Tab Leads and Tab Seal Film Market by Material (Aluminum, Copper, Nickel, Polyamide, End User (Consumer Electronics, Electric Vehicles, Military, Industrial) and Region (North America, Europe, APAC, Rest of World) - Global Forecast to 2027

Updated on : September 02, 2025

Tab Leads and Tab Seal Film Market

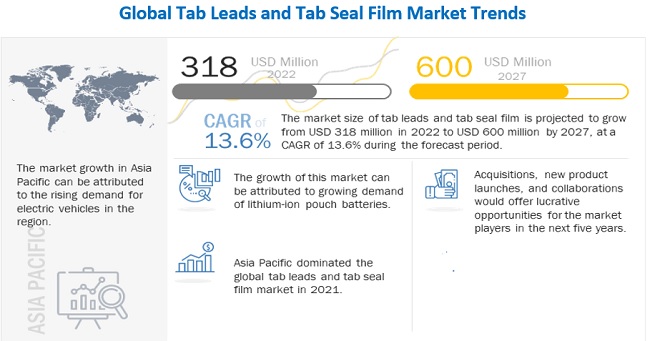

Tab leads and tab seal film market was valued at USD 318 million in 2022 and is projected to reach USD 600 million by 2027, growing at 13.6% cagr from 2022 to 2027. The tab leads & tab seal film performs effectively for various applications, which in turn, has contributed significantly to the growth this market over the years.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Tab Leads And Tab Seal Film Market

The pandemic is estimated to have an adverse impact on various factors of the value chain of tab leads and tab seal film market, which is expected to reflect during the forecast period, especially in the year 2020.

The outbreak of the COVID-19 pandemic and its subsequent waves resulted in the temporary shutdown of production plants and related activities in most of the major economies across the globe. Most countries worldwide resorted to nationwide lockdown to control the spread of the virus. It slowed down the growth of various sectors and disrupted the global supply chains, consequently affecting the growth of the tab leads and tab seal film. Limited transportation, travel restrictions, and halt of manufacturing activities have hampered the growth of tab leads and tab seal film market.

Tab Leads And Tab Seal Film Market Dynamics

Driver: Growing demand for pouch batteries in electric vehicles

The automobile industry is shifting toward sustainable clean fuels. The transportation system is highly dependent upon oil as a fuel, of which approximately 70% is being used for vehicles. Factors such as energy savings, reduction in pollution, and adoption of electric vehicles by consumers are expected to propel the growth of the EV market. Electric vehicles are currently perceived as the future of the automobile industry and transportation systems. There is growing adoption of pouch batteries in electric vehicles as they are lightweight and effectively utilize the available space. Thus, the growing usage of pouch batteries will bolster the demand for tab leads and tab seal film market.

Restraint: Gray market disrupting market share of established players

Major tab lead and lithium pouch battery manufacturers are facing tough competition from the gray market that is supplying cheap and sub-standard products. The gray market comprises unorganized and local players that sell goods manufactured in-house with their local brand names. The existence of both the local and gray market players reduces the opportunity for global players to increase their revenue (market share). This restricts the entry of global players into the local markets, thereby limiting their investments in tab leads and tab seal film markets.

Opportunity: Increasing usage of pouch lithium-ion batteries in military equipment

Defense expenditure is an essential component of national security, with every country allocating a significant portion of its resources toward defense. This expenditure includes spending on troops' benefits, and a vital portion of defense expenditure goes towards equipment and maintenance. The growing usage of pouch batteries in military equipment can be attributed to their properties, such as efficient usage of space. Thus, high spending on defense and growing usage of pouch batteries in military equipment will enhance the demand for pouch lithium-ion batteries leading to the growth of tab leads and tab seal film market.

Challenge: High cost as compared to cylindrical lithium-ion batteries due to lack of standard size

Cylindrical lithium-ion batteries are being widely used in the automotive industry, particularly in electric vehicles. These batteries are being used in electric vehicles for a longer duration than pouch batteries. Major companies such as Tesla and BYD use cylindrical lithium-ion batteries on a large scale. Compared to pouch lithium batteries, 18650 cylindrical lithium batteries can be produced at a quicker rate, leading to more kWh of cell produced per hour. This decreases the overall production cost of the battery, which directly impacts the manufacturer's revenues. This factor will negatively impact the market for pouch lithium-ion batteries and thus for tab leads and tab seals as well.

“Aluminium segment is expected to dominate the tab leads and tab seal film market, by raw material in terms of value”

Aluminum’s ability to enhance battery stability is expected to drive demand for tab leads. Aluminum is used inside and outside of making pouch lithium-ion batteries and their parts. Majorly aluminum functions as a barrier against all permeation and provide mechanical and chemical protection, thus providing stability to the battery.

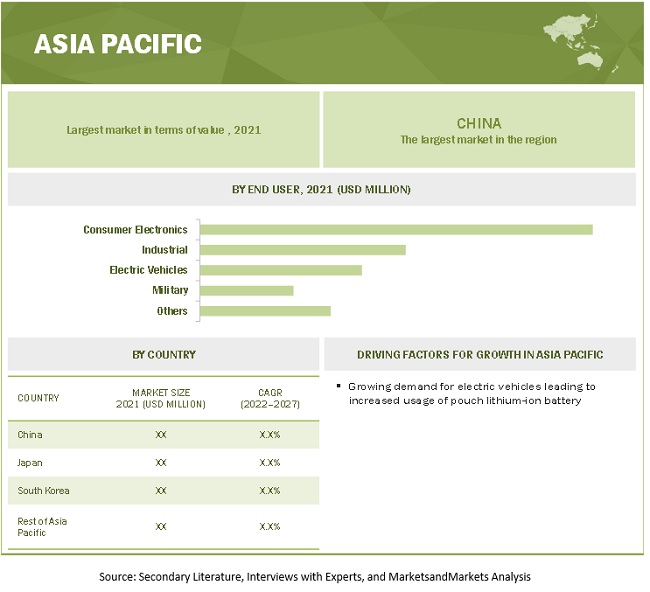

“Consumer Electronics is expected to dominate the tab leads and tab seal film market, by end user in terms of value”

Growing demand for pouch batteries in drones will bolster consumer electronics segment. According to Federal Aviation Administration, around 315,437 commercial drones are registered in the US till 23rd May 2022. Thus, the growth in consumer electronics will propel tab leads and tab seal film market.

“Asia Pacific region is expected to dominate the tab leads and tab seal film market, in terms of value”

China is one of the major countries in Asia Pacific, investing significantly in the production of commercial electric vehicles with export plans. OEMs such as BYD plan to open plants in other parts of the world to manufacture electric buses and electric trucks to meet regional demand. Hence the presence of countries such as China and Japan are expected to boost tab leads & tab seal film market.

To know about the assumptions considered for the study, download the pdf brochure

Tab Leads and Tab Seal Film Market Players

Sumitomo Electric Industries (Japan), MISUZU Holding (China), SAMA (South Korea), Yujin Technology (South Korea), NEPES (South Korea), Nitto Denko Corporation (Japan) are some of the key players in the tab leads & tab seal film market. These players have adopted strategies such as joint ventures, and expansions to enhance their business revenue and market share.

Tab Leads and Tab Seal Film Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million ) |

|

Segments Covered |

Material, End User, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Rest of World |

|

Companies Covered |

Sumitomo Electric Industries (Japan), MISUZU Holding (China), SAMA (South Korea), Yujin Technology (South Korea), NEPES (South Korea), Nitto Denko Corporation (Japan) are some of the key players in the tab leads & tab seal film market (Total of 19 companies) |

This research report categorizes the tab leads & tab seal film market based on material, end user, and region.

Based on Material, the tab leads & tab seal film market has been segmented as follows:

- Aluminum

- Copper

- Nickel

- Polyamide

- Others (polypropylene and other polyolefin)

Based on End User, the tab leads & tab seal film market has been segmented as follows:

- Consumer Electronics

- Electric Vehicles

- Military

- Industrial

- Others (forklift, floor scrubber, and other specialty applications)

Based on Region, tab leads & tab seal film Market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Rest of World

Recent Developments

- In January 2022, NEPES YAHAD, a battery component subsidiary of NEPES, supplied lead tabs to overseas secondary battery manufacturers for the first time.

- In October 2021, Toray agreed to establish a battery separator film joint venture with LG Chem in Hungary. To meet anticipated demand, Toray and LG Chem decided to increase film substrate production and add new coating facilities at the THU location, where battery separator film will be manufactured.

Frequently Asked Questions (FAQ):

What is the size of the global tab leads & tab seal film market?

The market size of tab leads and tab seal film is projected to grow from USD 318 million in 2022 to USD 600 million by 2027, at a CAGR of 13.6% during the forecast period.

Who are the major players in the global tab leads & tab seal film market?

Some of the major players in the tab leads & tab seal film market include Sumitomo Electric Industries (Japan), MISUZU Holding (China), SAMA (South Korea), Yujin Technology (South Korea), NEPES (South Korea), Nitto Denko Corporation (Japan). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 TAB LEADS AND TAB SEAL FILM MARKET SEGMENTATION

FIGURE 2 REGIONAL SCOPE

1.4 INCLUSIONS & EXCLUSIONS

1.4.1 TAB LEADS AND TAB SEAL FILM MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 3 TAB LEADS AND TAB SEAL FILM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE

FIGURE 4 MAIN MATRIX CONSIDERED FOR CONSTRUCTING AND ASSESSING DEMAND FOR TAB LEADS AND TAB SEAL FILM MARKET

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF TAB LEADS AND TAB SEAL FILM MARKET

FIGURE 8 METHODOLOGY FOR SUPPLY-SIDE SIZING OF TAB LEADS AND TAB SEAL FILM MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.3 FORECAST

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 9 TAB LEADS AND TAB SEAL FILM MARKET: DATA TRIANGULATION

2.5.1.1 Key assumptions while calculating demand-side market size

2.5.1.2 Limitations

2.5.1.3 Risk analysis

3 EXECUTIVE SUMMARY (Page No. - 39)

TABLE 1 TAB LEADS AND TAB SEAL FILM MARKET

FIGURE 10 ALUMINUM SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

FIGURE 11 CONSUMER ELECTRONICS BY END USER IS EXPECTED TO ACCOUNT FOR LARGEST SHARE

FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN TAB LEADS AND TAB SEAL FILM MARKET BY VALUE IN 2021

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN TAB LEADS AND TAB SEAL FILM MARKET

FIGURE 13 TAB LEADS AND TAB SEAL FILM MARKET PROJECTED TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

4.2 TAB LEADS AND TAB SEAL FILM MARKET, BY REGION

FIGURE 14 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF TAB LEADS AND TAB SEAL FILM DURING FORECAST PERIOD

4.3 TAB LEADS AND TAB SEAL FILM MARKET, BY MATERIAL

FIGURE 15 ALUMINUM HELD LARGEST MARKET SHARE BY VALUE IN 2021

4.4 TAB LEADS AND TAB SEAL FILM MARKET, BY END USER

FIGURE 16 OTHERS SEGMENT IS EXPECTED TO BE FASTEST GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: TAB LEADS AND TAB SEAL FILM MARKET

5.1.1 DRIVERS

5.1.1.1 Growing demand for pouch batteries in electric vehicles

FIGURE 18 GLOBAL VOLUME SALES OF BATTERY ELECTRIC VEHICLES AND PLUG-IN HYBRID ELECTRIC VEHICLES, 2018–2021

5.1.2 RESTRAINTS

5.1.2.1 Gray market disrupting market share of established players

5.1.2.2 Low energy density of pouch lithium-ion batteries

5.1.3 OPPORTUNITIES

5.1.3.1 Increasing usage of pouch lithium-ion batteries in military equipment

5.1.4 CHALLENGES

5.1.4.1 High cost as compared to cylindrical lithium-ion batteries due to lack of standard size

5.1.4.2 Impact of COVID-19 on tab leads and tab seal film market

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 19 TAB LEADS AND TAB SEAL FILM MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 2 TAB LEADS AND TAB SEAL FILM MARKET: PORTER'S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 VALUE CHAIN

FIGURE 20 TAB LEADS AND TAB SEAL FILM MARKET: VALUE CHAIN

5.4 ECOSYSTEM/MARKET MAP

FIGURE 21 TAB LEADS AND TAB SEAL FILM BATTERY MARKET: ECOSYSTEM/MARKET MAP

5.5 REGULATORY LANDSCAPE

TABLE 3 REGULATIONS AND STANDARDS FOR BATTERIES

5.6 PATENT ANALYSIS

FIGURE 22 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

FIGURE 23 PUBLICATION TRENDS- LAST 10 YEARS

5.6.1 INSIGHT

FIGURE 24 LEGAL STATUS OF PATENTS

5.6.2 JURISDICTION ANALYSIS

FIGURE 25 TOP JURISDICTION, BY DOCUMENT

5.6.3 TOP COMPANIES/APPLICANTS

TABLE 4 LIST OF PATENTS

TABLE 5 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.7 TRADE DATA

TABLE 6 IMPORT DATA OF LITHIUM CELLS AND BATTERIES

TABLE 7 EXPORT DATA OF LITHIUM CELLS AND BATTERIES

6 TAB LEADS AND TAB SEAL FILM MARKET, BY MATERIAL (Page No. - 59)

6.1 INTRODUCTION

FIGURE 26 ALUMINUM SEGMENT TO DOMINATE TAB LEADS AND TAB SEAL FILM MARKET DURING FORECAST PERIOD

TABLE 8 TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 9 TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MATERIAL, 2022–2027 (USD MILLION)

6.2 TAB LEADS BY MATERIAL

6.2.1 ALUMINUM

6.2.1.1 Aluminum’s ability to enhance battery stability to drive demand for tab leads

6.2.2 NICKEL

6.2.2.1 Growing application in consumer electronics to boost market for this segment

6.2.3 COPPER

6.2.3.1 High electric conductivity and reliability of copper to enhance its demand

6.3 TAB SEAL FILM BY MATERIAL

6.3.1 POLYAMIDE

6.3.1.1 Ability to avoid short-circuiting in pouch lithium-ion batteries drives demand for this segment

6.4 OTHERS

7 TAB LEADS AND TAB SEAL FILM MARKET, BY END USER (Page No. - 63)

7.1 INTRODUCTION

FIGURE 27 CONSUMER ELECTRONICS SEGMENT TO HOLD SIGNIFICANT SHARE DURING FORECAST PERIOD

TABLE 10 TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 11 TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

7.2 CONSUMER ELECTRONICS

7.2.1 GROWING DEMAND FOR POUCH BATTERIES IN DRONES WILL BOLSTER CONSUMER ELECTRONICS SEGMENT

TABLE 12 CONSUMER ELECTRONICS: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 13 CONSUMER ELECTRONICS: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 MILITARY

7.3.1 GROWING APPLICATION OF POUCH LITHIUM-ION BATTERIES IN MILITARY EQUIPMENT TO BOOST THIS SEGMENT

TABLE 14 MILITARY: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 MILITARY: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 ELECTRIC VEHICLES

7.4.1 GROWING DEMAND FOR ELECTRIC VEHICLES TO BOLSTER THIS SEGMENT

TABLE 16 ELECTRIC VEHICLES: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 ELECTRIC VEHICLES: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.5 INDUSTRIAL

7.5.1 GROWING POWER SECTOR TO CREATE DEMAND FOR INDUSTRIAL SEGMENT

TABLE 18 INDUSTRIAL: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 INDUSTRIAL: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.6 OTHERS

TABLE 20 OTHERS: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 OTHERS: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 TAB LEADS AND TAB SEAL FILM MARKET, BY REGION (Page No. - 70)

8.1 INTRODUCTION

FIGURE 28 ASIA PACIFIC TO BE LARGEST TAB LEADS AND TAB SEAL FILM MARKET DURING FORECAST PERIOD

TABLE 22 GLOBAL: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 GLOBAL: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SNAPSHOT

TABLE 24 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 25 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 26 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END-USER, 2018–2021 (USD MILLION)

TABLE 27 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY CONSUMER ELECTRONICS, 2018–2021 (USD MILLION)

TABLE 29 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY CONSUMER ELECTRONICS, 2022–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY ELECTRIC VEHICLES, 2018–2021 (USD MILLION)

TABLE 31 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY ELECTRIC VEHICLES, 2022–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MILITARY, 2018–2021 (USD MILLION)

TABLE 33 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MILITARY, 2022–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY INDUSTRIAL, 2018–2021 (USD MILLION)

TABLE 35 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY INDUSTRIAL, 2022–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY OTHERS, 2018–2021 (USD MILLION)

TABLE 37 NORTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY OTHERS, 2022–2027 (USD MILLION)

8.2.1 US

8.2.1.1 Growing usage of pouch lithium-ion batteries in region is expected to fuel market

TABLE 38 US: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 39 US: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Government investment in electric vehicles is expected to fuel demand

TABLE 40 CANADA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 41 CANADA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.2.3 MEXICO

8.2.3.1 Spiraling demand for pouch lithium-ion batteries in country is expected to enhance tab leads and tab seal film market

TABLE 42 MEXICO: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 43 MEXICO: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.3 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SNAPSHOT

TABLE 44 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 45 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 46 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 47 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 48 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY CONSUMER ELECTRONICS, 2018–2021 (USD MILLION)

TABLE 49 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY CONSUMER ELECTRONICS, 2022–2027 (USD MILLION)

TABLE 50 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY ELECTRIC VEHICLES, 2018–2021 (USD MILLION)

TABLE 51 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY ELECTRIC VEHICLES, 2022–2027 (USD MILLION)

TABLE 52 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MILITARY, 2018–2021 (USD MILLION)

TABLE 53 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MILITARY, 2022–2027 (USD MILLION)

TABLE 54 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY INDUSTRIAL, 2018–2021 (USD MILLION)

TABLE 55 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY INDUSTRIAL, 2022–2027 (USD MILLION)

TABLE 56 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY OTHERS, 2018–2021 (USD MILLION)

TABLE 57 ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY OTHERS, 2022–2027 (USD MILLION)

8.3.1 CHINA

8.3.1.1 Growing usage of lithium batteries in different applications to boost demand for tab leads and tab seal film

TABLE 58 CHINA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 59 CHINA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.3.2 JAPAN

8.3.2.1 Gradually shifting to electric vehicles will create growth opportunities for tab leads and tab seal film

TABLE 60 JAPAN: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 61 JAPAN: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.3.3 SOUTH KOREA

8.3.3.1 Presence of key EV battery producers will propel market for tab leads and tab seal film in country

TABLE 62 SOUTH KOREA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 63 SOUTH KOREA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.3.4 REST OF ASIA PACIFIC

TABLE 64 REST OF ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 65 REST OF ASIA PACIFIC: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.4 EUROPE

FIGURE 31 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SNAPSHOT

TABLE 66 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY CONSUMER ELECTRONICS, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY CONSUMER ELECTRONICS, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY ELECTRIC VEHICLES, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY ELECTRIC VEHICLES, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MILITARY, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MILITARY, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY INDUSTRIAL, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY INDUSTRIAL, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY OTHERS, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY OTHERS, 2022–2027 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Rising expenditure on defense is expected to propel demand for tab leads and tab seal film

TABLE 80 GERMANY: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 81 GERMANY: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.4.2 FRANCE

8.4.2.1 Growth of EVs and military expenditure to bolster demand for tab leads and tab seal film in country

TABLE 82 FRANCE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 83 FRANCE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.4.3 REST OF EUROPE

TABLE 84 REST OF EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 85 REST OF EUROPE: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.5 REST OF WORLD

TABLE 86 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END-USER, 2018–2021 (USD MILLION)

TABLE 89 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 90 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY CONSUMER ELECTRONICS, 2018–2021 (USD MILLION)

TABLE 91 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY CONSUMER ELECTRONICS, 2022–2027 (USD MILLION)

TABLE 92 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY ELECTRIC VEHICLES, 2018–2021 (USD MILLION)

TABLE 93 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY ELECTRIC VEHICLES, 2022–2027 (USD MILLION)

TABLE 94 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MILITARY, 2018–2021 (USD MILLION)

TABLE 95 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY MILITARY, 2022–2027 (USD MILLION)

TABLE 96 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY INDUSTRIAL, 2018–2021 (USD MILLION)

TABLE 97 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY INDUSTRIAL, 2022–2027 (USD MILLION)

TABLE 98 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY OTHERS, 2018–2021 (USD MILLION)

TABLE 99 REST OF WORLD: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY OTHERS, 2022–2027 (USD MILLION)

8.5.1 MIDDLE EAST & AFRICA

8.5.1.1 Growing demand for electric vehicles will drive market

TABLE 100 MIDDLE EAST & AFRICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

8.5.2 SOUTH AMERICA

8.5.2.1 Government focus on military expenditure and electric vehicle infrastructure to boost market

TABLE 102 SOUTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 103 SOUTH AMERICA: TAB LEADS AND TAB SEAL FILM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 104)

9.1 INTRODUCTION

9.2 RANKING OF LEADING PLAYERS, 2022

FIGURE 32 RANKING OF LEADING PLAYERS IN TAB LEADS AND TAB SEAL FILM MARKET, 2021

9.3 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 104 COMPANY OVERALL FOOTPRINT

TABLE 105 COMPANY PRODUCT FOOTPRINT

TABLE 106 COMPANY REGION FOOTPRINT

9.4 COMPANY EVALUATION QUADRANT

9.4.1 STAR

9.4.2 EMERGING LEADER

9.4.3 PERVASIVE

9.4.4 PARTICIPANT

FIGURE 33 TAB LEADS AND TAB SEAL FILM MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

9.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2022

9.5.1 PROGRESSIVE COMPANY

9.5.2 RESPONSIVE COMPANY

9.5.3 DYNAMIC COMPANY

9.5.4 STARTING BLOCK

FIGURE 34 TAB LEADS AND TAB SEAL FILM MARKET (GLOBAL): SME EVALUATION QUADRANT, 2022

9.6 COMPETITIVE SCENARIO

9.6.1 DEALS

TABLE 107 DEALS, 2019–2022

TABLE 108 OTHERS, 2019–2022

10 COMPANY PROFILES (Page No. - 114)

10.1 INTRODUCTION

(Business overview, Products/solutions/services offered, Recent Developments, MNM view)*

10.2 KEY PLAYERS

10.2.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

TABLE 109 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

FIGURE 35 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 110 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.2 T&T ENERTECHNO CO., LTD.

TABLE 111 T&T ENERTECHNO CO., LTD.: COMPANY OVERVIEW

TABLE 112 T&T ENERTECHNO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.3 NEPES

TABLE 113 NEPES: COMPANY OVERVIEW

FIGURE 36 NEPES: COMPANY SNAPSHOT

TABLE 114 NEPES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 115 NEPES: OTHER

10.2.4 MISUZU HOLDING

TABLE 116 MISUZU HOLDING: COMPANY OVERVIEW

TABLE 117 MISUZU HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.5 SOULBRAIN CO., LTD.

TABLE 118 SOULBRAIN CO., LTD.: COMPANY OVERVIEW

TABLE 119 SOULBRAIN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.6 SAMA

TABLE 120 SAMA: COMPANY OVERVIEW

FIGURE 37 SAMA: COMPANY SNAPSHOT

TABLE 121 SAMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.7 YUJIN TECHNOLOGY

TABLE 122 YUJIN TECHNOLOGY: COMPANY OVERVIEW

TABLE 123 YUJIN TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.8 CLAVIS CORPORATION

TABLE 124 CLAVIS CORPORATION: COMPANY OVERVIEW

TABLE 125 CLAVIS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.9 AVOCET STEEL

TABLE 126 AVOCET STEEL: COMPANY OVERVIEW

TABLE 127 AVOCET STEEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.10 ZACROS (SHENZHEN) CO., LTD.

TABLE 128 ZACROS (SHENZHEN) CO., LTD.: COMPANY OVERVIEW

TABLE 129 ZACROS (SHENZHEN) CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.11 TORAY BATTERY SEPARATOR FILM KOREA

TABLE 130 TORAY BATTERY SEPARATOR FILM KOREA: COMPANY OVERVIEW

TABLE 131 TORAY BATTERY SEPARATOR FILM KOREA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 132 TORAY BATTERY SEPARATOR FILM KOREA: DEALS

TABLE 133 TORAY BATTERY SEPARATOR FILM KOREA: OTHERS

10.2.12 DAEST COATING INDIA PVT LTD.

TABLE 134 DAEST COATING INDIA PVT LTD: COMPANY OVERVIEW

TABLE 135 DAEST COATING INDIA PVT LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.13 NITTO DENKO CORPORATION

TABLE 136 NITTO DENKO CORPORATION: COMPANY OVERVIEW

FIGURE 38 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

TABLE 137 NITTO DENKO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.14 DUNMORE

TABLE 138 DUNMORE: COMPANY OVERVIEW

TABLE 139 DUNMORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.15 DAI NIPPON PRINTING CO., LTD.

TABLE 140 DAI NIPPON PRINTING CO., LTD.: COMPANY OVERVIEW

FIGURE 39 DAI NIPPON PRINTING CO., LTD.: COMPANY SNAPSHOT

TABLE 141 DIA NIPPON PRINTING CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

10.2.16 SHOWA DENKO K.K.

TABLE 142 SHOWA DENKO K.K.: COMPANY OVERVIEW

FIGURE 40 SHOWA DENKO K.K.: COMPANY SNAPSHOT

TABLE 143 SHOWA DENKO K.K.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 144 SHOWA DENKO K.K.: OTHERS

10.2.17 OKURA INDUSTRIAL CO., LTD.

TABLE 145 OKURA INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

FIGURE 41 OKURA INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

TABLE 146 OKURA INDUSTRIAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

10.3 OTHER PLAYERS

10.3.1 LS FOUR TECH CO., LTD.

TABLE 147 LS FOUR TECH CO., LTD: COMPANY OVERVIEW

10.3.2 JIANGSU JIULAN NEW ENERGY TECHNOLOGY CO., LTD

TABLE 148 JIANGSU JIULAN NEW ENERGY TECHNOLOGY CO., LTD: COMPANY OVERVIEW

11 APPENDIX (Page No. - 143)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS.

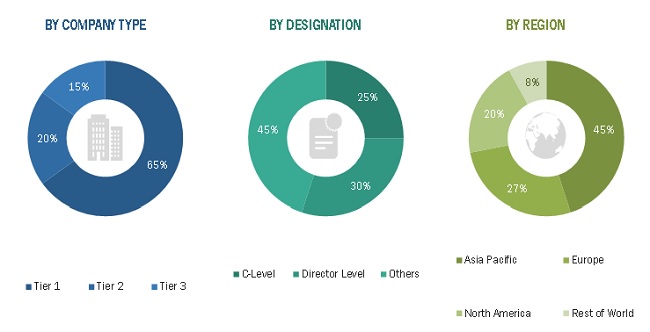

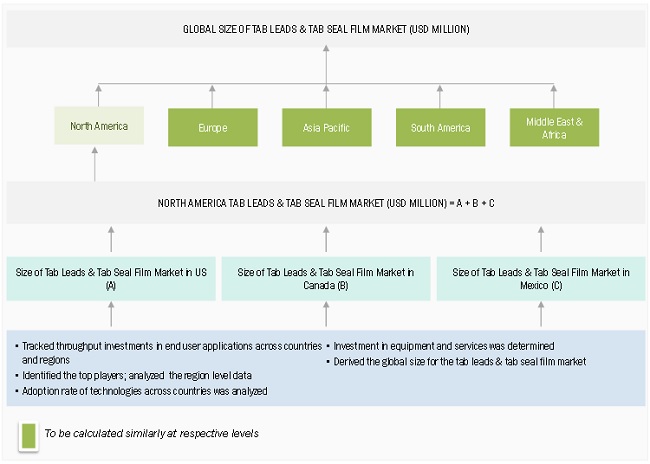

The study involved four major activities in estimating the current size of the tab leads & tab seal film market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the tab leads & tab seal film value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The tab leads & tab seal film market comprises several stakeholders, such as manufacturers of tab leads and tab seal film, traders, distributors, and suppliers of tab leads and tab seal film, OEMS, associations and industrial bodies, and research and consulting firms.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the tab leads & tab seal film market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the tab leads & tab seal film market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the tab leads & tab seal film market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the tab leads & tab seal film market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Tab Leads & Tab Seal Film Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To determine and project the size of the tab leads & tab seal film market with respect to material, end user, and region, from 2018 to 2027

- To identify attractive opportunities in the market by determining the largest and the fastest-growing segments across key regions

- To project the size of the market segments, in terms of value, with respect to five regions: Asia Pacific, North America, Europe, Rest of World

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, opportunities, restraints, and challenges)

- To analyze competitive developments, such as expansions, and joint ventures in the tab leads & tab seal film market

- To analyze the demand-side factors based on the impact of macroeconomic and microeconomic factors on different segments of the market across different regions

Competitive Intelligence

- To identify and profile key players in the tab leads & tab seal film market

- To determine the market share of key players operating in the market

- To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further country-level breakdown of the Rest of Asia Pacific into Taiwan, Thailand, Malaysia, Australia, New Zealand, and India in the tab leads & tab seal film market

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Tab Leads and Tab Seal Film Market