Terpene Resins Market by product type (Solid, Liquid), grade (Industrial, Technical), application (Inks & coatings, adhesives & sealants, chewing gums pulp & paper, plastic & rubber, leather processing), and Region- Global Forecast to 2027

Terpene Resins Market Size

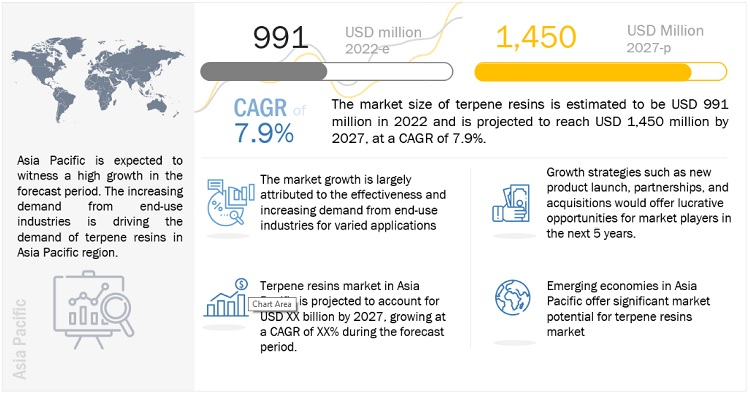

The global terpene resins market was valued at USD 991 million in 2022 and is projected to reach USD 1,450 million by 2027, growing at a cagr 7.9% from 2022 to 2027. The overall increase in demand for terpene resins in emerging regions such as Asia Pacific and Middle East & Africa is driving the market. Rising demand from end-use industries including inks & coatings, plastic & rubber processing, pulp & paper, leather processing, chewing gum, and adhesives & sealants is driving the global market.

Global Terpene Resins Market Trends

Note: e-estimated, p-projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Terpene Resins Market Dynamics

Driver: Increasing demand for terpene resins from adhesives & sealants

Terpene resins are used as tackifiers in adhesives & sealants to increase the stickiness or adhesion of the product. Tackifiers are substances added to adhesives to improve their ability to adhere to surfaces. Terpene resins are particularly effective in this regard because they have a high molecular weight and a high degree of branching, which gives them good compatibility with other types of adhesives, such as rubber and synthetic resins. Terpene resins can also improve the flexibility and impact resistance of adhesives & sealants. Terpene-based adhesives are used in different end-use industries, including packaging, automotive, construction/assembly, and footwear. The growth in these end-use industries is expected to drive the market demand for terpene resins.

Restrain: Limited feedstock supply and volatility of raw material prices

Price and availability of raw materials is a key factor for terpene resin manufacturers when deciding the cost structure of their products. Major raw material feedstocks required to produce terpene resins are derived from natural and petroleum-based resources. The limited availability of natural feedstocks and higher regional concentration of suppliers in certain regions are projected to impact the terpene resins market. Furthermore, fluctuations in oil prices and a weak global economy may also restrain the growth of this market.

Opportunity: High demand for bio-based resins

High demand for bio-based resins is a significant opportunity for the terpene resins market. Bio-based resins are made from renewable resources, such as plant-based materials, and have a lower carbon footprint compared to traditional petroleum-based resins. This makes them a more sustainable and environmentally friendly alternative to traditional resins. The increasing concern for the environment and the need to reduce dependence on fossil fuels is creating huge opportunities for bio-based terpene resins. The government regulations to reduce greenhouse gas emissions and the increasing consumer awareness about the environmental impact of traditional resins are also contributing to the growing demand for bio-based resins. The use of bio-based terpene resins in various industries, such as construction, automotive, and packaging are expected to increase in the near future.

Challenge: High cost of raw materials

Terpene resins are derived from natural sources, such as pine and other coniferous trees, which are often found in remote and hard-to-access locations. The cost of harvesting and transporting these raw materials can be high, which is a major factor contributing to the high cost of terpene resins. In addition, the process of extracting and purifying the terpenes from the raw materials is also expensive and energy intensive. This includes the cost of equipment, labor, and energy required to separate the terpenes from the raw materials, as well as the cost of purifying and refining the terpenes to a suitable purity level for use in resins.

Solid segment accounted for the largest share amongst product type in the terpene resins market

Based on product type, the terpene resins market has been classified into solid and liquid. Terpene resins are manufactured and supplied in the above-mentioned forms to meet specific application requirements. Terpene resins are manufactured and supplied in solid forms, such as flaked, granular, and powered, which can be used in various applications, including adhesives & sealants, paper & pulp, leather processing, and chewing gums. The liquid form of terpene resins is normally supplied in containers to avoid environmental-related conditions, such as weather, temperature, and moisture.

Industrial grade segment to lead the grade in the overall terpene resins market

Based on grade, the terpene resins market has been classified into industrial and technical grades. The industrial grade resin refers to a type of plastic or polymer material that is suitable for use in industrial applications. It is typically made to be strong, durable, and resistant to wear and tear. Whereas, technical grade resin, is a type of resin that is specifically formulated to meet the technical requirements of a particular application or industry. It may have specific properties, such as high-temperature resistance, UV resistance, or chemical resistance, that make it suitable for use in certain applications. In general, technical grade resin has more stringent quality control and purity standards than industrial grade resin.

Adhesives and sealants application segment to lead the terpene resins market

The terpene resins market, by application, is segmented into inks & coatings, plastic & rubber processing, pulp & paper, leather processing, adhesives & sealants, chewing gum, and others, which include tires, pharmaceuticals, food & beverage, polymer modifiers, and aromatic oils. Terpene resins are a versatile and natural material used in a wide range of applications in the adhesives & sealant industry making it the leading segment in the applications. They are used as a binder, sealant, and coating material, and are valued for their natural origin, low toxicity, and environmental friendliness. Terpene resins are commonly used in water-based adhesives & sealants, and also used as a raw material in the production of other adhesives & sealants, such as rosin-based adhesives and hot-melt adhesives. They are also used in the production of varnishes, lacquers, and other coatings to protect and enhance the appearance of various materials.

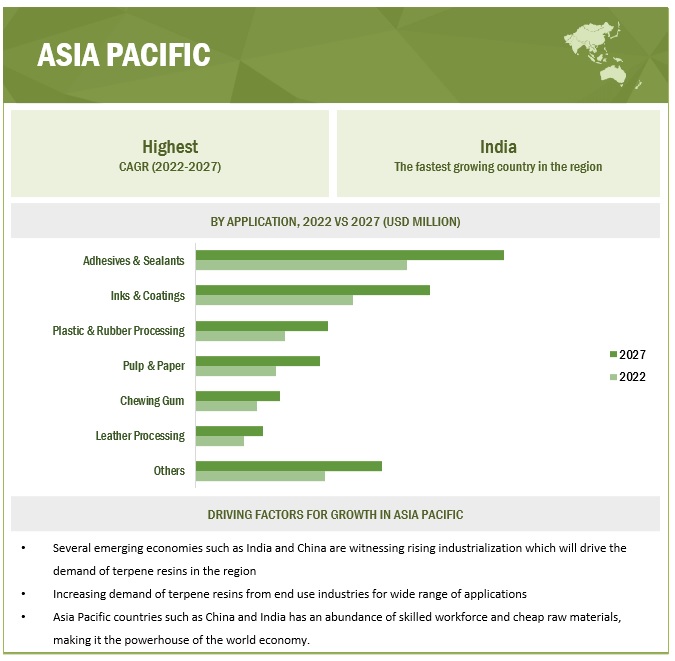

Asia Pacific is estimated to grow at the fastest growth rate in the global terpene resins market.

The Asia Pacific region accounted for the largest market share in 2021 and is also expected to grow at the highest CAGR, during the forecast period. The market is driven by increasing demand from end-use industries coupled with the superior properties of terpene resins, such as chemical inactivity, non-toxicity, and effectiveness as compared to that of some of the conventionally used products that is expected to boost the market growth during the forecast period in the region.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in the terpene resins market Mangalam Organics Limited (India), Yasuhara Chemical Co. Ltd (Japan), Ingevity (US), Kraton Corporation (US), Baolin Chemical Industry Co. Ltd (China), Lesco Chemical Company (China), Arakawa Chemicals (Japan), Xinyi Sonyuan Chemical Co. Ltd (Japan). These players have established a strong foothold in the market by adopting strategies, such as new product launches, strategic partnerships, investment & expansions, and acquisitions between 2019 and 2022.

Scope of the Report:

|

Report Metric |

Details |

|

Years considered for the study |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million) and Volume (KT) |

|

Segments |

Product type, Grade, Applications and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

Mangalam Organics Limited (India), Yasuhara Chemical Co. Ltd (Japan), Ingevity (US), Kraton Corporation (US), Baolin Chemical Industry Co. Ltd (China), Lesco Chemical Company (China), Arakawa Chemicals (Japan), Xinyi Sonyuan Chemical Co. Ltd (Japan), and others. Total more than 20 players were covered. |

This research report categorizes the terpene resins market based on Product type, Grade, Applications and Region.

By Product Type:

- Solid

- Liquid

By Grade:

- Technical

- Industrial

By Applications:

- Inks & coatings

- Adhesives & sealants

- Chewing gums

- Pulp & paper

- Plastic & rubber

- Leather processing

- Others

By Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

- The terpene resins market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In March 2022, Yasuhara signed an agreement with Leaf Resources to purchase terpenes for the next five years. This agreement helps strengthen Yasuhara’s terpene resins business.

- In April 2022, Ingevity has developed new biobased oilfield products such as EnvaWet UHS 3100 and EnvaDry P-FL, derived from pine-based tree oil. These products provide unique performance and sustainability advantages.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the Terpene resins market?

The growth of the Terpene resins market can be attributed to the increasing demand of terpene resins in the end use industries for wide verity of applications.

What are the key applications of driving the terpene resins market?

Adhesives & sealants is the largest application of terpene resins. Terpene resins are also used in other applications such as inks & coatings, plastic & rubber processing, pulp & paper, leather processing, chewing gums, and aromatic oils among others.

Who are the major manufacturers of the Terpene resins?

Major manufacturers of Terpene resins include Mangalam Organics Limited (India), Yasuhara Chemical Co. Ltd (Japan), Ingevity (US), Kraton Corporation (US), and Arakawa Chemicals (Japan).

What is the restraining factor for terpene resins?

The biggest restraint for this market can be the unstable geopolitical situation and limited feedstock supply with volatility of raw material prices.

What will be the growth prospects of the Terpene resins market?

High demand for bio-based resins is expected to provide the growth opportunities to terpene resins manufacturers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for terpene resins from adhesives & sealants applications- Increasing demand from plastic & rubber processing applications- Rising popularity of terpene resins-based coatingsRESTRAINTS- Limited feedstock supply and volatility of raw material prices- Increasing market penetration of limonene- Unstable geopolitical situationsOPPORTUNITIES- High demand for bio-based resinsCHALLENGES- High cost of raw materials- Volatility of the market- Environmental concerns regarding manufacturing of terpene resins

-

5.3 VALUE CHAINRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND CONSUMERS

-

5.4 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF RIVALRY

-

5.5 TECHNOLOGY ANALYSISMANUFACTURING PROCESS OF TERPENE RESINS

-

5.6 REGULATORY LANDSCAPECODE OF FEDERAL REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.7 TRADE ANALYSISIMPORT-EXPORT SCENARIO

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE BASED ON REGIONAVERAGE SELLING PRICE BASED ON PRODUCT TYPE

-

5.9 ECOSYSTEM MAPPING OF TERPENE RESINS MARKET

-

5.10 CASE STUDIESKRATON CORPORATION

-

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 KEY CONFERENCES & EVENTS IN 2022–2023

-

5.13 PATENT ANALYSISINTRODUCTIONMETHODOLOGY- Document Type- Publication trends over last ten yearsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.14 KEY FACTORS AFFECTING BUYING DECISIONQUALITYSERVICE

- 6.1 INTRODUCTION

- 6.2 SOLID TERPENE RESIN

- 6.3 LIQUID TERPENE RESIN

- 7.1 INTRODUCTION

- 7.2 INDUSTRIAL GRADE

- 7.3 TECHNICAL GRADE

- 8.1 INTRODUCTION

- 8.2 INKS & COATINGS

- 8.3 ADHESIVES & SEALANTS

- 8.4 CHEWING GUM

- 8.5 PULP & PAPER

- 8.6 PLASTIC & RUBBER

- 8.7 LEATHER PROCESSING

- 8.8 OTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICCHINA- Cost-effective labor and availability of cheap raw materials to drive marketJAPAN- Increasing demand for terpene resins in pulp & paper industry to drive marketINDIA- Investments and advancements across industries to drive marketSOUTH KOREA- Growing industries and commercial construction projects to drive marketAUSTRALIA- Strong spending on building & construction activities to drive marketREST OF ASIA PACIFIC

-

9.3 NORTH AMERICAUS- Developments in chemical industry and growth in automotive sector to drive marketCANADA- Thriving automotive sector to drive marketMEXICO- Investments in infrastructure development and recovering automotive industry to drive market

-

9.4 EUROPEGERMANY- Developments and investments in consumer sector to lead to growth of chemical industryFRANCE- Favorable demographic trends support terpene resins marketUK- Demand from energy, automotive, and construction industries to boost marketITALY- Recovering construction industry to drive demandSPAIN- Steady demand from adhesives & sealants application to drive marketREST OF EUROPE

-

9.5 MIDDLE EAST & AFRICASAUDI ARABIA- Manufacturers’ interest to set up units to drive marketUAE- Government initiatives to promote local players to boost demand.SOUTH AFRICA- Government investments to boost economyREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICABRAZIL- Expansion of production capacities to drive marketARGENTINA- Rising investments in healthcare infrastructure and construction activities to drive marketREST OF SOUTH AMERICA

-

10.1 INTRODUCTIONTERPENE RESINS MARKET, KEY DEVELOPMENTS

- 10.2 RANKING ANALYSIS OF KEY MARKET PLAYERS

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS OF TOP PLAYERS

- 10.5 MARKET EVALUATION MATRIX

-

10.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.7 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 10.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 10.9 COMPANY REGION FOOTPRINT

- 10.10 STRENGTH OF PRODUCT PORTFOLIO

- 10.11 BUSINESS STRATEGY EXCELLENCE

-

10.12 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSMANGALAM ORGANICS LIMITED- Business overview- Products offered- MnM viewYASUHARA CHEMICAL CO. LTD- Business overview- Products offered- Recent developments- MnM viewINGEVITY- Business overview- Products offered- Recent developments- MnM viewKRATON CORPORATION- Business overview- Products offered- Recent developments- Other developments- MnM viewBAOLIN CHEMICAL INDUSTRY CO. LTD- Business overview- Products offered- MnM viewLESCO CHEMICAL LIMITED- Business overview- Products offered- MnM viewARAKAWA CHEMICAL INDUSTRIES, LTD.- Business overview- Products offered- Other developments- MnM viewXINYI SONYUAN CHEMICAL CO. LTD- Business overview- Products offered- MnM view

-

11.2 OTHER PLAYERSAKROCHEM CHEMICALFOREVEREST RESOURCES LTD.HWALONGRESIN CHEMICALS CO. LTDJINAN FUTURE CHEMICAL CO., LTDGOLDENSEA CHEMICALS CO. LTDHENAN TIANFU CHEMICAL CO. LTDBOC SCIENCESMEGAWIDE CHEMICALS CO. LTDDRTCHINA MK GROUP CO. LTDCAREER HENAN CHEMICAL COMPANYPUYANG CHANGYU PETROLEUM RESINS CO. LTDDUJODWALA RESINS AND TERPENES LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 TERPENE RESINS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 IMPORT TRADE DATA FOR PHENOLIC TERPENE RESINS

- TABLE 6 EXPORT TRADE DATA FOR PHENOLIC TERPENE RESINS

- TABLE 7 AVERAGE SELLING PRICE BASED ON PRODUCT TYPE (USD/KG)

- TABLE 8 TERPENE RESINS: ECOSYSTEM

- TABLE 9 TERPENE RESINS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 10 GRANTED PATENTS ACCOUNT FOR 10% OF TOTAL COUNT IN LAST 10 YEARS

- TABLE 11 LIST OF PATENTS BY GANZHOU TAIPU NEW MAT CO LTD

- TABLE 12 LIST OF PATENTS BY GANZHOU TAIPU CHEMICAL CO LTD

- TABLE 13 TOP PATENT OWNERS IN LAST 10 YEARS

- TABLE 14 TERPENE RESINS MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

- TABLE 15 TERPENE RESINS MARKET, BY PRODUCT TYPE, 2020–2027 (KILOTON)

- TABLE 16 TERPENE RESINS MARKET, BY GRADE, 2020–2027 (USD MILLION)

- TABLE 17 TERPENE RESINS MARKET, BY GRADE, 2020–2027 (KILOTON)

- TABLE 18 TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 19 TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 20 TERPENE RESINS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 21 TERPENE RESINS MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 22 ASIA PACIFIC: TERPENE RESINS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 23 ASIA PACIFIC: TERPENE RESINS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 24 ASIA PACIFIC: TERPENE RESINS MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

- TABLE 25 ASIA PACIFIC: TERPENE RESINS MARKET, BY PRODUCT TYPE, 2020–2027 (KILOTON)

- TABLE 26 ASIA PACIFIC: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 27 ASIA PACIFIC: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 28 CHINA: TERPENE RESINS MARKET, APPLICATION, 2020–2027 (USD MILLION)

- TABLE 29 CHINA: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 30 JAPAN: TERPENE RESINS MARKET, APPLICATION, 2020–2027 (USD MILLION)

- TABLE 31 JAPAN: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 32 INDIA: TERPENE RESINS MARKET, APPLICATION, 2020–2027 (USD MILLION)

- TABLE 33 INDIA: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 34 SOUTH KOREA: TERPENE RESINS MARKET, APPLICATION, 2020–2027 (USD MILLION)

- TABLE 35 SOUTH KOREA: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 36 AUSTRALIA: TERPENE RESINS MARKET, APPLICATION, 2020–2027 (USD MILLION)

- TABLE 37 AUSTRALIA: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 38 REST OF ASIA PACIFIC: TERPENE RESINS MARKET, APPLICATION, 2020–2027 (USD MILLION)

- TABLE 39 REST OF ASIA PACIFIC: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 40 NORTH AMERICA: TERPENE RESINS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: TERPENE RESINS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 42 NORTH AMERICA: TERPENE RESINS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: TERPENE RESINS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

- TABLE 44 NORTH AMERICA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 46 US: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 47 US: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 48 CANADA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 49 CANADA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 50 MEXICO: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 51 MEXICO: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 52 EUROPE: TERPENE RESINS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 53 EUROPE: TERPENE RESINS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 54 EUROPE: TERPENE RESINS MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

- TABLE 55 EUROPE: TERPENE RESINS MARKET, BY PRODUCT TYPE, 2020–2027 (KILOTON)

- TABLE 56 EUROPE: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 57 EUROPE: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 58 GERMANY: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 59 GERMANY: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 60 FRANCE: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 61 FRANCE: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 62 UK: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 63 UK: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 64 ITALY: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 65 ITALY: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 66 SPAIN: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 67 SPAIN: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 68 REST OF EUROPE: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 69 REST OF EUROPE: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 70 MIDDLE EAST & AFRICA: TERPENE RESINS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 71 MIDDLE EAST & AFRICA: TERPENE RESINS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 72 MIDDLE EAST & AFRICA: TERPENE RESINS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

- TABLE 73 MIDDLE EAST & AFRICA: TERPENE RESINS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

- TABLE 74 MIDDLE EAST & AFRICA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 75 MIDDLE EAST & AFRICA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 76 SAUDI ARABIA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 77 SAUDI ARABIA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 78 UAE: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 79 UAE: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 80 SOUTH AFRICA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 81 SOUTH AFRICA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 82 REST OF MIDDLE EAST & AFRICA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 83 REST OF MIDDLE EAST & AFRICA: TERPENE RESINS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 84 SOUTH AMERICA: TERPENE RESINS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 85 SOUTH AMERICA: TERPENE RESINS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 86 SOUTH AMERICA: TERPENE RESINS MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

- TABLE 87 SOUTH AMERICA: TERPENE RESINS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

- TABLE 88 SOUTH AMERICA TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 89 SOUTH AMERICA: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 90 BRAZIL: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 91 BRAZIL: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 92 ARGENTINA: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 93 ARGENTINA: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 94 REST OF SOUTH AMERICA: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 95 REST OF SOUTH AMERICA: TERPENE RESINS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 96 OVERVIEW OF STRATEGIES ADOPTED BY SOME KEY MARKET PLAYERS

- TABLE 97 TERPENE RESINS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 98 TERPENE RESINS MARKET: REVENUE ANALYSIS (USD)

- TABLE 99 MARKET EVALUATION MATRIX

- TABLE 100 PRODUCT LAUNCHES, 2018–2022

- TABLE 101 DEALS, 2018–2022

- TABLE 102 OTHER DEVELOPMENTS, 2018–2021

- TABLE 103 MANGALAM ORGANICS LIMITED: COMPANY OVERVIEW

- TABLE 104 MANGALAM ORGANICS LIMITED: PRODUCT OFFERINGS

- TABLE 105 YASUHARA CHEMICAL CO. LTD: COMPANY OVERVIEW

- TABLE 106 YASUHARA CHEMICAL CO. LTD: PRODUCT OFFERINGS

- TABLE 107 YASUHARA CHEMICAL CO. LTD: DEALS

- TABLE 108 INGEVITY: COMPANY OVERVIEW

- TABLE 109 INGEVITY: PRODUCT OFFERINGS

- TABLE 110 INGEVITY: PRODUCT LAUNCHES

- TABLE 112 INGEVITY: OTHER DEVELOPMENTS

- TABLE 113 KRATON CORPORATION: COMPANY OVERVIEW

- TABLE 114 KRATON CORPORATION: PRODUCT OFFERINGS

- TABLE 116 KRATON CORPORATION: OTHER DEVELOPMENTS

- TABLE 117 BAOLIN CHEMICAL INDUSTRY CO. LTD: COMPANY OVERVIEW

- TABLE 118 BAOLIN CHEMICAL INDUSTRY CO. LTD: PRODUCT OFFERINGS

- TABLE 119 LESCO CHEMICAL LIMITED: COMPANY OVERVIEW

- TABLE 120 LESCO CHEMICAL LIMITED: PRODUCT OFFERINGS

- TABLE 121 ARAKAWA CHEMICAL INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 122 ARAKAWA CHEMICAL INDUSTRIES, LTD.: PRODUCT OFFERINGS

- TABLE 123 ARAKAWA CHEMICAL INDUSTRIES, LTD: OTHER DEVELOPMENTS

- TABLE 124 XINYI SONYUAN CHEMICAL CO. LTD: COMPANY OVERVIEW

- TABLE 125 XINYI SONYUAN CHEMICAL CO. LTD: PRODUCT OFFERINGS

- FIGURE 1 TERPENE RESINS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: APPROACH 1

- FIGURE 3 MARKET SIZE ESTIMATION: APPROACH 2

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TERPENE RESINS MARKET: DATA TRIANGULATION

- FIGURE 7 SOLID TERPENE RESIN TO LEAD MARKET

- FIGURE 8 INDUSTRIAL GRADE SEGMENT TO LEAD MARKET

- FIGURE 9 ADHESIVES & SEALANTS TO BE LARGEST APPLICATION IN MARKET

- FIGURE 10 ASIA PACIFIC WAS LARGEST TERPENE RESINS MARKET

- FIGURE 11 HIGH GROWTH IN ASIA PACIFIC TO DRIVE TERPENE RESINS MARKET

- FIGURE 12 LIQUID TERPENE RESIN TO BE FASTER-GROWING SEGMENT OF TERPENE RESINS MARKET

- FIGURE 13 TECHNICAL GRADE TO BE FASTER-GROWING SEGMENT OF TERPENE RESINS MARKET

- FIGURE 14 PULP & PAPER TO BE FASTEST-GROWING SEGMENT OF TERPENE RESINS MARKET

- FIGURE 15 ADHESIVES & SEALANTS AND CHINA ACCOUNTED FOR SIGNIFICANT SHARES (2021)

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TERPENE RESINS MARKET

- FIGURE 19 TERPENE RESINS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE BASED ON REGION (USD/SQUARE METER)

- FIGURE 21 ECOSYSTEM MAPPING

- FIGURE 22 TRENDS/DISRUPTIONS IN TERPENE RESINS MARKET

- FIGURE 23 LEGAL PATENTS STATUS

- FIGURE 24 TOP JURISDICTION-BY DOCUMENT

- FIGURE 25 KEY PATENT APPLICANTS

- FIGURE 26 SUPPLIER SELECTION CRITERION

- FIGURE 27 SOLID SEGMENT TO LEAD TERPENE RESINS MARKET

- FIGURE 28 INDUSTRIAL GRADE SEGMENT TO REGISTER HIGHER CAGR IN TERPENE RESINS MARKET

- FIGURE 29 ADHESIVES & SEALANTS APPLICATION TO LEAD TERPENE RESINS MARKET

- FIGURE 30 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC: TERPENE RESINS MARKET SNAPSHOT

- FIGURE 32 RANKING OF TOP FIVE PLAYERS TERPENE RESINS MARKET, 2022

- FIGURE 33 TERPENE RESINS MARKET SHARE, BY COMPANY (2022)

- FIGURE 34 TERPENE RESINS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 35 TERPENE RESINS MARKET: COMPANY EVALUATION MATRIX FOR SMES

- FIGURE 36 MANGALAM ORGANICS LIMITED: COMPANY SNAPSHOT

- FIGURE 37 YASUHARA CHEMICAL CO. LTD: COMPANY SNAPSHOT

- FIGURE 38 INGEVITY: COMPANY SNAPSHOT

- FIGURE 39 ARAKAWA CHEMICAL INDUSTRIES, LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for terpene resins market. The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, extensive use of secondary sources, directories, and databases, such as World Bank, Statista, Organization for Economic Cooperation and Development (OECD), Bloomberg, International Monetary Fund (IMF), Trademap, Zauba, Environmental Protection Agency (EPA), European Environment Agency, and other government & private websites, associations related to the terpene resins industry. The study also involves analyzing regulations and regional government websites to identify and collect information useful for this technical, market-oriented, and commercial terpene resins market study.

Primary Research

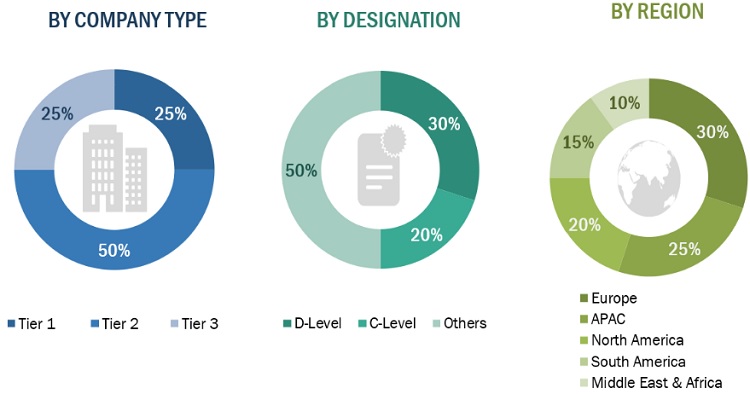

The terpene resins market comprises several stakeholders such as raw material suppliers, distributors, manufacturers, end-users, and regulatory organizations in the supply chain. Primary sources include experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of major market players, and industry consultants, have been conducted to obtain and verify critical qualitative and quantitative information and assess growth prospects.

Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the terpene resins market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, product type, grades, and applications in various applications and markets were identified through extensive secondary research.

- The industry’s value chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size - using the market size estimation process explained above - the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of terpene resins and their applications.

Objectives of the Study:

- To analyze and forecast the terpene resins market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market by system, process, technology, and applications.

- To forecast the size of the market with respect to five regions, namely, Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with the key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders.

- To analyze competitive developments such as new product launch, merger & acquisition, agreement & collaboration, and investment & expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- Notes: 1. Micro markets are defined as sub segments of the terpene resins market included in the report.

- 2. Core competencies of the companies are covered in terms of their key developments and strategies adopted to sustain their position in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the terpene resins market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Terpene Resins Market