Tablet Coatings Market Size, Share & Trends by Polymer (Cellulosic, Vinyl, Acrylic), Functionality (Delayed Release, Sustained Release), Type (Sugar Coated, Film Coated, Enteric Coated), End User (Pharmaceutical, Nutraceutical) & Region - Global Forecast to 2025

Tablet Coatings Market Size, Share & Trends

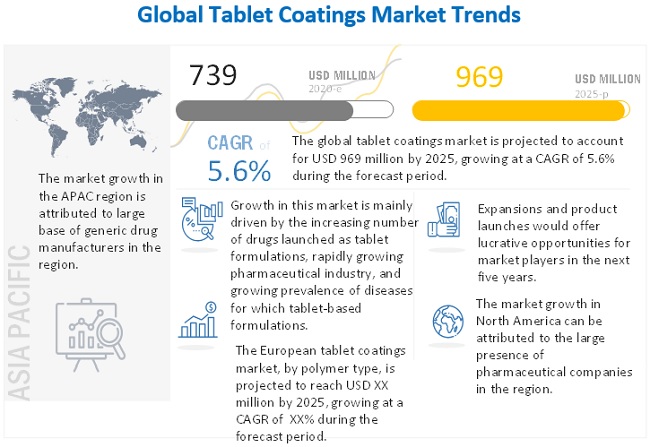

The size of global tablet coatings market in terms of revenue was estimated to be worth $739 million in 2020 and is poised to reach $969 million by 2025, growing at a CAGR of 5.6% from 2020 to 2025. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Growth in this market is majorly driven by the growing pharmaceutical industry coupled with the increasing R&D activities taking place in this field. The growing generics market, rapidly growing biopharmaceuticals sector, growing nutraceutical industry, and the rising adoption of orphan drugs are supporting the growth of the market. Moreover, the shifting focus of pharmaceutical manufacturing to emerging markets along with the increasing outsourcing of operations to these countries present significant opportunities for market growth. Additionally, the rising focus on technological advancements in niche market areas also offers significant growth opportunities for players operating in this space. However, the increasing regulatory stringency regarding the approval of drugs and excipients, the high cost associated with the microencapsulation process are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Tablet Coatings Market Dynamics

Driver: Rising adoption of orphan drugs

An orphan drug is a pharmaceutical agent developed to treat rarely occurring medical conditions referred to as orphan diseases. Owing to the surge in the number of treatments for rare diseases, the pharmaceutical industry is expected to witness a rising demand for pharmaceutical ingredients, including APIs and excipients. According to the US NIH, there are as many as 7,000 conditions classified as rare by US standards (affecting less than 200,000 Americans). Since the introduction of the Orphan Drug Act, only about 600 drugs have been approved, leaving most rare diseases without any licensed treatment. Additionally, drug makers typically charge higher prices for orphan drugs (being protected by market exclusivity granted to any company that secures an orphan drug approval). To date, insurers have mostly agreed to cover such drugs, despite their higher price, due to the lack of other options. The continuous focus of drug manufacturers on the development of treatment options for rare diseases is further expected to drive the growth of the global market. Some of the major pharmaceutical companies selling orphan drugs in the market are Celgene (US), Roche (Switzerland), Teva (Israel), Bristol-Myers Squibb (US), Biogen (US), AbbVie (US), Amgen (US), Novartis (Switzerland), Takeda (Japan), and Jazz Pharmaceuticals (Ireland).

Restraint: High cost associated with the microencapsulation process in sustained-release formulations

Controlled drug delivery systems offer numerous advantages compared to conventional dosage forms, which include improved efficacy, reduced toxicity, and improved patient compliance and convenience. Such systems often use macromolecules as carriers for the drugs. However, recently, nano- and microparticles have found widespread application in the development of such sustained-release formulations. Although a large number of market players have adopted the sustained-release coating technology in various industries, constant R&D is required to sustain in the market. The high cost of R&D resources, along with the processing technology, is hindering the market growth for such formulations. The development of microencapsulated material sometimes needs to be customized, and at times is required to be carried out at an industrial scale instead of a pilot scale. This increases the processing cost of products and ultimately leads to an increase in their cost.

Opportunity: Growth in the biosimilars market

Biosimilars are cost-effective because they are not required to comply with the stringent requirements imposed by regulatory authorities, as they are generic versions of patented biologic drugs. Over the last decade, over 200 biologics have been approved by the US FDA. As patents and exclusivity periods for these biologics begin to expire, an opportunity for the development of follow-on biologics or biosimilars by a different sponsor is created. According to the World Preview 2018 report, sales of up to USD 251 billion are at risk between 2018 and 2024, which points towards the fact that the pharmaceutical industry has just entered a second patent cliff era where top biologic blockbusters will be challenged by biosimilars. The expiration of patents and other intellectual property rights for originator biologicals is expected to open up opportunities for biosimilars to enter the market. Biologics are expected to contribute to around half of the revenue generated by the top 100 pharmaceutical products. Moreover, there is an overall increase in the number of FDA approvals for biosimilars. Recognizing their potential, companies like Evonik (Germany) have increased their production capacity by acquiring companies like SurModics, which focuses on controlled-release applications. In addition, Evonik also acquired complementary technologies like Boehringer Ingelheim’s RESOMER platform to improve its capability in this market segment.

Challenge: Changing trade policies between countries

With the current changes in government policies all over the world, upcoming trade policies could prove to be a challenge for the pharmaceutical industry, and in turn, the excipients industry. Trade between the developing countries who are considered to be pharmerging countries such as China, India, and Brazil and developed countries like the US and European countries, who are top markets in the industry, could be severely affected. BREXIT is another pressing issue in this market. Although the effects of BREXIT on the pharmaceutical industry are still unclear, companies like Novartis, Astra Zeneca, and Roche have already shifted manufacturing sites in order to reduce any further risks.

The cellulose polymers segment accounted for the largest share of the table coatings industry

Based on the polymers used for manufacture of tablet coatings, the cellulosic polymers segment accounted for the largest share of the global tablet coatings market. The large share of this segment can be attributed to the high adoption of these polymers owing to the ability to form coatings generally having acceptable properties (such as good film strength, aqueous solubility, and compressibility), less sensitivity to wet granulation, flowability, and better tableting at a low price. Factors such as the global regulatory acceptance and ready availability from a number of vendors are also driving the adoption of these polymers for coating applications.

The non-functional non-modifying coatings segment is expected to account for the largest share of the tablet coatings industry

Based on functionality, the non-functional non-modifying coatings segment commanded the largest share of the table coatings market. The large share of this segment can be attributed to high use of these coatings for the manufacture of immediate-release dosage forms. Also, the growing demand for innovative drug delivery formulations and dietary supplements using immediate-release coatings will continue to drive market growth.

The film-coated tablets segment is expected to grow at the highest rate in the table coatings industry during the forecast period

The table coatings market is segmented into film-coated, sugar-coated, gelatin-coated, enteric-coated tablets and other tablet coatings based on type. In 2019, the film-coated segment dominated the global market, by type, and is also expected to grow at the highest CAGR during the forecast period. These coatings also minimize the risk of medication errors leveraging pigments/ colors for identification and also improves patient compliance through aesthetic appeal which further support market growth.

The pharmaceutical industry end-user segment is expected to account for the largest share of the tablet coatings industry

The table coatings market, by end-user, is segmented into pharmaceutical and nutraceutical industry. The pharmaceutical industry segment accounted for the largest market share in 2019. The demand for tablet coatings in the pharmaceutical industry is largely driven by the growing prevalence of diseases for which tablet-based formulations form the primary treatment. The rising demand for innovative drug delivery formulations is also supporting the growth of the market for the pharmaceutical industry.

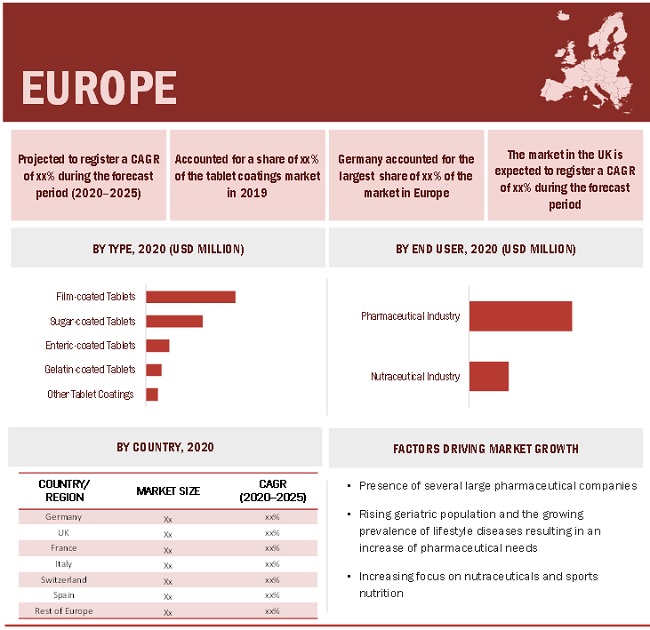

Europe is expected to account for the largest share of the tablet coatings industry

Europe accounted for the largest share of the table coatings market, followed by North America, the Asia Pacific, Latin America, and the Middle East & Africa. The large share of this market segment can be characterized by the presence of a number of pharmaceutical giants with large production capacities leading to a high consumption of excipients. The growing emphasis on superior pharmaceutical products, generics, and biosimilars has also led to the increase in the demand for novel excipients, which, in turn, is expected to drive the market growth in this region in the coming years.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the table coatings market are Colorcon Inc. (US), Sensient Technologies Corporation (US), BASF SE (Germany), Evonik Industries AG (Germany), Ashland Global Holdings Inc. (US), DuPont De Numeours Inc. (US), Kerry Group plc (Ireland), Roquette Freres (France), Eastman Chemical Company (US), Air Liquide S.A. (France), and Merck KGaA (Germany).

Scope of the Tablet Coatings Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$739 million |

|

Projected Revenue Size by 2025 |

$969 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 5.6% |

|

Market Driver |

Rising adoption of orphan drugs |

|

Market Opportunity |

Growth in the biosimilars market |

The study categorizes the tablet coatings market to forecast revenue and analyze trends in each of the following submarkets:

By Polymer Type

- Cellulosic Polymers

- Vinyl Derivatives

- Acrylic Polymers

- Other Polymers

By Functionality

- Non-functional non-modifying coatings

- Functional modifying coatings

- Functional non-modifying coatings

By Type

- Film-coated tablets

- Sugar-coated tablets

- Enteric-coated tablets

- Gelatin-coated tablets

- Other tablet coatings

By End User

- Pharmaceutical Industry

- Nutraceutical Industry

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Switzerland

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East & Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Recent Developments of Tablet Coatings Industry

- In 2020, Colorcon launched the Acryl-EZE II film coating line which extends the pH range covered by its enteric coatings.

- In 2020, Evonik launched the EUDRATEC Fasteric releases, an advanced oral drug delivery technology that provides enteric protection followed by rapid, homogeneous release for effective targeting of the upper small intestine.

- In 2019, Ashland announced the launch of Aquarius Nutra TF, which provides titanium oxide-based coating to tablets in the European market.

- In 2019, Kerry Group opened its new USD 22 million (EUR 20 million) state-of-the-art facility in Bangalore, India to serve the Taste & Nutrition business division’s global and regional customers in the South West Asia region.

- In 2017, BASF Group opened the Innovation Campus Asia Pacific in India, marking the largest R&D investment in South Asia. The company invested USD 61.6 million (EUR 50 million) in this center to increase its global and regional research activities.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global tablet coatings market?

The global tablet coatings market boasts a total revenue value of $969 million by 2025.

What is the estimated growth rate (CAGR) of the global tablet coatings market?

The global tablet coatings market has an estimated compound annual growth rate (CAGR) of 5.6% and a revenue size in the region of $739 million in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 TABLET COATINGS MARKET

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

2.1.2.1 Primary sources

2.1.2.2 Key data from primary sources

2.1.2.3 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION: ASHLAND

FIGURE 6 MARKET ANALYSIS APPROACH

FIGURE 7 TOP-DOWN APPROACH

FIGURE 8 CAGR PROJECTIONS

2.3 DATA TRIANGULATION APPROACH

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 HEALTH ASSESSMENT

2.7 COVID-19 ECONOMIC ASSESSMENT

2.8 ASSESSING THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 10 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 11 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 12 TABLET COATINGS MARKET, BY POLYMER TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY FUNCTIONALITY, 2020 VS. 2025 (USD MILLION)

FIGURE 14 GLOBAL MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 15 GLOBAL MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 16 GEOGRAPHIC ANALYSIS: GLOBAL TABLET COATINGS INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 TABLET COATINGS MARKET OVERVIEW

FIGURE 17 RISING DEMAND FOR INNOVATIVE DRUG DELIVERY FORMULATIONS TO DRIVE MARKET GROWTH

4.2 LATIN AMERICA: , BY FUNCTIONALITY AND COUNTRY

FIGURE 18 NON-FUNCTIONAL NON-MODIFYING COATINGS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE LATIN AMERICAN MARKET IN 2019

4.3 GLOBAL TABLET COATINGS INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 19 CHINA TO REGISTER THE HIGHEST REVENUE GROWTH DURING THE FORECAST PERIOD

4.4 GLOBAL MARKET, BY REGION (2018–2025)

FIGURE 20 EUROPE WILL CONTINUE TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.5 GLOBAL MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 21 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 1 TABLET COATINGS MARKET: IMPACT ANALYSIS

5.2.1 MARKET DRIVERS

5.2.1.1 Growing pharmaceuticals market

FIGURE 22 GLOBAL PHARMACEUTICAL DRUG SALES (2008–2022)

FIGURE 23 TOTAL R&D PIPELINE SIZE (2011–2017)

5.2.1.2 Surge in the generics market

TABLE 2 DRUGS GOING OFF-PATENT

FIGURE 24 GROWTH OF THE GENERICS MARKET, 2006 VS. 2016

5.2.1.3 Increasing uptake of biopharmaceuticals

5.2.1.4 Rising adoption of orphan drugs

FIGURE 25 INCREASING PENETRATION OF ORPHAN DRUGS (2010–2024)

FIGURE 26 RISING NUMBER OF ORPHAN INDICATIONS APPROVED IN THE US

5.2.1.5 Growing demand for nutraceuticals

5.2.2 MARKET RESTRAINTS

5.2.2.1 Cost and time-intensive drug development process

FIGURE 27 ESTIMATED PRE-APPROVAL COST OF BRINGING A NEW CHEMICAL OR BIOLOGICAL ENTITY TO MARKET (1970–2010)

5.2.2.2 Increasing regulatory stringency

5.2.2.3 High cost associated with the microencapsulation process in sustained-release formulations

5.2.2.4 Unfavorable drug price control policies

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Shifting focus of pharmaceutical manufacturing and outsourcing of operations to emerging countries

5.2.3.2 Growth in the biosimilars market

FIGURE 28 TOTAL NUMBER OF NEW MOLECULAR ENTITY (NME) & NEW BIOLOGIC LICENSE APPLICATION (BLA) FILINGS AND APPROVALS IN THE US, 2006–2018

TABLE 3 CLINICAL STUDIES FOR BIOLOGICS & BIOSIMILARS (2017)

TABLE 4 US: INDICATIVE LIST OF APPROVED BIOSIMILARS

5.2.3.3 Rising focus on sports nutrition

5.2.3.4 Technological advancements in niche markets

5.2.4 MARKET CHALLENGES

5.2.4.1 Safety and quality concerns

5.2.4.2 Changing trade policies between countries

5.2.4.3 Increasing penetration of counterfeit drugs in the market

5.2.4.4 Alcohol-induced dose-dumping due to sustained-release dosages

6 INDUSTRY INSIGHTS (Page No. - 71)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 NEED FOR SOLVENT/LIQUID-FREE COATING TECHNOLOGIES

6.2.2 TECHNOLOGICAL ADVANCEMENTS

6.2.3 IMPROVING EXCIPIENT CAPABILITIES BY USING NANOTECHNOLOGY

6.2.4 PHARMACEUTICAL EXCIPIENTS INFLUENCING THE COST OF PRODUCTION

6.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 TABLET COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.4 REGULATORY ANALYSIS

6.4.1 NORTH AMERICA

6.4.1.1 US

6.4.1.2 Canada

6.4.2 EUROPE

6.4.3 ASIA PACIFIC

6.4.3.1 Japan

6.4.3.2 China

6.4.3.3 India

6.5 VALUE CHAIN ANALYSIS

FIGURE 29 GLOBAL TABLET COATINGS INDUSTRY: VALUE CHAIN ANALYSIS

6.6 ECOSYSTEM ANALYSIS

6.6.1 ECOSYSTEM ANALYSIS FOR THE PHARMACEUTICAL MARKET

6.6.2 ECOSYSTEM ANALYSIS FOR THE GLOBAL MARKET

FIGURE 30 GLOBAL MARKET: ECOSYSTEM ANALYSIS

6.7 PARENT MARKET ANALYSIS

FIGURE 31 PHARMACEUTICAL EXCIPIENTS MARKET SNAPSHOT

6.8 IMPACT OF COVID-19 ON THE GLOBAL MARKET

6.9 PATENT ANALYSIS

6.9.1 PATENT PUBLICATION TRENDS FOR PHARMACEUTICAL COATING EXCIPIENTS

FIGURE 32 PATENT PUBLICATION TRENDS (2015–2020)

6.9.2 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR PHARMACEUTICAL COATING EXCIPIENTS

FIGURE 33 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR PHARMACEUTICAL COATING EXCIPIENT PATENTS (2015–2020)

6.9.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PHARMACEUTICAL COATING EXCIPIENT PATENTS

FIGURE 34 TOP APPLICANT COUNTRIES FOR PHARMACEUTICAL COATING EXCIPIENT PATENTS (2015–2020)

7 TABLET COATINGS MARKET, BY POLYMER TYPE (Page No. - 87)

7.1 INTRODUCTION

TABLE 6 GLOBAL TABLET COATINGS INDUSTRY, BY POLYMER TYPE, 2018–2025 (USD MILLION)

7.2 CELLULOSIC POLYMERS

7.2.1 HIGH COMPRESSIBILITY AND AQUEOUS SOLUBILITY OF THESE POLYMERS DRIVING THEIR ADOPTION

TABLE 7 GLOBAL MARKET FOR CELLULOSIC POLYMERS, BY COUNTRY, 2018–2025 (USD MILLION)

7.3 VINYL DERIVATIVES

7.3.1 SELF-SEALING AND HIGH ADHESION CHARACTERISTICS ARE IMPROVING THE UTILITY OF THESE COPOLYMERS

TABLE 8 GLOBAL TABLET COATINGS INDUSTRY FOR VINYL DERIVATIVES, BY COUNTRY, 2018–2025 (USD MILLION)

7.4 ACRYLIC POLYMERS

7.4.1 ACRYLIC POLYMERS CAN BE USED WITH VARIOUS SOLVENTS AND PROVIDE HIGH VERSATILITY FOR USE AS COATINGS

TABLE 9 GLOBAL MARKET FOR ACRYLIC POLYMERS, BY COUNTRY, 2018–2025 (USD MILLION)

7.5 OTHER POLYMERS

TABLE 10 GLOBAL MARKET FOR OTHER POLYMERS, BY COUNTRY, 2018–2025 (USD MILLION)

8 TABLET COATINGS MARKET, BY FUNCTIONALITY (Page No. - 96)

8.1 INTRODUCTION

TABLE 11 GLOBAL TABLET COATINGS INDUSTRY, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

8.2 NON-FUNCTIONAL NON-MODIFYING COATINGS

8.2.1 IMPROVED SWALLOWABILITY AND DRUG STABILITY OFFERED BY THESE COATINGS ARE DRIVING THEIR ADOPTION

TABLE 12 GLOBAL MARKET FOR NON-FUNCTIONAL NON-MODIFYING COATINGS, BY COUNTRY, 2018–2025 (USD MILLION)

8.3 FUNCTIONAL MODIFYING COATINGS

8.3.1 INCREASING RESEARCH ACTIVITIES FOR SUSTAINED-RELEASE FORMULATIONS TO PROPEL MARKET GROWTH

TABLE 13 GLOBAL MARKET FOR FUNCTIONAL MODIFYING COATINGS, BY COUNTRY, 2018–2025 (USD MILLION)

8.4 FUNCTIONAL NON-MODIFYING COATINGS

8.4.1 GROWING PREFERENCE FOR TARGETED-DRUG DELIVERY IS DRIVING THE ADOPTION OF THESE COATINGS

TABLE 14 GLOBAL MARKET FOR FUNCTIONAL NON-MODIFYING COATINGS, BY COUNTRY, 2018–2025 (USD MILLION)

9 TABLET COATINGS MARKET, BY TYPE (Page No. - 102)

9.1 INTRODUCTION

TABLE 15 GLOBAL TABLET COATINGS INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

9.2 FILM-COATED TABLETS

9.2.1 FILM-COATED TABLETS SEGMENT DOMINATED THE MARKET IN 2019

TABLE 16 FILM-COATED TABLETS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

9.3 SUGAR-COATED TABLETS

9.3.1 SUGAR COATS ARE WIDELY USED FOR THE MANUFACTURE OF IMMEDIATE-RELEASE TABLETS

TABLE 17 SUGAR-COATED TABLETS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

9.4 ENTERIC-COATED TABLETS

9.4.1 LAUNCH OF NEW ENTERIC COATS IN THE MARKET SUPPORTING THEIR ADOPTION IN THE PHARMACEUTICAL INDUSTRY

TABLE 18 ENTERIC-COATED TABLETS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

9.5 GELATIN-COATED TABLETS

9.5.1 GEL-CAPS ARE MAJORLY USED FOR IMPROVING THE STABILITY OF PHOTOSENSITIVE ACTIVE PHARMACEUTICAL INGREDIENTS

TABLE 19 LIST OF DRUGS TYPICALLY SUBJECTED TO GELATIN COATING

TABLE 20 GELATIN-COATED TABLETS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

9.6 OTHER TABLET COATINGS

TABLE 21 OTHER GLOBAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

10 TABLET COATINGS MARKET, BY END USER (Page No. - 111)

10.1 INTRODUCTION

TABLE 22 GLOBAL TABLET COATINGS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

10.2 PHARMACEUTICAL INDUSTRY

10.2.1 GROWING NEED TO ADDRESS FORMULATION-RELATED ISSUES DRIVING THE UPTAKE OF TABLET COATINGS

TABLE 23 GLOBAL TABLET COATINGS INDUSTRY FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

10.3 NUTRACEUTICAL INDUSTRY

10.3.1 INCREASING DEMAND FOR QUALITY-SPECIALIZED DIETARY SUPPLEMENTS IS EXPECTED TO PROMOTE MARKET GROWTH

TABLE 24 GLOBAL MARKET FOR NUTRACEUTICAL INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

11 TABLET COATINGS MARKET, BY REGION (Page No. - 116)

11.1 INTRODUCTION

FIGURE 35 GLOBAL TABLET COATINGS INDUSTRY: GEOGRAPHIC SNAPSHOT (2019)

TABLE 25 GLOBAL MARKET, BY REGION, 2018–2025 (USD MILLION)

11.2 EUROPE

FIGURE 36 EUROPE: TABLET COATINGS MARKET SNAPSHOT

TABLE 26 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 EUROPE: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 28 EUROPE: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 29 EUROPE: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 30 EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.1 GERMANY

11.2.1.1 Germany held the largest share of the European market in 2019

TABLE 31 GERMANY: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 32 GERMANY: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 33 GERMANY: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 34 GERMANY: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.2 FRANCE

11.2.2.1 Growth in the generics market in the country is expected to propel the tablet coatings market

TABLE 35 FRANCE: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 36 FRANCE: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 37 FRANCE: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 38 FRANCE: TABLET COATINGS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

11.2.3 UK

11.2.3.1 Growing domestic market for pharmaceuticals and various government investments are driving market growth

TABLE 39 UK: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 40 UK: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 41 UK: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 42 UK: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.4 SWITZERLAND

11.2.4.1 Increasing R&D in the pharmaceutical industry will drive market growth in Switzerland

TABLE 43 SWITZERLAND: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 44 SWITZERLAND: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 45 SWITZERLAND: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 46 SWITZERLAND: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.5 ITALY

11.2.5.1 Budgetary constraints and restricted healthcare spending to impede the growth of the Italian market

TABLE 47 ITALY: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 48 ITALY: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 49 ITALY: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 50 ITALY: TABLET COATINGS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

11.2.6 SPAIN

11.2.6.1 Increasing developments in the pharmaceutical packaging industry are propelling market growth in Spain

TABLE 51 SPAIN: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 52 SPAIN: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 53 SPAIN: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 54 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.7 REST OF EUROPE

TABLE 55 ROE: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 56 ROE: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 57 ROE: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 58 ROE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 37 NORTH AMERICA: TABLET COATINGS MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: TABLET COATINGS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

11.3.1 US

11.3.1.1 The US dominates the North American tablet coatings market

FIGURE 38 USE OF DIETARY SUPPLEMENTS IN THE US (2008–2017)

TABLE 64 US: KEY MACROINDICATORS

TABLE 65 US: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 66 US: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 67 US: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 68 US: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Strong growth of emerging markets and slowdown in new product approvals to hamper market growth in Canada

TABLE 69 CANADA: KEY MACROINDICATORS

TABLE 70 CANADA: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 71 CANADA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 72 CANADA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 CANADA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: TABLET COATINGS MARKET SNAPSHOT

TABLE 74 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 ASIA PACIFIC: TABLET COATINGS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Early adoption of technologically advanced products attracting market players to Japan

TABLE 79 JAPAN: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 80 JAPAN: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 81 JAPAN: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 JAPAN: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.2 CHINA

11.4.2.1 China is one of the fastest-growing markets for tablet coatings

TABLE 83 CHINA: PHARMACEUTICALS MARKET (USD BILLION)

TABLE 84 CHINA: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 85 CHINA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 86 CHINA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Growing contract manufacturing base in the country will drive market growth

TABLE 88 INDIA: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 89 INDIA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 90 INDIA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 INDIA: TABLET COATINGS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Highly attractive medical tourism industry of South Korea to propel market growth

TABLE 92 SOUTH KOREA: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 93 SOUTH KOREA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 94 SOUTH KOREA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 SOUTH KOREA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.5 AUSTRALIA

11.4.5.1 Favorable R&D tax benefits offered in the country are expected to drive market growth

TABLE 96 AUSTRALIA: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 97 AUSTRALIA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 98 AUSTRALIA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 AUSTRALIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 100 ROAPAC: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 101 ROAPAC: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 102 ROAPAC: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 ROAPAC: TABLET COATINGS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

11.5 LATIN AMERICA

FIGURE 40 LATIN AMERICA: TABLET COATINGS MARKET SNAPSHOT

TABLE 104 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 105 LATIN AMERICA: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 106 LATIN AMERICA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 107 LATIN AMERICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 LATIN AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Growing focus on quality pharmaceuticals is a major factor driving market growth

TABLE 109 BRAZIL: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 110 BRAZIL: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 111 BRAZIL: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 BRAZIL: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5.2 MEXICO

11.5.2.1 Improving healthcare infrastructure to drive market growth in Mexico

TABLE 113 MEXICO: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 114 MEXICO: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 115 MEXICO: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 116 MEXICO: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5.3 REST OF LATIN AMERICA

TABLE 117 ROLA: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 118 ROLA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 119 ROLA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 120 ROLA: TABLET COATINGS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.6.1 SAUDI ARABIA

11.6.1.1 Wider access to healthcare services is increasing the demand for pharmaceuticals

TABLE 126 SAUDI ARABIA: MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 127 SAUDI ARABIA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 128 SAUDI ARABIA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 129 SAUDI ARABIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.6.2 UAE

11.6.2.1 Growing manufacturing base in the country is expected to support market growth

TABLE 130 UAE: , MARKET BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 131 UAE: , MARKET BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 132 UAE: , MARKET BY TYPE, 2018–2025 (USD MILLION)

TABLE 133 UAE: , TABLET COATINGS INDUSTRY BY END USER, 2018–2025 (USD MILLION)

11.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 134 ROMEA: TABLET COATINGS MARKET, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 135 ROMEA: MARKET, BY FUNCTIONALITY, 2018–2025 (USD MILLION)

TABLE 136 ROMEA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 137 ROMEA: MARKET, BY END USER, 2018–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 178)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 41 REVENUE ANALYSIS OF TOP PLAYERS IN THE TABLET COATINGS MARKET

12.4 MARKET SHARE ANALYSIS

FIGURE 42 GLOBAL TABLET COATINGS INDUSTRY SHARE, BY KEY PLAYER, 2019

12.5 COMPETITIVE LEADERSHIP MAPPING

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE

12.5.4 PARTICIPANTS

FIGURE 43 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

12.6 COMPANY PRODUCT FOOTPRINT

FIGURE 44 PRODUCT PORTFOLIO ANALYSIS: GLOBAL MARKET

12.7 GEOGRAPHIC FOOTPRINT OF MAJOR PLAYERS IN THE GLOBAL MARKET

FIGURE 45 GEOGRAPHIC REVENUE MIX: GLOBAL MARKET (2019)

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 138 GLOBAL MARKET: PRODUCT LAUNCHES, 2018–2020

12.8.2 EXPANSIONS

TABLE 139 GLOBAL MARKET: EXPANSIONS, 2018–2020

12.8.3 ACQUISITIONS

TABLE 140 GLOBAL MARKET: ACQUISITIONS, 2018–2020

12.8.4 OTHER STRATEGIES

TABLE 141 GLOBAL TABLET COATINGS INDUSTRY: OTHER STRATEGIES, 2018–2020

13 COMPANY PROFILES (Page No. - 189)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1.1 COLORCON, INC.

13.1.2 SENSIENT TECHNOLOGIES CORPORATION

FIGURE 46 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT (2019)

13.1.3 BASF SE

FIGURE 47 BASF SE: COMPANY SNAPSHOT (2019)

13.1.4 EVONIK INDUSTRIES AG

FIGURE 48 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT (2019)

13.1.5 ASHLAND GLOBAL HOLDINGS INC.

FIGURE 49 ASHLAND GLOBAL HOLDINGS INC.: COMPANY SNAPSHOT (2020)

13.1.6 DUPONT DE NEMOURS, INC.

FIGURE 50 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT (2019)

13.1.7 ROQUETTE FRÈRES

FIGURE 51 ROQUETTE FRÈRES: COMPANY SNAPSHOT (2019)

13.1.8 KERRY GROUP PLC

FIGURE 52 KERRY GROUP PLC: COMPANY SNAPSHOT

13.1.9 EASTMAN CHEMICAL COMPANY

FIGURE 53 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT (2019)

13.1.10 AIR LIQUIDE S.A.

FIGURE 54 AIR LIQUIDE S.A.: COMPANY SNAPSHOT (2019)

13.1.11 MERCK KGAA

FIGURE 55 MERCK KGAA: COMPANY SNAPSHOT (2019)

13.1.12 COREL PHARMA CHEM

13.1.13 BIOGRUND GMBH

13.1.14 IDEAL CURES PVT. LTD.

13.1.15 WINCOAT COLOURS & COATINGS PVT. LTD.

13.2 OTHER PLAYERS

13.2.1 SPECTRUM CHEMICAL MFG. CORP.

13.2.2 LUBRIZOL CORPORATION

13.2.3 COATINGS PLACE, INC.

13.2.4 AQUADRY PHARMA PVT. LTD.

13.2.5 ARIES EXIM PVT. LTD.

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 234)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global tablet coatings market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

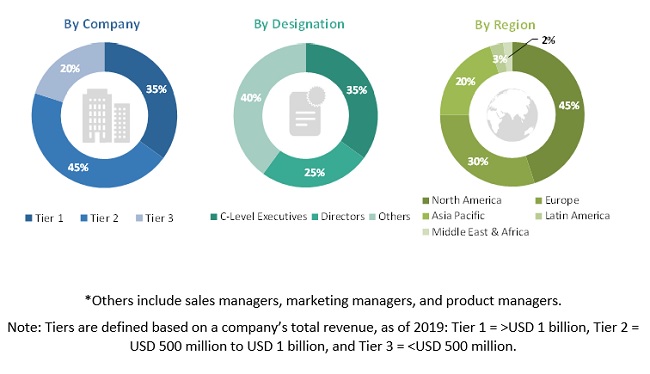

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the tablet coatings market. The primary sources from the demand side include industry experts such as experts from drugs manufacturing companies, nutraceutical companies, and contract manufacturing organizations.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by polymer type, functionality, type, end user, and region).

Data Triangulation

After arriving at the market size, the total tablet coatings market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the tablet coatings market by polymer type, functionality, type, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall tablet coatings market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the tablet coatings market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the tablet coatings market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as acquisitions; new product launches; expansions; collaborations, agreements, and partnerships; and R&D activities of the leading players in the tablet coatings market

- To benchmark players within the tablet coatings market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific tablet coatings market into Singapore, New Zealand, and others

- Further breakdown of the Rest of Europe tablet coatings market into the Belgium, Netherlands, Denmark, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Tablet Coatings Market