System Integration Services Market

System Integration Services Market by Service Type (Infrastructure Integration Services, Enterprise Application Integration Services, Consulting Services, and Managed Integration Services) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

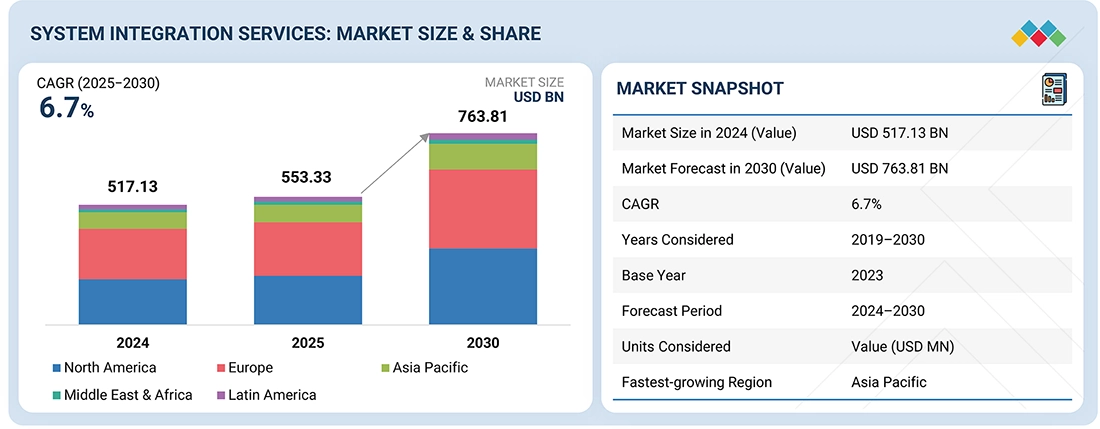

The system integration services market is expected to grow substantially, expanding from USD 553.33 billion in 2025 to USD 763.81 billion by 2030, reflecting a CAGR of 6.7%. This surge is driven by the rising demand for cloud adoption, digital transformation, and legacy system modernization. Enterprises across the BFSI, IT & telecom, government, and manufacturing sectors increasingly require seamless integration of hybrid and multi-cloud environments, API management, and automation solutions. This growth is fueled by the need for real-time data exchange, improved operational efficiency, and secure, scalable digital infrastructure to support Industry 4.0, AI/ML initiatives, and hybrid IT deployments.

KEY TAKEAWAYS

-

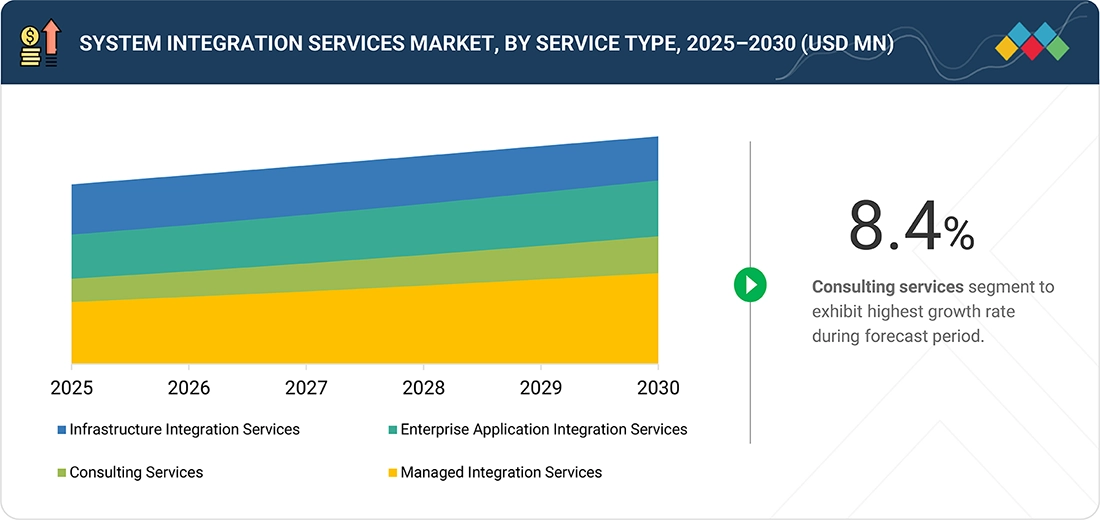

BY SERVICE TYPEInfrastructure integration services lead in terms of adoption, driven by the demand for seamless connectivity across hybrid and multi-cloud environments, legacy modernization, and enterprise IT landscapes. Consulting services unlock higher ROI from integration initiatives by guiding strategic prioritization and architecture decisions. Organizations leveraging these services achieve faster transformation, lower risk, and measurable operational gains, making consulting a key driver of the system integration services market growth.

-

BY ORGANIZATION SIZESmall and medium-sized enterprises (SMEs) increasingly adopt system integration services to connect cloud, on-premises, and legacy systems efficiently. These solutions enhance workflow automation, data visibility, and IT agility, enabling SMEs to scale their operations and compete effectively with larger enterprises.

-

BY VERTICALBFSI leads in the adoption of system integration services, driven by the need for real-time transaction processing, secure data exchange, and seamless integration of core banking, payment, and customer systems.

-

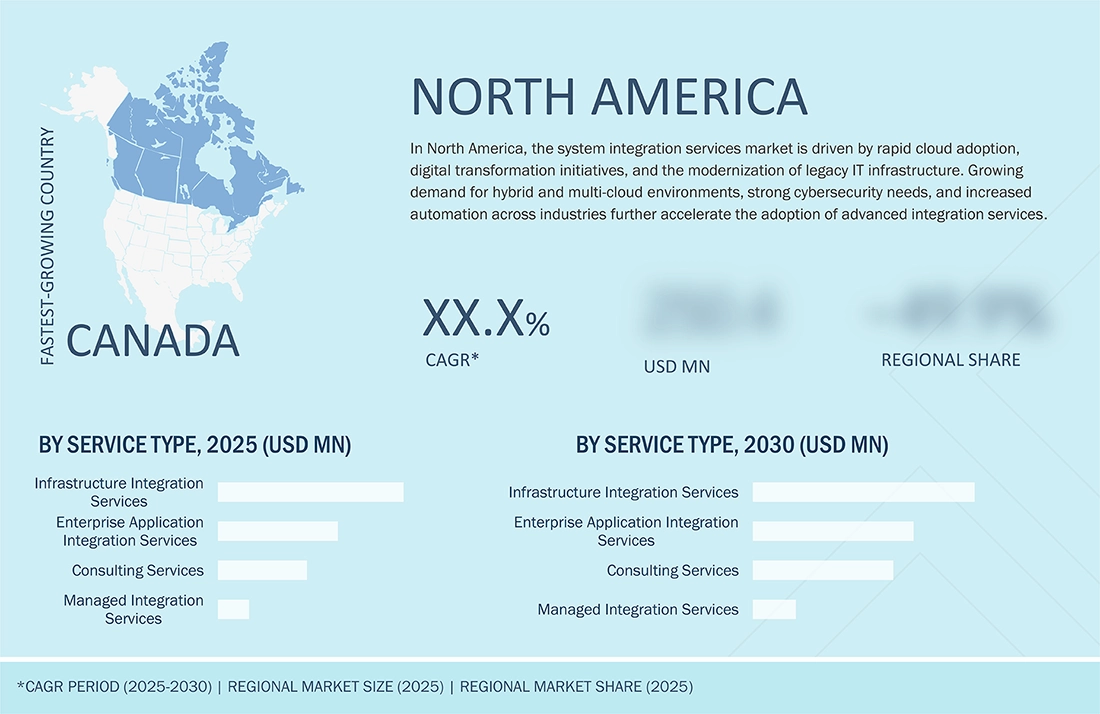

BY REGIONNorth America is the leading market, fueled by widespread cloud adoption, digital transformation initiatives, and the modernization of legacy IT systems. The US drives growth, with enterprises across BFSI, IT, and government investing in integration services to enable real-time data flow, secure operations, and scalable digital infrastructure.

-

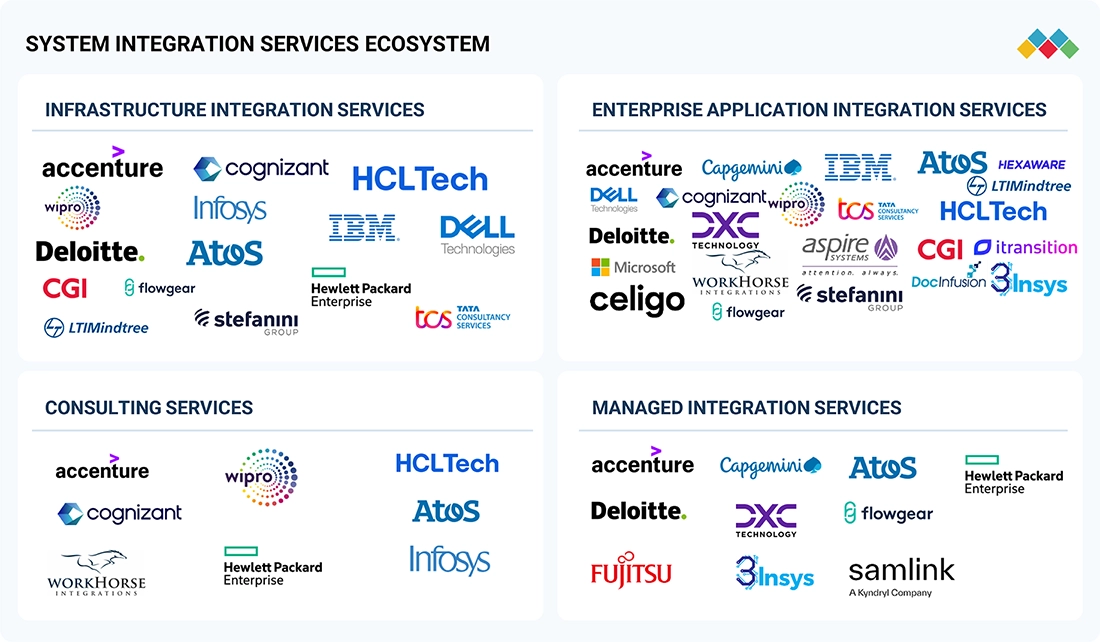

COMPETITIVE LANDSCAPELeading vendors such as Accenture (Ireland), TCS (India), and Cognizant (US) are leveraging strategic partnerships, cloud alliances, and technology investments to expand their system integration services. These initiatives aim to deliver seamless, scalable, and secure integration solutions that meet the evolving needs of enterprises across BFSI, IT & telecom, and government sectors worldwide.

Rising complexity in enterprise IT landscapes, fragmented applications, and multi-vendor ecosystems are boosting demand for advanced system integration services. Companies seek unified platforms, API Management, and automated orchestration to ensure seamless operations, improved collaboration, and faster deployment of digital initiatives across industries.

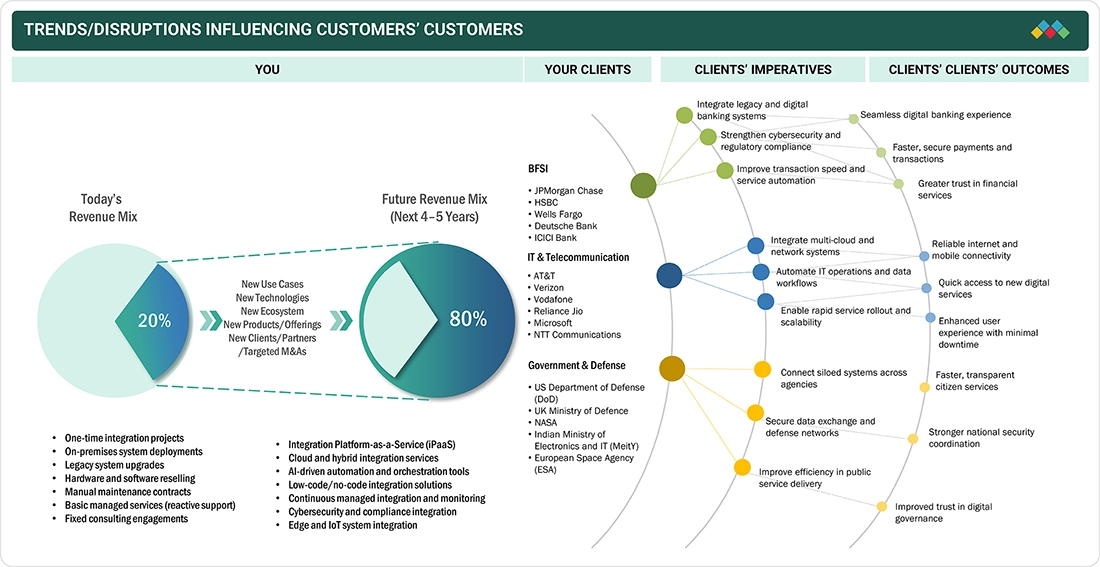

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Rising digital adoption and complex IT landscapes create pressure on organizations to ensure seamless operations. System integration services, supported by hybrid cloud platforms, API management, and automated workflows, help enterprises streamline processes, reduce errors, and improve data flow. Investments in modernization, security, and scalable architectures directly influence efficiency, agility, and business growth, driving demand for integration service providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

IT and OT System Integration Strengthening Industrial Operations

-

API Fragmentation Driving Middleware Integration

Level

-

Budget Overrun and Extended Deployment Timelines Impacting ROI

Level

-

Cybersecurity Integration Services for Distributed Enterprises

-

AI/ML Operationalization Requiring Legacy System Integration

Level

-

Complex Integration Requirements and Skill Shortages

-

Continuous Maintenance and Support Burden

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: IT and OT system integration strengthening industrial operations

The rapid convergence of IT and OT systems is driving demand for system integration services across industries, enabling real-time monitoring, predictive maintenance, and seamless operations in complex, connected environments. Supporting this trend, 70% of OT systems in manufacturing firms across the US, Latin America, and Europe are expected to connect to corporate IT networks by 2025, up from 50% in 2024, illustrating the broader momentum for IT–OT integration. Real-time monitoring and predictive maintenance Seamless IT–OT communication Enhanced operational efficiency These capabilities make system integration services essential for enterprises pursuing digital transformation and Industry 4.0 initiatives globally.

Restraint: Budget overrun and extended deployment timelines impacting ROI

The risks of budget overruns and extended deployment timelines pose a restraint to system integration services adoption. These difficulties lead to: Increased project costs Delayed ROI realization Strained IT budgets and resource allocation Complex legacy upgrades, multi-application synchronization, and customized middleware development make projects prone to unexpected expenses and schedule delays. According to a 2025 Gearset study, deployments were 26% more likely to be delayed than delivered early, costing organizations an average of USD 131,000 per year.

Opportunity: Cybersecurity integration services for distributed enterprises

The shift toward distributed digital ecosystems is driving demand for integrated cybersecurity services. Key trends include: 65% of enterprises planning to replace VPNs in 2025 81% intending to adopt Zero Trust architectures within 12 months Rising ransomware and supply chain attacks increasing security needs System integration services enable unified security frameworks—connecting identity management, threat detection, and SASE—to protect remote offices, cloud platforms, and edge locations, ensuring consistent policy enforcement and enhanced digital resilience.

Challenge: Complex integration requirements and skill shortages

Complex integration requirements and skill shortages are a pressing challenge for system integration services: 77% of organizations report being impacted by IT skill gaps, with 56% prioritizing upskilling and reskilling by 2025. The increasing complexity of connecting legacy systems with cloud, IoT, and automation platforms leads to: Delays in integration projects Inconsistent implementation quality Reduced interoperability between systems These challenges slow deployment, limit scalability, and create demand for vendors offering expert integration solutions, training, and support to help organizations fully realize digital transformation goals.

System Integration Services Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

BÜCHI Labortechnik modernized its fragmented IT landscape with Microsoft Solutions Partner CloudFronts using Azure Integration Services. The deployment connected 20 business applications, streamlined workflows, and enabled real-time data exchange across hybrid environments. | 60+ interfaces integrated across ERP, CRM, and PIM | 1 million integration requests processed daily | Faster deployment of new integrations (within 3 days) | Reduced operational costs and improved efficiency | Centralized, secure API management and real-time monitoring |

|

Komatsu modernized its legacy ERP in Australia by implementing IBM’s webMethods iPaaS. The solution enabled real-time data flow between Microsoft Dynamics, Salesforce, and IBM AS/400, automated workflows, and streamlined supplier integrations, creating a unified business transaction platform. | 30% faster deployment and 80% reduction in integration time | Real-time data sharing across ERP, CRM, and partner systems | Streamlined procurement and supplier collaboration | Automated workflows with no additional headcount | Unified “single source of truth” for business transactions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent system integration services market companies include providers of infrastructure integration services, enterprise application integration services, consulting services, and managed services. These companies deliver end-to-end integration solutions across industries, leveraging advanced technologies, hybrid cloud platforms, and global expertise to ensure seamless connectivity, operational efficiency, and scalable digital transformation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

System Integration Services Market, By Service Type

The infrastructure integration services segment is projected to dominate the system integration services market throughout the forecast period. Enterprises are increasingly adopting these services for their: Seamless connectivity across legacy, cloud, and hybrid systems Real-time data synchronization and workflow automation Scalable and secure IT architectures Streamlined multi-application integration These services enable efficient operations, reduce errors, and support rapid digital transformation across distributed enterprise environments.

System Integration Services Market, By Organization Size

Small and medium-sized enterprises (SMEs) are expected to register the highest CAGR in the system integration services market due to their growing adoption of digital transformation and cloud-based solutions. Key drivers include: Integration of legacy systems with cloud and SaaS applications Automation of workflows and data synchronization Scalable IT architecture for growing business needs Enhanced operational efficiency and faster time-to-market These capabilities make system integration services essential for SMEs seeking agile, cost-effective, and scalable digital operations.

System Integration Services Market, By Vertical

Manufacturing is expected to register the highest CAGR in the system integration services market, as integration solutions are essential for: Connecting OT and IT systems for real-time monitoring Automating production workflows and data exchange Enabling scalable, flexible, and secure operations Supporting predictive maintenance and quality control These services enhance operational efficiency, reduce downtime, and drive digital transformation across smart factories and industrial operations.

REGION

North America to hold largest share in system integration services market during forecast period.

North America is experiencing rapid growth in the system integration services market, fueled by major investments in cloud infrastructure, AI, and enterprise digital transformation. In 2025, Amazon announced a USD 10 billion expansion of AWS data centers in North Carolina, driving large-scale integration needs across hybrid cloud and AI workloads. Similarly, Bain Capital’s investment in HSO, a key Microsoft partner, is strengthening the region’s ecosystem for integrated cloud, data, and AI solutions. These developments are accelerating demand for: Unified IT and cloud infrastructure integration AI and data-driven automation Secure, scalable enterprise connectivity As organizations adopt AI-first and hybrid IT strategies, system integration services are becoming central to optimizing operations, improving interoperability, and maintaining North America’s digital leadership.

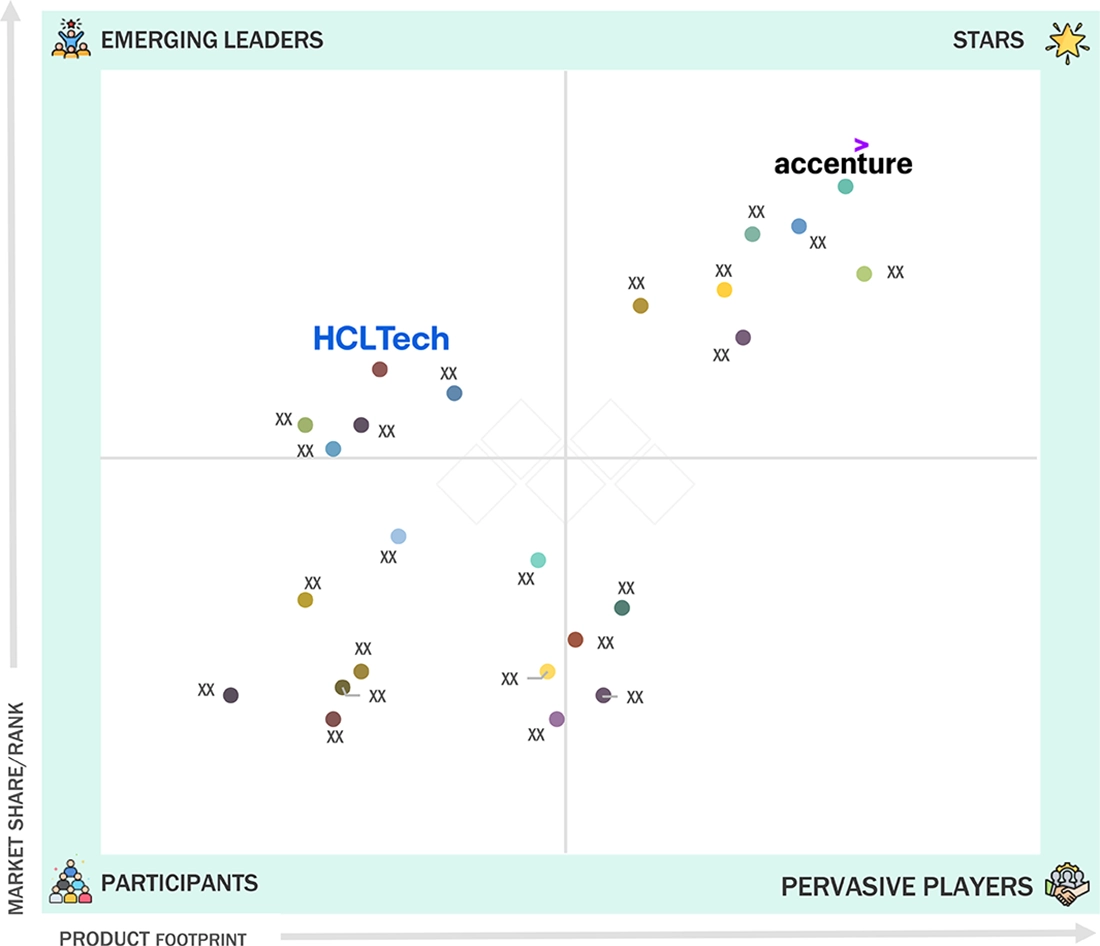

System Integration Services Market: COMPANY EVALUATION MATRIX

Accenture (Star) leads the system integration services market with a strong global presence, offering end-to-end infrastructure, application, and managed integration solutions across industries. Its scale, expertise in hybrid cloud, AI-driven automation, and broad partner ecosystem make it a preferred choice for complex digital transformation initiatives. HCLTech (Emerging Leader) is expanding its presence with specialized integration services, focusing on cloud migration, low-code platforms, and API management. While Accenture dominates through global reach and comprehensive capabilities, HCLTech shows strong potential in targeted, industry-specific integration projects.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 517.13 Billion |

| Market Forecast in 2030 (Value) | USD 763.81 Billion |

| Growth Rate | CAGR of 6.7% from 2024-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Service Type: Infrastructure Integration Services, Enterprise Application Integration Services, Consulting Services, Managed Integration Services I By Organization Size: Large Enterprises, Small Enterprises I By Vertical: BFSI, Retail & E-commerce, IT & Telecom, Healthcare & Life Sciences, Government & Defense, Manufacturing, Media & Entertainment, Transportation & Logistics, Other Verticals |

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, Latin America |

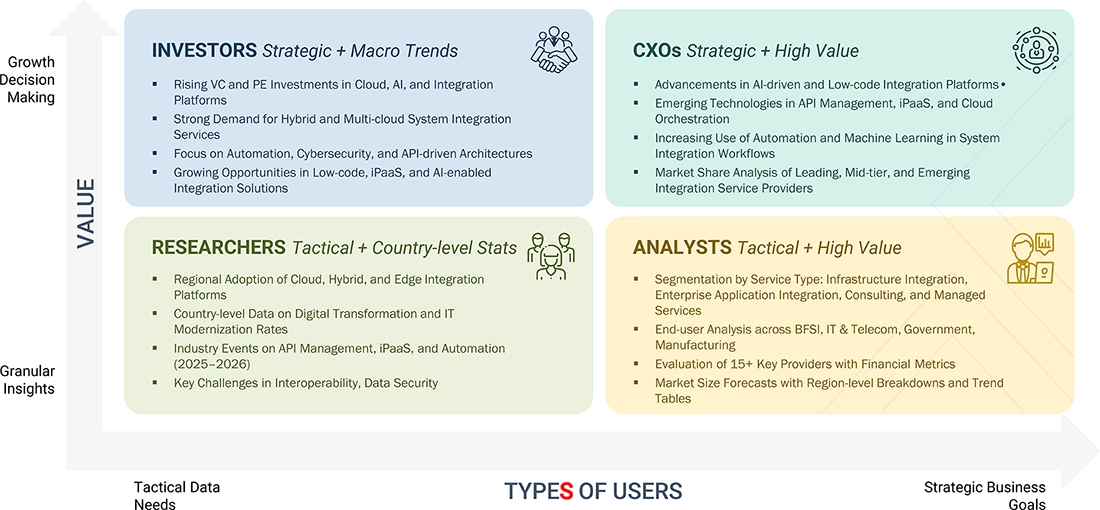

WHAT IS IN IT FOR YOU: System Integration Services Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | In-depth segmentation of the North American System Integration Services Market Extended regional breakdowns for: Europe Asia Pacific Middle East & Africa Latin America |

|

| Leading Solution Provider (EU) | Detailed profiling of additional market players (up to 5 vendors), including product portfolios, strategic initiatives, and regional presence |

|

RECENT DEVELOPMENTS

- October 2025 : Accenture acquired UK-based AI consultancy Decho to integrate Palantir and generative AI capabilities across health, government, defense, and commercial sectors, enhancing platform deployment, data model design, and advanced AI integration for transformative client outcomes.

- October 2025 : TCS expanded its partnership with Google Cloud to integrate Gemini Enterprise, enabling development and orchestration of agentic AI solutions. The deal enhances AI-driven workflows, multi-agent integration, and enterprise innovation across industries, supporting scalable, secure, and efficient operations.

- September 2025 : Wipro partnered with CrowdStrike to launch CyberShield MDR, integrating Falcon SIEM, AI automation, and third-party security tools to deliver unified, managed threat detection and response, enhancing enterprise cybersecurity operations globally.

- May 2025 : Capgemini, Mistral AI, and SAP collaborated to integrate generative AI models into SAP Business Technology Platform, delivering secure, industry-specific AI solutions for regulated sectors, enhancing operations, decision-making, and personalized customer experiences with scalable, compliant, and ethical AI integration.

- April 2025 : IBM acquired Hakkoda to integrate its cloud data modernization and AI expertise, enhancing IBM Consulting’s ability to deliver scalable, industry-specific data solutions, Snowflake implementations, and generative AI readiness, accelerating enterprise AI-driven transformation across multiple sectors.

Table of Contents

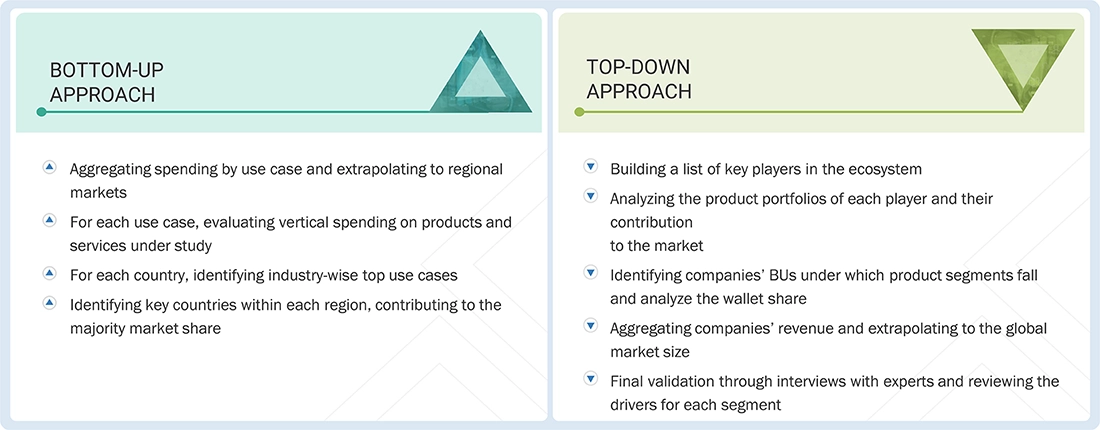

Methodology

The study involved major activities in estimating the current size of the lithium iron phosphate batteries market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, data triangulation was done to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

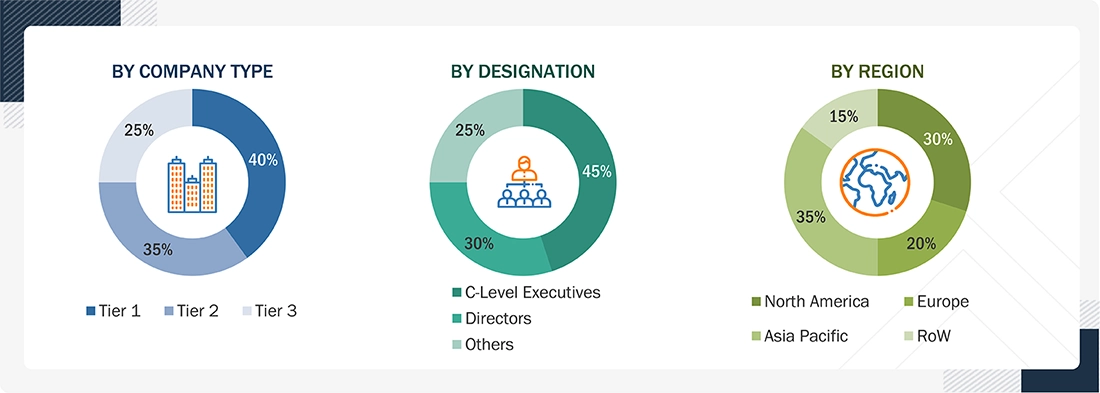

Primary Research

During the primary research phase, a wide range of respondents from both the supply and demand sides were interviewed to gather qualitative and quantitative insights for this report. On the supply side, participants included industry leaders such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and other senior executives from companies and organizations active in the lithium iron phosphate batteries market. The overall market engineering process employed a combination of top-down and bottom-up approaches, supplemented by multiple data triangulation techniques, to estimate and forecast the market across all defined segments and subsegments. Comprehensive qualitative and quantitative analyses were carried out to validate the findings and highlight key insights throughout the study. The following section provides a detailed breakdown of the primary respondents:

Notes: “Others” include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024; Tier 1: > USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the lithium iron phosphate batteries market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

System Integration Services Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined through the estimation process outlined above, it was further divided into multiple segments and subsegments. To ensure accuracy, the data triangulation technique was applied wherever relevant, enabling precise calculations for each category. The triangulation process incorporated an analysis of key factors and trends from both the demand and supply sides. Additionally, the market size was validated through the use of both top-down and bottom-up methodologies.

Market Definition

A lithium iron phosphate (LiFePO4) battery is a type of lithium-ion battery that charges and discharges at high speed. It uses lithium iron phosphate as the cathode and graphite as the anode. The battery delivers a constant voltage and has a higher charge cycle. The charge cycle is 2,000–3,000 per battery; these properties differentiate it from other lithium-ion batteries. Low cost, natural abundance of iron, safety characteristics, nontoxicity, excellent thermal stability, better electrochemical performance, and high specific capacity are the other properties that have helped lithium iron phosphate batteries gain considerable market acceptance. Improvements in coating and the usage of nanoscale phosphate have made these batteries more efficient.

The market for lithium iron phosphate batteries is defined as the sum of revenues generated by global companies through the sales of their lithium iron phosphate batteries. The scope of the current study includes the bifurcation of this market by design, capacity, industry, application, voltage, and region.

Stakeholders

- Lithium iron phosphate battery manufacturers and providers

- Electric vehicle (EV) manufacturing companies

- Lithium-ion battery manufacturers & providers

- R&D laboratories

- Energy & power sector consulting companies

- Distributors of lithium iron phosphate batteries

- Government and research organizations

- State and national regulatory authorities

Report Objectives

- To define, describe, segment, and forecast the lithium iron phosphate batteries market based on capacity, industry, application, voltage, and region, in terms of value

- To forecast the market sizes for five major regions, namely North America, Europe, Asia Pacific, South America, the Middle East & Africa, along with their key countries, in terms of value

- To provide information on the design of lithium iron phosphate batteries

- To forecast the lithium iron phosphate batteries market by industry and region, in terms of volume

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the lithium iron phosphate batteries market

- To provide the supply chain analysis, trends/disruptions impacting customer business, ecosystem analysis, regulatory landscape, patent analysis, case study analysis, technology analysis, key conferences & events, the impact of AI/Gen AI, macroeconomic outlook, pricing analysis, Porter’s five forces analysis, and regulatory analysis, the impact of the 2025 US tariffs on the market

- To analyze opportunities for stakeholders in the lithium iron phosphate batteries market and draw a competitive landscape of the market

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study

- To benchmark market players using the company evaluation quadrant, which analyzes market players on the broad categories of business and product strategies adopted by them

- To compare key market players with respect to product specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, product launches, partnerships, joint ventures & collaborations, in the lithium iron phosphate batteries market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the lithium iron phosphate batteries by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current market size of the system integration services market?

The global system integration services market was valued at USD 553.33 billion in 2025 and is projected to reach USD 763.82 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030.

Which region leads the market?

North America leads the system integrations services market, followed by Europe and Asia Pacific, with Asia Pacific advancing fastest due the rapid digital transformation and industrial automation across countries such as China, India, and Japan. Growing investments in smart manufacturing, cloud adoption, and government-backed digital initiatives are fueling strong demand for integrated and scalable IT infrastructure solutions.

What are the emerging trends in the system integration services market?

Key emerging trends in the system integration services market include the increasing adoption of AI, IoT, and cloud-based integration platforms to unify complex IT and OT systems. The rise of automation, edge computing, and cybersecurity-driven integration is transforming how enterprises optimize operations and enhance digital resilience.

Who are the key companies in this market?

Leading players in the market include Accenture (Ireland), TCS (India), Cognizant (US), Delloitte (UK) and IBM (US)

What factors are driving market growth?

The system integration services market is driven by IT and OT system integration strengthening industrial operations, legacy system migration to cloud.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the System Integration Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in System Integration Services Market