SUV Market

SUV Market (Mini, Compact, Mid- & Full-Size, MPV), Propulsion (Diesel, Gasoline, Electric), Class (B, C, D, E), Seating Capacity (5-seater,>5-seater), EV Type (BEV, PHEV, FCEV), and Region - Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

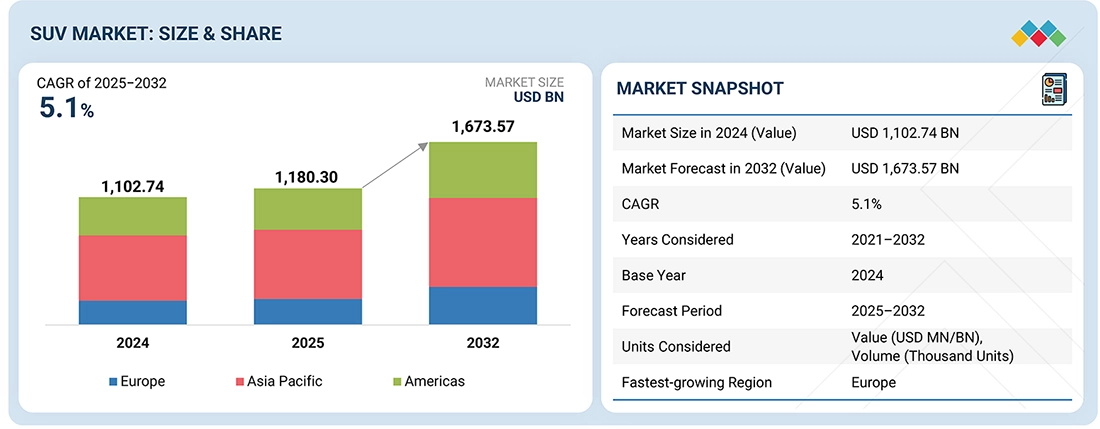

The SUV market is projected to reach USD 1,673.57 billion by 2032, from USD 1,180.30 billion in 2025, with a CAGR of 5.1%. The market growth is mainly driven by platform-level engineering upgrades, such as multi-load-path crash structures, optimized roll-center geometry, and electronically controlled dampers, which enable larger vehicles to maintain sedan-like handling and stability. Torque-rich hybrid powertrains with upgraded thermal management enable heavier SUVs to meet fuel efficiency and emission constraints without compromising towing capacity. Automakers are also deploying modular AWD systems and brake-based torque vectoring, making compact and mid-size SUVs more agile and suitable for mixed urban–rural driving conditions, especially in emerging economies. In Europe, stringent CO2 targets are accelerating adoption of 48V mild hybrid SUVs and compact crossovers due to their favorable mass–aero balance. North America continues to lead in full-frame and three-row SUVs, where improvements in trailer-sway control, long-travel suspensions, and high-load cooling packages support demand.

KEY TAKEAWAYS

-

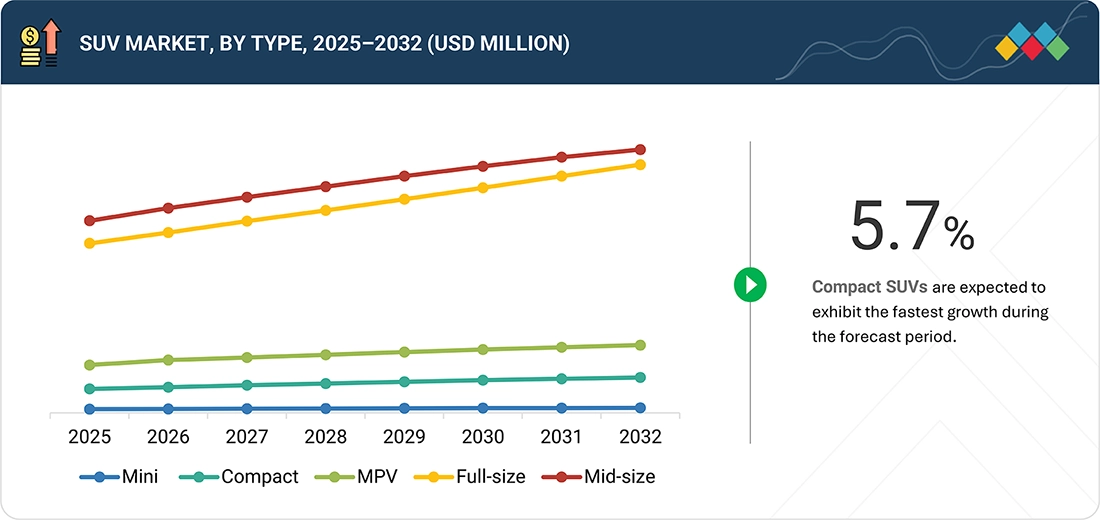

BY TYPEFull-size SUVs are expected to record a CAGR of 5.6% during the forecast period.

-

BY SEATING CAPACITY>5-seater SUVs are expected to exhibit the fastest growth between 2025 and 2030.

-

BY PROPULSIONThe gasoline segment is expected to dominate the SUV market during the forecast period.

-

ELECTRIC & HYBRID VEHICLE TYPEBattery electric SUVs are expected to lead the electric & hybrid SUV market during the forecast period.

-

BY REGIONAsia Pacific is estimated to be the largest market for SUVs, accounting for more than 50% share in 2025.

-

COMPETITIVE LANDSCAPEKey players, such as Toyota Motor Corporation, Volkswagen AG, Honda, Stellantis, and General Motors, are advancing lightweight materials, active/adaptive damping, and NVH-focused suspension and chassis innovations to enhance comfort, handling, and efficiency in modern SUVs.

Consumer inclination toward comfort and automatic safety features, along with benefits such as high ground clearance, a commanding driver's seating position, robustness, and off-road driving capabilities, is expected to drive the SUV market in the coming years.

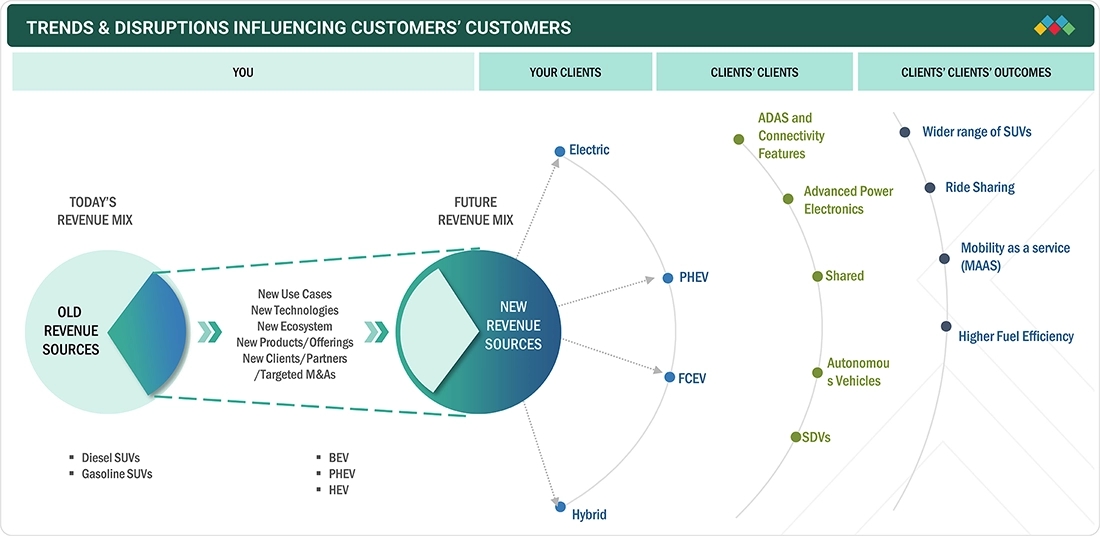

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Shifting consumer demand and emerging trends in the SUV market are pushing OEMs and Tier-1 suppliers toward lighter, stronger, and more intelligent chassis and suspension systems. The inclination toward advanced architectures, such as multilink rear setups, active/air suspensions, and software-controlled adaptive damping, directly reshapes the requirements for comfort, handling, safety, and energy efficiency. These evolving needs ripple across the value chain, influencing raw-material choices, component design, electronics integration, and vehicle-level tuning, unlocking new revenue opportunities for suppliers offering high-performance, lightweight, and software-enabled SUV solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Demand for premium vehicles with advanced features

-

Consumer inclination toward compact and mid-size SUVs

Level

-

High cost of SUVs

Level

-

Trend of electrification

Level

-

Range limitations of electric SUVs

-

Adherence to fuel economy and emission limits

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Demand for premium vehicles with advanced features

Demand for premium SUVs is surging as affluent buyers seek digital driving experiences and ADAS features over traditional performance. OEMs are differentiating with electrified powertrains, particularly PHEV and BEV models, enhanced by advanced thermal systems and high-density batteries. Premium SUVs now make up nearly two-thirds of global luxury production, with strong demand in North America, Europe, and China, where features like high-stiffness platforms and advanced cabin technologies are prioritized. Growth in India and Southeast Asia is fueled by localized platforms and expanding charging networks.

Restraint: High cost of SUVs

High upfront and ownership costs hinder the adoption of premium and full-size SUVs. They demand expensive components, advanced technology, and complex systems, leading to higher prices than sedans and compact cars. Operating expenses are also elevated due to greater fuel consumption, maintenance, and insurance costs. For electric SUVs, the battery pack is the main cost driver, affecting long-term ownership economics. Consequently, price sensitivity in developing markets slows down the mass adoption of SUVs, even with growing interest.

Opportunity: Trend of electrification

The electrification of SUVs is rapidly increasing, with nearly 60% of future EV launches based on SUVs as automakers focus on decarbonizing this high-margin segment. Companies are developing dedicated electric SUV platforms to reduce battery costs and meet demand in China, the US, and Europe, while affordable compact electric SUVs are promoting adoption in India and Southeast Asia. As these vehicles evolve into software-centric revenue platforms featuring advanced electronics, ADAS, and OTA capabilities, opportunities arise for battery suppliers, ADAS Tier-1s, thermal system providers, and software integrators.

Challenge: Range limitations of electric SUVs

Long-range electric SUVs face limitations due to heavy 70–100 kWh battery packs that typically provide only 300–450 km of range, with reduced performance in cold climates and under load. Charging infrastructure is fragmented with inconsistent standards (CCS2, NACS, CHAdeMO) and slow growth, requiring an estimated USD 3 trillion in global investment by 2040. Until advancements in energy density, thermal efficiency, and ultra-fast charging occur, the long-distance usability and charging confidence of electric SUVs will impede widespread adoption.

suv-market-trend-analysis: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Design and supply of SUV-specific components, including high-strength body structures, lightweight chassis modules, thermal systems, braking systems, batteries, motors, ADAS hardware, lighting systems, interiors, and ride/handling components | Improve SUV performance, safety, and durability | Enable electrification and weight reduction | Support higher range and efficiency | Enhance comfort, NVH, and premium differentiation across segments |

|

Deploy public fast chargers, home chargers, and ultra-fast highway charging for long-range SUVs | Reduce range anxiety, enable long-distance travel, support EV SUV adoption, improve charging convenience and reliability |

|

Develop and launch electric, hybrid, and premium SUVs, as well as integrate ADAS, connectivity, and long-range battery systems | Accelerate electrification | Improve profitability | Differentiate through technology | Enhance safety and user experience |

|

Develop and integrate ADAS Level 2+, connectivity platforms, digital cockpit systems, battery-management software, predictive maintenance, OTA update frameworks, and vehicle-to-cloud data services for electric and premium SUVs | Enhance vehicle safety and autonomy | Improve energy efficiency and battery health | Enable OTA-based feature upgrades | Reduce warranty costs | Strengthen user experience | Support differentiation in premium and mass-market SUV segments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem mapping highlights various players in the SUV market, including battery manufacturers, SUV charging providers, software providers, component manufacturers, and OEMs. The leading players are Toyota Motor Corporation, Volkswagen AG, Honda, Stellantis, and General Motors, among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

SUV Market, By propulsion

Gasoline propulsion is prevalent in SUVs due to advancements in small turbocharged GDI engines that achieve diesel-like torque while simplifying vehicle design by eliminating diesel components. These engines provide better NVH, allowing for effective integration with premium features like torque-vectoring and active suspensions. Additionally, hybrid systems, such as 48V e-boost and e-superchargers, complement gasoline engines, making them the preferred choice for electrified SUVs in markets like the US, Japan, and India. However, this dominance may not be guaranteed in the future.

Electric & Hybrid SUV Market, By Type

Battery electric SUVs are favored due to their tall architecture, accommodating large 80–120 kWh battery packs for longer ranges. China leads the market with LFP/NCM battery integration and 800V SiC-based e-axles for enhanced efficiency and faster charging. The SUV design allows for better cooling systems, improving durability. OEMs prefer battery electric SUVs for higher margins, which help offset battery costs and enable advanced features like dual-motor torque vectoring and ADAS. Despite these advantages, BEVs may not be the most technically scalable SUV propulsion option globally.

SUV Market, By Type

The mid-size SUV segment is growing as manufacturers adopt modular monocoque platforms, enhancing flexibility, NVH damping, and crash-energy absorption. The shift toward high-efficiency turbocharged engines, dual-clutch transmissions, and 48V hybrids enables these vehicles to handle heavier bodies while maintaining fuel economy. Improvements in electronic brake distribution, adaptive damping, and mid-range AWD systems enhance stability on diverse road conditions, increasing their appeal in Europe and the Americas. In the Asia Pacific region, demand is fueled by models with optimized third-row seating and multi-link suspensions for urban comfort.

SUV Market, By Seating Capacity

The >5-seater SUV segment is growing as OEMs utilize modular platforms and advanced rear suspension designs to integrate third-row seating without affecting safety or comfort. Hybrid and 48V powertrains allow for heavier 7–8-seat models with good efficiency. North America leads in demand for full-size SUVs, while Asia Pacific is rapidly expanding with family-oriented monocoque designs. Larger SUVs also enhance ADAS sensor integration, making them ideal for advanced driver-assist features.

REGION

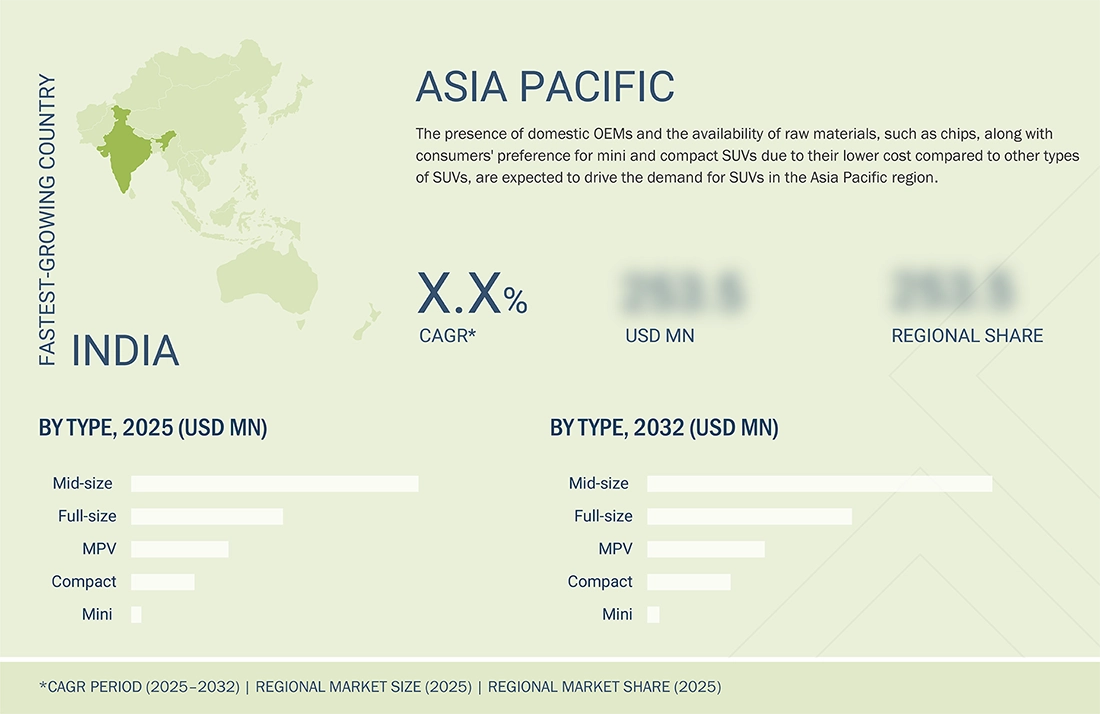

Asia Pacific is expected to be the largest region in the global SUV market during the forecast period.

The Asia Pacific SUV market is growing as manufacturers adapt modular platforms (like Toyota TNGA and Hyundai-Kia N3) for local conditions, enhancing ground clearance and suspension for rough terrains. China's dominance in battery supply and e-axle integration is driving the shift toward affordable electric SUVs. In India and Southeast Asia, demand for compact and mid-size SUVs is rising, featuring cost-optimized designs and advanced technology for urban traffic. Japan favors hybrid SUVs with efficient engines for snowy regions. Overall, competitive pricing and local production are shifting consumer preference from sedans to SUVs, prioritizing comfort, visibility, and advanced safety features.

suv-market-trend-analysis: COMPANY EVALUATION MATRIX

In the SUV market, Toyota Motor Corporation (Star) leads with a dominant global footprint, strong hybrid & electrified SUV platforms, and deep vertical integration in powertrain, chassis, and ADAS technologies. BYD (Emerging Leader) is rapidly scaling with competitive battery electric SUV architectures, in-house battery and e-drive technologies, and cost-efficient platforms that are accelerating its penetration across Asia, Europe, and the Americas.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Toyota Motor Corporation

- Hyundai Motors

- Volkswagen AG

- General Motors

- Honda Motor Co., Ltd

- Ford Motor Company

- Stellantis

- Daimler AG

- Nissan Motor Co., Ltd

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 1,180.30 BN |

| Market Forecast in 2032 (Value) | USD 1,673.57 BN |

| Growth Rate | CAGR of 5.1% from 2025 to 2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Unit Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, Americas |

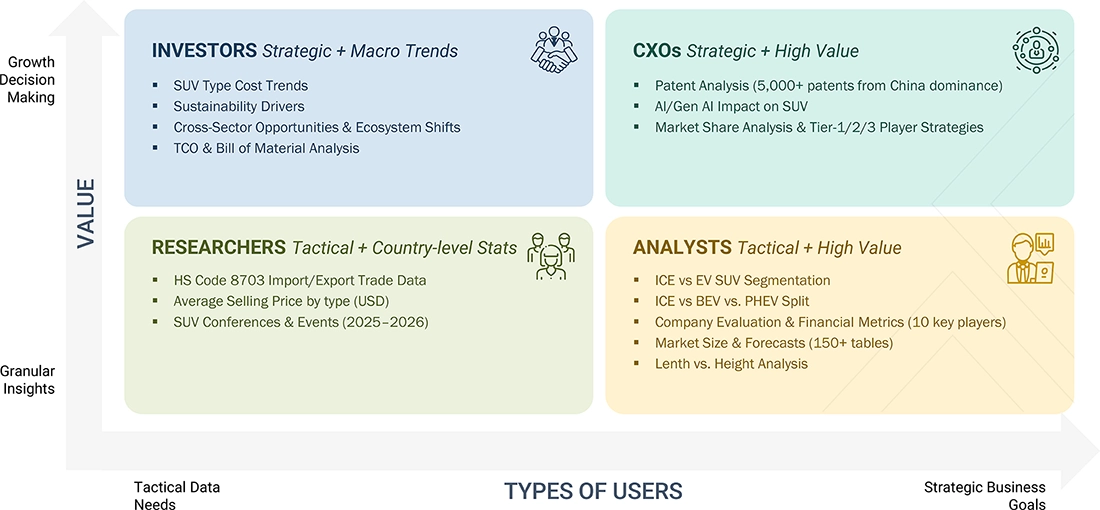

WHAT IS IN IT FOR YOU: suv-market-trend-analysis REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global OEMs and Tier-1 suppliers are evaluating next-gen SUV platforms, including hybrid, BEV, and premium SUV architectures. | Benchmarking of SUV-specific suspension systems (double-wishbone, multilink, semi-active dampers, adaptive air suspension) for ride quality, cornering stiffness, and off-road articulation | Identification of platform-level differentiation zones, such as electronically cross-linked dampers, axle-decoupling systems, and predictive chassis controls |

| OEMs are expanding their premium and long-range electric SUV lineups, which require higher load-bearing capability and lower NVH levels. | ||

| OEMs requesting support for material substitution to improve fuel efficiency or EV range |

RECENT DEVELOPMENTS

- October 2025 : Hyundai Motor Company and Beijing Hyundai unveiled their new energy vehicle (NEV) strategy for China and launched the all-new ELEXIO electric SUV in Yantai. The ELEXIO features an 88.1 kWh battery with a 722 km range (CLTC), fast charging from 30–80% in 27 minutes, and advanced AI features powered by the Qualcomm 8295 chip. Designed for families, it offers a spacious 506–1,540 L trunk, Dolby Atmos audio, and robust safety with 77.5% high-strength steel and nine airbags.

- August 2025 : Hyundai Motor Company and General Motors announced plans to co-develop five new vehicles, marking a major step in their strategic collaboration. The partnership includes four models for Central and South America: a compact SUV, a car, and two pickups (compact and mid-size), as well as an electric commercial van for North America, all launching around 2028. General Motors will lead the development of mid-size trucks, while Hyundai will focus on compact vehicles and vans. Once production scales, the companies expect annual sales of over 800,000 units, leveraging shared platforms with distinct brand designs.

- July 2025 : GMC has introduced the 2026 Acadia Denali Ultimate, the newest model to feature its ultra-premium trim. The SUV showcases a Vader Chrome grille, 22-inch machined wheels, and exclusive badging, while the interior offers Woodland Mahogany leather massaging seats, Paldao wood accents, and Denali Ultimate detailing. The trim highlights GMC’s focus on combining luxury craftsmanship with real-world capability in its mid-size SUV lineup.

- March 2025 : Toyota Motor Corporation has begun sales of the all-new Crown Estate in Japan. Celebrating the 70th anniversary of the Crown lineup, the new model embodies Toyota’s “making ever-better cars” philosophy under the TNGA platform and in-house company system. As part of Toyota’s Cluster Strategy, the Crown now includes four distinct models introduced since 2022, designed to meet diverse customer needs while continuing the brand’s legacy of innovation.

- February 2025 : Honda announced its Next Generation Fuel Cell Module (150 kW output) and Fuel Cell Power Generator at H2 & FC EXPO. The new module offers 50% lower cost, over double durability, and triple power density versus the current model. Mass production starts in 2026–2027, advancing Honda’s goal of a sustainable, hydrogen-based society.

- January 2025 : Hyundai Motor India Limited (HMIL) introduced the Hyundai CRETA Electric at the Bharat Mobility Global Expo 2025. The model is available with two battery options: a 51.4 kWh battery pack providing a range of 473 km on a single charge and a 42-kWh battery pack offering a range of 390 km.

Table of Contents

Methodology

The research study involved extensive use of secondary sources such as company annual reports/presentations, industry association publications, magazines, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases to identify and collect information on the SUV market. In-depth interviews were conducted with various primary sources, including experts from related industry players, component suppliers, and automotive OEMs, to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

During secondary research, various secondary sources were used to identify and collect information on the SUV market. Secondary sources referred to for this research study include automobile organizations (OICA, CAAM, JAMA, ACEA, etc.), regulatory bodies, corporate filings (annual reports, investor presentations, and financial statements), and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

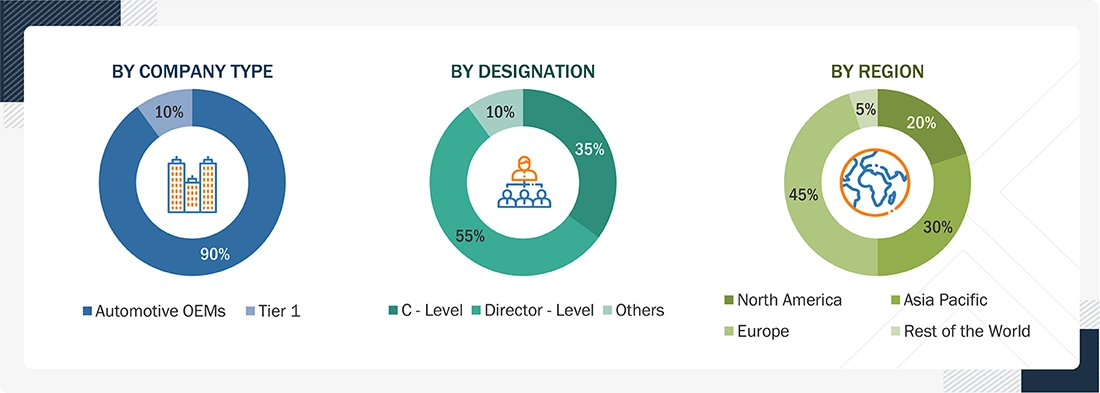

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the SUV market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (automotive OEMs) and supply (SUV component manufacturers and distributors) sides across four major regions, namely North America, Europe, Asia Pacific, and the Rest of the World. Approximately 90% primary interviews were conducted from the demand side and 10% from the supply side. Primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

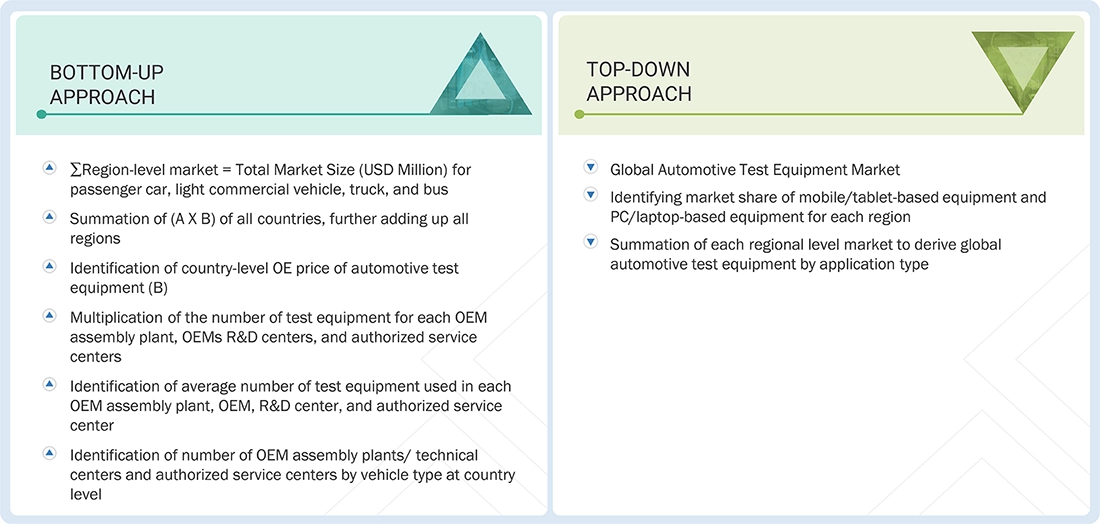

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the size of the SUV market and other dependent submarkets, as mentioned below:

Bottom-up Approach

- Key players in the SUV market were identified through secondary research, and their global market share was determined through primary and secondary research.

- The research methodology included the study of country-level penetration share of SUV production, by type (mini, compact, mid-size, full-size, and MPV/MUV). These penetrations have been derived through secondary sources and validated through primary interviews.

- At the country level, the penetration of each SUV type is multiplied by the total SUV production numbers to estimate the volume of the SUV market by type (ICE).

- The average selling price of each SUV type is derived at the country level from OEM websites.

- It is then multiplied by the volume of the country-level SUV market by type to derive the country-level market in terms of value.

- The summation of country-level markets provides the regional-level SUV market, by type, in terms of volume and value.

- All major penetration rates, percentage shares, splits, and breakdowns for the vehicle type of the SUV market were determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

SUV Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global SUV market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data for the market by value for key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply participants.

Market Definition

A sport utility vehicle or SUV combines characteristics of both on- and off-road vehicles, such as increased ground clearance and four-wheel drive. SUVs are similar to station wagons or minivans, but they have a tough look and design suited for off-road activities.

According to KIA (South Korea), MPV stands for a multi-purpose vehicle. It is characterized by a spacious cabin and ample occupancy. MPV is considered a category under recreational vehicles.

According to KIA (Seoul, South Korea), a full-size SUV is distinguishable by its ability to tow large items, handle rough terrain, contain ample space for passengers and cargo, and have 3 rows of seats. A full-size SUV is distinctive compared to other SUV sizes and car classifications since it combines multiple characteristics into a single vehicle.

Key Stakeholders

- SUV manufacturers

- Automotive raw material suppliers

- R&D centers

- Associations, forums, and alliances related to automobiles

- Automobile organizations/associations

- EV component manufacturers

- EV manufacturers

- Government agencies and policymakers

- SUV traders and distributors

Report Objectives

-

To segment and forecast the size of the SUV market in terms of volume (thousand units) and value (USD million) from 2021 to 2032, based on

- Type (mini, compact, mid-size, full-size, MPV/MUV)

- Seating capacity (5-seater and >5-seater)

- Propulsion (diesel, gasoline, and electric)

- Class (B, C, D, and E)

- Electric & hybrid vehicle type (BEV, PHEV, and FCEV)

- Region (Asia Pacific, Europe, and Americas)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market share and core competencies

-

To study the following with respect to the market:

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Conferences and Events

- Key Stakeholders and Buying Criteria

- Investment and Funding Scenario

- To track and analyze competitive developments such as product launches, deals, and others undertaken by key market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the SUV Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in SUV Market