largest Share of the Surgical Tourniquets Market

6.3 Tourniquet Cuffs

6.3.1 Pneumatic Tourniquet Cuffs

6.3.1.1 Single-Use Pneumatic Tourniquet Cuffs

6.3.1.1.1 Preference for Single-Use Pneumatic Tourniquet Cuffs is Increasing Among End Users

6.3.1.2 Reusable Pneumatic Tourniquet Cuffs

6.3.1.2.1 Risk of Infection Transmission to Restrain the Growth of This Market Segment

6.3.2 Non-Pneumatic Tourniquet Cuffs

6.3.2.1 Issues Related to Safety and Effectiveness Limiting the Use of Non-Pneumatic Tourniquet Cuffs

6.4 Tourniquet Accessories

7 Surgical Tourniquets Market, By Application (Page No. - 48)

7.1 Introduction

7.2 Lower-Limb Surgery

7.2.1 Lower-Limb Surgery Segment Dominates the Market, By Application

7.3 Upper-Limb Surgery

7.3.1 US Accounted for the Largest Share of the Surgical Tourniquets Market for Upper-Limb Surgery

8 Surgical Tourniquets Market, By End User (Page No. - 52)

8.1 Introduction

8.2 Hospitals and Trauma Centers

8.2.1 Hospital and Trauma Centers to Dominate the End-User Market

8.3 Ambulatory Surgery Centers

8.3.1 Increasing Number of Centers in the US to Drive the Adoption of Surgical Tourniquets

8.4 Military

8.4.1 US Accounted for the Largest Share of the Surgical Tourniquets Market for Military

8.5 Other End Users

9 Surgical Tourniquets Market, By Region (Page No. - 58)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increasing Number of Orthopedic Procedures—A Major Factor Driving Market Growth in the US

9.2.2 Canada

9.2.2.1 Increasing Number of Joint Replacement Procedures and Growing Geriatric Population to Drive the Market in Canada

9.3 Europe

9.3.1 Germany

9.3.1.1 Increasing Number of Hip and Knee Replacement Procedures to Drive Market Growth in Germany

9.3.2 UK

9.3.2.1 Increasing Number of Joint Replacement Surgeries to Drive Market Growth in the UK

9.3.3 France

9.3.3.1 Rising Geriatric Population to Support Market Growth in France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Strong Presence of Global and Local Players to Support Market Growth in China

9.4.2 Japan

9.4.2.1 Rising Number of Joint Replacement Surgeries to Support Market Growth in Japan

9.4.3 India

9.4.3.1 Large Patient Population and the Rising Number of Road Accidents to Support Market Growth in India

9.4.4 Rest of Asia Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 97)

10.1 Overview

10.2 Market Share Analysis

10.3 Market Share Analysis

10.3.1 Zimmer Biomet

10.3.2 Stryker Corporation

10.4 Competitive Leadership Mapping (Overall Market) (2018)

10.4.1 Visionary Leaders

10.4.2 Innovators

10.4.3 Dynamic Differentiators

10.4.4 Emerging Companies

11 Company Profiles (Page No. - 101)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Zimmer Biomet

11.2 Stryker Corporation

11.3 Delfi Medical Innovation

11.4 Hammarplast Medical

11.5 VBM Medizintechnik

11.6 Ulrich Medical

11.7 Pyng Medical (Part of Teleflex)

11.8 OHK Medical Devices

11.9 Huaxin Medical Equipment Factory

11.10 Sam Medical

11.11 C.A.T Resources

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 114)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (94 Tables)

Table 1 Incidence of Osteoarthritis and Osteoporosis

Table 2 Important Market Developments in Emerging Countries

Table 3 AST Guidelines for Best Practices for the Safe Use of Tourniquets

Table 4 Surgical Tourniquets: Market, By Type, 2017–2024 (USD Million)

Table 5 Surgical Tourniquet Systems Market, By Country, 2017–2024 (USD Million)

Table 6 Surgical Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 7 Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 8 Pneumatic Tourniquet Cuffs Market, By Country, 2017–2024 (USD Million)

Table 9 Single-Use Pneumatic Tourniquet Cuffs Market, By Country, 2017–2024 (USD Million)

Table 10 Reusable Pneumatic Tourniquet Cuffs Market, By Country, 2017–2024 (USD Million)

Table 11 Non-Pneumatic Tourniquet Cuffs Market, By Country, 2017–2024 (USD Million)

Table 12 Surgical Tourniquet Accessories Market, By Country, 2017–2024 (USD Million)

Table 13 Market, By Application, 2017–2024 (USD Million)

Table 14 Market for Lower-Limb Surgery, By Country, 2017–2024 (USD Million)

Table 15 Market for Upper-Limb Surgery, By Country, 2017–2024 (USD Million)

Table 16 Market, By End User, 2017–2024 (USD Million)

Table 17 Market for Hospital and Trauma Centers, By Country, 2017–2024 (USD Million)

Table 18 Market for Ambulatory Surgery Centers, By Country, 2017–2024 (USD Million)

Table 19 Market for Military, By Country, 2017–2024 (USD Million)

Table 20 Market for Other End Users, By Country, 2017–2024 (USD Million)

Table 21 Market, By Region, 2017–2024 (USD Million)

Table 22 North America: Market, By Country, 2017–2024 (USD Million)

Table 23 North America: Market, By Type, 2017–2024 (USD Million)

Table 24 North America: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 25 North America: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 26 North America: Market, By Application, 2017–2024 (USD Million)

Table 27 North America: Market, By End User, 2017–2024 (USD Million)

Table 28 US: Market, By Type, 2017–2024 (USD Million)

Table 29 US: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 30 US: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 31 US: Market, By Application, 2017–2024 (USD Million)

Table 32 US: Market, By End User, 2017–2024 (USD Million)

Table 33 Canada: Market, By Type, 2017–2024 (USD Million)

Table 34 Canada: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 35 Canada: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 36 Canada: Market, By Application, 2017–2024 (USD Million)

Table 37 Canada: Market, By End User, 2017–2024 (USD Million)

Table 38 Europe: Market, By Country, 2017–2024 (USD Million)

Table 39 Europe: Market, By Type, 2017–2024 (USD Million)

Table 40 Europe: Tourniquets Cuffs Market, By Type, 2017–2024 (USD Million)

Table 41 Europe: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 42 Europe: Market, By Application, 2017–2024 (USD Million)

Table 43 Europe: Market, By End User, 2017–2024 (USD Million)

Table 44 Germany: Market, By Type, 2017–2024 (USD Million)

Table 45 Germany: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 46 Germany: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 47 Germany: Market, By Application, 2017–2024 (USD Million)

Table 48 Germany: Market, By End User, 2017–2024 (USD Million)

Table 49 UK: Market, By Type, 2017–2024 (USD Million)

Table 50 UK: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 51 UK: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 52 UK: Market, By Application, 2017–2024 (USD Million)

Table 53 UK: Market, By End User, 2017–2024 (USD Million)

Table 54 France: Market, By Type, 2017–2024 (USD Million)

Table 55 France: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 56 France: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 57 France: Market, By Application, 2017–2024 (USD Million)

Table 58 France: Market, By End User, 2017–2024 (USD Million)

Table 59 RoE: Market, By Type, 2017–2024 (USD Million)

Table 60 RoE: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 61 RoE: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 62 RoE: Market, By Application, 2017–2024 (USD Million)

Table 63 RoE: Market, By End User, 2017–2024 (USD Million)

Table 64 Asia Pacific: Market, By Country, 2017–2024 (USD Million)

Table 65 Asia Pacific: Market, By Type, 2017–2024 (USD Million)

Table 66 Asia Pacific: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 67 Asia Pacific: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 68 Asia Pacific: Market, By Application, 2017–2024 (USD Million)

Table 69 Asia Pacific: Market, By End User, 2017–2024 (USD Million)

Table 70 China: Market, By Type, 2017–2024 (USD Million)

Table 71 China: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 72 China: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 73 China: Market, By Application, 2017–2024 (USD Million)

Table 74 China: Market, By End User, 2017–2024 (USD Million)

Table 75 Japan: Market, By Type, 2017–2024 (USD Million)

Table 76 Japan: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 77 Japan: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 78 Japan: Market, By Application, 2017–2024 (USD Million)

Table 79 Japan: Market, By End User, 2017–2024 (USD Million)

Table 80 India: Market, By Type, 2017–2024 (USD Million)

Table 81 India: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 82 India: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 83 India: Market, By Application, 2017–2024 (USD Million)

Table 84 India: Market, By End User, 2017–2024 (USD Million)

Table 85 RoAPAC: Market, By Type, 2017–2024 (USD Million)

Table 86 RoAPAC: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 87 RoAPAC: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 88 RoAPAC: Market, By Application, 2017–2024 (USD Million)

Table 89 RoAPAC: Market, By End User, 2017–2024 (USD Million)

Table 90 RoW: Market, By Type, 2017–2024 (USD Million)

Table 91 RoW: Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 92 RoW: Pneumatic Tourniquet Cuffs Market, By Type, 2017–2024 (USD Million)

Table 93 RoW: Market, By Application, 2017–2024 (USD Million)

Table 94 RoW: Market, By End User, 2017–2024 (USD Million)

List of Figures (28 Figures)

Figure 1 Market Segmentation

Figure 2 Surgical Tourniquets Market: Research Methodology

Figure 3 Research Design

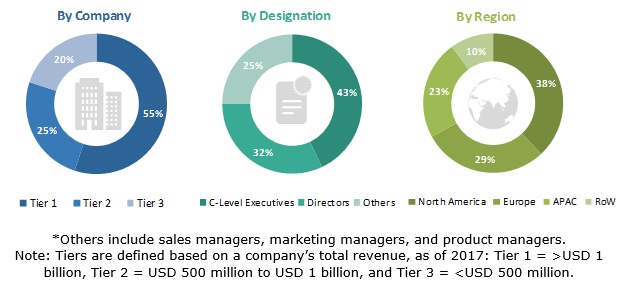

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Market Share, By Type, 2018

Figure 9 Market Share, By Application, 2018

Figure 10 Market Share, By End User, 2018

Figure 11 Geographic Snapshot: Surgical Tourniquets Market, 2018

Figure 12 Increasing Incidence of Road Accidents and Falls to Drive the Growth of the Surgical Tourniquets Market

Figure 13 Tourniquet Systems to Dominate the North American Market During the Forecast Period

Figure 14 Tourniquet Systems to Dominate the European Market During the Forecast Period

Figure 15 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 16 Market: Drivers, Restraints, Opportunities, & Challenges

Figure 17 Market, By Type, 2019 Vs. 2024 (USD Million)

Figure 18 Market, By Applications, 2019 Vs. 2024 (USD Million)

Figure 19 Market, By End User, 2019 Vs. 2024 (USD Million)

Figure 20 Market, By Region, 2019 Vs. 2024 (USD Million)

Figure 21 North America: Surgical Tourniquets: Market Snapshot

Figure 22 Europe: Surgical Tourniquets: Market Snapshot

Figure 23 Asia Pacific: Surgical Tourniquets: Market Snapshot

Figure 24 RoW: Surgical Tourniquets: Market Snapshot

Figure 25 Market Share Analysis By Key Players (2015–2018)

Figure 26 Competitive Leadership Mapping: Surgical Tourniquets

Figure 27 Zimmer Biomet: Company Snapshot

Figure 28 Stryker Corporation: Company Snapshot

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the surgical tourniquets market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the surgical tourniquets market. The primary sources from the demand side included industry experts, such as researchers and scientists, and industry experts from medical devices companies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, application, end user, and region).

Data Triangulation

After arriving at the market size, the surgical tourniquets market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments.

Objectives of the Study

- To define, describe, segment, and forecast the global surgical tourniquets market by type, application, end user, and region.

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the surgical tourniquets market in four main regions along with their respective key countries (North America, Europe, the Asia Pacific, and the Rest of the World)

- To profile key players in the global surgical tourniquets market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as product launches and expansions; and R&D activities of the leading players in the surgical tourniquets market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- A further breakdown of the Rest of Asia Pacific surgical tourniquets market into South Korea, New Zealand, and other South East Asian countries

- A further breakdown of the European surgical tourniquets market into Spain, Belgium, Netherlands, Sweden, and the Rest of Europe.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surgical Tourniquets Market