Synchronous Generator Market by Prime Mover (Steam turbine, Gas turbines), Speed ( 1,500 RPM, 3,000 RPM), Power Rating (2-5 MVA, 5-10 MVA, 10-20 MVA, 20-30 MVA, & 30-50 MVA), End User (Renewable Power Generation) & Region - Global Forecast to 2028

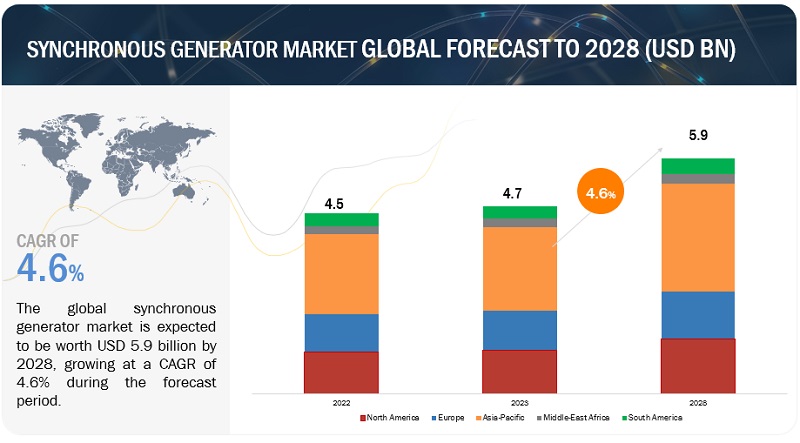

[200 Pages Report] The synchronous generator market is expected to grow from an estimated USD 4.7 billion in 2023 to USD 5.9 billion by 2028, at a CAGR of 4.6% during the forecast period. The growing demand for electricity, driven by industrialization, urbanization, and population growth, has led to a significant increase in power generation capacity worldwide. The need for reliable backup power solutions has increased due to the rising frequency of power outages caused by natural disasters, grid failures, and other unforeseen events. Synchronous generators play a vital role in power plants, including thermal, hydro, and nuclear, where they are used to convert mechanical energy into electrical energy. They often used as backup power sources in critical facilities like hospitals, data centers, telecommunications networks, and residential complexes.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Synchronous Generator market Dynamics

Driver: Rising electricity Demand

Synchronous generators are critical in power generation infrastructure, providing efficient and reliable power generation across various applications, including steam and gas turbines. One of the key factors driving the growth of the synchronous generator market is the rising demand for electricity, particularly in developing economies. As these economies continue to grow and urbanize, there is a corresponding increase in demand for electricity to power homes, businesses, and industries. The synchronous generator is an essential component of the power generation infrastructure and is commonly used in industrial and commercial settings to provide reliable and efficient power

Restraint: Environmental concerns associated with synchronous generators

Synchronous generators can have significant environmental impacts related to carbon emissions and noise pollution. Synchronous generators are often powered by fossil fuels, such as coal or natural gas, which release carbon dioxide and other greenhouse gases into the atmosphere when burned. These emissions contribute to global climate change and air pollution, which can negatively impact human health and the environment. The amount of carbon emissions produced by synchronous generators depends on the type of fuel used and the generator’s efficiency. The operation of synchronous generators can produce high noise pollution levels, which can adversely affect human health and the environment. The noise generated by synchronous generators can be particularly problematic in urban areas with high noise pollution levels. The noise produced by synchronous generators can cause hearing damage and sleep disturbances for humans and disrupt local ecosystems and wildlife. Additionally, noise pollution can negatively impact property values and community well-being.

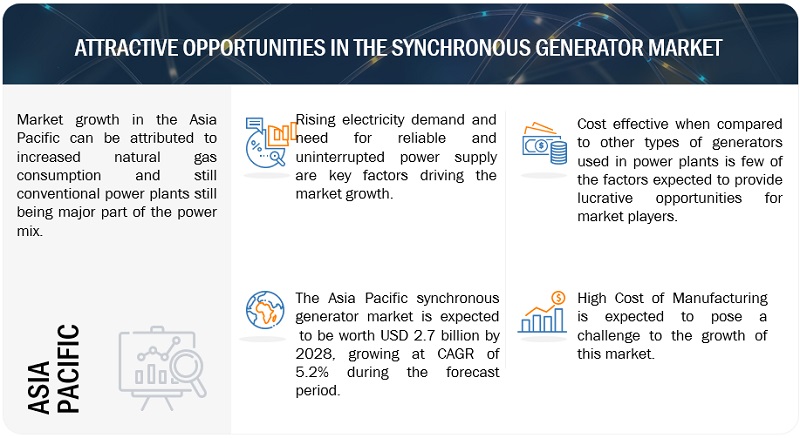

Opportunity: Cost-effectiveness associated with synchronous generators compared with other generator types used in thermal power plants

A synchronous generator is a cost-effective option compared with other types of generators. This is due to its longer life span and minimal maintenance requirements, which result in a lower total cost of ownership over the long term. Compared to other generators, synchronous generators are designed to last longer, which can reduce the overall cost of owning a generator. This is because the components used in synchronous generators are built to withstand high temperatures and pressures, which are common in thermal power plants. As a result, synchronous generators require less frequent maintenance and are less likely to break down, which can lead to costly repairs and downtime. Additionally, synchronous generators are designed with simplicity in mind, reducing the likelihood of wear and tear over time. This simplicity also makes them easier to repair and maintain, saving time and money in the long run

Challenge: High manufacturing cost

Synchronous generators can have a higher manufacturing cost than other types of generators due to the complexity of their design and the materials used in their construction. The manufacturing cost of synchronous generators can vary depending on factors such as the generator’s size, materials used, and manufacturing process. Generally, the cost of manufacturing a synchronous generator is relatively high compared to other types of generators due to the complexity of its design and the materials required for construction. The cost of materials, such as copper wire and steel laminations, can also impact the overall manufacturing cost. Moreover, the labor, energy, and equipment cost in the manufacturing process also contributes to the total manufacturing cost.

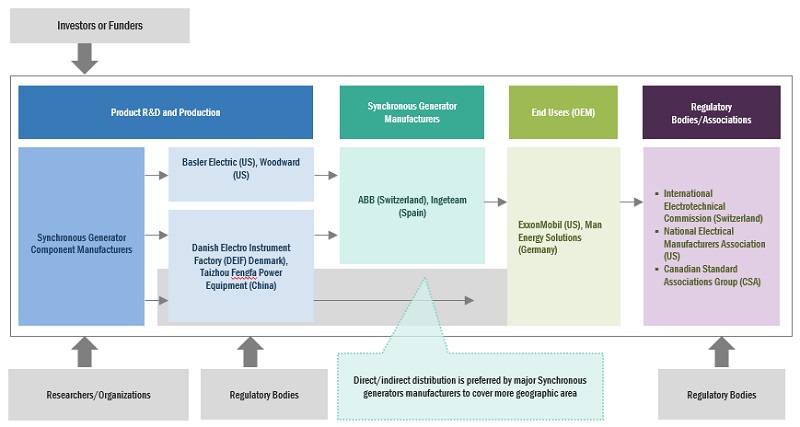

Synchronous Generator Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Synchronous Generator Market and components. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ABB (Switzerland), WEG (Brazil), Siemens Energy (Germany), Meidensha Corporation (Japan), and Andritz (Austria).

The Others segment by prime mover holds the largest segment in 2022

Others include wind turbine, hydro turbine, and diesel driven. Hydro turbines, wind turbines, and diesel-driven synchronous generators are essential devices that convert distinct forms of energy into electrical energy. Hydro turbines harness the power of flowing water to generate electricity, while wind turbines capture the wind’s kinetic energy. On the other hand, diesel-driven synchronous generators rely on the combustion of diesel fuel to produce electrical power. These technologies are pivotal in generating clean and sustainable electricity, catering to various energy requirements in various sectors.

3,000 RPM segment by speed is estimated to be the second fastest segment for synchronous generator market

Operating at a higher speed of 3,000 RPM allows for a more compact and lightweight generator design. This makes it suitable for applications where space is limited, or mobility is required, such as in portable generators or smaller power generation systems. The higher rotational speed of 3,000 RPM enables the generator to deliver a higher power output per unit size. This increased power density is advantageous in applications where a compact generator is needed to provide substantial power.

Renewable Power Generation segment by end user is estimated to be the largest segment for synchronous generator market

Renewable power generation market projected to grow at 6.8% market share during the forecast period of 2023-2028. Synchronous generators are widely used in hydroelectric power plants. Water turbines, driven by the force of flowing water or falling water, are coupled to synchronous generators to produce electricity. This setup is commonly used in large-scale hydroelectric projects. They are also frequently employed in wind turbines to convert mechanical energy from the wind into electrical energy. Synchronous generators offer advantages in renewable power generation, such as stable frequency output, grid synchronization capability, and the ability to provide reactive power for grid stability

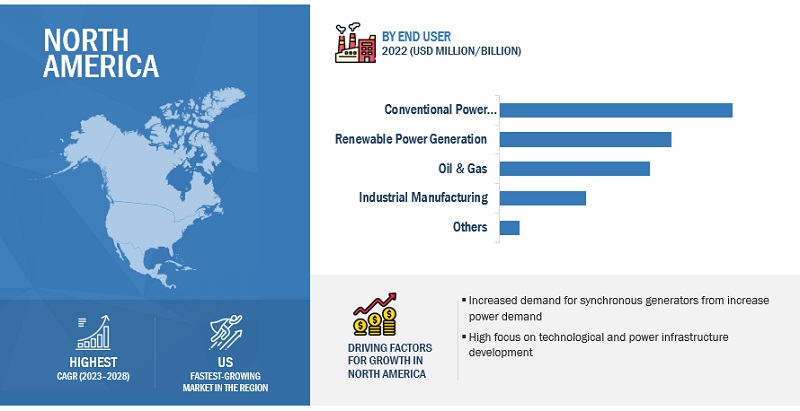

North America is expected to account for second largest market during the forecast period.

North America accounted for a 23.2% share of the synchronous generator market in 2022. The region has been segmented into the US, Canada, and Mexico. The power generation industry has grown due to infrastructure development, industrial demand, expansion of the renewable energy sector, technological advancements, and a supportive regulatory environment. The largest market in North America is the US. Companies in this region are focusing on developing new technologies to improve the efficiency of synchronous generators. Natural gas production has grown by 3.3% per year from 2011 and reached 1,135.8 billion cubic meters in 2021. With rapid urbanization, the demand for power generation has increased, which is enhancing the investment in the development of power generation industry, further driving the growth of the synchronous generator market. Besides, the North American governments have implemented policies to support the growth of the industry.

Key Market Players

The synchronous generator market is dominated by a few major players that have a wide regional presence. The major players in the synchronous generator market are ABB (Switzerland), WEG (Brazil), Siemens Energy (Germany), Meidensha Corporation (Japan), and Andritz (Austria). Between 2018 and 2022, Strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the synchronous generator market.

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Prime Mover, By Speed, By Power rating, By End User |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

ABB (Switzerland), Siemens Energy (Germany), WEG (Brazil), Menzel Elektromotoren (Germany), Ingeteam (Spain), CG Power (India), NIDEC Industrial Solutions (Japan), Marelli Motori (Italy), TMEIC (Japan), Ideal Electric (US), MECC ALTE (Italy), Heinzmann GMBH & Co. KG (Germany), Meidinsha Corporation (Japan), Jeumont Electric (France), Andritz Group (Austria), Alsaldo Energia (Italy), Lloyd Dynamowerke GMBH (Germany), Elin Motors (Austria), Partzsch Group (Germanny), Alconza (South Africa) |

This research report categorizes the synchronous generator market based on Prime Mover, Speed, Power rating, End User, and region.

By Speed

- 1,500 RPM

- 3,000 RPM

By Prime Mover

- Steam Turbine

- Gas Turbine

- Others

By Power Rating

- 2-5 MVA

- 5-10 MVA

- 10-20 MVA

- 20-30 MVA

- 30-50 MVA

By End User

- Renewable Power Generation

- Oil & Gas

- Conventional Power Generation

- Industrial Manufacturing

- Others

By Region

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In Nov 2022, ABB secured its first order from COSCO Shipping, China’s largest shipping company, for in-line permanent magnet shaft generator systems.

- In Nov 2022, Menzel Elektromotoren supplies complete rotary converter sets for test fields, with motors and generators from its own production, as well as frequency converters, transformers, all accessories, controls, and software being programmed in-house

- In Oct 2022, WEG installed a state-of-the-art gearless wind turbine generator at the cost of INR 88 crore at Vadalivilai, which is close to the advantageous Aralvaimozhi Pass.

- In Apr 2022, ABB introduced latest in-line shaft generator from ABB will enable ship operators to benefit from the efficiency, performance, and reliability advantages of permanent magnet technology. The new generator brings flexibility and ease of installation to a wide range of vessels, including bulk carriers, container carriers, liquid natural gas tankers, and ferries transporting passengers and cars

Frequently Asked Questions (FAQ):

What is the current size of the synchronous generators market?

The current market size of global synchronous generator market is estimated to be USD 4.5 billion in 2022.

What is the major drivers for synchronous generator market?

Synchronous generators are critical in power generation infrastructure, providing efficient and reliable power generation across various applications, including steam and gas turbines. One of the key factors driving the growth of the synchronous generator market is the rising demand for electricity, particularly in developing economies. As these economies continue to grow and urbanize, there is a corresponding increase in demand for electricity to power homes, businesses, and industries. The synchronous generator is an essential component of the power generation infrastructure and is commonly used in industrial and commercial settings to provide reliable and efficient power. Many regions are trying to sunstitute natural gas as major power source compared to thermal or coal power plants, thus increasing the drilling and excavation processes. This has increased exploration and production activities, further driving the demand for synchronous generators to power these operations.

Which is the largest-growing region during the forecasted period in synchronous generator market?

Asia Pacific is expected to account for the largest market size during the forecast period. Countries in Asia Pacific, such as China, are focusing on increasing oil and natural gas production to meet their primary oil and gas requirements, creating growth opportunities for the regional synchronous generator market

Which is the second largest-growing segment, by power rating during the forecasted period in synchronous generator market?

The 30-50 MVA segment, by power rating, is projected to hold the second -largest market share during the forecast period. These generators are known for their high-power rating, finding applications across industrial, commercial, and utility sectors. Featuring durable build and advanced functionalities, they ensure dependable and efficient electrical power generation

Which is the fastest-growing segment, by prime mover during the forecasted period in synchronous generator market?

Gas turbine synchronous generators, by prime mover is projected to be the fastest growing market during the forecast period. The ability to respond rapidly to changes in demand makes gas turbine generators highly flexible and suitable for grid stabilization and load following applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

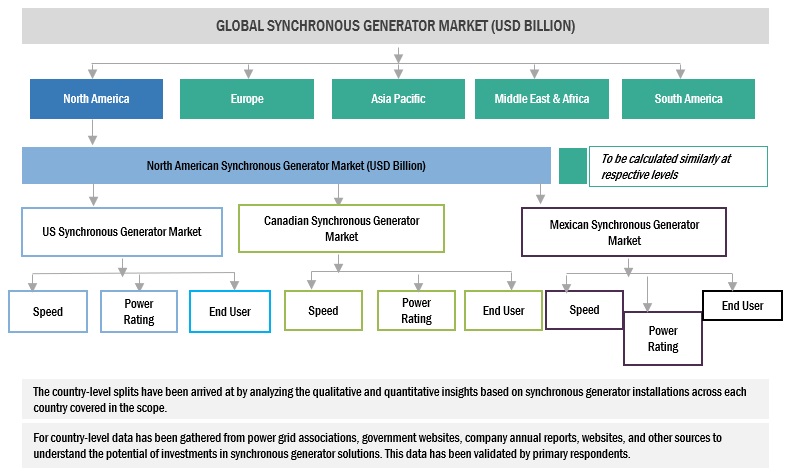

This study involved major activities in estimating the current size of the synchronous generator market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global synchronous generator market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

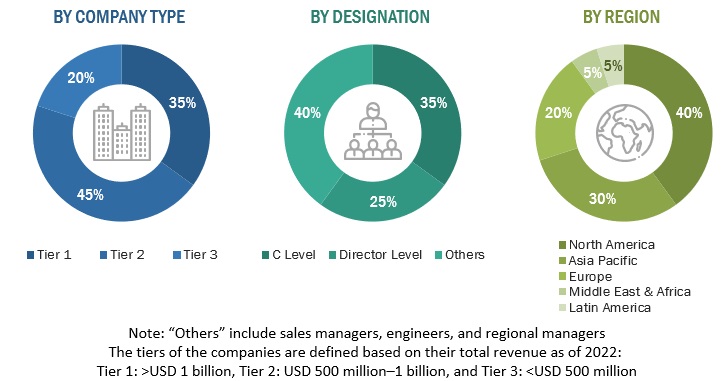

The synchronous generator market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand side of this market is characterized by end-users. Moreover, the demand is also fueled by the growing demand of upgrading aging power infrastructure systems. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The bottom-up approach has been used to estimate and validate the size of the synchronous generator market.

- In this approach, the synchronous generator production statistics for each product type have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various synchronous generator.

- Several primary interviews have been conducted with key opinion leaders related to synchronous generator system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Synchronous Generator Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the synchronous generator market ecosystem.

Market Defenition

Synchronous generators, also known as alternators, are electrical machines that convert mechanical energy into electrical energy. They are commonly used in power generation applications, such as power plants or wind turbines, to produce electricity. Synchronous generators are designed to operate at a constant speed, known as the synchronous speed, which is determined by the frequency of the AC power being generated and the number of poles in the rotor.

The growth of the Synchronous generators market during the forecast period can be attributed to the rising demand of electricity across major countries in North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Key Stakeholders

- Government Utility Providers

- Independent Power Producers

- Synchronous Generator manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Generation utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Synchronous Generator manufacturers, distributors, and suppliers

- Synchronous Generator original equipment manufacturers (OEMs)

Objectives of the Study

- To define, describe, and forecast the size of the synchronous generator market by prime mover, speed, power rating, End User, and region, in terms of value

- To estimate and forecast the global synchronous generator market for various segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), South America, Middle East & Africa, in terms of value

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To provide a detailed overview of the synchronous generator value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the synchronous generator market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the synchronous generator market size in terms of value.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Synchronous Generator Market